North America Pharmaceutical Excipients Market

Market Size in USD Billion

CAGR :

%

USD

4.69 Billion

USD

7.82 Billion

2024

2032

USD

4.69 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.69 Billion | |

| USD 7.82 Billion | |

|

|

|

|

North America Pharmaceutical Excipients Market Size

- The North America pharmaceutical excipients market size was valued at USD 4.69 billion in 2024 and is expected to reach USD 7.82 billion by 2032, at a CAGR of 6.6% during the forecast period

- The market growth is largely fueled by the increasing demand for safe, effective, and high-quality pharmaceutical formulations, which drives the adoption of advanced excipients across the pharmaceutical industry. Ongoing innovations in drug delivery systems, including oral, injectable, and topical formulations, further support market expansion

- Furthermore, rising focus on patient-centric drug development, regulatory compliance, and the need for excipients that improve stability, bioavailability, and manufacturability are establishing pharmaceutical excipients as critical components in modern drug formulation. These converging factors are accelerating the uptake of novel excipients solutions, thereby significantly boosting the industry's growth

North America Pharmaceutical Excipients Market Analysis

- Pharmaceutical excipients, serving as functional ingredients in dietary supplements, nutraceuticals, and pharmaceutical formulations, are increasingly vital components of modern health and wellness products in both commercial and consumer applications due to their ability to enhance stability, efficacy, taste, and overall product quality

- The escalating demand for pharmaceutical excipients is primarily fueled by the growing consumption of dietary supplements, functional foods, and nutraceutical products, along with rising health awareness among consumers and advancements in excipient technology

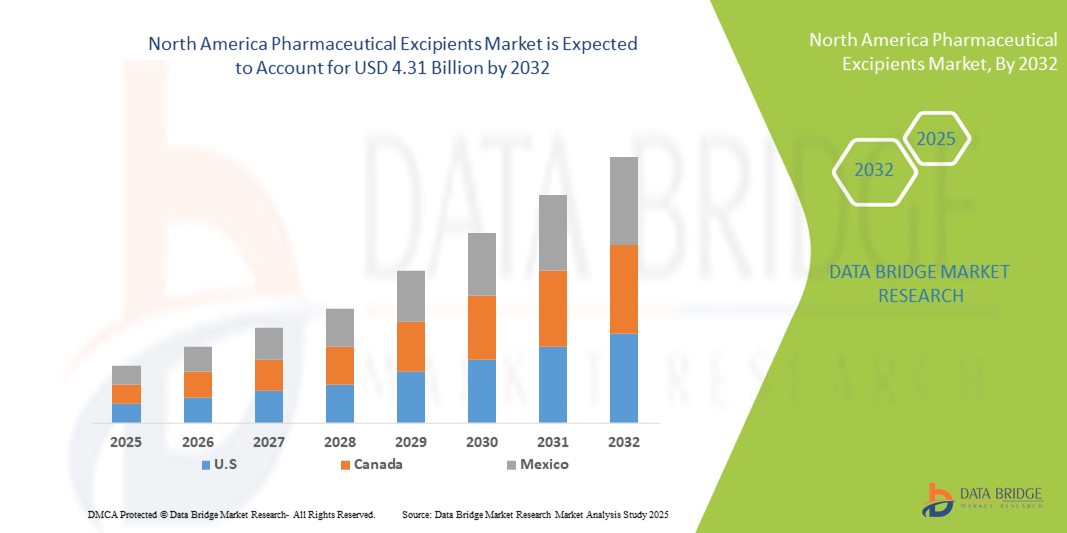

- U.S. dominated the pharmaceutical excipients market with the largest revenue share of 71.5% in 2024, supported by strong healthcare infrastructure, high consumer awareness regarding health and wellness, and the presence of leading excipient suppliers. Ongoing innovations in nutraceutical formulations and increasing demand for high-quality excipients further drive market growth

