North America Pharmacy Automation Market

Market Size in USD Billion

CAGR :

%

USD

3.49 Billion

USD

7.43 Billion

2024

2032

USD

3.49 Billion

USD

7.43 Billion

2024

2032

| 2025 –2032 | |

| USD 3.49 Billion | |

| USD 7.43 Billion | |

|

|

|

|

North America Pharmacy Automation Market Size

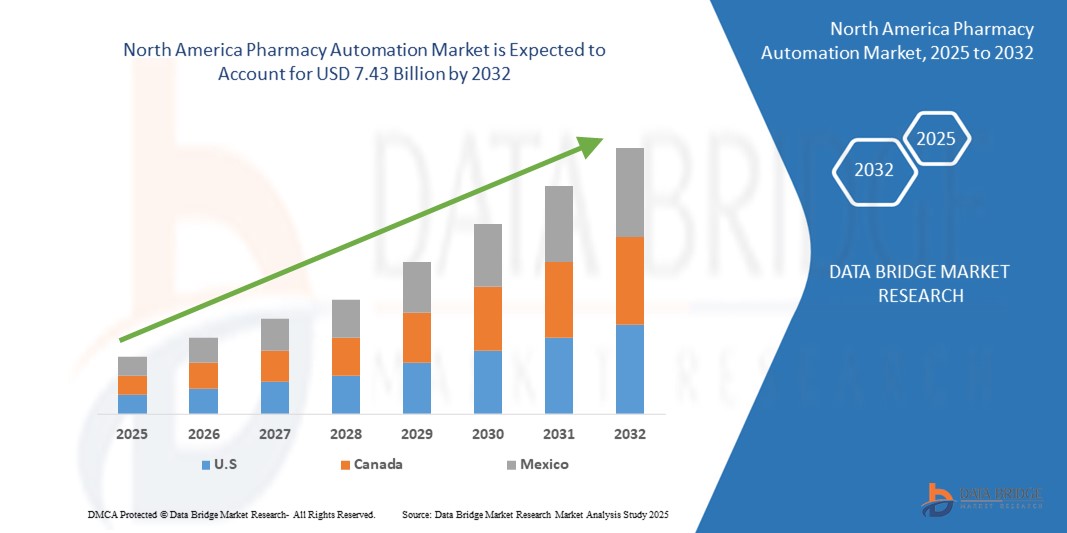

- The North America pharmacy automation market size was valued at USD 3.49 billion in 2024 and is expected to reach USD 7.43 billion by 2032, at a CAGR of 9.9% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within healthcare IT and pharmacy automation solutions, leading to increased digitalization in both retail and hospital pharmacy settings

- Furthermore, rising consumer and healthcare provider demand for efficient, accurate, and integrated solutions for medication dispensing and management is establishing pharmacy automation as the modern standard of care. These converging factors are accelerating the uptake of North America Pharmacy Automation solutions, thereby significantly boosting the industry's growth

North America Pharmacy Automation Market Analysis

- Pharmacy automation, offering automated or digital dispensing and management of medications, are increasingly vital components of modern healthcare systems in both retail and hospital settings due to their enhanced efficiency, accuracy, and seamless integration with pharmacy information systems

- The escalating demand for pharmacy automation is primarily fueled by the increasing need for error reduction in dispensing, growing labor costs in pharmacies, and a rising preference for the convenience of automated medication management

- The U.S. is expected to dominate the North America pharmacy automation market with a share of 79.8%, driven by high adoption of advanced healthcare automation technologies, stringent regulatory focus on medication safety, and the strong presence of key industry players.

- Mexico is expected to witness a significant compound annual growth rate (CAGR) of approximately 10.9% in the North America pharmacy automation devices market between 2024 and 2030. This growth is fueled by the increasing adoption of automated systems in healthcare settings, the need to streamline workflows, reduce medication errors, and manage the growing volume of prescriptions within Mexico's expanding pharmaceutical sector

- The software segment is another significant and dominating segment within the North America pharmacy automation market with a market share of 32.3%. This includes pharmacy information systems (PIS), inventory management software, and software for medication dispensing and packaging. Efficient software is crucial for managing complex pharmacy operations, ensuring accuracy, and integrating various automated systems

