North America Plant Based Beverages Market

Market Size in USD Billion

CAGR :

%

USD

8.02 Billion

USD

13.12 Billion

2024

2032

USD

8.02 Billion

USD

13.12 Billion

2024

2032

| 2025 –2032 | |

| USD 8.02 Billion | |

| USD 13.12 Billion | |

|

|

|

|

Plant-Based Beverages Market Size

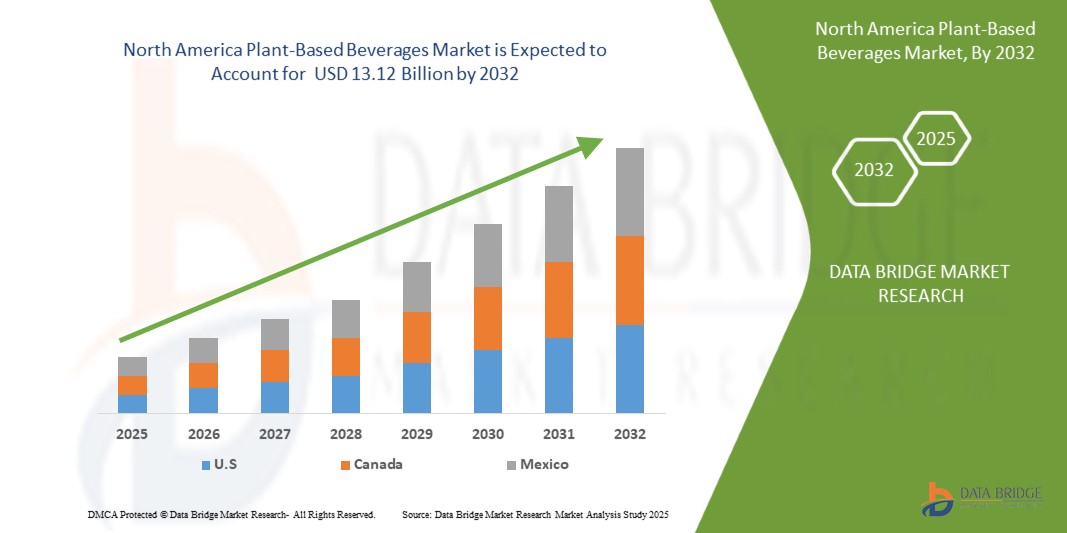

- The North America Plant-Based Beverages Market size was valued at USD 8.02 Billion in 2024 and is expected to reach USD 13.12 Billion by 2032, at a CAGR of 8.9% during the forecast period

- The North America Plant-Based Beverages Market is experiencing robust growth, fueled by rising consumer preference for sustainable and health-oriented alternatives to traditional dairy products. Key plant-based sources—such as almond, oat, soy, and coconut—are increasingly favored for their nutritional value, environmental sustainability, and compatibility with lactose-free, vegan, and allergen-sensitive diets across the U.S. and Canada

- This market shift is further reinforced by heightened awareness of wellness trends, clean-label demands, and the popularity of plant-forward lifestyles, including veganism and flexitarianism. Market players are responding with continuous product innovation, focusing on enhanced taste, texture, protein content, and fortified nutritional profiles

Plant-Based Beverages Market Analysis

- Plant-based beverages are witnessing strong growth across North America, driven by heightened health awareness, rising lactose intolerance, and a significant consumer shift toward sustainable, plant-based alternatives to traditional dairy. Beverages derived from almond, oat, soy, coconut, and rice are increasingly integrated into mainstream retail and foodservice channels due to their nutritional benefits and adaptability to diverse dietary lifestyles, including vegan and flexitarian diets.

- The demand for clean-label, nutrient-enriched, and allergen-free products is accelerating innovation across the North American market. Manufacturers are prioritizing protein fortification, sugar reduction, and the inclusion of functional ingredients such as calcium, vitamins, and probiotics to meet evolving health trends. Enhanced flavor profiles and texture improvements are also driving consumer adoption.

