North America Postpartum Hemorrhage Treatment Devices Market

Market Size in USD Million

CAGR :

%

USD

396.17 Million

USD

546.68 Million

2024

2032

USD

396.17 Million

USD

546.68 Million

2024

2032

| 2025 –2032 | |

| USD 396.17 Million | |

| USD 546.68 Million | |

|

|

|

|

Postpartum Hemorrhage Treatment Devices Market Size

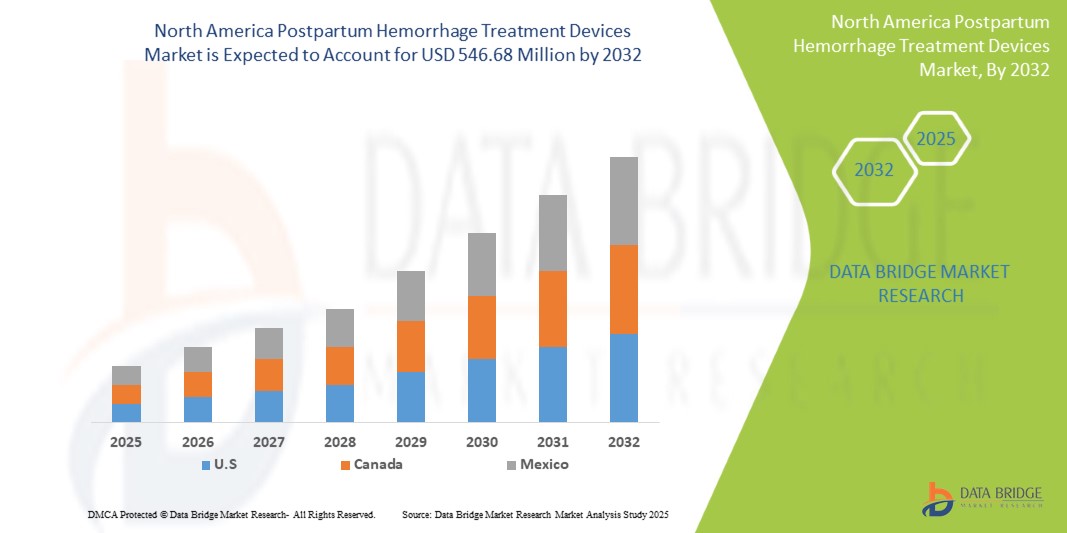

- The North America postpartum hemorrhage treatment devices market was valued at USD 396.17 million in 2024 and is expected to reach USD 546.68 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.1%, primarily driven by the anticipated launch of new treatment devices

- This growth is driven by factors such as the rising incidence of postpartum haemorrhage, particularly in developing countries, drives the demand for postpartum hemorrhage treatment devices

Postpartum Hemorrhage Treatment Devices Analysis

- The increasing incidence of postpartum hemorrhage (PPH), driven by factors such as rising rates of cesarean deliveries and complications during childbirth, has resulted in a growing demand for effective treatment devices

- Additionally, innovations in medical technology including the development of advanced uterine tamponade devices, hemostatic agents, and minimally invasive surgical techniques are significantly improving patient outcomes and propelling market growth

- For instance, the market for PPH treatment devices shows notable geographical variation, with significant growth observed in developing regions due to rising healthcare investments and a heightened focus on improving maternal health infrastructure

- In conclusion, the combination of rising clinical need and ongoing technological advancements is creating strong growth opportunities for manufacturers and healthcare providers, ultimately supporting efforts to reduce maternal mortality and enhance postpartum care worldwide

Report Scope and Postpartum Hemorrhage Treatment Devices Segmentation

|

Attributes |

Postpartum Hemorrhage Treatment Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Postpartum Hemorrhage Treatment Devices Market Trends

“Increased Adoption of Uterine Balloon Tamponade Devices”

- Uterine balloon tamponade devices are designed to control PPH by providing direct pressure to the uterine wall, promoting hemostasis

- Their effectiveness in clinical settings has been widely documented, leading to increased confidence among healthcare providers in using these devices as a first-line intervention for managing PPH, thus driving their adoption

- For instance, there has been a concerted effort within the healthcare community to improve training and education regarding PPH management. This includes specific training on the use of uterine balloon tamponade techniques. Enhanced awareness among healthcare professionals about the importance of prompt intervention has led to a broader acceptance and utilization of these devices in both developed and developing regions

- Uterine balloon tamponade devices are increasingly being integrated into comprehensive maternal care protocols, particularly in emergency obstetric settings. This integration is supported by guidelines from organizations such as the WHO and various maternal health initiatives, which promote evidence-based practices to prevent and manage PPH effectively

