North America Ophthalmic Operational Microscope Market

Market Size in USD Million

CAGR :

%

USD

579.52 Million

USD

1,089.41 Million

2024

2032

USD

579.52 Million

USD

1,089.41 Million

2024

2032

| 2025 –2032 | |

| USD 579.52 Million | |

| USD 1,089.41 Million | |

|

|

|

|

North America Ophthalmic Operational Microscope Market Analysis

The North America ophthalmic operational microscope market is expanding rapidly, driven by advancements in technology and a growing focus on improving surgical outcomes in eye care. These microscopes are essential for performing precise eye surgeries, such as cataract removals, retinal surgeries, and glaucoma treatments, offering superior magnification and illumination. The increasing demand for personalized medicine and precision healthcare is propelling the adoption of these high-end instruments. Moreover, the rise in chronic diseases like diabetes, which can lead to various vision complications, further fuels the market’s growth. Technological innovations, along with a well-established healthcare infrastructure, are key factors driving the demand for ophthalmic microscopes in the region.

North America Ophthalmic Operational Microscope Market Size

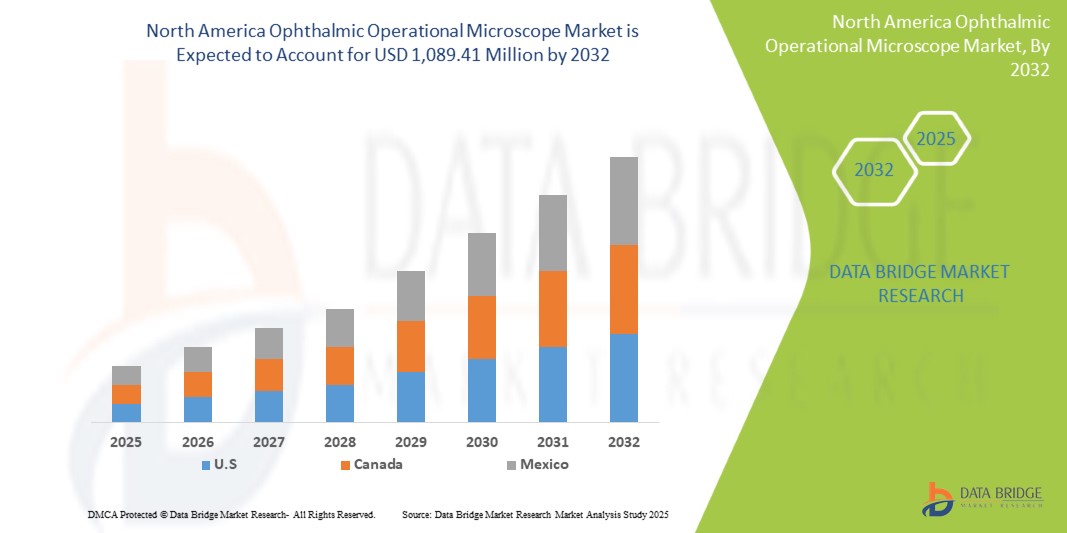

North America ophthalmic operational microscope market is expected to reach USD 1,089.41 million by 2032 from USD 579.52 million in 2024, growing at a CAGR of 8.2% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

North America Ophthalmic Operational Microscope Market Trends

“Increased Adoption of 3D Imaging and Digital Integration”

One prominent trend in the North America ophthalmic operational microscope market is the growing adoption of 3D imaging and digital integration. These advanced features enhance the precision and accuracy of ophthalmic surgeries by providing surgeons with high-definition, stereoscopic views of the eye’s internal structures. 3D imaging technology offers better depth perception, enabling surgeons to visualize intricate details of the retina, cornea, and other delicate tissues, which is crucial for complex procedures like retinal surgery or cataract removal. Digital integration also allows for the seamless capture of high-resolution images and videos during surgeries, facilitating better documentation and post-operative analysis. This trend is revolutionizing the way ophthalmic surgeries are performed, improving patient outcomes and increasing the demand for technologically advanced microscopes in the market.

