North America Operating Room Equipment Supplies Market

Market Size in USD Billion

CAGR :

%

USD

7.59 Billion

USD

12.75 Billion

2025

2033

USD

7.59 Billion

USD

12.75 Billion

2025

2033

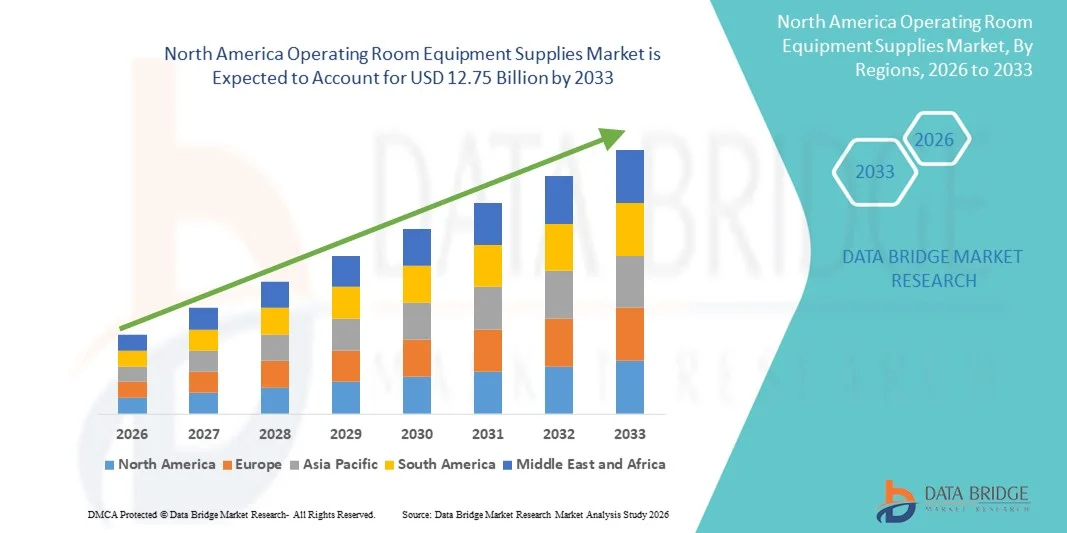

| 2026 –2033 | |

| USD 7.59 Billion | |

| USD 12.75 Billion | |

|

|

|

|

North America Operating Room Equipment Supplies Market Size

- The North America operating room equipment supplies market size was valued at USD 7.59 billion in 2025 and is expected to reach USD 12.75 billion by 2033, at a CAGR of 6.7% during the forecast period

- The market growth is largely fueled by the increasing number of surgical procedures, rising hospital infrastructure investments, and technological advancements in surgical instruments and disposable OR supplies

- Furthermore, the growing focus on improving patient safety, reducing infection risks, and enhancing surgical efficiency is driving demand for high-quality, reliable operating room equipment and consumables. These converging factors are accelerating the adoption of advanced OR solutions, thereby significantly boosting the industry's growth

North America Operating Room Equipment Supplies Market Analysis

- Operating room equipment supplies, including surgical instruments, consumables, and specialized devices, are increasingly vital components of modern healthcare infrastructure in both hospitals and outpatient surgical centers due to their role in enhancing surgical precision, patient safety, and procedural efficiency

- The escalating demand for operating room equipment supplies is primarily fueled by the rising number of surgical procedures, increasing hospital infrastructure investments, and growing focus on infection control and patient outcomes

- The United States dominated the operating room equipment supplies market with the largest revenue share of 62.7% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and the presence of key industry players

- Canada is expected to be the fastest growing country in the operating room equipment supplies market during the forecast period due to increasing healthcare infrastructure development, rising healthcare expenditure, and growing demand for advanced surgical solutions

- Instruments segment dominated the operating room equipment supplies market with a market share of 49.5% in 2025, driven by their critical role in ensuring procedural accuracy, safety, and compatibility with advanced surgical technologies

Report Scope and North America Operating Room Equipment Supplies Market Segmentation

|

Attributes |

North America Operating Room Equipment Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Operating Room Equipment Supplies Market Trends

Advancements in Minimally Invasive and Robotic-Assisted Surgery

- A significant and accelerating trend in the North America operating room equipment supplies market is the increasing adoption of minimally invasive and robotic-assisted surgical technologies, which enhance procedural precision, reduce patient recovery time, and improve surgical outcomes

