North America Plant-Derived and Synthetic Sugar Market Analysis and Insights

The North America plant-derived and synthetic sugar market are being driven by the numerous benefits they offer to both companies and employees. The market for plant-derived and synthetic sugar is also being driven by an increase in demand for healthy food ingredients in the food and beverage industry. People's awareness of natural sweeteners puts manufacturers' demand to supply natural sweeteners. It ultimately acts as a driver for the growth of the market. Consumers are increasingly looking for foods that are minimal in calories, fat, sodium, and added sugars as part of a growing trend toward healthy eating. Manufacturers of artificial and plant-derived sugar can take advantage of this opportunity to enter this expanding market. However, the high cost of plant-derived sugar compared to regular sugar is one of the main restraining factors limiting the market's growth.

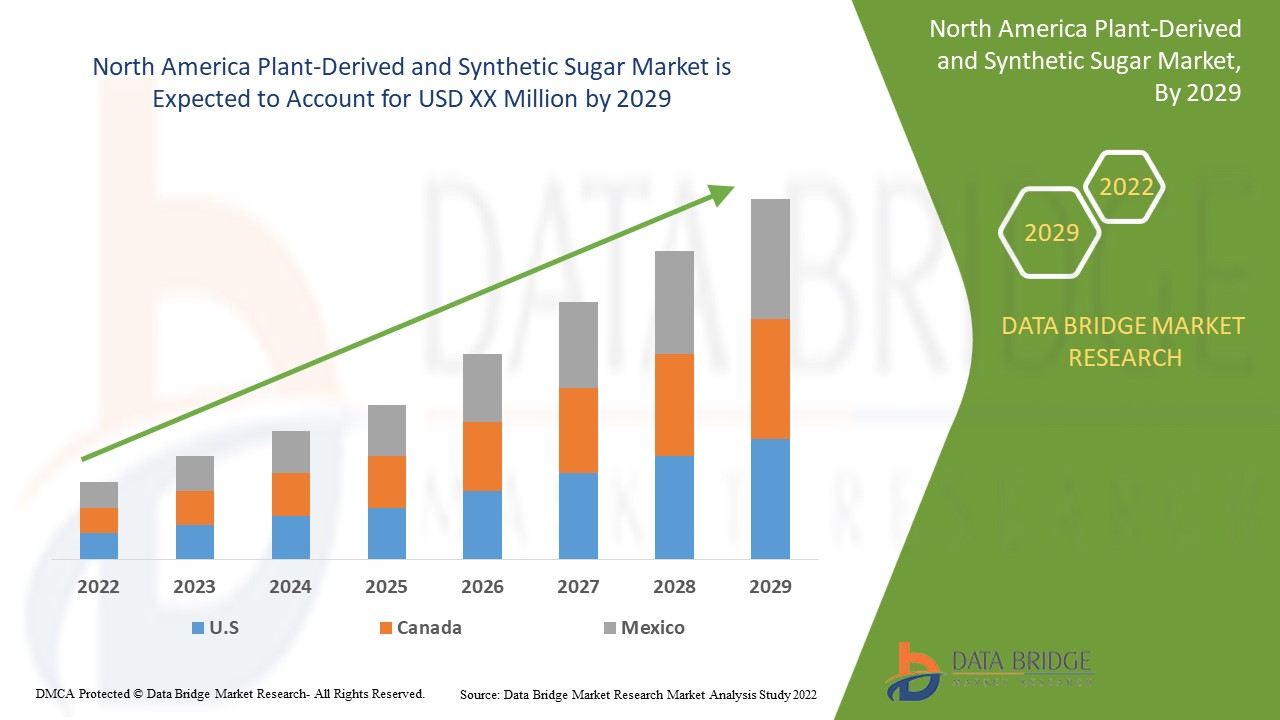

Data Bridge Market Research analyses that the North America plant-derived and synthetic sugar market will grow at a CAGR of 3.2% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Plant-Derived Sugar, Synthetic Sugar), Form (Dry, Liquid), Application (Food & Beverages, Dietary Supplements, Pharmaceutical, Sports Nutrition, Others). |

|

Regions Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

ADM, Cargill, Incorporated, Ingredion, Ajinomoto Co., Inc., BENEO, DuPont, Mafco Worldwide LLC, NOW® Foods, Roquette Frères, NutraSweetM™ Co, Tate & Lyle, Pyure, Hermes Sweeteners Ltd., Südzucker AG, HSWT, Layn Corp., WILMAR INTERNATIONAL LTD, Celanese Corporation, Grupo PSA, JK Sucralose Inc. |