Report Scope and North America Ophthalmic Operational Microscope Market Segmentation

|

Attributes |

North America Ophthalmic Operational Microscope Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Turkey, Netherlands, Switzerland, Austria, Poland, Norway, Ireland, Hungary, Lithuania, Rest of Europe, China, Japan, India, South Korea, Australia, Taiwan, Philippines, Thailand, Malaysia, Vietnam, Indonesia, Singapore, Rest of Asia-Pacific, Brazil, Argentina, Chili, Colombia, Peru, Venezuela, Ecuador, Uruguay, Paraguay ,Bolivia, Trinidad And Tobago, Curaçao, Rest Of South America, South Africa, Saudi Arabia, U.A.E, Egypt, Israel, Kuwait, Rest of Middle East and Africa, Guatemala, Costa Rica, Honduras, EL Salvador, Nicaragua, and Rest of Central America |

|

Key Market Players |

Carl Zeiss Meditec AG (Germany), Danaher Corporation (Leica Microsystems) (U.S.), Alcon Inc. (Switzerland), Topcon Corporation (Japan), and Bausch + Lomb (Canada), Takagi Seiko Co., Ltd. (Japan), Möller-Wedel Optical (Germany), Seiler Instrument & Manufacturing Co. (U.S.), Nidek Co., Ltd. (Japan), and Takara Sunoptic Technologies (U.S.). Additionally, Mitaka USA, Inc. (U.S.), Visionix (France), Heine Optotechnik (Germany), and Ocular Instruments (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Ophthalmic Operational Microscope Market Definition

he North America Ophthalmic Operational Microscope Market pertains to the sector involved in the development, manufacturing, distribution, and use of advanced microscopes specifically designed for ophthalmic surgeries and eye care procedures. These microscopes provide high magnification and detailed visualization, essential for a range of delicate eye surgeries, including cataract removal, retinal repair, glaucoma surgery, and corneal transplants. With superior optics, adjustable magnification, high-definition imaging, and ergonomic designs, ophthalmic operational microscopes allow surgeons to conduct procedures with greater precision and accuracy, minimizing risks and improving patient outcomes. The market in North America, particularly in the United States and Canada, has seen significant growth, primarily due to several factors. The region is home to some of the most advanced healthcare systems, with extensive investments in medical technology, leading to the increased adoption of cutting-edge ophthalmic equipment. Additionally, the growing prevalence of age-related eye conditions, such as cataracts and macular degeneration, along with the rising incidence of chronic diseases like diabetes, which can cause diabetic retinopathy, is driving the demand for ophthalmic surgeries.

North America Ophthalmic Operational Microscope Market Dynamics

Drivers

- Growing Need Due To Prevalence Of Eye Diseases

The rising prevalence of eye diseases such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy is significantly contributing to the increased demand for ophthalmic operational microscopes. As the North America population ages, the incidence of these conditions continues to grow, with older adults being more prone to various vision impairments that require surgical intervention. Cataracts, in particular, are one of the most common causes of blindness worldwide, necessitating surgical procedures that demand high levels of precision. Similarly, the increasing cases of glaucoma and age-related macular degeneration require highly skilled ophthalmic surgeons to perform intricate surgeries with utmost accuracy to preserve vision.

The ongoing advancements in the field of ophthalmology further highlight the need for cutting-edge equipment, such as operational microscopes, that offer high-definition imaging, magnification, and better lighting to support delicate surgeries. As more individuals seek treatment for these conditions, the demand for operational microscopes rises, ensuring improved surgical outcomes and reducing the risks associated with eye surgeries. The growing prevalence of eye diseases, particularly in aging populations, directly drives the demand for ophthalmic operational microscopes, thereby acting as a key driver for the market’s expansion.

For Instances,

- In July 2022, according to the article published by National Center for Biotechnology Information, the rising prevalence of blindness with age, particularly among individuals aged 70-79 years (4.11%) and those ≥80 years (11.62%), highlights the growing demand for ophthalmic interventions. This trend acts as a key driver for the North America ophthalmic operational microscope market, as it increases the need for advanced surgical tools and technologies to address age-related vision impairments.’

