North America Orthopedic Implants Including Dental Implants Market

Market Size in USD Billion

CAGR :

%

USD

23.52 Billion

USD

66.62 Billion

2024

2032

USD

23.52 Billion

USD

66.62 Billion

2024

2032

| 2025 –2032 | |

| USD 23.52 Billion | |

| USD 66.62 Billion | |

|

|

|

|

North America Orthopedic Implants (Including Dental Implants) Market Size

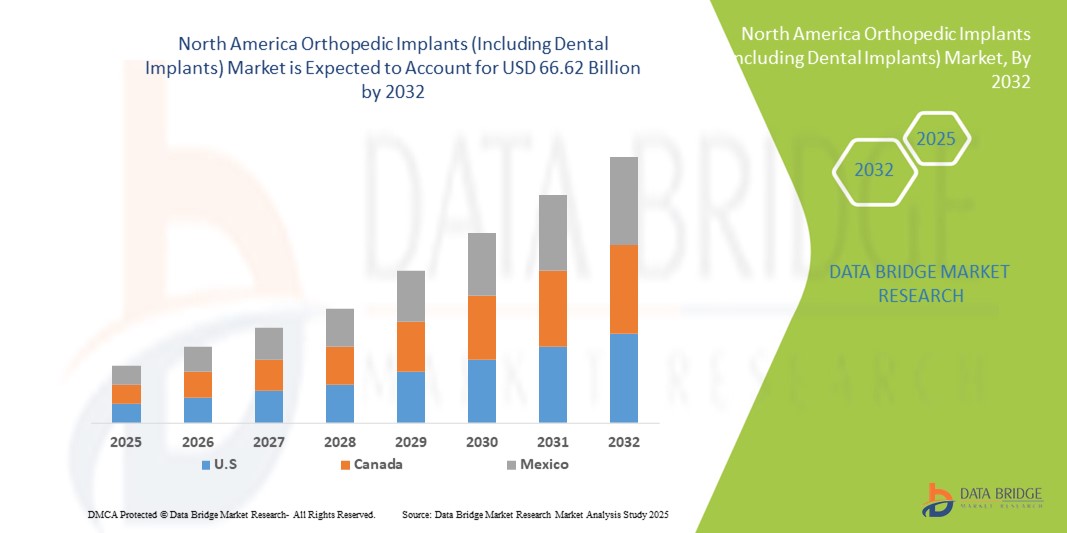

- The North America orthopedic implants (including dental implants) market size was valued at USD 23.52 billion in 2024 and is expected to reach USD 66.62 billion by 2032, at a CAGR of 13.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of musculoskeletal disorders, aging populations, and rising incidences of trauma and degenerative joint diseases, driving the demand for orthopedic implants

- Furthermore, advancements in implant materials, minimally invasive surgical techniques, and personalized implant solutions are enhancing patient outcomes and recovery times, thereby boosting the adoption of Orthopedic Implants (Including Dental Implants) solutions and significantly contributing to the industry's growth

North America Orthopedic Implants (Including Dental Implants) Market Analysis

- Orthopedic Implants (Including Dental Implants) is increasingly driven by the rising prevalence of musculoskeletal disorders, aging populations, and the growing adoption of advanced surgical procedures in both orthopedic and dental care. These factors are fueling the expansion of implant surgeries and supporting the uptake of technologically advanced implants with improved biocompatibility and functionality

- The escalating need for minimally invasive surgeries, coupled with technological advancements in implant design and biomaterials, is further driving the market. Growing awareness about post-surgical outcomes and enhanced patient recovery has led hospitals and specialty clinics to adopt high-quality orthopedic and dental implants

- U.S. dominated the orthopedic implants (including dental implants) market with the largest revenue share of 41.5% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, a well-established healthcare ecosystem, and a strong presence of leading implant manufacturers. The country is witnessing substantial growth in both orthopedic and dental implant procedures due to innovations in 3D printing, bioresorbable materials, and patient-specific implants

- Canada is expected to be the fastest-growing country in the orthopedic implants (including dental implants) market during the forecast period, projected to expand at a CAGR of 10.8% from 2025 to 2032, supported by increasing government healthcare initiatives, rising patient awareness of musculoskeletal health, and the growing adoption of advanced implant technologies in both orthopedic and dental care

- The Metallic Biomaterials segment dominated the orthopedic implants (including dental implants) market with a market revenue share of 58.7% in 2024, largely because of their unmatched mechanical strength, durability, and proven long-term performance

Report Scope and Orthopedic Implants (Including Dental Implants) Market Segmentation

|

Attributes |

Orthopedic Implants (Including Dental Implants) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Orthopedic Implants (Including Dental Implants) Market Trends

