North America Optical Fiber Components Market

Market Size in USD Billion

CAGR :

%

USD

2.72 Billion

USD

4.10 Billion

2024

2032

USD

2.72 Billion

USD

4.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.72 Billion | |

| USD 4.10 Billion | |

|

|

|

|

North America Optical Fiber Components Market Size

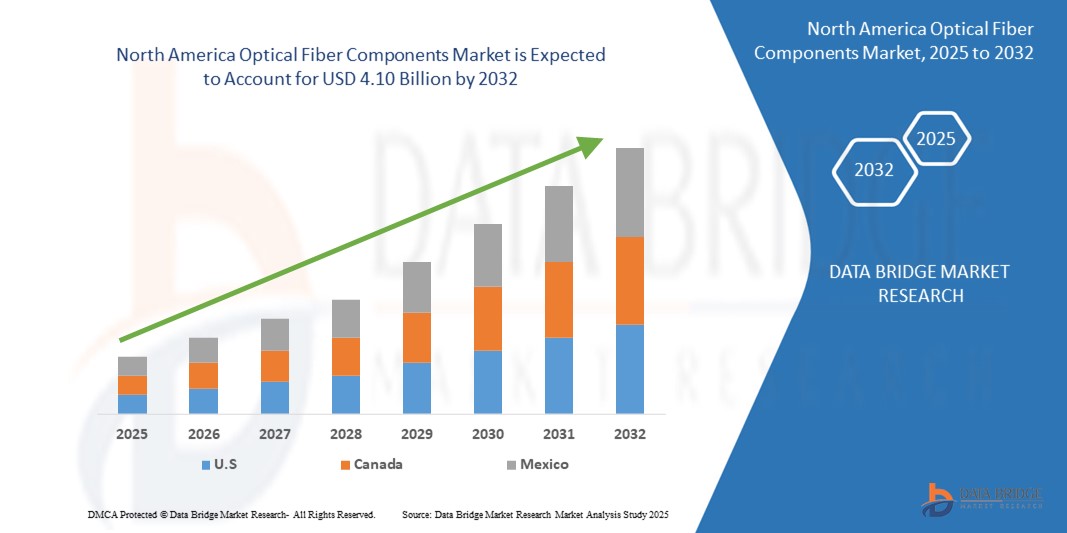

- The North America Optical Fiber Components Market was valued at USD 2.72 billion in 2025 and is expected to reach approximately USD 4.10 billion by 2032, growing at a CAGR of 6.03% during the forecast period...

- This growth is being fueled by rising investments in high-speed broadband networks, rapid 5G deployments, and the expansion of hyperscale data centers across the U.S. and Canada. In addition, increasing demand for low-latency connectivity, cloud-based services, and AI-driven digital infrastructure is prompting telecom operators and enterprises to upgrade to advanced fiber-optic components, including transceivers, WDM modules, and optical amplifiers.

North America Optical Fiber Components Market Analysis

- The North America optical fiber components market is witnessing strong momentum as the region undergoes rapid digital transformation across telecom, enterprise, and government sectors. With soaring demand for faster, more reliable internet—driven by 5G rollouts, cloud computing, and data center expansion—optical fiber components such as transceivers, cables, connectors, and WDM systems are becoming essential infrastructure.

- The U.S. is leading adoption, supported by significant federal investments in broadband expansion and rural connectivity under programs like BEAD (Broadband Equity, Access, and Deployment). Meanwhile, Canada is also accelerating fiber deployments to meet rising digital service needs across industries and communities.

- As enterprises modernize their networks to support AI, IoT, and edge computing, the need for high-bandwidth, low-latency fiber optic infrastructure is only increasing. At the same time, the transition from legacy copper networks to fiber is boosting demand for durable and scalable components.

- With tech-forward cities, hyperscale data center growth, and a mature telecom ecosystem, North America is expected to remain a critical growth hub for next-gen optical fiber component innovation and deployment

North America Optical Fiber Components Market Segmentation

|

Attributes |

North America Optical Fiber Components Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

The rapid rollout of 5G networks and the growing demand for hyperscale data centers across the U.S. and Canada are driving investments in high-performance optical fiber components to ensure ultra-low latency and high-speed data transmission..

