North America Physical Security Information Management Psim Market

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

9.38 Billion

2024

2032

USD

3.92 Billion

USD

9.38 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 9.38 Billion | |

|

|

|

|

Physical Security Information Management (PSIM) Market Size

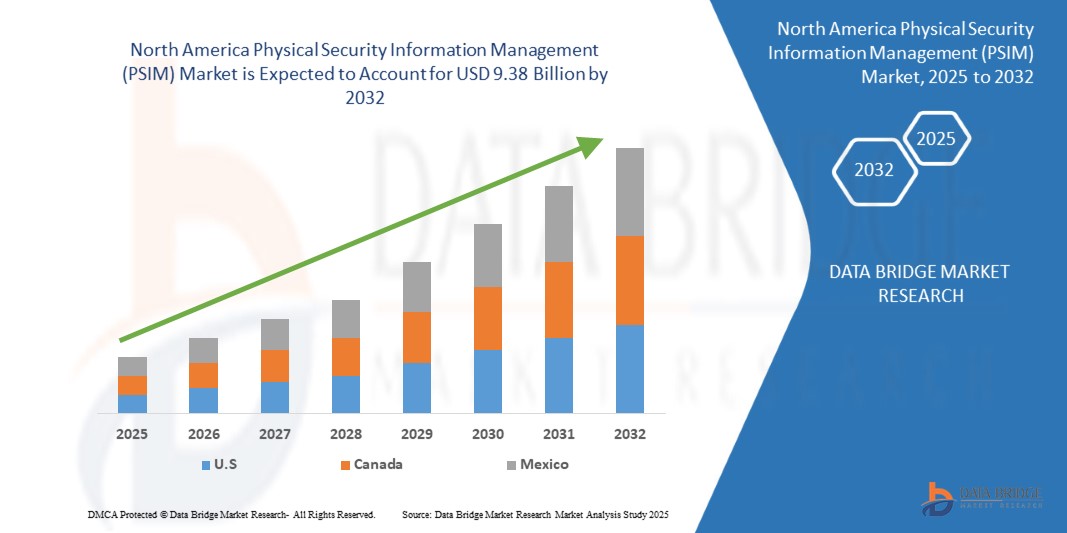

- The North America Physical Security Information Management (PSIM) Market size was valued at USD 3.92 billion in 2024 and is expected to reach USD 9.38 billion by 2032, at a CAGR of 11.52% during the forecast period

- The market expansion is strongly driven by the increasing adoption of smart home technology and connected devices, which is leading to heightened digitalization across properties. As homeowners and enterprises prioritize seamless integration and real-time monitoring, PSIM solutions are becoming essential in modern security infrastructure.

- Additionally, there is a surge in consumer demand for secure, user-friendly, and centrally managed access control systems. This shift is steering organizations and individuals alike toward adopting PSIM as a comprehensive solution for managing video surveillance, alarms, access control, and emergency response systems through a unified platform.

Physical Security Information Management (PSIM) Market Analysis

- Physical Security Information Management (PSIM) solutions, which enable electronic or digital access control for doors, gates, and entire premises, are becoming essential components of modern security infrastructures across North America. Their integration into both residential and commercial environments is driven by enhanced user convenience, remote access functionality, and seamless compatibility with broader smart home and building automation ecosystems.

- The growing penetration of smart home technologies across the U.S. and Canada is a key driver of the regional PSIM market. Consumers are increasingly seeking interconnected solutions that allow for real-time surveillance, remote control of entry points, and unified management of alarms, sensors, and video feeds, all of which are core functionalities of PSIM platforms.

- The U.S. holds the largest share of 76.67% in the North American PSIM market as of 2024, reflecting its leadership in smart home adoption, security innovation, and digital transformation. The market is fueled by rising consumer interest in DIY home security setups, voice-command-enabled systems, and mobile-app integration.

- The PSIM+ segment accounted for the largest market revenue share in 2024, driven by the increasing need for comprehensive, enterprise-grade security systems capable of integrating multiple subsystems such as access control, video surveillance, fire alarms, and intrusion detection

Report Scope and Physical Security Information Management (PSIM) Market Segmentation

|

Attributes |

Physical Security Information Management (PSIM Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Physical Security Information Management (PSIM) Market Trends

“Growing Demand Due to Rising Security Concerns and Smart Home Adoption”

- The increasing frequency of security breaches, break-ins, and vandalism incidents across North American residential and commercial properties has amplified the demand for integrated, intelligent security systems like PSIM.

- Consumers and businesses are increasingly adopting smart home and building technologies, which seamlessly integrate with PSIM platforms to provide centralized control, monitoring, and response capabilities.

