North America Powered Surgical Instruments Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

1.99 Billion

2024

2032

USD

1.14 Billion

USD

1.99 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 1.99 Billion | |

|

|

|

|

Powered Surgical Instruments Market Size

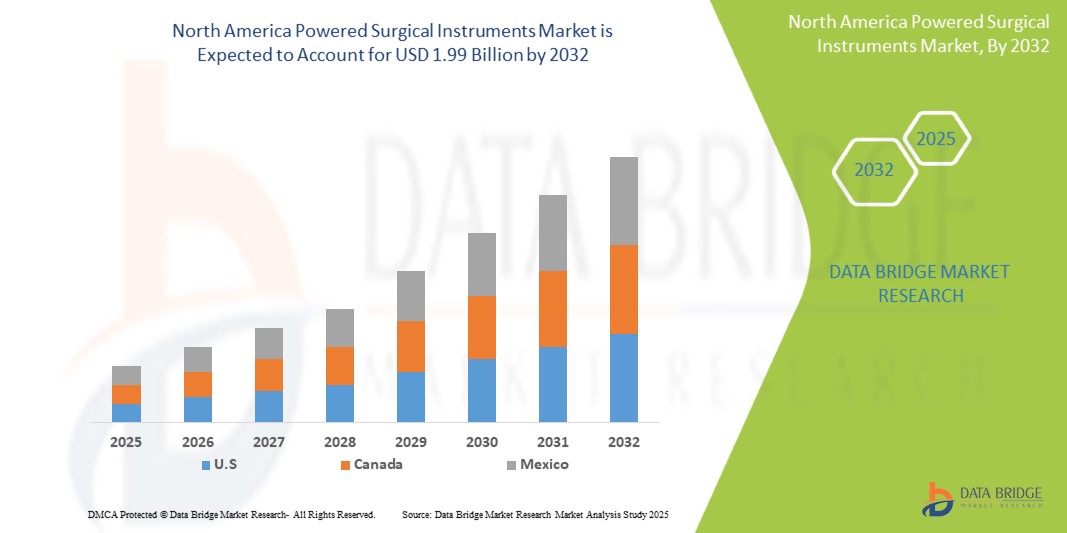

- The North America Powered Surgical Instruments market size was valued at USD 1.14 billion in 2024 and is expected to reach USD 1.99 billion by 2032, at a CAGR of 4.15% during the forecast period

- The market growth is largely fueled by the rising incidence of chronic diseases requiring surgical intervention, the increasing geriatric population, and the growing demand for minimally invasive surgeries.

- Furthermore, technological advancements in powered surgical instruments, such as improved battery life, enhanced precision, and integration with robotic systems, are driving market expansion. These converging factors are accelerating the uptake of powered surgical instruments across various medical applications, thereby significantly boosting the industry's growth.

Powered Surgical Instruments Market Analysis

- The powered surgical instruments market comprises a range of electrically, battery-powered, or pneumatically driven tools designed to enhance precision, efficiency, and control during various surgical procedures. These instruments are vital for cutting, drilling, reaming, sawing, and stapling in specialties like orthopedics, neurosurgery, and ENT. Their adoption is driven by the increasing volume of complex surgeries, the demand for minimally invasive techniques, and continuous technological advancements that improve patient outcomes and surgeon performance.

- The escalating demand for powered surgical instruments is primarily fueled by the increasing number of surgical procedures performed globally, the growing adoption of outpatient procedures, and the rising focus on improving surgical outcomes and patient safety.

- The U.S. dominates the Powered Surgical Instruments market in North America with the largest revenue share of 87.6% in 2025, attributed to a highly developed surgical infrastructure, increasing volume of surgical procedures, favorable reimbursement landscape, and early adoption of advanced powered systems across specialties such as orthopedics, cardiology, and neurosurgery.

- The U.S. is expected to be the fastest-growing country in the North America Powered Surgical Instruments market during the forecast period, driven by a rising aging population, a surge in elective and minimally invasive surgeries, technological advancements such as battery-powered and pneumatic systems, and strategic investments by key market players in R&D and facility expansion.

- Orthopedic surgery is expected to dominate the North America Powered Surgical Instruments market with a market share of 41.9% in 2025, due to the high prevalence of joint disorders, increasing demand for total knee and hip replacements, and extensive use of powered instruments for bone cutting, reaming, and drilling.

Report Scope and Powered Surgical Instruments Market Segmentation

|

Attributes |

Powered Surgical Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Powered Surgical Instruments Market Trends

“Integration of AI and robotics in powered surgical instruments for enhanced precision and automation”

- Technological Advancements and Integration of Smart Technologies: A significant and accelerating trend in the North America powered surgical instruments market is the continuous technological advancement and the integration of smart technologies like AI and IoT. This evolution is significantly enhancing surgical precision, efficiency, and patient safety.