Market Definition

Plant-derived and Synthetic Sugar are products used for sweetening. Plant-derived sugar is defined as sugar that is taken straight from a plant source and sold to consumers unaltered. Synthetic sugars, on the other hand, are made indirectly from a separate source of sugar. Some plant-derived sugar including stevia, Xylitol, Erythritol, Yacon Syrup, and others, is a suitable replacement for sugar to reduce the risk of having different diseases from sugar. Additionally, Consumers all over the world are favoring a healthy diet and avoiding sugary goods that are rich in calories and linked to cardiac disease. Due to the growing popularity of plant-based products, plant-based sugar is receiving more and more attention. However, the high pricing of both sugars compared to normal sugar is among the restraining factors for the plant-derived and synthetic sugar market.

Plant-Derived And Synthetic Sugar Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers:

- WIDE APPLICATION OF PLANT DERIVED AND SYNTHETIC SUGAR IN VARIOUS NORTH AMERICA INDUSTRIES

Plant-derived and synthetic sugar has immense potential to be used in food and beverages, pharmaceutical, biofuel, cosmetics, and others. Hybrid sugarcane (Saccharum spp.) has enormous potential as a significant North America feedstock for biofuel generation. Due to its outstanding ability to produce biomass, high carbohydrate (sugar + fiber) content, and a favorable energy input/output ratio, it is regarded as one of the finest possibilities for creating biofuels nowadays. It is essential to develop enhanced sugarcane cultivars with superior biomass degradability in order to increase the conversion of sugarcane biomass into biofuels. In addition to flavor and texture in food and beverages, sugar is a pharmaceutical excipient used in tablets and capsules to enhance appearance, portability, and texture. Sugar is also becoming increasingly popular in natural cosmetics.

- GROWTH IN THE DEMANDS FOR NATURAL SWEETENERS AS A SAFER ALTERNATIVE TO ARTIFICIAL SWEETENERS

Long-term use of artificial sweeteners can lead to diabetes, which interferes with the body's capacity to control blood sugar and makes market expansion challenging. Consuming artificial sweeteners over an extended period of time may result in gastrointestinal problems like diarrhea and bloating. A recent study found that high-intensity sweets like saccharin and aspartame can result in blood-related conditions like leukemia, which can be lethal and cause mortality. People are aware of all these adverse effects of artificial sweeteners, so they prefer to buy safer alternatives to artificial sweeteners like plant based sweeteners such as Stevia, Erythritol, Xylitol, Yacon syrup, Monk fruit sweetener, and others. These alternatives give many health befits also.

Restraint

- GROWING HEALTH PROBLEMS DUE TO HIGH SUGAR INTAKE

Other common sweeteners that are frequently used in place of sugar include molasses, honey, maple syrup, and coconut sugar. Long-term high natural sugar or sugar substitute consumption can be harmful to human health. Additionally, even while these natural sugar replacements may be a healthier choice than normal sugar if used sparingly, they shouldn't be viewed as a temporary solution to human health problems. In reality, long-term use of large amounts of natural sugars or sugar substitutes may boost the desire for sweets and may help to cause problems, including weight gain and type 2 diabetes. There are many different natural sweeteners available due to the incredible diversity of plants, yet they all have particular drawbacks. Furthermore, there is no assurance that a chemical made in a factory will be any safer than one made in a laboratory. Before being accepted as safe as a food additive, these plant sweeteners still need to undergo comprehensive testing.