- North America accounted for a significant share of the global Plant-Based Beverages Market in 2024, supported by advanced food processing infrastructure, high purchasing power, and a well-established health and wellness culture. The U.S. remains the dominant contributor, driven by widespread retail availability, aggressive marketing by plant-based brands, and growing foodservice integration in cafés, restaurants, and institutional catering.

- The United States leads the regional market, underpinned by robust consumer demand, technological advancements in plant protein extraction, and strategic investments by key players in R&D and product development. Major brands and startups alike are scaling up to meet demand, often leveraging e-commerce and direct-to-consumer channels for greater market reach.

- Among product categories, oat-based beverages are gaining rapid momentum due to their creamy consistency, suitability for coffee and lattes, and low allergenic potential. Almond and soy beverages continue to hold strong positions but face challenges related to environmental concerns and allergens. Coconut and rice beverages are also growing niche segments due to their unique taste profiles and digestibility.

- Ongoing expansion of private-label offerings, investments in sustainable sourcing and processing, and partnerships between CPG giants and food-tech innovators are expected to solidify North America’s role as a critical growth engine and innovation hub in the global Plant-Based Beverages Market

Report Scope and Plant-Based Beverages Market Segmentation

|

Attributes |

Plant-Based Beverages Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Mexico |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant-Based Beverages Market Trends

“Health-Driven Innovation and Sustainability in Plant-Based Beverages”

- A prominent and growing trend in the North America Plant-Based Beverages Market is the shift toward health-driven innovation and sustainable product development, driven by increasing consumer demand for clean-label, allergen-free, and nutrient-rich alternatives to traditional dairy beverages.

- Leading companies such as Danone, Nestlé, and Oatly are heavily investing in R&D to develop beverages fortified with plant-based proteins, vitamins, and probiotics that cater to evolving health and wellness preferences across European markets.

- The market is experiencing a strong push toward organic, non-GMO, and sustainably sourced raw materials such as almonds, oats, soy, and peas—aligned with Europe’s stringent environmental and food safety regulations.

- Advancements in food processing technologies, including high-pressure processing (HPP) and enzymatic treatment, are enabling manufacturers to enhance shelf life, flavor profiles, and nutrient retention while reducing the need for synthetic additives.

- There is growing consumer interest in functional plant-based beverages that offer specific health benefits, such as immunity support, digestive health, and energy enhancement, fostering innovation in botanical infusions, adaptogens, and fiber-enriched formulations.

- This trend toward health-conscious, sustainably produced, and functionally enhanced beverages is redefining market competition. Companies that prioritize transparency, eco-innovation, and tailored nutrition are emerging as leaders in Europe's dynamic plant-based beverage landscape

Plant-Based Beverages Market Dynamics

Driver

“Rising Demand Driven by Health Consciousness, Dietary Shifts, and Sustainable Food Innovation”

- The growing global emphasis on health and wellness is a primary driver fueling the Plant-Based Beverages Market. Increasing awareness of lactose intolerance, dairy allergies, and the benefits of plant-based diets is pushing consumers toward nutritious alternatives such as almond, soy, oat, and pea-based beverages

- For example, in January 2025, Nestlé expanded its plant-based portfolio in Europe with a new line of oat and fava bean beverages fortified with protein and fiber, addressing both health and sustainability goals for modern consumers

- Heightened environmental concerns and ethical considerations surrounding animal agriculture are prompting a surge in demand for sustainable, cruelty-free beverage options. This trend is reinforced by growing alignment with climate-friendly consumption patterns, especially among younger demographics in Europe and North America

- Innovative processing technologies—such as enzymatic hydrolysis, cold-press extraction, and ultra-high temperature (UHT) pasteurization—are enhancing the taste, texture, and nutritional profile of plant-based beverages, helping brands bridge the sensory gap with dairy products.

