North America Non Grain Oriented Electrical Steel Market

Market Size in USD Billion

CAGR :

%

USD

4.33 Billion

USD

6.55 Billion

2024

2032

USD

4.33 Billion

USD

6.55 Billion

2024

2032

| 2025 –2032 | |

| USD 4.33 Billion | |

| USD 6.55 Billion | |

|

|

|

|

Non-grain Oriented Electrical Steel Market Size

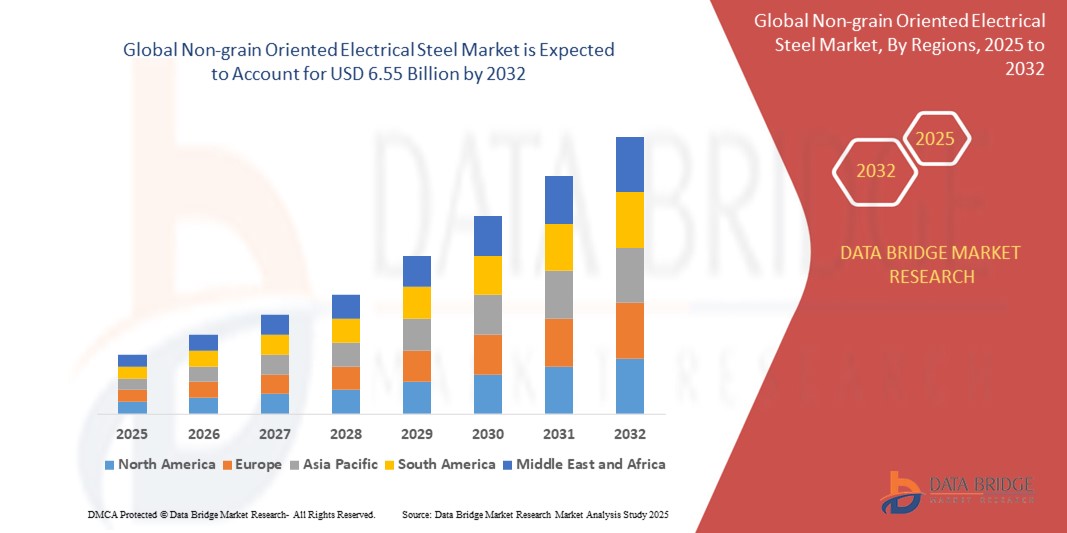

- The North America non-grain oriented electrical steel market size was valued at USD 4.33 billion in 2024 and is expected to reach USD 6.55 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fueled by the increasing demand for high-efficiency electric motors, transformers, and generators across automotive, industrial, and power sectors, driven by global trends in electrification and energy optimization

- Furthermore, growing investments in renewable energy infrastructure, electric vehicle production, and grid modernization are elevating the need for non-grain oriented electrical steel due to its superior magnetic properties in rotating machinery. These converging factors are significantly accelerating the adoption of NOES, thereby propelling market expansion

Non-grain Oriented Electrical Steel Market Analysis

- Non-grain oriented electrical steel is a type of silicon steel characterized by uniform magnetic properties in all directions, making it ideal for use in electric motors, generators, and alternators. It plays a critical role in enhancing energy efficiency and reducing core losses in dynamic electrical applications

- The rising deployment of electric vehicles, smart grids, and industrial automation systems is intensifying demand for NOES, as manufacturers seek materials that offer high permeability, low hysteresis loss, and compatibility with compact, high-speed motor designs

- U.S. dominated the non-grain oriented electrical steel market with a share of 75.5% in 2024, due to its robust industrial base, extensive manufacturing of electric motors, and rapid adoption of energy-efficient technologies across power and automotive sectors

- Canada is expected to be the fastest growing region in the non-grain oriented electrical steel market during the forecast period due to national commitments toward energy efficiency, clean technology adoption, and electric mobility

- Fully processed segment dominated the market with a market share of 59.1% in 2024, due to its superior magnetic properties and consistent performance in rotating machinery. This type is extensively utilized in applications requiring precise magnetic flux control, such as motors and generators, especially within the energy and automotive sectors. The high demand is also driven by the increasing push for electrification and energy efficiency standards across industrial and commercial infrastructures

