North America Paper Bags Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

1.88 Billion

2024

2032

USD

1.23 Billion

USD

1.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.88 Billion | |

|

|

|

|

Paper Bags Market Size

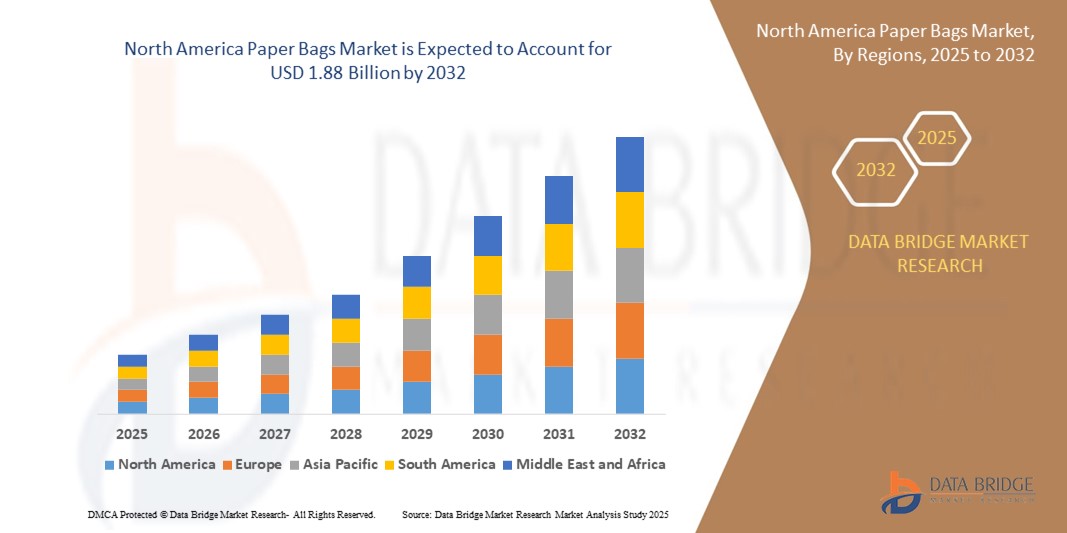

- The North America paper bags market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.88 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the shift toward sustainable packaging solutions and mounting regulatory pressure to reduce single-use plastic, leading to increased adoption of paper bags across retail, foodservice, and industrial sectors

- Furthermore, rising consumer awareness regarding environmental impact, coupled with the growing demand for biodegradable and recyclable alternatives, is positioning paper bags as a preferred choice among both brands and consumers. These converging factors are accelerating the transition from plastic to paper, thereby significantly boosting the industry's growth

Paper bags Market Analysis

- Paper bags are eco-friendly packaging solutions made from kraft or recycled paper, widely used for carrying groceries, food items, apparel, and other consumer goods. They are available in various types, sizes, and sealing formats, catering to retail, foodservice, pharmaceuticals, and construction sectors

- The escalating demand for paper bags is primarily driven by government bans on plastic, sustainability goals set by corporations, and the increasing use of paper bags as a branding tool in premium and eco-conscious retail environments

- U.S. dominated the paper bags market with a share of 83.10% in 2024, due to increasing regulatory restrictions on plastic use and rising adoption of sustainable packaging across retail, foodservice, and grocery sectors. The growing demand for recyclable, biodegradable alternatives and heightened consumer environmental awareness have positioned the U.S. as the regional leader

- Canada is expected to be the fastest growing region in the paper bags market during the forecast period due to national plastic reduction policies and a strong consumer shift toward eco-conscious packaging

- Single use segment dominated the market with a market share of 64.2% in 2024, due to stringent hygiene requirements across the pharmaceutical and food industries. Regulatory emphasis on contamination control and convenience in packaging disposal has led to the widespread adoption of single-use paper bags. They are also cost-effective for high-volume operations, especially in fast-paced environments such as retail and F&B sectors

Report Scope and Paper Bags Market Segmentation

|

Attributes |

Paper Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paper bags Market Trends

“Rising Adoption of Biodegradable Materials”

