North America Panel Mount Industrial Display Market

Market Size in USD Billion

CAGR :

%

USD

616.29 Billion

USD

1,237.05 Billion

2025

2033

USD

616.29 Billion

USD

1,237.05 Billion

2025

2033

| 2026 –2033 | |

| USD 616.29 Billion | |

| USD 1,237.05 Billion | |

|

|

|

|

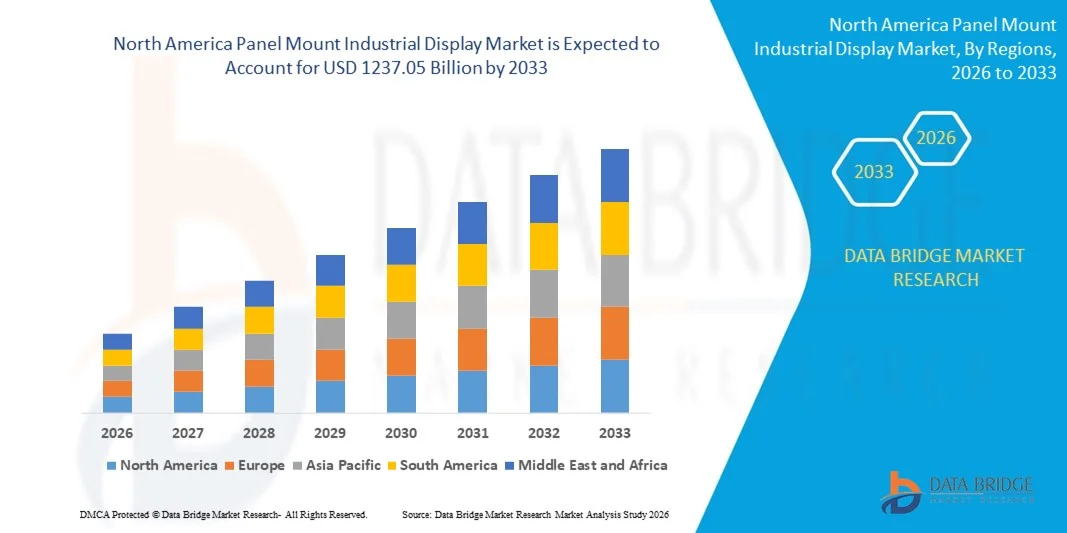

What is the North America Panel Mount Industrial Display Market Size and Growth Rate?

- The North America panel mount industrial display market size was valued at USD 616.29 billion in 2025 and is expected to reach USD 1237.05 billion by 2033, at a CAGR of 9.10% during the forecast period

- Market expansion is driven by increasing demand for rugged, reliable, and high-visibility display solutions in sectors such as manufacturing, transportation, and energy, supporting real-time data monitoring and process automation

- In addition, the shift toward Industry 4.0 and the integration of IoT-enabled systems are enhancing the need for durable human-machine interfaces (HMIs), fueling adoption of panel mount displays across industrial environments

What are the Major Takeaways of Panel Mount Industrial Display Market?

- Panel mount industrial displays, designed for integration into control panels and enclosures, are becoming essential components in modern industrial automation systems across manufacturing, energy, transportation, and healthcare due to their rugged construction, high durability, and seamless HMI (Human-Machine Interface) capabilities

- The rising demand for panel mount displays is primarily driven by increased factory automation, the growth of industrial IoT (IIoT), and a growing need for real-time monitoring and operational efficiency in mission-critical environments

- The U.S. dominated the North America panel mount industrial display market with the largest revenue share of 46.8% in 2024, driven by a highly developed food processing industry, strong demand for packaged and ready-to-eat foods, and significant investments in automated processing, packaging, and material handling systems across meat, dairy, and beverage segments

- Canada is witnessing the fastest growth rate of 9.36%, supported by increasing processed food exports, expanding automation in dairy and meat processing, and stringent adherence to food safety regulations

- The software segment dominated the market with a revenue share of 62.4% in 2024, driven by the growing need for advanced visualization, data management, and control interfaces in industrial automation

Report Scope and Panel Mount Industrial Display Market Segmentation

|

Attributes |

Panel Mount Industrial Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Panel Mount Industrial Display Market?

