North America Pet Food Flavors and Ingredients Market Analysis and Insights

The cost of owning pets and purchasing pet food has increased significantly in recent years, which is a major driver of the North America pet food flavors and ingredients market. As pet owners spend more money on different types of pet food, the North America pet food market has also grown with the increase in the number of pets. Some of the major drivers of the market are the growing adoption of dogs and cats and the growing emphasis on improving productivity and health. Due to affordability and availability, the safest pet foods are currently made with synthetic substances. In addition, overall demand has been boosted by a marked shift in consumer demand for grain-free and vegan pet foods. The industry is expected to continue to grow as pet food is readily available on multiple platforms, including retail stores, supermarkets, and online stores.

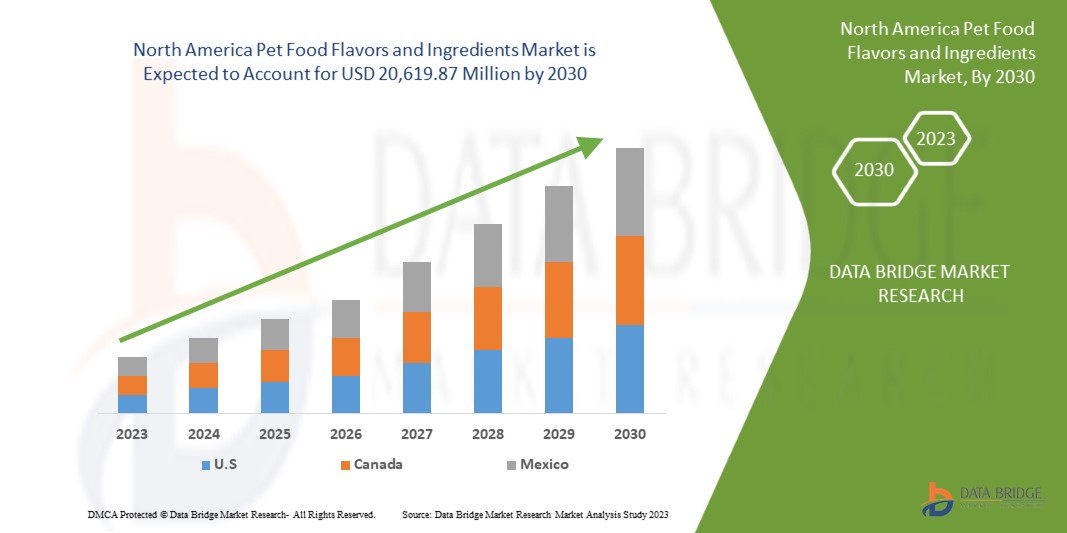

Data Bridge Market Research analyzes that the North America pet food flavors and ingredients market is expected to reach the value of USD 20,619.87 million by 2030, at a CAGR of 10.2% during the forecast period. Product type accounts for the largest type segment in the market due to increase in pet adoption and rising high quality of pet foods for pet North America. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Flavors and Palatability Enhancer, Mold Inhibitors, Antimicrobials, Pellet Binder, Enzymes, Amino Acid, Feed Acidifiers, Probiotics, Vitamins, Nitrogen, Phytogenic, Carotenoids, Trace Minerals, Antioxidants, Mycotoxin Binders, Cocolorants, Preservatives, and others), Pet Food Type (Dog Food, Cat Food, Aqua Pets Food, Birds Food, and Others), Source (Animal Based, Plant Based, Yeast, and Others), Form (Dry and Liquid), Functionality (Preservation, Processing, Nutrition, and Others), Category (Organic and Conventional), Distribution Channel (Direct and Indirect). |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Glanbia PLC, Ingredion, Barentz, Kerry Group plc., Cargill, Incorporated, ADM, BASF SE, International Flavors & Fragrances Inc., DSM, Symrise, Kemin Industries, Inc. and its group of companies, Chr. Hansen Holding A/S, Lallemand Inc., The Scoular Company, Roquette Frères, Balchem Inc., Wysong, The Peterson Company, and Omega Protein Corporation among others. |

Market Definition

Pet food is special food for domestic animals or food designed to meet their nutritional needs. Pet food is a plant or animal product, such as meat, that is used to feed pets. Fruits and vegetables, animal products, grains and oilseeds, vitamins, and minerals are all included in pet food. Pet food ingredients are high in vitamins, fiber, protein, carbohydrates, and calcium. Grains and vegetables are usually used especially for dog food. Each component is crucial to enrich the animal's body. The protein content of meat is generally considered high, and it also adds flavor to food. Many ingredients, such as meat, poultry, and grains, are believed to be safe and do not require premarket approval. Omega-3 and omega-6 fatty acids are also produced, which are essential for animal metabolism and digestion. Pet food manufacturers use different ingredients to balance pet nutrition. In addition to acting as preservatives, conditioners, emulsifiers, stabilizers, and color or flavor substitutes, they are also used in pet food.

