North America Nucleic Acid Isolation Purification Market

Market Size in USD Billion

CAGR :

%

USD

3.46 Billion

USD

7.65 Billion

2024

2032

USD

3.46 Billion

USD

7.65 Billion

2024

2032

| 2025 –2032 | |

| USD 3.46 Billion | |

| USD 7.65 Billion | |

|

|

|

|

Nucleic Acid Isolation and Purification Market Size

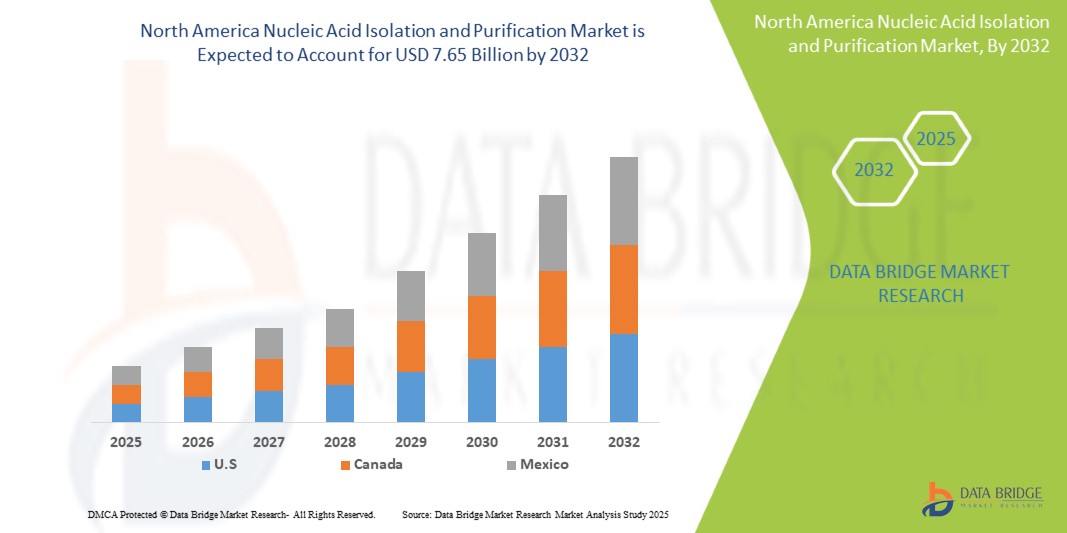

- The North America nucleic acid isolation and purification market was valued at USD 3.46 billion in 2024 and is expected to reach USD 7.65 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.0%, primarily driven by the anticipated launch of new treatment devices

- This growth is driven by factors such as the increasing prevalence of genetic disorders, particularly in developing countries, drives the demand for increasing demand for diagnostic testing

Nucleic Acid Isolation and Purification Analysis

- The increasing demand for nucleic acid-based diagnostics, personalized medicine, and biopharmaceutical research has significantly driven the need for efficient nucleic acid isolation and purification technologies

- In addition, advancements in automation, magnetic bead-based separation, and microfluidic platforms are enhancing the speed, yield, and accuracy of nucleic acid extraction, supporting high-throughput applications in clinical and research settings

- For instance, the market for nucleic acid isolation and purification shows notable growth in regions like Asia-Pacific, where expanding biotech sectors and increased R&D funding are accelerating technology adoption

- In conclusion, the convergence of growing application areas and continuous innovation in isolation techniques is fostering robust market expansion, enabling improved molecular diagnostics, drug discovery, and genomic research globally

Report Scope and Nucleic Acid Isolation and Purification Segmentation

|

Attributes |

Nucleic Acid Isolation and Purification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nucleic Acid Isolation and Purification Market Trends

“Growing Applications of Liquid Biopsy In Non-Invasive Diagnostics”

- Liquid biopsy, which analyzes circulating nucleic acids (DNA, RNA, exosomes) in bodily fluids such as blood, enables early detection, monitoring, and personalized treatment of various diseases, particularly cancer.

- The complexity of extracting high-quality nucleic acids from these diverse and often fragmented samples requires advanced isolation and purification technologies

- For instance, Liquid biopsy, combined with high-throughput omics technologies, is transforming disease management through non-invasive, personalized diagnostics. Expanding use across diverse biofluids and integration into clinical practice highlight its growing utility. Standardization, improved protocols, and biomarker discovery are driving nucleic acid purification advancements, enabling more accurate, accessible, and individualized patient care

- The rise of liquid biopsy as a non-invasive diagnostic tool offers significant opportunities for the nucleic acid isolation and purification market.