- The rise in flexitarian diets and increasing support from governments and health organizations for reduced meat and dairy intake are amplifying market traction. Retailers are responding by expanding shelf space and private label offerings in the plant-based category

- This convergence of health awareness, sustainability priorities, and food-tech innovation is accelerating global market growth. Emerging economies in Asia-Pacific and Latin America are seeing rapid adoption due to urbanization, changing consumer preferences, and rising disposable incomes

Restraint/Challenge

“High Production Costs and Supply Chain Constraints Hindering Market Scalability”

- The relatively high production costs associated with sourcing premium plant-based ingredients—such as almonds, oats, and peas—pose a significant challenge to the widespread adoption of plant-based beverages. These ingredients often require more land, water, or specialized processing compared to conventional dairy, driving up operational expenditures for manufacturers.

- For instance, fluctuations in global almond prices due to climate-related agricultural disruptions in California and Spain have led to increased input costs for almond-based beverages, directly impacting pricing strategies and profit margins.

- In addition, the plant-based beverage market faces complex formulation challenges, including achieving desired taste, texture, and nutritional equivalence to dairy. This necessitates investments in advanced processing equipment, food science expertise, and continuous R&D—raising barriers to entry, particularly for small and mid-sized producers.

- Regulatory inconsistencies across regions concerning product labeling, nutritional claims, and use of dairy-related terms (such as “milk”) further complicate market expansion. In the European Union, for example, legal restrictions on labeling plant-based alternatives as “milk” limit marketing flexibility and consumer clarity.

- Global supply chain disruptions, exacerbated by geopolitical tensions and extreme weather events, have hindered the consistent availability of raw materials and packaging components, causing production delays and inventory volatility.

- Overcoming these constraints will require strategic investments in resilient supply chains, sustainable agriculture partnerships, and innovations in ingredient efficiency and cost-effective processing technologies to ensure long-term market viability and scalability

Plant-Based Beverages Market Scope

- By Type

On the basis of type, the Plant-Based Beverages Market is segmented into Soy, Coconut, Almond, Oat, and Others.

The Almond segment dominates the market with the largest revenue share of 28.4% in 2024, driven by its widespread consumer acceptance, mild taste, and perceived health benefits including low calorie content and heart-friendly properties. Popular across North America and Europe, almond-based beverages are frequently fortified with calcium, vitamins, and protein, making them a preferred dairy alternative among health-conscious and lactose-intolerant populations

- By Function

On the basis of function, the Plant-Based Beverages Market is segmented into Cardiovascular Health, Cancer Prevention, Bone Health, Lactose Free Alternative, and Others.

The Cardiovascular Health segment dominates the market with the largest revenue share of 34.6% in 2024, driven by the increasing consumer preference for heart-friendly plant-based ingredients such as soy, oats, and almonds. These ingredients are rich in dietary fiber, plant sterols, and unsaturated fats, which contribute to lowering LDL cholesterol and supporting overall heart health. The rising incidence of cardiovascular diseases and the growing awareness of preventive healthcare are encouraging consumers to adopt plant-based beverages as part of a heart-healthy lifestyle

- By Product

On the basis of product, the Plant-Based Beverages Market is segmented into Plain and Flavored.

The Flavored segment dominates the market with the largest revenue share of 26.5% in 2024, driven by its enhanced taste profile, wide variety of flavor options, and increasing consumer preference for indulgent yet healthy beverages

- By Packaging

On the basis of packaging, the Plant-Based Beverages Market is segmented into Glass Bottles, Plastic Bottles and Pouches, Carton, and Cans.

The Carton segment dominates the market with the largest revenue share of 24.8% in 2024, driven by its eco-friendly appeal, convenience, and extended shelf life. Carton packaging is widely adopted for plant-based beverages due to its lightweight nature, ease of storage, and recyclability, aligning well with the sustainability goals of both consumers and manufacturers

- By Sales Channel

On the basis of sales channel, the Plant-Based Beverages Market is segmented into Hypermarkets/Supermarkets, Convenience Stores, Independent Small Groceries, Specialty Stores, and Online Retailers.