- For instance, the da Vinci Surgical System is widely used in hospitals across the U.S., enabling surgeons to perform complex procedures with enhanced dexterity and control, while reducing the need for large incisions

- Integration of advanced imaging, navigation, and robotic instruments in operating rooms allows real-time visualization and improved surgical accuracy, driving demand for specialized consumables and instruments compatible with these systems

- Hospitals are increasingly outfitting ORs with interconnected surgical platforms that streamline workflow, reduce procedure time, and enhance safety, enabling seamless operation of robotic tools alongside traditional surgical instruments

- This trend towards more precise, technology-driven, and efficient surgical solutions is fundamentally reshaping expectations for OR performance, leading companies such as Medtronic to develop advanced minimally invasive instruments and robotic-compatible consumables

- The demand for OR equipment that supports robotic-assisted and minimally invasive surgeries is growing rapidly across hospitals and surgical centers, as healthcare providers increasingly prioritize patient safety, efficiency, and outcome improvements

- Adoption of smart OR management systems is increasing, integrating equipment tracking, inventory management, and predictive maintenance to optimize operational efficiency and reduce procedural delays

- The rise of tele-surgery and remote-assisted surgical procedures is creating opportunities for equipment that enables high-fidelity communication, real-time imaging, and remote collaboration between surgeons and specialists

North America Operating Room Equipment Supplies Market Dynamics

Driver

Increasing Surgical Volume and Hospital Infrastructure Investments

- The rising number of surgical procedures, coupled with significant investments in hospital infrastructure, is a major driver of demand for operating room equipment supplies

- For instance, in March 2025, Hologic, Inc. announced expansion of its surgical equipment offerings for outpatient centers, focusing on high-volume minimally invasive procedures to meet growing healthcare needs

- As hospitals aim to improve patient safety and surgical outcomes, advanced OR supplies, including disposable surgical tools, imaging equipment, and precision instruments, are increasingly adopted

- Furthermore, the focus on upgrading operating rooms to accommodate modern surgical technologies is driving consistent demand for compatible equipment and consumables across healthcare facilities

- Rising healthcare expenditure, coupled with government initiatives supporting hospital modernization, is propelling adoption of innovative OR solutions in both public and private hospitals, boosting overall market growth

- Increasing prevalence of chronic diseases and an aging population are driving higher demand for surgeries, thereby boosting consumption of operating room equipment supplie

- Strategic partnerships and collaborations between medical device manufacturers and healthcare providers are accelerating product adoption and facilitating the introduction of cutting-edge OR technologies

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high cost of advanced surgical instruments, robotic systems, and disposable OR consumables can limit adoption, particularly in smaller hospitals or budget-constrained facilities

- For instance, expensive robotic-assisted surgical tools such as Intuitive Surgical’s da Vinci system require substantial upfront investment, which may deter some healthcare providers from upgrading their ORs

- Strict regulatory standards for surgical instruments and consumables, including FDA approvals, pose challenges for manufacturers and hospitals in ensuring compliance before deployment

- Maintaining sterilization standards, patient safety, and regulatory documentation adds complexity and cost to OR equipment adoption, particularly for novel technologies and high-precision instruments

- While hospitals continue to modernize, overcoming cost and compliance challenges through innovative financing, modular equipment solutions, and streamlined regulatory pathways will be vital for sustained market growth

- Limited trained surgical personnel to operate advanced OR equipment can slow adoption, especially in smaller or rural hospitals where specialized training is less accessible

- Supply chain disruptions for high-quality surgical instruments and consumables can create delays in procurement, affecting hospital operations and limiting widespread equipment adoption

North America Operating Room Equipment Supplies Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the market is segmented into instruments and accessories. Instruments dominated the market with the largest revenue share of 49.5% in 2025, driven by their critical role in ensuring procedural accuracy, safety, and compatibility with advanced surgical technologies. Hospitals and specialty surgical centers prioritize high-quality surgical instruments for their precision and durability, especially in complex procedures such as cardiovascular and neurosurgeries. The adoption of robotic-assisted and minimally invasive surgeries has further fueled demand for sophisticated instruments, including laparoscopic tools and precision orthopedic devices. Manufacturers continuously innovate instruments to improve ergonomics, sterilization efficiency, and procedural outcomes, which enhances their market appeal. Strong hospital budgets and high surgical volumes in the U.S. contribute to the sustained dominance of this segment. Instruments are also preferred due to regulatory compliance and established clinical trust compared to newer disposable alternatives.

