North America Nondestructive Testing Services And Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

8.27 Billion

2024

2032

USD

4.10 Billion

USD

8.27 Billion

2024

2032

| 2025 –2032 | |

| USD 4.10 Billion | |

| USD 8.27 Billion | |

|

|

|

|

North America Non-destructive Testing Services and Equipment Market Size

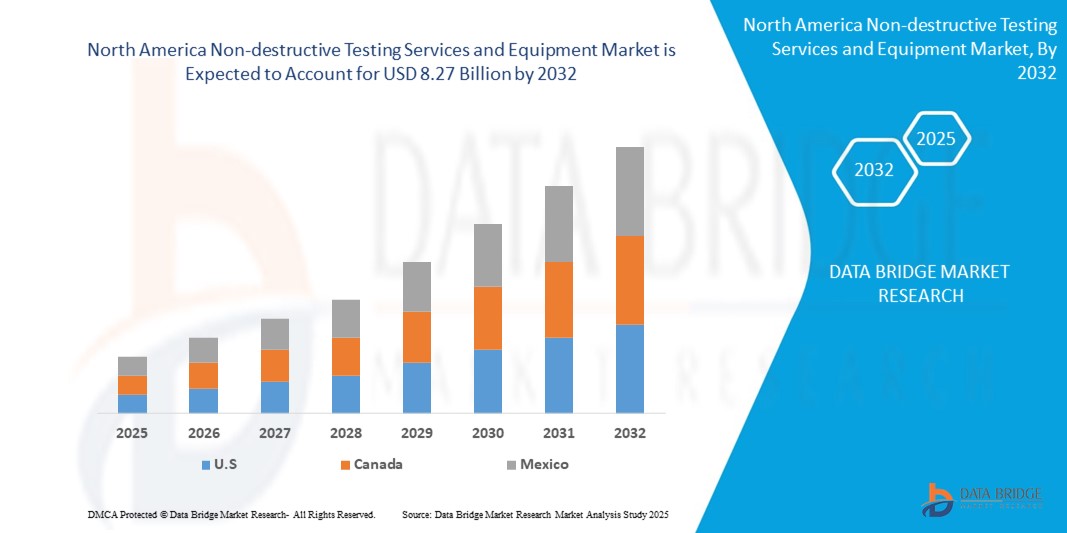

- The North America Non-destructive Testing Services and Equipment market size was valued at USD 4.10 Billion in 2024 and is expected to reach USD 8.27 Billion by 2032, at a CAGR of8.11% during the forecast period

- Non-Destructive testing equipment is used for quality control and safety assessment purposes. Their usage has extensive advantages over applications, such as in aerospace for inspecting the aircraft, in automotive for maintaining quality assurance, and many others. The equipment is based on the medical radiography which is used in a hospital. It is extensively used in petrochemical, chemical, and building industries for radiographic inspection of boilers, pipes and structures.

North America Non-destructive Testing Services and Equipment Market Analysis

- Non-destructive testing equipment is a valuable equipment which is used by many industries to estimate the properties of a structure, material, component or system without causing any damage. Numerous types of non-destructive testing equipment include ultrasonic testing, magnetic particle testing, visual inspection, radiography and penetrant testing.

- The non-destructive testing equipment market accounted for an augmented demand from the power generation industry because most of these established plants have aged and were constructed and designed using materials, standards and components, therefore, meeting industrial practices prevalent at the time of construction. Exposure to environmental conditions can cause damages to unforeseen. Non-destructive testing equipment provides that purpose to check any such flaws and aid solve the problem before it increases.

- U.S. dominates the North America Non-destructive Testing Services and Equipment market with the largest revenue share of 52.1% in 2025, The U.S. represents the largest market within North America for NDT services and equipment. Several factors contribute to this dominance, including the presence of a large manufacturing sector, extensive oil and gas infrastructure, and a significant aerospace and defense industry. The increasing focus on infrastructure development and maintenance, coupled with stringent regulatory standards for product quality and safety, drives the demand for NDT in the U.S.

