North America Poultry Probiotic Ingredients Market Analysis and Insights

The poultry probiotic ingredient market demand has increased in developed and developing countries. The main purpose of prebiotics is to modify the intestinal microbiota favourably for the host animal and induce positive effects. The poultry probiotic ingredients diagnostics market is growing due to the increase in the geriatric population, the launch of new products for poultry probiotic ingredients, and the reimbursement policy for poultry feed. The market will grow in the forecasted period due to the exploration of emerging markets, strategic initiative to research, and increasing poultry probiotic ingredients products. The market is growing in the forecast year due to the high demand of poultry feed. However, stringent requirement for approval is expected to hamper the market growth.

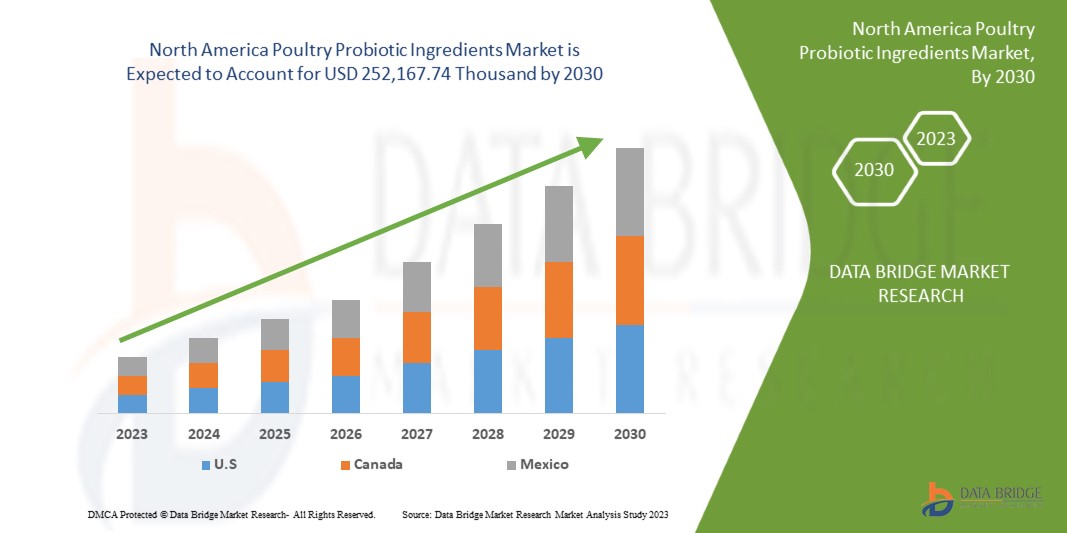

Data Bridge Market Research analyzes that the North America poultry probiotic ingredients market is expected to reach the value of USD 252,167.74 thousand by 2030, at a CAGR of 5.5% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Bacteria Based and Fungi and Yeast Based), Type (Single Strain and Multiple Strain), Form (Dry and Liquid), Function (Feed Intake and Efficiency, Yield, Gut Health, Nutrition, Egg Production and Quality Immunity and Others), Application (Broilers, Layers, Breeders, Chicks and Poults, Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Lallemand Inc, Unique Biotech, Phileo by Lesaffre, Novozymes, Evonik Industries AG, ASAHI GROUP HOLDINGS LTD, Chr. Hansen Holding A/S, Advanced Enzyme Technologies, International Flavors & Fragrances Inc, and Kemin Industries Inc, among others |

Market Definition

Probiotics are made by selecting the strain of the desired microorganism, growing them in media, fermentation, concentrating them in a centrifuge, and finally blending them into a powder. Use probiotic powder to make capsules or tablets, or keep it in a traditional powder format. Probiotics are live bacteria, fungi, or yeasts that supplement the gastrointestinal flora and help maintain a healthy digestive system, thereby promoting poultry's growth performance and overall health. When administered in appropriate and regular quantities, these probiotics can confer a health benefit for the host animal or bird.