- As liquid biopsy is increasingly used for early disease detection and treatment monitoring, there is a growing need for advanced purification technologies capable of extracting high-quality nucleic acids from complex biological fluids.

Nucleic Acid Isolation and Purification Market Dynamics

Driver

“Rising Investment in Genomics Research”

- The influx of funding from governments, private sectors, and research institutions worldwide has intensified the need for reliable and high-quality nucleic acid isolation to support large-scale sequencing projects, gene editing, biomarker discovery, and personalized medicine initiatives.

- This investment boosts demand for efficient and accurate purification systems that ensure DNA and RNA samples meet the quality required for advanced applications like CRISPR, Next-Generation Sequencing (NGS), and other genomic tools

- As research expands, so does the requirement for scalable, high-throughput isolation methods, reinforcing market growth and driving innovation in nucleic acid purification technologies

For instance,

- In December 2022, as per BMJ, the government was planning to invest more than USD 190.54 million into improving the diagnosis of rare genetic diseases in newborns, improving cancer diagnoses, and tackling health inequalities as part of its three-year plan. As investment increases, there are new innovations in this field that act as drivers of market growth

- In September 2023, according to NHGRI, the National Human Genome Research Institute (NHGRI) accelerates genomics research by funding and collaborating with scientists across government, public, and private institutions. Through initiatives like the All of Us Research Program and ENCODE, NHGRI supports research on genetic variations and their impact on health. Partnerships extend to technology advancements in sequencing and data analysis, enhancing genomic tools and knowledge-sharing. This collaborative approach aims to drive breakthroughs in precision medicine and public health

- Increased investment in genomics research propels the nucleic acid isolation and purification market, as more funding supports advanced genetic studies and the development of targeted treatments

- This demand for high-quality DNA and RNA purification grows with expanded applications like NGS and CRISPR, creating a need for scalable, efficient isolation solutions to support cutting-edge genomics

Opportunity

“Rise In Technological Advancements and Automation”

- Technological innovations such as fully automated extraction systems, high-throughput sequencing, and microfluidics are enhancing accuracy, speed, and scalability in genetic research and diagnostics

- By reducing manual intervention, these advancements minimize human error and improve consistency in sample processing. They cater to the growing demand in genomics, proteomics, and personalized medicine by enabling labs to process larger sample volumes with precision and efficiency

For instance,

- In December 2023, as per Technology Networks, Thermo Fisher Scientific Inc., a global leader in scientific services, has launched the Thermo Scientific KingFisher Apex Dx, an automated nucleic acid purification instrument, along with the Applied Biosystems MagMAX Dx Viral/Pathogen NA Isolation Kit. These products work together to enable the isolation and purification of viral and bacterial pathogens from respiratory samples. Designed for In Vitro Diagnostic (IVD) and In Vitro Diagnostic Regulation (IVD-R) compliance, these automated solutions provide laboratories with enhanced reliability for downstream testing results

- In November 2023, Elsevier highlighted that, the development of RNA/DNA automated extraction and purification devices for infectious disease diagnosis signifies a pivotal advancement in biotechnology, highlighting the rise in technological innovations and automation within the field. These devices streamline complex laboratory workflows, enabling rapid and precise sample processing that is crucial for accurate diagnosis, especially during disease outbreaks. Technological advancements have led to more compact, efficient, and user-friendly systems, reducing manual intervention and enhancing throughput and reliability. Automation not only minimizes errors but also increases the speed of diagnostic processes, supporting timely clinical decisions and improving patient outcomes. The integration of these advanced technologies is transforming diagnostics, making them more accessible, scalable, and adaptable to various healthcare settings

- The rapid advancements in technology and automation are transforming the nucleic acid isolation and purification market by boosting accuracy, efficiency, and integration with downstream processes

- These innovations enable labs to meet growing demand across genomics, diagnostics, and personalized medicine with higher throughput and reduced costs. As these technologies become more widely accessible, they expand research and diagnostic capabilities, driving broader adoption in labs and institutions worldwide, ultimately accelerating progress across numerous scientific and medical fields

Restraint/Challenge

“Technical Difficulties in Nucleic Acid Isolation Across Different Sample Types”