- Canada is expected to be the fastest growing region in the North America Non-destructive Testing Services and Equipment market during the forecast period due a The Canadian NDT services and equipment market is also experiencing steady growth, albeit at a slightly lower CAGR compared to the U.S. Key industries driving this market include oil and gas, power generation (including nuclear and renewables), and aerospace. The vast network of pipelines across Canada necessitates regular and thorough NDT inspections.

- The radiography testing equipment segment is anticipated to hold the largest market share of 29.2% in the North America Non-destructive Testing Services and Equipment Market during the forecast period. This dominance can be primarily attributed to the enhanced performance and improved fuel efficiency offered by lightweight frames, particularly in diesel-powered commercial and utility LED light, even amidst the ongoing shift towards cleaner energy alternatives.

Report Scope and North America Non-destructive Testing Services and Equipment Market Segmentation

|

Attributes |

North America Non-destructive Testing Services and Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Non-destructive Testing Services and Equipment Market Trends

“Enhanced Precision Through Digital Integration and Automation”

- A significant and accelerating trend in the North American NDT market is the deepening integration of digital technologies and automation into inspection processes. This fusion enhances the precision and efficiency of testing, providing more accurate and faster results.

- For instance, the adoption of digital radiography and ultrasonic testing equipment allows for real-time image acquisition and analysis, improving defect detection capabilities. Additionally, GE HealthCare offers advanced digital radiography systems with AI and automation features aimed at improving diagnostic speed and accuracy (as of recent years). Their "Critical Care Suite" (AI algorithms for triage and quality control embedded on X-ray systems) and "Quality Care Suite" are examples of this integration.

- Similarly, the use of robotic crawlers and drones for remote inspections in industries like oil & gas and infrastructure reduces human error and increases safety. AI-powered software is also being increasingly utilized for automated data interpretation and reporting, streamlining workflows. This move towards digitally integrated and automated NDT systems is significantly enhancing the reliability and speed of quality assurance.

- Consequently, companies are developing NDT solutions with features like cloud connectivity for data management and automated defect recognition algorithms. The demand for NDT services and equipment offering seamless digital integration and automation is growing rapidly across key industries, as they increasingly prioritize accuracy, efficiency, and comprehensive data management for asset integrity.

North America Non-destructive Testing Services and Equipment Market Dynamics

Driver

“Growing Demand Driven by Stringent Quality Standards, Aging Assets, and Technological Advancements”

- The increasing emphasis on stringent quality standards across industries, coupled with the growing need to assess the condition of aging infrastructure and the continuous advancements in NDT technologies, is a significant driver for the heightened demand for NDT services and equipment in North America.

- The aerospace and automotive sectors require increasingly rigorous testing to ensure product safety and reliability. As the region's infrastructure ages, regular and thorough NDT inspections are crucial for preventing failures and ensuring public safety.

- For instance, August 2023, ASNT India American Society for Nondestructive Testing (ASNT) established a dedicated facility in Chennai. This initiative aims to enhance the availability of NDT training, certification, and research activities in India and the Middle East, specifically addressing the growing need for skilled NDT technicians in industries like aerospace. They offer ASNT-approved training courses and certification exams.

- Furthermore, the development of more sophisticated and versatile NDT techniques, such as advanced ultrasonic methods and electromagnetic testing, provides enhanced capabilities for defect detection and material characterization. The benefits of ensuring structural integrity, preventing costly failures, and complying with evolving industry regulations are key factors propelling the adoption of NDT in both manufacturing and maintenance sectors. The trend towards adopting innovative NDT solutions and the increasing availability of advanced equipment further contribute to market growth.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Concerns surrounding the cybersecurity vulnerabilities of connected devices pose a significant challenge to broader market penetration within the North American Non-destructive Testing (NDT) services and equipment market, particularly concerning advanced, digitally integrated NDT solutions. As NDT equipment and analysis platforms increasingly rely on network connectivity and sophisticated software for data acquisition, processing, and remote monitoring, they become potentially susceptible to hacking attempts and data breaches. This raises anxieties among end-users, especially in sensitive industries like aerospace, defense, and energy, regarding the security of their critical inspection data and the potential for operational disruption.

