North America Patient Handling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.84 Billion

USD

13.87 Billion

2024

2032

USD

5.84 Billion

USD

13.87 Billion

2024

2032

| 2025 –2032 | |

| USD 5.84 Billion | |

| USD 13.87 Billion | |

|

|

|

|

North America Patient Handling Equipment Market Size

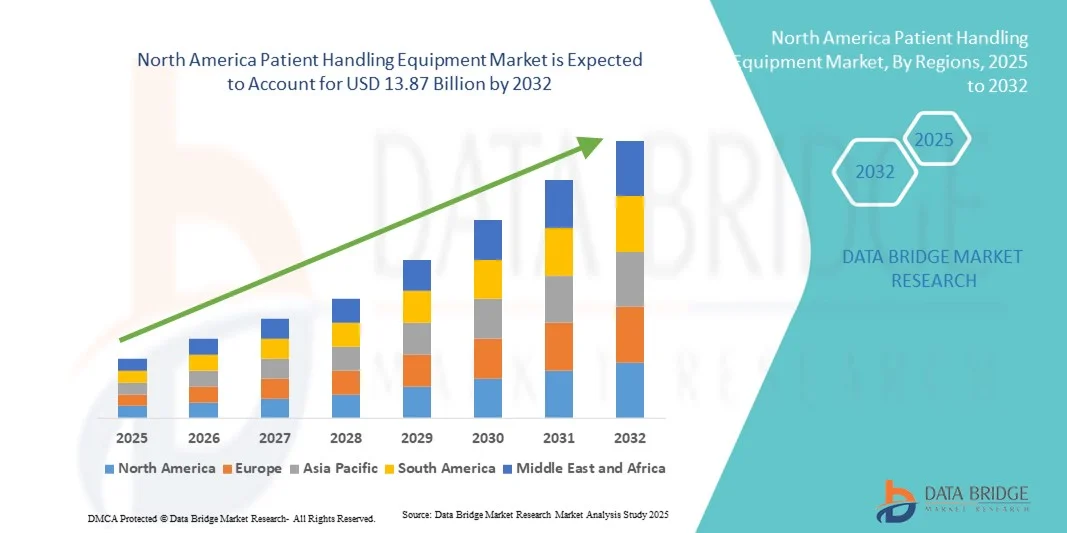

- The North America patient handling equipment market size was valued at USD 5.84 billion in 2024 and is expected to reach USD 13.87 billion by 2032, at a CAGR of 11.00% during the forecast period

- The market growth is largely driven by increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and the growing geriatric population requiring specialized care, leading to heightened demand for efficient patient handling solutions in hospitals, long-term care, and rehabilitation facilities

- Furthermore, advancements in ergonomic designs, automation, and safety-focused technologies, combined with heightened awareness around caregiver safety and patient comfort, are positioning patient handling equipment as a critical component of modern healthcare operations. These converging trends are accelerating the adoption of advanced patient handling solutions, thereby significantly propelling market growth

North America Patient Handling Equipment Market Analysis

- Patient handling equipment, encompassing medical beds, patient lifts, mobility aids, and transfer devices, is increasingly critical in modern healthcare facilities for ensuring patient safety, improving caregiver efficiency, and enhancing overall operational workflows across hospitals, long-term care, and rehabilitation centers

- The growing demand for patient handling equipment is primarily driven by an aging population, rising prevalence of chronic diseases, increasing hospitalizations, and a strong emphasis on reducing caregiver injuries through ergonomic and automated solutions

- The United States dominated the patient handling equipment market with the largest revenue share of 83.4% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading manufacturers. The country experienced substantial growth in equipment adoption, particularly in acute care and long-term care facilities, driven by innovations in motorized beds, smart lifts, and patient repositioning technologies

- Japan is expected to be the fastest-growing country in the patient handling equipment market during the forecast period due to rising healthcare investments, increasing geriatric population, and growing awareness about patient and caregiver safety

- Medical beds segment dominated the patient handling equipment market with a market share of 42.2% in 2024, driven by their critical role in patient care, customizable features, and compatibility with advanced monitoring and safety systems