Advancements in Implant Technology and Surgical Techniques

- A significant and accelerating trend in the North America orthopedic implants (including dental implants) market is the development of advanced implant materials and innovative surgical techniques. These advancements are significantly improving patient outcomes, reducing recovery times, and enhancing the longevity and functionality of implants

- For instance, the adoption of 3D-printed patient-specific implants allows surgeons to customize implant shapes and sizes to match the patient’s anatomy, resulting in better fit, reduced complications, and more predictable surgical outcomes. Similarly, bioresorbable and coated implants are being introduced to improve osseointegration and reduce post-operative infections

- Innovations in minimally invasive surgical techniques and robotic-assisted surgeries are enabling precise placement of implants, improving accuracy, and reducing surgical trauma. Advanced instrumentation and navigation systems also support surgeons in achieving optimal alignment and functional restoration

- The integration of novel biomaterials, such as titanium alloys, zirconia, and highly cross-linked polyethylene, has enhanced the strength, durability, and biocompatibility of orthopedic and dental implants. These materials are increasingly preferred in both joint replacement and dental restoration procedures

- This trend towards more effective, reliable, and patient-centric implant solutions is fundamentally reshaping the expectations of orthopedic and dental surgeons, as well as patients. Consequently, leading companies in the sector are investing heavily in research and development to deliver next-generation implants with improved performance and safety

- The demand for technologically advanced and high-performance orthopedic and dental implants is growing rapidly across hospitals, specialty clinics, and outpatient surgical centers, driven by the rising prevalence of musculoskeletal disorders, aging populations, and increased awareness of treatment options

North America Orthopedic Implants (Including Dental Implants) Market Dynamics

Driver

Growing Need Due to Rising Musculoskeletal Disorders and Aging Population

- The increasing prevalence of musculoskeletal disorders, osteoporosis, arthritis, and dental conditions, coupled with the rapid rise in the geriatric population across North America, is a significant driver for the heightened demand for orthopedic and dental implants. The elderly are more prone to joint degeneration, fractures, and tooth loss, thereby fueling the market

- For instance, in March 2023, Zimmer Biomet Holdings, Inc. introduced advanced hip and knee replacement solutions in the U.S., designed to enhance surgical precision and patient recovery. Such strategic innovations and product launches by key companies are expected to drive the Orthopedic Implants (Including Dental Implants) industry growth in the forecast period

- As patients increasingly prioritize better mobility, faster recovery, and improved quality of life, the demand for technologically advanced implants has surged. These implants, often developed using biocompatible materials and minimally invasive surgical techniques, offer compelling advantages over traditional treatment options

- Furthermore, the growing popularity of preventive healthcare and elective surgeries is contributing to the rising adoption of orthopedic and dental implants. Higher awareness about dental aesthetics and joint health is prompting more individuals to seek advanced implant-based treatments across both hospitals and specialty clinics

- The convenience of durable, long-lasting implants, coupled with increasing insurance coverage for orthopedic and dental procedures, is a key factor propelling adoption in the market. Continuous R&D efforts by manufacturers to design patient-specific implants using technologies such as 3D printing further contribute to market expansion

Restraint/Challenge

High Costs and Stringent Regulatory Approvals

- The relatively high cost of advanced orthopedic and dental implants poses a significant challenge to broader adoption. Premium implants with advanced coatings, custom designs, or robotic-assisted surgery compatibility often come with a higher price tag, which can be a barrier for price-sensitive patients, particularly in developing regions or among uninsured populations

- In addition, the stringent regulatory approval processes required for implantable medical devices significantly extend product launch timelines. Companies must meet rigorous safety, biocompatibility, and clinical efficacy standards, which can delay market entry and increase development costs

- Concerns regarding post-surgical complications, such as implant rejection, infection, or device failure, also create hesitancy among some patients and healthcare providers. Such risks require robust post-market surveillance and continuous product innovation to ensure safety and reliability

- The dependency on skilled surgeons and advanced infrastructure is another limitation. Many complex orthopedic and dental implant procedures require specialized training and high-tech facilities, which may not be widely available in smaller healthcare settings

- Overcoming these challenges through cost-optimization strategies, regulatory harmonization, greater surgeon training, and the development of more accessible implant technologies will be vital for sustained market growth

