North America Polyglycerol Esters Market

Market Size in USD Million

CAGR :

%

USD

143.32 Million

USD

171.79 Million

2024

2032

USD

143.32 Million

USD

171.79 Million

2024

2032

| 2025 –2032 | |

| USD 143.32 Million | |

| USD 171.79 Million | |

|

|

|

|

North America Polyglycerol Esters Market Size

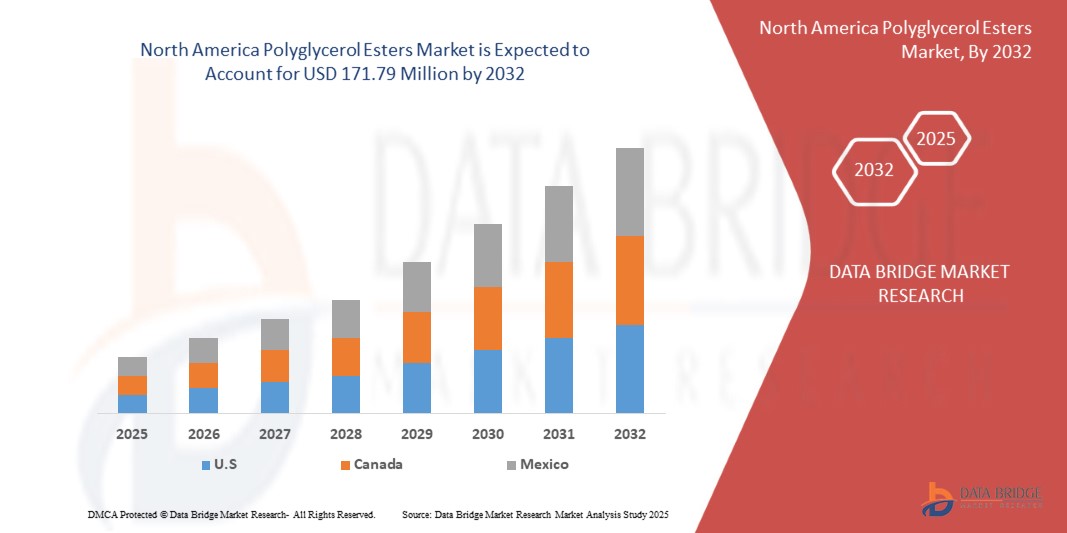

- The North America Polyglycerol Esters Market size was valued at USD 143.32 million in 2024 and is expected to reach USD 171.79 million by 2032, at a CAGR of 2.29% during the forecast period

- The market growth is largely fueled by the increasing adoption of polyglycerol esters as natural, multifunctional emulsifiers across food, personal care, and pharmaceutical applications. Rising consumer preference for clean-label, plant-derived, and sustainable ingredients is encouraging manufacturers to replace synthetic additives with PGEs, thereby strengthening their market penetration globally

- Furthermore, the growing demand for high-performance emulsifiers that enhance texture, stability, and shelf life in processed foods, beverages, cosmetics, and drug formulations is accelerating the uptake of polyglycerol esters. These converging factors are driving widespread adoption and significantly boosting overall market growth

North America Polyglycerol Esters Market Analysis

- Polyglycerol esters are non-ionic emulsifiers derived from natural fatty acids and polyglycerol, offering applications as solubilizers, thickeners, spreading agents, and stabilizers in multiple industries. They are extensively used in bakery, dairy, confectionery, cosmetics, and pharmaceuticals, owing to their versatility, safety, and compatibility with sustainable product trends

- The escalating demand for polyglycerol esters is primarily fueled by the growth of processed food consumption, increasing focus on clean-label formulations, and rising consumer awareness of eco-friendly and multifunctional ingredients. Their broad application scope and ability to meet regulatory and consumer expectations make them an essential component in the evolving food and personal care industries

- U.S. dominated the North America Polyglycerol Esters Market in 2024, due to strong demand from the food processing industry, particularly in bakery, confectionery, dairy, and beverage applications

- Canada is expected to be the fastest growing country in the North America Polyglycerol Esters Market during the forecast period due to rising demand for natural emulsifiers in processed foods, beverages, and personal care products

- Food grade segment dominated the market with a market share of 53.1% in 2024, due to its extensive application in bakery, confectionery, dairy, and beverage products as an emulsifier and stabilizer. Food processors favor food-grade PGE due to its ability to improve texture, extend shelf life, and enhance product consistency without compromising safety. Rising consumer demand for clean-label and plant-derived emulsifiers has also strengthened the position of food grade PGEs in global markets, especially in packaged food production

