North America Optical Imaging Market

Market Size in USD Million

CAGR :

%

USD

292.00 Million

USD

548.53 Million

2024

2032

USD

292.00 Million

USD

548.53 Million

2024

2032

| 2025 –2032 | |

| USD 292.00 Million | |

| USD 548.53 Million | |

|

|

|

|

Optical Imaging Market Size

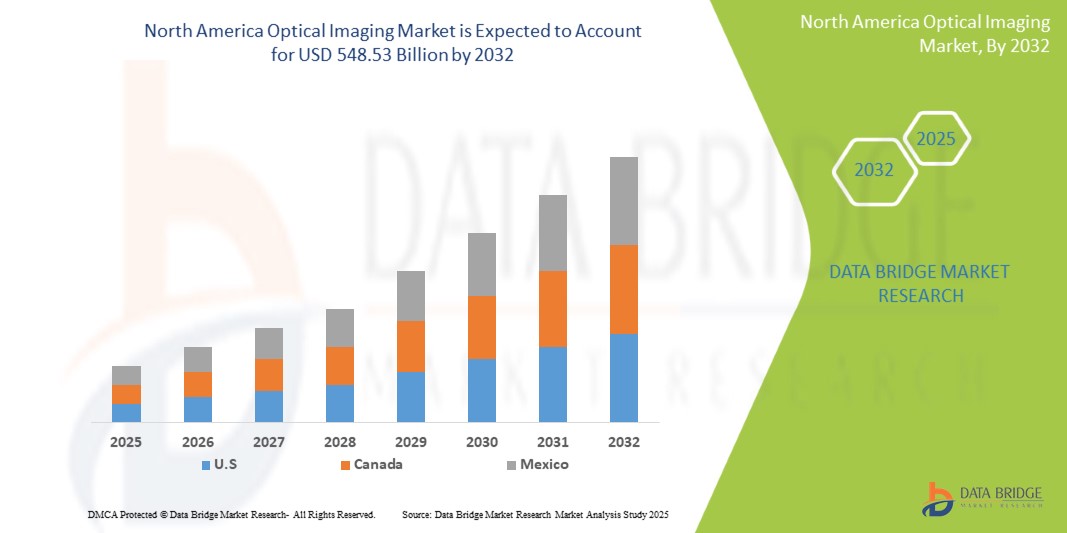

- The North America Optical Imaging Market size was valued at USD 292 Million in 2024 and is expected to reach USD 548.53 Million by 2032, at a CAGR of 8.2% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced imaging technologies in healthcare, including ophthalmology, oncology, and neurology, coupled with increasing demand for non-invasive diagnostic procedures

- Furthermore, continuous technological advancements, rising investments in medical research and development, and the presence of key market players in the region are accelerating the uptake of Optical Imaging solutions, significantly boosting industry growth

Optical Imaging Market Analysis

- The North America Optical Imaging Market is experiencing rapid growth driven by increasing adoption in medical diagnostics, especially in ophthalmology, oncology, cardiology, and neurology, where non-invasive imaging techniques are essential for early disease detection and monitoring.

- Market expansion is fueled by the rising prevalence of chronic diseases, growing awareness of early diagnosis, and the integration of optical imaging with advanced technologies like AI, machine learning, and image-guided therapy systems.

- U.S. leads the North America Optical Imaging Market, accounting for the largest revenue share of 40.01% in 2025, due to its robust healthcare infrastructure, early adoption of cutting-edge technologies, high healthcare spending, and the presence of key market players, particularly where ongoing R&D and innovation in biomedical optics drive significant growth.

- Canada is expected to be the fastest-growing region during the forecast period, owing to rapid urbanization, increasing healthcare awareness, and substantial investments in medical infrastructure and research.

- The OCT (Optical Coherence Tomography) segment is projected to dominate the North America Optical Imaging Market with the largest market share in 2025, driven by its extensive use in ophthalmology, non-invasive nature, and high-resolution capabilities for tissue imaging.