North America Poultry Probiotic Ingredients Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

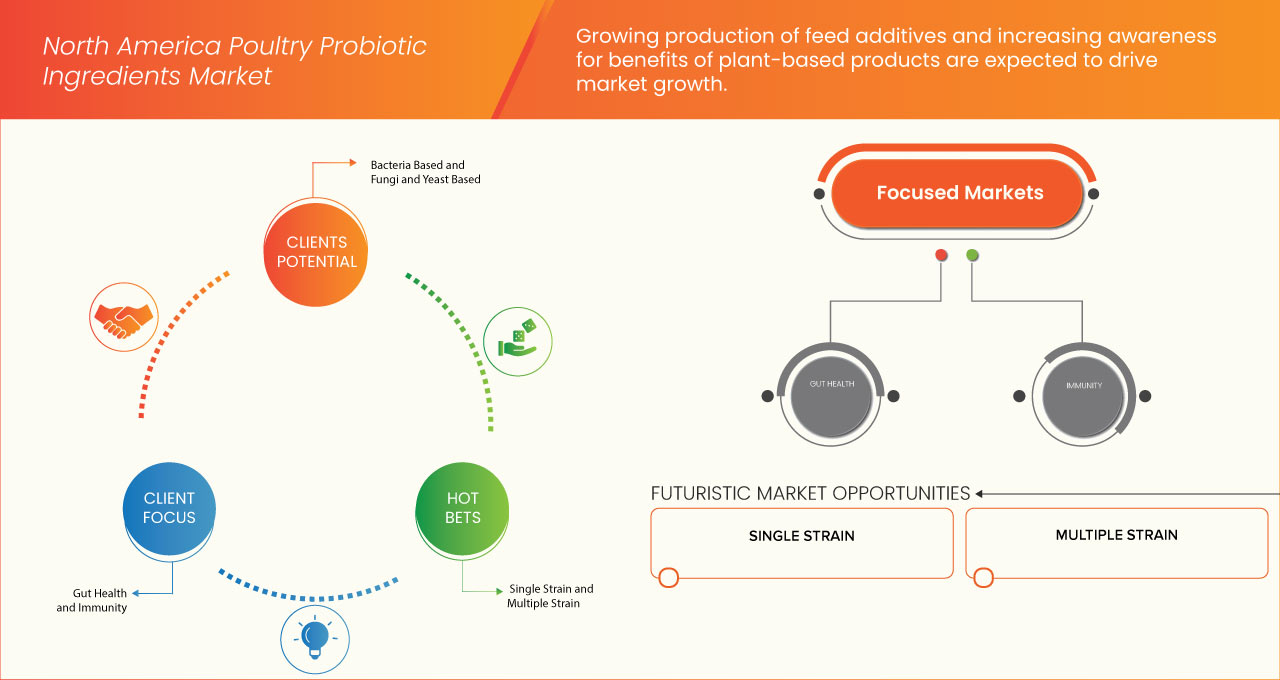

- Growing Production of Feed Additives

The mode of action of probiotics in poultry includes maintaining normal intestinal microflora by competitive exclusion and antagonism resulting in: Altered metabolism by increasing digestive enzyme activity and decreasing bacterial enzyme activity and ammonia production. There are a number of feed additives used in poultry feed, such as antibiotics, probiotics, oligosaccharides, enzymes and organic acids

Feed additives are the type of products which are used in animal nutrition in order to improve the characteristics of feed, such as to enhance the flavor or to make feed materials more readily digestible. It is a mixtures thereof, chemical substances and microorganisms other than feed premixes and materials, which have the characteristics of certain functionality. North America, production of feed additives increases day by day which is boosting the demand of the market

- Increasing Awareness for Benefits of Plant-Based Products

Animal welfare have fueled the transition toward plant-based diets. Another important factor driving this change is the favorable health advantages of plant-based probiotics such as meat substitutes that taste as meat such as pea starch used in various products. Furthermore, these replacements are thought to be rich in nutrition, and promoting improved physical health.

The rising customer preference for safe lifestyles and numerous government policies in various countries has created a new opportunity for the North America poultry probiotic ingredients industry to create environmentally sustainable, cheaper and viable alternatives to plant-based food consumption.

Furthermore, poultry probiotics is highly nutritious which contains micronutrients such as thermophilus, acidophilus, bulgaricus, caseifa, rciminis, fermentum, plantarum, reuter and has various health benefits such as reducing heart risk, maintaining weight and increasing metabolism of both birds and animals in poultry. This is why consumers prefer poultry probiotics to maintain poultry birds and animals health.

Opportunity

- Growing Commercial Application

Poultry probiotics products are primarily used in poultry feed due to their low anti-nutritional factor content and high nutritional value. However, probiotics are live micro-organisms included in the diet of animals as feed additives or supplements. Commonly known as a direct-fed microbial, probiotics provide beneficial properties to the host, primarily through action in the gastrointestinal tract of the animal. Supplementation of probiotics in the diet can improve animal health and performance, through contributions to gut health and nutrient use.