Report Scope and Non-grain Oriented Electrical Steel Market Segmentation

|

Attributes |

Non-grain Oriented Electrical Steel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-grain Oriented Electrical Steel Market Trends

“Increasing Demand for Energy-Efficient Electrical Equipment”

- The North America non-grain oriented electrical steel market is expanding rapidly due to an intensifying need for energy-efficient electrical devices across sectors such as power, automotive, and household appliances

- For instance, companies such as United States Steel Corporation and leading suppliers are launching new grades of semi-processed and fully processed electrical steel, supporting the surge in high-efficiency motors, generators, and transformers for modernized grid and consumer applications

- The shift to renewable energy generation—especially wind and solar—requires high-performance transformers and electrical apparatus, driving up usage of non-grain oriented steel as these devices benefit from low core losses and high magnetic permeability

- Grid modernization initiatives and infrastructure upgrades throughout North America are generating robust demand for new electrical machinery, further incentivizing adoption of advanced electrical steel solutions

- The proliferation of electric vehicles (EVs) is spurring demand for non-grain oriented electrical steel in the production of efficient and lightweight motor cores and battery components

- Partnerships between domestic steelmakers and technology firms are leading to ongoing innovation, improved material quality, and faster time to market for next-generation electrical steel products

Non-grain Oriented Electrical Steel Market Dynamics

Driver

“Rising Demand for Energy-efficient Power Transmission”

- The drive toward minimizing energy losses in transmission and distribution networks is a primary factor elevating demand for non-grain oriented electrical steel, as its properties are critical for fabricating efficient transformers and motor systems

- For instance, the modernization of North America’s aging power grid—along with stringent government regulations and incentives for energy efficiency—has led utilities and equipment manufacturers to prioritize non-grain oriented electrical steel in new installations and grid upgrades

- Increased electrification in transportation, growing EV sales, and the scaling of renewable energy generation require robust electric motor and transformer technology, fueling consumption of high-quality electrical steel

- Rising energy costs across the continent make performance improvements through better magnetic materials financially attractive for industrial and utility operators

- Manufacturers are investing in R&D to develop steel grades that further reduce core losses, enhance power density, and comply with evolving environmental standards

Restraint/Challenge

“Raw Material Costs and Availability”

- Volatility in prices and supply of key raw materials such as silicon, coal, iron ore, and steel scrap poses a significant challenge to electrical steel production, directly impacting manufacturing economics and pricing stability

- For instance, North American producers have reported that reliance on imported specialty materials, coupled with global supply chain disruptions and surges in ferrosilicon prices, has led to persistent cost pressures and short-term shortages in the market

- Price fluctuations in raw inputs often stem from global trading shifts, environmental regulations, and logistical delays, which can disrupt production planning and lead to higher costs for end users

- Economic uncertainty and unpredictable demand, including downturns or policy-driven slowdowns, may delay grid upgrades or investments in new power infrastructure, constraining market growth

- The lack of sufficient domestic raw material sources for certain specialty alloys increases vulnerability to international market disruptions and intensifies the need for local supply chain resilience

Non-grain Oriented Electrical Steel Market Scope

The market is segmented on the basis of type, thickness, distribution channel, application, and end-user.

- By Type

On the basis of type, the North America non-grain oriented electrical steel market is segmented into fully processed and semi-processed. The fully processed segment dominated the largest market revenue share of 59.1% in 2024, attributed to its superior magnetic properties and consistent performance in rotating machinery. This type is extensively utilized in applications requiring precise magnetic flux control, such as motors and generators, especially within the energy and automotive sectors. The high demand is also driven by the increasing push for electrification and energy efficiency standards across industrial and commercial infrastructures.

The semi-processed segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to its cost-effectiveness and flexibility in post-processing customization. Manufacturers prefer semi-processed steel for applications where the end-use requirements vary, enabling tailored magnetic performance at lower material costs. This adaptability makes it a preferred choice for regional manufacturers seeking scalable solutions across multiple end-user applications.

