North America Protein Hydrolysates For Animal Feed Application Market

Market Size in USD Million

CAGR :

%

USD

172.98 Million

USD

242.25 Million

2024

2032

USD

172.98 Million

USD

242.25 Million

2024

2032

| 2025 –2032 | |

| USD 172.98 Million | |

| USD 242.25 Million | |

|

|

|

|

Protein Hydrolysates for Animal Feed Application Market Size

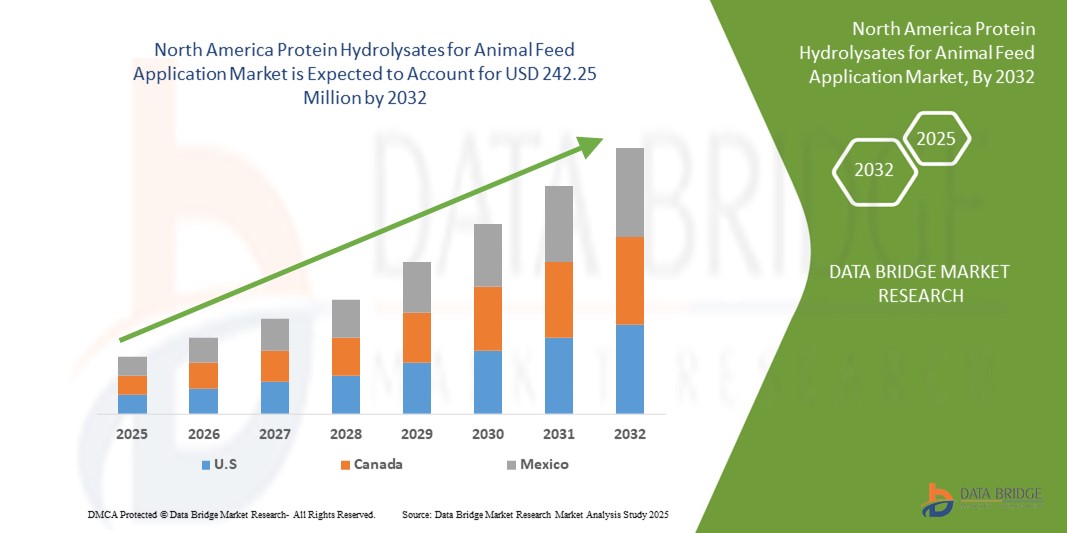

- The North America protein hydrolysates for animal feed application market size was valued at USD 172.98 million in 2024 and is expected to reach USD 242.25 million by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by increasing demand for high-quality animal feed, advancements in feed formulation technologies, and growing awareness of the benefits of protein hydrolysates in enhancing animal nutrition and performance

- The rising focus on sustainable and efficient livestock production, coupled with consumer demand for premium animal-derived products, is accelerating the adoption of protein hydrolysates in animal feed applications across the region

Protein Hydrolysates for Animal Feed Application Market Analysis

- Protein hydrolysates, derived from various sources such as animal, fish, plant, and milk proteins, are increasingly integral to animal feed formulations due to their high digestibility, bioavailability, and ability to improve growth performance and immunity in livestock

- The demand for protein hydrolysates is fueled by the expansion of the livestock and aquaculture industries, heightened focus on animal health and welfare, and the need for sustainable feed ingredients to reduce reliance on traditional protein sources

- The U.S. dominated the North America protein hydrolysates for animal feed application market with the largest revenue share of 62.5% in 2024, driven by advanced livestock farming practices, significant investments in feed innovation, and a strong presence of key market players

- Canada is expected to be the fastest-growing country in the market during the forecast period, attributed to increasing livestock production, rising adoption of advanced feed solutions, and supportive government initiatives promoting sustainable agriculture

- The animal protein hydrolysate segment dominated the largest market revenue share of 38.2% in 2024, driven by its rich amino acid profiles sourced from poultry, swine, and cattle, which are essential for livestock growth and development

