North America Printing Inks Packaging Inks Market

Market Size in USD Billion

CAGR :

%

USD

2.65 Billion

USD

4.25 Billion

2025

2033

USD

2.65 Billion

USD

4.25 Billion

2025

2033

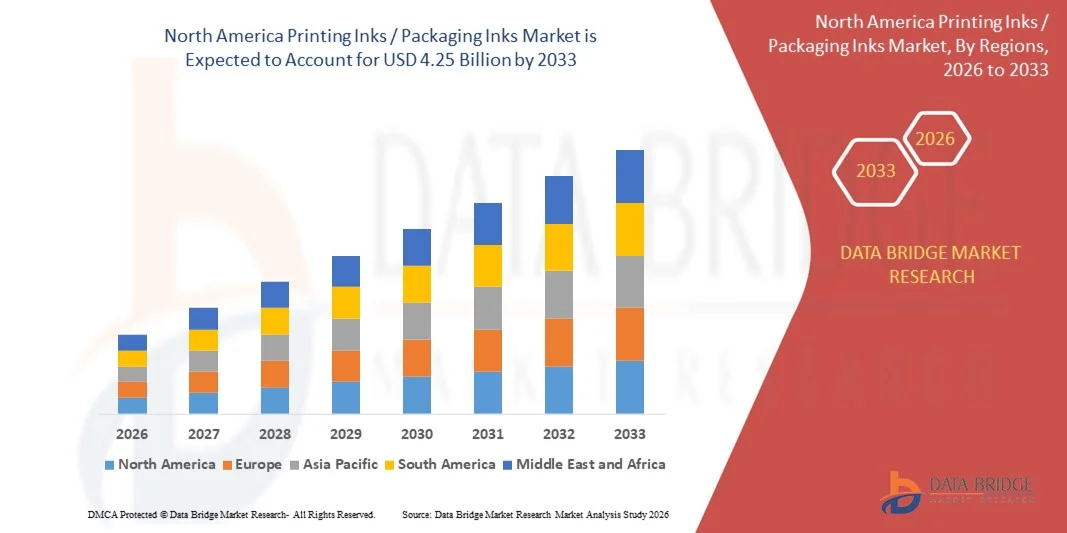

| 2026 –2033 | |

| USD 2.65 Billion | |

| USD 4.25 Billion | |

|

|

|

|

North America Printing Inks / Packaging Inks Market Size

- The North America printing inks / packaging inks market size was valued at USD 2.65 billion in 2025 and is expected to reach USD 4.25 billion by 2033, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by the increasing demand for high-quality, sustainable, and environmentally friendly inks in the packaging and printing industry, driving innovation across water-based, UV-curable, and low-VOC ink technologies

- Furthermore, rising consumer preference for visually appealing, durable, and food-safe packaging is encouraging manufacturers to adopt advanced printing inks that meet regulatory standards and enhance product aesthetics, significantly boosting industry growth

North America Printing Inks / Packaging Inks Market Analysis

- Printing inks and packaging inks, including flexo, offset, gravure, and digital ink formulations, are essential for delivering high-quality prints on diverse substrates such as paper, board, plastics, and aluminum in commercial and packaging applications

- The escalating demand for these inks is primarily fueled by the growth of packaged goods, e-commerce, and brand differentiation strategies, coupled with increasing environmental regulations that drive the adoption of sustainable and low-migration ink solutions

- U.S. dominated the printing inks / packaging inks market in 2025, due to strong demand for high-quality, food-safe, and sustainable packaging across food, beverage, pharmaceutical, and consumer goods industries

- Canada is expected to be the fastest growing region in the printing inks / packaging inks market during the forecast period due to rising demand for sustainable packaging, expansion of food and beverage processing, and increasing regulatory emphasis on environmental compliance

- Paper and board segment dominated the market with a market share of 43% in 2025, due to its widespread use in packaging, labeling, and commercial printing. Paper-based substrates offer ease of printing, recyclability, and cost-effectiveness, making them a preferred choice for both manufacturers and brand owners. Strong adoption is further supported by the growing demand for sustainable and recyclable packaging solutions in developed and emerging markets

Report Scope and Printing Inks / Packaging Inks Market Segmentation

|

Attributes |

Printing Inks / Packaging Inks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Printing Inks / Packaging Inks Market Trends