- Canada is expected to be the fastest-growing country in the pharmaceutical excipients market during the forecast period, projected to expand at a CAGR of 11.8% from 2025 to 2032, driven by government healthcare initiatives, increasing availability of advanced nutraceutical products, and rising adoption of preventive healthcare solutions

- The oral excipients segment dominated the pharmaceutical excipients market with a revenue share of 51.2% in 2024, driven by the prevalence of oral drug delivery systems in North America. Oral excipients ensure stability, consistent release profiles, and patient compliance, which is critical for chronic and acute treatments

Report Scope and Pharmaceutical Excipients Market Segmentation

|

Attributes |

Pharmaceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Pharmaceutical Excipients Market Trends

Enhanced Functionality and Versatility in Pharmaceutical Formulations

- A significant and accelerating trend in the North America pharmaceutical excipients market is the increasing adoption of multifunctional excipients that enhance the stability, solubility, and bioavailability of nutraceutical and pharmaceutical formulations. These excipients are helping manufacturers optimize product performance and meet stringent quality standards

- For instance, advanced coating agents and flavoring excipients are being incorporated into dietary supplements and functional foods to improve taste, mask unpleasant flavors, and ensure consistent release profiles, making products more appealing and effective for consumers

- The use of natural and synthetic carriers is growing, enabling better encapsulation of active ingredients, protection from degradation, and controlled release, which ultimately enhances the efficacy and shelf-life of nutraceutical and pharmaceutical products

- Integration of excipients into complex formulations allows manufacturers to create multifunctional products that combine therapeutic benefits with improved organoleptic properties, convenience, and patient compliance

- This trend toward more versatile and high-performance excipients is reshaping manufacturer and consumer expectations, encouraging innovation in formulation science. Consequently, leading companies are developing novel excipients tailored for specific applications such as protein supplements, vitamin formulations, and mineral-enriched nutraceuticals

- The demand for excipients that offer multifunctionality, compatibility with diverse formulations, and regulatory compliance is growing rapidly across both pharmaceutical and nutraceutical sectors, as manufacturers prioritize product quality, efficacy, and consumer acceptability

North America Pharmaceutical Excipients Market Dynamics

Driver

Growing Need Due to Rising Demand for Advanced Drug Formulations

- The increasing focus on patient-centric drug delivery, along with the growing demand for safe, effective, and high-quality pharmaceutical products, is a major factor driving the adoption of pharmaceutical excipients across the industry. Excipients now play a crucial role in improving the stability, solubility, and bioavailability of drugs, making them essential in modern pharmaceutical manufacturing

- For instance, in 2024, Colorcon and Ashland introduced advanced excipient solutions specifically designed to enhance drug performance, including taste-masking agents, controlled-release polymers, and high-purity stabilizers. Initiatives such as these by leading companies are expected to significantly drive market growth in the forecast period

- Pharmaceutical manufacturers are increasingly seeking excipients that can enable innovative formulations, such as orally disintegrating tablets, sustained-release capsules, and injectable biologics, to meet patient compliance and therapeutic needs

- The rapid expansion of the biopharmaceutical sector, including biologics, biosimilars, and specialty therapies, is further fueling the demand for high-quality, functional excipients suitable for complex formulations and sensitive APIs

- Ready-to-use excipient solutions that simplify formulation, reduce manufacturing time, and maintain consistent quality are gaining traction among pharmaceutical companies, particularly for high-volume production

- Regulatory-compliant excipients that meet global standards, such as USP, EP, and JP, are highly preferred, providing manufacturers with confidence in safety and efficacy while accelerating product development timelines

- The convenience, versatility, and reliability of advanced excipients in supporting multiple dosage forms and enhancing drug performance make them indispensable in both small-scale and large-scale pharmaceutical production

Restraint/Challenge

Regulatory Compliance and High Development Costs

- Stringent regulatory requirements for pharmaceutical excipients, particularly for novel or high-purity grades, present a significant challenge for market expansion. Companies must comply with FDA, EMA, and other global guidelines, which involves extensive documentation, testing, and validation processes