Report Scope and Protein Hydrolysates for Animal Feed Application Market Segmentation

|

Attributes |

Protein Hydrolysates for Animal Feed Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Hydrolysates for Animal Feed Application Market Trends

“Increasing Adoption of Precision Nutrition and Sustainable Feed Solutions”

- The North America protein hydrolysates for animal feed application market is experiencing a notable trend toward the adoption of precision nutrition, leveraging advanced technologies to optimize feed formulations for specific livestock needs

- Protein hydrolysates, derived from sources such as animal, fish, plant, and milk proteins, are increasingly valued for their high digestibility and bioavailability, enabling tailored nutrition for poultry, swine, cattle, calves, aquaculture, equine, and pets

- The integration of data analytics and IoT technologies is enhancing feed management, allowing producers to monitor animal health and growth metrics in real-time, improving feed efficiency and reducing waste

- For instance, companies are developing platforms that analyze livestock performance data to create customized feed blends, optimizing nutrient absorption and supporting sustainable farming practices

- This trend is driven by the growing emphasis on sustainability, with plant-based and fish-based hydrolysates gaining traction due to their eco-friendly profiles and ability to utilize by-products such as fish waste

- The shift toward powder and paste forms of hydrolysates is also notable, with powder dominating due to its ease of handling, longer shelf life, and versatility in feed formulations

Protein Hydrolysates for Animal Feed Application Market Dynamics

Driver

“Rising Demand for High-Quality Animal Nutrition and Sustainable Practices”

- The increasing demand for high-quality, nutrient-rich animal feed, driven by consumer preferences for premium meat, dairy, and seafood products, is a key driver for the North America protein hydrolysates market

- Protein hydrolysates enhance animal health and productivity by providing essential amino acids, peptides, and nutrients, improving growth rates, feed efficiency, and immune health across livestock segments such as poultry, swine, and aquaculture

- Regulatory support in the U.S. and Canada, including incentives for sustainable agriculture and waste reduction, is promoting the use of hydrolysates derived from by-products, particularly in aquaculture and pet food applications

- The expansion of 5G and IoT technologies is enabling real-time monitoring and data-driven feed optimization, further boosting the adoption of hydrolysates in commercial and industrial applications

- Major livestock and aquaculture producers are increasingly incorporating factory-formulated hydrolysate-based feeds to meet consumer expectations for ethically sourced and high-quality animal products

Restraint/Challenge

“High Production Costs and Regulatory Compliance Issues”

- The high cost of producing protein hydrolysates, particularly through enzymatic hydrolysis, which requires specialized enzymes and precise processing conditions, poses a significant barrier to market growth, especially for smaller producers in North America

- Integrating hydrolysates into existing feed systems can be complex and costly, requiring investments in infrastructure and technology, which may deter adoption in cost-sensitive markets

- Data security and regulatory compliance concerns are also major challenges. The collection and analysis of livestock performance data through IoT-enabled feed systems raise concerns about data privacy, potential breaches, and compliance with stringent regulations such as the U.S. Food Safety Modernization Act (FSMA) and Canada’s Safe Food for Canadians Regulations

- The fragmented regulatory landscape across the U.S., Canada, and Mexico regarding feed additives and data U.S.ge complicates operations for manufacturers and service providers operating across borders

- These factors may limit market expansion, particularly in regions with high cost sensitivity or stringent regulatory oversight

Protein Hydrolysates for Animal Feed Application market Scope

The market is segmented on the basis of source, form, livestock, technology, and application.

- By Source

On the basis of source, the North America protein hydrolysates for animal feed application market is segmented into animal protein hydrolysate, fish protein hydrolysate, plant protein hydrolysate, and milk protein hydrolysate. The animal protein hydrolysate segment dominated the largest market revenue share of 38.2% in 2024, driven by its rich amino acid profiles sourced from poultry, swine, and cattle, which are essential for livestock growth and development. Its widespread use in poultry and swine feed formulations supports its dominance in the region, particularly in the U.S., where high consumer spending on animal feed products fuels demand.