Probiotic species is increasing productivity and optimizing poultry performance and health under existing commercial production conditions. The multi-strain Lactobacillus supplements could be used as probiotics in commercial poultry production as they promote growth

Enzymatic production by different strains of bacteria has caused rapid growth and advancement in the field of probiotics. Bacillus licheniformis strains have been heavily used in the industry because of its ability to produce amylase, alkaline, protease, keratinase and B-mannanase

Restraint/Challenge

- Availability of Feed Additive Substitutes

Antimicrobial growth promoters are a replacement of feed additive strategies and a responsible use of antibiotics is an alternative of feed additive. The rapid development in the antimicrobial resistance in the animal health care urges the need for effective strategies to reduce probiotic use in animal production. There is easily availability of substitutes of feed additive in the market which has similar or all most same applications of feed additive, due to which availability of substitutes hampers the demand of the market.

Various type of iron and minerals packed animals food is easily available in the market which is no required to add additives in the products to enhance their nutrients property in the product which includes corn feed, grain and soybeans, among others.

Easy availability of substitutes have disturbed the growth of the market, as end-users have different types of options which are available in the market as end-users can compare each product and then decide to purchase it which restricts the growth of the market, for this reason, availability of substitutes is acting as a challenge for hampering the demand of North America poultry probiotics ingredients market

Recent Developments

- In March 2023, International Flavors & Fragrances Inc said they had achieved industrial-scale production of a strict anaerobic 'next generation' probiotic strain. The company has also announced that they have achieved the successful production of a strict anaerobic 'next generation' probiotic strain at industrial scale.

- In January 2023, the Evonik Industries AG launched a new category of nutraceuticals called IN VIVO BIOTICS. The company said these next-generation synbiotics will combine probiotics with other health ingredients.

- In December 2022, Asahi Group was recognized with a Prestigious "A" Score for North America Climate Stewardship by the North America Environmental Non-profit carbon disclosure project. The company said Asahi Group strives to achieve zero environmental impact in its business activities by 2050.

- In November 2021, Novozymes announced that they had acquired a majority stake in Synergia Life Sciences Pte. Ltd. The company said it would strengthen and accelerates its position in human health and functional foods.