- AVAILABILITY OF SUBSTITUTE FOR PLANT BASED SUAGRS AND SYNTHETIC SUGARS

Health-conscious consumers frequently substitute honey, maple syrup, molasses, coconut sugar, and other common sugary sweeteners for sugar. These hardly differ from sugar at all. The human body won't be able to recognize the difference, even though they may have a tiny bit less sugar and a few more nutrients. Additionally, even while these natural sugar replacements may be a healthier choice than normal sugar if used sparingly, they shouldn't be viewed as a temporary solution to your health problems. Due to a lack of knowledge, pricing concerns, the negative consequences of artificial sugars, and other factors, the long-term consumption of regular sugar by people may make it more difficult for them to choose plant-based sugars. Additionally, there are very few plant-based sugars and synthetic sugars available to regular customers.

Opportunity

- CHANGES IN LIFESTYLE AND DEMOGRAPHICS TO ENCOURAGE VARIOUS EATING HABITS

In growing economies, modernization and urbanization have boosted the food sector. Consumers' eating habits have changed dramatically; it has been influenced by changing lifestyles. Increased disposable incomes and a higher standard of living as a result of improvements in various nations' economic conditions have significantly increased consumption of both plant-derived and synthetic sugar. This trend of consumption of ready-to-eat foods has also increased and expanded over the past few years as a result of the growing number of working women and their busy schedules.

Challenges

- Government- imposed strict restrictions and regulations

Consumers' growing inclination towards healthy food and health-conscious nature has significantly increased the use of products with no added sugar and sweetener labels. The government set up certain rules and actions to reduce sugar intake through selective taxation, reformulations, and packaging label. The government has been continuously monitoring the situation in the sugar sector, including sugar production, consumption, export, and price trends in wholesale and retail markets all over the country.

Though food and drug administration (FDA) approved products are considered safe, there are questionable health downsides associated with artificial and non-nutritive sweeteners. In the case of natural sweeteners, overconsumption can lead to health problems like tooth decay, poor nutrition, etc.

Post-COVID-19 Impact

The demand and supply for sugar and synthetic sugar products had initially decreased during the beginning of the COVID-19 pandemic due to temporary lockdown and social distancing, which resulted in trade restrictions, transportation restrictions, and production restrictions. This has slightly affected the North America Plant-Derived Sugar and Synthetic Sugar Market.

The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. In addition, the food ingredient industry, like sweeteners that are used in the food and beverage industry, faces many serious disruptions, such as supply chain breaks, technology events cancellations, and office shutdowns due to this outbreak. It has ultimately affected the overall sugar and sweetener ingredient industry. However, post covid, the demand for plant-based sugar in health and wellness food products has increased rapidly owing to the increased number of health-conscious people and increased awareness about healthy food ingredients and their benefits.

Furthermore, the government restrictions, trade, and import-export has been made easier, and many of the restrictions have been removed after COVID-19, which made it easier for health and wellness food manufacturers to fulfill the demands of the consumers and added to the growth of the market.

Recent Developments

- In February 2022, IFF is acquiring Health Wright products. HWP is a North America leader in the consumer Health and Nutrition industries, providing the highest-quality nutritional supplements. The acquisition will bring formulation and finished format capabilities to IFF’s Health & Biosciences probiotics, natural extracts, and botanicals businesses, allowing for innovation in custom formulation and combination products through joint capabilities.

- In August 2021, an article titled "Plant-Based Sweeteners: A Complete Guide" was published by Ochsner Health. It was made very obvious that there are more calorie-free, plant-based sweeteners available now than ever before, making it simpler than ever to cut back on added sugar.