- For instance, innovations include high-speed electric and pneumatic surgical drills that provide enhanced power and control for complex procedures like spinal surgeries, neurotological operations, and orthopedics. The integration of advanced automation and precision technologies into electrosurgical devices further expands their functionality, offering increased precision in tissue cutting and coagulation, reduced blood loss, and faster patient recovery.

- The development of battery-powered instruments with improved longevity and power management systems is increasing their portability and convenience, especially for emergency and remote surgical settings. Furthermore, robotic-assisted surgical systems increasingly rely on powered instruments for high-precision operations, driving market growth.

- This trend towards more intelligent, precise, and efficient powered surgical instruments is fundamentally reshaping modern surgical practices. Consequently, companies are investing heavily in R&D to develop next-generation instruments with enhanced features.

- The demand for powered surgical instruments that offer advanced capabilities and seamless integration with digital workflows is growing rapidly across hospitals and ambulatory surgical centers, as healthcare providers prioritize improved surgical outcomes and operational efficiency

Powered Surgical Instruments Market Dynamics

Driver

“Increasing volume of surgeries”

- Increasing Volume of Surgical Procedures: The rising number of surgical procedures performed in North America, driven by the increasing prevalence of chronic diseases and an aging population, is a significant driver for the heightened demand for powered surgical instruments

- For instance, the growing incidence of musculoskeletal fractures, neurological disorders, cardiovascular diseases, and various cancers necessitates a higher volume of surgical interventions. Powered surgical instruments offer increased precision, control, and efficiency, making them essential for performing these complex procedures effectively

- The growing geriatric population is more susceptible to age-related conditions requiring surgical treatments, such as joint replacements and spinal surgeries, further boosting the demand for advanced surgical tools.

- The shift towards minimally invasive surgical (MIS) techniques, which offer benefits like smaller incisions, reduced pain, and faster recovery, is also propelling the adoption of powered instruments designed for MIS procedures.

- Increasing healthcare expenditure and investments in upgrading surgical facilities contribute to the market's expansion

Restraint/Challenge

“High initial and maintenance costs”

- High Cost and Technical Complexity: The high cost of advanced powered surgical instruments and the associated technical complexities present a significant challenge to widespread market adoption, particularly for smaller healthcare facilities and those with budget constraints.

- For instance, the initial investment for purchasing sophisticated powered instruments, along with ongoing maintenance and repair costs, can be substantial. This high cost of ownership can deter adoption, especially in less well-funded institutions.

- The technical complexity of these instruments often necessitates specialized training and experience for surgeons and operating room staff, adding to the operational burden. A shortage of skilled professionals capable of operating and maintaining these devices can further impede market penetration.

- Additionally, stringent regulatory compliance requirements for development, production, and marketing add to the cost and complexity for manufacturers. Concerns regarding the reliability and safety of powered instruments, including potential malfunctions or user errors, also exist

Powered Surgical Instruments Market Scope

The market is segmented on the basis power source, product and application.

- By Power source

On the basis of power source, the Powered Surgical Instruments market is segmented into electric instruments, battery-powered instruments, and pneumatic instruments. The electric instruments segment dominates the largest market revenue share of 42.5% in 2025, attributed to their consistent power output, high performance in long-duration procedures, and compatibility with a wide range of surgical tools. These instruments are widely used in orthopedic and neurosurgical procedures where high torque and reliability are critical.

The battery-powered instruments segment is anticipated to witness the fastest growth rate of 5.4% from 2025 to 2032, driven by their enhanced portability, reduced dependence on cords and power outlets, and growing demand for minimally invasive and outpatient procedures. Advances in lithium-ion battery technology have improved runtime and reduced charging times, making these tools increasingly favored in ambulatory and field-based surgical settings.

- By Application

On the basis of application, the market is segmented into orthopedic surgery, oral and maxillofacial surgery, neurosurgery, ENT surgery, cardiothoracic surgery, and plastic and reconstructive surgery. The Orthopedic surgery segment held the largest market revenue share in 2025, driven by the high prevalence of musculoskeletal disorders, rising number of joint replacement and spinal procedures, and the essential role powered tools play in bone cutting, drilling, and fixation.

The plastic and reconstructive surgery segment is expected to witness the fastest CAGR from 2025 to 2032, as demand rises for precision-driven, cosmetic, and reconstructive procedures. The increasing trend of elective surgeries, technological advancements in micro-powered tools, and growing aesthetic awareness contribute to the rapid expansion of this segment.

- By Product

On the basis of Product, the market is segmented into handpieces, power sources and controls, and accessories. The handpieces segment dominates the market with the largest revenue share in 2025, as these are essential components of powered surgical systems used across a broad range of procedures including cutting, drilling, and reaming. Continuous improvements in ergonomic design, sterilization compatibility, and multifunctionality are driving their widespread adoption.

