North America Playing Cards And Board Games Market

Market Size in USD Billion

CAGR :

%

USD

5.64 Billion

USD

9.21 Billion

2025

2033

USD

5.64 Billion

USD

9.21 Billion

2025

2033

| 2026 –2033 | |

| USD 5.64 Billion | |

| USD 9.21 Billion | |

|

|

|

|

North America Playing Cards and Board Games Market Size

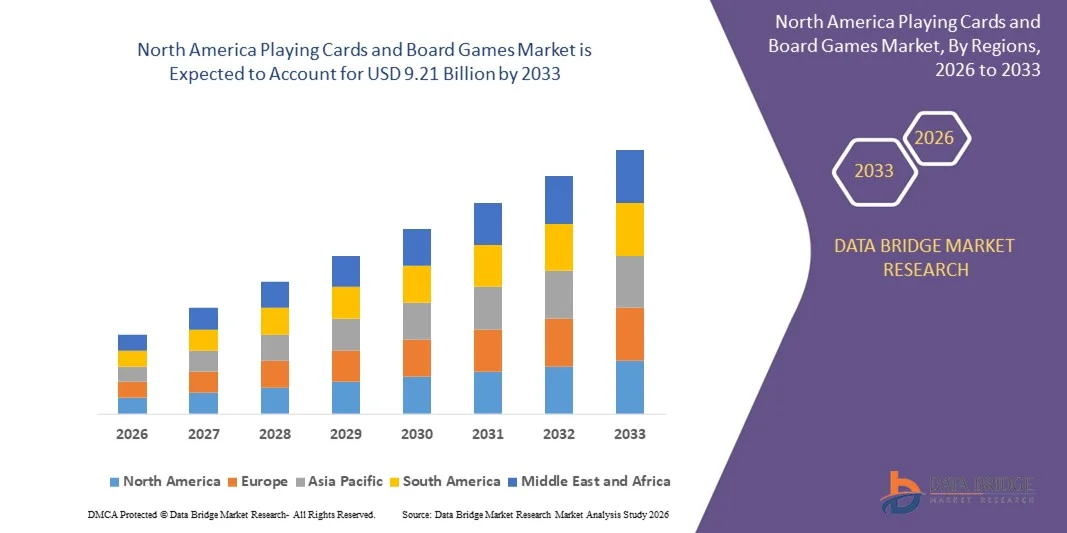

- The North America playing cards and board games market was valued at USD 5.64 billion in 2025 and is expected to reach USD 9.21 billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 6.4%, primarily driven by rising consumer engagement with recreational, social, and family-oriented activities, along with the growing popularity of strategy-based and educational board games. In addition, increasing demand for high-performance production, packaging, and distribution solutions—supported by technological advancements in automation and artificial intelligence—is enhancing operational efficiency across the value chain.

- Furthermore, the expansion of manufacturing and transportation sectors, coupled with higher trade volumes across North America, continues to accelerate the adoption of modern gaming products and drive steady market growth.

North America Playing Cards and Board Games Market Analysis

- The North America playing cards and board games market continues to evolve with advanced technology integration and increasing demand for social, strategic, and recreational games. Although automation is primarily associated with the logistics and port sector, similar trends of digitalization, AI-driven analytics, and product innovation are being mirrored in the gaming industry to enhance distribution efficiency, consumer engagement, and production capabilities.

- Automated logistics and AI-enabled supply chain systems—including automated stacking mechanisms and intelligent inventory management—are becoming key enablers for the efficient distribution of gaming products across North America. These systems help reduce manual processes, improve delivery timeframes, optimize warehouse utilization, and support large retail networks—ultimately strengthening the overall playing cards and board games supply chain.

- Technologies like Automated Stacking Systems (ASCs) and AI-based guided systems in logistics are supporting game manufacturers and distributors by enabling optimized storage, reduced handling times, and continuous monitoring of inventory levels. As the gaming industry scales up through e-commerce, licensed gaming products, and international collaborations, such technologies help maintain supply consistency and reduce operational costs.

- The shift towards smarter distribution platforms and predictive demand planning enables faster replenishment cycles for popular card and board games. These advancements are particularly crucial during seasonal sales, new game launches, and promotional campaigns, where precision in order fulfillment becomes essential.