Accessories are anticipated to witness the fastest growth rate of 7.8% from 2026 to 2033, fueled by rising demand for supporting consumables such as drapes, sutures, surgical trays, and specialty disposables. Accessories complement surgical instruments and are essential for infection control, efficiency, and procedural standardization. The surge in single-use and disposable OR consumables, driven by stringent infection prevention guidelines, is boosting growth in this segment. In addition, growing investments in outpatient surgical centers and specialty hospitals increase the demand for reliable, cost-effective accessories that ensure safe and smooth surgical workflows. Hospitals are increasingly opting for accessory kits tailored to specific procedures, which also promotes rapid adoption.

- By Application

On the basis of application, the market is segmented into orthopedic and trauma surgeries, cardiovascular surgeries, gastrointestinal surgeries, nephrology, neurosurgeries, oncosurgery, general surgery, and others. Orthopedic and Trauma Surgeries dominated the market with a 28.6% share in 2025, driven by the increasing prevalence of musculoskeletal disorders, fractures, and sports-related injuries. Advanced instruments such as bone drills, orthopedic implants, and fixation devices are in high demand, particularly in U.S. hospitals performing joint replacement and trauma repair procedures. The rise in minimally invasive orthopedic techniques has further increased the adoption of precision surgical tools. Aging populations and active lifestyles contribute to higher surgical volumes, supporting market dominance. Hospitals and specialty centers prioritize state-of-the-art orthopedic instruments to improve patient outcomes and reduce recovery time. The segment also benefits from reimbursement support for orthopedic surgeries in the U.S., incentivizing the procurement of high-quality equipment.

Neurosurgeries are expected to witness the fastest growth rate of 8.5% from 2026 to 2033, driven by increasing neurological disorders, spinal surgeries, and advancements in robotic-assisted neurosurgical procedures. Surgeons require high-precision instruments and specialized disposables for brain and spinal operations, boosting demand. The integration of navigation systems, imaging devices, and minimally invasive neurosurgical tools is accelerating adoption. In addition, hospitals are investing in neurosurgery-capable ORs to handle complex cases efficiently. Growing awareness of neurological conditions and early diagnosis trends also contribute to rising surgical volumes, further supporting segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty surgical centers, and ambulatory surgery centers. Hospitals dominated the market with the largest revenue share of 57.2% in 2025, owing to high surgical volumes, established infrastructure, and the ability to invest in advanced OR equipment and instruments. Hospitals perform a wide range of procedures across multiple specialties, requiring diverse OR supplies and instruments. High patient inflow, government funding for hospital upgrades, and focus on improving patient outcomes support sustained dominance. Hospitals also benefit from in-house sterilization and maintenance capabilities, which increases the efficiency of instrument utilization. Large hospitals often implement robotic-assisted and minimally invasive surgeries, driving demand for sophisticated instruments.

Specialty Surgical Centers are anticipated to witness the fastest growth rate of 9.1% from 2026 to 2033, driven by the rise of focused surgical care models such as orthopedic, ophthalmic, and outpatient cardiac centers. These centers prioritize efficiency, patient turnover, and procedure-specific instruments, creating strong demand for specialized OR equipment. The expansion of ambulatory and elective surgery services in the U.S. is further accelerating adoption. Centers increasingly adopt disposable accessories and minimally invasive instruments to reduce turnaround time and improve procedural safety. Growth is also supported by partnerships with medical device manufacturers offering customized surgical kits for high-volume procedures.

North America Operating Room Equipment Supplies Market Regional Analysis

- The United States dominated the operating room equipment supplies market with the largest revenue share of 62.7% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and the presence of key industry players

- Healthcare providers in the country prioritize high-quality, reliable instruments and consumables that enhance surgical precision, patient safety, and procedural efficiency across multiple specialties

- This widespread adoption is further supported by high healthcare expenditure, strong regulatory frameworks ensuring patient safety, and the presence of major medical device manufacturers, establishing the U.S. as the leading market for operating room equipment supplies in the region

U.S. Operating Room Equipment Supplies Market Insight

The U.S. operating room equipment supplies market captured the largest revenue share of 62.7% in 2025 within North America, fueled by increasing surgical volumes, advanced hospital infrastructure, and rising investments in modern OR technologies. Healthcare providers are prioritizing high-quality surgical instruments, disposables, and accessories to improve patient safety, procedural efficiency, and surgical outcomes. The growing adoption of minimally invasive and robotic-assisted surgeries, alongside integrated OR management systems, is further propelling market growth. In addition, the presence of leading medical device manufacturers and high healthcare expenditure supports continuous innovation and uptake of advanced equipment. The U.S. market remains the most mature and technologically advanced within North America, driving the region’s overall dominance.

