North America Neuropathic Pain Market

Market Size in USD Billion

CAGR :

%

USD

3.08 Billion

USD

6.15 Billion

2024

2032

USD

3.08 Billion

USD

6.15 Billion

2024

2032

| 2025 –2032 | |

| USD 3.08 Billion | |

| USD 6.15 Billion | |

|

|

|

|

North America Neuropathic Pain Market Size

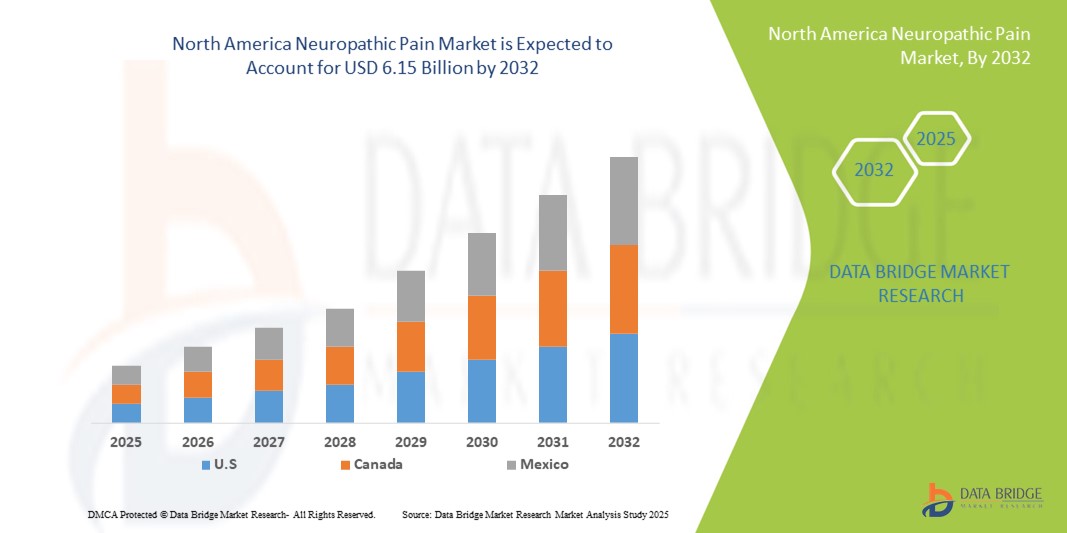

- The North America neuropathic pain market size was valued at USD 3.08 billion in 2024 and is expected to reach USD 6.15 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic conditions such as diabetes, cancer, and multiple sclerosis, which significantly increase the risk of neuropathic pain, along with advancements in targeted drug therapies and interventional procedures. Growing awareness about the importance of early diagnosis and treatment is also driving demand for innovative pain management solutions in both developed and emerging healthcare markets

- Furthermore, increasing patient demand for effective, safe, and non-opioid alternatives for long-term pain relief is establishing neuropathic pain therapies as a critical component of modern healthcare systems. These converging factors are accelerating the uptake of Neuropathic Pain solutions, thereby significantly boosting the industry’s growth

North America Neuropathic Pain Market Analysis

- Neuropathic pain treatments, encompassing pharmacological therapies, interventional procedures, and innovative digital health approaches, are becoming increasingly vital in modern healthcare due to the rising prevalence of chronic conditions such as diabetes, cancer, and multiple sclerosis. The demand for these solutions is fueled by the growing need for effective pain management, enhanced patient quality of life, and integration of advanced therapies into healthcare systems

- The escalating adoption of neuropathic pain management therapies is primarily driven by rising disease burden, increasing healthcare expenditure, and greater awareness among both patients and healthcare providers regarding innovative treatment options

- U.S. dominated the North America neuropathic pain market with the largest revenue share of 78.4% in 2024, supported by the presence of major pharmaceutical companies, advanced clinical research infrastructure, and robust investment in R&D. The country has seen substantial growth in neuropathic pain treatment adoption, with expanded drug approvals, increasing utilization of combination therapies, and integration of digital monitoring tools that optimize treatment outcomes

- Canada is expected to be the fastest growing country in the North America neuropathic pain market during the forecast period, driven by increasing government support for chronic pain management programs, rising outsourcing of clinical trials, and the adoption of patient-centric digital health platforms. Expanding research collaborations, growing awareness among healthcare providers, and greater access to innovative therapies such as novel anticonvulsants and antidepressants contribute to Canada’s rapid market growth