- By Thickness

On the basis of thickness, the market is segmented into 0.23 MM, 0.27 MM, 0.30 MM, 0.35 MM, 0.5 MM, 0.65 MM, and others. The 0.27 MM segment held the largest revenue share in 2024, primarily due to its balanced magnetic performance and energy efficiency. It is widely adopted in motor laminations and transformers, offering an optimal trade-off between core loss and mechanical strength. The rising use of electric motors in automotive and industrial applications has strengthened demand for this standard thickness.

Meanwhile, the 0.23 MM segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing focus on reducing energy losses and improving system efficiency. This ultra-thin steel variant is gaining traction in next-generation electric motors and power generators where low core loss is critical. Technological advancements in precision rolling and material science are further accelerating its adoption across high-performance electrical equipment.

- By Distribution Channel

On the basis of distribution channel, the market is bifurcated into offline and online. The offline segment dominated the market in 2024 due to strong supplier-distributor networks and the technical complexity involved in choosing and customizing steel grades for specific applications. Direct purchases from authorized dealers and manufacturers remain preferred for bulk industrial orders where consultation and logistical support are critical.

The online segment is projected to grow at the fastest rate from 2025 to 2032, fueled by digital transformation across industrial procurement processes. Increased transparency, access to product specifications, and the rise of e-commerce platforms catering to B2B transactions are reshaping the purchasing behavior of regional manufacturers. Online distribution is particularly gaining momentum among small and medium enterprises seeking convenience and competitive pricing.

- By Application

On the basis of application, the market is segmented into transformers, inductors, battery, filters, motors, electrical ballasts, power generators, magnetic bearings, and others. The motors segment accounted for the largest market share in 2024, driven by high-volume demand from industrial automation, HVAC systems, and the growing shift toward electric vehicles. Non-grain oriented steel’s isotropic magnetic properties make it ideal for rotating components, delivering consistent performance across varying magnetic orientations.

The battery segment is expected to exhibit the fastest growth over the forecast period, driven by the surge in energy storage systems and electric mobility solutions. Non-grain oriented steel is increasingly used in components supporting battery cooling and electromagnetic shielding. The regional push toward cleaner transportation and renewable integration is further catalyzing application in battery packs and peripheral devices.

- By End-User

On the basis of end-user, the market is segmented into energy and power, automotive, household appliances, building and construction, aviation, and others. The energy and power segment held the largest market revenue share in 2024 due to widespread deployment of non-grain oriented steel in transformers, generators, and grid-support systems. The material’s high magnetic permeability and efficiency under alternating currents make it indispensable for electric power distribution and generation infrastructure.

The automotive segment is poised to register the fastest CAGR from 2025 to 2032, spurred by the regional acceleration of electric vehicle manufacturing and supportive policy frameworks. Non-grain oriented electrical steel plays a critical role in e-mobility by enhancing the performance of electric drive motors and auxiliary components. North American OEMs are increasingly investing in localized sourcing strategies to meet rising demand, further fueling market growth in this segment.

Non-grain Oriented Electrical Steel Market Regional Analysis

- U.S. dominated the non-grain oriented electrical steel market with the largest revenue share of 75.5% in 2024, driven by its robust industrial base, extensive manufacturing of electric motors, and rapid adoption of energy-efficient technologies across power and automotive sectors

- The country hosts a large number of OEMs and transformer manufacturers that demand high-grade non-grain oriented electrical steel for use in motors, generators, and other rotating machinery. The U.S. is also a hub for R&D in magnetic materials, with continuous advancements in thin-gauge electrical steel aimed at reducing core losses and enhancing motor performance

- Growth in electric vehicle production, grid modernization projects, and federal initiatives promoting domestic manufacturing are further reinforcing demand. The increasing adoption of smart grid systems and renewable energy sources is driving new applications of non-grain oriented steel in advanced transformers and battery systems

Canada Non-grain Oriented Electrical Steel Market Insight

Canada is projected to register the fastest CAGR in the North America non-grain oriented electrical steel market from 2025 to 2032, fueled by national commitments toward energy efficiency, clean technology adoption, and electric mobility. The growth is strongly supported by provincial programs in Ontario and Quebec aimed at scaling domestic production of electric motors, EV components, and renewable energy systems. These efforts are increasing demand for electrical steel grades that offer high magnetic permeability and thermal stability. Canada’s proactive investment in grid reliability, hydroelectric modernization, and localized value chains for clean transportation is further enhancing the market outlook.