Report Scope and North America Pharmacy Automation Market Segmentation

|

Attributes |

North America Pharmacy Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.. |

North America Pharmacy Automation Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A significant and accelerating trend in the North America pharmacy automation market is the deepening integration with artificial intelligence (AI) and, to a limited extent, voice-controlled interfaces for specific tasks. This fusion of technologies is significantly enhancing user convenience and control over medication dispensing and inventory management

- For instance, some advanced pharmacy automation systems are exploring or implementing voice commands for tasks such as initiating dispensing of commonly requested medications or retrieving inventory information under secure and controlled conditions. Similarly, AI is being integrated to offer more intuitive user interfaces and streamlined data entry processes for pharmacists and technicians

- AI integration in North America pharmacy automation enables features such as learning pharmacy staff interaction patterns to potentially suggest more efficient dispensing workflows and providing more intelligent alerts based on medication demand or potential stockouts. For instance, AI algorithms could analyze dispensing history to predict peak demand times, optimizing robotic dispensing schedules

- This trend towards more intelligent, intuitive, and interconnected pharmacy systems is fundamentally reshaping user expectations for pharmacy efficiency and medication management. Consequently, companies are developing AI-enabled pharmacy automation with features such as automated inventory adjustments based on predicted demand and voice command compatibility for specific, secure pharmacy operations

- The demand for pharmacy automation that offers seamless AI and voice control integration (where applicable and secure) is growing rapidly across both retail and hospital sectors, as pharmacies increasingly prioritize convenience, efficiency, and comprehensive smart pharmacy functionality

North America Pharmacy Automation Market Dynamics

Driver

“Growing Need Due to Rising Focus on Medication Safety and Efficiency”

- The increasing prevalence of medication errors and the escalating need for efficient pharmacy operations, coupled with the accelerating adoption of digital health solutions, is a significant driver for the heightened demand for North America pharmacy automation

- For instance, in April 2024, major pharmacy chains in North America announced investments in advanced robotic dispensing systems aimed at reducing dispensing errors and improving workflow efficiency. Such strategic initiatives by key players are expected to drive the North America Pharmacy Automation industry growth in the forecast period

- As healthcare providers become more aware of the potential for medication errors and seek enhanced efficiency in dispensing and inventory management, pharmacy automation offers advanced features such as robotic dispensing, barcode verification, and automated inventory control, providing a compelling upgrade over manual processes

- Furthermore, the growing popularity of integrated pharmacy management systems and the desire for interconnected healthcare environments are making pharmacy automation an integral component of these systems, offering seamless integration with electronic health records and inventory management software

- The convenience of faster prescription filling, reduced wait times for patients, and the ability to manage inventory and dispensing through automated systems are key factors propelling the adoption of pharmacy automation in both retail and hospital pharmacies. The trend towards central fill pharmacies and mail-order services further contributes to market growth

Restraint/Challenge

“Concerns Regarding Initial Investment and System Integration”

- Concerns surrounding the high initial investment required for implementing sophisticated pharmacy automation systems, pose a significant challenge to broader market penetration. As pharmacy automation involves significant upfront costs for equipment, software, and installation, it raises anxieties among potential adopters about the return on investment, especially for smaller pharmacies

- For instance, the substantial capital expenditure associated with robotic dispensing systems has made some independent pharmacies hesitant to adopt advanced automation solutions

- Addressing these financial concerns through flexible financing options, demonstrating clear cost savings through reduced errors and improved efficiency, and offering scalable automation solutions is crucial for building wider adoption

- While the long-term benefits of automation often outweigh the initial costs, the perceived complexity and upfront investment can still hinder widespread adoption, especially for those who lack the capital or technical expertise for seamless integration

- Overcoming these challenges through more affordable and scalable automation solutions, clear guidelines and support for system integration, and education on the long-term benefits of automation will be vital for sustained market growth

North America Pharmacy Automation Market Scope

The market is segmented on the basis of product, pharmacy type, pharmacy size, application, end user and distribution channel.