- U.S. is expected to dominate the playing cards and board games market with the largest revenue share of 73.57% in 2026, supported by heavy investments in port automation, smart logistics, and digital infrastructure. Major ports such as Los Angeles, Long Beach, and New York/New Jersey have adopted ASCs, AGVs, and advanced Terminal Operating Systems (TOS) to reduce congestion and improve throughput. Supportive federal and state initiatives, aimed at strengthening supply chain resilience and sustainability, along with the presence of major operators like APM Terminals, SSA Marine, and DP World, position the U.S. as a regional leader.

- Canada is expected to be the fastest-growing region in the playing cards and board games market during the forecast period with a CAGR of 6.7%, fueled by rising containerized trade and automation in logistics infrastructure. Modernization efforts involving AI-powered inventory monitoring, autonomous vehicles, and remote-controlled cranes will further enhance the distribution capabilities of gaming products across the country.

- In 2026, the board games segment is expected to dominate the market with a 71.34% market share due to their ability to strike an optimal balance between capital investment and operational flexibility makes them a preferred category for manufacturers and distributors—offering scalable growth with enhanced production efficiency and lower risk compared to fully automated product lines.

Report Scope and Playing Cards and Board Games Market Segmentation

|

Attributes |

Playing Cards and Board Games Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Playing Cards and Board Games Market Trends

Subscription-Model Expansion

- The subscription-based model offers a compelling growth avenue for the North America playing cards and board games market. By transitioning from traditional one-time purchases to recurring delivery of curated game experiences, manufacturers and retailers can benefit from improved customer lifetime value, predictability of demand, and deeper engagement. Subscription services facilitate discovery of new titles, reduce the risk of consumer choice overload, and allow brands to bundle exclusive or limited-edition content.

- Additionally, the model supports incremental monetisation through tiered memberships, themed boxes, and community-driven features. As e-commerce logistics and digital payments mature, subscription frameworks become more feasible across geographies and consumer segments, creating a scalable channel for the tabletop games industry to diversify revenue streams and foster brand loyalty.

- In May 2022, Gibsons (company announcement) launched a monthly jigsaw-puzzle subscription offering, demonstrating publisher-level adoption of recurring-revenue product formats in adjacent tabletop/puzzle categories.

- In October 2024, Build Game Box published a company press release announcing the launch of a monthly subscription box for game design and desktop game kits, indicating new entrant activity in curated game-box subscriptions.

- The North America playing cards and board games market is increasingly positioned to benefit from the expansion of subscription-based models. Publisher acquisitions of digital platforms, integration of premium membership services, and the emergence of curated game-box offerings all indicate growing institutional commitment to recurring-revenue formats. These developments are reinforced by maturing digital-commerce infrastructure, rising consumer interest in curated physical experiences, and the steady adoption of hybrid physical-digital engagement models.

- As subscription ecosystems scale, they strengthen pathways for product discovery, customer retention, and portfolio monetisation. Collectively, these factors point toward a market environment that supports sustained subscription adoption, enabling industry participants to diversify revenue, stabilise demand, and enhance long-term strategic positioning within the tabletop entertainment landscape.

North America Playing Cards and Board Games Market Dynamics

Driver

Rise in Demand for Thematic and Strategy-Based Board Games

- Demand for thematic and strategy-based board games has been observed to increase significantly, providing a substantial growth driver for the North America playing cards and board games market. Consumers are increasingly seeking games that go beyond simple mechanics and offer deeper narrative engagement, strategic decision-making, and immersive thematic settings.

- These preferences reflect broader shifts in leisure-time allocation: players seek social interaction, intellectual stimulation and replay value rather than just casual or party-style formats. The growth in immersive themes (fantasy, historical, scientific), complex strategy mechanics (resource management, area control, legacy elements) and community-driven play (clubs, cafés, competitive frameworks) has broadened the addressable market and allowed game-publishers to launch premium variants and expansions with higher price-points. As a result, thematic and strategy-based titles are enhancing product differentiation, supporting longer shelf-life, and strengthening consumer loyalty in the tabletop segment.