- Different sample sources, such as blood, tissue, urine, and saliva, present unique challenges due to the varying levels of nucleic acid concentrations, the presence of inhibitors, and the complexity of the biological matrix

- Blood samples may contain low amounts of circulating free DNA or RNA, while tissue samples can be more challenging due to the high levels of contaminants and cellular components that interfere with nucleic acid extraction

- Also, certain samples, like those from formalin-fixed paraffin-embedded tissues, require specialized methods to prevent degradation or loss of nucleic acids during the isolation process

For instance,

- In September 2020, article published by APOS stated, biological samples such as saliva or urine contain low concentrations of nucleic acids, requiring highly sensitive protocols to ensure accurate extraction. Tissues, particularly those with high levels of proteins or lipids, often present obstacles in separating pure nucleic acids without contamination. Also, samples like FFPE tissues are subjected to formalin fixation, which cross-links nucleic acids and makes extraction more difficult. However, overcoming the inherent complexities of different sample types remains a critical focus for future developments, ensuring that nucleic acid extraction and isolation methods are adaptable, efficient, and scalable for a broad range of clinical and research applications

- In September 2020,as per Complex sample matrices often contain inhibitors that interfere with nucleic acid amplification, reducing test sensitivity and reliability. Effective lysis and extraction methods must avoid these inhibitors while remaining compatible with simplified workflows. Balancing performance with portability is essential for adapting nucleic acid purification processes to field-ready, point-of-need diagnostic platforms

- Technical challenges in isolating nucleic acids from various sample types, such as blood, tissue, and urine, create obstacles in the nucleic acid purification market

- These samples often present low nucleic acid yields, inhibitors, or complex biological matrices, requiring specialized methods for effective extraction

North America Nucleic Acid Isolation and Purification Market Scope

North America nucleic acid isolation and purification market is categorized into five notable segments the basis of product, method, type, sample type, and end user.

|

Segmentation |

Sub-Segmentation |

|

BY PRODUCT |

|

|

BY METHOD |

|

|

BY TYPE |

|

|

BY SAMPLE TYPE |

|

|

BY END USER |

|

U.S. Nucleic Acid Isolation and Purification Market Regional Analysis

“U.S. is the Dominant region in the Nucleic Acid Isolation and Purification Market”

- U.S. is the dominant country in the nucleic acid isolation and purification market due to its well-established biotechnology and pharmaceutical industries, along with high investment in genomic research and precision medicine

- Furthermore, the presence of major market players, robust healthcare infrastructure, and increasing demand for molecular diagnostics contribute to the U.S. market leadership

- Additionally, strong government funding for research initiatives and widespread adoption of advanced automation technologies further enhance U.S.’s position in the North America market

“U.S. is Projected to Register the Highest CAGR in Market”

- U.S. is projected to register strong growth in the North America nucleic acid isolation and purification market, driven by expanding biotechnology sectors and increasing investments in life sciences research

- Furthermore, the growing adoption of personalized medicine, rising demand for molecular diagnostics, and a surge in academic and clinical research activities are contributing to market expansion

- Additionally, supportive government initiatives, improving healthcare infrastructure, and the presence of emerging biotech startups are expected to further accelerate the adoption of nucleic acid isolation and purification technologies in the U.S.

Nucleic Acid Isolation and Purification Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina Inc. (U.S.)

- PerkinElmer (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- QIAGEN (Germany)

- Takara Bio Inc. (Japan)

- MACHEREY-NAGEL GmbH & Co. KG (Germany)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- Merck KGaA (Germany)

- Cytiva (Danaher Corporation) (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Promega Corporation (U.S.)

- New England Biolabs (U.S.)

- Omega Bio-tek, Inc. (U.S.

- Zymo Research Corporation (U.S.)

Latest Developments in Nucleic Acid Isolation and Purification

- In April 2025 , Analytik Jena has introduced a new 1536-tip tray for the CyBio Well vario, enabling parallel pipetting in 1536 channels with volumes ranging from 100 nL to 8 µL. This innovation, ideal for high-throughput applications, ensures high accuracy, minimal reagent consumption, and supports sustainable, reproducible laboratory workflows

- In March 2024 , Analytik Jena has launched the multi N/C x300 series of TOC/TNb analyzers, offering user-friendly design, flexible automation, and intuitive software. Ideal for environmental and pharmaceutical applications, these analyzers ensure high throughput, reliability, and low operational costs, enabling efficient sample preparation, calibration, and maintenance with pharma-compliant data integrity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 DEFINITION AND IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