Businesses across sectors are upgrading to fiber-based networks to support cloud computing, remote work, and real-time data exchange, boosting demand for transceivers, cables, and WDM components..

The shift toward edge computing in smart cities, manufacturing, and healthcare is creating new use cases for compact, high-capacity fiber components at the network edge—enhancing speed and reducing congestion.

Government-backed broadband expansion programs (like BEAD in the U.S.) and private investments by telecom operators are accelerating last-mile fiber deployments, especially in underserved rural areas.

Innovations like coherent optics, silicon photonics, and integrated optical amplifiers are pushing the performance boundaries of fiber components—offering opportunities for vendors to cater to evolving enterprise and telecom needs. |

|

Value Added Data Infosets |

|

North America Optical Fiber Components Market Trends

“Growing Role of AI and Automation in Fiber Network Monitoring and Optimization”

- A key trend reshaping the North America optical fiber components market is the integration of AI and automation in fiber network operations. Traditional fiber networks required manual diagnostics and scheduled maintenance, which often resulted in delayed fault detection and longer downtimes. However, with AI-powered network monitoring tools, telecom providers and data centers can now proactively detect signal degradation, anticipate component failure, and optimize traffic routing in real time.

- In the U.S. and Canada, where fiber networks form the backbone of 5G, cloud computing, and high-frequency financial services, the need for near-zero latency and uninterrupted uptime is driving the adoption of intelligent fiber monitoring systems. These systems leverage machine learning to analyze terabytes of optical signal data, identify usage anomalies, and recommend preventive actions—minimizing service disruptions and enhancing customer experience.

- Furthermore, automated provisioning and software-defined networking (SDN) capabilities are allowing telecom operators to reconfigure optical paths, adjust bandwidth, and manage cross-connections without manual intervention. This shift not only reduces operational expenses but also supports scalability as demand surges across smart cities, autonomous transport, and edge computing applications.

- As North America continues its digital infrastructure expansion, AI and automation are becoming essential for ensuring the efficiency, agility, and resilience of optical fiber networks. The convergence of optical hardware and intelligent software is no longer a luxury—it’s a competitive necessity.

North America Optical Fiber Components Market Dynamics

Driver

“Soaring Demand for High-Speed Connectivity and Cloud Infrastructure”

- The North American region is witnessing an unprecedented surge in bandwidth demand, driven by rapid cloud migration, video streaming, remote work, and next-gen technologies like AI, edge computing, and autonomous systems. From metro networks to hyperscale data centers, the need for faster, scalable, and low-latency connectivity is pushing enterprises and telecom providers to modernize their optical networks.

- Optical fiber components—such as transceivers, amplifiers, and WDM modules—are at the heart of this transition, enabling high-capacity transmission over longer distances with minimal signal loss. As cloud service providers expand data center footprints across the U.S. and Canada, demand for robust and modular optical infrastructure is climbing sharply.

- Moreover, the growing adoption of 5G is amplifying this need further. Fiber is essential to backhaul and fronthaul high-frequency 5G signals across distributed antenna systems and small cell networks. This convergence of cloud and mobile ecosystems is driving sustained investment in fiber optic technologies, with North America leading global deployment initiatives.

- With government incentives, private-public partnerships, and broadband expansion programs like the U.S. BEAD (Broadband Equity, Access, and Deployment) initiative, the fiber optics ecosystem is well-positioned for long-term, transformative growth across both urban and underserved areas.

Restraint/Challenge

“High Capital Investment and Complex Installation Processes

- Despite the robust outlook, one of the most significant challenges facing the North America optical fiber components market is the steep capital expenditure required for full-scale deployment. Laying fiber networks—especially in rural or underground environments—requires expensive trenching, permits, labor, and materials. Additionally, core components like DWDM systems, high-speed transceivers, and optical switches come with a high price tag

- Installation is also highly labor-intensive and often involves navigating legacy infrastructure, coordinating with multiple stakeholders, and overcoming zoning or regulatory hurdles. This slows down rollout timelines and adds logistical complexity for telecom operators and ISPs.