Mexico Non-grain Oriented Electrical Steel Market Insight

Mexico is expected to experience steady growth in the non-grain oriented electrical steel market between 2025 and 2032, underpinned by its growing role as a manufacturing hub for electrical appliances, industrial motors, and automotive components. The country’s strategic proximity to the U.S. and favorable trade frameworks under USMCA have attracted substantial investment in electric motor production, wire harness systems, and transformer manufacturing. Northern industrial states such as Nuevo León and Coahuila are witnessing increased establishment of facilities integrating non-grain oriented electrical steel. As Mexico strengthens its domestic capabilities in electrical component manufacturing, the demand for high-performance steel suited for mass production and export will continue to rise.

Non-grain Oriented Electrical Steel Market Share

The non-grain oriented electrical steel industry is primarily led by well-established companies, including:

- POSCO (South Korea)

- ThyssenKrupp AG (Germany)

- Tata Steel Limited (India)

- ArcelorMittal S.A. (Luxembourg)

- Nippon Steel Corporation (Japan)

- Voestalpine AG (Austria)

- JFE Shoji Power Canada Inc. (Canada)

- Cleveland-Cliffs Inc. (U.S.)

- Aperam S.A. (Luxembourg)

- Mapes & Sprowl Steel (U.S.)

- Arnold Magnetic Technologies (U.S.)

Latest Developments in North America Non-grain Oriented Electrical Steel Market

- In February 2025, ArcelorMittal announced that it is moving forward with the construction of a state-of-the-art non-grain oriented electrical steel (NOES) manufacturing facility in Alabama. This strategic investment is expected to significantly expand domestic production capacity in the U.S., addressing rising demand for NOES used in electric motors, generators, and energy infrastructure. The facility aims to support growing sectors such as electric vehicles, renewable power generation, and smart grid deployment. By localizing production, the company will also help reduce import dependence, shorten supply chains, and enhance U.S. competitiveness in advanced electrical steel manufacturing

- In July 2024, Fastmarkets launched pricing indexes for non-grain oriented electrical steel in domestic China and imports into India, recognizing NOES as an increasingly critical material in the global energy transition. As demand surges for high-efficiency electrical components in EVs, renewable energy systems, and grid modernization projects, transparent and standardized pricing mechanisms are essential for supporting trade, investment, and supply chain planning. This move signals growing global recognition of NOES as a strategic metal, helping market participants make informed decisions amid evolving geopolitical and energy dynamics

- In June 2024, JFE Steel Corporation announced that its low-carbon JGreeX™ grain-oriented electrical steel has been selected by a leading U.S.-based manufacturer of data center transformers—marking the product’s first adoption in the U.S. While the focus is on grain-oriented steel, the development reflects a broader industry trend toward sustainable steel solutions, influencing procurement choices across both GOES and NOES segments. As energy-intensive sectors such as data centers seek to reduce their environmental footprint, this adoption highlights rising demand for eco-friendly electrical steels in mission-critical infrastructure

- In March 2023, U.S. Steel Corporation initiated production of its new electrical steel product, InduX, at the Big River Steel facility following the successful commissioning of its non-grain oriented electrical steel line. This milestone marks a pivotal expansion in domestic NOES supply, catering to surging demand in EV powertrains, industrial automation, and efficient power transmission equipment. With InduX, U.S. Steel positions itself to support national efforts in electrification and energy resilience while reducing lead times, improving material availability, and fostering technological innovation in the NOES segment

- In May 2022, a coalition of nine key trade associations—including the Edison Electric Institute (EEI), American Public Power Association (APPA), National Rural Electric Cooperative Association (NRECA), and GridWise Alliance—formally urged the Biden administration to prioritize support for domestic electrical steel production. They warned of "significant and persistent" supply chain disruptions affecting critical sectors such as utilities, defense, and transportation. This appeal underscored the growing strategic importance of NOES and the urgent need for policy measures and investments to secure a stable, domestic supply base to meet national electrification and infrastructure goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Non Grain Oriented Electrical Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Non Grain Oriented Electrical Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Non Grain Oriented Electrical Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.