- In December 2021, according to the article published by National Center for Biotechnology Information, the North America population is aging rapidly, with Australia projected to have nearly 25% of its population aged 65 years and older by 2066. Older individuals experience significantly higher healthcare needs, including eye diseases. This increase in age-related health issues drives demand for advanced ophthalmic care, acting as a key driver for the growth of the North America ophthalmic operational microscope market.

As a result of the rising prevalence of eye diseases such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy, there is a significant increase in the demand for ophthalmic operational microscopes. The aging North America population contributes to the higher incidence of these conditions, which require precise surgical intervention. Cataracts, being a leading cause of blindness, demand highly accurate surgeries, while glaucoma and macular degeneration also necessitate delicate procedures to preserve vision. With the growing need for high-definition imaging, magnification, and advanced lighting, the demand for these specialized microscopes rises, acting as a key driver for the expansion of the ophthalmic operational microscope market.

- Impact of an Aging Population on Ophthalmic Care

The aging population worldwide is a significant driver of the ophthalmic operational microscope market. As individuals age, they become more susceptible to a wide range of age-related eye conditions, including cataracts, glaucoma, macular degeneration, and diabetic retinopathy, all of which require surgical intervention. Cataracts, in particular, are highly prevalent among the elderly, leading to an increased demand for cataract surgeries that rely heavily on operational microscopes to ensure precision and optimal outcomes.

The elderly population grows, so does the need for regular eye examinations and surgeries to treat vision-threatening conditions. This demographic shift results in a higher volume of complex ophthalmic procedures, which demand advanced surgical tools, such as operational microscopes, that offer enhanced visualization, magnification, and illumination. The growing elderly population, coupled with the rising number of eye-related health concerns, directly contributes to the increased demand for ophthalmic operational microscopes, making it a key driver for the expansion of the market.

For Instance,

- In November 2022, according to the article published in National Institute on Aging, Vision impairment and blindness are closely linked to aging, with India home to 25% of the world’s visually impaired population. As India’s population ages, the demand for vision care services is expected to rise. This demographic shift drives the need for advanced ophthalmic treatments.

- In July 2022, according to the article published in The Ocular Surface, Dry Eye Disease (DED), a common age-related condition, is influenced by changes in the ocular surface microenvironment due to aging. As the North America population ages, the prevalence of DED and other vision-related issues increases, leading to greater demand for advanced ophthalmic treatments. This aging trend acts as a significant driver for the growth of the North America ophthalmic operational microscope market.

The aging population across the globe plays a crucial role in driving the growth of the ophthalmic operational microscope market. As people age, they become more prone to various eye conditions, such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy, all of which often require surgical intervention. Cataracts, a common issue among the elderly, significantly increase the demand for cataract surgeries, where operational microscopes are essential for precision and successful outcomes. Furthermore, the increasing number of older individuals requiring eye surgeries, regular checkups, and treatments for vision-threatening conditions leads to a higher demand for advanced ophthalmic equipment. This demographic trend directly boosts the need for ophthalmic operational microscopes, making it a vital driver for market growth.

Opportunities

- Advancing Ophthalmology with Artificial Intelligence Integration

The integration of Artificial Intelligence (AI) in ophthalmic microscopes can act as a significant opportunity for the North America Ophthalmic Operational Microscope Market. AI-powered ophthalmic microscopes can enhance visualization, automate tasks, and improve diagnostic accuracy, enabling surgeons to make more informed decisions during surgical procedures. AI algorithms can analyze real-time images and provide instant feedback on surgical procedures, helping surgeons identify potential complications, such as retinal tears or detachment. Additionally, AI-powered microscopes can also assist in image analysis, enabling surgeons to review and compare images, track patient progress, and make more accurate diagnoses.

For Instance,

- In January 2025, according to an article published in the JMA Journal, AI algorithms, particularly those based on deep learning, can analyze retinal images with high accuracy, identifying and grading the severity of DR. These systems can quickly and efficiently process large volumes of images, reducing the burden on ophthalmologists and improving screening coverage. The ability of AI to detect early-stage DR and predict disease progression is crucial for timely intervention, which can significantly delay or even reverse the progression of the disease.