- The high cost of research, development, and scale-up for new excipient grades, including specialized binders, solubilizers, and stabilizers, can be a barrier for smaller or emerging companies looking to enter the market

- Addressing these regulatory and cost-related challenges requires robust quality assurance systems, validated manufacturing processes, and close alignment with regulatory agencies to ensure compliance and timely approvals

- Leading companies such as BASF, Dow, DFE Pharma, and Ashland emphasize adherence to stringent quality standards, providing excipients with verified performance and safety profiles to build trust among pharmaceutical manufacturer

- The need for extensive safety and efficacy testing, particularly for excipients used in sensitive formulations such as injectables or biologics, can delay product launches and increase operational costs

- High development costs for specialized excipients, such as those used in controlled-release or targeted delivery systems, may limit adoption among cost-sensitive manufacturers, particularly in emerging markets

- Overcoming these challenges through investment in innovation, cost-effective production, and regulatory guidance is critical for sustained growth in the pharmaceutical excipients market, ensuring a balance between safety, performance, and accessibility

North America Pharmaceutical Excipients Market Scope

The market is segmented on the basis of functionality, dosage form, route of administration, end user, and distribution channel.

- By Functionality

On the basis of functionality, the pharmaceutical excipients market is segmented into binders and adhesives, disintegrants, coating material, solubilizers, flavors, sweetening agents, diluents, lubricants, buffers, emulsifying agents, preservatives, antioxidants, sorbents, solvents, emollients, glidients, chelating agents, antifoaming agents, and others. The binders and adhesives segment dominated the market with a revenue share of 32.4% in 2024, driven by their critical role in ensuring tablet cohesion, mechanical strength, and uniformity in pharmaceutical dosage forms. These excipients enhance drug release profiles, improve patient compliance, and are compatible with a wide range of oral formulations, making them indispensable in large-scale manufacturing. They are extensively used in both generic and novel drug formulations across North America, and major pharmaceutical manufacturers prioritize high-quality binders to ensure consistency and stability. Their importance in improving tablet compressibility and formulation robustness makes them a staple in every production line, contributing to strong and sustained demand.

The lubricants segment is expected to witness the fastest CAGR of 12.1% from 2025 to 2032, driven by increasing adoption in high-speed tablet manufacturing processes and growing demand for oral solid formulations. Lubricants reduce friction during tablet compression and ejection, improve processing efficiency, and minimize wear on equipment. Their rising use in combination with other excipients for optimized drug release and patient safety is fueling rapid growth. Manufacturers are focusing on innovative lubricant formulations that are compatible with moisture-sensitive or heat-sensitive active ingredients. The growing trend toward outsourcing formulation development and the need for excipients that improve scalability and consistency are also boosting this segment’s growth. Regulatory compliance and stringent quality standards in North America further drive demand for high-performance lubricants, making them a key area of investment and research.

- By Dosage Form

On the basis of dosage form, the pharmaceutical excipients market is segmented into solid, semi-solid, and liquid. The solid dosage form segment dominated with a market share of 45.3% in 2024, attributed to the widespread use of tablets and capsules in prescription and over-the-counter medications. Solid forms offer cost-effective production, extended shelf life, and ease of transport, which makes them highly preferred by manufacturers. They allow for precise dosing, compatibility with multiple excipients, and better patient compliance. Solid dosage forms are widely used across North America in hospitals, retail pharmacies, and contract manufacturing facilities. The ability to incorporate multiple active pharmaceutical ingredients (APIs) and controlled-release technologies enhances their dominance.

The liquid dosage form segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032, driven by increasing demand for pediatric, geriatric, and nutraceutical formulations that are easier to administer. Liquids provide faster absorption and dose flexibility, making them ideal for populations with swallowing difficulties. The rise in functional beverages, oral syrups, and suspensions has further accelerated adoption. Manufacturers are investing in excipients that enhance solubility, stability, and taste-masking for liquid forms. The growing trend of home healthcare and ready-to-use liquid formulations also contributes to the rapid growth of this segment.