- In March 2023, Yahoo Finance reported that strategy-based board games were witnessing higher demand, noting that while preschool children preferred chance-based tabletop games, adults were moving toward more strategic titles.

- The reviewed instances collectively indicate a clear and sustained shift toward deeper thematic engagement and strategic gameplay within the North America board-games market. Across multiple regions and sources, rising consumer interest in narrative-rich mechanics, cooperative formats, intellectually stimulating play structures and immersive social environments has been consistently documented. This trend reflects changing leisure preferences, where players increasingly prioritise depth, replay value and meaningful interaction.

- The convergence of retail demand patterns, evolving design approaches and growing social-play ecosystems reinforces the view that thematic and strategy-based titles are becoming central to market expansion, strengthening long-term growth prospects and shaping future product-development priorities across the value chain.

Restraint/Challenge

Competitive Displacement from the Larger Digital/Video Games

- The growth of digital and video game platforms is exerting competitive pressure on the physical playing cards and board games market. As consumers allocate more leisure time and spending towards immersive digital entertainment—including mobile games, consoles, and online multiplayer experiences—the analog tabletop segment faces a displacement risk. Digital formats offer convenience, frequent content updates, subscription models, and social connectivity, which heighten competitive intensity. Consequently, manufacturers and retailers of board games and playing cards must contend with not only traditional leisure alternatives, but also a rapidly expanding digital ecosystem that weakens analog market share, increases consumer-acquisition costs, and heightens the need for differentiated positioning and hybridization of physical-digital blends.

- In March 2023, a peer-reviewed study in PLOS ONE observed that video-game play time was a significant predictor of cognitive-function metrics whereas board-game play was not, suggesting higher engagement levels and longer sessions in digital formats.

- It is concluded that displacement risk from the larger digital/video game sector constitutes a significant challenge for the playing cards and board games market. The evidence demonstrates that digital gaming has achieved dominant revenue share, sustained consumer engagement and rapid innovation, thereby reducing the available leisure time and spend for physical tabletop formats. For analogue-game producers, this means increased urgency to enhance value through hybrid digital integration, augment social-play propositions, and strengthen marketing differentiation. Without such strategic adaptation, the analog segment may face slower growth, thinner margins and diminished competitive standing within an entertainment landscape increasingly dominated by digital experiences.

North America Playing Cards and Board Games Market Scope

The market is segmented on the basis of product type, age group, distribution channel, end user.

- By Product Type

On the basis of product type, the North America playing cards and board games market is segmented into board games, playing cards. In 2026, the board games segment is expected to dominate the market with a 71.34% market share, driven by strong consumer demand for family-oriented, educational, and strategy-based games. Factors such as cost-effectiveness, versatility across age groups, and high replay value are driving segment growth. The rise in board game cafés, hobby communities, crowdfunding platforms (kickstarter, gamefound), and retail expansions are further strengthening the board game segment’s leadership in the market.

The playing cards segment is the fastest-growing in the North America playing cards and board games market, with a CAGR of 6.6%, driven by rising popularity of card-based entertainment, collectible trading card games (TCGs), casino gaming trends, and compact travel-friendly product formats. Increasing consumer preference for portable, low-cost card games, along with the growth of digital–physical hybrid formats and AI-assisted game design, is accelerating demand. Additionally, licensed IP-based card games, emerging competitive/card tournaments, and growing e-commerce distribution channels are expected to boost market expansion across the region.

- By Age Group

On the basis of age group, the North America playing cards and board games market is segmented into 5–12 years, above 12 years, 2–5 years, 0–2 years. In 2026, the 5–12 years segment is expected to dominate with a 43.16% market share, driven by strong demand for educational, skill-building, and family-oriented games that support learning and social interaction. The popularity of stem-themed games, school-based board game activities, and curriculum-aligned card games is boosting adoption. Additionally, increasing parental focus on cognitive development, attention span improvement, and screen-free entertainment is supporting steady growth in this segment.