- For instance, in April 2024, Onity, Inc. (a part of Honeywell International, Inc.) upgraded its IoT-based Passport locking system with next-gen sensors to enhance perimeter security. This advancement reflects a broader market trend toward smarter, more responsive security ecosystems across the U.S. and Canada.

- PSIMs enable advanced functions such as real-time alerts, remote surveillance, and automated emergency responses, making them essential in the context of rising threats and smart infrastructure evolution.

Physical Security Information Management (PSIM) Market Dynamics

Driver

“Accelerated Implementation in Government, BFSI, and Commercial Infrastructure”

- Government institutions, financial service providers, and commercial enterprises in North America are increasingly investing in scalable PSIM systems to ensure security across large facilities, campuses, and multi-site locations.

- Projects under the U.S. Safe Cities initiative, and mandates for compliance with critical infrastructure protection (CIP) standards, are key catalysts in deploying PSIM platforms that integrate surveillance, access control, and incident response.

- Organizations prefer PSIM systems for their ability to unify disparate security components, including legacy hardware, under a single software interface that enhances situational awareness and operational efficiency.

Restraint/Challenge

“High Cost of Implementation and Integration Complexity”

- One of the primary restraints in the North American PSIM market is the high initial cost associated with system design, customization, and integration—especially for older infrastructures with legacy equipment.

- Complexities in ensuring interoperability between various subsystems (e.g., video surveillance, intrusion detection, access control) can lead to extended deployment timelines and increased IT dependency.

- For small businesses and public sector bodies operating under tight budgets, these barriers may delay adoption or limit the scope of PSIM implementation.

- Additionally, the need for specialized training and ongoing maintenance may further dissuade smaller stakeholders from fully embracing PSIM solutions.

Physical Security Information Management (PSIM) Market Scope

The market is segmented on the basis of product, component, deployment type, organization size, and vertical.

- By Product

On the basis of product, the Physical Security Information Management (PSIM) Market is segmented into PSIM+, PSIM, and PSIM Lite. The PSIM+ segment accounted for the largest market revenue share in 2024, driven by the increasing need for comprehensive, enterprise-grade security systems capable of integrating multiple subsystems such as access control, video surveillance, fire alarms, and intrusion detection. PSIM+ offers extensive scalability and is widely adopted across large infrastructures including airports, government buildings, and industrial complexes.

The PSIM Lite segment is projected to witness the fastest CAGR from 2025 to 2032, supported by its affordability and ease of use, making it ideal for small- to medium-sized businesses and facilities that need integrated security but with simpler configurations and fewer customization requirements.

- By Component

On the basis of component, the market is segmented into software and services. The software segment dominated the market in 2024, due to the growing demand for advanced, real-time analytics, dashboard control, and user-friendly interfaces. Customized PSIM software is particularly favored in high-security verticals like defense and banking.

The services segment is expected to grow at a robust CAGR during the forecast period, as the complexity of PSIM systems drives the demand for professional installation, regular maintenance, and training services to ensure optimal functionality.

- By Deployment Type

On the basis of deployment type, the market is segmented into cloud and on-premise. The cloud segment held the largest market share in 2024, owing to its flexibility, scalability, and cost-efficiency. Cloud-based PSIMs are favored for enabling remote access, real-time updates, and integration with other IoT systems.

The on-premise segment, however, remains strong in sectors with strict data sovereignty and compliance requirements, such as government, utilities, and critical infrastructure.

- By Organization Size

On the basis of organization size, the market is segmented into large organizations and small and medium organizations. Large organizations led the market in 2024, driven by their need for complex, multi-layered security systems and the budget capability to deploy integrated PSIM platforms across multiple locations.

The small and medium organization segment is projected to grow rapidly from 2025 onward, as affordable and scalable PSIM Lite and cloud-based solutions become more accessible, especially to small enterprises in retail, hospitality, and education

- By Vertical

On the basis of vertical, the PSIM market is segmented into government and defense sector, banking, financial services and insurance (BFSI), residential, commercial, healthcare, transportation, utility and energy, hospitality, retail, manufacturing, and others. The government and defense sector accounted for the largest revenue share in 2024, as national and public security systems increasingly rely on integrated platforms for incident response and threat mitigation.

The commercial segment is expected to exhibit the fastest CAGR from 2025 to 2032, driven by increasing demand from office complexes, malls, and co-working spaces for unified and automated security solutions that reduce manual interventions and enhance operational efficiency

Physical Security Information Management (PSIM) Market Regional Analysis

- The U.S. holds the largest share of 76.67% in the North American PSIM market as of 2024, reflecting its leadership in smart home adoption, security innovation, and digital transformation. The market is fueled by rising consumer interest in DIY home security setups, voice-command-enabled systems, and mobile-app integration.