- The Prescription-Based Devices segment dominated the North America neuropathic pain market with the largest market revenue share of 62.9% in 2024, as advanced neuromodulation systems, including implantable SCS and peripheral nerve stimulators, require physician approval and clinical monitoring

Report Scope and Neuropathic Pain Market Segmentation

|

Attributes |

Neuropathic Pain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Neuropathic Pain Market Trends

Growing Need for Advanced and Patient-Centric Pain Management

- A significant and accelerating trend in the North America neuropathic pain market is the growing focus on advanced pharmacological therapies and patient-centric treatment approaches. The rising burden of diabetes, cancer, and post-surgical complications is driving demand for more effective and long-lasting neuropathic pain management solutions

- For instance, in 2023 the U.S. FDA approved expanded indications for certain anticonvulsants and antidepressants, reinforcing their clinical utility in neuropathic pain management. Similarly, innovative formulations of topical therapies are being introduced to reduce side effects while improving targeted pain relief

- The integration of digital health platforms and telemedicine in neuropathic pain treatment enables real-time patient monitoring, medication adherence tracking, and early intervention strategies. These solutions are helping clinicians optimize pain management protocols while providing patients with more convenient and personalized care

- Multimodal treatment strategies, combining pharmacological therapies with non-invasive interventions such as neuromodulation, are gaining traction. This approach addresses the limitations of single therapies, reduces opioid dependency, and enhances overall treatment outcomes in neuropathic pain patients

- This trend toward more advanced, comprehensive, and integrated solutions is reshaping patient and clinician expectations in chronic pain management. Consequently, major pharmaceutical companies are investing in the development of next-generation therapies such as sodium channel blockers, gene-based treatments, and extended-release formulations to better meet unmet needs

- The demand for effective neuropathic pain solutions is growing rapidly across both hospital and outpatient settings, as healthcare providers and patients increasingly prioritize improved quality of life, long-term efficacy, and reduced reliance on opioids

North America Neuropathic Pain Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Chronic Diseases and Pain Conditions

- The rising prevalence of chronic conditions such as diabetes, cancer, multiple sclerosis, and post-herpetic neuralgia is a significant driver for the heightened demand for neuropathic pain treatments. With millions of new cases being diagnosed each year, the need for long-term and effective pain management strategies continues to grow

- For instance, in March 2023, the U.S. FDA approved an extended-release formulation of pregabalin designed to improve patient compliance by reducing daily dosing requirements. Such advancements by key pharmaceutical companies are expected to drive the Neuropathic Pain market growth in the forecast period

- As patients and healthcare providers become more aware of the debilitating impact of neuropathic pain on quality of life, there is an increasing focus on treatments that not only reduce pain intensity but also improve sleep quality, mobility, and overall functioning

- Furthermore, the growing demand for non-opioid pain management solutions is propelling innovation in anticonvulsants, antidepressants, topical therapies, and neuromodulation devices, offering safer and more targeted alternatives for patients

- The convenience of oral formulations, the availability of combination therapies, and the ability to personalize treatment plans are key factors driving adoption in both hospital and outpatient settings. The trend toward multimodal treatment approaches and greater patient-centric care is further contributing to sustained growth in the neuropathic pain market

Restraint/Challenge

Concerns Regarding Side Effects and High Treatment Costs

- Concerns surrounding the potential side effects of neuropathic pain medications, including dizziness, drowsiness, weight gain, and dependency risks, pose a significant challenge to broader treatment adoption. Patients may discontinue therapies due to tolerability issues, resulting in unmet medical needs

- For instance, published reports have highlighted patient dissatisfaction with existing therapies due to limited efficacy and adverse effects, leading to reduced adherence and highlighting the need for improved treatment options

- Addressing these safety concerns through the development of next-generation therapies with better tolerability profiles and reduced systemic side effects is crucial for strengthening patient trust and adherence. Companies such as Pfizer, Novartis, and Eli Lilly are emphasizing innovations in drug delivery systems and extended-release formulations to improve outcomes

- In addition, the relatively high cost of some advanced neuropathic pain treatments, including biologics and neuromodulation devices, can be a barrier to adoption for patients in low- and middle-income regions. Even in developed markets, the economic burden of long-term treatment remains a concern for healthcare systems and patients alike

- While insurance coverage and patient assistance programs are helping mitigate these costs, the perceived financial strain of continuous therapy can still hinder widespread adoption

- Overcoming these challenges through better reimbursement strategies, continued R&D for safer drugs, and broader awareness campaigns will be vital for sustained growth in the global neuropathic pain market

North America Neuropathic Pain Market Scope

The market is segmented on the basis of type, product type, procedure, technology, modality, mode of purchase, pain type, indication, end-user, and distribution channel.