The above 12 years segment is the fastest-growing segment in the North America playing cards and board games market, with a CAGR of 6.9%, driven by the rising popularity of strategy games, role-playing games (RPGs), party/card games, collectible Trading Card Games (TCGs), and hobby-level board gaming communities. Increasing adoption of digital–physical hybrid formats, competitive gaming events, and themed board game cafés is accelerating market expansion. Furthermore, this segment benefits from AI-powered game development, immersive gameplay formats, and innovative crowd-funded board games, supporting rapid growth across North America.

- By Distribution Channel

On the basis of distribution channel, the North America playing cards and board games market is segmented into offline, online. In 2026, the offline segment is expected to dominate the market with 62.24% market share, driven by the continued strong demand for in-store experiences, traditional retail outlets, specialty game shops, and board game cafés. Physical retail remains popular for consumers who prefer hands-on interaction with products, social gaming events, and immediate availability. Established distribution networks, including major toy and hobby stores, as well as regional chains, continue to reinforce the offline segment’s leadership.

Online is the fastest-growing segment with a CAGR of 6.9% in the North America playing cards and board games market driven by the convenience of e-commerce platforms, broader product accessibility, and the rising popularity of digital and hybrid game formats. Online channels offer advantages such as direct-to-consumer sales, crowd-funded game launches, and rapid delivery services. Additionally, integration of AI-driven recommendations, Augmented Reality (AR) demos, and community-building features on e-commerce sites enhance customer engagement and buying decisions. The ongoing expansion of online marketplaces, social media marketing, and subscription box services further accelerates the rapid growth of this segment.

- By End User

On the basis of end user, the North America playing cards and board games market is segmented into children's, adult. In 2026, the children’s segment is expected to dominate the market with 58.27% market share, driven by strong demand for educational, developmental, and family-friendly games that promote learning, creativity, and social interaction. Parents and educators increasingly prefer games designed to enhance cognitive skills, problem-solving, and teamwork in children. Additionally, expanding product ranges tailored to different childhood age groups and the growth of school and community gaming programs contribute to the segment’s leading position.

Children's is the fastest-growing segment with CAGR of 6.6% in the North America playing cards and board games market driven by increasing parental focus on educational and developmental toys, rising demand for interactive and screen-free entertainment options, and the expansion of early childhood learning programs that incorporate board games. Additionally, growing awareness of the cognitive and social benefits of board games for children, along with innovative product designs targeting various age groups, are driving sustained market growth in this segment.

North America Playing Cards and Board Games Market Regional Analysis

- U.S. is expected to dominate the playing cards and board games market with the largest revenue share of 73.57% in 2026, supported by mature retail ecosystem, significant consumer spending power, and the presence of major industry players such as Hasbro, Mattel, Spin Master. Strong distribution networks across brick-and-mortar stores, specialty game shops, and e-commerce platforms provide extensive market reach. Additionally, increasing investments in game innovation, licensing partnerships with popular franchises, and growing interest in both classic and modern tabletop games reinforce the U.S. position as the key market in North America.

- Canada is expected to be the fastest-growing region in the playing cards and board games market during the forecast period with a CAGR of 6.7%, fueled by expanding consumer interest in board gaming culture, increasing numbers of board game cafés and hobbyist communities, and rising adoption of digital–physical hybrid games. Investments in local manufacturing, government support for creative industries, and improved retail and e-commerce infrastructure further accelerate market expansion in Canada.

- Furthermore, ongoing collaborations between North American publishers and global brands, alongside growing demand for educational and family-oriented games, are propelling growth across the region. Innovations in game design, crowd-funded projects, and digital integrations (such as app-assisted gameplay) are also key factors boosting market momentum in both the U.S. and Canada.

Canada Playing Cards and Board Games Market Insight

The Canada playing cards and board games market holds a significant position within the North American industry, driven by rising consumer spending on indoor entertainment, growing board game cafés, and the revival of tabletop gaming culture. Canada’s strong toy and game distribution networks — supported by major retailers such as Walmart, Toys “R” Us, Chapters Indigo, and Amazon Canada — continue to enhance market accessibility. Additionally, the expansion of e-commerce platforms and localized manufacturing initiatives are improving reach and reducing import dependency.