- The U.S. market has seen a sharp rise in demand for keyless entry and AI-powered PSIM platforms, particularly those compatible with Alexa, Google Assistant, and Apple HomeKit. Moreover, rising security concerns, increasing urbanization, and the focus on smart city initiatives are significantly accelerating the deployment of PSIM systems across residential buildings, commercial establishments, and government infrastructure.

Canada Physical Security Information Management (PSIM) Market Insight

The Canadian PSIM market is expanding steadily, supported by strong government initiatives on critical infrastructure protection and the growing penetration of smart buildings. Canadians show increasing interest in eco-friendly and highly integrated security systems that are capable of remote control and real-time alerts. The country’s focus on sustainable urban development and public safety, combined with a tech-savvy population, is contributing to the adoption of PSIMs in high-rise residential complexes, healthcare institutions, and commercial properties. The market also benefits from widespread availability of cloud-based platforms and integrated video management systems tailored to Canadian regulatory and privacy standards.

Mexico Physical Security Information Management (PSIM) Market Insight

Mexico is emerging as a key growth market for PSIM systems in North America, driven by increasing concerns over urban crime, infrastructure security, and digital surveillance. The Mexican market is witnessing an uptick in demand for centralized, cost-effective, and mobile-friendly PSIM platforms, particularly in urban centers and industrial zones. Government initiatives aimed at modernizing public security infrastructure and enhancing the resilience of smart cities are driving adoption. Additionally, commercial real estate developers and hospitality players are deploying integrated access control and emergency response solutions, boosting the PSIM market’s footprint in the country.

Physical Security Information Management (PSIM) Market Share

The Physical Security Information Management (PSIM industry is primarily led by well-established companies, including:

- Tyco Integrated Security (United States)

- Bold Group(United States)

- AxxonSoft(Russia)

- Qognify (United States)

- STANLEY Convergent Security Solutions, Inc.(United States)

- HEXAGON(Sweden)

- Network Harbor(United States)

- Siemens(Germany)

- AlertEnterprise Inc(United States)

- Nanodems Corporation (Turkey)

- ProTech Security(United States)

- HID Global Corporation / ASSA ABLOY AB(Sweden)

- Genetec Inc.(Canada)

- TELUS (Canada)

- Hanwha Techwin America(South Korea)

- Avigilon Corporation (Canada)

- Aventura Technologies, Inc.(United States)

- Saab (Sweden)

- Verkada Inc.(United States)

- Bell Canada(Canada)

- Cloudastructure, Inc.(United States)

Latest Developments in North America Physical Security Information Management (PSIM) Market

- In May 2024, Genetec Inc., a leading PSIM and unified security solutions provider based in Canada, announced the launch of its next-generation Security Center 5.12 platform, which enhances situational awareness through improved map-based visualization, threat-level automation, and AI-powered analytics. This update aligns with the growing demand for intelligent, centralized security management in North American smart cities and enterprise campuses, reaffirming Genetec’s role in advancing scalable PSIM adoption across the region.

- In April 2024, Verkada Inc., headquartered in California, expanded its cloud-based PSIM offerings by introducing new intrusion detection and emergency response features integrated directly into its unified platform. These additions enable real-time coordination across video surveillance, access control, and environmental sensors—supporting schools, healthcare institutions, and government facilities in bolstering proactive threat mitigation. Verkada’s move reflects the rising need for simplified, all-in-one PSIM solutions in critical infrastructure.

- In February 2024, AlertEnterprise Inc. introduced its AI-enhanced Guardian platform for PSIM applications across utilities and financial sectors. The platform enables biometric access management and insider threat detection through behavior analytics and policy-based automation. This launch is particularly significant for regulated industries in North America seeking to align with evolving compliance requirements such as NERC CIP and CCPA, while simultaneously modernizing their physical and cybersecurity convergence.

- In January 2024, HID Global, a subsidiary of ASSA ABLOY AB, revealed a collaboration with Cloudastructure Inc. to integrate its access control credentials with cloud-hosted PSIM systems. This partnership facilitates seamless identity verification and centralized monitoring for commercial properties and data centers, highlighting an industry trend toward hybrid-cloud security architecture and scalable credentialing solutions.

- In November 2023, Avigilon Corporation (a Motorola Solutions company) unveiled its Avigilon Unity platform, a unified PSIM suite combining video, access, and analytics into a single interface. With AI-assisted incident detection and a user-friendly dashboard, the solution targets enterprise and campus security across the U.S. and Canada. This development underscores Avigilon’s commitment to streamlining security operations and accelerating response times through integrated PSIM capabilities.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.