North America Orthopedic Implants (Including Dental Implants) Market Scope

The market is segmented on the basis of product type, biomaterial, procedures, fixation type, end user, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into reconstructive joint replacements, spinal implants, motion preservation devices/non-fusion devices, dental implants, trauma implants, orthobiologics, and others. The reconstructive joint replacements segment dominated the market with the largest revenue share of 41.5% in 2024, supported by the rapidly aging population and the high prevalence of osteoarthritis and rheumatoid arthritis. Hip and knee replacements are the most commonly performed procedures in North America, with millions of patients opting for surgical solutions to restore mobility and quality of life. Advancements in implant biomaterials, including highly cross-linked polyethylene and titanium alloys, have significantly improved implant longevity. The adoption of minimally invasive techniques has further expanded the candidate pool, encouraging earlier interventions. Reimbursement policies in the U.S. and Canada also support higher procedure volumes, driving further market penetration. Increasing awareness of lifestyle improvement post-surgery and supportive government health initiatives continue to make reconstructive joint replacements the backbone of the orthopedic implants market.

The Dental Implants segment is anticipated to witness the fastest growth at a CAGR of 8.9% from 2025 to 2032, fueled by the rising demand for restorative and cosmetic dentistry. Increasing rates of tooth loss due to aging, trauma, and periodontal diseases are expanding the need for durable dental solutions. Growing acceptance of dental implants over traditional dentures reflects a shift toward permanent and more natural-looking alternatives. The integration of digital dentistry technologies such as CAD/CAM, 3D imaging, and guided surgery has streamlined implant placement and improved clinical outcomes. Cosmetic dentistry trends are also shaping growth, as patients increasingly prioritize aesthetics and functionality. Dental tourism within North America, along with expanded insurance coverage for certain implant procedures, is further accelerating uptake. Collectively, these factors make dental implants the fastest-growing product category within the orthopedic implants sector.

- By Biomaterial

On the basis of biomaterial, the market is segmented into metallic biomaterials, ceramic biomaterials, polymeric biomaterials, natural biomaterials, and others. The Metallic Biomaterials segment held the largest market revenue share of 58.7% in 2024, largely because of their unmatched mechanical strength, durability, and proven long-term performance. Titanium and its alloys remain the gold standard for orthopedic and dental implants due to their excellent biocompatibility and osseointegration. Stainless steel and cobalt-chromium alloys are also widely used, particularly in trauma and reconstructive implants, owing to their load-bearing capacity. Decades of clinical data validate the safety and reliability of metallic implants, making them the most trusted choice among surgeons. The versatility of metallic biomaterials in both permanent and temporary implants strengthens their dominance in the orthopedic sector. Moreover, manufacturers are introducing surface-modified and porous metallic implants to enhance bone integration. These innovations ensure that metallic biomaterials continue to play a central role in implantology.

The Ceramic Biomaterials segment is expected to witness the fastest growth at a CAGR of 9.4% from 2025 to 2032, driven by rising use in both orthopedic and dental implant applications. Zirconia ceramics, in particular, are gaining traction due to their superior wear resistance, biocompatibility, and natural tooth-like aesthetics. Their ability to minimize bacterial adhesion and provide hypoallergenic solutions makes them highly attractive for dental implants. In orthopedic procedures, ceramic-on-ceramic bearings are increasingly used in hip replacements to reduce wear and extend implant longevity. The trend toward metal-free alternatives for patients with allergies or sensitivities further boosts demand. Research and innovation into bioactive ceramics capable of promoting bone regeneration are expanding their clinical utility. Collectively, these advantages position ceramics as a transformative growth driver in the biomaterials landscape.

- By Procedures

On the basis of procedures, the market is segmented into open surgery, minimally invasive surgery (MIS), and Others. The Open Surgery segment accounted for the largest market share of 54.1% in 2024, as it continues to be the standard for complex orthopedic interventions such as trauma repair, spinal corrections, and major joint reconstructions. Open surgery allows direct visualization of the surgical site, providing surgeons with higher control during complex implant placements. While MIS is growing rapidly, many cases still require open procedures due to anatomical complexity and patient-specific conditions. The widespread availability of trained surgeons experienced in open methods further reinforces dominance. In addition, open surgeries are often necessary in emergency trauma cases, which remain a significant portion of orthopedic interventions. Hospitals across North America are also well-equipped for open approaches, which ensures procedural continuity. Therefore, despite innovation in minimally invasive methods, open surgery retains its market lead.