Report Scope and North America Patient Handling Equipment Market Segmentation

|

Attributes |

North America Patient Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Patient Handling Equipment Market Trends

Enhanced Efficiency Through Automation and Smart Designs

- A significant and accelerating trend in the North America patient handling equipment market is the integration of automation, IoT-enabled monitoring, and ergonomic designs to enhance caregiver efficiency and patient safety. This fusion of technologies is significantly improving workflow and reducing strain in healthcare facilities

- For instance, the Hill-Rom NaviCare Nurse Communication System integrates motorized beds and patient monitoring, allowing nurses to remotely adjust positions and track patient activity, improving care efficiency. Similarly, Arjo Sara Stedy combines lift-assist and sensor technology to enhance safe patient transfers

- Smart beds and lifts enable features such as automated repositioning, fall detection, and real-time activity tracking, which help optimize patient care and reduce workplace injuries. For instance, the Joerns UltraCare bed offers automated repositioning and pressure relief features to minimize caregiver effort

- The seamless integration of patient handling equipment with hospital IT systems facilitates centralized monitoring of patient movement, bed availability, and vital statistics. Through a single interface, staff can manage beds, lifts, and mobility aids, creating a safer and more streamlined care environment

- This trend towards intelligent, ergonomic, and interconnected patient handling solutions is fundamentally reshaping expectations in healthcare delivery. Consequently, companies such as Hill-Rom and Arjo are developing smart lifts and beds with automated adjustment, load-sensing, and integration with hospital monitoring systems

- The demand for patient handling equipment that offers automated, safe, and digitally integrated features is growing rapidly across hospitals, long-term care, and rehabilitation centers, as healthcare providers increasingly prioritize efficiency, patient comfort, and caregiver safety

North America Patient Handling Equipment Market Dynamics

Driver

Growing Need Due to Aging Population and Healthcare Infrastructure Expansion

- The increasing prevalence of elderly patients, chronic conditions, and complex care needs, coupled with expanding healthcare infrastructure, is a significant driver for the heightened demand for advanced patient handling equipment

- For instance, in March 2024, Hill-Rom introduced the Progressa smart bed series with integrated monitoring and mobility support, aiming to improve patient handling and reduce caregiver injuries. Such strategies by leading companies are expected to drive market growth in the forecast period

- As hospitals and long-term care facilities face growing patient loads, automated lifts, repositioning devices, and ergonomic beds provide safer and more efficient handling solutions, reducing caregiver strain and improving patient outcomes

- Furthermore, increasing awareness of occupational safety regulations and the need to prevent musculoskeletal injuries among healthcare workers are making advanced patient handling equipment an essential investment in modern healthcare facilities

- Features such as automated lifting, load-sensing systems, and integration with patient monitoring software, combined with growing adoption of rehabilitation and long-term care services, are key factors propelling market growth across North America

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high initial investment required for advanced patient handling equipment, combined with strict regulatory requirements for safety and compliance, poses a significant challenge to broader market penetration

- For instance, specialized lifts and motorized beds often need FDA clearance and adherence to OSHA and ISO safety standards, increasing costs and limiting adoption in smaller clinics

- Addressing these cost and regulatory challenges through leasing options, hospital budgeting, and compliance-focused designs is crucial for expanding market reach. Companies such as Arjo and Joerns emphasize equipment durability, safety certifications, and maintenance programs to reassure buyers

- Additionally, training staff to operate advanced equipment safely and efficiently can require significant time and resources, which may slow adoption despite the benefits

- While leasing, financing, and modular equipment options are gradually increasing accessibility, perceived high costs and compliance hurdles continue to constrain adoption, particularly for smaller healthcare facilities

- Overcoming these challenges through affordable solutions, enhanced staff training, and continued emphasis on safety compliance will be vital for sustained market growth

North America Patient Handling Equipment Market Scope

The market is segmented on the basis of mode, product type, type of care, accessories, application, and end user.