5.2 NORTH AMERICA REGULATORY SCENARIO

5.3 EUROPE REGULATORY SCENARIO

5.4 REGULATORY SUBMISSIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF GENETIC DISORDERS

6.1.2 INCREASING DEMAND FOR DIAGNOSTIC TESTING

6.1.3 RISING INVESTMENT IN GENOMICS RESEARCH

6.1.4 INCREASE IN LAUNCH OF DIAGNOSTIC PRODUCTS

6.2 RESTRAINTS

6.2.1 RISKS ASSOCIATED WITH SAMPLE CONTAMINATION

6.2.2 HIGH COST OF EQUIPMENT AND REAGENTS

6.3 OPPORTUNITIES

6.3.1 RISE IN TECHNOLOGICAL ADVANCEMENTS AND AUTOMATION

6.3.2 INCREASING ADOPTION OF NEXT-GENERATION SEQUENCING (NGS)

6.3.3 GROWING APPLICATIONS OF LIQUID BIOPSY IN NON-INVASIVE DIAGNOSTICS

6.4 CHALLENGES

6.4.1 TECHNICAL DIFFICULTIES IN NUCLEIC ACID ISOLATION ACROSS DIFFERENT SAMPLE TYPES

6.4.2 ENVIRONMENTAL AND SUSTAINABILITY CONCERNS

7 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE

7.1 OVERVIEW

7.2 NEXT GENERATION SEQUENCING (NGS)

7.3 GENOMIC DNA ISOLATION AND PURIFICATION

7.4 TOTAL RNA ISOLATION AND PURIFICATION

7.5 PCR CLEAN-UP

7.6 PLASMID DNA ISOLATION AND PURIFICATION

7.7 MESSENGER RNA ISOLATION AND PURIFICATION

7.8 CIRCULATING NUCLEIC ACID ISOLATION AND PURIFICATION

7.9 MICRORNA ISOLATION AND PURIFICATION

7.1 OTHERS

8 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 HOMOGENIZER

8.2.2 SPECTROPHOTOMETERS

8.2.3 FLUOROMETERS

8.2.4 OTHERS

8.2.4.1 Benchtop

8.2.4.2 Standalone

8.2.4.2.1 Automated

8.2.4.2.2 Manual

8.3 KITS

8.3.1 DNA ISOLATION & PURIFICATION KITS

8.3.2 RNA ISOLATION & PURIFICATION KITS

8.3.3 VIRAL NUCLEIC ACID ISOLATION KITS

8.3.4 PLASMID PURIFICATION KIT

8.3.5 PCR AND GEL KIT

8.3.6 OTHERS

8.3.6.1 MAGNETIC BEAD-BASED KIT

8.3.6.2 COLUMN-BASED KIT

8.3.6.3 REAGENT-BASED KIT

8.3.6.3.1 VIRAL/PATHOGEN NUCLEIC ACID ISOLATION KIT

8.3.6.3.2 PLANT DNA ISOLATION KIT

8.3.6.3.3 CELL-FREE TOTAL NUCLEIC ACID KIT

8.3.6.3.4 CELL-FREE DNA ISOLATION KIT

8.3.7 GENOMIC DNA PURIFICATION KIT

8.3.8 VIRAL RNA/DNA PURIFICATION KIT

8.3.9 PLANT DNA PURIFICATION KIT

8.3.10 MICROBIOME DNA PURIFICATION KIT

8.3.11 OTHERS

8.3.12 MAGNETIC BEAD-BASED KIT

8.3.13 COLUMN-BASED KIT

8.3.14 REAGENT-BASED KIT

8.3.15 VIRAL/PATHOGEN NUCLEIC ACID ISOLATION KIT

8.3.16 MRNA PURIFICATION KIT

8.3.17 PLANT RNA ISOLATION KIT

8.3.18 CELL-FREE NUCLEIC ACID ISOLATION KIT

8.3.19 OTHERS

8.3.20 RNA ISOLATION KIT

8.3.21 MI RNA ISOLATION KIT

8.3.22 VIRAL RNA/DNA KIT

8.3.23 MAGNETIC BEAD-BASED KITS

8.3.24 VIRAL SPIN-COLUMN KITS

8.4 REAGENTS

8.4.1 DNA ISOLATION REAGENT

8.4.2 RNA ISOLATION REAGENT

8.4.3 OTHERS

9 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY SAMPLE TYPE

9.1 OVERVIEW

9.2 FFPE SAMPLES

9.3 BLOOD CELLS

9.4 BACTERIA, YEAST, AND PLANTS

9.5 CELL-FREE SAMPLES

9.6 CULTURED CELLS

9.7 MAMMALIAN CELLS

9.8 BRAIN AND KIDNEY TISSUE

9.9 OTHERS

10 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY METHOD

10.1 OVERVIEW

10.2 MAGNETIC BEAD-BASED ISOLATION AND PURIFICATION

10.3 COLUMN -BASED ISOLATION AND PURIFICATION

10.4 REAGENT-BASED ISOLATION AND PURIFICATION

10.5 OTHERS

11 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTICS

11.2.1 INSTRUMENTS

11.2.2 KITS

11.2.3 REAGENTS

11.3 DRUG DISCOVERY AND DEVELOPMENT

11.3.1 INSTRUMENTS

11.3.2 KITS

11.3.3 REAGENTS

11.4 PERSONALIZED MEDICINE

11.4.1 INSTRUMENTS

11.4.2 KITS

11.4.3 REAGENTS

11.5 AGRICULTURE AND ANIMAL RESEARCH

11.5.1 INSTRUMENTS

11.5.2 KITS

11.5.3 REAGENTS

11.6 OTHERS

12 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND DIAGNOSTIC CENTERS

12.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.4 CONTRACT RESEARCH ORGANIZATIONS

12.5 CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATION (CDMO)

12.6 ACADEMIC/RESEARCH INSTITUTES

12.7 OTHERS

13 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MERCK KGAA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 CYTIVA (DANAHER CORPORATION)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 AGILENT TECHNOLOGIES, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 BIO-RAD LABORATORIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 F. HOFFMANN-LA ROCHE LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ANALYTIK JENA GMBH+CO. KG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AUTOGEN, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DAAN GENE CO., LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 HIMEDIA LABORATORIES

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ILLUMINA, INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 KURABO INDUSTRIES LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 LGC BIOSEARCH TECHNOLOGIES

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MACHEREY-NAGEL GMBH & CO. KG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MAGGENOME TECHNOLOGIES PVT. LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 MEDOX BIOTECH INDIA PVT. LTD.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MERIDIAN BIOSCIENCE, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NEW ENGLAND BIOLABS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NORGEN BIOTEK CORP.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 OMEGA BIO-TEK, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PCR BIOSYSTEMS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 PERKINELMER