Enhanced Functionality Through AI and Edge Computing Integration

- A significant and accelerating trend in the global panel mount industrial display market is the expanding integration of artificial intelligence (AI) and edge computing capabilities into industrial display systems. This convergence is significantly improving real-time data processing, predictive maintenance, and human-machine interface (HMI) responsiveness in industrial environments

- For instance, panel mount displays embedded with AI-enabled analytics are increasingly used in smart factories to monitor equipment health and optimize production workflows. Companies such as Advantech and Siemens are developing intelligent HMI displays that incorporate AI algorithms to identify anomalies, detect faults early, and suggest corrective actions, thereby minimizing downtime and improving operational efficiency

- AI integration enables these displays to learn from historical data and user inputs, offering adaptive interfaces that streamline workflows and reduce operator error. Combined with edge computing, these systems process data locally, reducing latency and ensuring real-time responsiveness in critical applications such as assembly lines, oil & gas operations, and transportation systems

- In addition, voice command and natural language processing (NLP) technologies are being explored for next-generation industrial displays, allowing operators to interact with machines more intuitively. For instance, future AI-enabled HMIs could allow voice-controlled system adjustments or real-time verbal alerts based on operational thresholds

- The integration of AI and edge technologies is also facilitating remote diagnostics and centralized control in distributed industrial settings. Operators can access and control multiple systems through a single interface, enhancing visibility and coordination across large-scale facilities

- This trend is reshaping expectations for industrial display systems—moving from static data screens to intelligent, adaptive interfaces capable of enhancing decision-making and operational agility. As industries increasingly shift toward smart manufacturing and automation, demand for AI-enhanced panel mount displays is expected to rise sharply across sectors such as automotive, energy, and logistics

What are the Key Drivers of Panel Mount Industrial Display Market?

- The rising demand for real-time process monitoring, increased automation, and smart industrial infrastructure is a key driver of the global panel mount industrial display market. As industries transition toward Industry 4.0, the need for durable, high-performance display systems integrated with control panels is growing significantly across manufacturing, energy, healthcare, and logistics sectors

- For Instance, in March 2024, Advantech launched a new line of panel mount industrial displays with edge computing capabilities and high-brightness screens for outdoor and harsh environments. These innovations address the growing need for data-rich, responsive HMI interfaces in complex operational settings

- Industrial environments increasingly require robust display units that offer features such as multi-touch capability, wide temperature tolerance, high IP ratings for water and dust resistance, and compatibility with modern control systems. These displays provide critical data visualization, machine diagnostics, and operator interface functions, enhancing productivity and safety

- Moreover, with the proliferation of Industrial Internet of Things (IIoT) devices and smart sensors, the ability to aggregate and display operational data in real-time has become a foundational requirement. Panel mount displays allow seamless integration with PLCs, SCADA systems, and other industrial automation platforms, making them an indispensable tool in connected factory ecosystems

- The growing emphasis on remote control, predictive maintenance, and centralized control across multiple facilities is further boosting demand for intelligent display interfaces. These displays not only streamline decision-making but also reduce downtime through proactive system alerts and visualization of performance metrics

Which Factor is Challenging the Growth of the Panel Mount Industrial Display Market?

- Despite their benefits, high upfront costs associated with ruggedized and customized panel mount industrial displays present a barrier to adoption, particularly for small and medium-sized enterprises (SMEs) and in developing economies. These costs can include not only the hardware but also specialized installation, integration with existing systems, and ongoing maintenance

- For instance, many advanced industrial displays designed for harsh environments must meet stringent certifications (e.g., IP65, NEMA ratings), utilize industrial-grade components, and offer extended lifecycles—factors that increase production and end-user pricing

- In addition, environmental limitations can impact adoption. While modern displays are built to withstand vibration, dust, moisture, and extreme temperatures, some highly corrosive or explosive industrial environments still pose challenges for long-term reliability. In such cases, specialized enclosures or custom mounting solutions may be required, further adding to complexity and cost

- Another challenge is the integration with legacy systems in older factories or infrastructure where compatibility issues can delay deployment or require costly modifications. While many manufacturers now offer modular or backward-compatible systems, the transition to fully digital, touch-enabled display systems can be resource-intensive

- Overcoming these challenges will require continued innovation in cost-effective manufacturing, development of modular, easy-to-integrate systems, and increased availability of rugged yet affordable solutions targeted at emerging markets. Educating end users on the long-term ROI and operational benefits of intelligent display systems will also be essential to accelerate adoption globally

How is the Panel Mount Industrial Display Market Segmented?