Rising Adoption of Sustainable and Eco-Friendly Inks

- A significant trend in the printing inks and packaging inks market is the growing adoption of sustainable and eco-friendly ink solutions, driven by increasing consumer awareness of environmental impact and the need for safer packaging materials. This trend is pushing manufacturers to develop bio-based, water-based, and low-VOC inks that reduce carbon footprint while maintaining print quality

- For instance, Flint Group and Sun Chemical have introduced water-based and soy-based inks for flexible and paper packaging applications, supporting sustainable practices across the printing and packaging industries. These initiatives help companies meet regulatory standards and cater to environmentally conscious consumers

- The demand for clean-label and recyclable packaging is encouraging brands to integrate inks that are fully compostable or recyclable without compromising color vibrancy. This is shaping product development toward eco-friendly formulations that align with circular economy principles

- Regulatory pressures and sustainability certifications are motivating printing ink manufacturers to innovate with non-toxic pigments and renewable raw materials. Compliance with initiatives such as EU REACH and FSC-certified packaging is guiding market strategies toward safer and greener products

- The market is witnessing increasing collaborations between ink manufacturers and packaging companies to co-develop solutions that ensure high-quality prints on eco-conscious substrates. Such partnerships are driving growth in sustainable packaging inks while meeting functional and aesthetic requirements

- Consumer preference for branded and premium packaging is pushing for inks that combine sustainability with high performance, including improved adhesion, gloss, and print resolution. This trend is reinforcing the shift toward inks that support both brand identity and environmental responsibility

North America Printing Inks / Packaging Inks Market Dynamics

Driver

Growing Demand for High-Quality and Food-Safe Packaging

- The rising need for high-quality packaging that ensures product safety is driving demand for specialized printing inks and packaging inks, particularly in food, beverage, and pharmaceutical segments. These inks must meet stringent safety standards while providing vibrant and consistent print quality

- For instance, Siegwerk and Hubergroup supply food-safe inks that comply with FDA and Swiss Ordinance regulations, enabling brands to package consumables safely without compromising visual appeal. Such inks support both regulatory compliance and enhanced consumer trust in packaged goods

- The expansion of e-commerce and premium packaged products is further increasing the requirement for durable inks that maintain print quality during transportation and storage. Brands seek inks that resist smudging, fading, and chemical interactions with packaging materials

- Advancements in digital and flexographic printing technologies are encouraging the development of inks compatible with high-speed production while maintaining safety standards. This compatibility is enhancing operational efficiency and reducing production downtime

- Sustainability concerns are boosting the preference for inks with reduced volatile organic compounds (VOCs) and heavy metals, supporting eco-friendly packaging initiatives. These developments are reinforcing the integration of quality, safety, and environmental responsibility in ink formulations

Restraint/Challenge

Stringent Environmental and Regulatory Compliance

- The printing inks and packaging inks market faces challenges from strict environmental and regulatory requirements, which limit the types of raw materials and chemicals that can be used in production. Compliance with global and regional regulations adds complexity to product development and supply chain management

- For instance, companies such as Sun Chemical invest heavily in research and development to ensure their inks meet EU REACH, FDA, and other international safety standards, which increases operational costs. These compliance obligations influence formulation choices and constrain rapid innovation

- Meeting emissions standards for volatile organic compounds (VOCs) and hazardous substances requires specialized equipment and continuous monitoring, adding to manufacturing complexity. Companies must balance regulatory adherence with production efficiency and cost management

- The market also faces challenges in recycling and disposal of printed materials containing traditional inks, prompting a shift toward bio-based and water-based alternatives. These requirements affect both product design and post-consumer handling processes

- Maintaining consistent color performance while adhering to stringent regulatory and environmental standards remains a key hurdle for manufacturers. This constraint requires ongoing innovation and investment in safer, more compliant ink technologies to sustain market competitiveness

North America Printing Inks / Packaging Inks Market Scope

The market is segmented on the basis of technology, type, resin, substrate, and application.

- By Technology

On the basis of technology, the printing inks market is segmented into solvent based, oil based, water based, UV curable, LED curable, EB curable, and others. The water-based segment dominated the market with the largest market revenue share in 2025, driven by its eco-friendly characteristics, low VOC content, and compliance with stringent environmental regulations. Manufacturers and brand owners increasingly prefer water-based inks due to their safe application in food and beverage packaging, as well as their compatibility with a wide range of substrates. The market sees strong adoption of water-based inks due to their ability to deliver high-quality prints while reducing environmental impact and production hazards.