- The alignment of these devices with clinical guidelines is facilitating their widespread adoption in hospitals and birthing centers

Postpartum Hemorrhage Treatment Devices Market Dynamics

Driver

“Rising Incidence of Postpartum Haemorrhage”

- The increasing incidence of Postpartum Hemorrhage (PPH) has created a pressing need for effective treatment devices in the North America market

- Enhanced awareness of maternal health issues and better identification of at-risk populations have led to a surge in the demand for innovative solutions

- As healthcare systems prioritize maternal safety, the adoption of advanced medical devices aimed at preventing or managing PPH is on the rise, including uterine compression devices and hemostatic agents

For instance,

- In May 2020, according to NCBI, Postpartum Haemorrhage (PPH) is the leading cause of maternal mortality worldwide. In the US, PPH increased by 26%. This alarming rise in cases highlights the critical importance of addressing PPH and serves as a catalyst for increased investment in innovative treatment solutions and technologies aimed at preventing and managing this potentially life-threatening condition

- In August 2024, World Health Organization stated that Postpartum Haemorrhage (PPH), commonly defined as a blood loss of 500 ml or more within 24 hours after birth, is the leading cause of maternal mortality worldwide. It affects millions of women every year and accounts for over 20% of all maternal deaths reported North Americaly

- Additionally, factors such as a rise in cesarean sections and higher rates of complicated pregnancies are contributing to the urgency for improved PPH management solutions. Healthcare organizations are focusing on the development and implementation of standardized protocols to address PPH effectively, driving market growth. Innovations in technology are resulting in new, more efficient devices, further enhancing treatment options and improving maternal outcomes on a global scale

Opportunity

“Training And Educational Programs for Proper Use of PPH Treatment Devices”

- Developing comprehensive training and educational programs for the proper use of PPH (Postpartum Hemorrhage) treatment devices presents a valuable opportunity to strengthen maternal health services

- These programs can be tailored for healthcare workers at various levels from community health workers to skilled birth attendants and hospital staff ensuring that all personnel involved in maternal care are equipped with the necessary knowledge and hands-on experience

- Emphasis on practical demonstrations, simulations, and case-based learning can significantly improve device handling and timely intervention. Additionally, ongoing refresher courses and digital learning platforms can help maintain high competency levels, leading to better patient outcomes and reduced maternal mortality

For instance,

- In April 2025, MDPI highlighted that VIRTUAL REALITY (VR) presents a promising advancement in obstetric education, aligning with modern learning preferences and enhancing clinical preparedness. Its integration into training programs can improve the management of Postpartum Hemorrhage (PPH) by providing immersive, patient-centered learning experiences that strengthen both technical skills and emotional readiness in maternal care

- In December 2024, findings from Journal of Obstetrics and Gynaecology indicate that A combined case-based learning (CBL) and Problem-Based Learning (PBL) approach integrated with scenario simulation significantly enhanced clinical thinking, operational skills, and PPH knowledge among experienced maternity staff. This method proved effective in rural settings, improved trainee confidence, and showed potential in reducing severe postpartum hemorrhage cases and transfer rates

- The implementation of targeted training and educational programs for the proper use of Postpartum Hemorrhage (PPH) treatment devices is essential to improving maternal health outcomes globally.

- Evidence from diverse studies highlights the effectiveness of approaches such as simulation-based learning, virtual reality, and integrated case-based and problem-based methodologies.

Restraint/Challenge

“Side Effects Associated With The Postpartum Hemorrhage Treatment”

- The presence of side effects related to Postpartum Hemorrhage (PPH) treatment devices can deter healthcare providers from fully embracing these technologies

- Concerns about complications such as infection, uterine perforation, or adverse reactions to materials often lead clinicians to weigh the benefits of utilizing these devices against the associated risks

- As a result, some healthcare professionals may prefer conservative management approaches or traditional methods over newer interventions, limiting the adoption of innovative treatments designed to address PPH effectively

For instance,

- In July 2021, Karger Pharmacology stated that injectable PGs, when used to treat PPH, are effective in reducing blood loss but probably induce cardiovascular or respiratory side effects. The potential cardiovascular and respiratory side effects associated with injectable Prostaglandins (PGs) for treating Postpartum Hemorrhage (PPH), as highlighted by Karger Pharmacology, may lead to increased safety concerns among healthcare providers, subsequently diminishing the confidence in their use and negatively impacting the North America PPH treatment devices market