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 PROMEGA CORPORATION

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 QIAGEN

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENTS/NEWS

16.25 SAGE SCIENCE, INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TAKARA BIO INC.

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 THERMO FISHER SCIENTIFIC INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 TIANGEN BIOTECH (BEIJING) CO.,LTD.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 XI'AN TIANLONG SCIENCE AND TECHNOLOGY CO., LTD

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 ZYMO RESEARCH CORPORATION

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA NEXT GENERATION SEQUENCING (NGS) IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA GENOMIC DNA ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA TOTAL RNA ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA PCR CLEAN-UP IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PLASMID DNA ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA MESSENGER RNA ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA CIRCULATING NUCLEIC ACID ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA MICRORNA ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 15 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 16 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA DNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 23 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 24 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 27 NORTH AMERICA RNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 30 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 31 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 33 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 34 NORTH AMERICA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 36 NORTH AMERICA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 37 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 40 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 41 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY SAMPLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA FFPE SAMPLES IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA BLOOD CELLS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA BACTERIA, YEAST, AND PLANTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA CELL-FREE SAMPLES IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA CULTURED CELLS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA MAMMALIAN CELLS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA BRAIN AND KIDNEY TISSUE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHERS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA MAGNETIC BEAD-BASED ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA COLUMN-BASED ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA REAGENT-BASED ISOLATION AND PURIFICATION IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA OTHERS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA DIAGNOSTICS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA DIAGNOSTICS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA DRUG DISCOVERY AND DEVELOPMENT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA DRUG DISCOVERY AND DEVELOPMENT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA PERSONALIZED MEDICINE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA PERSONALIZED MEDICINE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA AGRICULTURE AND ANIMAL RESEARCH IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA AGRICULTURE AND ANIMAL RESEARCH IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA OTHERS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA HOSPITALS AND DIAGNOSTIC CENTERS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATION (CDMO) IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ACADEMIC/RESEARCH INSTITUTES IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA OTHERS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 76 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 77 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA DNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 84 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 86 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 87 NORTH AMERICA RNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 90 NORTH AMERICA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 91 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 93 NORTH AMERICA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 94 NORTH AMERICA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 96 NORTH AMERICA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (ASP)