North America Pet Food Flavors and Ingredients Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

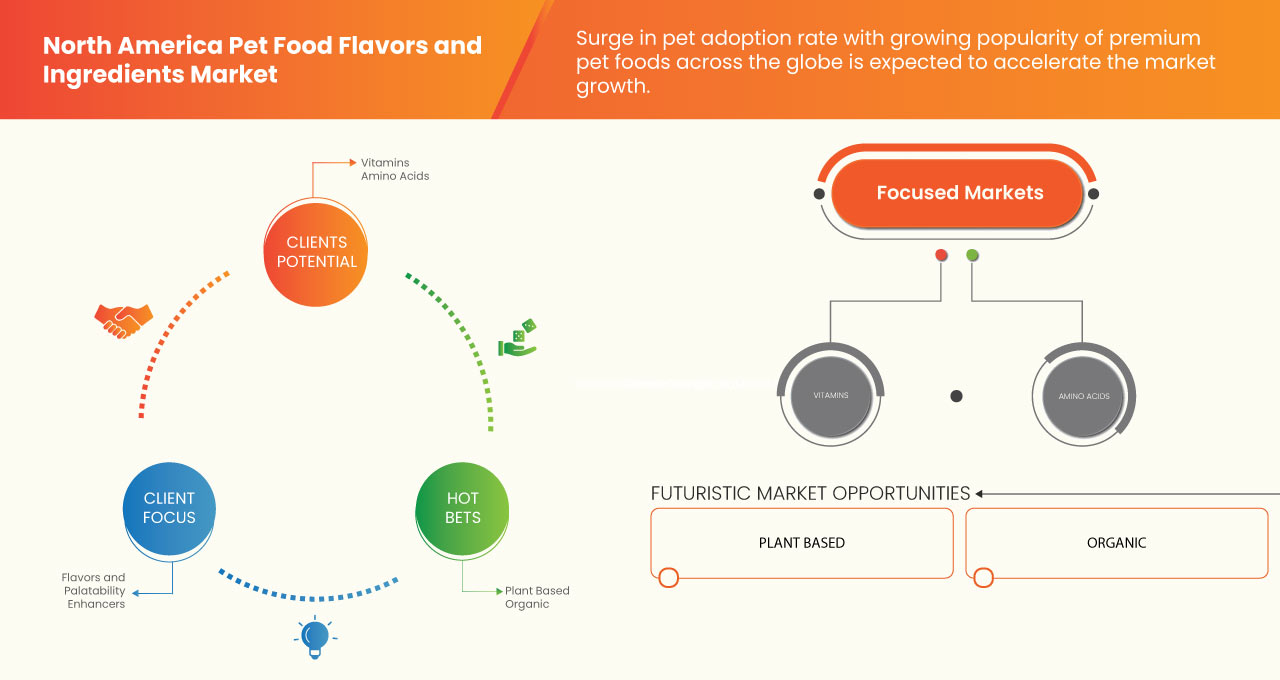

- Surge in pet adoption rate with the growing popularity of premium pet foods across the globe

The North America pet food flavor ingredients market is poised to show strong growth due to increased adoption of pets, rising expenditure on pet care, increasing demand for insect-based pet food, and a booming pet food market. The pet industry has grown exponentially in recent years. According to the American Pet Products Association, about 85 million households have a pet, and pet ownership has increased from 56 percent to 68 percent over the past 30 years. The introduction of technology and online shopping has contributed to some of the changes in pet ownership. Due to the effects of COVID-19, many people have been forced to stay at home for long periods, either due to shelter-in-place orders or due to work-from-home advice. Soon after, the amount of time spent at home increased, and adoptions and fosters were registered at pet shelters. Since the outbreak of the COVID-19 pandemic, the number of pets around the world has increased significantly. Also, emerging pet food ingredients market trends, such as the increasing popularity of premium foods across the country, are driving the growth of the pet food flavors and ingredients market, and this trend is expected to continue during the forecast period.