- By Type

On the basis of type, the neuropathic pain market is segmented into Spinal Cord Stimulation (SCS) Devices, external peripheral nerve stimulation, and transcutaneous electrical nerve stimulation (TENS) devices. The Spinal Cord Stimulation (SCS) Devices segment dominated the largest market revenue share of 46.5% in 2024, driven by its high clinical success in treating chronic neuropathic pain conditions such as failed back surgery syndrome and complex regional pain syndrome. Advanced SCS systems offer improved features like closed-loop feedback, longer battery life, and MRI compatibility, enhancing patient outcomes and safety. Strong physician preference and widespread availability of reimbursement policies support their adoption in hospitals and specialty centers across North America. In addition, growing clinical research and FDA approvals are expanding the range of indications treated by SCS. With robust evidence supporting long-term pain relief and reduced opioid dependency, SCS devices remain the gold standard for severe neuropathic pain, ensuring continued dominance in the market.

The external peripheral nerve stimulation segment is anticipated to witness the fastest CAGR of 13.6% from 2025 to 2032, supported by its minimally invasive approach, cost-effectiveness, and growing application in diabetic neuropathy, post-surgical pain, and trauma-related neuropathies. Unlike SCS, these devices are easier to implant or apply, making them attractive to both patients and physicians seeking less complex procedures. Increased patient preference for non-surgical pain management and expanding clinical studies demonstrating efficacy are fueling its acceptance. Furthermore, healthcare systems are promoting outpatient procedures and home-based treatments, where peripheral nerve stimulation fits well. With ongoing product innovations such as wearable stimulators and wireless technology, the adoption of external peripheral nerve stimulation is expected to accelerate significantly.

- By Product Type

On the basis of product type, the neuropathic pain market is segmented into rechargeable and non-rechargeable. The rechargeable segment accounted for the largest market revenue share of 55.1% in 2024, primarily due to its cost-effectiveness over the long term, as patients require fewer replacement surgeries compared to non-rechargeable devices. Rechargeable implants offer improved battery life, lasting up to 10–15 years, which significantly reduces healthcare costs and enhances patient satisfaction. Younger patients with long life expectancy are especially inclined toward rechargeable systems as they reduce surgical burden. Continuous innovations in wireless charging and compact device designs are improving usability. Moreover, healthcare providers prefer recommending rechargeable devices as they minimize surgical complications and hospital workload associated with frequent replacements. This strong value proposition ensures sustained dominance of the rechargeable segment.

The non-rechargeable segment is expected to expand at the fastest CAGR of 12.4% from 2025 to 2032, driven by its simplicity, affordability, and convenience, particularly among elderly patients who may find recharging processes challenging. Non-rechargeable devices are often chosen for patients with shorter life expectancy or limited dexterity, reducing complexity in usage. Manufacturers are increasingly focusing on extending battery performance in this category, making them more appealing. The ease of implantation and reduced learning curve for patients and caregivers further boost adoption. In addition, lower upfront costs make these devices accessible to a broader population, especially in healthcare systems with cost-sensitive patients. Together, these factors drive strong future growth.

- By Procedure

On the basis of procedure, the neuropathic pain market is segmented into invasive and non-invasive. The invasive segment dominated the largest market revenue share of 58.7% in 2024, as implantable devices such as SCS remain the cornerstone for managing refractory neuropathic pain conditions. Invasive procedures are widely recognized for their high efficacy, providing long-term pain relief in patients who fail conventional drug therapies. Robust clinical evidence, well-established surgical expertise, and favorable reimbursement frameworks further support the adoption of invasive procedures across North America. Technological advancements in implantable neuromodulators, including miniaturization and improved precision targeting, have further strengthened physician confidence. Moreover, hospitals and surgical centers remain well-equipped with specialized teams to handle these complex procedures, ensuring their sustained dominance.

The non-invasive segment is projected to register the fastest CAGR of 14.1% from 2025 to 2032, as patients increasingly seek safe, affordable, and accessible pain management alternatives. Non-invasive devices such as TENS and transcranial magnetic stimulation are gaining strong traction for their ability to deliver effective relief without surgical intervention. They are particularly attractive for home use, empowering patients to self-manage chronic pain. Rising demand for wearable and portable solutions is boosting this category, coupled with growing consumer awareness of non-drug therapies. Healthcare systems also support non-invasive solutions to reduce hospitalization costs and surgical risks. As technological innovations enhance device performance and expand therapeutic applications, adoption is set to accelerate rapidly.