- The paper bags market is experiencing robust growth as businesses and consumers increasingly prioritize eco-friendly packaging, with the adoption of biodegradable and recyclable materials becoming a defining trend

- For instance, companies such as International Paper Company, Mondi Group, Smurfit Kappa, and WestRock are introducing innovative paper bags made from sustainably sourced kraft paper, bioplastics, and compostable coatings to meet regulatory and consumer demand for sustainable packaging solutions

- The food and beverage sector, along with retail and e-commerce, is rapidly shifting to paper bags for takeout, grocery, and delivery, driven by bans on single-use plastics and the need for packaging that aligns with green initiatives

- Advanced materials—such as thinner, stronger kraft paper and moisture-resistant coatings—are enhancing the durability and versatility of paper bags, supporting their use across a wider range of products including perishables and bulk goods

- Branding and customization are on the rise, with retailers and quick-service restaurants leveraging custom-printed paper bags to promote sustainability and enhance consumer experience

- In conclusion, the convergence of e-commerce growth, regulatory action, and sustainability initiatives is positioning paper bags as a critical component in the future of Asia Pacific packaging and logistics, with market leaders investing in new technologies and expanding eco-friendly product lines

Paper bags Market Dynamics

Driver

“Shift Towards Eco-Friendly Alternatives to Plastic”

- The growing global movement to reduce plastic waste is the primary driver for the Asia Pacific paper bags market, with legislative bans and consumer preferences accelerating the shift to biodegradable and recyclable options

- For instance, companies such as International Paper Company, Mondi Group, Smurfit Kappa, and WestRock are scaling up production of paper bags for major retailers and foodservice providers across China, India, Australia, and Southeast Asia, who are replacing plastic bags to comply with regulations and meet sustainability goals

- The rise of e-commerce and direct-to-consumer shipping is fueling demand for lightweight, protective, and cost-effective paper bags across a variety of sectors

- The convenience, printability, and perceived environmental benefits of paper bags make them a preferred choice for both large enterprises and small businesses aiming to enhance their green credentials

- Increased investment in recycling infrastructure and the development of locally sourced, FSC-certified paper are further supporting the shift toward paper-based packaging solutions

Restraint/Challenge

“High Production Costs and Raw Material Constraints”

- The production of paper bags is more expensive than plastic alternatives due to higher raw material, energy, and water requirements, which can limit adoption in cost-sensitive markets

- For instance, the average import price for paper sacks and bags in Asia Pacific reached $2,778 per tonne in 2018, with countries such as Japan paying as much as $3,754 per tonne, highlighting significant price variability and cost pressures across the region

- Paper bags generally offer less durability, especially in wet or heavy-use conditions, making them less suitable for transporting liquids, frozen products, or bulky items. Fluctuating prices and supply of raw materials such as wood pulp and recycled paper, as well as the need for sustainable forestry practices, can impact cost stability and supply chain reliability

- Limited recycling infrastructure and inconsistent collection systems in some Asia Pacific regions hinder the circularity of paper bags, particularly for those with mixed-material construction

- Environmental concerns related to deforestation and the carbon footprint of paper production remain, especially in regions lacking advanced recycling or sustainable forestry management

Paper bags Market Scope

The market is segmented on the basis of product type, usage, capacity, size, sealing and handle, shape, distribution channel, and end-user.

- By Products

On the basis of products, the antiviral drugs market is segmented into Flat Paper Bags, Multi-Wall Paper Sacks, Open Mouth, Pasted Valve, Lock Paper Bags, Self-Opening-Style (SOS) Bags, Stand Up Pouch, and Others. The Flat Paper Bags segment dominated the largest market revenue share in 2024, driven by their eco-friendly profile, affordability, and widespread use in packaging lightweight items such as bakery products and pharmaceuticals. These bags are especially preferred for single-use applications where biodegradability and minimal environmental impact are critical purchasing factors. Their easy customizability and compatibility with printing technologies further enhance branding and product visibility for end-users.

The Stand-Up Pouch segment is projected to witness the fastest growth rate from 2025 to 2032 due to the increasing demand for flexible, resealable, and space-efficient packaging. These pouches offer extended shelf life and protection from contamination, making them ideal for pharmaceutical and cosmetic products. Their aesthetic appeal, convenience, and adaptability to both dry and liquid contents are also accelerating adoption in retail and e-commerce channels.