Thus, the surge in pet adoption rate and the growing popularity of premium pet foods around the globe are expected to act as an opportunity for the market's growth.

- Increasing demand for customized pet foods from pet owners

Pet owners are adopting the mindset that personalization is right, not a privilege, and the ability for pet owners to have input in what they buy has impacted the pet food industry. Pet owners are now willing to pay more for customized pet food products that satisfy their pet's particular dietary needs. When generational differences among pet owners are considered, young pet owners are expected to pay more for customized treats/pet foods than older pet owners. This shows that the trend toward customization is expected to continue to grow as younger shoppers start their pet parenting journey and gain more buying power.

Thus, increasing demand for customized pet foods from pet owners is expected to act as a driving factor for market growth.

Restraint

- Stringent mandates for pet food manufacturers

Pet food manufacturers, government agencies, and veterinarians play vital roles in ensuring the safety of pet food and safeguarding pets and their owners. It behooves veterinary practitioners to be aware of recent federal legislation affecting pet food safety, the role of the manufacturer in producing safe foods, and their own role in identifying potential pet food–related illnesses, reporting suspected cases and educating pet owners about pet food safety. Since pet food requires extreme safety in production, several associations and governments have set strict standards that manufacturers must adhere to, especially in Western countries. Strict oversight of pet food, from ingredients to production and sales to distribution, market rigidity may prevent large companies from investing in the sector and hamper the growth of the North America pet food flavors and ingredients market in the coming years.

Thus, stringent mandates for pet food manufacturers are expected to act as a restraining factor for the market's growth.

Opportunity

- Increasing demand for cannabidiol (CBD) pet food

A safe and well-processed cannabinoid derived from hemp, CBD pet supplements support pet health by working with their endocannabinoid systems. Some of the main reasons many pet owners turn to CBD pet food are that it supports healthy joints, helps promote cardiovascular function, and prevents the spread of heartworms. In 2020, U.S. pet sales were nearly USD 800 million, and consumers are willing to pay more for pet health services. CBD pet supplements offer a number of claims, including wheat, corn, and soy free, which means they are all-natural and contribute to market growth.

Moreover, growing consumer awareness of nutritional advantages associated with hemp derivatives and increasing production of industrial hemp have directed the growth of the market for hemp derivatives. CBD foods are expected to last longer than traditional pet foods.

Thus, increasing demand for cannabidiol pet food is expected to act as an opportunity for market growth.

Challenge

- Increasing competition in the pet food flavors and ingredients market

The companies within the industry are expected to grow even more in the future, which will create high competition in the pet food flavors and ingredients market. New market players are coming up with innovative marketing strategies, such as offering products at lower costs and using innovative ingredients, which is a challenging factor for the tier-1 and tier-2 players. Competition among companies exists when they produce and market similar services and products aimed at the same consumer group. This is becoming a challenging factor for companies to gain significant market share. Big giants in the pet food flavors and ingredients market, such as ADM, Koninklijke DSM N.V., and DuPont among others, have extensive distribution networks, strong North America footprint, and strong R&D, which poses a problem for small players to compete with these players. A large number of players in Europe's pet food industry increases the completion in the pet food flavors and ingredients market.

Thus, increasing competition in the pet food flavors and ingredients market is expected to act as a challenge for market growth.

Post-COVID-19 Impact on North America Pet Food Flavors and Ingredients Market

The COVID-19 pandemic has had a somewhat positive impact on the pet food flavors and ingredients market. Since the outbreak of the COVID-19 pandemic, the number of pets adopted across the globe. has increased at a significant pace. This rise in the adoption of pets is acting as a catalyst for the market's growth.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pet food flavors and ingredients market.

Recent Developments

- In January 2022, Kerry Group Plc, the world's leading taste and nutrition company, officially opened a new 21,500-square-foot state-of-the-art facility at its Jeddah operation in the Kingdom of Saudi Arabia. The company has invested over EUR 80 million in the region over the past four years and this new facility, which is Kerry's largest in the Middle East, North Africa and Turkey (MENAT) region, is one of the most modern and efficient in the world and will produce great tasting, nutritious and sustainable food ingredients which will be distributed across the Middle East. This has helped the company to grow.