North America Plant-Derived and Synthetic Sugar Market Scope

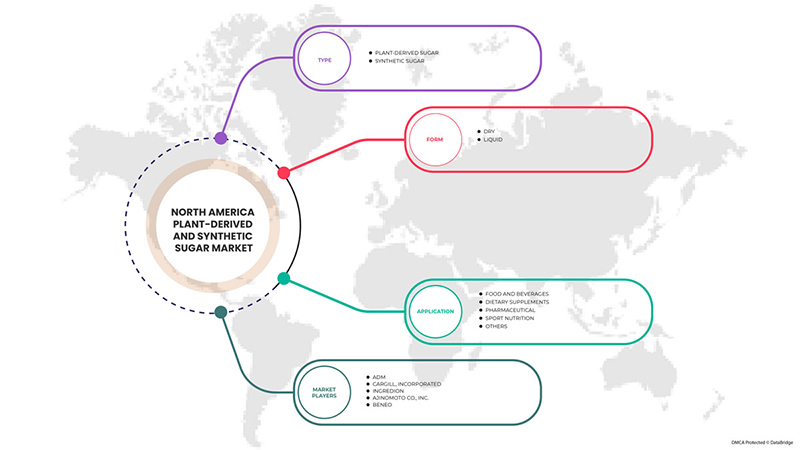

North America plant derived and synthetic sugar market is segmented on the basis of type, application, and form. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Plant-Derived Sugar

- Synthetic Sugar

On the basis of type, the North America plant derived, and synthetic sugar market is segmented into plant derived sugar, synthetic sugar.

Application

- Food & Beverages

- Dietary Supplements

- Pharmaceutical

- Sports Nutrition

- Others

On the basis of end users, the North America plant derived, and synthetic sugar market is segmented into food & beverages, dietary supplements, pharmaceutical, sports nutrition, and others.

Form

- Dry

- Liquid

On the basis of form, the North America plant derived, and synthetic sugar market is segmented into dry and liquid.

North America Plant-Derived and Synthetic Sugar Market Regional Analysis/Insights

The North America Plant-derived, and synthetic sugar market is analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the North America Plant-derived, and synthetic sugar market report are the U.S., Canada, and Mexico.

U.S. is expected to dominate the North America Plant-derived and synthetic sugar market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the Growing demand for this sugar is the major reason for the growth of Plant-derived and synthetic sugar in the North America region.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of form are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Plant-derived and synthetic sugar Market Share Analysis

The Competitive North America Plant-derived, and synthetic sugar market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the company's focus on the North America Plant-derived and synthetic sugar market.

Some of the major players operating in the North America Plant-derived and synthetic sugar market ADM, Cargill, Incorporated, Ingredion, Ajinomoto Co., Inc., BENEO, DuPont, Mafco Worldwide LLC, NOW® Foods, Roquette Frères, NutraSweetM™ Co, Tate & Lyle, Pyure, Hermes Sweeteners Ltd., Südzucker AG, HSWT, Layn Corp., WILMAR INTERNATIONAL LTD, Celanese Corporation, Grupo PSA, JK Sucralose Inc among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 IMPORT-EXPORT ANALYSIS

4.3.1 IMPORT-EXPORT ANALYSIS- NORTH AMERICA PLANT-DERIVED SYNTHETIC SUGAR MARKET

4.3.2 IMPORT-EXPORT ANALYSIS- NORTH AMERICA SYNTHETIC SUGAR MARKET

4.4 INDUSTRY TRENDS FOR NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

4.4.1 INDUSTRY TRENDS

4.4.1.1 DEMAND FOR SYNTHETIC SUGAR

4.4.1.2 GROWING POPULARITY OF PLANT DERIVED SUGAR

4.4.2 FUTURE PERSPECTIVE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 PROMOTING BY EMPHASIZING THEIR HEALTH BENEFITS