Report Scope and Optical Imaging Market Segmentation

|

Attributes |

Optical Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Optical Imaging Market Trends

“Miniaturization and Portability for Point-of-Care Diagnostics”

- A prominent and rapidly accelerating trend in the North America Optical Imaging Market is the push towards miniaturized and portable imaging systems, enabling the widespread adoption of point-of-care (POC) diagnostics and remote monitoring. This shift aims to bring advanced imaging capabilities closer to the patient, facilitating quicker diagnoses and treatment decisions outside traditional clinical settings.

- This trend is driven by the demand for more accessible and convenient diagnostic tools, especially in primary care settings and for screening in underserved areas. Examples include handheld Optical Coherence Tomography (OCT) scanners for ophthalmology and dermatology, and compact systems for real-time microscopic assessment.

- For instance, Forus Health, with a presence in the US, offers compact, portable, and easy-to-use non-mydriatic digital imaging devices like the 3nethra classic HD for acquiring high-resolution images of the posterior and anterior surfaces of the human eye. Similarly, companies like Butterfly Network have made significant strides with handheld ultrasound devices (e.g., Butterfly iQ+) that integrate with smartphones, demonstrating the broader trend of bringing complex imaging to the point of care. While Butterfly iQ+ is ultrasound, it exemplifies the portability and smartphone integration trend that optical imaging is also adopting. Furthermore, research institutions in North America are actively developing micro-imagers that are extremely thin and flexible, potentially for non-invasive internal imaging using optical methods.

Optical Imaging Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases and Aging Population”

- The rising incidence of chronic conditions such as cancer, cardiovascular diseases, neurological disorders, and eye-related ailments is a primary driver for the growth of the North America Optical Imaging Market. These conditions necessitate early and accurate detection, as well as ongoing monitoring, for effective management and improved patient outcomes.

- The growing geriatric population in North America further fuels this demand, as older individuals are more susceptible to age-related diseases that benefit significantly from non-invasive and high-resolution optical imaging techniques.

- For instance, according to sources like Prevent Blindness (US), the number of people suffering from cataracts in the US is projected to significantly increase by 2050, directly increasing the demand for ophthalmic optical imaging solutions like OCT. Similarly, the high prevalence of heart diseases in the U.S. (e.g., a heart attack every 40 seconds) underscores the need for advanced cardiac imaging.

- Optical imaging plays a crucial role in improving patient outcomes by facilitating the early identification of abnormalities and tracking disease progression, thereby enabling timely diagnosis and effective treatment strategies.

- The non-ionizing nature of optical imaging, which minimizes patient exposure to hazardous radiation, makes it a preferred choice for repeated monitoring and screening in these high-risk populations, further driving its adoption.

Restraint/Challenge

“High Initial Costs and Reimbursement Challenges”

- The relatively high initial cost of advanced optical imaging systems poses a significant restraint to broader market penetration in North America. These sophisticated devices, while offering superior diagnostic capabilities, represent a substantial capital investment for healthcare providers.

- This cost factor can particularly impact smaller clinics, diagnostic centers, and hospitals with limited budgets, hindering their ability to acquire and implement cutting-edge optical imaging technologies.

- Furthermore, reimbursement challenges and unfavorable reimbursement policies in the North American healthcare landscape can impact the profitability and adoption of optical imaging procedures. Changes in reimbursement rates or complex billing processes can deter healthcare facilities from investing in these technologies.

- For instance, reports indicate that changes in reimbursement policies, particularly in the US, have sometimes led to reduced reimbursements for certain procedures, which can make it financially challenging for providers to maintain or expand their optical imaging services.

- While continuous technological advancements are making some devices more affordable and user-friendly, the perception of a premium price point for advanced features (e.g., integrated AI or multi-modality capabilities) can still be a barrier for price-sensitive consumers or healthcare systems.