- In November 2022, ADM unveiled its third annual outlook on the North America consumer trends that will shape the food, beverage and animal nutrition industries and drive market growth in the years ahead. Dissecting the intersection of health and well-being, sustainability and food security, ADM has identified eight spaces that detail consumers' evolving behaviors, attitudes, and aspirations. The eight areas serve as anchor points to inspire innovation, ushering in a new wave of products and services for 2023. This has helped the company to grow its product portfolio.

North America Pet Food Flavors and Ingredients Market Scope

North America pet food flavors and ingredients market is segmented into product type, pet food type, source, form, functionality, category, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY PRODUCT TYPE

- Flavors and palatability enhancer

- Mold inhibitors

- Antimicrobials

- Pellet binder

- Enzymes

- Amino acid

- Feed acidifiers

- Probiotics

- Vitamins

- Nitrogen

- Phytogenic

- Carotenoids

- Trace minerals

- Antioxidants

- Mycotoxin binders

- Cocolorants

- Preservatives

- Others

On the basis of product type, the North America pet food flavors and ingredients market is segmented into flavors and palatability enhancer, mold inhibitors, antimicrobials, pellet binder, enzymes, amino acid, feed acidifiers, probiotics, vitamins, nitrogen, phytogenic, carotenoids, trace minerals, antioxidants, mycotoxin binders, Cocolorants, preservatives, and others.

BY PET FOOD TYPE

- Dog food

- Cat food

- Aqua pet food

- Birds food

- Others

On the basis of pet food type, the North America pet food flavors and ingredients market is segmented into dog food, cat food, aqua pet food, birds food, and others.

BY SOURCE

- Animal based

- Plant based

- Yeast

- Others

On the basis of source, the North America pet food flavors and ingredients market is segmented into animal based, plant based, yeast, and others.

BY FORM

- Dry

- Liquid

On the basis of form, the North America pet food flavors and ingredients market is segmented into dry and liquid.

BY FUNCTIONALITY

- Preservation

- Processing

- Nutrition

- Others

On the basis of functionality, the North America pet food flavors and ingredients market is segmented into preservation, processing, nutrition, and others.

BY CATEGORY

- Organic

- Conventional

On the basis of category, the North America pet food flavors and ingredients market is segmented into organic and conventional.

BY DISTRIBUTION CHANNEL

- Direct

- Indirect

On the basis of distribution channel, the North America pet food flavors and ingredients market is segmented into direct and indirect.

North America Pet Food Flavors and Ingredients Market Regional Analysis/Insights

The North America pet food flavors and ingredients market is analyzed, and market size information is provided by product type, pet food type, source, form, functionality, category, and distribution channel.

The countries covered in this market report U.S., Canada, and Mexico.

- In 2023, the U.S. is expected to dominate the North America pet food flavors and ingredients market due to the strong presence of key players such as Kerry Group plc, Cargill, Incorporated, ADM, BASF SE and others.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Pet Food Flavors and Ingredients Market Share Analysis

North America pet food flavors and ingredients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America pet food flavors and ingredients market.

Some of the major players operating in the North America pet food flavors and ingredients market are Glanbia PLC, Ingredion, Barentz, Kerry Group plc., Cargill, Incorporated, ADM, BASF SE, International Flavors & Fragrances Inc., DSM, Symrise, Kemin Industries, Inc. and its group of companies, Chr. Hansen Holding A/S, Lallemand Inc., The Scoular Company, Roquette Frères, Balchem Inc., Wysong, The Peterson Company, and Omega Protein Corporation among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES

4.2 FACTORS INFLUENCING PURCHASING DECISIONS OF END-USERS

4.3 GROWTH STRATEGIES ADOPTED BY THE KEY MARET PLAYERS

4.3.1 PARTICIPATING IN TRADE FAIRS AND BUSINESS EVENTS

4.3.2 ORGANIZING PET SHOWS TO GAIN VISIBILITY

4.3.3 PROVIDING QUALITY PRODUCT

4.3.4 ATTRACTIVE PACKAGING

4.3.5 SELLING THE PET FOOD PRODUCT ON E-COMMERCE WEBSITES

4.3.6 MARKETING THROUGH E-MAIL

4.3.7 HIRING A BRAND AMBASSADOR

4.3.8 FEEDBACK FROM CUSTOMER

4.4 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET- IMPORT & EXPORT ANALYSIS OF PET FOODS ACROSS THE GLOBE ACCORDING TO PER YEAR