North America Poultry Probiotic Ingredients Market Segmentation

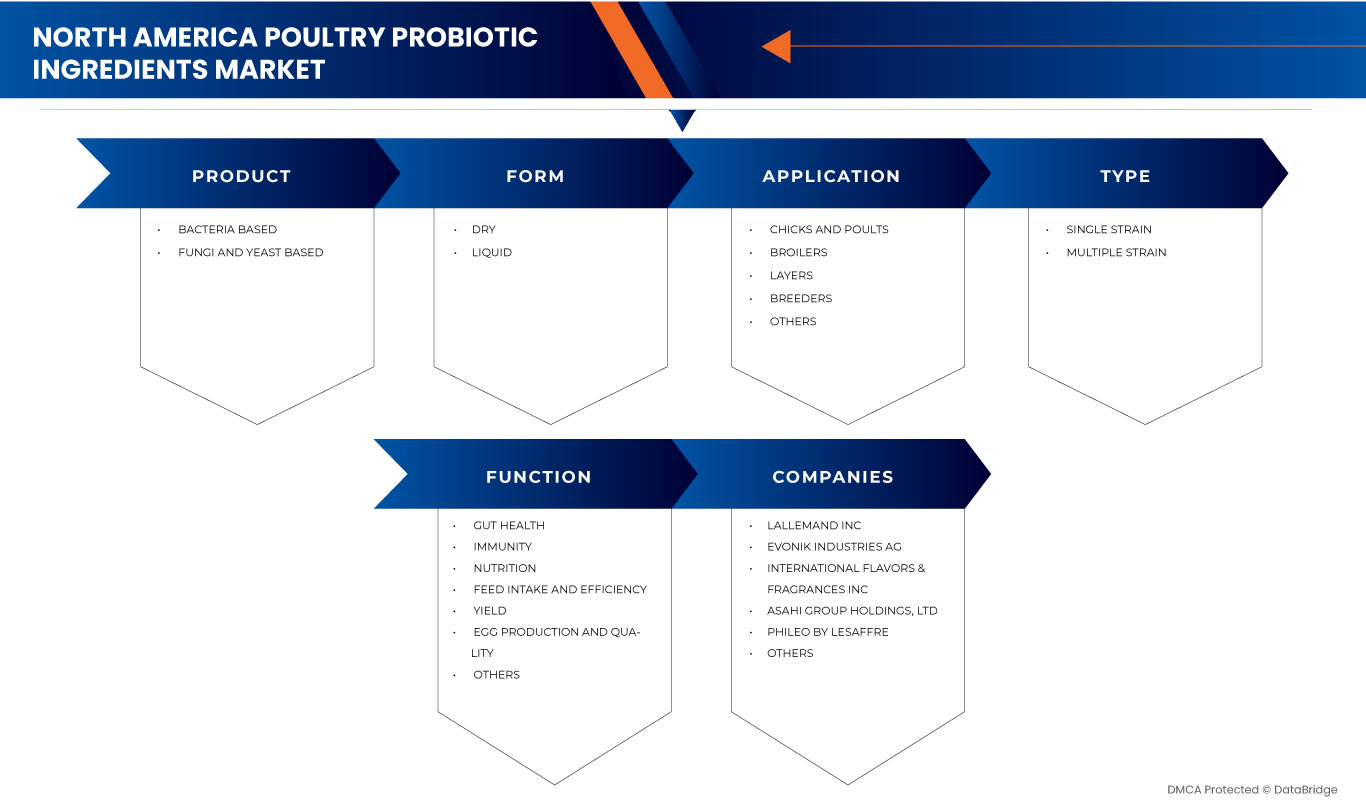

The North America poultry probiotic ingredients market is segmented into five notable segments based on product, type, form, function and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Bacteria Based

- Fungi and Yeast Based

On the basis of product, the North America poultry probiotic ingredients market is segmented into bacteria based and fungi and yeast based.

Type

- Single Strain

- Multiple Strain

On the basis of type, the North America poultry probiotic ingredients market is segmented into single strain and multiple strain.

Form

- Dry

- Liquid

On the basis of form, the North America poultry probiotic ingredients market is segmented into dry and liquid.

Function

- Feed Intake and Efficiency

- Yield

- Gut Health

- Nutrition

- Egg Production and Quality

- Immunity

- Others

On the basis of function, the North America poultry probiotic ingredients market is segmented into feed intake and efficiency, yield, gut health, nutrition, egg production and quality, immunity, and others

Application

- Broilers

- Layers

- Breeders

- Chick and Poults

- Others

On the basis of application, the North America poultry probiotic ingredients market is segmented into broilers, layers, breeders, chick and poults, and others.

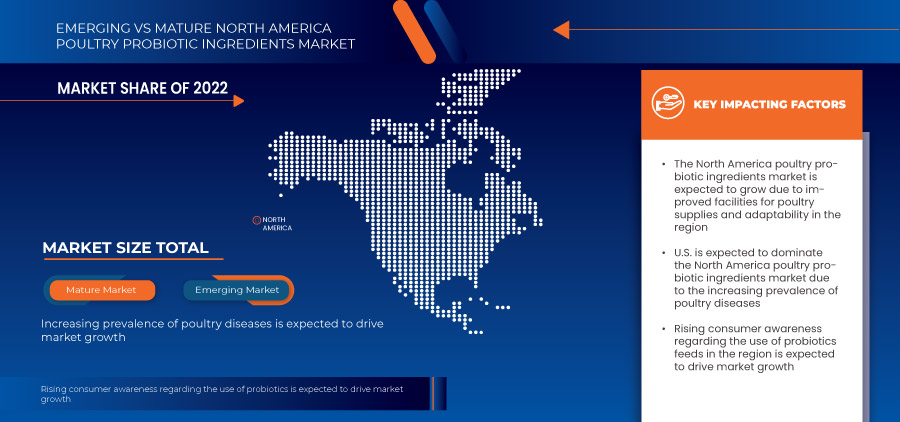

North America Poultry Probiotic Ingredients Market Regional Analysis/Insights

The North America poultry probiotic ingredients market is analysed, and market size insights and trends are provided based on product, type, form, function, and application.