4.5.2 WEIGHT MANAGEMENT

4.5.3 LAUNCHING ORGANIC PRODUCTS

4.5.4 CONCLUSION

4.6 PRODUCTION AND CONSUMPTION

4.7 TECHNOLOGICAL ADVANCEMENT IN THE PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

5 POST-COVID IMPACT

5.1 AFTERMATH OF COVID-19

5.2 IMPACT ON DEMAND AND SUPPLY CHAIN

5.3 IMPACT ON PRICE

5.4 CONCLUSION

6 VALUE CHAIN ANALYSIS: NORTH AMERICA PLANT DERIVED SUGAR AND SYNTHETIC SUGAR MARKET

7 REGULATORY FRAMEWORK AND GUIDELINES

7.1 NORTH AMERICA

8 SUPPLY CHAIN OF NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

8.1 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

8.1.1 RAW MATERIAL PROCUREMENT

8.1.2 PREPARATION OF SUGAR IN SUGAR MILLS

8.1.3 MARKETING AND DISTRIBUTION

8.1.4 END USERS

8.2 SUPPLY CHAIN OF SYNTHETIC SUGAR

8.2.1 RAW MATERIAL PROCUREMENT

8.2.2 PREPARATION OF SYNTHETIC SUGAR IN THE LAB

8.2.3 MARKETING AND DISTRIBUTION

8.2.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN THE DEMAND FOR HEALTHY FOOD INGREDIENTS IN THE FOOD AND BEVERAGE SECTOR

9.1.2 WIDE APPLICATION OF PLANT-DERIVED AND SYNTHETIC SUGAR IN VARIOUS GLOBAL INDUSTRIES

9.1.3 GROWTH IN THE DEMAND FOR NATURAL SWEETENERS AS A SAFER ALTERNATIVE TO ARTIFICIAL SWEETENERS

9.1.4 GROWTH IN THE CONSUMER DEMAND FOR IN CONFECTIONERY PRODUCTS

9.1.5 RISE IN THE HEALTH BENEFITS ASSOCIATED WITH SYNTHETIC SUGAR

9.2 RESTRAINTS

9.2.1 HIGH COSTS OF PLANT-DERIVED AND SYNTHETIC SUGAR

9.2.2 ARTIFICIAL SWEETENERS' ADOPTION IS BEING HAMPERED BY THE GROWING UNCERTAINTY AROUND THEIR SAFETY IN NUMEROUS FOOD PRODUCTS.