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 FUTURE PERSPECTIVE:

4.5.2 CONCLUSION:

4.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7 PRICING ANALYSIS – NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

4.8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.9.1 MEAT

4.9.2 SOYBEAN

4.9.3 SEA FOOD

4.1 SUPPLY CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 PET FOOD AND INGREDIENTS PRODUCTION/PROCESSING

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

4.11 VALUE CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

5 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: REGULATORY FRAMEWORK

5.1 CLASSIFICATION OF PET FOOD (CHINA)

5.2 LABELING REQUIREMENTS (NORTH AMERICA)

5.3 LABELING REQUIREMENTS (EUROPEAN UNION)

5.4 PET FOOD CERTIFICATIONS

5.4.1 ORGANIC

5.4.2 MARINE STEWARDSHIP COUNCIL (MSC)

5.4.3 VEGAN

5.4.4 GMP+ FSA

5.4.5 FAMI-QS CODE

5.4.6 SAFE FEED/SAFE FOOD CERTIFICATION PROGRAM

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGE IN PET ADOPTION RATE WITH GROWING POPULARITY OF PREMIUM PET FOODS ACROSS THE GLOBE

6.1.2 SHIFT FROM PHYSICAL HEALTH TO HOLISTIC WELLNESS

6.1.3 INCREASING DEMAND FOR CUSTOMIZED PET FOODS FROM PET OWNERS

6.1.4 FOCUS ON MINI-MEALS INSTEAD OF MEALS PER DAY FOR PETS

6.2 RESTRAINTS

6.2.1 STRINGENT MANDATES FOR PET FOOD MANUFACTURERS

6.2.2 INTRODUCTION OF CHEMICALS IN THE PET FOOD

6.2.3 LINK BETWEEN CERTAIN PET FOODS AND HEART DISEASES

6.2.4 ADULTERATION IN PET FOOD PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR CANNABIDIOL (CBD) PET FOOD

6.3.2 SUPER PREMIUM PET FOOD PRODUCTS IN THE MARKET

6.3.3 INTRODUCTION OF ALTERNATIVE PROTEIN INGREDIENTS IN PET FOODS

6.3.4 E-COMMERCE SECTOR CONTINUES TO CREATE OPPORTUNITIES IN THE PET FOOD FLAVORS AND INGREDIENTS MARKET

6.4 CHALLENGES

6.4.1 INCREASING COMPETITION IN THE PET FOOD FLAVORS AND INGREDIENTS MARKET

6.4.2 THREAT FROM COUNTERFEIT PRODUCTS

7 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 VITAMINS

7.2.1 FAT SOLUBLE

7.2.1.1 VITAMIN A

7.2.1.2 VITAMIN D

7.2.1.3 VITAMIN E

7.2.1.4 VITAMIN K

7.2.2 WATER SOLUBLE

7.2.2.1 VITAMIN B COMPLEX

7.2.2.2 VITAMIN C

7.2.2.2.1 ANIMAL BASED

7.2.2.2.2 PLANT BASED

7.2.2.2.3 YEAST

7.2.2.2.4 OTHERS

7.3 AMINO ACID

7.3.1 LYSINE

7.3.2 METHIONINE

7.3.3 TRYPTOPHAN

7.3.4 THREONINE

7.3.5 OTHERS

7.3.5.1 ANIMAL BASED

7.3.5.2 PLANT BASED

7.3.5.3 YEAST

7.3.5.4 OTHERS

7.4 TRACE MINERALS

7.4.1 IRON

7.4.2 COPPER

7.4.3 MANGANESE

7.4.4 ZINC

7.4.5 SELENIUM

7.4.6 OTHERS