The accessories segment is projected to witness the fastest CAGR from 2025 to 2032, owing to the increasing customization needs of surgical tools and the recurring demand for consumables such as blades, burrs, and reamers. Innovations in disposable accessories and precision engineering are enhancing procedural safety and efficiency.

Powered Surgical Instruments Market Regional Analysis

- U.S. dominates the Powered Surgical Instruments market with the largest revenue share of 87.6% in 2024, attributed to its advanced surgical infrastructure, high surgical procedure volumes, and early adoption of next-generation surgical technologies. The widespread use of powered instruments in orthopedic, neurosurgical, and cardiothoracic procedures within U.S. hospitals and ambulatory surgical centers (ASCs) underscores this leadership position.

- The country benefits from a robust reimbursement framework, strong presence of industry leaders such as Medtronic, Stryker, and Zimmer Biomet, and continued investment in surgical robotics and power-assisted tools. Additionally, the growing trend of outpatient surgeries, especially in orthopedics and plastic surgery, is fueling the demand for compact, battery-powered devices in ASC settings.

- Technological innovations—such as modular handpieces, smart battery systems, and integrated safety features—alongside ongoing training programs for surgical teams, further bolster the U.S. market. High investment in research and rapid FDA approvals for next-gen devices continue to maintain the U.S.'s dominance in this space.

Canada Powered Surgical Instruments Market Insight

The Canada powered surgical instruments market is projected to grow at a healthy CAGR over the forecast period, driven by an increasing number of surgical procedures, particularly in orthopedic and neurosurgery domains. Canada’s publicly funded healthcare system supports broad access to surgical care, and recent investments in modernizing operating rooms have accelerated the integration of powered surgical systems. Provinces like Ontario and British Columbia have prioritized surgical wait-time reduction strategies, prompting hospitals to adopt high-efficiency tools, including advanced powered handpieces and battery-driven systems. In addition, Canada's stringent health regulations and growing collaborations with U.S.-based device manufacturers ensure the availability of high-quality, compliant powered surgical devices

Mexico Powered Surgical Instruments Market Insight

The Mexico powered surgical instruments market is expected to expand at a robust CAGR during the forecast period, bolstered by growing healthcare investments, expanding private hospital networks, and government-led surgical infrastructure enhancements. Urban centers such as Mexico City, Monterrey, and Guadalajara are leading in the adoption of powered surgical systems for orthopedic, dental, and ENT procedures. National health initiatives focused on improving surgical outcomes and patient recovery times are encouraging the shift from manual to powered instruments, especially in trauma and reconstructive surgeries. While challenges related to cost and access persist in rural areas, partnerships with international manufacturers and local distributors are improving market penetration.

Powered Surgical Instruments Market Share

The Powered Surgical Instruments industry is primarily led by well-established companies, including:

- BD (Becton, Dickinson and Company) (U.S.)

- Hologic, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Cook Medical (U.S.)

- Devicor Medical Products, Inc. (U.S.)

- Argon Medical Devices, Inc. (U.S.)

- Planmed Oy (Finland)

- C.R. Bard, Inc. (U.S.)

- Carestream Health (U.S.)

- FUJIFILM Corporation (Japan)

- Hitachi Medical Systems (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

Latest Developments in North America Powered Surgical Instruments Market

- In April 2024, MOLLI Surgical introduced the OncoPen, a minimally invasive surgical pen designed to enhance precision and improve outcomes in breast cancer surgery. The device aims to support surgeons in accurately targeting and removing tumors, thereby reducing tissue damage and improving cosmetic results for patients undergoing breast-conserving procedures.

- In February 2024, Dentsply Sirona launched its Midwest Energo portfolio of electric handpieces in North America. The T1 and T2 models feature smaller heads, quieter operation, and reduced heat generation, enhancing patient safety and comfort. Designed for durability and sustainability, the handpieces also boast a 25% lower carbon footprint compared to previous models.

- In June 2022, Ethicon, a Johnson & Johnson MedTech company, launched the ECHELON 3000 Stapler in the U.S. This digitally enabled surgical stapler features one-handed powered articulation, a 39% greater jaw aperture, and a 27% wider articulation span compared to previous models. Designed for both open and minimally invasive procedures, it enhances access and control in challenging surgical environments.

- In September 2021, Panther Healthcare launched the Smart Powered Stapler platform, offering intelligent, automated control over tissue compression, transection, and resection. This battery-powered device features real-time tissue thickness recognition and adaptive firing, enhancing precision in gastrointestinal, thoracic, colorectal, gynecologic, and oncology surgeries across open and laparoscopic procedures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.