North America Polylactic Acid Pla Market

Market Size in USD Million

CAGR :

%

USD

276.13 Million

USD

645.58 Million

2024

2032

USD

276.13 Million

USD

645.58 Million

2024

2032

| 2025 –2032 | |

| USD 276.13 Million | |

| USD 645.58 Million | |

|

|

|

|

North America Polylactic Acid (PLA) Market Size

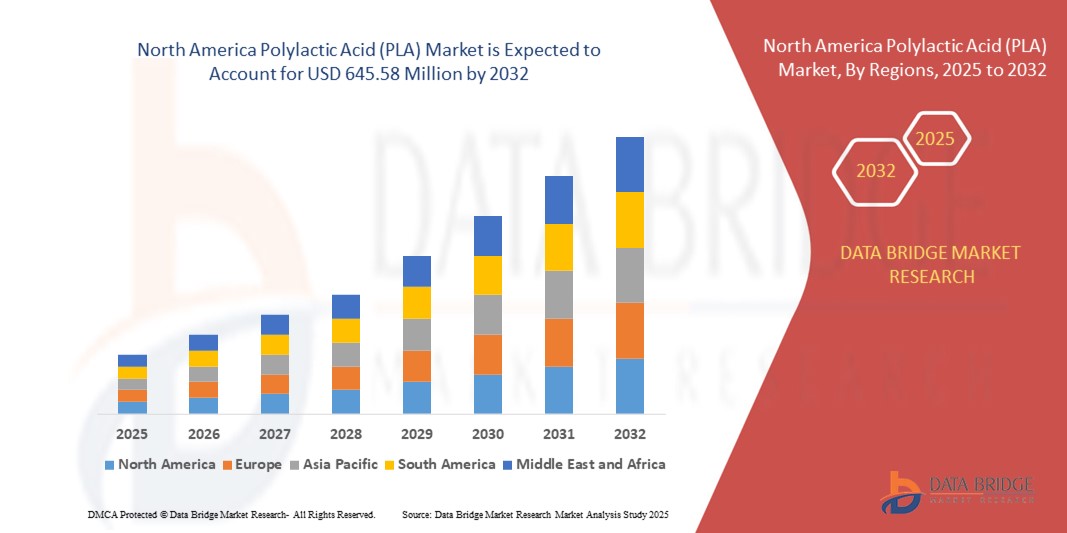

- The North America polylactic acid (PLA) market size was valued at USD 276.13 million in 2024 and is expected to reach USD 645.58 million by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable packaging materials, increased awareness regarding biodegradable plastics, and growing adoption of PLA in sectors such as food packaging, agriculture, textiles, and 3D printing

- In addition, government regulations banning single-use plastics and incentives promoting the use of bio-based alternatives are accelerating market expansion across the region

North America Polylactic Acid (PLA) Market Analysis

- The North America Polylactic Acid (PLA) market is undergoing significant transformation due to increasing consumer preference for environmentally friendly products and stricter environmental policies

- The food and beverage industry holds a major share in PLA consumption, driven by the shift from traditional petroleum-based plastics to compostable packaging solutions

- U.S. Polylactic Acid (PLA) market captured the largest revenue share of 78.2% in 2024 within North America, supported by rising demand for biodegradable packaging and the implementation of state-level bans on single-use plastics

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America polylactic acid (PLA) market due to increasing government initiatives to ban single-use plastics, growing investment in green technologies, and rising consumer awareness of environmentally friendly alternatives

- The regular PLLA segment accounted for the largest market revenue share in 2024, driven by its high crystallinity, superior mechanical strength, and widespread usage in packaging and medical applications. It is the most commercially viable and commonly produced PLA variant in the region, supported by favorable manufacturing economics and regulatory approval for food contact use.

Report Scope and North America Polylactic Acid (PLA) Market Segmentation

|

Attributes |

North America Polylactic Acid (PLA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Bioplastic Applications in 3D Printing and Automotive |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Polylactic Acid (PLA) Market Trends

Rising Demand for Biodegradable Packaging in Food and Beverage Sector

- The shift toward sustainable packaging in North America is driving the adoption of polylactic acid (PLA) as an eco-friendly alternative to petroleum-based plastics. Increasing consumer awareness of plastic pollution and the environmental impact of single-use packaging has prompted manufacturers to integrate PLA into their product lines, especially in food containers, wrappers, and disposable utensils

- Government regulations across the region, including bans on plastic straws, bags, and cutlery, are accelerating the transition to compostable materials. Food service chains and grocery retailers are increasingly turning to PLA-based products to meet compliance standards while aligning with corporate sustainability goals

- The food and beverage sector benefits from PLA's compostability, transparency, and barrier properties, making it suitable for a wide range of packaging formats. Brands are using PLA to differentiate themselves and appeal to environmentally conscious consumers seeking plastic-free packaging solutions