7.4.6.1 PLANT BASED

7.4.6.2 ANIMAL BASED

7.4.6.3 YEAST

7.4.6.4 OTHERS

7.5 PRESERVATIVES

7.5.1 NATURAL

7.5.1.1 TOCOPHEROL

7.5.1.2 ASCORBATE

7.5.1.3 OTHERS

7.5.2 SYNTHETIC

7.5.2.1 PROPYLENE GLYCOL

7.5.2.2 BUTYLATED HYDROXYANISOLE (BHA)

7.5.2.3 BUTYLATED HYDROXYTOLUENE (BHT)

7.5.2.4 PROPYL GALLATE

7.5.2.5 THOXYQUIN

7.5.2.6 OTHERS

7.5.2.6.1 PLANT BASED

7.5.2.6.2 ANIMAL BASED

7.5.2.6.3 YEAST

7.5.2.6.4 OTHERS

7.6 FLAVORS AND PALATABILITY ENHANCER

7.6.1 REACTION FLAVORS/DIGESTS

7.6.2 COMPOUNDED FLAVORS

7.6.2.1 NATURAL FLAVORS

7.6.2.2 SYNTHETIC FLAVORS

7.6.2.2.1 ANIMAL BASED

7.6.2.2.2 PLANT BASED

7.6.2.2.3 YEAST

7.6.2.2.4 OTHERS

7.7 PROBIOTICS

7.7.1 LACTOBACILLI

7.7.2 BIFIDOBACTERIA

7.7.3 YEAST

7.7.4 STREPTOCOCCUS THERMOPHILUS

7.7.4.1 YEAST

7.7.4.2 PLANT BASED

7.7.4.3 ANIMAL BASED

7.7.4.4 OTHERS

7.8 ANTIOXIDANTS

7.8.1 BHA

7.8.2 BHT

7.8.3 ETHOXYQUIN

7.8.4 OTHERS

7.8.4.1 PLANT BASED

7.8.4.2 ANIMAL BASED

7.8.4.3 YEAST

7.8.4.4 OTHERS

7.9 PELLET BINDERS

7.9.1 LIGNIN BASED BINDERS/LIGNOSULFONATES

7.9.2 STARCHES

7.9.3 HEMI-CELLULOSE BINDERS

7.9.4 GUMS

7.9.5 OTHERS

7.9.5.1 PLANT BASED

7.9.5.2 ANIMAL BASED

7.9.5.3 YEAST

7.9.5.4 OTHERS

7.1 ENZYMES

7.10.1 AMYLASE

7.10.2 PROTEASE

7.10.3 CELLULASE

7.10.4 XYLANASE

7.10.5 GLUCANASE

7.10.6 PHYTASE

7.10.7 MANNASE

7.10.8 OTHERS

7.10.8.1 PLANT BASED

7.10.8.2 ANIMAL BASED

7.10.8.3 YEAST

7.10.8.4 OTHERS

7.11 FEED ACIDIFIERS

7.11.1 PROPIONIC ACID

7.11.2 CITRIC ACID

7.11.3 LACTIC ACID

7.11.4 SORBIC ACID

7.11.5 FORMALDEHYDE

7.11.6 MALIC ACID

7.11.7 OTHERS

7.11.7.1 ANIMAL BASED

7.11.7.2 PLANT BASED

7.11.7.3 YEAST

7.11.7.4 OTHERS

7.12 MOLD INHIBITORS

7.12.1 SORBATES, SODIUM BENZOATE

7.12.2 SODIUM PROPIONATE

7.12.3 ACETIC ACID

7.12.4 OTHERS

7.12.4.1 PLANT BASED

7.12.4.2 ANIMAL BASED

7.12.4.3 YEAST

7.12.4.4 OTHERS

7.13 MYCOTOXIN BINDERS

7.13.1 SILICATES

7.13.2 CLAYS

7.13.3 CHEMICAL POLYMERS

7.13.4 GLUCAN PRODUCTS

7.13.5 OTHERS

7.14 NITROGEN

7.14.1 UREA

7.14.2 AMMONIA

7.14.3 OTHERS

7.14.3.1 PLANT BASED

7.14.3.2 ANIMAL BASED

7.14.3.3 YEAST

7.14.3.4 OTHERS

7.15 PHYTOGENIC

7.15.1 ESSENTIAL OILS

7.15.2 HERBS & SPICES

7.15.3 OLEORESIN

7.15.4 OTHERS

7.16 CAROTENOIDS

7.16.1 BETA-CAROTENE

7.16.2 LUTEIN

7.16.3 ASTAXANTHIN

7.16.4 CANTHAXANTHIN

7.16.4.1 PLANT BASED

7.16.4.2 ANIMAL BASED

7.16.4.3 YEAST

7.16.4.4 OTHERS

7.17 ANTIMICROBIALS

7.17.1 PLANT BASED

7.17.2 ANIMAL BASED

7.17.3 YEAST

7.17.4 OTHERS

7.18 COLORANTS