- By Route of Administration

On the basis of route of administration, the pharmaceutical excipients market is segmented into oral excipients, topical excipients, parenteral excipients, and other excipients. The oral excipients segment dominated with a revenue share of 51.2% in 2024, driven by the prevalence of oral drug delivery systems in North America. Oral excipients ensure stability, consistent release profiles, and patient compliance, which is critical for chronic and acute treatments. They are widely used in tablets, capsules, and powders, forming the backbone of pharmaceutical manufacturing. Manufacturers prioritize high-quality oral excipients for large-scale production, regulatory compliance, and formulation innovation.

The parenteral excipients segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, fueled by increasing adoption of injectable drugs, biologics, and advanced therapies. These excipients are critical for ensuring sterility, stability, and compatibility in parenteral formulations. The growing demand for vaccines, monoclonal antibodies, and biopharmaceuticals in North America is driving rapid growth. Advanced excipients enhance solubility, reduce immunogenicity, and maintain efficacy in injectable solutions. The expansion of hospital networks and contract manufacturing organizations further supports this trend.

- By End User

On the basis of end user, the pharmaceutical excipients market is segmented into pharmaceutical and biopharmaceutical companies, contract formulators, research organizations and academics, and others. The pharmaceutical and biopharmaceutical companies segment dominated with a revenue share of 48.6% in 2024, owing to the large-scale production requirements, strict adherence to quality standards, and the continuous demand for advanced excipients in drug formulations. These companies rely heavily on excipients to enhance formulation stability, improve bioavailability, and ensure patient compliance across diverse dosage forms. High-volume production, ongoing product innovation, and stringent regulatory compliance in North America further reinforce the segment’s dominance. Additionally, pharmaceutical and biopharmaceutical companies invest in research and development to optimize excipient performance, making this segment a cornerstone of the market. The widespread adoption of new technologies, coupled with the increasing prevalence of chronic diseases and demand for generic and specialty drugs, continues to drive consistent growth.

The contract formulators segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, driven by the rising trend of outsourcing drug development and manufacturing. Contract formulators are increasingly dependent on specialized excipients to improve formulation efficiency, scalability, and compliance with regulatory guidelines in North America. The growing demand for personalized medicine, novel dosage forms, and biopharmaceutical products is fueling the need for tailored excipient solutions. Companies in this segment focus on high-performance excipients that enhance product stability, solubility, and patient acceptability. Additionally, the expansion of contract research and manufacturing services across North America provides further opportunities for growth, making this segment a critical driver of market innovation.

- By Distribution Channel

On the basis of distribution channel, the pharmaceutical excipients market is segmented into direct tender, retail sales, and others. The direct tender segment dominated with a revenue share of 42.1% in 2024, owing to bulk procurement practices by major pharmaceutical manufacturers and long-term contracts with excipient suppliers. Direct tender allows manufacturers to secure consistent quality, maintain regulatory compliance, and achieve cost efficiencies through large-scale purchasing. The reliance on established supply chains and strategic partnerships strengthens the dominance of this segment. Additionally, the direct tender model ensures timely availability of high-quality excipients for large production runs, supporting uninterrupted manufacturing and innovation in pharmaceutical formulations.

The retail sales segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, fueled by growing consumer demand for over-the-counter medications, nutraceuticals, and functional supplements. Expanding retail pharmacy networks, e-commerce platforms, and increasing consumer awareness about health and wellness are key factors driving rapid growth. Retail distribution provides smaller-scale access to specialized excipients for emerging pharmaceutical brands, compounding pharmacies, and local manufacturers. Furthermore, the rising popularity of self-medication and preventive healthcare solutions continues to boost retail channel adoption across North America.