The plant protein hydrolysate segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032. Increasing consumer demand for sustainable and environmentally friendly feed ingredients, coupled with advancements in plant-based protein processing, is driving adoption. This segment is gaining traction in Canada, where growing awareness of eco-friendly feed solutions aligns with the region's focus on sustainable agriculture.

- By Form

On the basis of form, the North America protein hydrolysates for animal feed application market is segmented into powder and paste forms. The powder segment dominated with a market revenue share of 62.8% in 2024, attributed to its ease of handling, longer shelf life, and versatility in feed formulations. Powdered hydrolysates are preferred in large-scale feed production, particularly in the U.S., due to their consistent mixing and cost-effectiveness.

The paste segment is anticipated to experience significant growth from 2025 to 2032, driven by its high nutritional value and increasing application in specialized feed for aquaculture and pet nutrition. The segment’s growth is supported by innovations in paste formulations that enhance digestibility, particularly in Canada’s expanding aquaculture sector.

- By Livestock

On the basis of livestock, the North America protein hydrolysates for animal feed application market is segmented into poultry, swine, cattle, calves, aquaculture, equine, and pet. The poultry segment held the largest market revenue share of 34.8% in 2024, driven by the high demand for poultry products such as meat and eggs in the U.S., where protein hydrolysates enhance feed efficiency and growth rates. The segment benefits from the region’s large poultry industry and consumer focus on high-quality animal nutrition.

The aquaculture segment is expected to witness the fastest growth rate of 7.2% from 2025 to 2032. The rising demand for high-quality seafood products and sustainable aquafeed formulations in Canada, coupled with the use of fish protein hydrolysates for their rich amino acid profiles and omega-3 fatty acids, drives this segment’s rapid expansion.

- By Technology

On the basis of technology, the North America protein hydrolysates for animal feed application market is segmented into acid hydrolysis and enzymatic hydrolysis. The enzymatic hydrolysis segment held the largest market revenue share of 58.6% in 2024, owing to its ability to produce high-quality, bioavailable protein hydrolysates with precise control over peptide size. This technology is widely adopted in the U.S. for its superior digestibility and nutritional retention, particularly in poultry and aquaculture feed.

The acid hydrolysis segment is anticipated to grow significantly from 2025 to 2032, driven by its cost-effectiveness and efficiency in large-scale production. In Canada, where the market is growing rapidly, acid hydrolysis is gaining traction for its ability to meet the increasing demand for affordable protein hydrolysates in livestock and aquaculture feed.

- By Application

On the basis of application, the North America protein hydrolysates for animal feed application market is segmented into industrial and commercial applications. The industrial application segment dominated with a market revenue share of 60.4% in 2024, driven by the widespread use of protein hydrolysates in large-scale feed manufacturing for livestock and aquaculture in the U.S. The segment benefits from the region’s advanced feed production infrastructure and high demand for efficient, nutrient-dense feed solutions.

The commercial application segment is expected to witness robust growth from 2025 to 2032, fueled by increasing adoption in pet food and specialized livestock feed. In Canada, the fastest-growing market, rising consumer awareness of pet health and premium nutrition drives demand for protein hydrolysates in commercial feed formulations.

Protein Hydrolysates for Animal Feed Application Market Regional Analysis

- The U.S. dominated the North America protein hydrolysates for animal feed application market with the largest revenue share of 62.5% in 2024, driven by advanced livestock farming practices, significant investments in feed innovation, and a strong presence of key market players

- Canada is expected to be the fastest-growing country in the market during the forecast period, attributed to increasing livestock production, rising adoption of advanced feed solutions, and supportive government initiatives promoting sustainable agriculture

U.S. Protein Hydrolysates for Animal Feed Application Market Insight

The U.S. protein hydrolysates for animal feed application market captured the largest revenue share of 88.9% in 2024 within North America, fueled by strong demand from the livestock and pet food sectors. Consumer awareness of the benefits of protein hydrolysates, such as enhanced digestibility and improved animal growth, drives market growth. The trend toward premium pet nutrition and increasing regulations promoting sustainable feed ingredients further boost market expansion. The integration of hydrolysates in both industrial feed production and commercial applications complements market growth, creating a robust ecosystem.