The Minimally Invasive Surgery (MIS) segment is projected to grow at the fastest CAGR of 10.2% from 2025 to 2032, as patients increasingly demand faster recovery and reduced postoperative complications. MIS techniques allow for smaller incisions, resulting in reduced blood loss, lower infection risk, and shorter hospital stays. Advances in robotic-assisted systems, computer navigation, and intraoperative imaging have made MIS safer and more precise. Rising preference among younger, more active patients for procedures with minimal downtime supports this trend. Surgeons are increasingly trained in MIS techniques, expanding accessibility across healthcare facilities. Favorable reimbursement policies for outpatient and same-day procedures are also encouraging adoption. As technology continues to evolve, MIS is expected to reshape the orthopedic implants landscape significantly over the coming decade.

- By Fixation Type

On the basis of fixation type, the market is segmented into cement orthopedic implants, cementless orthopedic implants, and hybrid orthopedic implants. The cementless orthopedic implants segment dominated the market with a 46.8% share in 2024, primarily because of their ability to promote natural bone ingrowth and achieve long-term biological fixation. Surgeons increasingly recommend cementless implants for younger and more active patients, given their durability and reduced revision rates. Porous coatings and surface modifications have significantly improved osseointegration, driving broader acceptance. Patients also prefer cementless implants as they reduce complications associated with cement breakdown over time. Advances in imaging and surgical precision have further enhanced outcomes for cementless fixation. The strong presence of leading manufacturers offering innovative cementless designs strengthens this segment’s dominance. With a shift toward biologically integrated solutions, cementless implants will likely remain the most preferred fixation type.

The hybrid orthopedic implants segment is anticipated to register the fastest growth with a CAGR of 8.1% from 2025 to 2032, as they provide an optimal balance between cemented and cementless techniques. Hybrid fixation is particularly valuable in revision surgeries and complex cases where one method alone may not be sufficient. By combining the immediate stability of cemented fixation with the long-term benefits of cementless integration, hybrids deliver superior clinical outcomes. Surgeons are increasingly adopting hybrid methods in knee and hip replacements for patients with diverse anatomical needs. Rising demand for tailored solutions in complex cases further supports adoption. Continuous innovation in implant design that accommodates hybrid fixation is also driving this segment. As patient-specific approaches gain traction, hybrid implants are poised for strong growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, home care settings, academic and research institutes, and others. The hospitals segment held the largest revenue share of 62.3% in 2024, as they remain the central hubs for advanced orthopedic and dental surgeries. Hospitals benefit from comprehensive infrastructure, highly skilled specialists, and the ability to manage complex procedures that smaller facilities cannot. Their strong relationships with implant manufacturers ensure steady product supply and access to the latest technologies. Reimbursement models in North America are designed around hospital-based procedures, further reinforcing their dominance. The higher patient inflow to hospitals for trauma and emergency care also contributes to this leadership. In addition, teaching hospitals and research centers are at the forefront of introducing new implant technologies, further enhancing their influence. For these reasons, hospitals will continue to lead in the adoption of orthopedic implants.

The Ambulatory Surgical Centers (ASCs) segment is expected to grow at the fastest CAGR of 9.8% from 2025 to 2032, as healthcare increasingly shifts toward cost-efficient, outpatient care models. ASCs are equipped with advanced technologies that support minimally invasive orthopedic and dental procedures, making them attractive alternatives to traditional hospital settings. Patients prefer ASCs for their shorter wait times, reduced costs, and convenient care delivery. Insurance providers are also incentivizing ASC use to reduce overall healthcare expenditure. Growth is further supported by the rising trend of same-day joint replacements and outpatient spine surgeries. The ability of ASCs to provide high-quality care in a less resource-intensive setting is accelerating their expansion. As patient and payer preferences continue to align, ASCs are poised to see rapid growth in orthopedic implant utilization.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct tender, retail sales, and others. The direct tender segment dominated the market with a 49.6% share in 2024, as hospitals and large healthcare networks prefer centralized procurement models to secure bulk discounts and ensure reliable supply. Strong manufacturer–hospital partnerships make direct tenders the most efficient channel for implant acquisition. These agreements often include training, service, and maintenance packages, making them more attractive to healthcare providers. Direct tender processes also ensure compliance with regulatory standards and quality benchmarks. For complex orthopedic implants, this channel offers healthcare institutions confidence in product traceability and safety. The scale and consistency of demand from hospitals reinforce the strength of this segment. As cost-efficiency remains a key priority, direct tenders will continue to dominate procurement strategies.

The retail sales segment is forecasted to witness the fastest growth at a CAGR of 7.6% from 2025 to 2032, supported by increasing patient-driven purchases of dental implants and related accessories. The growing presence of e-commerce platforms and retail pharmacies has made implants and consumables more accessible to individual patients. Patients seeking elective procedures, especially in dental care, are driving demand through retail channels. This trend is further supported by rising awareness and marketing of direct-to-consumer dental solutions. Retail availability also allows greater flexibility in purchasing replacement components or supplementary implant products. As consumer health spending increases, retail sales will play a more prominent role in the market’s growth.