The Hypermarkets/Supermarkets segment dominates the market with the largest revenue share of 55.8% in 2024, driven by their extensive product offerings, high footfall, and strong shelf visibility. These retail formats serve as a one-stop destination, offering consumers a wide variety of plant-based beverage brands and product types under one roof. Strategic in-store promotions, attractive discounts, and the availability of both global and regional brands contribute to higher consumer engagement

Plant-Based Beverages Market Regional Analysis

North America Plant-Based Beverages Market Insight

- North America holds a substantial share in the global Plant-Based Beverages Market and is expected to witness steady growth, driven by increasing demand for dairy alternatives, clean-label nutrition, and environmentally sustainable food choices. The region benefits from a mature health and wellness culture, supportive labeling regulations, and strong market penetration across retail and foodservice channels.

- Growth is further supported by product innovation in oat, almond, soy, and coconut-based beverages, alongside the expansion of e-commerce and private-label offerings. U.S. government dietary guidelines encouraging plant-forward consumption and rising investment in plant-protein technologies are reinforcing market momentum

U.S. Plant-Based Beverages Market Insight

- The U.S. Plant-Based Beverages Market is projected to grow at a strong pace, propelled by consumer demand for lactose-free, allergen-friendly, and functional beverage alternatives.

- The proliferation of plant-based brands in mainstream and health-focused retail, coupled with foodservice adoption in cafés and fast-casual chains, is expanding the category's visibility and accessibility.

- High innovation activity in protein fortification, low-sugar formulations, and enhanced taste/texture is driven by a competitive landscape of multinational companies and startups targeting health-conscious millennials and Gen Z consumers

Canada Plant-Based Beverages Market Insight

- The Canada Plant-Based Beverages Market is gaining momentum, supported by growing plant-based dietary adoption, heightened awareness of dairy allergies, and governmental efforts toward sustainable food production

- Canadian consumers are increasingly embracing oat and almond-based beverages for their nutritional value and culinary versatility, particularly in urban regions like Toronto, Vancouver, and Montreal

- Domestic brands are scaling innovation in functional ingredients and clean-label certifications, while retail players continue to expand shelf space for plant-based products, enhancing consumer access and driving market expansion

Plant-Based Beverages Market Share

The Plant-Based Beverages industry is primarily led by well-established companies, including:

- Danone S.A. (France)

- Nestlé S.A. (Switzerland)

- The Hain Celestial Group, Inc. (U.S.)

- Blue Diamond Growers (U.S.)

- Califia Farms, LLC (U.S.)

- The Coca-Cola Company (U.S.)

- SunOpta Inc. (Canada)

- Oatly AB (Sweden)

- Pacific Foods of Oregon, LLC (U.S.)

- Ripple Foods PBC (U.S.)

- Vitasoy International Holdings Ltd. (Hong Kong)

- Elmhurst Milked Direct LLC (U.S.)

- Campbell Soup Company (U.S.)

- Earth’s Own Food Company Inc. (Canada)

- Sanitarium Health Food Company (Australia)

- Good Karma Foods, Inc. (U.S.)

Latest Developments in North America Plant-Based Beverages Market

- In April 2025, Alpro, a leading plant-based beverage brand, announced a significant shift in its production strategy by sourcing British-grown oats for its oat milk products. This move aims to enhance sustainability and support local agriculture. The transition is facilitated by the high-tech Navara Oat Milling facility in Northamptonshire, which processes the locally sourced oats for Alpro's production needs.

- In January 2025, Oatly Group AB partnered with Nespresso to launch a limited-edition coffee blend designed specifically for oat milk enthusiasts. The Nespresso Oatly Barista Edition Coffee offers rich, biscuity notes that complement Oatly's oat drink, catering to the growing demand for plant-based coffee alternatives.

- In October 2024, Rude Health, a prominent UK-based plant-based milk producer, was acquired by Finnish dairy company Oddlygood. This acquisition aims to expand Oddlygood's presence in the UK market and diversify its plant-based product offerings. Rude Health's co-founder, Camilla Barnard, will continue to contribute as a brand consultant post-acquisition.