- For smaller enterprises and local network providers, these upfront costs can be prohibitive, limiting their ability to scale infrastructure quickly—even if demand is present. Moreover, the specialized skill sets required for fiber splicing, testing, and network optimization are still in short supply, adding further constraints to fast-track deployments.

- Without cost-effective, plug-and-play fiber solutions and broader workforce training, the pace of optical network modernization may face delays, especially in semi-urban and rural areas where ROI is less immediate.

The North America Optical Fiber Components Market is segmented based on component, system type, application, and end-user industry.

-

- By component

The market includes key components such as optical transceivers, optical amplifiers, optical cables, connectors, splitters, circulators, and WDM (Wavelength Division Multiplexing) components. Optical transceivers and cables hold the largest share due to their widespread use in high-speed data transmission across telecom and data center infrastructures.

-

- By Data Rate:

Segments include Up to 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and Above 100 Gbps. Demand for components supporting 100 Gbps and above is growing rapidly with the expansion of hyperscale data centers and 5G backhaul requirements across the U.S. and Canada.

- By Application

The primary applications are data communication, telecommunication, enterprise networking, industrial automation, and military & aerospace. Data communication and telecom are the dominant segments, driven by digital transformation initiatives and the growth of cloud infrastructure.

- By end-user industry

End users include telecom operators, data centers, government & defense, IT & ITeS, healthcare, BFSI, and education sectors. Telecom and hyperscale data centers are the largest consumers, while sectors like healthcare and BFSI are growing rapidly due to increased digitalization and data traffic.

North America Optical Fiber Components Market Regional Analysis

North America surface vision and inspection market insight.

The North America optical fiber components market is witnessing strong growth due to increasing demand for high-speed internet, 5G infrastructure, and data center expansion. The region’s digital transformation across telecom, IT, and enterprise sectors is creating a robust foundation for sustained fiber component deployment.

United States

The U.S. leads the North American market, supported by large-scale 5G rollouts, rising cloud consumption, and government-backed broadband initiatives like the BEAD program. Telecom providers are heavily investing in optical transceivers, WDM modules, and high-bandwidth cables to enable faster connectivity in metro, long-haul, and edge networks. Additionally, the growing adoption of fiber in healthcare and smart city projects is enhancing market traction.

Canada

Canada is focusing on modernizing its network backbone to support remote work, e-learning, and digital services across provinces. Investments are being channeled into rural broadband and urban fiber deployments. Canadian service providers are leveraging optical amplifiers and splitters to boost network efficiency, especially in enterprise and education sectors.

Mexico

Mexico's market is emerging with increased investments in optical cable infrastructure driven by expanding mobile connectivity and rising internet penetration. The growth of online streaming, fintech, and smart infrastructure initiatives is accelerating fiber component usage. While challenges such as cost and urban-rural disparity remain, government-private collaborations are expected to improve accessibility and network coverage.

The following companies are recognized as major players in the Global Surface Vision and Inspection market:

- Corning Incorporated (New York, USA)

- CommScope Inc. – (North Carolina, USA)

- Ciena Corporation – (Maryland, USA)

- Cisco Systems, Inc. – (California, USA)

- Lumentum Holdings Inc. – (California, USA)

- II-VI Incorporated (Coherent Corp.) – (Pennsylvania, USA)

- Viavi Solutions Inc. –( Arizona, USA)

- Belden Inc. – (Missouri, USA)

- Finisar Corporation – (California, USA)

- Prysmian Group – (Milan, Italy)

Latest Developments in North America Optical Fiber Components Market

- In January 2025, Corning announced stronger-than-expected revenue forecasts, driven by robust demand for its optical fiber products across AI-powered data centers and 5G backhaul infrastructure in North America.

- In October 2024, AT&T signed a multi-year fiber supply agreement worth over USD 1 billion with Corning, aiming to accelerate its fiber-to-the-home rollout and reach over 30 million locations by 2025.

- In April 2025, Corning introduced its next-generation high-density optical fiber cables at the OFC Conference, specifically designed to meet the bandwidth and latency requirements of AI-driven and hyperscale data centers.

- In early 2025, leading telecom operators in the U.S. began ramping up deployments of 400G optical modules to support the growing need for higher bandwidth and ultra-low latency in metropolitan and edge networks.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.