Report Scope and North America Polyglycerol Esters Market Segmentation

|

Attributes |

North America Polyglycerol Esters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Polyglycerol Esters Market Trends

Rising Demand for Food Emulsifiers

- The growing demand for food emulsifiers is driving significant expansion in the North America Polyglycerol Esters Market, as these compounds are increasingly used to improve the stability, texture, and shelf life of processed foods. With global consumption of packaged and convenience food products rising, manufacturers are turning to PGEs as multifunctional emulsifiers that enhance both product quality and consumer satisfaction

- For instance, Palsgaard A/S has expanded its portfolio of polyglycerol esters for bakery and confectionery segments, enabling consistent product performance in applications such as cakes, ice cream, and chocolates. Similarly, BASF develops PGE-based ingredients with a focus on regulating fat crystallization, improving aeration, and providing texture stability in margarine and dairy substitutes

- Polyglycerol esters are highly valued in food processing due to their ability to stabilize oil-in-water mixtures, enhance flavor dispersion, and maintain shelf stability in variable storage conditions. The rising penetration of convenience foods in emerging economies and shifting consumer lifestyles are directly boosting demand for such food-grade emulsifiers

- The push for clean-label ingredients is also influencing the trend, as polyglycerol esters are widely recognized as safe and versatile additives. Manufacturers are increasingly substituting synthetic emulsifiers with PGEs to meet consumer preferences for natural, safe, and sustainable food components

- In addition, the growth of premium bakery, plant-based food alternatives, and frozen desserts further underscores the importance of reliable emulsifiers. PGEs ensure consistency in industrial food production and also support innovation in new product formulations aimed at health-conscious consumers

- Ultimately, the rising demand for food emulsifiers across processed and packaged food categories positions polyglycerol esters as a critical growth driver. This trend is expected to continue as consumer expectations for quality, safety, and convenience reinforce the global reliance on advanced emulsifier solutions

North America Polyglycerol Esters Market Dynamics

Driver

Expansion of Pharmaceutical Industry

- The rapid expansion of the pharmaceutical industry is positively influencing the demand for polyglycerol esters, as they are increasingly being used in drug formulation and delivery systems. Their properties as solubilizers, dispersing agents, and emulsifiers make PGEs highly useful in stabilizing pharmaceutical compounds and enhancing bioavailability

- For instance, Croda International offers specialty PGEs designed for use in oral drug delivery systems, supporting the solubilization of poorly soluble active pharmaceutical ingredients (APIs). This has enabled pharmaceutical manufacturers to leverage PGEs for developing improved formulations that meet efficacy and stability requirements

- The global increase in production of generic drugs and biologics is further propelling demand, as PGEs provide critical support in stabilizing sensitive molecules. Their compatibility with a wide range of pharmaceutical excipients makes them adaptable for multiple dosage forms including tablets, capsules, ointments, and syrups

- In addition, the industry’s focus on patient-centric drug formulations is reinforcing the role of PGEs. Improved taste-masking properties, enhanced stability, and safe pharmacological profiles make them reliable ingredients for therapeutic development, especially in pediatric and geriatric formulations

- In conclusion, the expansion of the pharmaceutical sector is ensuring sustained demand for polyglycerol esters. Their versatility across drug delivery systems and formulation stability positions them as indispensable excipients that will continue to play a central role in pharmaceutical innovation and manufacturing growth

Restraint/Challenge

Regulatory Compliance and Approval Issues

- One of the major challenges in the North America Polyglycerol Esters Market lies in complex regulatory compliance and approval procedures across different regions. Since PGEs are used in both food and pharmaceutical applications, they are subject to stringent evaluation by agencies to ensure safety and quality standards are consistently met

- For instance, companies introducing PGEs in the EU must comply with European Food Safety Authority (EFSA) evaluations and labeling requirements, while in the U.S., the FDA enforces compliance through GRAS (Generally Recognized as Safe) status. These differing standards increase complexity and slow down manufacturers’ time-to-market strategies

- The process of securing approvals for new applications, especially in pharmaceuticals or infant nutrition, is resource-intensive and time-consuming. Extensive testing, documentation, and compliance checks create hurdles, particularly for smaller companies that lack regulatory expertise and financial resources

- Furthermore, periodic revisions to regulatory guidelines and increased consumer scrutiny of food additives add uncertainty to business planning. Manufacturers are compelled to continuously adapt to evolving compliance frameworks while also maintaining transparency in ingredient sourcing and application

- As a result, regulatory compliance and approval issues remain a structural restraint on the North America Polyglycerol Esters Market. Overcoming these challenges will require consistent collaboration with regulators, proactive risk management, and investment in sustainable R&D practices to ensure product safety while meeting market growth demands

North America Polyglycerol Esters Market Scope

The market is segmented on the basis of grade, form, hydroxyl value, color, and application.