The UV curable segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for high-speed printing, superior print durability, and enhanced resistance to chemicals and abrasion. UV curable inks are increasingly used in premium packaging applications and labels, providing vibrant colors and rapid curing times that improve production efficiency. The integration of UV curable technology with digital and flexible printing processes further accelerates its adoption across various industries.

- By Type

On the basis of type, the printing inks market is segmented into flexo inks, offset inks, gravure inks, jet inks, metal decorative inks, security inks, and others. The flexo inks segment dominated the market with the largest market revenue share in 2025, driven by its widespread use in flexible packaging, corrugated cartons, and labels. Flexo inks are preferred for their fast-drying properties, ability to print on multiple substrates, and cost-effectiveness in large-volume printing operations. Manufacturers favor flexo inks due to their compatibility with automated high-speed printing lines and consistent print quality.

The jet inks segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing adoption of digital printing technologies in packaging and commercial applications. Jet inks enable high-resolution prints, variable data printing, and short-run customizations, making them ideal for modern packaging demands. The increasing trend of e-commerce and personalized packaging also contributes to the accelerated adoption of jet inks across regions.

- By Resin

On the basis of resin, the printing inks market is segmented into polyurethane, acrylic, vinyl, polyamide, polyketone, nitrocellulose, and others. The acrylic segment dominated the market with the largest market revenue share in 2025, driven by its excellent adhesion, color retention, and chemical resistance across various substrates. Acrylic resins are preferred in food and beverage packaging due to their safe, non-toxic properties and ability to deliver high-quality, durable prints. The market also witnesses strong adoption of acrylic resins because of their flexibility in blending with other resins and suitability for diverse printing technologies.

The polyurethane segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its superior mechanical strength, abrasion resistance, and versatility in specialty packaging applications. Polyurethane-based inks are increasingly used in high-end product labels, metal decorative coatings, and flexible packaging requiring enhanced durability. Rising demand for long-lasting and premium packaging solutions drives the accelerated adoption of polyurethane inks globally.

- By Substrate

On the basis of substrate, the printing inks market is segmented into paper and board, polyethylene, aluminum, polyvinyl chloride, polypropylene, polyvinyl acetate, polyolefin, cellophane, polyester, nylon, and others. The paper and board segment dominated the market with the largest market revenue share of 43% in 2025, driven by its widespread use in packaging, labeling, and commercial printing. Paper-based substrates offer ease of printing, recyclability, and cost-effectiveness, making them a preferred choice for both manufacturers and brand owners. Strong adoption is further supported by the growing demand for sustainable and recyclable packaging solutions in developed and emerging markets.

The polyethylene segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing applications in flexible packaging, pouches, and shrink films. Polyethylene substrates provide excellent moisture resistance, durability, and compatibility with modern ink technologies, enhancing print quality and shelf appeal. Rising consumer preference for flexible packaging and extended shelf-life products accelerates the adoption of polyethylene-based printing inks.

- By Application

On the basis of application, the printing inks market is segmented into food packaging, wall paper, corrugated and solid board, panels, labels, laminates, carrier bags, aluminum foils, shrink wrap films, envelopes, paper synthetic films, wrapping paper, heavy-duty sacks, deep freeze packaging, hygiene packaging, flower wrap, and others. The food packaging segment dominated the market with the largest market revenue share in 2025, driven by rising demand for safe, visually appealing, and functional packaging. Printing inks for food packaging are preferred for their compliance with food safety regulations, high color vibrancy, and resistance to moisture and oils. The market sees strong adoption in food packaging due to increasing consumer demand for packaged foods, convenience products, and extended shelf-life solutions.

The labels segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding e-commerce, premium product branding, and regulatory labeling requirements. Label inks require high precision, durability, and compatibility with different packaging substrates, driving innovation in specialty inks. Rising demand for attractive and informative packaging labels accelerates the adoption of label-specific printing inks across multiple industries.

North America Printing Inks / Packaging Inks Market Regional Analysis

- U.S. dominated the printing inks / packaging inks market with the largest revenue share in 2025, driven by strong demand for high-quality, food-safe, and sustainable packaging across food, beverage, pharmaceutical, and consumer goods industries

- Strong demand for flexible, corrugated, and specialty packaging is supported by advanced printing infrastructure, high adoption of digital and flexographic printing technologies, and growing preference for eco-friendly and low-VOC ink solutions that meet regulatory standards

- The presence of leading ink manufacturers such as Sun Chemical, Flint Group, and INX International Ink, along with continuous innovation in water-based, UV-curable, and food-compliant inks, reinforces the U.S. leadership position in the regional market

Canada Printing Inks / Packaging Inks Market Insight

Canada is projected to register the fastest CAGR in the North America printing inks and packaging inks market from 2026 to 2033, supported by rising demand for sustainable packaging, expansion of food and beverage processing, and increasing regulatory emphasis on environmental compliance. For instance, companies such as Siegwerk and Hubergroup are expanding their eco-friendly and food-safe ink offerings to meet Canadian packaging standards and sustainability goals. Growth in packaged food consumption, higher adoption of recyclable packaging materials, and investments in modern printing technologies are accelerating market expansion. These factors position Canada as the fastest-growing country in the region during the forecast period.