- In 2024, Alpro expanded its chilled product portfolio by introducing six new items, including plant-based protein drinks and yogurt alternatives. Notably, the Creamy Oat & Almond No-Sugars range was extended with a 500ml option. These products are fortified with calcium and vitamins, aligning with consumer preferences for nutritious, low-sugar plant-based beverages

- In 2024, Oatly Group AB collaborated with Germany's largest coffee chain, Coffee Fellows, to offer dairy-free oat-based beverages across approximately 275 outlets in Germany, Austria, Belgium, Luxembourg, and the Netherlands. This partnership aims to increase the accessibility of plant-based options in mainstream coffee shops.

- In September 2023, Boermarke, a Dutch dairy company with over three decades in the industry, announced its transition to exclusively producing plant-based dairy products. The company aims to make these products available in all European supermarkets within three years, reflecting a significant shift towards plant-based alternatives in the dairy sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PLANT-BASED BEVERAGES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE NORTH AMERICA PLANT-BASED BEVERAGES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 NORTH AMERICA PLANT-BASED BEVERAGES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRIVATE LABEL VS BRAND ANALYSIS

5.2 VALUE CHAIN ANALYSIS

5.3 SUPPLY CHAIN ANALYSIS

5.4 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.5 SHOPPING BEHAVIOUR AND DYNAMICS

5.5.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.5.2 ADVERTISEMENT

5.5.2.1. TELEVISION ADVERTISEMENT

5.5.2.2. ONLINE ADVERTISEMENT

5.5.2.3. IN-STORE ADVERTISEMENT

5.5.2.4. OUTDOOR ADVERTISEMENT

5.6 PROMOTIONAL ACTIVITIES

5.7 NEW PRODUCT LAUNCH STRATEGY

5.7.1.1. NUMBER OF NEW PRODUCT LAUNCH

5.7.1.1.1. LINE EXTENSION

5.7.1.1.2. NEW PACKAGING

5.7.1.1.3. RE-LAUNCHED

5.7.1.1.4. NEW FORMULATION

5.7.1.2. DIFFERNTIAL PRODUCT OFFERING

5.7.1.3. MEETING CONSUMER REQUIREMENT

5.7.1.4. PACKAGE DESIGNING

5.7.1.5. PRICING ANALYSIS

5.7.1.6. PRODUCT POSITIONING

5.8 LABELING AND CLAIMS

5.9 FACTORS INFLUENCING THE PURCHASE

5.1 BRAND COMPETITIVE ANALYSIS

5.11 CONSUMER TYPE AND THEIR BUYING PERCEPTION

5.11.1.1. MILLENIALS

5.11.1.2. GEN X

5.11.1.3. BABY BOOMERS

6 NORTH AMERICA PLANT-BASED BEVERAGES MARKET , BY TYPE , 2022-2031, (USD MILLION)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