- In 2024, MDPI announced that misoprostol for the treatment of postpartum heamorrhage is connected to more side effects such as fever, chills, nausea, and vomiting. This may negatively impact the North America Postpartum Hemorrhage (PPH) treatment devices market by reducing healthcare providers' confidence in pharmaceutical options and prompting a shift towards seeking more reliable and effective medical devices for managing PPH

- Moreover, potential side effects can negatively impact patient confidence in treatment options available for PPH. If patients are informed about the risks of complications associated with certain devices, they may be reluctant to pursue more advanced medical interventions, choosing instead to rely on alternative solutions or delaying treatment

- This apprehension among patients can contribute to lower acceptance and utilization rates of these devices, ultimately hindering market growth and reducing the overall effectiveness of PPH management strategies in improving maternal health outcomes

North America Postpartum Hemorrhage Treatment Devices Market Scope

North America postpartum hemorrhage treatment devices Market is categorized into five notable segments which are based on the basis of type, condition, patient type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By type |

|

|

By Condition |

|

|

By Patient Type |

|

|

By End User

|

|

|

By Distribution Channel |

|

North America Postpartum Hemorrhage Treatment Devices Market Regional Analysis

“U.S. is the Dominant country in the North America Postpartum Hemorrhage Treatment Devices Market”

- U.S., boasts a highly advanced healthcare infrastructure, which includes state-of-the-art facilities, cutting-edge medical technologies, and a well-established network of healthcare providers. This infrastructure enables the effective diagnosis and treatment of PPH, leading to the rapid adoption of innovative treatment devices.

- The country experiences a relatively high rate of cesarean deliveries, which is a significant risk factor for postpartum hemorrhage. As a result, there is an increased necessity for effective PPH treatment options. The higher prevalence of surgical births coupled with a growing focus on maternal safety drives the demand for advanced PPH treatment devices in North America.

- The U.S., regulatory frameworks like the FDA facilitate the approval and market introduction of new medical devices. Moreover, significant funding for research and development in maternal health from both government and private sectors fosters innovation in PPH treatment solutions. This environment encourages ongoing advancements and adoption of effective devices, further cementing the region's leadership in the market.

“U.S. is Projected to Register the Highest CAGR in the Market”

- The U.S. has strong maternal health awareness programs and better antenatal care, which leads to early detection and proactive management of postpartum hemorrhage, driving demand for advanced treatment devices.

- An increasing number of women are giving birth at 35+ years, which is associated with a higher risk of PPH, fueling the need for preventive and therapeutic devices like balloon tamponades, non-pneumatic anti-shock garments (NASG), and surgical devices.

Postpartum Hemorrhage Treatment Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (U.S.)

- Organon Group of Companies (U.S.)

- Laborie (U.S.)

- Cooper Companies (U.S.)

- Belmont Medical Technologies (U.S.)

- Coagulant Therapeutics (U.S.)

- Sterimed Group (India)

- RevMedx (U.S.)

- Maternova Inc. (U.S.)

- Sinapi Biomedical (South Africa)

- Utah Medical Products, Inc. (U.S.)

- Angiplast Private Limited (India)

- Krishco Medical Products Pvt. Ltd. (India)

- 3rd Stone Design (U.S.)

- Advin Health Care (India)

Latest Developments in Postpartum Hemorrhage Treatment Devices

- In April 2025, Organon has acquired U.S. rights to TOFIDENCE, a tocilizumab biosimilar to ACTEMRA, from Biogen. This strengthens Organon’s biosimilars portfolio in immunology, expanding treatment options for arthritis and COVID-19. TOFIDENCE, launched in May 2024, treats multiple inflammatory conditions and supports growth in Organon’s biosimilars business with significant market potential

- In November 2023, CooperCompanies has acquired select Cook Medical assets for USD 300 million, enhancing its women’s health and surgical portfolio under CooperSurgical. The deal includes products like the Bakri Balloon and Doppler monitors. Expected to boost revenue and earnings in 2024, the acquisition strengthens Cooper’s North America position in fertility and gynecologic healthcare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET END USER COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 INDUSTRY INSIGHTS

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.4 COST ANALYSIS BREAKDOWN

4.5 TECHNOLOGY ROADMAP

4.6 VALUE CHAIN ANALYSIS

4.7 OPPORTUNITY MAP ANALYSIS

4.8 HEALTHCARE ECONOMY

4.9 REIMBURSEMENT FRAMEWORK

4.1 TARIFFS AND ITS IMPACT ON THE MARKET

4.10.1 DEFINITION AND IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.10.2 NORTH AMERICA VS. REGIONAL TARIFF STRUCTURES

4.10.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.10.4 TARIFF REGULATIONS IN KEY MARKETS