- For instance, high-profile reports of vulnerabilities in Industrial Internet of Things (IIoT) devices across various sectors have made some organizations hesitant to fully embrace interconnected NDT systems. The potential compromise of inspection results or the manipulation of testing parameters could have severe consequences for product safety, structural integrity, and regulatory compliance. Addressing these cybersecurity concerns through robust encryption protocols, secure authentication mechanisms, regular software updates, and comprehensive data protection strategies is crucial for building and maintaining user trust in advanced NDT technologies. Leading providers are increasingly emphasizing their commitment to secure data handling and system integrity in their offerings to reassure potential clients.

- Additionally, the relatively high initial cost of some advanced NDT equipment and software platforms compared to traditional methods can be a barrier to adoption, particularly for smaller businesses, independent service providers, or organizations with budget constraints. While more standardized and potentially lower-cost digital NDT tools are emerging, premium technologies such as robotic inspection systems, advanced ultrasonic arrays, and sophisticated data analytics software often come with a significant capital investment. This can slow down the adoption rate, especially for end-users who may not immediately perceive a return on investment that justifies the higher upfront expenditure.

North America Non-destructive Testing Services and Equipment Market Scope

The market is segmented on the type, method, service, vertical.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Method |

|

|

By Service |

|

|

By Vertical |

|

North America Non-destructive Testing Services and Equipment Market Scope

The market is segmented on the basis type, method, service, vertical.

- By Type

On the basis of type, the North America Non-destructive Testing Services and Equipment market is segmented into radiography testing equipment, ultrasonic testing equipment, magnetic particle testing equipment, liquid penetrant testing equipment, visual inspection equipment, eddy current equipment, other technologies. The radiography testing equipment segment dominates the largest market revenue share of 29.2% in 2025, The need for high-penetration inspection capabilities in industries like oil & gas and heavy manufacturing. The ability of radiographic methods to detect subsurface flaws in thick materials makes it indispensable for ensuring the safety and reliability of critical components. Furthermore, the advancements in digital radiography, offering faster image acquisition and enhanced analysis, are driving its adoption over traditional film-based techniques. The increasing focus on weld integrity and corrosion detection in pipelines and pressure vessels further fuels the demand for advanced radiographic solutions.

The ultrasonic testing equipment segment is anticipated to witness the fastest growth rate of 19.2% from 2025 to 2032, The versatility and cost-effectiveness of ultrasonic testing equipment are key drivers in the North American market. Its ability to inspect a wide range of materials and detect various types of defects without causing damage makes it a preferred choice across numerous industries. The increasing adoption of composite materials, particularly in the aerospace sector, necessitates advanced ultrasonic techniques like phased array. Moreover, the demand for portable and user-friendly ultrasonic testing equipment for on-site inspections and the growing emphasis on preventative maintenance across industries contribute significantly to market growth.

- By Method

On the basis of method, the North America Non-destructive Testing Services and Equipment market is segmented into visual inspection, surface inspection, volumetric inspection. The visual inspection held the largest market revenue share in 2025 of, driven by its fundamental role as the first line of defense in quality control across various industries. Its cost-effectiveness and ease of implementation make it a universally applied NDT method. Increasing awareness regarding surface defects and their potential impact on structural integrity, coupled with stringent aesthetic standards in manufacturing, fuels the demand for thorough visual inspection. Advancements in digital imaging and analysis tools are also enhancing the capabilities and reliability of visual inspection, further driving its adoption for detailed surface assessments.

The surface inspection segment is expected to witness the fastest CAGR from 2025 to 2032, The surface inspection segment in North America is driven by the critical need to identify surface-breaking discontinuities that can lead to premature failure in components and structures. Industries with high safety and reliability requirements, such as aerospace, automotive, and power generation, heavily rely on techniques like liquid penetrant testing and magnetic particle testing to detect these flaws. The increasing demand for high-quality surface finishes and the need to prevent corrosion and fatigue cracking are significant factors driving the adoption of effective surface inspection methods. Furthermore, advancements in automated surface inspection systems are enhancing efficiency and accuracy drive the market growth

- By Service

On the basis of service, the North America Non-destructive Testing Services and Equipment market is segmented into inspection services, equipment rental services, calibration services, and training services. The inspection services held the largest market revenue share in 2025, The demand for Non-destructive testing services in North America is driven by the need for specialized expertise and independent verification of asset integrity across industries. Outsourcing inspections allows companies to access advanced techniques and certified personnel without significant capital investment. Regulatory compliance and the aging infrastructure requiring regular assessments further fuel the growth of this service-oriented segment.