6.1 OVERVIEW

6.2 PLANT-BASED MILK

6.2.1 ALMOND MILK

6.2.1.1. ALMOND MILK , BY TYPE

6.2.1.1.1. HOMEMADE

6.2.1.1.2. SHELF-STABLE

6.2.1.1.3. REFRIGERATED

6.2.1.2. ALMOND MILK, BY FORMULATION

6.2.1.2.1. SWEETENED

6.2.1.2.2. UNSWEETENED

6.2.2 COCONUT MILK

6.2.2.1. COCONUT MILK, BY TYPE

6.2.2.1.1. FULL FAT COCONUT MILK

6.2.2.1.2. LITE COCONUT MILK

6.2.2.1.3. REFRIGERATOR COCUNUT MILK

6.2.2.1.4. OTHERS

6.2.2.2. COCONUT MILK, BY FORMULATION

6.2.2.2.1. SWEETENED

6.2.2.2.2. UNSWEETENED

6.2.3 CASHEW MILK

6.2.3.1. CASHEW, BY TYPE

6.2.3.1.1. DESSERT WHOLES

6.2.3.1.2. SCORCHED WHOLES

6.2.3.1.3. WHITE WHOLES

6.2.3.1.4. OTHERS

6.2.3.2. CASHEW MILK, BY FORMULATION

6.2.3.2.1. SWEETENED

6.2.3.2.2. UNSWEETENED

6.2.4 WALNUT MILK

6.2.4.1. WALNUT, BY TYPE

6.2.4.1.1. BLACK WALNUT

6.2.4.1.2. BUTTERNUT

6.2.4.1.3. ENGLISH WALNUT

6.2.4.2. WALNUT MILK, BY FORMULATION

6.2.4.2.1. SWEETENED

6.2.4.2.2. UNSWEETENED

6.2.5 HAZELNUT MILK

6.2.5.1. HAZELNUT, BY TYPE

6.2.5.1.1. HYBRID HAZELNUT

6.2.5.1.2. BEAKED HAZELNUT

6.2.5.2. HAZELNUT MILK, BY FORMULATION

6.2.5.2.1. SWEETENED

6.2.5.2.2. UNSWEETENED

6.2.6 SOY MILK

6.2.6.1. SOY MILK, BY FORMULATION

6.2.6.1.1. SWEETENED

6.2.6.1.2. UNSWEETENED

6.2.7 OAT MILK

6.2.7.1. OAT MILK, BY FORMULATION

6.2.7.1.1. SWEETENED

6.2.7.1.2. UNSWEETENED

6.2.8 RICE MILK

6.2.8.1. RICE MILK, BY FORMULATION

6.2.8.1.1. SWEETENED

6.2.8.1.2. UNSWEETENED

6.2.9 FLAX MILK

6.2.9.1. FLAX MILK, BY FORMULATION

6.2.9.1.1. SWEETENED

6.2.9.1.2. UNSWEETENED

6.2.10 OTHERS

6.3 LEMONADE

6.3.1 LEMONADE, BY TYPES

6.3.1.1. PLAIN LEMONADE

6.3.1.2. MINTY LEMONADE

6.3.1.3. FRUITS LEMONADE

6.3.1.3.1. FRUITS LEMONADE, BY TYPES

6.3.1.3.2. MANFGO LEMONADE

6.3.1.3.3. PINEAPPLE LEMONADE

6.3.1.3.4. BLUE BERRY LEMONADE

6.3.1.3.5. BLACK BERRY LEMONADE

6.3.1.3.6. OTHERS

6.4 NECTOR DRINKS

6.4.1 NECTOR DRINKS, BY FLAVOUR

6.4.1.1.1. MANGO

6.4.1.1.2. LITCHI

6.4.1.1.3. APPLE

6.4.1.1.4. GUVAVA

6.4.1.1.5. MIX FRUIT

6.4.1.1.6. OTHERS

6.5 ENERGY /SPORTS DRINKS

6.5.1 ENERGY DRINKS,BY FLAVOUR

6.5.1.1. MANGO FLAVOR

6.5.1.2. SARSI FLAVOR

6.5.1.3. GRAPE FLAVOR

6.5.1.4. NONI FLAVOR

6.5.1.5. BASIL SEED FLAVOR

6.5.1.6. COCONUT FLAVOR

6.6 JUICES

6.6.1 JUICEA, BY TYPES

6.6.1.1. VEGETABLE JUICES

6.6.1.1.1. VEGETABLE JUICES ,BY TYPE

6.6.1.1.1.1 BEET JUICE

6.6.1.1.1.2 CABBAGE JUICE

6.6.1.1.1.3 CARROT JUICE

6.6.1.1.1.4 WATER MELON JUICE

6.6.1.1.1.5 OTHERS

6.6.1.2. FRUIT JUICES

6.6.1.2.1. FRUIT JUICES,BY TYPES

6.6.1.2.1.1 ORANGE JUICE

6.6.1.2.1.2 APPLE JUICE

6.6.1.2.1.3 GRAPE JUICE

6.6.1.2.1.4 PINEAPPLE JUICE

6.6.1.2.1.5 OTHERS

6.7 OTHERS(SHAKES AND NOGS)

7 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2022-2031, (USD MILLION)