Canada Protein Hydrolysates for Animal Feed Application Market Insight

Canada is expected to witness the fastest growth rate in the North America protein hydrolysates for animal feed application market, driven by rising demand for high-quality, nutrient-dense feed for livestock and pets. Increasing consumer focus on animal health and sustainability, coupled with growing aquaculture and poultry sectors, encourages adoption. Evolving regulations promoting environmentally friendly feed solutions and advancements in hydrolysis technologies, such as enzymatic hydrolysis, further support market growth in Canada.

Protein Hydrolysates for Animal Feed Application Market Share

The protein hydrolysates for animal feed application industry is primarily led by well-established companies, including:

- Titan Biotech Limited (India)

- BRF Ingredients (Brazil)

- Eco Agri (Cambodia)

- Bioibérica (Spain)

- Kemin Industries, Inc. (U.S.)

- Janatha Fish Meal & Oil Products. (India)

- Bio-marine Ingredients Ireland Ltd. (Ireland)

- ZXCHEM U.S. INC (U.S.)

- Nutrifish (Tunisia)

- Sampi, A. Costantino & C. S.P.A (Italy)

- CRESCENT BIOTECH (India)

- Interra International (U.S.)

- Tessenderlo Group (Belgium)

- Cargill, Incorporated (U.S.)

- Kerry Group Plc (Ireland)

What are the Recent Developments in North America Protein Hydrolysates for Animal Feed Application Market?

- In August 2023, Bio-Marine Ingredients Ireland, Ltd. (BMII), an Irish company specializing in fish-derived nutrients, launched a new fish protein hydrolysate product for animal feed applications in North America. This product, produced using a patented enzymatic hydrolysis process, enhances digestibility and nutrient bioavailability for livestock and aquaculture, strengthening BMII’s foothold in the North American market and addressing the growing demand for sustainable feed ingredients

- In March 2023, Kemin Industries, Inc., a global leader in nutritional solutions, announced a strategic partnership with a leading North American aquaculture feed manufacturer to integrate its plant-based protein hydrolysate into aquafeed formulations. This collaboration aims to improve feed efficiency and fish health, leveraging Kemin’s expertise in sustainable protein sources to meet the rising demand for eco-friendly aquaculture solutions in the region

- In February 2023, Bioiberica S.A.U., a Spanish bioscience company, introduced Palbio 50 RD, a high-quality animal protein hydrolysate for poultry feed, to the North American market. Specifically designed for broilers and laying hens, this product enhances gut health and feed efficiency, expanding Bioiberica’s portfolio and reinforcing its commitment to supporting the North American poultry industry’s nutritional needs

- In January 2023, Symrise Nutrition, through its Diana Aqua division, acquired a U.S.-based protein hydrolysate processing facility to enhance its production capacity for fish protein hydrolysates used in animal feed. This acquisition strengthens Symrise’s supply chain in North America, enabling the company to meet increasing demand for high-quality, sustainable feed ingredients for aquaculture and pet nutrition

- In November 2022, Titan Biotech Ltd. collaborated with a Canadian feed distributor to launch a new plant protein hydrolysate product tailored for swine and poultry in North America. This partnership leverages Titan’s expertise in enzymatic hydrolysis to deliver cost-effective, nutrient-rich feed solutions, addressing the region’s growing preference for plant-based protein sources in animal nutrition

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Protein Hydrolysates For Animal Feed Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Protein Hydrolysates For Animal Feed Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Protein Hydrolysates For Animal Feed Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.