Mexico Playing Cards and Board Games Market Insight

The Mexico playing cards and board games market is expected to grow steadily, driven by increasing consumer spending on indoor recreation, expanding retail networks, and strong trade ties with the U.S. and Latin America. The rise of specialty game stores, board game cafés, and online distribution channels is boosting product accessibility and market penetration. Major urban centers such as Mexico City, Monterrey, and Guadalajara are emerging as growth hubs for organized tabletop gaming communities and hobbyist events.

The Major Market Leaders Operating in the Market Are:

- Mattel (U.S.)

- Hasbro (U.S.)

- Asmodee Nordics (Denmark)

- Spin Master (Canada)

- Cartamundi (Belgium)

- NINGBO THREE A GROUP CO., LTD (China)

- Ravensburger Group (Germany)

- Buffalo Games (U.S.)

- HABA USA (U.S.)

- CMON (Singapore)

- UNIVERSITY GAMES CORPORATION (U.S.)

- Z-MAN Games (U.S.)

- USAOPOLY, Inc. (U.S.)

- GOLIATH GAMES LLC (Netherlands)

- LongPack Games (China)

- CZECH GAMES EDITION (Czech Republic)

- Piatnik (Austria)

- R&R Games (U.S.)

- NECA/WizKids LLC (WizKids) (U.S.)

- Hicreate Games (China)

Latest Developments in North America Playing Cards and Board Games

- In April 2025, Z-MAN Games announced Disney Stitch: The Fix for 626, a fast-paced deduction card game inspired by the beloved Lilo & Stitch franchise and the award-winning mechanics of Love Letter. Designed for 2–5 players, the game tasks participants with capturing Stitch while managing a unique double-sided token that switches between “Good Stitch” and “626,” directly influencing gameplay and scoring. With a focus on family-friendly, interactive mechanics and minimal player elimination, the game is accessible and engaging for younger audiences. Completing the experience is a plush, collectible Stitch-shaped storage bag that enhances both portability and appeal for Disney fans, families, and casual gamers alike.

- In May 2024, The Op Games has launched MONOPOLY®: One Piece Edition under license from Hasbro, celebrating the 25th anniversary of the iconic manga and anime series. This edition features a custom gameboard, nine special character tokens, and gameplay focused on assembling powerful teams from Dressrosa. Fans can buy, sell, and trade beloved characters like Luffy, Zoro, and Nami, and this launch helps The Op Games expand its market reach, attract anime fans, and strengthen its portfolio of licensed games.

- In July 2025, Hansen Company announced a regional distribution agreement granting University Games exclusive worldwide rights to distribute the entire Hansen product line, including Hoberman Spheres, Fame Master models, handheld electronic games, Hansen-branded classic games, and various distributed games and dolls. This exclusive agreement will enhance University Games' product portfolio and strengthen its position in the regional market.

- In February 2022, Ravensburger AG announced a strategic investment in Gamefound, the crowdfunding platform dedicated to board games. As part of this partnership, Ravensburger will provide industry expertise and support the platform’s growth and development, helping creators bring more games to market. This marks Ravensburger’s first investment through its “Next Ventures” program, aiming to expand innovation in games, toys, and puzzles, while Gamefound benefits from enhanced tools and resources to serve the regional board gaming community.

- In November, R&R Games announced the release of Amalfi: Renaissance, a strategic worker placement game where players act as merchant families sailing to establish trade routes and collect treasures. The game features unique ships that serve both as workers and resource markers, emphasizing economic strategy and resource management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPETITIVE INSIGHTS

4.1.1 MARKET STRUCTURE AND ROLES

4.1.2 MANUFACTURING CAPACITY AND SCALE ADVANTAGES

4.1.3 PRODUCT, IP, AND LICENSING STRATEGIES

4.1.4 DIGITAL, HYBRID, AND TECHNOLOGY COMPETITION

4.1.5 HOBBY PUBLISHERS, MINIATURES AND COMMUNITY ECONOMICS

4.1.6 REGIONAL MANUFACTURERS, CHINA OEMS AND SUPPLY OPTIONS

4.1.7 DISTRIBUTION CHANNELS AND GO-TO-MARKET COMPETITION

4.1.8 QUALITY, PROVENANCE, AND ANTI-COUNTERFEIT POSITIONING

4.1.9 SUSTAINABILITY, COMPLIANCE AND REGULATORY PRESSURES

4.1.10 CONSOLIDATION, FINANCING AND STRATEGIC MOVES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 PRICE SENSITIVITY AND VALUE CONSIDERATION