- In November 2023, according to an article published in the National Library of Medicine, AI plays a pivotal role in optimizing postoperative visual outcomes, guiding the surgeon’s actions, and assessing the procedure’s effectiveness. The amount of data generated during the operation contributes to the indispensability of AI as a tool for enhancing patient outcomes.

The integration of AI in ophthalmic microscopes can also lead to improved patient outcomes, reduced recovery times, and enhanced quality of life. By leveraging AI-powered image analysis, surgeons can identify patients at risk for complications and take proactive measures to prevent them. Furthermore, AI-powered microscopes can also enable personalized medicine and surgical planning, allowing surgeons to create individualized treatment plans based on patient-specific anatomical and physiological data. With AI-powered ophthalmic microscopes, the North America Ophthalmic Operational Microscope Market can expand its capabilities, improve surgical outcomes, and provide better care for patients, ultimately driving growth and expansion for the market.

- Government Initiatives Driving Technological Adoption in Ophthalmology

The increase in governmental initiatives presents a significant opportunity for the North America Ophthalmic Operational Microscope Market by fostering advancements in healthcare infrastructure and accessibility. Governments worldwide are increasingly recognizing the importance of eye health and are implementing programs aimed at improving ophthalmic services. These initiatives often include funding for research and development, subsidized healthcare services, and public awareness campaigns about the importance of regular eye examinations. Such supportive policies not only enhance the overall standards of medical care but also drive demand for advanced ophthalmic technologies, including operational microscopes, as healthcare facilities strive to adopt state-of-the-art equipment to provide high-quality treatment.

For Instance,

In August 2021, according to an article, ‘Digital Transformation in Ophthalmic Clinical Care During the COVID-19 Pandemic’, Over the past decade in Scotland, a government-led initiative known as the Scottish Eyecare Integration Project introduced electronic digital image exchange to aid referrals from community optometrists to hospital eye services. This is reported to have greatly reduced outpatient waiting times and improved patient satisfaction, and contributing to an online university education platform.

Moreover, government support often extends to partnerships with private sector stakeholders, further enhancing innovation and facilitating access to cutting-edge ophthalmic solutions. Increased funding for hospitals and clinics can lead to the modernization of medical equipment, creating a robust market for advanced operational microscopes. Additionally, fiscal incentives and grants provided by governments for healthcare upgrades can encourage healthcare providers to invest in new technologies, thereby propelling market growth. As eye conditions become more prevalent North Americaly, the collaboration between government initiatives and the private sector can significantly accelerate the adoption of operational microscopes, ultimately improving patient outcomes and expanding the market's reach.

Restraints/Challenges

- High Equipment Costs Hindering Market Penetration

The high cost of ophthalmic operational microscopes poses a significant challenge for the North America Ophthalmic Operational Microscope Market, particularly affecting the purchasing decisions of healthcare facilities, especially in developing regions. These microscopes, which are essential for performing intricate eye surgeries, can often range from tens of thousands to several hundred thousand dollars. This substantial financial barrier can deter smaller clinics and hospitals with limited budgets from upgrading their equipment or investing in new technologies, leading to a reliance on outdated tools. Consequently, such limitations can result in disparities in the quality of care and access to advanced surgical procedures, ultimately hindering the overall growth of the market.

For Instance,

- In November 2024, according to an article published by the Ningbo Haishu HONYU Opto-Electro Co., Ltd One of the main concerns surrounding the high cost of ophthalmic surgical microscopes is its potential impact on healthcare affordability and accessibility. The high cost of ophthalmic surgical microscopes adds to this burden, as it limits the ability of healthcare facilities to invest in the latest technology and equipment, thereby affecting the quality of care provided to patients.

Furthermore, the high cost of equipment creates a ripple effect throughout the healthcare system, as facilities must also consider maintenance, training, and operational expenses associated with sophisticated ophthalmic microscopes. Hospitals may face challenges in justifying the significant investment required, particularly in regions where reimbursement rates for ophthalmic surgeries are limited. The financial pressures can lead to budgeting constraints, forcing healthcare providers to prioritize essential services over capital investment in advanced surgical technologies. This situation can stifle innovation and slow the adoption of modern techniques, which are necessary for improving patient outcomes and advancing the field of ophthalmology, thereby restraining the overall growth potential of the North America market for ophthalmic operational microscopes.