By Product

On the basis of product, the North America pharmacy automation market is segmented into systems, software, and services. The systems segment held the largest market revenue share in 2025 with a market share of 32.3%, driven by the fundamental need for automated dispensing and storage solutions in pharmacies to enhance efficiency and accuracy. These systems form the core infrastructure for pharmacy automation

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for sophisticated software solutions that integrate various automation systems, manage inventory, analyze data, and ensure regulatory compliance. As pharmacies adopt more complex automation, advanced software becomes crucial for seamless operation and optimization

By Pharmacy Type

On the basis of pharmacy type, the North America pharmacy automation market is segmented into independent, chain, and federal. The chain pharmacies segment held the largest market revenue share in 2025, driven by their higher prescription volumes, greater capital investment capabilities for automation technologies, and the need for standardized and efficient dispensing processes across multiple locations

The independent pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing recognition of automation's benefits in improving efficiency and competing with larger chains, coupled with the development of more affordable and scalable automation solutions suitable for smaller pharmacy sizes

By Pharmacy Size

On the basis of pharmacy size, the North America pharmacy automation market is segmented into large size pharmacy, medium size pharmacy, and small size pharmacy. The large size pharmacy segment accounted for the largest market revenue share in 2025, driven by their high prescription volumes, complex inventory management needs, and greater resources for investing in comprehensive automation systems to streamline operations

The small size pharmacy segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the growing availability of compact and cost-effective automation solutions designed to improve efficiency and accuracy in dispensing, enabling them to better manage workload and patient safety

By Application

On the basis of application, the North America pharmacy automation market is segmented into drug dispensing and packaging, drug storage, and inventory management. The drug dispensing and packaging segment held the largest market revenue share in 2025, driven by the direct impact of automation on reducing dispensing errors, improving speed, and ensuring accurate medication delivery to patients, which are primary concerns in pharmacy operations

The inventory management segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need for efficient tracking, storage optimization, and reduction of medication waste, as pharmacies recognize the significant cost savings and operational improvements achievable through automated inventory management systems

By End User

On the basis of end user, the North America pharmacy automation market is segmented into inpatient pharmacies, outpatient pharmacies, retail pharmacies, online pharmacies, central fill/mail order pharmacies, pharmacy benefit management organizations, and others. The retail pharmacies segment accounted for the largest market revenue share, driven by the high volume of prescriptions dispensed and the increasing adoption of automation to improve efficiency, reduce wait times, and enhance customer service in these settings

The central fill/mail order pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing trend of centralized prescription processing and mail-order services to improve efficiency and reduce costs, necessitating significant investments in automation technologies for large-scale dispensing and fulfillment

By Distribution Channel

On the basis of distribution channel, the North America pharmacy automation market is segmented into direct tender and third party distributor. The direct tender segment held the largest market revenue share in 2025, driven by the direct relationships between manufacturers and end-users, allowing for customized solutions and comprehensive service agreements, particularly for complex automation systems

The third party distributor segment is expected to witness a steady growth rate, leveraging their established networks and broader reach to facilitate the adoption of pharmacy automation solutions, especially among smaller and independent pharmacies that may benefit from bundled offerings and local support

North America Pharmacy Automation Market Regional Analysis

- North America dominates the North America pharmacy automation market with the largest revenue share of approximately 42.3% in 2024, driven by a growing demand for enhanced patient care and medication safety, as well as increased awareness of the benefits of pharmacy automation technology

- Healthcare providers in the region highly value the reduction in manual errors, enhanced medication safety through technologies such as barcode scanning, and the ability for pharmacists to dedicate more time to direct patient care offered by pharmacy automation systems

- This widespread adoption is further supported by stringent government regulations promoting patient safety, high healthcare expenditure, and a technologically advanced healthcare infrastructure, establishing pharmacy automation as a favored solution for both retail and hospital pharmacies

U.S. North America Pharmacy Automation Market Insight

The U.S. North America pharmacy automation market captured the largest revenue share of 79.8% within North America in 2025, fueled by the swift uptake of automation technologies and the expanding trend of digital pharmacy management. Pharmacies are increasingly prioritizing the enhancement of dispensing accuracy and efficiency through intelligent, automated systems. The growing preference for error reduction and streamlined workflows, combined with robust demand for integrated pharmacy management software and robotic dispensing, further propels the North America Pharmacy Automation industry. Moreover, the increasing integration of pharmacy automation with electronic health records and other healthcare IT systems is significantly contributing to the market's expansion.