- By Technology

On the basis of technology, the neuropathic pain market is segmented into transcutaneous electrical nerve stimulation, transcranial magnetic stimulation, and respiratory electrical stimulation. The transcutaneous electrical nerve stimulation (TENS) segment captured the largest market revenue share of 41.8% in 2024, supported by its cost-effectiveness, simplicity, and broad use in both homecare and clinical environments. TENS devices are widely recognized for their ability to relieve mild-to-moderate neuropathic pain across conditions like diabetic neuropathy and post-herpetic neuralgia. Their portability and affordability make them particularly attractive for patients managing long-term conditions. Healthcare professionals often recommend TENS as a first-line device due to its safety profile and accessibility. The expanding range of compact, user-friendly, and smartphone-connected TENS units continues to boost patient adoption. Furthermore, increasing availability through pharmacies and online platforms enhances accessibility, ensuring its strong market position.

The transcranial magnetic stimulation segment is expected to record the fastest CAGR of 13.9% during 2025–2032, driven by its effectiveness in addressing central neuropathic pain syndromes and refractory cases that fail other interventions. TMS has gained recognition in outpatient clinical settings, offering a non-invasive but highly targeted therapeutic approach. Ongoing clinical trials and FDA approvals for expanded indications are strengthening its credibility. Rising investments in neurotechnology startups are also accelerating innovation in TMS systems. With increasing adoption in psychiatric care, TMS is now extending its utility into pain management, further fueling demand. Improved awareness among physicians and patients is expected to expand usage significantly over the forecast period.

- By Modality

On the basis of modality, the neuropathic pain market is segmented into stationary and portable. The stationary segment dominated the largest market revenue share of 54.2% in 2024, primarily due to its strong adoption in hospitals, clinics, and rehabilitation centers where advanced and high-power neuromodulation systems are utilized. Stationary devices are capable of delivering precise and continuous therapy, making them ideal for patients requiring intensive treatment under medical supervision. Their integration with advanced imaging and monitoring technologies further enhances accuracy and clinical outcomes. Moreover, favorable reimbursement policies for hospital-based procedures and the availability of skilled healthcare professionals drive demand. High treatment efficacy and strong institutional adoption ensure the continued dominance of stationary systems in North America.

The portable segment is projected to grow at the fastest CAGR of 14.8% from 2025 to 2032, driven by the rising popularity of wearable and home-based devices that provide patients with flexibility and convenience. Portable solutions such as TENS and compact nerve stimulation units allow patients to self-manage chronic pain without frequent hospital visits. Increased focus on patient-centric care and preference for minimally invasive, on-the-go treatment options are fueling this growth. Advancements in lightweight designs, wireless connectivity, and integration with mobile apps are expanding their appeal. In addition, the affordability and accessibility of portable devices through retail and online channels make them attractive to a wide population, particularly those seeking cost-effective long-term care.

- By Mode of Purchase

On the basis of mode of purchase, the neuropathic pain market is segmented into over-the-counter devices and prescription-based devices. The prescription-based devices segment dominated the largest market revenue share of 62.9% in 2024, as advanced neuromodulation systems, including implantable SCS and peripheral nerve stimulators, require physician approval and clinical monitoring. These devices are often prescribed for complex neuropathic pain conditions where other treatments fail, ensuring strong demand within hospital and specialist settings. Physicians prefer prescription-based devices due to their proven clinical efficacy, regulatory oversight, and established reimbursement pathways. Patients with severe chronic pain are also more likely to trust devices recommended and managed by healthcare professionals, reinforcing the dominance of this segment. Furthermore, continuous innovation in implantable technologies strengthens physician reliance on prescription-based therapies.

The over-the-counter devices segment is anticipated to witness the fastest CAGR of 15.1% during 2025–2032, supported by the growing availability of consumer-friendly TENS units and wearable stimulators that can be purchased without a prescription. Rising demand for self-care solutions and convenience is driving patient adoption of OTC devices, particularly for mild-to-moderate neuropathic pain. The affordability of these products and their wide availability across pharmacies, online platforms, and retail chains enhance accessibility. Increased awareness campaigns promoting drug-free pain management options are further accelerating uptake. Moreover, ongoing product innovations—such as smartphone-connected OTC devices and AI-powered wearables—are making these solutions more appealing to tech-savvy consumers, boosting their rapid growth.