North America Orthopedic Implants (Including Dental Implants) Market Regional Analysis

- North America dominated the orthopedic implants (including dental implants) market with the largest revenue share in 2024, driven by rising cases of musculoskeletal disorders, an aging population, and growing demand for advanced treatment solutions. The region benefits from a strong presence of leading implant manufacturers, high healthcare expenditure, and continuous innovation in orthopedic and dental technologies

- Patients in North America highly value the availability of minimally invasive surgeries, advanced biomaterials, and custom-made implants, which improve recovery times and long-term outcomes. The increasing adoption of 3D printing, robotics-assisted surgeries, and digital dentistry solutions is further accelerating market expansion in the region

- This widespread growth is further supported by robust healthcare infrastructure, favorable reimbursement policies, and rising awareness about preventive and corrective treatments for both orthopedic and dental conditions. Collectively, these factors establish North America as the global leader in orthopedic implants, including dental implants

U.S. Orthopedic Implants (Including Dental Implants) Market Insight

The U.S. orthopedic implants (including dental implants) market dominated the orthopedic implants (including dental implants) market with the largest revenue share of 41.5% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, a well-established healthcare ecosystem, and the presence of leading implant manufacturers such as Zimmer Biomet, Stryker, and Dentsply Sirona. The country is witnessing substantial growth in both orthopedic and dental implant procedures, driven by the integration of 3D printing, bioresorbable materials, AI-assisted planning tools, and patient-specific implants that enhance surgical precision and patient outcomes.

Canada Orthopedic Implants (Including Dental Implants) Market Insight

The Canada orthopedic implants (including dental implants) market is expected to be the fastest-growing country in the Orthopedic Implants (Including Dental Implants) market during the forecast period, projected to expand at a CAGR of 10.8% from 2025 to 2032. Growth is supported by increasing government healthcare initiatives, rising investments in advanced hospital infrastructure, and growing patient awareness of musculoskeletal health. In addition, the adoption of next-generation implant technologies, particularly in minimally invasive orthopedic procedures and digital dental implantology, is accelerating the country’s market expansion.

North America Orthopedic Implants (Including Dental Implants) Market Share

The orthopedic implants (including dental implants) industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Smith + Nephew (U.K.)

- Medtronic (Ireland)

- Stryker (U.S.)

- B. Braun SE (Germany)

- Integra LifeSciences Corporation (U.S.)

- Narang Medical Limited (India)

- W.L. Gore & Associates, Inc. (U.S.)

- 3M (U.S.)

- Arthrex, Inc. (U.S.)

- General Electric Company (U.S.)

- DJO, LLC (U.S.)

- Samay Surgical (India)

- BioHorizons (U.S.)

- Envista (U.S.)

- Egifix (India)

- Institut Straumann AG (Switzerland)

- Canwell Medical Co., Ltd. (China)

- Corin Group (U.K.)

- Globus Medical (U.S.)

- CONMED Corporation (U.S.)

- Bonetech Medisys Pvt. Ltd. (India)

- EgiFix Medical (India)

Latest Developments in North America Orthopedic Implants (Including Dental Implants) Market

- In July 2024, ZimVie announced FDA 510(k) clearance and the U.S. launch of GentekR Restorative, expanding its portfolio of prosthetic offerings and strengthening its position in restorative and dental implant solutions

- In December 2024, Zimmer Biomet received FDA clearance for its Persona SoluTion PPS Femur component, which, when paired with its Persona OsseoTi Tibia and OsseoTi Patella, offers enhanced implant compatibility and improved clinical outcomes for joint replacement procedures

- In March 2025, Johnson & Johnson MedTech showcased a new era of digital orthopaedics at the AAOS 2025 Annual Meeting in San Diego, introducing innovations across joint reconstruction, trauma, spine, and extremities sectors, including data-driven enabling technologies and advanced implants to enhance precision and efficiency in surgery.

- In January 2025, Zimmer Biomet announced its agreement to acquire Paragon 28 for approximately USD 1.1 billion. The acquisition is aimed at expanding Zimmer’s surgical implant offerings for foot and ankle disorders, as well as enhancing its strength in fracture, trauma, and joint replacement categories

- In May 2025, RevBio received both FDA approval to expand its clinical trial and CMS reimbursement for its regenerative bone adhesive for cranial flap fixation. This marks a significant step forward for its biomaterial-based implant stabilization technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.