9.2.3 GROWTH HEALTH PROBLEMS DUE TO HIGH SUGAR INTAKE

9.2.4 AVAILABILITY OF SUBSTITUTE FOR PLANT-DERIVED AND SYNTHETIC SUGARS

9.3 OPPORTUNITIES

9.3.1 EXPANSION AND NEW PRODUCT LAUNCHES IN THIS INDUSTRY

9.3.2 INCREASE IN THE HEALTH-CONSCIOUSNESS AMONG GLOBAL CONSUMERS

9.3.3 CHANGES IN LIFESTYLE AND DEMOGRAPHICS TO ENCOURAGE VARIOUS EATING HABITS

9.3.4 CONSUMERS SHIFTING PREFERENCE TOWARD LOW-SUGAR DRINKS

9.4 CHALLENGES

9.4.1 IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF FINAL PRODUCTS AND RAW MATERIAL

9.4.2 GOVERNMENT- IMPOSED STRICT RESTRICTIONS AND REGULATIONS

9.4.3 PRODUCT LABELING AND TRADE ISSUES

9.4.4 INADEQUATE RAW MATERIAL AVAILABILITY

10 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE

10.1 OVERVIEW

10.2 PLANT-DERIVED SUGAR

10.2.1 PLANT DERIVED SUGAR, BY TYPE

10.2.1.1 CANE SUGAR

10.2.1.2 SUGAR BEET SUGAR

10.2.1.3 STEVIA

10.2.1.4 MONK FRUIT SWEETENER

10.2.1.5 COCONUT SUGAR

10.2.1.6 MAPLE SUGAR

10.2.1.7 MOLASSES SUGAR

10.2.1.8 BROWN RICE SUGAR

10.2.1.9 MALTITOL

10.2.1.10 ALLULOSE

10.2.1.11 ERYTHRITOL

10.2.1.12 XYLITOL

10.2.1.13 OTHERS

10.2.2 PLANT DERIVED SUGAR, BY CATEGORY

10.2.2.1 CONVENTIONAL SUGAR

10.2.2.2 ORGANIC SUGAR

10.3 SYNTHETIC SUGAR

10.3.1 SYNTHETIC SUGAR, BY TYPE

10.3.1.1 ASPARTAME

10.3.1.2 SACCHARINE

10.3.1.3 ACE-K

10.3.1.4 CYCLAMATE

10.3.1.5 SUCROLOSE

10.3.1.6 GLYCYRRHIZIN

10.3.1.7 ALITAME

10.3.1.8 ADVANTAME

10.3.1.9 NEOTAME

10.3.1.10 OTHERS

11 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM

11.1 OVERVIEW

11.2 DRY

11.2.1 DRY, BY TYPE

11.2.1.1 POWDER

11.2.1.2 CRYSTAL

11.2.1.3 CRYSTALIZED POWDER

11.3 LIQUID

12 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD AND BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 TABLE TOP SUGAR