The equipment rental services segment held a significant market share in 2025. Equipment rental services is driven by cost-effectiveness and flexibility. Renting allows businesses, especially SMEs, to access advanced NDT equipment for specific projects without the burden of ownership and maintenance costs. This model is particularly attractive for short-term needs and for evaluating equipment before making purchase decisions.

- By Vertical

On the basis of vertical, the North America non-destructive testing services and equipment market is segmented into manufacturing, oil and gas, aerospace and defence, public infrastructure, automotive, and power generation. The oil and gas segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. Due to the critical need for ensuring the safety and integrity of extensive pipeline networks, storage tanks, and processing facilities. Stringent regulations concerning environmental protection and operational safety mandate regular and thorough inspections to prevent leaks, corrosion, and structural failures. The harsh operating environments and the transportation of hazardous materials further amplify the importance of reliable NDT methods, driving demand for advanced inspection technologies and specialized service providers.

U.S. North America Non-destructive Testing Services and Equipment Market Insight

The U.S. North America Non-destructive Testing Services and Equipment market captured the largest revenue share of 52.1% within Germany in 2025, fueled by the stringent U.S. safety regulations across industries like aerospace, energy, and infrastructure are a primary driver for the NDT market. The aging infrastructure necessitates frequent inspections for safety and longevity. Increasing adoption of advanced materials requiring sophisticated testing and a strong focus on quality control in manufacturing further fuel market growth. Technological advancements enhancing inspection efficiency also contribute significantly.

Canada North America Non-destructive Testing Services and Equipment Market Insight

The Canada North America Non-destructive Testing Services and Equipment market is poised to grow at the fastest CAGR of over 24.1% in 2025, In Canada the vast and often remote infrastructure necessitates reliable Non-destructive Testing Services and Equipment for maintenance and safety. Increasing adoption of advanced Non-destructive Testing Services and Equipment techniques for quality assurance and the growing demand for specialized inspection services further drive the market growth in Canada.

North America Non-destructive Testing Services and Equipment Market Share

The North America Non-destructive Testing Services and Equipment industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- Fujilim Corporation (Japan)

- Ashtead Group plc (U.K.)

- SOCOMORE (U.S.)

- Mistras Group (U.S.)

- Olympus Corporation (Japan)

- Nikon Metrology NV. (U.S.)

- Magnaflux (U.S.)

- Zetec Inc. (U.S.)

- Eddfyi (Canada)

- Sonatest (U.K.)

- Carestream Health (U.S.)

- Intertek Group Plc (U.K.)

- SGS SA (U.S.)

Latest Developments in North America Non-destructive Testing Services and Equipment Market

- In July 2023, Waygate Technologies enhanced the Krautkrämer USM 100 ultrasonic testing device to improve performance and functionality for NDT applications across various sectors. The upgraded USM 100 offers improved sensitivity and ease of use, facilitating more accurate and efficient inspections.

- October 2023, Creaform (AMETEK, Inc.) Updated the VXintegrity surface damage assessment tool to version 3.0, providing enhanced features for non-destructive testing. The software update offers an easy-to-use method for users to access Finite Element Analysis (FEA) simulations for Level III evaluations and utilize American Petroleum Institute (API) 579 standard tools for Level I and II evaluations.

- October 2024 NDT Global (Eddyfi NDT) launched a new 56-inch ultrasonic inline inspection tool developed in partnership with Aramco, tailored for large-diameter pipelines. The tool is designed to meet the specific inspection needs of large-diameter pipelines, enhancing the efficiency and accuracy of inspections.

- October 2022, ICR Integrity Launched the INSONO methodology for inspecting composite repairs on metallic components. The INSONO technology is designed to confirm the condition and longevity of composite repairs, offering operators confidence regarding the usage and long-term performance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Nondestructive Testing Services And Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Nondestructive Testing Services And Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Nondestructive Testing Services And Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.