Canada Operating Room Equipment Supplies Market Insight

The Canada operating room equipment supplies market is anticipated to witness the fastest growth in North America during the forecast period, driven by increasing investments in hospital modernization and the expansion of specialty surgical centers. Rising awareness of patient safety, infection control, and surgical efficiency is accelerating adoption of high-quality instruments, disposable consumables, and advanced OR accessories. Government initiatives to improve healthcare infrastructure and the growing prevalence of chronic diseases contribute to higher surgical volumes, supporting market expansion. Canadian hospitals are increasingly adopting minimally invasive and robotic-assisted surgical technologies, further boosting demand. The trend toward tele-surgery and connected OR systems also positions Canada as a rapidly growing market within the region.

Mexico Operating Room Equipment Supplies Market Insight

The Mexico operating room equipment supplies market is projected to expand steadily during the forecast period, driven by rising investments in healthcare infrastructure, modernization of hospitals, and increasing surgical procedures in urban centers. Growing awareness of surgical safety, infection control, and adoption of advanced medical technologies are fueling demand for quality OR instruments and disposable consumables. Government initiatives supporting healthcare access and hospital upgrades are accelerating the modernization of surgical facilities. In addition, collaborations between international medical device manufacturers and local distributors are improving the availability of advanced equipment. The adoption of minimally invasive procedures and telemedicine-compatible OR technologies is also contributing to the growth of the Mexican market.

North America Operating Room Equipment Supplies Market Share

The North America Operating Room Equipment Supplies industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- Stryker (U.S.)

- STERIS plc (U.S.)

- Medtronic (Ireland)

- Zimmer Biomet. (U.S.)

- CONMED Corporation (U.S.)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- Arthrex, Inc. (U.S.)

- Hill‑Rom Holdings, Inc. (U.S.)

- Mizuho OSI (U.S.)

- Getinge AB (Sweden)

- Olympus Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Drägerwerk AG & Co. KGaA (Germany)

- Smith+Nephew (U.K.)

- GE Healthcare (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

What are the Recent Developments in North America Operating Room Equipment Supplies Market?

- In January 2025, Mindray North America launched its first‑ever surgical table the HyBase V6 Surgical Table marking its entry into the OR‑table segment and expanding its footprint in the operating room equipment space. The new table is designed for flexibility across a range of patient profiles and surgical procedures, offering ergonomic comfort, unobstructed access and easier device accommodation, aimed at improving OR workflow and patient positioning

- In March 2024, Getinge announced the U.S. launch of the Maquet Corin OR Table along with the Maquet Ezea Surgical Light at the Association of periOperative Registered Nurses Conference (AORN) 2024 providing hospitals with new solutions to streamline surgical workflows, enhance patient and staff safety, and improve OR efficiency through smart-table capabilities and optimized lighting

- In February 2024, Virtual Incision Corporation received U.S. regulatory clearance (FDA marketing authorization) for the MIRA™ Surgical System, which is the world’s first miniaturized robotic-assisted surgery (miniRAS) device approved for adult colectomy procedures broadening access to robotic-assisted surgery even in settings with limited space or resources, and signaling growing adoption of compact, less‑resource‑intensive robotic systems in North America ORs

- In January 2023, GE HealthCare announced it would acquire IMACTIS a firm specializing in CT‑guided interventional navigation systems to strengthen its interventional guidance and image‑guided therapy capabilities in the U.S. market. The acquisition expands the reach of advanced CT‑navigation technologies used during minimally invasive and percutaneous procedures in OR

- In December 2022, Mindray released its new HyLED C Series surgical lights designed for improved illumination, flexible positioning, and optimized lighting conditions in operating rooms. According to Mindray, the HyLED C Series offers features such as multi‑patch illumination for consistent light field, adjustable light spot size and color temperature, and ergonomic controls enhancing visibility and surgical precision for both open and minimally invasive surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.