4.10.4.1 MEDICARE/MEDICAID TARIFF POLICIES

4.10.4.2 CMS PRICING MODELS

4.10.4.3 OTHERS

4.10.5 TARIFFS ON MEDICAL DEVICES & EQUIPMENT

4.10.5.1 IMPORT/EXPORT DUTIES ON MEDICAL EQUIPMENT

4.10.5.2 IMPACT ON PRICING AND AVAILABILITY OF HIGH-END MEDICAL TECHNOLOGY

4.10.5.3 CASE STUDIES OF TARIFF CHANGES AFFECTING THE INDUSTRY

4.10.6 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.10.7 TARIFF EXEMPTIONS AND INCENTIVES

4.10.8 DUTY-FREE IMPORTS FOR ESSENTIAL MEDICINES AND VACCINES

4.10.9 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.10.10 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING INCIDENCE OF POSTPARTUM HAEMORRHAGE

6.1.2 ONGOING TECHNOLOGICAL ADVANCEMENTS FOR POSTPARTUM HEMORRHAGE TREATMENTS

6.1.3 RISING BIRTH RATES ASSOCIATED WITH AN INCREASE IN THE NUMBER OF POSTPARTUM HEMORRHAGE

6.1.4 REGULATORY SUPPORT AND APPROVALS ASSOCIATED WITH THE TREATMENT DEVICES

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS ASSOCIATED WITH THE POSTPARTUM HEMORRHAGE TREATMENT

6.2.2 LIMITED RESEARCH AND DEVELOPMENT FOR PPH TREATMENT

6.3 OPPORTUNITIES

6.3.1 TRAINING AND EDUCATIONAL PROGRAMS FOR PROPER USE OF PPH TREATMENT DEVICES

6.3.2 SUPPORT FROM GOVERNMENTAL AND NON-GOVERNMENTAL ORGANIZATIONS IN PPH DEVICE ADOPTION

6.3.3 TELEMEDICINE INTEGRATION TO ENHANCE POSTPARTUM HEMORRHAGE DEVICE USE

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL IMPACT AND DISPOSAL ISSUES OF SINGLE-USE PPH DEVICES

6.4.2 STERILITY CHALLENGES AND INFECTION RISKS IN PPH DEVICES

7 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE

7.1 OVERVIEW

7.2 UTERINE BALLOON TAMPONADE

7.2.1 BAKRI BALLOON

7.2.1.1 BAKRI POSTPARTUM BALLOON

7.2.1.2 BAKRI POSTPARTUM BALLOON WITH RAPID INSTILLATION COMPONENTS

7.2.2 FOLEY CATHETER

7.2.2.1 STANDARD FOLEY CATHETER

7.2.2.2 CONDOM-LOADED FOLEY CATHETER

7.3 UNIJECT PREFILLED INJECTION SYSTEM

7.3.1 OXYTOCIN-BASED INJECTION SYSTEM

7.3.2 CARBETOCIN-BASED INJECTION SYSTEM

7.4 NON-PNEUMATIC ANTI-SHOCK GARMENT

7.4.1 STANDARD NON-PNEUMATIC ANTI-SHOCK GARMENT

7.4.1.1 MEDIUM

7.4.1.2 LARGE

7.4.2 MODIFIED NON-PNEUMATIC ANTI-SHOCK GARMENT

7.4.2.1 MEDIUM

7.4.2.2 LARGE

7.5 VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES

7.5.1 JADA SYSTEM

7.5.2 OTHERS

7.6 OTHERS

7.6.1 COMPRESSION DEVICES

7.6.1.1 B-LYNCH

7.6.1.2 HAYMAN

7.6.1.3 OTHER

7.6.2 UTERINE ARTERY LIGATION PRODUCTS

7.6.3 OTHERS

8 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY PATIENT TYPE

8.1 OVERVIEW

8.2 PRIMARY PPH

8.3 SECONDARY PPH

9 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY CONDITION

9.1 OVERVIEW

9.2 MAJOR POSTPARTUM HEMORRHAGE (MORE THAN 1000 ML)

9.3 MINOR POSTPARTUM HEMORRHAGE (500-1000 ML)

9.4 MASSIVE POSTPARTUM HEMORRHAGE (2000 ML OR MORE)

9.5 SECONDARY POSTPARTUM HEMORRHAGE

10 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 RETAIL SALES

10.3.1 OFFLINE SALES

10.3.2 ONLINE SALES

10.4 OTHERS

11 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 PUBLIC HOSPITALS

11.2.1.1 TIER 2

11.2.1.2 TIER 3

11.2.1.3 TIER 1

11.2.2 PRIVATE HOSPITALS

11.2.2.1 TIER 2

11.2.2.2 TIER 3

11.2.2.3 TIER 1

11.3 MATERNITY CENTERS

11.4 SPECIALTY CLINICS

11.5 HOME CARE SETTINGS

11.6 OTHERS

12 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT NEWS

15.2 ORGANON GROUP OF COMPANIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS/NEWS

15.3 LABORIE

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 COOPERCOMPANIES

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BELMONT MEDICAL TECHNOLOGIES