The market is segmented on the basis of component, deployment mode, tier type, function, and end use.

- By Component

On the basis of component, the global panel mount industrial display market is segmented into software and services. The software segment dominated the market with a revenue share of 62.4% in 2024, driven by the growing need for advanced visualization, data management, and control interfaces in industrial automation. Software solutions enable seamless integration with machinery and industrial networks, enhancing operational efficiency and real-time decision-making. Industrial operators increasingly rely on sophisticated software for diagnostics, predictive maintenance, and analytics, fueling demand in this segment.

The services segment is projected to witness the fastest CAGR from 2025 to 2032, supported by rising requirements for installation, maintenance, customization, and technical support services. As industries upgrade to more complex and connected panel mount displays, expert services are crucial for ensuring system reliability, longevity, and smooth operation, especially in sectors such as manufacturing and energy.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into cloud and on-premise deployment. The on-premise segment held the largest market share of 58.7% in 2024, favored for its security, control, and compliance benefits in critical industrial environments. Many manufacturing and energy firms prefer on-premise deployments to safeguard sensitive operational data and maintain uninterrupted control over production processes.

Conversely, the cloud deployment segment is expected to experience the fastest CAGR from 2025 to 2032, driven by the rise of IoT, Industry 4.0, and smart factory initiatives. Cloud platforms offer scalable, flexible solutions with remote monitoring capabilities, enabling enterprises to optimize operations and reduce infrastructure costs. Cloud deployment supports real-time analytics and centralized management, appealing to emerging industrial setups and distributed facilities.

- By Tier Type

On the basis of tier type, the market is categorized into advanced, intermediate, and basic tiers. The advanced tier segment dominated the market with a share of 54.1% in 2024, preferred by large-scale industries requiring high-performance displays with multi-functional capabilities, enhanced durability, and integration with complex industrial systems. These displays offer superior resolution, ruggedness, and advanced software compatibility necessary for precision manufacturing and automation.

The intermediate tier segment is projected to register the fastest CAGR from 2025 to 2032, driven by increasing adoption among mid-sized companies upgrading from basic systems. Offering a balance of features and cost-efficiency, intermediate-tier displays cater to a broad range of industrial applications needing reliable and flexible visualization solutions. Basic-tier displays, while still significant, show moderate growth, mainly in entry-level applications.

- By Function

On the basis of function, the market is segmented into labor management system, analytics and optimization, billing management, inventory control, and yard/dock management. The analytics and optimization segment held the largest market share of 43.7% in 2024, highlighting the importance of real-time data analysis for improving operational productivity, predictive maintenance, and resource allocation. Panel mount displays integrated with analytics software enable better visibility into process efficiency and system health, facilitating data-driven decision-making.

The labor management system segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by growing automation of workforce scheduling, productivity tracking, and compliance monitoring across manufacturing, logistics, and healthcare sectors. Enhanced labor management capabilities improve efficiency, reduce downtime, and support compliance with industry regulations. Other functions such as billing management, inventory control, and yard/dock management contribute to steady growth as part of comprehensive industrial operation systems.

- By End Use

On the basis of end use, the panel mount industrial display market is segmented into 3PL, automotive, manufacturing, food & beverages, healthcare, e-commerce, chemicals, electricals & electronics, metals & machinery, and others. The manufacturing segment dominated the market with a 36.5% share in 2024, fueled by the widespread digital transformation and automation of production processes. Panel mount displays play a key role in machine monitoring, quality control, and process automation, driving demand in this sector.

The healthcare segment is expected to register the fastest CAGR from 2025 to 2032, supported by increasing integration of panel mount displays into diagnostic equipment, surgical devices, and patient monitoring systems. The need for hygienic, durable, and high-precision displays in medical environments, alongside the growth of digital health technologies, boosts market growth in this sector. Other end-use sectors such as automotive, 3PL, and e-commerce continue to adopt panel mount displays for operational efficiency and control.

Which Region Holds the Largest Share of the Panel Mount Industrial Display Market?