- By Mode

On the basis of mode, the patient handling equipment market is segmented into mechanical equipment and non-mechanical equipment. The mechanical equipment segment dominated the market with the largest revenue share of 46.8% in 2024, driven by the widespread adoption of motorized beds, patient lifts, and other automated handling devices in hospitals and long-term care facilities. Mechanical equipment ensures precise and safe patient handling, reduces caregiver fatigue, and enhances patient comfort. Healthcare facilities often prefer mechanical solutions for critical care, bariatric care, and long-term care due to their durability, automation features, and compliance with safety standards. Continuous technological upgrades, including programmable lift settings, load-sensing capabilities, and integration with monitoring systems, further support market dominance. Moreover, mechanical equipment adoption is encouraged by regulatory compliance and workplace safety standards that prioritize automated handling.

The non-mechanical equipment segment is anticipated to witness the fastest growth rate of 19.3% from 2025 to 2032, fueled by increasing demand for cost-effective, portable, and lightweight patient handling aids. Non-mechanical equipment such as slings, transfer boards, and walking aids offers easy deployment in home care and smaller healthcare settings. Rising awareness among caregivers and patients regarding mobility assistance and fall prevention solutions contributes to rapid adoption. These devices are also favored for their low maintenance requirements and versatility in multiple care settings. Manufacturers are increasingly innovating ergonomic designs and lightweight materials to enhance usability. The non-mechanical segment’s growth is further supported by increasing in-home care demand and adoption in emerging healthcare facilities.

- By Product Type

On the basis of product type, the market is segmented into medical beds, patient repositioning equipment, mobility aids, bathroom safety, and ambulatory aids. The medical beds segment dominated the market with the largest revenue share of 42.2% in 2024, owing to its critical role in patient care and treatment outcomes. Hospitals and rehabilitation centers prefer advanced medical beds equipped with motorized adjustments, pressure relief systems, and integrated monitoring sensors. The dominance is strengthened by hospital expansions, acute care demands, and rising geriatric population requiring specialized care. Medical beds also enable better infection control and patient positioning, which improves recovery outcomes. Advanced models allow remote control and integration with hospital management systems for streamlined operations.

The patient repositioning equipment segment is expected to witness the fastest growth rate of 20.5% from 2025 to 2032, driven by the increasing focus on caregiver safety and prevention of musculoskeletal injuries. Devices such as patient lifts, transfer slings, and repositioning sheets are gaining traction in hospitals, long-term care, and home care settings. Rising chronic and immobile patient populations accelerate demand. These products also improve patient comfort and reduce the risk of pressure ulcers. Technological improvements such as automated lifting and sensor integration further increase efficiency. Training programs in hospitals and elderly care facilities are enhancing adoption rates.

- By Type of Care

On the basis of type of care, the market is segmented into long-term care, bariatric care, acute and critical care, wound care, fall prevention, and others. The acute and critical care segment dominated the market with the largest revenue share of 39.2% in 2024, due to the need for advanced patient handling equipment in ICU and high-dependency units. Hospitals prefer motorized beds, lifts, and monitoring-integrated equipment to ensure patient safety and facilitate rapid interventions. Acute care facilities drive demand for features such as pressure redistribution, automated repositioning, and real-time monitoring. These solutions also help reduce caregiver strain and improve patient recovery outcomes. Integration with hospital IT systems enhances centralized monitoring and operational efficiency. Continuous innovation in ergonomic designs keeps acute care facilities at the forefront of adoption.

The long-term care segment is expected to witness the fastest growth rate of 18.7% from 2025 to 2032, fueled by the rising geriatric population and increasing prevalence of chronic diseases. Long-term care facilities are investing in ergonomic and user-friendly patient handling solutions to ensure patient comfort and caregiver safety. Beds, lifts, and mobility aids designed for sustained daily use are in higher demand. These devices also support fall prevention and reduce the incidence of injuries among immobile patients. Training programs and awareness campaigns for caregivers further increase adoption. Home care services and assisted living facilities are also contributing to segment growth.