TABLE 97 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 99 NORTH AMERICA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 100 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA DIAGNOSTICS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA DRUG DISCOVERY AND DEVELOPMENT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA PERSONALIZED MEDICINE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA AGRICULTURE AND ANIMAL RESEARCH IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY SAMPLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 112 U.S. INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 113 U.S. INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. DNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 U.S. MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 119 U.S. MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 120 U.S. COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.S. COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 122 U.S. COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 123 U.S. RNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 126 U.S. MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 127 U.S. COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 129 U.S. COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 130 U.S. VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 132 U.S. VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (ASP)

TABLE 133 U.S. REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 135 U.S. REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 136 U.S. NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.S. NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. DIAGNOSTICS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. DRUG DISCOVERY AND DEVELOPMENT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. PERSONALIZED MEDICINE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. AGRICULTURE AND ANIMAL RESEARCH IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY SAMPLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 148 CANADA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 149 CANADA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA DNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 155 CANADA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 156 CANADA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 158 CANADA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 159 CANADA RNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 162 CANADA MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 163 CANADA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 165 CANADA COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 166 CANADA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 168 CANADA VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (ASP)

TABLE 169 CANADA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 171 CANADA REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 172 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA DIAGNOSTICS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA DRUG DISCOVERY AND DEVELOPMENT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA PERSONALIZED MEDICINE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 CANADA AGRICULTURE AND ANIMAL RESEARCH IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY SAMPLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 184 MEXICO INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 185 MEXICO INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO INSTRUMENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO DNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 191 MEXICO MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 192 MEXICO COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 194 MEXICO COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 195 MEXICO RNA ISOLATION & PURIFICATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 198 MEXICO MAGNETIC BEAD-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 199 MEXICO COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 201 MEXICO COLUMN-BASED KIT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 202 MEXICO VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 204 MEXICO VIRAL NUCLEIC ACID ISOLATION KITS IN NUCLEIC ACID ISOLATION, BY TYPE, 2018-2032 (ASP)

TABLE 205 MEXICO REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 207 MEXICO REAGENTS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 208 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO DIAGNOSTICS IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO DRUG DISCOVERY AND DEVELOPMENT IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO PERSONALIZED MEDICINE IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO AGRICULTURE AND ANIMAL RESEARCH IN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY SAMPLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 LINE CHART, BY PRODUCT (2024)

FIGURE 15 THREE SEGMENTS COMPRISE THE NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET, BY PRODUCT (2024)

FIGURE 16 INCREASING PREVALENCE OF GENETIC DISORDERS IS EXPECTED TO DRIVE THE NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 17 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET

FIGURE 19 DISTRIBUTION OF REPORTED GENETIC CONDITIONS AMONG CHILDREN BY AGE GROUP (AGES 0–17)

FIGURE 20 DISTRIBUTION OF REPORTED GENETIC CONDITIONS AMONG CHILDREN BY GENDER

FIGURE 21 DISTRIBUTION OF REPORTED GENETIC CONDITIONS AMONG CHILDREN BY RACE AND ETHNICITY

FIGURE 22 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY TYPE, 2024

FIGURE 23 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 24 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 25 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY PRODUCT, 2024

FIGURE 27 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 28 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 29 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 30 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY SAMPLE TYPE, 2024

FIGURE 31 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY SAMPLE TYPE, 2025-2032 (USD THOUSAND)

FIGURE 32 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY SAMPLE TYPE, CAGR (2025-2032)

FIGURE 33 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY METHOD, 2024

FIGURE 35 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY METHOD, 2025-2032 (USD THOUSAND)

FIGURE 36 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY METHOD, CAGR (2025-2032)

FIGURE 37 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY METHOD, LIFELINE CURVE

FIGURE 38 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY APPLICATION, 2024

FIGURE 39 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 40 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 41 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 42 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY END USER, 2024

FIGURE 43 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 44 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY END USER, CAGR (2025-2032)

FIGURE 45 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 46 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: SNAPSHOT (2024)

FIGURE 47 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.