- The U.S. dominated the North America panel mount industrial display market with the largest revenue share of 46.8% in 2024, driven by a highly developed food processing industry, strong demand for packaged and ready-to-eat foods, and significant investments in automated processing, packaging, and material handling systems across meat, dairy, and beverage segments

- Widespread adoption of automation, robotics, conveyor systems, and sensor-enabled smart packaging solutions across large manufacturing facilities is strengthening the region’s market leadership

- Strong regulatory frameworks, continuous modernization of processing infrastructure, and integration of AI- and IoT-enabled technologies further reinforce the U.S. as the most technology-driven regional market

Canada Panel Mount Industrial Display Market Insight

Canada is witnessing the fastest growth rate of 9.36%, supported by increasing processed food exports, expanding automation in dairy and meat processing, and stringent adherence to food safety regulations. Adoption of robotic palletizing, advanced material handling systems, and cold-chain solutions is enhancing operational efficiency. Government programs promoting agri-food innovation and sustainable processing infrastructure reinforce Canada’s position as a high-growth market within North America.

Mexico Panel Mount Industrial Display Market Insight

Mexico is expanding steadily, driven by growth in food and beverage manufacturing, rising foreign direct investment, and its strategic role as an export hub for North America. Implementation of automated packaging lines, conveyor systems, and warehouse material handling solutions improves production scalability. Favorable trade agreements, cost-efficient manufacturing, and modernization of processing facilities position Mexico as an emerging growth market in the region.

Which are the Top Companies in Panel Mount Industrial Display Market?

The Panel Mount Industrial Display industry is primarily led by well-established companies, including:

- Texas Instruments Incorporated (U.S.)

- LIHOM XTALS (South Korea)

- Masterclock Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- Infineon Technologies AG (Germany)

- TXC (Taiwan)

- KYOCERA Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Abracon (U.S.)

- Seiko Epson Corporation (Japan)

- Microchip Technology Inc. (U.S.)

- Rakon Limited (New Zealand)

- NIHON DEMPA KOGYO CO., LTD. (Japan)

- Silicon Laboratories (U.S.)

- SiTime Corp. (U.S.)

- Analog Devices, Inc. (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

What are the Recent Developments in Global Panel Mount Industrial Display Market?

- In April 2023, Advantech Co., Ltd., a global leader in industrial computing and display solutions, launched an advanced line of rugged panel mount industrial displays designed specifically for harsh manufacturing environments in Southeast Asia. This initiative demonstrates Advantech’s focus on delivering durable, high-performance HMI solutions tailored to the demanding needs of industrial automation sectors. By leveraging cutting-edge touchscreen technology and IoT compatibility, Advantech is strengthening its foothold in the rapidly expanding global panel mount industrial display market

- In March 2023, Siemens AG unveiled its latest panel mount industrial display series integrated with AI-driven analytics for predictive maintenance applications in smart factories. Targeting automotive and energy sectors, Siemens' new offering emphasizes real-time monitoring and enhanced operational efficiency. This advancement showcases Siemens’ ongoing commitment to innovation in industrial display technology and its role in accelerating Industry 4.0 adoption worldwide

- In March 2023, Schneider Electric completed the deployment of its advanced panel mount displays as part of the “Smart Grid Modernization” project in Germany. These displays are being utilized in remote monitoring and control centers, enhancing grid reliability and operational visibility. This project highlights Schneider Electric’s dedication to integrating state-of-the-art visualization tools into critical infrastructure, contributing to smarter and more resilient energy networks

- In February 2023, Rockwell Automation, Inc. announced a strategic partnership with key manufacturing players in North America to integrate its panel mount industrial displays with edge computing platforms. This collaboration aims to boost real-time data processing and enhance automation capabilities on factory floors. The initiative underscores Rockwell Automation’s commitment to providing comprehensive solutions that optimize production efficiency and enable smarter industrial ecosystems

- In January 2023, LG Display Co., Ltd. introduced a new series of ultra-high-definition panel mount industrial displays featuring OLED technology, showcased at the CES 2023 event. These displays provide superior image quality and low power consumption, catering to advanced industrial applications including medical devices and transportation systems. LG Display’s innovation exemplifies the company’s push toward expanding its presence in the global industrial display market with next-generation visual solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Panel Mount Industrial Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Panel Mount Industrial Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Panel Mount Industrial Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.