- Overcoming these challenges will require concerted efforts from manufacturers to develop more cost-effective solutions, alongside advocacy for favorable reimbursement policies and educational initiatives to highlight the long-term cost-benefits and clinical advantages of optical imaging.

Optical Imaging Market Scope

The market is segmented on the basis of technique, Therapeutic Area, Application, end user, product.

- By technique

On the basis of technique, the Optical Imaging Market is segmented into Optical Coherence Tomography, Near-Infrared Spectroscopy, Hyper spectral Imaging, Photo acoustic Tomography, Diffused Optical Tomography and Super Resolution Microscopy. The Optical Coherence Tomography segment dominates the largest market revenue share of 23.2% in 2025, driven by its high-resolution imaging capabilities and non-invasive nature. Additionally, increasing adoption for early diagnosis of retinal and neurological diseases fuels its market growth.

The Hyper spectral Imaging segment is anticipated to witness the fastest growth rate of 7.7% from 2025 to 2032, fueled by its ability to provide detailed spectral information for precise disease detection and tissue analysis. Its expanding applications in medical diagnostics, agriculture, and defense sectors further drive demand. Additionally, advancements in sensor technology and decreasing costs are making hyperspectral imaging more accessible, supporting its rapid market growth.

- By therapeutic area

On the basis of therapeutic area, the Optical Imaging Market is segmented into Ophthalmology, Oncology, Cardiology, Dermatology, Neurology, Dentistry and Others. The Ophthalmology held the largest market revenue share in 2025 of, driven by the rising prevalence of eye diseases such as age-related macular degeneration, diabetic retinopathy, and glaucoma. Advances in optical imaging technology have improved early detection and treatment, boosting demand in this field. Additionally, increasing awareness and adoption of minimally invasive diagnostic procedures further contribute to its market dominance.

The Cardiology segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing prevalence of cardiovascular diseases and advancements in non-invasive imaging technologies. Additionally, rising adoption of OCT for early diagnosis and monitoring of cardiac conditions fuels its rapid growth.

- By Application

On the basis of application, the Optical Imaging Market is segmented into Pre-Clinical and Clinical Research, Pathological Imaging and Intra-Operative Imaging. The Pre-Clinical and Clinical Research held the largest market revenue share in 2025, driven by the increasing demand for advanced imaging technologies to support drug development and clinical trials. Growing investments from pharmaceutical and biotech companies in research activities also contribute to its dominance. Furthermore, the need for precise diagnostic tools to monitor treatment efficacy fuels the expansion of this segment.

The Pathological Imaging is expected to witness the fastest CAGR from 2025 to 2032, favored for its high accuracy and enhanced visualization capabilities in disease diagnosis. Its ability to integrate with digital pathology and AI-driven analysis improves efficiency and precision. Moreover, increasing adoption in personalized medicine and early detection of diseases further drives its rapid growth.

- By End User

On the basis of end user, the Optical Imaging Market is segmented into Hospitals and Clinics, Research Laboratories, Pharmaceutical and Biotechnology Companies and Diagnostic Imaging Centres. The Hospitals and Clinics segment accounted for the largest market revenue share in 2024, driven by the high volume of patient admissions and the need for advanced diagnostic and treatment services. Additionally, the increasing adoption of cutting-edge medical technologies in healthcare facilities contributes to its dominant market position.

The Research Laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the ongoing advancements in medical research and the growing demand for innovative diagnostic tools. Additionally, increased funding and collaboration in biomedical research accelerate the adoption of new pathological imaging technologies in laboratories.

- By Product

On the basis of Product, the Optical Imaging Market is segmented into Imaging Systems, Cameras, Optical Imaging Software, Illumination Systems, Lenses and Other Optical Imaging Products. The Imaging Systems segment accounted for the largest market revenue share in 2024, driven by technological advancements and the growing demand for high-resolution, non-invasive diagnostic tools. Additionally, widespread adoption in clinical settings and rising prevalence of chronic diseases further boost its market dominance.