4.2.2 ROLE OF SOCIAL INFLUENCE, FAMILY ENGAGEMENT, AND GROUP

4.2.3 IMPACT OF CLIMATE AND REGIONAL CONDITIONS

4.2.4 IMPORTANCE OF BRAND TRUST AND PRODUCT RELIABILITY

4.2.5 SHIFT TOWARD THEMATIC DEPTH, AESTHETICS AND COLLECTIBILITY

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 RAW MATERIALS

4.3.3 MANUFACTURING AND PACKAGING

4.3.4 DISTRIBUTION

4.3.5 END USERS

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4.1 AUTOMATION, ROBOTICS & INDUSTRY 4.0 IN PRINTING, CUTTING & PACKAGING

4.4.2 ADVANCED MATERIALS & SURFACE ENGINEERING

4.4.3 DIGITAL–PHYSICAL HYBRIDIZATION (NFC, BLUETOOTH, APP INTEGRATION)

4.4.4 AUGMENTED REALITY (AR) & ARTIFICIAL INTELLIGENCE (AI) INTEGRATION

4.4.5 RAPID PROTOTYPING & SHORT-RUN CUSTOMIZATION

4.4.6 SUSTAINABILITY TECHNOLOGIES & ECO-FRIENDLY MATERIALS

4.4.7 QUALITY ASSURANCE & ANTI-COUNTERFEIT TECHNOLOGIES

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY

4.5.2 TECHNICAL EXPERTISE AND R&D SUPPORT

4.5.3 SUPPLY-CHAIN RELIABILITY AND LOGISTICS COVERAGE

4.5.4 COMPLIANCE, SAFETY, AND REGULATORY DOCUMENTATION

4.5.5 SUSTAINABILITY AND ENVIRONMENTAL CREDENTIALS

4.5.6 COST STRUCTURE, PRICING TRANSPARENCY AND TOTAL COST OF OWNERSHIP

4.5.7 FINANCIAL STABILITY AND BUSINESS CONTINUITY CAPACITY

4.5.8 FLEXIBILITY, CUSTOMIZATION, AND COLLABORATION CAPABILITIES

4.5.9 RISK MANAGEMENT, CONTINGENCY PLANNING AND TRACEABILITY

5 MARKET OVERVIEW

5.1 DRIVERS-

5.1.1 RISE IN DEMAND FOR THEMATIC AND STRATEGY-BASED BOARD GAMES

5.1.2 ONLINE COMMERCE AND DIGITAL RETAIL CHANNELS

5.1.3 GROWING INTEREST IN OFFLINE SOCIAL ENTERTAINMENT

5.1.4 HIGH-PROFILE INTELLECTUAL-PROPERTY TIE-UPS AND LICENSED PROJECTS

5.2 RESTRAINTS

5.2.1 COMPETITIVE DISPLACEMENT FROM THE LARGER DIGITAL/VIDEO GAMES

5.2.2 PRONOUNCED SEASONAL DEMAND PATTERNS, PARTICULARLY AROUND HOLIDAY PERIODS, RESULTING IN UNEVEN REVENUE CYCLES AND COMPLEX INVENTORY MANAGEMENT REQUIREMENTS