• By Grade

On the basis of grade, the North America Polyglycerol Esters Market is segmented into food grade, pharmaceutical grade, and industrial grade. The food grade segment dominated the largest market revenue share of 53.1% in 2024, driven by its extensive application in bakery, confectionery, dairy, and beverage products as an emulsifier and stabilizer. Food processors favor food-grade PGE due to its ability to improve texture, extend shelf life, and enhance product consistency without compromising safety. Rising consumer demand for clean-label and plant-derived emulsifiers has also strengthened the position of food grade PGEs in global markets, especially in packaged food production.

The pharmaceutical grade segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its increasing use as a solubilizer, bioavailability enhancer, and stabilizing agent in drug formulations. Growing investments in novel drug delivery systems and rising focus on excipients that meet regulatory standards are boosting demand. The pharmaceutical industry’s shift toward safer, biocompatible, and multifunctional excipients positions pharmaceutical-grade PGE as a key enabler in capsule formulations, ointments, and controlled-release medicines.

• By Form

On the basis of form, the market is segmented into thickeners, solubilizers, spreading agents, additives, waxy solids, and inert ingredients. The solubilizers segment accounted for the largest revenue share in 2024, supported by its high adoption across food, beverage, and personal care formulations to improve solubility and dispersion of hydrophobic compounds. Solubilizer-grade PGEs are particularly important in beverages, sauces, creams, and lotions where uniform consistency is critical, and the demand aligns with the rising preference for stable, natural emulsifiers.

The spreading agents segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by their increasing use in cosmetics, skin care, and pharmaceutical topical applications. PGEs as spreading agents enhance sensory properties, skin-feel, and product absorption, making them attractive to formulators of high-performance creams and lotions. Growth is further fueled by rising consumer demand for multifunctional personal care ingredients that offer both efficacy and safety, supporting broader adoption in premium beauty and dermatological products.

• By Hydroxyl Value

On the basis of hydroxyl value, the market is segmented into 50 to 150, 30 to 49, less than 30, and more than 150. The 50 to 150 hydroxyl value segment dominated the market share in 2024, owing to its balanced emulsification properties suitable for food processing, dairy stabilization, and personal care formulations. This range provides versatility in performance, making it the preferred choice for manufacturers aiming for both functional stability and cost-effectiveness.

The less than 30 hydroxyl value segment is expected to register the fastest growth from 2025 to 2032, driven by its use in high-end specialty formulations where mild emulsification and stability are critical. This segment finds growing application in pharmaceuticals, premium cosmetics, and niche food products, where controlled emulsification and gentle stabilization enhance product quality. Increasing demand for specialized emulsifiers in health-driven and premium product categories is accelerating adoption of this range.

• By Color

On the basis of color, the North America Polyglycerol Esters Market is segmented into light yellow, amber, light tan, and brown. The light yellow segment dominated the market revenue share in 2024, as it is widely preferred in food and personal care applications due to its clean appearance and suitability in products requiring minimal visual impact. Manufacturers favor light yellow PGEs for bakery, dairy, and cosmetic formulations where clarity, aesthetics, and consumer appeal are important.

The amber segment is forecasted to witness the fastest growth during 2025–2032, attributed to its suitability in industrial and specialized applications, including surfactants and detergents. Amber-colored PGEs offer higher tolerance to processing variations and provide consistent performance in formulations where color uniformity is less critical. Growing demand for bio-based surfactants and industrial additives further supports expansion of this category.

• By Application

On the basis of application, the market is segmented into food, personal care, pharmaceuticals, surfactants & detergents, and others. The food segment dominated the largest revenue share in 2024, driven by rising consumption of processed and convenience foods requiring efficient emulsifiers. PGEs enhance bakery softness, dairy creaminess, and beverage stability, making them indispensable in large-scale food manufacturing. The trend toward natural, plant-derived food additives has also reinforced the dominance of PGEs in this sector.

The personal care segment is projected to grow at the fastest CAGR from 2025 to 2032, propelled by rising consumer demand for natural and multifunctional ingredients in skincare, haircare, and cosmetics. PGEs serve as effective emulsifiers, moisturizers, and spreading agents, providing sensory benefits and stability to creams, lotions, and sunscreens. The clean-label movement, coupled with growth in organic beauty products, is creating new opportunities for PGEs in the personal care industry.