- By Usage

On the basis of usage, the market is categorized into Single Use and Re-Usable. The Single Use segment accounted for the largest market share of 64.2% in 2024, fueled by stringent hygiene requirements across the pharmaceutical and food industries. Regulatory emphasis on contamination control and convenience in packaging disposal has led to the widespread adoption of single-use paper bags. They are also cost-effective for high-volume operations, especially in fast-paced environments such as retail and F&B sectors.

The Re-Usable segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by growing sustainability initiatives and consumer preference for environmentally responsible packaging solutions. These bags are increasingly used by premium brands and supermarkets to promote eco-conscious consumption habits while maintaining durability and visual appeal.

- By Capacity

On the basis of capacity, the market is segmented into Less Than 1 Kg, 1 Kg–5 Kg, 5 Kg–10 Kg, and More Than 10 Kg. The 1 Kg–5 Kg segment led the market in 2024, attributed to its versatility across a wide range of end-use industries, including food, pharmaceuticals, and animal feed. This capacity range is optimal for handling both perishable and non-perishable items without compromising on convenience or storage efficiency.

The More Than 10 Kg segment is anticipated to register the highest growth during the forecast period, driven by rising industrial applications in agriculture, construction, and chemicals. These bags provide robust structural integrity, cost-effectiveness for bulk transport, and compatibility with automated filling and handling systems.

- By Size

On the basis of size, the market is segmented into Small Size, Medium Size, Large Size, and Extra-Large Size. The Medium Size segment held the largest market revenue share in 2024, driven by its ideal balance between capacity, portability, and usage convenience. This size segment finds significant traction in the retail, food service, and pharmaceutical sectors where compact but functional packaging is essential.

The Extra-Large Size segment is projected to grow at the fastest rate from 2025 to 2032, supported by rising bulk handling requirements and demand for sustainable alternatives to plastic sacks. These bags are increasingly utilized in construction and agriculture industries where high-volume, durable, and weather-resistant packaging is required.

- By Sealing and Handle

On the basis of Sealing and Handle, market is segmented into Heat Seal, Hand Length Handle, Ziplock, Twisted Handle, Flat Handle, and Others. The Heat Seal segment dominated the market in 2024 due to its superior sealing strength, tamper-evident properties, and broad adoption in pharmaceutical and food-grade packaging. Heat sealing ensures product integrity, extending shelf life while minimizing leakage and spoilage.

The Ziplock segment is expected to witness the fastest growth, as resealable functionality becomes a key consumer demand for convenience and reuse. The integration of ziplock features with biodegradable materials is also gaining momentum, especially in urban and premium retail packaging.

- By Shape

On the basis of shape, the market is divided into Rectangle, Square, Circular, and Others. The Rectangle segment captured the largest share in 2024, favored for its practical storage benefits, stackability, and suitability for printing and labeling. Rectangular bags are widely used across sectors such as pharmaceuticals and cosmetics where shelf presence and operational efficiency matter.

The Circular segment is anticipated to record the highest growth over the forecast period due to rising demand for innovative and differentiated packaging in premium and niche product categories. Circular bags offer visual uniqueness and are often adopted by brands aiming for consumer distinction.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Convenience Stores, Supermarkets/Hypermarkets, Specialty Stores, E-Commerce, and Others. The Supermarkets/Hypermarkets segment held the dominant share in 2024, driven by bulk purchasing trends and direct visibility of packaged products. These stores serve as key points of purchase for reusable and branded paper bags, especially in urban centers.

E-Commerce is forecasted to experience the fastest growth from 2025 to 2032 due to the surge in online shopping and home delivery models. As packaging becomes a key brand touchpoint, e-retailers are increasingly shifting to paper-based solutions for eco-friendliness and aesthetic appeal.