The Cameras segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in imaging technology that enhance diagnostic accuracy and resolution. Growing adoption of digital and AI-enabled cameras in medical imaging further accelerates its rapid growth.

Optical Imaging Market Regional Analysis

- U.S. dominates the Optical Imaging Market with the largest revenue share of 35.2% in 2024, primarily driven by robust research and development activities, significant technological advancements, and a well-established healthcare infrastructure.

- The region benefits from high healthcare expenditure, increasing adoption of advanced diagnostic and therapeutic procedures, and a strong presence of key market players who are continuously innovating in optical imaging technologies.

- Furthermore, rising awareness about early disease diagnosis, coupled with a growing prevalence of chronic diseases and cancer, is fueling the demand for sophisticated optical imaging solutions across various medical and research applications in North America.

U.S. Optical Imaging Market Insight

The U.S. Optical Imaging Market captured the largest revenue share of 35.2% within North America in 2025. This dominance is primarily driven by substantial investments in research and development, a high prevalence of chronic diseases requiring advanced diagnostics, and the rapid adoption of innovative imaging technologies in healthcare facilities. The robust presence of leading optical imaging device manufacturers and a favorable reimbursement landscape for advanced medical procedures further contribute to the market's growth in the U.S. The increasing demand for non-invasive and real-time imaging techniques in fields such as oncology, ophthalmology, and dermatology is also a key factor propelling the U.S. market.

Canada Optical Imaging Market Insight

The Canada Optical Imaging Market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by increasing government funding for healthcare research, a rising elderly population, and the growing adoption of minimally invasive diagnostic procedures. The focus on early disease detection and personalized medicine, coupled with the expansion of healthcare infrastructure, is fostering the adoption of optical imaging technologies across Canadian provinces. Canadian consumers and healthcare providers are increasingly recognizing the benefits of these advanced imaging modalities in improving patient outcomes.

Mexico Optical Imaging Market Insight

The Mexico Optical Imaging Market is anticipated to grow at a noteworthy CAGR during the forecast period. This growth is driven by improving healthcare access, increasing healthcare expenditure, and a rising awareness regarding advanced diagnostic methods among the population.The expanding medical tourism sector and the growing prevalence of non-communicable diseases are also contributing to the demand for optical imaging solutions in Mexico. Furthermore, collaborations between international optical imaging companies and local healthcare providers are expected to stimulate market growth in the country.

Optical Imaging Market Share

The Optical Imaging industry is primarily led by well-established companies, including:

- Carl Zeiss Meditec AG

- Abbott Laboratories

- GE Healthcare

- Heidelberg Engineering GmbH

- Optovue, Inc.

- Topcon Corporation

- Canon Inc.

- Stryker Corporation

- Leica Microsystems (a division of Leica Camera AG)

- Nidek Co., Ltd.

Latest Developments in North America Optical Imaging Market

- In July 2020, the Centers for Medicare, and Medicaid Services (CMS) implemented major changes in reimbursements for several vitreoretinal procedures. They implemented a 15% reimbursement cut for all cataract surgeries performed within the US. Thus, reimbursement changes pose a great barrier to the market growth

- In January 2023, Canon Medical Inc., partnered with ScImage. The strategic partnership between the two companies will directly broaden and advance Canon Medical Systems’ outreach in hemodynamics with the Fysicon QMAPP Hemo portfolio (Fysicon is a Canon Medical subsidiary). As a result, Canon Medical plans to increase its presence in the cardiac market, offering innovative solutions and unique business models tailored to each client’s specific needs

- In August 2021, Topcon partnered with RetInSight to develop a seamless interface between RetInSight’s AI-assisted retinal biomarker applications and Topcon’s market-leading OCT devices and cloud-based data management solution, Harmony

- In December 2020, Carl Zeiss acquired arivis to further strengthen its software competencies and market position in 3D image visualization, image processing, and analysis software for research microscopy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.