- Competitive Market Dynamics Challenging Brand Differentiation

The intense competition within the North America ophthalmic operational microscope market presents a significant challenge for manufacturers striving to differentiate their products and maintain market share. With numerous established players and new entrants vying for position, companies are compelled to innovate continuously and develop advanced features to attract customers. This competition often leads to pricing pressures, forcing manufacturers to lower costs to stay competitive. As a result, companies may struggle to maintain healthy profit margins, potentially affecting their ability to invest in research and development, marketing, and after-sales support, which are essential for fostering brand loyalty and long-term success.

For Instance, in October 2020, OM-6 is the most excellent entry-level operating microscope, offering the world’s first LED light source in the entry-level/compact ophthalmic operating microscope. It provides solutions to the issue of bulb burnout as well as the troubles caused by damages to the light guides. OM-6 offers the outstanding optical performance in terms of brightness, wide field of view and the deep focal depth.

Furthermore, this competitive landscape can lead to market saturation, where many similar products exist, making it challenging for specific brands to stand out. In an environment where differentiation is crucial, companies must not only focus on the technological superiority of their microscopes but also enhance customer service, training programs, and value-added services to create a comprehensive offering. The effort required to navigate this competitive dynamic can stretch resources thin and lead to strategic misalignments, particularly for smaller firms that may lack the financial and operational capacity to compete effectively against larger, well-established brands. This scenario can stifle innovation and limit the overall growth potential of the ophthalmic operational microscope market.

North America Ophthalmic Operational Microscope Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Application

- Cataract Surgery

- Phacoemulsification

- Extracapsular Cataract Extraction (Ecce)

- Corneal Surgery

- Lasik

- Keratoplasty

- Retinal Surgery

- Vitrectomy

- Retinal Detachment Surgery

- Macular Hole Repair

- Glaucoma Surgery

- Laser-Assisted Procedures

- Trabeculectomy

- Others

- Cataract Surgery

Product Type

- Product Type

- Devices

- Floor-Standing Microscopes

- Ceiling-Mounted Microscopes

- Table-Mounted Microscopes

- Wall-Mounted Microscopes

- Accessories

- Lenses

- Cameras

- Light Sources

- Filters

- Eyepieces/Binoculars

- Heads-Up Displays (Huds)

- Others

- Devices

Technology

- Technology

- Hybrid Microscopes

- Digital Microscopes

- Optical Microscopes

Magnification Type

- Magnification Type

- Variable Magnification

- Fixed Magnification

End User

- Hospitals

- Ophthalmology Clinics

- Ambulatory Surgical Centers (Ascs)

- Others

Distribution Channel

- Direct Sales

- Distributor Sales

North America Ophthalmic Operational Microscope Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, application, product type, technology, magnification type, end user, and distribution channel as referenced above.

The countries covered in the market U.S., Canada, and Mexico.

U.S. is expected to dominate and the fastest growing in North America ophthalmic operational microscope market due to advanced healthcare infrastructure and increasing demand for eye surgeries. In addition, technological innovations and a growing aging population further drive this trend.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and up stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Ophthalmic Operational Microscope Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Ophthalmic Operational Microscope Market Leaders Operating in the Market Are:

- Carl Zeiss Meditec AG (Germany)

- Danaher Corporation (Leica Microsystems) (U.S.)

- Alcon Inc. (Switzerland)

- Topcon Corporation (Japan)

- Bausch + Lomb (Canada)

- Takagi Seiko Co., Ltd. (Japan)

- Möller-Wedel Optical (Germany)

- Seiler Instrument & Manufacturing Co. (U.S.)

- Nidek Co., Ltd. (Japan)

- Takara Sunoptic Technologies (U.S.)

- Mitaka USA, Inc. (U.S.)

- Visionix (France)

- Heine Optotechnik (Germany)

- Ocular Instruments (U.S.)