- By Accessories

On the basis of accessories, the market is segmented into hospital bed accessories, medical bed accessories, lifting accessories, transfer accessories, stretcher accessories, and others. The lifting accessories segment dominated the market with the largest revenue share of 37.5% in 2024, due to the high adoption of motorized and manual lifting devices in hospitals and care centers. Lifting accessories, including slings, hoists, and transfer attachments, are crucial for safe patient movement and injury prevention among caregivers. Demand is driven by regulatory focus on workplace safety and awareness of ergonomic handling techniques. Hospitals and rehabilitation centers also prefer lifting accessories for bariatric and immobile patients. Technological advancements in load sensing, safety straps, and material durability further boost adoption. Rising chronic and aging patient populations maintain steady demand.

The transfer accessories segment is expected to witness the fastest growth rate of 21.1% from 2025 to 2032, driven by the increasing need for patient repositioning aids in hospitals and home care settings. Transfer boards, pivot discs, and slide sheets provide efficient solutions for mobility-limited patients. Rising adoption of fall prevention protocols and caregiver training programs further propels growth. Lightweight and foldable designs are making transfer accessories more accessible. Integration with smart beds and lifts is increasing convenience and safety. Greater awareness of ergonomic solutions in smaller clinics and home care is supporting adoption.

- By Application

On the basis of application, the market is segmented into acute and critical care, long-term care, mobility assistance, fall prevention, and others. The mobility assistance segment dominated the market with the largest revenue share of 40.3% in 2024, as hospitals and home care settings invest in mobility aids such as wheelchairs, walkers, and patient lifts to improve independence and safety. Advanced mobility equipment reduces hospital stay durations and enhances patient rehabilitation outcomes. Facilities prefer integrated systems for monitoring patient movement and improving caregiver efficiency. Demand is further supported by regulatory compliance for safety and accessibility. Ergonomic designs and customizable mobility aids enhance comfort and adoption rates. Technological upgrades such as smart lifts and sensor-based monitoring also support dominance.

The fall prevention segment is expected to witness the fastest growth rate of 22.4% from 2025 to 2032, driven by growing concerns about injuries among elderly and immobile patients. Fall prevention aids, including bed rails, grab bars, and sensor-based monitoring systems, are increasingly adopted in hospitals, elderly care facilities, and home care settings. Awareness campaigns and government safety regulations further accelerate adoption. Devices are increasingly designed for portability and easy installation. Integration with hospital management and monitoring systems enhances preventive capabilities. The segment’s rapid growth is also supported by increased home care adoption and aging population trends.

- By End User

On the basis of end user, the market is segmented into hospitals, home care settings, elderly care facilities, and others. The hospital segment dominated the market with the largest revenue share of 44.5% in 2024, owing to the high volume of patients and need for advanced, multi-functional equipment. Hospitals invest heavily in motorized beds, lifts, and integrated monitoring systems to ensure patient safety and streamline caregiver operations. Acute care, bariatric care, and rehabilitation services reinforce demand. Hospitals also prioritize equipment that supports regulatory compliance and occupational safety. Advanced features such as smart beds, load-sensing lifts, and integration with IT systems enhance operational efficiency. The segment’s dominance is further reinforced by continuous technology upgrades and staff training programs.

The home care settings segment is expected to witness the fastest growth rate of 23.1% from 2025 to 2032, fueled by the increasing preference for in-home care among elderly and chronically ill patients. Rising adoption of portable beds, non-mechanical aids, and ergonomically designed mobility solutions enables caregivers to provide safe and effective care outside hospital environments. Awareness campaigns, government incentives, and telehealth integration further drive adoption. Lightweight and easy-to-use equipment increases accessibility. Families and private caregivers are increasingly investing in safe patient handling solutions. The segment’s growth is accelerated by rising aging populations and focus on cost-effective home care solutions.