The countries covered in this market report are the U.S., Canada, and Mexico

U.S. is expected to dominate the North America poultry probiotic ingredients market because of the rising awareness and government funding for poultry probiotic ingredients, and increasing strategic initiatives by major market players.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Poultry Probiotic Ingredients Market Share Analysis

The North America poultry probiotic ingredients market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the market are Lallemand Inc, Unique Biotech, Phileo by Lesaffre, Novozymes, Evonik Industries AG, ASAHI GROUP HOLDINGS LTD, Chr. Hansen Holding A/S, Advanced Enzyme Technologies, International Flavors & Fragrances Inc, and Kemin Industries Inc, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 VALUE CHAIN ANALYSIS

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING AND DISTRIBUTION

4.2.3 END USERS

4.3 PORTER'S FIVE FORCES

4.3.1 BARGAINING POWER OF SUPPLIERS

4.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.3 THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES PRODUCTS

4.3.5 INTENSITY OF COMPETITIVE RIVALRY

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING PRODUCTION OF FEED ADDITIVES

5.1.2 INCREASING AWARENESS OF THE BENEFITS OF PLANT-BASED PRODUCTS

5.1.3 INCREASED DEMAND AND CONSUMPTION OF LIVESTOCK-BASED PRODUCTS

5.2 RESTRAINTS

5.2.1 STRICT RESTRICTIONS AND REGULATIONS IMPOSED BY THE GOVERNMENT

5.2.2 INADEQUATE RAW MATERIAL AVAILABILITY

5.3 OPPORTUNITIES

5.3.1 GROWING COMMERCIAL APPLICATION

5.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 AVAILABILITY OF FEED ADDITIVES SUBSTITUTES

5.4.2 PRODUCT LABELLING AND TRADE ISSUES

6 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 MEXICO

6.1.3 CANADA

7 COMPANY SHARE ANALYSIS: NORTH AMERICA

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 LALLEMAND INC

9.1.1 COMPANY SNAPSHOT

9.1.2 PRODUCT PORTFOLIO

9.1.3 RECENT DEVELOPMENT

9.2 EVONIK INDUSTRIES AG

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 INTERNATIONAL FLAVORS & FRAGRANCES INC

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 ASAHI GROUP HOLDINGS, LTD

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 PHILEO BY LESAFFRE

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 RECENT DEVELOPMENT

9.6 ADVANCED ENZYME TECHNOLOGIES

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 CHR. HANSEN HOLDING A/S

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENT

9.8 KEMIN INDUSTRIES, INC

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 NOVOZYMES

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 UNIQUE BIOTECH

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA BACTERIA BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA BACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA LACTOBACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA BIFIDOBACTERIUM IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA PEDIOCOCCUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA FUNGI AND YEAST BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA CHICKS AND POULTS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA BROILERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA LAYERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA BREEDERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. BACTERIA BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. BACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. LACTOBACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. BIFIDOBACTERIUM IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. PEDIOCOCCUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. FUNGI AND YEAST BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. POULTRY PROBIOTIC INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. POULTRY PROBIOTIC INGREDIENTS MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. POULTRY PROBIOTIC INGREDIENTS MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. POULTRY PROBIOTIC INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. CHICKS AND POULTS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. BROILERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 U.S. LAYERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. BREEDERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 32 MEXICO POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 MEXICO BACTERIA BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 MEXICO BACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 MEXICO LACTOBACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 MEXICO BIFIDOBACTERIUM IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 MEXICO PEDIOCOCCUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 38 MEXICO FUNGI AND YEAST BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 MEXICO POULTRY PROBIOTIC INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 MEXICO POULTRY PROBIOTIC INGREDIENTS MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 41 MEXICO POULTRY PROBIOTIC INGREDIENTS MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 42 MEXICO POULTRY PROBIOTIC INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 MEXICO CHICKS AND POULTS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 MEXICO BROILERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 45 MEXICO LAYERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 MEXICO BREEDERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA BACTERIA BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA BACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA LACTOBACILLUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA BIFIDOBACTERIUM IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA PEDIOCOCCUS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA FUNGI AND YEAST BASED IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA POULTRY PROBIOTIC INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA POULTRY PROBIOTIC INGREDIENTS MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA POULTRY PROBIOTIC INGREDIENTS MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 57 CANADA POULTRY PROBIOTIC INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA CHICKS AND POULTS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA BROILERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA LAYERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA BREEDERS IN POULTRY PROBIOTIC INGREDIENTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: SEGMENTATION

FIGURE 12 INCREASING AWARENESS OF POULTRY PROBIOTIC INGREDIENTS AND INCREASED RESEARCH & DEVELOPMENT IN POULTRY PROBIOTIC INGREDIENTS ARE DRIVING THE NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 BACTERIA BASED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET

FIGURE 15 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET: SNAPSHOT, 2022

FIGURE 16 EUROPE POULTRY PROBIOTIC INGREDIENTS MARKET: COMPANY SHARE 2022 (%)

North America Poultry Probiotic Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Poultry Probiotic Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Poultry Probiotic Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.