7.18.1 ANNATTO EXTRACT

7.18.2 DEHYDRATED BEETS

7.18.3 CARAMEL

7.18.4 TURMERIC

7.18.5 PAPRIKA

7.18.6 SAFFRON

7.18.7 OTHERS

7.18.7.1 PLANT BASED

7.18.7.2 ANIMAL BASED

7.18.7.3 YEAST

7.18.7.4 OTHERS

7.19 OTHERS

8 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE

8.1 OVERVIEW

8.2 DOG FOOD

8.2.1 VITAMINS

8.2.2 AMINO ACID

8.2.3 FLAVORS AND PALATABILITY ENHANCER

8.2.4 PELLET BINDERS

8.2.5 TRACE MINERALS

8.2.6 ANTIOXIDANTS

8.2.7 PROBIOTICS

8.2.8 ENZYMES

8.2.9 PRESERVATIVES

8.2.10 FEED ACIDIFIERS

8.2.11 PHYTOGENIC

8.2.12 MOLD INHIBITORS

8.2.13 MYCOTOXIN BINDERS

8.2.14 COLORANTS

8.2.15 ANTIMICROBIALS

8.2.16 NITROGEN

8.2.17 CAROTENOIDS

8.2.18 OTHERS

8.3 CAT FOOD

8.3.1 VITAMINS

8.3.2 AMINO ACID

8.3.3 FLAVORS AND PALATABILITY ENHANCER

8.3.4 PELLET BINDERS

8.3.5 TRACE MINERALS

8.3.6 ANTIOXIDANTS

8.3.7 PROBIOTICS

8.3.8 ENZYMES

8.3.9 PRESERVATIVES

8.3.10 FEED ACIDIFIERS

8.3.11 PHYTOGENIC

8.3.12 MOLD INHIBITORS

8.3.13 MYCOTOXIN BINDERS

8.3.14 COLORANTS

8.3.15 ANTIMICROBIALS

8.3.16 NITROGEN

8.3.17 CAROTENOIDS

8.3.18 OTHERS

8.4 BIRDS FOOD

8.4.1 AMINO ACID

8.4.2 VITAMINS

8.4.3 TRACE MINERALS

8.4.4 ANTIOXIDANTS

8.4.5 PRESERVATIVES

8.4.6 PROBIOTICS

8.4.7 PELLET BINDERS

8.4.8 CAROTENOIDS

8.4.9 ENZYMES

8.4.10 COLORANTS

8.4.11 PHYTOGENIC

8.4.12 FLAVORS AND PALATABILITY ENHANCER

8.4.13 NITROGEN

8.4.14 MOLD INHIBITORS

8.4.15 MYCOTOXIN BINDERS

8.4.16 ANTIMICROBIALS

8.4.17 FEED ACIDIFIERS

8.4.18 OTHERS

8.5 AQUA PETS FOOD

8.5.1 VITAMINS

8.5.2 AMINO ACID

8.5.3 TRACE MINERALS

8.5.4 PELLET BINDERS

8.5.5 ANTIOXIDANTS

8.5.6 CAROTENOIDS

8.5.7 PRESERVATIVES

8.5.8 FLAVORS AND PALATABILITY ENHANCER

8.5.9 PROBIOTICS

8.5.10 ENZYMES

8.5.11 ANTIMICROBIALS

8.5.12 FEED ACIDIFIERS

8.5.13 NITROGEN

8.5.14 COLORANTS

8.5.15 PHYTOGENIC

8.5.16 MOLD INHIBITORS

8.5.17 MYCOTOXIN BINDERS

8.5.18 OTHERS

8.6 OTHERS

9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE

9.1 OVERVIEW

9.2 PLANT BASED

9.2.1 CEREAL & GRAINS

9.2.2 FRUITS & NUTS

9.2.3 VEGETABLES

9.2.4 OILSEEDS

9.2.5 OTHERS

9.3 ANIMAL BASED

9.3.1 BEEF

9.3.2 POULTRY

9.3.3 PORK

9.3.4 OTHERS

9.4 YEAST

9.5 OTHERS

10 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 LIQUID

11 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY

11.1 OVERVIEW

11.2 NUTRITION

11.3 PROCESSING

11.4 PRESERVATION

11.5 OTHERS

12 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 ORGANIC

12.3 CONVENTIONAL

13 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA.