Latest Developments in North America Ophthalmic Operational Microscope Market

- In January 2025, Bausch + Lomb Corporation, a North America leader in eye health, has announced the commercial launch of its enVista Aspire monofocal and toric intraocular lenses (IOLs) in the European Union, following the receipt of a CE Mark. The enVista Aspire lenses feature Intermediate Optimized optics, offering a broader depth of focus compared to traditional spherical and lower-order aspheric IOLs, while maintaining the benefits of the enVista® platform. The lenses are glistening-free and use StableFlex™ Technology for efficient unfolding and optic recovery. For astigmatism patients, the enVista Aspire Toric IOLs provide an effective solution with a +0.90-cylinder design and enhanced rotational stability, designed to treat astigmatism during cataract surgery

- In October 2024, At the AAO 2024 meeting, Alcon showcased its innovations, including the Voyager DSLT for glaucoma treatment, UNIFEYE and UNIPEXY handheld gas delivery systems, and pivotal data for AR-15512, a dry eye treatment. These advancements aimed to improve outcomes and surgical efficiency

- In September 2024, At the 42nd ESCRS Congress in Barcelona, Alcon presented new data supporting cataract surgery at more physiologic IOP for patients with ocular comorbidities. The company also highlighted its surgical products, including PCIOLs, IOLs, and the Wavelight platform, emphasizing innovation and education

- In September 2024, Haag-Streit announced the launch of METIS, its cutting-edge ophthalmic microscope system, which brings superior optical performance into the operating room with exceptional clarity, a brilliant coaxial red reflex, and optimized optics for precise color reproduction, high light transmission, and an expansive depth of field, making it ideal for delicate ophthalmic procedures. It will be officially launched in Q1 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: REGULATIONS