- For instance, in 2023, several quick-service restaurants in California and New York adopted PLA-coated paper cups and food trays as part of their plastic-reduction initiatives. These changes not only helped cut down on landfill waste but also improved brand perception among eco-aware customers

- While PLA-based packaging is gaining momentum, its long-term success depends on advancements in composting infrastructure, end-of-life management, and cost parity with traditional materials. Stakeholders must work collaboratively to enhance recycling systems and drive consumer education on proper disposal practices

North America Polylactic Acid (PLA) Market Dynamics

Driver

Supportive Regulatory Framework and Corporate Sustainability Initiatives

• Stringent environmental policies and supportive legislation in North America are fostering the rapid growth of the PLA market. Both the U.S. and Canada have implemented federal and state-level measures aimed at reducing plastic waste, including bans on non-biodegradable packaging and mandates for bio-based alternatives in government procurement

• Companies across sectors are actively adopting sustainable practices and committing to carbon reduction goals. This includes shifting to biodegradable materials such as PLA in packaging, labeling, and consumer products. These commitments are often linked to environmental, social, and governance (ESG) reporting requirements, which prioritize transparency and sustainability

• Large-scale food, retail, and beverage companies are collaborating with PLA manufacturers to ensure a steady supply of compliant materials. The partnership model is helping PLA producers secure long-term contracts and invest in capacity expansion

• For instance, in 2024, a leading Canadian retail chain announced the rollout of PLA-based packaging for its private-label food products across 500 stores, reinforcing its zero-waste pledge and boosting demand for compostable materials

• While regulations and corporate initiatives are creating favorable conditions, challenges remain in harmonizing standards and building infrastructure to handle increased volumes of biodegradable waste. Addressing these gaps will be critical to realizing the full potential of PLA in the regional market

Restraint/Challenge

High Production Costs and Limited Industrial Composting Facilities

• Despite its environmental benefits, the cost of producing PLA remains significantly higher than that of conventional plastics. Factors such as feedstock price volatility, processing complexity, and limited economies of scale make PLA less competitive for cost-sensitive applications, especially among small manufacturers and packaging firms

• Another major barrier is the lack of adequate composting infrastructure in North America. Most municipal waste management systems are not equipped to process industrial compostables such as PLA, resulting in these materials being sent to landfills where they do not degrade as intended

• Consumer confusion around disposal and composting standards further reduces the effectiveness of PLA solutions. Misplaced PLA items in recycling or general waste streams can contaminate sorting processes and undermine sustainability goals

• For instance, in 2023, a waste audit conducted in several U.S. cities found that over 60% of PLA-labeled products ended up in landfills due to the absence of access to certified composting facilities and inconsistent labeling practices

• Addressing these issues requires collaboration among governments, waste management providers, and manufacturers. Investing in local composting capacity, standardizing labeling, and improving public education on biodegradable packaging are essential to drive scalable adoption and long-term impact

North America Polylactic Acid (PLA) Market Scope

The market is segmented on the basis of type, raw material, form, application, end user, and grade.

- By Type

On the basis of type, the North America polylactic acid (PLA) market is segmented into racemic PLLA (poly-L-lactic acid), regular PLLA (poly-L-lactic acid), PDLA (poly-D-lactic acid), and PDLLA (poly-DL-lactic acid). The regular PLLA segment accounted for the largest market revenue share in 2024, driven by its high crystallinity, superior mechanical strength, and widespread usage in packaging and medical applications. It is the most commercially viable and commonly produced PLA variant in the region, supported by favorable manufacturing economics and regulatory approval for food contact use.

The PDLLA segment is expected to witness the fastest growth rate from 2025 to 2032, due to its high flexibility, slow degradation rate, and expanding application in biodegradable medical implants and drug delivery systems. Its biocompatibility makes it ideal for sutures, tissue engineering, and orthopedic uses, especially with rising demand for bioresorbable materials in healthcare.

- By Raw Material

On the basis of raw material, the market is segmented into corn, cassava, sugarcane, sugar beet, and others. The corn segment held the largest share in 2024, attributed to its high starch content, widespread cultivation across the U.S., and established processing infrastructure. Corn-based PLA benefits from consistent supply chains and is widely used in the production of bioplastics for packaging and disposable goods.

The sugarcane segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption in bio-based product manufacturing and sustainable sourcing initiatives. Sugarcane is emerging as a preferred alternative due to its lower environmental footprint and strong support from regional sustainability programs.

- By Form

Based on form, the PLA market is segmented into films and sheets, coatings, fiber, and others. The films and sheets segment dominated the market in 2024, led by growing demand for compostable packaging in food service, retail, and e-commerce industries. These forms are widely used due to their flexibility, transparency, and suitability for thermoforming and lamination applications.