Mexico Printing Inks / Packaging Inks Market Insight

Mexico is expected to grow steadily from 2026 to 2033, driven by expanding manufacturing of packaged food, beverages, and consumer goods, along with increasing exports to North America. Demand for cost-effective and high-quality packaging inks is rising across flexible and corrugated packaging segments, supported by improving printing infrastructure and local production capabilities. International ink suppliers such as Sun Chemical and local packaging companies maintain strong production and distribution networks, ensuring consistent supply. Growing focus on food safety compliance and gradual adoption of sustainable ink solutions contribute to sustained market growth throughout the forecast period.

North America Printing Inks / Packaging Inks Market Share

The printing inks / packaging inks industry is primarily led by well-established companies, including:

- DIC CORPORATION (Japan)

- SAKATA INX CORPORATION (Japan)

- Siegwerk Druckfarben AG & Co. KGaA (Germany)

- TOYO INK SC HOLDINGS CO., LTD. (Japan)

- hubergroup Deutschland GmbH (Germany)

- Flint Group (Switzerland)

- Kao Collins Corporation (U.S.)

- SICPA HOLDING SA (Switzerland)

- T&K TOKA Corporation (Japan)

- TOKYO PRINTING INK MFG CO., LTD (Japan)

- Sun Chemical Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Zeller+Gmelin GmbH & Co. KG (Germany)

- Wikoff Color Corporation (U.S.)

Latest Developments in North America Printing Inks / Packaging Inks Market

- In May 2024, Flint Group expanded its TerraCode range with the introduction of TerraCode Bio, an environmentally friendly product line featuring bio-based extenders and coatings for the corrugated packaging market. This launch strengthens Flint Group’s position in the sustainable packaging inks segment, addressing the rising demand for eco-conscious materials and offering corrugated converters solutions that combine regulatory compliance with enhanced print performance. The addition of bio-based components supports market trends toward reduced carbon footprint and aligns with growing consumer preference for green packaging

- In May 2024, DuPont unveiled Artistri PN1000 low-viscosity pigment inks at drupa 2024, highlighting improved optical density and food-contact compliance. This launch positions DuPont to capture the expanding market for high-performance, food-safe inks, particularly in packaging applications where visual appeal and regulatory adherence are critical. By offering inks that meet stringent safety standards without compromising print quality, DuPont reinforces its competitiveness in the specialty pigment and packaging inks segment

- In March 2024, DIC India inaugurated a toluene-free liquid ink plant in Gujarat with a 10,000-ton annual capacity, representing an investment of INR 1.1 billion (~USD 0.013 billion). This facility addresses the growing market need for environmentally friendly, low-VOC inks in India and neighboring regions. The plant enables DIC to scale production of sustainable inks, strengthen supply reliability, and meet the rising demand from packaging and printing sectors seeking compliance with stricter environmental and health regulations

- In February 2024, Flint Group introduced Novasens P670 PRIME, a Low-Odor, Low-Migration (LOLM) process ink range designed for sheetfed offset packaging printers globally. This development enhances the company’s market offering by providing printers with solutions that improve operational efficiency, reduce waste, and support sustainability objectives. The LOLM formulation aligns with the increasing industry focus on food-safe inks, helping printers meet regulatory standards while maintaining high-quality printing performance

- In January 2024, ALTANA, a specialty chemicals group, completed the acquisition of Silberline Group’s business, a U.S.-based developer and producer of effect pigments for applications including automotive coatings, printing inks, plastics, protective coatings, and packaged consumer goods. This strategic acquisition expands ALTANA’s market presence in high-value pigment applications, strengthens its portfolio in specialty inks, and enhances its ability to offer innovative solutions that cater to evolving demands in decorative and functional packaging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Printing Inks Packaging Inks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Printing Inks Packaging Inks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Printing Inks Packaging Inks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.