North America Patient Handling Equipment Market Regional Analysis

- The U.S. dominated the patient handling equipment market with the largest revenue share of 83.4% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading manufacturers

- Healthcare facilities in the region prioritize advanced patient handling solutions such as motorized beds, patient lifts, and mobility aids to enhance patient safety, reduce caregiver injuries, and streamline hospital workflows

- This widespread adoption is further supported by stringent workplace safety regulations, high healthcare spending, and the presence of leading equipment manufacturers, establishing patient handling solutions as essential for hospitals, long-term care, and rehabilitation centers

Canada Patient Handling Equipment Market Insight

The Canada patient handling equipment market is expected to grow at a notable CAGR during the forecast period, fueled by rising demand for elderly care solutions and expansion of healthcare facilities. Canadian hospitals and long-term care centers are increasingly investing in ergonomic and automated patient handling equipment to reduce workplace injuries and improve patient care. Government initiatives promoting healthcare modernization and patient safety are encouraging adoption of motorized beds, lifts, and repositioning devices. The country’s focus on rehabilitation and home care services is also driving demand for portable and user-friendly mobility aids. Technological innovations, such as load-sensing lifts and integrated monitoring systems, further enhance market growth. The market is witnessing significant uptake in both urban hospitals and remote care facilities, supporting steady expansion.

Mexico Patient Handling Equipment Market Insight

The Mexico patient handling equipment market is poised to expand at a considerable CAGR during the forecast period, driven by rising healthcare infrastructure investments and increasing awareness about patient and caregiver safety. Hospitals and long-term care facilities are adopting advanced beds, lifts, and mobility solutions to improve patient outcomes and operational efficiency. The government’s focus on modernizing hospitals and implementing occupational safety standards is stimulating market growth. The growing prevalence of chronic and age-related conditions is creating higher demand for specialized patient handling equipment. Additionally, increasing awareness among home care providers and rehabilitation centers is boosting adoption of non-mechanical and ergonomic aids. Mexico’s expanding healthcare network and partnerships with international equipment suppliers further support market development.

North America Patient Handling Equipment Market Share

The North America Patient Handling Equipment industry is primarily led by well-established companies, including:

- Etac AB (U.K.)

- Guldmann A/S (Denmark)

- Handicare Group AB (Sweden)

- Hill-Rom Holdings, Inc. (U.S.)

- Invacare International Holdings Corp (U.S.)

- Joerns Healthcare (U.S.)

- LINET (Czech Republic)

- Medline Industries, Inc. (U.S.)

- Permobil AB (Sweden)

- Prism Medical Ltd (U.K.)

- Rowa Automatisierungssysteme GmbH (Germany)

- Stryker (U.S.)

- Stiegelmeyer GmbH & Co. KG (Germany)

- Sunrise Medical LLC (U.S.)

- V. Guldmann A/S (Denmark)

- Welch Allyn, Inc. (U.S.)

- Getinge AB (Sweden)

- Oxford Healthcare Ltd (U.K.)

What are the Recent Developments in North America Patient Handling Equipment Market?

- In April 2025, Arjo introduced the Maxi Move 5®, an advanced mobile patient floor lift designed to reduce caregiver injuries and optimize care efficiency. This top-of-the-line lift features innovative technical solutions, reinforcing Arjo's leadership in patient handling technology

- In May 2022, Invacare announced a strategic partnership to expand its distribution network in Asia. This move is expected to bolster Invacare's presence in the global market, including North America, by enhancing its supply chain and accessibility to healthcare providers

- In February 2022, Stryker Corporation completed the acquisition of Vocera Communications, a leader in digital care coordination and communication. This strategic move aims to enhance real-time communication and coordination in patient care, integrating Vocera's technologies with Stryker's patient handling equipment

- In March 2021, Drive DeVilbiss Healthcare launched a bariatric battery-powered patient lift designed for home care use. This lift features a jumbo actuator pump with an emergency button that can switch to manual mode, ensuring safe patient transfers for individuals up to 600 lbs

- In October 2021, Hill-Rom released updated safety guidelines for using its patient lifting equipment. These guidelines aim to ensure optimal safety and effectiveness in patient transfers, aligning with best practices and regulatory standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.