- By Pain Type

On the basis of pain type, the neuropathic pain market is segmented into peripheral neuropathy, entrapment neuropathy, phantom limb neuropathy, trigeminal neuralgia, post-herpetic neuralgia (PHN), post-traumatic neuropathy, foot pain, and Coccydynia. The peripheral neuropathy segment dominated the largest market revenue share of 37.6% in 2024, owing to the high prevalence of diabetic neuropathy, chemotherapy-induced neuropathy, and nerve compression disorders across North America. With diabetes affecting a significant population, peripheral neuropathy remains one of the most common indications for pain management devices. Patients often require long-term treatment, which supports steady demand for advanced neuromodulation and TENS solutions. Increasing awareness of early diagnosis and better clinical management further strengthens adoption. In addition, strong clinical evidence validating device efficacy for neuropathic conditions ensures continued reliance on device-based therapies for this category.

The post-herpetic neuralgia (PHN) segment is expected to expand at the fastest CAGR of 13.7% from 2025 to 2032, driven by the growing incidence of shingles-related complications, particularly among the aging population. PHN remains difficult to manage with pharmacological therapies alone, leading to higher acceptance of device-based treatments such as nerve stimulation and TENS. Rising healthcare focus on elderly patient care and supportive reimbursement for neuropathic pain interventions are boosting demand. Moreover, technological advancements in targeted nerve stimulation tailored for PHN patients are further improving adoption. Increasing physician recommendations for early intervention in PHN cases will continue to accelerate growth in this segment.

- By Indication

On the basis of indication, the neuropathic pain market is segmented into spinal stenosis, chemotherapy-induced peripheral neuropathy, diabetic neuropathy, and others. The diabetic neuropathy segment held the largest revenue share of 39.2% in 2024, attributed to the high and rising prevalence of diabetes across North America, which significantly increases the burden of neuropathic complications. Patients with diabetic neuropathy often experience chronic pain and reduced quality of life, leading to strong demand for long-term device-based management strategies. Healthcare providers increasingly recommend neuromodulation and non-invasive devices as adjunct or alternative therapies to reduce dependency on medications. In addition, favorable reimbursement coverage for diabetic neuropathy treatments enhances adoption. Continuous technological innovation and clinical research targeting this indication further reinforce its market dominance.

The chemotherapy-induced peripheral neuropathy (CIPN) segment is projected to grow at the fastest CAGR of 12.9% from 2025 to 2032, fueled by the rising incidence of cancer and the widespread use of chemotherapeutic agents known to cause nerve damage. CIPN significantly impacts patient quality of life and treatment adherence, creating urgent demand for effective pain management solutions. Device-based therapies are gaining strong acceptance as they offer non-pharmacological alternatives to reduce symptoms. Increasing oncology care integration with pain management services further supports growth. Ongoing clinical studies validating the efficacy of neuromodulation in CIPN patients are expected to boost adoption rates significantly in the coming years.

- By End-User

On the basis of end-user, the neuropathic pain market is segmented into hospitals, clinics, home healthcare, ambulatory surgical centers, and others. The hospitals segment accounted for the largest market share of 44.8% in 2024, due to their central role in delivering advanced pain management procedures such as SCS implantation, peripheral nerve stimulation, and other invasive therapies. Hospitals are equipped with skilled specialists, advanced infrastructure, and access to reimbursement frameworks that support adoption. They also serve as hubs for managing complex and refractory neuropathic pain cases requiring multidisciplinary intervention. Clinical trials and device evaluations are often conducted in hospital settings, further reinforcing their dominance. Moreover, strong collaborations between hospitals and device manufacturers ensure early adoption of innovative technologies.

The home healthcare segment is projected to record the fastest CAGR of 14.5% from 2025 to 2032, reflecting the growing trend of decentralizing care toward patient-centric and home-based models. Rising adoption of portable and wearable devices such as TENS and compact neuromodulators allows patients to self-manage pain effectively in the comfort of their homes. This reduces the burden on hospital systems and lowers overall treatment costs. Increasing preference for remote monitoring and telehealth solutions is accelerating adoption. Elderly patients and those with mobility challenges particularly benefit from home-based care. The integration of digital health platforms with device usage is further enhancing the scalability and efficiency of home healthcare.