14.1.3 MEXICO.

15 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMAPNT SHARE ANAKYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMAPNT SHARE ANAKYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SYMRISE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMAPNT SHARE ANAKYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMAPNT SHARE ANAKYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 BASF SE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMAPNT SHARE ANAKYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 BALCHEM INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 BARENTZ

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 CHR. HANSEN HOLDING A/S

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GLANBIA PLC

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 INGREDION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 COMAPNT SHARE ANAKYSIS

17.10.5 RECENT DEVELOPMENT

17.11 INTERNATIONAL FLAVORS & FRAGRANCES INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 COMAPNT SHARE ANAKYSIS

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 KEMIN INDUSTRIES, INC. AND ITS GROUP OF COMPANIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 KERRY GROUP PLC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 COMAPNT SHARE ANAKYSIS

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 LALLEMAND INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 OMEGA PROTEIN CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ROQUETTE FRÈRES

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 THE PETERSON COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 THE SCOULAR COMPANY

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 WYSONG

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 EXPORT VALUE OF PET FOOD PER YEAR

TABLE 2 IMPORT OF PET FOOD

TABLE 3 EXPORT OF ANIMAL-ORIGIN PET FOOD PRODUCTS

TABLE 4 VOLUME OF PET FOOD PRODUCED WORLDWIDE / YEAR, BY REGION

TABLE 5 SUPPLY CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

TABLE 6 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA YEAST IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA DRY IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA LIQUID IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA NUTRITION IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA PROCESSING IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRESERVATION IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA ORGANIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA CONVENTIONAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA DIRECT IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA INDIRECT IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 96 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 131 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 133 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 135 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 137 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 139 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 141 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 142 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 144 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 145 U.S. VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 U.S. VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 149 U.S. AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 151 U.S. TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 153 U.S. PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 157 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 159 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 160 U.S. PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 U.S. PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 162 U.S. ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 U.S. ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 164 U.S. PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 166 U.S. ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 U.S. ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 168 U.S. FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 U.S. FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 170 U.S. MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 U.S. MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 172 U.S. MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 U.S. NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 175 U.S. PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 U.S. CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 178 U.S. ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 179 U.S. COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 181 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 187 U.S. PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 188 U.S. ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 189 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 190 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 191 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 192 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 193 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 195 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 196 CANADA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 200 CANADA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 202 CANADA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 204 CANADA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 CANADA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 CANADA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 CANADA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 210 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 211 CANADA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 CANADA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 213 CANADA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 CANADA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 215 CANADA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 CANADA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 217 CANADA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 CANADA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 219 CANADA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 221 CANADA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 223 CANADA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 CANADA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 226 CANADA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 CANADA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 CANADA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 230 CANADA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 CANADA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 232 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 233 CANADA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 235 CANADA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 237 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 238 CANADA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 239 CANADA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 240 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 241 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 242 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 243 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 244 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 246 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 247 MEXICO VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 251 MEXICO AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 253 MEXICO TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 255 MEXICO PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 MEXICO NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 MEXICO SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 MEXICO PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 259 MEXICO FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 260 MEXICO PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 MEXICO PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 262 MEXICO ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 MEXICO ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 264 MEXICO PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 MEXICO PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 266 MEXICO ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 MEXICO ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 269 MEXICO FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 279 MEXICO COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 281 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 283 MEXICO CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 284 MEXICO BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 285 MEXICO AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 286 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 287 MEXICO PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 288 MEXICO ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 289 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 290 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 291 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 292 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 8 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SEGMENTATION

FIGURE 11 THE GROWING RISING TREND OF PET HUMANIZATION AROUND THE WORLD IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET FROM 2023 TO 2030

FIGURE 12 VITAMINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

FIGURE 14 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, 2022

FIGURE 19 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, 2022

FIGURE 23 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, 2022

FIGURE 27 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, LIFELINE CURVE

FIGURE 30 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, 2022

FIGURE 31 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 34 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, 2022

FIGURE 35 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, LIFELINE CURVE

FIGURE 38 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 39 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SNAPSHOT (2022)

FIGURE 43 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022)

FIGURE 44 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 46 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY PRODUCT TYPE (2021-2030)

FIGURE 47 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: COMPANY SHARE 2022 (%)

North America Pet Food Flavors And Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Pet Food Flavors And Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Pet Food Flavors And Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.