5.1 REGULATORY AGENCIES AND AUTHORITIES:

5.2 NORTH AMERICA (UNITED STATES AND CANADA)

5.3 EUROPEAN UNION

5.4 ASIA-PACIFIC

5.5 LATIN AMERICA

5.6 MIDDLE EAST AND AFRICA

5.7 PRODUCT APPROVAL:

5.8 CLASSIFICATION OF DEVICES:

5.9 SAFETY AND EFFICACY REQUIREMENTS:

5.1 QUALITY CONTROL AND COMPLIANCE:

5.11 IMPORT AND EXPORT REGULATIONS:

5.12 CONCLUSION:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING NEED DUE TO PREVALENCE OF EYE DISEASES

6.1.2 IMPACT OF AN AGING POPULATION ON OPHTHALMIC CARE

6.1.3 ADVANCEMENTS IN OPHTHALMIC PROCEDURES DRIVING MARKET GROWTH

6.1.4 EXPANDING WORKFORCE OF EYE SURGEONS AND ITS MARKET IMPLICATIONS

6.2 RESTRAINTS

6.2.1 SHORTAGE OF SKILLED OPHTHALMIC PROFESSIONALS LIMITS MARKET GROWTH

6.2.2 REGULATORY BARRIERS DELAY PRODUCT DEVELOPMENT AND MARKET AVAILABILITY

6.3 OPPORTUNITIES

6.3.1 ADVANCING OPHTHALMOLOGY WITH ARTIFICIAL INTELLIGENCE INTEGRATION

6.3.2 GOVERNMENT INITIATIVES DRIVING TECHNOLOGICAL ADOPTION IN OPHTHALMOLOGY

6.3.3 GROWING DEMAND FOR MINIMALLY INVASIVE SURGERIES

6.4 CHALLENGES

6.4.1 HIGH EQUIPMENT COSTS HINDERING MARKET PENETRATION

6.4.2 COMPETITIVE MARKET DYNAMICS CHALLENGING BRAND DIFFERENTIATION

7 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 CATARACT SURGERY

7.2.1 PHACOEMULSIFICATION

7.2.2 EXTRACAPSULAR CATARACT EXTRACTION (ECCE)

7.3 CORNEAL SURGERY

7.3.1 LASIK

7.3.2 KERATOPLASTY

7.4 RETINAL SURGERY

7.4.1 VITRECTOMY

7.4.2 RETINAL DETACHMENT SURGERY

7.4.3 MACULAR HOLE REPAIR

7.5 GLAUCOMA SURGERY

7.5.1 LASER-ASSISTED PROCEDURES

7.5.2 TRABECULECTOMY

7.6 OTHERS

8 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DEVICES

8.2.1 FLOOR-STANDING MICROSCOPES

8.2.2 CEILING-MOUNTED MICROSCOPES

8.2.3 TABLE-MOUNTED MICROSCOPES

8.2.4 WALL-MOUNTED MICROSCOPES

8.3 ACCESSORIES

8.3.1 LENSES

8.3.2 CAMERAS

8.3.3 LIGHT SOURCES

8.3.4 FILTERS

8.3.5 EYEPIECES/BINOCULARS

8.3.6 HEADS-UP DISPLAYS (HUDS)

8.3.7 OTHERS

9 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 HYBRID MICROSCOPES

9.3 DIGITAL MICROSCOPES

9.4 OPTICAL MICROSCOPES

10 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY MAGNIFICATION TYPE

10.1 OVERVIEW

10.2 VARIABLE MAGNIFICATION

10.3 FIXED MAGNIFICATION

11 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 OPHTHALMOLOGY CLINICS

11.4 AMBULATORY SURGICAL CENTERS (ASCS)

11.5 OTHERS

12 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 DISTRIBUTOR SALES

13 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CARL ZEISS MEDITEC AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LEICA MICROSYSTEMS

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 ALCON INC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 TOPCON CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HAAG-STREIT AG

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 BAUSCH

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SEGMENTED REVENUE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENT

16.7 HEINE OPTOTECHNIK

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 MÖLLER-WEDEL OPTICAL GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 NIDEK CO., LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 OCULAR INSTRUMENTS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 SEILER INSTRUMENT INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 SUNOPTIC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 TAKAGI SEIKO CO., LTD

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 VISIONIX

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA CATARACT SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA CORNEAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA CORNEAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA RETINAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA RETINAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA GLAUCOMA SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA GLAUCOMA SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA ACCESSORIES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA ACCESSORIES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA HYBRID MICROSCOPES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA DIGITAL MICROSCOPES SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OPTICAL MICROSCOPES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY MAGNIFICATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA VARIABLE MAGNIFICATION IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA FIXED MAGNIFICATION IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA HOSPITALS IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA OPHTHALMOLOGY CLINICS IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA AMBULATORY SURGICAL CENTERS (ASCS) IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHERS IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA DIRECT SALES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA DISTRIBUTOR SALES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA CATARACT SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA CORNEAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA RETINAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA GLAUCOMA SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ACCESSORIES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY MAGNIFICATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. CATARACT SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. CORNEAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. RETINAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. GLAUCOMA SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. ACCESSORIES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY MAGNIFICATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA CATARACT SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA CORNEAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA RETINAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA GLAUCOMA SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA ACCESSORIES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY MAGNIFICATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 MEXICO CATARACT SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO CORNEAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO RETINAL SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO GLAUCOMA SURGERY IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO DEVICES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO ACCESSORIES IN OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY MAGNIFICATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO OPHTHALMIC OPERATIONAL MICROSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 RISING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET FROM 2025 TO 2032

FIGURE 13 THE CATARACT SURGERY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET IN 2025 AND 2032

FIGURE 14 MARKET OVERVIEW

FIGURE 15 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY APPLICATION, 2024

FIGURE 16 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 17 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 18 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 19 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY PRODUCT TYPE, 2025-2032 (USD MILLION)

FIGURE 21 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 22 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY TECHNOLOGY, 2024

FIGURE 24 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 25 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 26 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 27 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY MAGNIFICATION TYPE, 2024

FIGURE 28 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY MAGNIFICATION TYPE, 2025-2032 (USD MILLION)

FIGURE 29 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY MAGNIFICATION TYPE, CAGR (2025-2032)

FIGURE 30 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY MAGNIFICATION TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY END USER, 2024

FIGURE 32 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 33 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY END USER, CAGR (2025-2032)

FIGURE 34 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 36 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 37 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 38 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: SNAPSHOT (2024)

FIGURE 40 NORTH AMERICA OPHTHALMIC OPERATIONAL MICROSCOPE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.