- By End-User

On the basis of end-user, the market is segmented into Food and Beverages, Animal Feed, Cosmetic Products, Agriculture, Construction, Pharmaceuticals, Chemicals, and Others. The Food and Beverages segment led the market in 2024, owing to high consumption volume, hygiene standards, and the rapid transition toward biodegradable packaging. These bags support safe storage, temperature stability, and clear product labeling.

The Pharmaceuticals segment is projected to grow at the fastest pace from 2025 to 2032 due to increasing regulatory mandates for sustainable secondary packaging, sterile protection, and traceability. The rising demand for paper bags with enhanced barrier properties and tamper-proof features is further supporting segment expansion.

Paper Bags Market Regional Analysis

- U.S. dominated the paper bags market with the largest revenue share of 83.10% in 2024, driven by increasing regulatory restrictions on plastic use and rising adoption of sustainable packaging across retail, foodservice, and grocery sectors. The growing demand for recyclable, biodegradable alternatives and heightened consumer environmental awareness have positioned the U.S. as the regional leader

- The widespread presence of major paper bag manufacturers, combined with strong retail infrastructure and corporate sustainability initiatives, continues to drive product demand. In addition, support from local and federal bans on single-use plastics is accelerating the transition to paper-based packaging solutions

- The U.S. market also benefits from growing innovation in paper bag design, strength, and reusability, further solidifying its dominance in North America’s sustainable packaging landscape

Canada Paper Bags Market Insight

Canada is projected to record the fastest CAGR in the North America paper bags market from 2025 to 2032, fueled by national plastic reduction policies and a strong consumer shift toward eco-conscious packaging. The rising preference for reusable and premium-quality paper bags, especially in foodservice and retail, is driving demand. Government support for green packaging alternatives and growing investments in domestic production capacity are further advancing the market.

Mexico Paper Bags Market Insight

The Mexico paper bags market is expected to experience steady growth between 2025 and 2032, supported by a growing retail sector, expanding foodservice operations, and increased pressure to reduce plastic waste. Rising environmental awareness, along with regulatory developments and regional trade links, are encouraging local manufacturers to scale up paper bag production to meet domestic and export-oriented demand.

Paper Bags Market Share

The paper bags industry is primarily led by well-established companies, including:

- WestRock Company (U.S.)

- Smurfit Kappa (Ireland)

- International Paper (U.S.)

- Inteplast Group (U.S.)

- PAPIER-METTLER KG (Germany)

- PackagingPro (Australia)

- JINAN XINSHUNYUAN PACKING CO., LTD (China)

- Mondi (U.K.)

- Thai Showa Paxxs Co., Ltd. (Thailand)

- Conitex Sonoco (U.S.)

Latest Developments in North America Paper Bags Market

- In July 2025, EP Group launched a targeted campaign encouraging fashion retailers to upgrade their paper bag offerings, signaling a push toward higher-quality and more sustainable packaging solutions in the apparel sector. This move is expected to influence retail packaging standards and drive demand for premium, brand-aligned paper bags

- In June 2025, Mondi introduced its re/cycle PaperPlus Bag Advanced, a high-performance solution tailored for humidity-sensitive goods, offering reduced plastic content. This innovation strengthens the trend toward hybrid paper-based packaging and enhances Mondi’s position in the industrial and e-commerce packaging segments by addressing both functionality and sustainability

- In June 2024, Mondi’s launch of the SolmixBag in Spain, in partnership with Cemex, marked a significant advancement in construction material packaging. By creating a bag that dissolves during the cement mixing process, Mondi is contributing to operational efficiency and sustainability in the building sector, encouraging broader industry adoption of eco-friendly, waste-reducing solutions

- In October 2024, Coles introduced a washable paper bag priced at USD 15, capable of carrying up to 20kg and withstanding machine washing. This innovation reflects a growing consumer shift toward durable and reusable packaging, reinforcing the retail sector’s move away from single-use plastics and expanding opportunities for long-life paper bag manufacturers

- In November 2024, Primark released festive-season wrapping paper shopping bags featuring a red stripe design that allows reuse as gift wrap. This creative approach to dual-use packaging enhances customer engagement and also supports sustainability goals, reinforcing paper bags as a versatile and environmentally responsible retail solution.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Paper Bags Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Paper Bags Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Paper Bags Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.