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ADVIN HEALTH CARE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ANGIPLAST PRIVATE LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COAGULANT THERAPEUTICS

15.8.1 COMPANY SNAPSHOT

15.8.2 PIPELINE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KRISHCO MEDICAL PRODUCTS PVT. LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 MATERNOVA INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 REVMEDX

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 3RD STONE DESIGN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 STERIMED GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 UTAH MEDICAL PRODUCTS, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 SINAPI BIOMEDICAL

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

List of Table

TABLE 1 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA UTERINE BALLOON TAMPONADE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA UTERINE BALLOON TAMPONADE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA BAKRI BALLOON IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA FOLEY CATHETER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA UNIJECT PREFILLED INJECTION SYSTEM IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA UNIJECT PREFILLED INJECTION SYSTEM IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA STANDARD NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA MODIFIED NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA COMPRESSION DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY PATIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PRIMARY PPH IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA SECONDARY PPH IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY CONDITION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA MAJOR POSTPARTUM HEMORRHAGE (MORE THAN 1000 ML) IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA MINOR POSTPARTUM HEMORRHAGE (500-1000 ML) IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA MASSIVE POSTPARTUM HEMORRHAGE (2000 ML OR MORE) IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SECONDARY POSTPARTUM HEMORRHAGE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA DIRECT TENDER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA RETAIL SALES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA RETAIL SALES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA OTHERS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA PUBLIC HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA PRIVATE HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA MATERNITY CENTERS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA SPECIALTY CLINICS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA HOME CARE SETTINGS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA OTHERS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA UTERINE BALLOON TAMPONADE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA BAKRI BALLOON IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA FOLEY CATHETER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA UNIJECT PREFILLED INJECTION SYSTEM IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA STANDARD NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA MODIFIED NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA COMPRESSION DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY CONDITION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY PATIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA PUBLIC HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA PRIVATE HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA RETAIL SALES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. UTERINE BALLOON TAMPONADE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. BAKRI BALLOON IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. FOLEY CATHETER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. UNIJECT PREFILLED INJECTION SYSTEM IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. STANDARD NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. MODIFIED NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. OTHER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. COMPRESSION DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY CONDITION, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY PATIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. PUBLIC HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. PRIVATE HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. RETAIL SALES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA UTERINE BALLOON TAMPONADE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA BAKRI BALLOON IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA FOLEY CATHETER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA UNIJECT PREFILLED INJECTION SYSTEM IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA STANDARD NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA MODIFIED NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CANADA OTHER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CANADA COMPRESSION DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CANADA NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY CONDITION, 2018-2032 (USD THOUSAND)

TABLE 90 CANADA NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY PATIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CANADA PUBLIC HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA PRIVATE HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA RETAIL SALES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO UTERINE BALLOON TAMPONADE IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO BAKRI BALLOON IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO FOLEY CATHETER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO UNIJECT PREFILLED INJECTION SYSTEM IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MEXICO NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MEXICO STANDARD NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 104 MEXICO MODIFIED NON-PNEUMATIC ANTI-SHOCK GARMENT IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 105 MEXICO VACUUM-INDUCED HEMORRHAGE CONTROL DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MEXICO OTHER IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MEXICO COMPRESSION DEVICES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MEXICO NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY CONDITION, 2018-2032 (USD THOUSAND)

TABLE 109 MEXICO NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY PATIENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MEXICO NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 MEXICO HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO PUBLIC HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO PRIVATE HOSPITALS IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO RETAIL SALES IN POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING INCIDENCE OF POSTPARTUM HAEMORRHAGE IS EXPECTED TO DRIVE THE NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 UTERINE BALLOON TAMPONADE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 15 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET, BY TYPE (2024)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET

FIGURE 17 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY TYPE, 2024

FIGURE 18 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY PATIENT TYPE, 2024

FIGURE 22 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY PATIENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY PATIENT TYPE, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY CONDITION, 2024

FIGURE 26 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY CONDITION, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY CONDITION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY CONDITION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: SNAPSHOT (2024)

FIGURE 38 NORTH AMERICA POSTPARTUM HEMORRHAGE TREATMENT DEVICES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.