5.3 OPPORTUNITIES

5.3.1 AUGMENTED-REALITY (AR) AND MIXED-REALITY INTEGRATIONS

5.3.2 PREMIUM COLLECTOR AND LICENSED-IP PRODUCTS

5.3.3 SUBSCRIPTION-MODEL EXPANSION

5.4 CHALLENGES

5.4.1 COMPLIANCE BURDENS AND COST OF MEETING EVOLVING PACKAGING/WASTE LAWS

5.4.2 FRAGMENTATION OF CONSUMER ATTENTION

6 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

6.1 OVERVIEW

6.2 GAMES

6.3 PLAYING CARDS

6.4 NORTH AMERICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.4.1 ASIA-PACIFIC

6.4.2 NORTH AMERICA

6.4.3 EUROPE

6.4.4 MIDDLE EAST AND AFRICA

6.4.5 SOUTH AMERICA

6.5 NORTH AMERICA PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5.1 ASIA-PACIFIC

6.5.2 NORTH AMERICA

6.5.3 EUROPE

6.5.4 MIDDLE EAST AND AFRICA

6.5.5 SOUTH AMERICA

7 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

7.1 OVERVIEW

7.2 5–12 YEARS

7.3 ABOVE 12 YEARS

7.4 2–5 YEARS

7.4.1 0–2 YEARS

7.5 NORTH AMERICA 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.5.1 ASIA-PACIFIC

7.5.2 NORTH AMERICA

7.5.3 EUROPE

7.5.4 MIDDLE EAST AND AFRICA

7.5.5 SOUTH AMERICA

7.6 NORTH AMERICA ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.6.1 ASIA-PACIFIC

7.6.2 NORTH AMERICA

7.6.3 EUROPE

7.6.4 MIDDLE EAST AND AFRICA

7.6.5 SOUTH AMERICA

7.7 NORTH AMERICA 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.7.1 ASIA-PACIFIC

7.7.2 NORTH AMERICA

7.7.3 EUROPE

7.7.4 MIDDLE EAST AND AFRICA

7.7.5 SOUTH AMERICA

7.8 NORTH AMERICA 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 NORTH AMERICA

7.8.3 EUROPE

7.8.4 MIDDLE EAST AND AFRICA

7.8.5 SOUTH AMERICA

8 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.2.1 SUPERMARKETS AND HYPERMARKETS

8.2.2 SPECIALTY STORES

8.2.3 OTHERS

8.3 ONLINE

8.3.1 3RD PARTY DISTRIBUTOR

8.3.2 COMPANY OWN WEBSITE

9 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY END USER

9.1 OVERVIEW

9.2 CHILDREN'S

9.2.1 BOY

9.2.2 GIRL

9.3 ADULT

10 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: COMPANY LANDSCAPE

11.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

12 COMPANY PROFILES

12.1 MATTEL

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HASBRO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 ASMODEE NORDICS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 SPIN MASTER

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 CARTAMUNDI

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BUFFALO GAMES

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 CMON

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 CZECH GAMES EDITION (CGE)

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 GOLIATH GAMES

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 HABA USA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 HICREATE GAMES

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 LONGPACK GAMES

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NECA/WIZKIDS LLC (WIZKIDS)

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NINGBO THREE A GROUP CO., LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 PIATNIK

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 R&R GAMES

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 THE RAVENSBURGER GROUP

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 UNIVERSITY GAMES CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 THE OP GAMES

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

12.2 Z-MAN GAMES

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 NORTH AMERICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 3 NORTH AMERICA PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA ADULT IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 30 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 U.S. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 U.S. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 33 U.S. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 U.S. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 35 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 36 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 37 U.S. OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 38 U.S. ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 39 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 U.S. CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 41 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 CANADA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 CANADA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 44 CANADA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 CANADA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 46 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 47 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 48 CANADA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 49 CANADA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 51 CANADA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 52 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 MEXICO BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 MEXICO BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 55 MEXICO PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 MEXICO PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 57 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 58 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 MEXICO OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 60 MEXICO ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 61 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 62 MEXICO CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: NORTH AMERICA VS. REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EXECUTIVE SUMMARY

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 TWO SEGMENTS COMPRISE THE NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL (2026)

FIGURE 12 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: SEGMENTATION

FIGURE 14 INCREASING CONSUMER PREFERENCE FOR THEMATIC AND STRATEGY-FOCUSED TABLETOP GAMES EXPECTED TO DRIVE THE NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 OFFLINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET IN 2026 & 2033

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DROC ANALYSIS

FIGURE 18 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

FIGURE 19 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

FIGURE 20 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 21 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: BY END USER, 2025

FIGURE 22 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: SNAPSHOT (2025)

FIGURE 23 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET: COMPANY SHARE 2025(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.