The fiber segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in the textile and hygiene industries. PLA-based fibers offer moisture management, softness, and biodegradability, making them ideal for sustainable clothing, diapers, and wipes.

- By Application

On the basis of application, the market is segmented into packaging, transport, agriculture, medical, electronics, textile, hygiene, and others. The packaging segment held the largest revenue share in 2024 due to increasing replacement of traditional plastics with PLA in food containers, wraps, and single-use items. Strong consumer preference for compostable packaging and regulatory support further bolster this segment.

The medical segment is expected to witness the fastest growth rate from 2025 to 2032, as demand rises for biodegradable sutures, implants, and drug delivery materials. PLA’s proven biocompatibility and absorption properties are contributing to its adoption in a variety of healthcare applications.

- By End User

Based on end user, the market is segmented into plastic films, bottles, and biodegradable medical devices. The plastic films segment accounted for the highest share in 2024, backed by robust consumption across food packaging, industrial wrapping, and agricultural mulch films. PLA’s ability to replace petroleum-based films is a major growth factor in this category.

The biodegradable medical devices segment is expected to witness the fastest growth rate from 2025 to 2032, driven by innovation in resorbable materials and growing acceptance of sustainable alternatives in clinical settings. Increasing regulatory approvals and advancements in medical-grade PLA are enhancing product adoption.

- By Grade

On the basis of grade, the market is categorized into thermoforming, extrusion, injection molding, and blow molding. The injection molding segment dominated the market in 2024, due to its versatility in producing a wide range of consumer goods, automotive components, and medical parts with complex geometries.

The thermoforming segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for PLA-based trays, containers, and clamshell packaging in the food and beverage industry. Its suitability for high-volume production and ease of recycling makes it an ideal choice for sustainable packaging applications.

North America Polylactic Acid (PLA) Market Regional Analysis

- U.S. PLA market captured the largest revenue share of 78.2% in 2024 within North America, supported by rising demand for biodegradable packaging and the implementation of state-level bans on single-use plastics

- The country’s well-developed food and beverage sector, coupled with regulatory encouragement for green materials, is fostering strong growth in PLA-based packaging solutions

- Increasing adoption of PLA in 3D printing, biomedical applications, and agriculture is also contributing to market expansion

- Furthermore, key players based in the U.S. are investing in capacity expansion and localized feedstock sourcing to meet the growing demand, solidifying the nation’s leadership in the regional PLA landscape

Canada Polylactic Acid (PLA) Market Insight

The Canada PLA market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising environmental consciousness and strong governmental emphasis on reducing plastic waste. National policies aimed at banning single-use plastics, along with funding for bio-based material innovation, are encouraging manufacturers and retailers to adopt PLA as a viable alternative. The country’s growing food packaging and healthcare sectors are increasingly integrating compostable materials such as PLA to meet sustainability goals. In addition, partnerships between research institutions and industry stakeholders are fostering advancements in PLA technology, further strengthening its role in Canada’s circular economy transition.

North America Polylactic Acid (PLA) Market Share

The North America Polylactic Acid (PLA) industry is primarily led by well-established companies, including:

- NatureWorks LLC (U.S.)

- Danimer Scientific (U.S.)

- TotalEnergies Corbion (U.S.)

- BASF Corporation (U.S.)

- Evonik Corporation (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Futerro USA Inc. (U.S.)

- Good Natured Products Inc. (Canada)

- Genpak LLC (U.S.)

- LOOP Industries Inc. (Canada)

Latest Developments in North America Polylactic Acid (PLA) Market

- In September 2023, Danimer Scientific and Chevron Phillips Chemical entered a strategic collaboration to develop high-volume biodegradable plastic products using Danimer’s Rinnovo polymers. This partnership focuses on scaling PLA-based bioplastics to meet the increasing demand for sustainable packaging. The move is expected to strengthen both companies’ market presence and accelerate the adoption of eco-friendly materials in commercial applications

- In May 2023, Sulzer partnered with Jindan New Biomaterials to implement its licensed PLA production technology at a new plant in Henan Province, China. With a planned annual capacity of 750,000 tonnes, the facility will focus on serving the food packaging, molded goods, and fiber sectors. This collaboration aims to boost global PLA supply and support market growth in bio-based plastics

- In June 2022, BASF and Australian firm Confoil jointly launched a certified compostable and dual-ovenable paper food tray, utilizing BASF’s ecovio PS 1606 biopolymer. Designed for both sustainability and performance, the solution targets eco-conscious consumers in North America. The development enhances Confoil’s regional presence while contributing to the shift toward compostable food packaging alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Polylactic Acid Pla Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Polylactic Acid Pla Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Polylactic Acid Pla Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.