North America Polyglycerol Esters Market Regional Analysis

- U.S. dominated the North America Polyglycerol Esters Market with the largest revenue share in 2024, driven by strong demand from the food processing industry, particularly in bakery, confectionery, dairy, and beverage applications

- The country’s mature packaged food and convenience food market, coupled with high consumer preference for clean-label and natural emulsifiers, has boosted adoption. Robust investments in food innovation, coupled with regulatory support for safe and sustainable additives, are reinforcing the dominance of PGEs in the U.S. market

- The presence of established manufacturers, advanced R&D activities, and wide application in personal care and pharmaceuticals further contribute to the segment’s leadership

Canada North America Polyglycerol Esters Market Insight

Canada is projected to register the fastest CAGR in the North America market from 2025 to 2032, supported by rising demand for natural emulsifiers in processed foods, beverages, and personal care products. Increasing consumer awareness of plant-based and health-friendly ingredients is fueling adoption across food and cosmetics industries. Expansion of domestic food manufacturing, coupled with a growing shift toward sustainable and multifunctional excipients in pharmaceuticals, strengthens growth prospects. The Canadian market is further supported by a regulatory environment favoring bio-based and safe additives.

Mexico North America Polyglycerol Esters Market Insight

Mexico is expected to witness steady growth between 2025 and 2032, fueled by rising urbanization, changing dietary preferences, and increasing demand for packaged foods and beverages. Growth in bakery, confectionery, and dairy sectors is creating consistent demand for PGEs as emulsifiers and stabilizers. Expanding cosmetics and personal care markets are also contributing to adoption, particularly in affordable skincare and haircare products. Collaborations between local food producers and international suppliers are enhancing product availability, supporting broader market penetration across the country.

North America Polyglycerol Esters Market Share

The polyglycerol esters industry is primarily led by well-established companies, including:

- Taiyo Kagaku Co.,Ltd. (Japan)

- Olean NV (Belgium)

- Evonik Industries AG (Germany)

- Lonza (Switzerland)

- NIHON EMULSION Co., Ltd. (Japan)

- BASF SE (Germany)

- Henan Chemsino Industry Co.,Ltd (China)

- ABITEC (U.S.)

- Foodchem International Corporation (China)

Latest Developments in North America Polyglycerol Esters Market

- In August 2024, Foodchem, a leading player in the food ingredients sector, announced its participation in FISA 2024 in São Paulo, Brazil, showcasing innovative food ingredient solutions at booth D-95. This engagement strengthens Foodchem’s global footprint by enhancing brand visibility in Latin America and supporting its strategy to expand customer reach across emerging markets. The event is expected to boost demand for polyglycerol esters in food and beverage applications by promoting their role as natural, multifunctional emulsifiers

- In March 2024, Lonza completed the acquisition of Roche's Genentech biologics site in Vacaville, California, for USD 1.2 billion, with an additional USD 500 million investment planned for facility upgrades. This expansion significantly increases Lonza’s production capacity, enabling the company to meet rising demand for bio-based ingredients and pharmaceutical excipients, including polyglycerol esters. The acquisition positions Lonza to cater to evolving requirements in the pharmaceutical and personal care industries, reinforcing its role in supplying sustainable and high-quality specialty ingredients

- In November 2023, Palsgaard announced a strategic investment to expand its emulsifier production capacity in Denmark, with operations set to scale by 2025. The expansion directly benefits the North America Polyglycerol Esters Market by ensuring greater supply availability for global food manufacturers seeking natural emulsification solutions. By enhancing its production base, Palsgaard is addressing growing demand for clean-label and plant-derived emulsifiers, thereby strengthening its position as a key supplier in the food and personal care industries

- In October 2023, BASF presented its latest home care, I&I cleaning, and personal care solutions at the SEPAWA Congress in Berlin as part of its Care Chemicals Initiative Care 360° – Solutions for Sustainable Life. The initiative integrates sustainability, digitalization, and innovation into product development, highlighting BASF’s commitment to environmentally responsible chemical solutions. This directly supports the adoption of polyglycerol esters in sustainable formulations, aligning with global consumer trends toward eco-friendly and multifunctional ingredients

- In September 2023, Croda International unveiled new advancements in its bio-based ingredients portfolio at in-cosmetics Latin America, emphasizing multifunctional emulsifiers for personal care applications. The showcase highlighted the versatility of polyglycerol esters in enhancing texture, stability, and sensory benefits of cosmetic formulations. By expanding its product offering in Latin America, Croda is strengthening its regional market presence and addressing the rising demand for natural and sustainable ingredients in beauty and personal care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Polyglycerol Esters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Polyglycerol Esters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Polyglycerol Esters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.