North America Pharmaceutical Excipients Market Regional Analysis

- North America dominated the pharmaceutical excipients market with the largest revenue share in 2024, driven by strong healthcare infrastructure, growing consumer awareness regarding health and wellness, and the presence of leading excipient suppliers. Ongoing innovations in nutraceutical formulations and increasing demand for high-quality excipients are further boosting market growth

- Consumers and pharmaceutical manufacturers in the region are increasingly prioritizing advanced excipient solutions that improve solubility, stability, bioavailability, and patient compliance. The demand for functional excipients supporting novel drug delivery systems, controlled-release formulations, and specialty nutraceuticals continues to expand

- Widespread adoption is supported by technological advancements in excipient manufacturing, regulatory-compliant formulations, and robust R&D investments by major players in the region. These factors collectively reinforce North America’s dominance in the global pharmaceutical excipients market

U.S. Pharmaceutical Excipients Market Insight

The U.S. pharmaceutical excipients market dominated the pharmaceutical excipients market with the largest revenue share of 71.5% in 2024, supported by a well-established healthcare infrastructure, high consumer awareness, and the presence of major excipient suppliers. Ongoing innovations in nutraceutical formulations and rising demand for high-quality excipients further drive market expansion. Pharmaceutical companies in the U.S. are increasingly integrating advanced excipients into formulations for oral, topical, and parenteral dosage forms. The focus on functional excipients that enhance bioavailability, stability, and therapeutic performance is a key growth driver. Strong investments in R&D, coupled with the availability of high-purity and specialized excipients, facilitate the development of innovative drug delivery systems, supporting the U.S. market’s leading position.

Canada Pharmaceutical Excipients Market Insight

The Canada pharmaceutical excipients market is expected to be the fastest-growing country in the pharmaceutical excipients market during the forecast period, projected to expand at a CAGR of 11.8% from 2025 to 2032. Growth is driven by increasing government healthcare initiatives, expanding access to advanced nutraceutical products, and rising adoption of preventive healthcare solutions. Pharmaceutical manufacturers in Canada are actively seeking high-quality, regulatory-compliant excipients to support innovative drug formulations, particularly in the nutraceutical and functional food sectors. The country’s focus on disease prevention, healthcare infrastructure improvements, and collaborations between research institutions and pharmaceutical companies further accelerate excipient adoption, ensuring robust market growth during the forecast period.

North America Pharmaceutical Excipients Market Share

The Pharmaceutical Excipients industry is primarily led by well-established companies, including:

- Kerry Group plc. (Ireland)

- DFE Pharma (Netherlands)

- Cargill, Incorporated (U.S.)

- Pfanstiehl (U.S.)

- Colorcon (U.S.)

- MEGGLE GmbH & Co. KG (Germany)

- Omya AG (Switzerland)

- Peter Greven GmbH & Co. KG (Germany)

- Ashland (U.S.)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- Croda International Plc (U.K.)

- Roquette Frères (France)

- The Lubrizol Corporation (U.S.)

- BASF SE (Germany)

- Avantor, Inc. (U.S.)

- BENEO (Germany)

Latest Developments in North America Pharmaceutical Excipients Market

- In March 2024, International Flavors & Fragrances (IFF) announced the sale of its Pharma Solutions business to French ingredients company Roquette for up to USD 2.85 billion, including debt. This divestiture encompassed IFF's pharmaceutical excipients and the Global Specialty Solutions division, which supports both industrial and methylcellulosic food applications. The transaction, expected to close in the first half of 2025, allows IFF to concentrate on its core growth strategies

- In September 2025, major pharmaceutical companies, including Eli Lilly, Johnson & Johnson, Roche, AstraZeneca, Novartis, Sanofi, Biogen, Merck, Amgen, Pfizer, Novo Nordisk, AbbVie, Gilead Sciences, and Cipla, announced significant investments to bolster their U.S. manufacturing capabilities. These investments are aimed at mitigating supply chain risks and preparing for potential trade disruptions, underscoring the industry's commitment to strengthening domestic production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.