7.1 OVERVIEW

7.2 ALMOND

7.3 COCONUT

7.4 CASHEW

7.5 WALNUT

7.6 HAZELNUT

7.7 SOY

7.8 OAT

7.9 RICE

7.1 FLAX

7.11 OTHERS

8 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY CATEGORY, 2022-2031, (USD MILLION)

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY FLAVOR , 2022-2031, (USD MILLION)

9.1 OVERVIEW

9.2 ORIGINAL/UNFLAVORED

9.3 FLAVORED

10 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY PRODUCT TYPE , 2022-2031, (USD MILLION)

10.1 OVERVIEW

10.2 REFRIGERATED

10.3 SHELF-STABLE

11 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY FORMULATION , 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 SWEETENED

11.3 UNSWEETENED

12 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY FORTIFICATION , 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 REGULAR

12.3 FORTIFIED

13 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY NATURE , 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 GMO

13.3 NON-GMO

14 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY CLAIM , 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 REGULAR

14.3 GLUTEN FREE

14.4 NUT FREE

14.5 SOY FREE

14.6 ARTIFICIAL PRESERAVTIVES & COLOR FREE

14.7 OTHERS

15 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY PACKAGING SIZE , 2022-2031, (USD MILLION)

15.1 OVERVIEW

15.2 LESS THAN 100 ML

15.3 110 ML

15.4 250 ML

15.5 500 ML

15.6 1000 ML

15.7 MORE THAN 1000 ML

16 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY PACKAGING TYPE , 2022-2031, (USD MILLION)

16.1 OVERVIEW

16.2 BOTTLES

16.2.1 BOTTLES, BY TYPE

16.2.1.1. GLASS

16.2.1.2. PLASTICS

16.2.1.3. OTHERS

16.3 CAN

16.4 PACKETS

16.5 OTHERS

17 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, (USD MILLION)

17.1 OVERVIEW

17.2 STORE BASED RETAILERS

17.2.1 SUPERMARKETS/HYPERMARKETS

17.2.2 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

17.2.3 CONVENIENCE STORES

17.2.4 GROCERY RETAILERS

17.2.5 SPECIALTY STORES

17.2.6 WHOLESALERS

17.2.7 OTHERS

17.3 NON-STORE RETAILERS

17.3.1 ONLINE RETAILERS

17.3.2 COMPANY WEBSITE

18 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.2 MERGERS & ACQUISITIONS

18.3 NEW PRODUCT DEVELOPMENT & APPROVALS

18.4 EXPANSIONS & PARTNERSHIP

18.5 REGULATORY CHANGES

19 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION)

19.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

19.2 NORTH AMERICA

19.2.1 U.S.

19.2.2 CANADA

19.2.3 MEXICO

20 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, SWOT & DBMR ANALYSIS

21 NORTH AMERICA PLANT-BASED BEVERAGES MARKET, COMPANY PROFILE

21.1 ALPRO (DANONE)

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENTS

21.2 OATLY, INC.

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 THE HAIN CELESTIAL GROUP, INC.

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 SANITARIUM HEALTH FOOD COMPANY

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 CALIFIA FARMS, LLC

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 THE HERSHEY COMPANY

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 SIMPLE FOODS

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 YEO HIAP SENG LTD.( FAR EAST ORGANIZATION)

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 PACIFIC FOODS (ACQUIRED BY CAMPBELL SOUP COMPANY)

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 ONLY EARTH

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 AXELUM RESOURCES CORP

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 MCCORMICK & COMPANY, INC

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 NESTLE SA

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENTS

21.14 CHOBANI GLOBAL HOLDINGS LLC

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SUNOPTA

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENTS

21.16 MOOALA BRANDS, LLC.

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT DEVELOPMENTS

21.17 ELMHURST

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 CONCLUSION

24 QUESTIONNAIRE

25 ABOUT DATA BRIDGE MARKET RESEARCH

North America Plant Based Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Plant Based Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Plant Based Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.