12.2.1.2 BEVERAGES

12.2.1.2.1 DAIRY BASED DRINKS

12.2.1.2.1.1 REGULAR

12.2.1.2.1.2 PROCESSED MILK

12.2.1.2.1.3 MILK SHAKES

12.2.1.2.1.4 FLAVORED MILK

12.2.1.2.2 JUICES

12.2.1.2.3 SMOOTHIES

12.2.1.2.4 PLANT BASED MILK

12.2.1.2.5 ENERGY DRINKS

12.2.1.2.6 SPORTS DRINKS

12.2.1.2.7 OTHERS

12.2.1.3 FROZEN DESSERTS

12.2.1.3.1 GELATO

12.2.1.3.2 CUSTARD

12.2.1.3.3 OTHERS

12.2.1.4 PROCESSED FOOD

12.2.1.4.1 READY MEALS

12.2.1.4.2 JAMS, PRESERVES & MARMALADES

12.2.1.4.3 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.4.4 SOUPS

12.2.1.4.5 OTHERS

12.2.1.5 CONVENIENCE FOOD

12.2.1.5.1 INSTANT NOODLES

12.2.1.5.2 PIZZA & PASTA

12.2.1.5.3 SNACKS & EXTRUDED SNACKS

12.2.1.5.4 OTHERS

12.2.1.6 CONFECTIONERY

12.2.1.6.1 HARD-BOILED SWEETS

12.2.1.6.2 MINTS

12.2.1.6.3 GUMS & JELLIES

12.2.1.6.4 CHOCOLATE

12.2.1.6.5 CHOCOLATE SYRUPS

12.2.1.6.6 CARAMELS & TOFFEES

12.2.1.6.7 OTHERS

12.2.1.7 BAKERY

12.2.1.7.1 BREAD & ROLLS

12.2.1.7.2 CAKES, PASTRIES & TRUFFLE

12.2.1.7.3 BISCUIT, COOKIES & CRACKERS

12.2.1.7.4 BROWNIES

12.2.1.7.5 TART & PIES

12.2.1.7.6 OTHERS

12.2.1.8 DAIRY PRODUCTS

12.2.1.8.1 YOGURT

12.2.1.8.2 ICE CREAM

12.2.1.8.3 CHEESE

12.2.1.8.4 OTHERS

12.2.1.9 BREAKFAST CEREAL

12.2.1.10 INFANT FORMULA

12.2.1.10.1 FIRST INFANT FORMULA

12.2.1.10.2 ANTI-REFLUX (STAY DOWN) FORMULA

12.2.1.10.3 COMFORT FORMULA

12.2.1.10.4 HYPOALLERGENIC FORMULA

12.2.1.10.5 FOLLOW-ON FORMULA

12.2.1.10.6 OTHERS

12.2.1.11 NUTRITIONAL BARS

12.2.1.12 FUNCTIONAL FOOD

12.2.2 FOOD & BEVERAGE, BY SWEETENER TYPE

12.2.2.1 PLANT-DERIVED SUGAR

12.2.2.2 SYNTHETIC SUGAR

12.3 DIETARY SUPPLEMENTS

12.3.1 DIETARY SUPPLEMENTS, BY TYPE

12.3.1.1 IMMUNITY SUPPLEMENTS

12.3.1.2 OVERALL WELLBEING SUPPLEMENTS

12.3.1.3 SKIN HEALTH SUPPLEMENTS

12.3.1.4 BONE AND JOINT HEALTH SUPPLEMENTS

12.3.1.5 BRAIN HEALTH SUPPLEMENTS

12.3.1.6 OTHERS

12.3.2 DIETARY SUPPLEMENTS, BY SWEETENER TYPE

12.3.2.1 PLANT-DERIVED SUGAR

12.3.2.2 SYNTHETIC SUGAR

12.4 PHARMACEUTICAL

12.4.1 PHARMACEUTICAL, BY TYPE

12.4.1.1 TABLETS

12.4.1.2 CAPSULES

12.4.1.3 OTHERS

12.4.2 PHARMACEUTICAL, BY SWEETENER TYPE

12.4.2.1 PLANT-DERIVED SUGAR

12.4.2.2 SYNTHETIC SUGAR

12.5 SPORTS NUTRITION

12.5.1 SPORTS NUTRITION, BY TYPE

12.5.1.1 PROTEIN POWDERS

12.5.1.2 SPORTS NUTRITION BARS

12.5.1.3 SPORT DRINK MIXES

12.5.1.4 ENERGY GELS

12.5.1.5 OTHERS

12.5.2 SPORTS NUTRITION, BY SWEETENER TYPE

12.5.2.1 PLANT-DERIVED SUGAR

12.5.2.2 SYNTHETIC SUGAR

12.6 OTHERS

12.6.1 OTHERS, BY SWEETENER TYPE

12.6.1.1 PLANT-DERIVED SUGAR

12.6.1.2 SYNTHETIC SUGAR

13 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY COUNTRY

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SUDZUKER AG

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIALS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 CARGILL, INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 INGREDION INCORPORATED

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 WILMAR INTERNATIONAL LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AJINOMOTO CO., INC

16.6.1 COMPANY SNAPSHOT

16.6.2 RECENT FINANCIALS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 BENEO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CELANESE CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 DUPONT

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GRUPO PSA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HERMES SWEETENERS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 JK SUCRALOSE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 LAYN CORP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MAFCO WORLDWIDE LLC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NUTRASWEETM CO

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 PYURE BRANDS LLC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ROQUETTE FRÈRES.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 TATE&LYLE

16.18.1 COMPANY SNAPSHOT

16.18.2 RECENT FINANCIALS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 TOP IMPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 2 TOP EXPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 3 TOP IMPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 4 TOP EXPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 5 PRODUCTION OF SUGAR IN 2021/2022

TABLE 6 CONSUMPTION OF SUGAR IN 2021/2022

TABLE 7 PRICES OF PLANT-DERIVED SUGAR:

TABLE 8 PRICES OF SYNTHETIC SUGAR:

TABLE 9 PRICES OF REGULAR SUGAR:

TABLE 10 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 29 NORH AMERICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 36 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 37 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 40 U.S. SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 42 U.S. DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 U.S. FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 63 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 66 CANADA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 CANADA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 CANADA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CANADA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 CANADA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 89 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 MEXICO PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 MEXICO DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 MEXICO FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 MEXICO BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 10 THE HIGH DEMAND FOR HEALTHY FOOD INGREDIENTS IN FOOD AND BEVERAGE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE PLANT DERIVED SUGAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 VALUE CHAIN OF PLANT DERIVED SUGAR AND SYNTHETIC SUGAR

FIGURE 13 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

FIGURE 14 SUPPLY CHAIN OF SYNTHETIC SUGAR

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

FIGURE 16 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2021

FIGURE 17 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2021

FIGURE 18 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET : BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SNAPSHOT (2021)

FIGURE 20 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021)

FIGURE 21 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY TYPE (2022 - 2029)

FIGURE 24 NORTH AMERICA: COMPANY SHARE 2021 (%)

North America Plant Derived Sugar And Synthetic Sugar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Plant Derived Sugar And Synthetic Sugar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Plant Derived Sugar And Synthetic Sugar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.