Canada North America Pharmacy Automation Market Insight

The Canada North America pharmacy automation market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulations focused on medication safety and the escalating need for enhanced efficiency in pharmacies. The increase in prescription volumes, coupled with the demand for advanced dispensing technologies, is fostering the adoption of pharmacy automation. Canadian pharmacies are also drawn to the improved inventory management and reduced dispensing errors these systems offer. The region is experiencing significant growth across retail, hospital, and long-term care pharmacy applications, with pharmacy automation being incorporated into both new and existing pharmacy setups.

Mexico North America Pharmacy Automation Market Insight

The Mexico North America pharmacy automation market is anticipated to grow at a noteworthy CAGR of 10.9% during the forecast period (estimates vary across sources, with some focusing on devices and others on the total market). This growth is driven by the escalating trend of pharmacy modernization and a desire for heightened accuracy and efficiency in medication dispensing. In addition, concerns regarding medication errors and the need for better inventory control are encouraging pharmacies to choose automated dispensing and management solutions. Mexico’s increasing adoption of healthcare technology, alongside its growing pharmaceutical sector, is expected to continue to stimulate market growth.

North America Pharmacy Automation Market Share

The North America pharmacy automation industry is primarily led by well-established companies, including:

- ARxIUM (U.S.)

- OMNICELL INC. (U.S.)

- Capsa Healthcare (U.S.)

- ScriptPro (U.S.)

- RxSafe, LLC (U.S.)

- Asteres Inc. (U.S.)

- InterLink AI, Inc. (U.S.)

- BD (U.S.)

- Baxter (U.S.)

- Fullscript (Canada)

- MCKESSON CORPORATION (U.S.)

- AmerisourceBergen Corporation (U.S.)

- UNIVERSAL LOGISTICS HOLDINGS, INC. (U.S.)

- Takazono Corporation (Japan)

- TOSHO Inc. (Japan)

Latest Developments in North America Pharmacy Automation Market

- In April 2023, Omnicell, Inc., a leading provider of medication management and adherence solutions, launched a strategic initiative across several hospital networks in North America aimed at enhancing medication safety and efficiency through its advanced pharmacy automation technologies. This initiative underscores the company's dedication to delivering innovative, reliable solutions tailored to the unique operational needs of the local healthcare market. By leveraging its global expertise and comprehensive product portfolio, Omnicell is not only addressing regional healthcare challenges but also reinforcing its position in the rapidly evolving North America pharmacy automation market

- In March 2023, BD (Becton, Dickinson and Company), a global medical technology company, announced the expansion of its automated dispensing cabinet (ADC) capabilities, specifically engineered for improving medication management workflows and reducing the risk of diversion in hospital and retail pharmacy settings across North America. This innovative approach is designed to enhance patient safety and operational efficiency, offering a reliable and effective solution for medication control. This advancement highlights BD's commitment to developing cutting-edge healthcare technologies that safeguard patient well-being and optimize pharmacy operations, ensuring greater protection and improved healthcare outcomes for institutions and their communities

- In March 2023, Capsa Healthcare, a company specializing in healthcare workflow solutions, successfully partnered with a large chain pharmacy in Canada, aimed at enhancing prescription fulfillment and patient counseling through its advanced pharmacy automation and workflow software. This initiative harnesses state-of-the-art technologies to create a more efficient and patient-centered pharmacy environment, underscoring Capsa Healthcare's dedication to utilizing its expertise in innovative pharmacy systems. The project highlights the increasing significance of integrated technology in pharmacy practice, contributing to the development of healthier, more efficiently served communities

- In February 2023, Meditech, a leading provider of electronic health records (EHRs), announced a strategic partnership with a regional healthcare organization in the Midwestern United States to integrate its pharmacy information system with advanced robotic dispensing technologies. This collaboration is designed to enhance medication accuracy and streamline accessibility for healthcare professionals, facilitating more efficient and secure delivery of care. The initiative underscores Meditech's commitment to driving innovation and improving operational effectiveness within the healthcare sector by connecting disparate pharmacy systems

- In January 2023, McKesson Corporation, a leading distributor of pharmaceuticals and provider of healthcare technology solutions, unveiled its latest advancements in central fill automation and workflow software at a major pharmacy industry conference in North America in 2023. These innovative technologies, equipped with enhanced data analytics and robotic integration, enable pharmacies to manage high-volume prescription processing more effectively. The McKesson announcement highlights the company’s commitment to integrating advanced technology into pharmacy operations, offering pharmacists enhanced efficiency and control while ensuring robust medication dispensing capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.