- By Distribution Channel

On the basis of distribution channel, the neuropathic pain market is segmented into direct tender, third party distributor, and others. The direct tender segment dominated the largest market revenue share of 51.3% in 2024, owing to strong procurement by hospitals, government institutions, and large healthcare networks. Direct purchasing agreements ensure cost savings, bulk supply, and reliable distribution of advanced neuromodulation systems. This channel is especially preferred for high-value implantable devices where quality assurance and long-term supplier relationships are critical. Manufacturers also benefit from predictable demand and stable partnerships with institutional buyers. The efficiency of direct tenders in reducing supply chain complexities reinforces their dominance in the North American market.

The third-party distributor segment is anticipated to witness the fastest CAGR of 12.6% from 2025 to 2032, driven by their role in expanding market access for smaller clinics, home healthcare providers, and retail channels. Distributors enable wider geographical coverage, especially in underserved or rural regions where direct manufacturer presence is limited. Their ability to manage diverse product portfolios, provide training, and ensure after-sales support strengthens their relevance. In addition, the rapid expansion of online and retail medical device distribution models is further boosting growth. By improving accessibility for both prescription and OTC devices, third-party distributors are expected to play an increasingly vital role in the neuropathic pain device market.

North America Neuropathic Pain Market Regional Analysis

- North America dominated the neuropathic pain market with the largest revenue share in 2024, supported by the strong presence of leading pharmaceutical companies, advanced clinical research infrastructure, and high healthcare expenditure

- The region’s growth is further driven by robust investment in R&D, increasing approvals of novel therapies, and a rising focus on personalized treatment options for patients suffering from chronic pain conditions

- Expanding digital health integration and favorable reimbursement frameworks continue to accelerate the adoption of neuropathic pain treatments across the region

U.S. Neuropathic Pain Market Insight

The U.S. Neuropathic Pain market captured the largest revenue share of 78.4% in 2024 within North America, supported by a strong pharmaceutical ecosystem and advanced clinical trial networks. The country has witnessed substantial growth in neuropathic pain treatment adoption, with multiple drug approvals, expanded use of combination therapies, and greater integration of digital monitoring tools that help optimize patient outcomes. Government initiatives to improve access to pain management solutions and the availability of favorable reimbursement programs further strengthen the U.S. market, making it the largest and most mature neuropathic pain market in the region.

Canada Neuropathic Pain Market Insight

The Canada is expected to be the fastest growing country in the North America Neuropathic Pain market during the forecast period, driven by increasing government support for chronic pain management programs and rising clinical trial outsourcing to Canadian research centers. The country is also witnessing growth in patient-centric care models, supported by the adoption of digital health platforms and telemedicine tools for pain management. Furthermore, expanding research collaborations with global pharmaceutical companies and greater access to innovative therapies, such as next-generation anticonvulsants and antidepressants, are contributing significantly to Canada’s rapid market growth.

North America Neuropathic Pain Market Share

The neuropathic pain industry is primarily led by well-established companies, including:

- Avanos Medical, Inc (U.S.)

- B. Braun SE (Germany)

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- OMRON Healthcare Co., Ltd. (Japan)

- NEVRO CORP (U.S.)

- electroCore, Inc. (U.S.)

- SPR (U.S.)

- NeuroMetrix, Inc. (U.S.)

- Integer Holdings Corporation (U.S.)

Latest Developments in North America Neuropathic Pain Market

- In July 2021, Nevro Corporation announced the FDA approval of its Senza Spinal Cord Stimulation (SCS) System for the treatment of chronic pain associated with painful diabetic neuropathy (PDN). This approval marked the first FDA indication for a spinal cord stimulation system specifically targeting PDN. Nevro initiated commercial launch activities in the U.S. under its HFX branding for PDN

- In January 2022, Medtronic received FDA approval for its Intellis and Vanta neurostimulators to treat chronic pain resulting from diabetic peripheral neuropathy (DPN). This approval expanded the indications for these devices, allowing for broader clinical adoption of neuromodulation therapies for neuropathic pain in the U.S. and Canada

- In January 2023, Abbott announced FDA approval of its Proclaim XR Spinal Cord Stimulation (SCS) system for the treatment of painful diabetic peripheral neuropathy (DPN). This approval provided an additional non-medication option for patients suffering from DPN, contributing to the diversification of treatment modalities available in the North American market

- In September 2024, Nevro received FDA approval for its HFX iQ with HFX AdaptivAI spinal cord stimulation system. This AI-driven technology aims to personalize and adapt therapy delivery for chronic neuropathic pain patients, representing a significant advancement in responsive neuromodulation. Nevro initiated a limited market release in the U.S. in the fourth quarter of 2024

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.