North America Pulses Market Analysis and Size

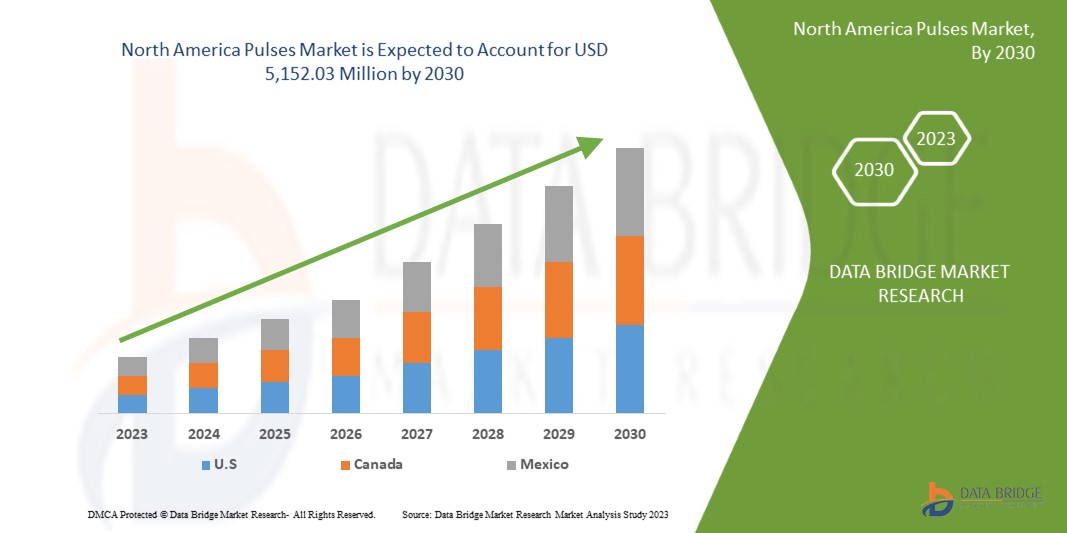

North America pulses market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.1% in the forecast period of 2023 to 2030 and is expected to reach USD 5,152.03 million by 2030. The increase in demand for pulses in various applications in different industries is expected to boost the market.

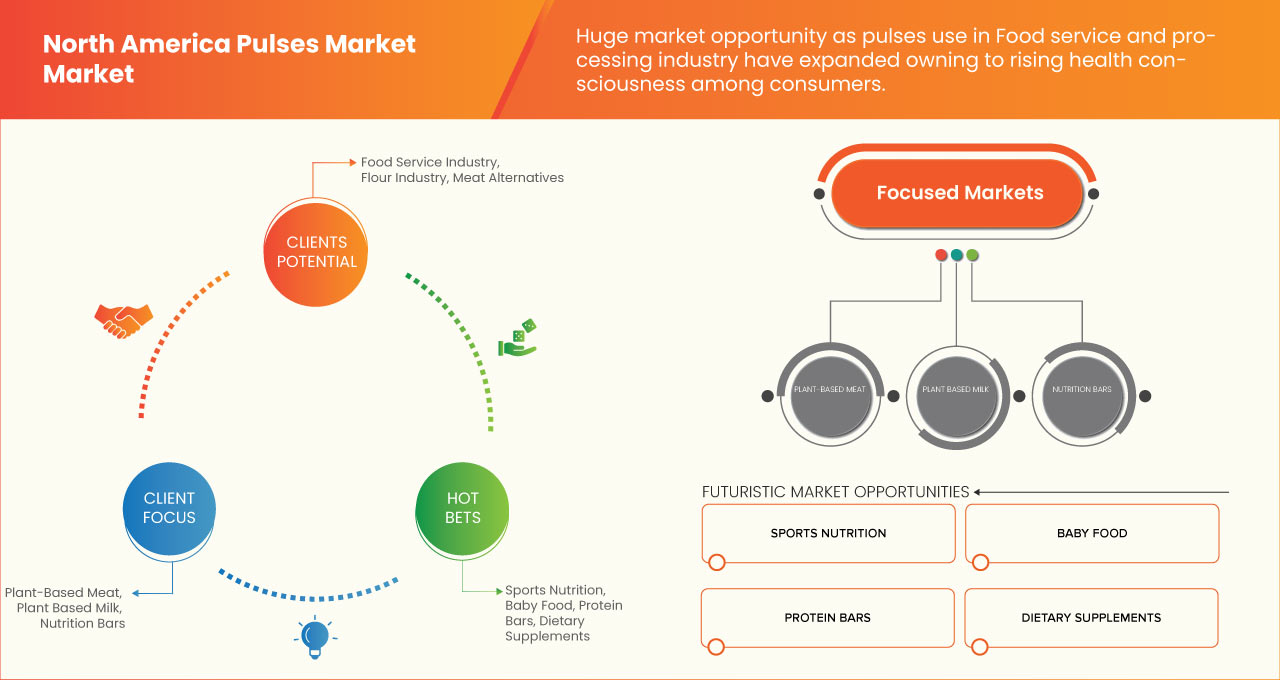

The rising demand for pulses in plant-based products is driving the market's expansion. Additionally, the market is further influenced by growing export of pulses from the North American region. In addition to the expansions, R&D and the modernization of pulse-based product development process in the market has opened up more business potential for pulse market key players.

The North America pulses market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Pulse-Type (Lentils, Peas, Beans, Grams, Lupins, and Others), Nature (Organic and Conventional), End User (Household / Retail, Food Processing Industry, Flour Industry, and Animal Feed), Distribution Channel (Direct and Indirect)

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

armada FOODS, Broadgrain, Simpson Seeds Inc., Woodland Foods., Nuragro, The Scoular Company, AGT Food and Ingredients, Columbia Grain International., BRR International Inc., Prime Seeds International Inc., AdasCan Grain Corporation., and MEHSOM Corp among others. |

Market Definition

Pulse is a legume crop that contains beans, lentils, chickpeas, and peas. Pulse crops are grown for their edible seeds, which are used in soups, stews, salads, and snacks. These seeds are abundant in protein, fiber, and other minerals.

Moreover, pulse crops are frequently cultivated as rotational crops, which means they are sown in a field between other crops to help preserve the fertility and health of the soil. They are a crucial crop for farmers in many regions of the world, including North America, because to their drought resistance and ability to grow in a variety of soil types and temperatures.

North America Pulses Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- GROWING APPLICATION OF PULSES IN DIFFERENT INDUSTRIES

The application of pulses in various industries has risen in recent years, and this trend will likely continue. Pulses are food components that can be used as many things to make for their easy handling, cost-effectiveness, and nutritional value. Increasing awareness of nutrient deficiencies among populations, such as consumers with chronic diseases, energy deficiencies, and vegans, who may not get enough of certain nutrients from their diets alone, the pulse can be a good source of nutrition for them. In addition, recent finding about the functional properties that can be extracted from pulse makes industries and research and development sectors aware of utilizing pulses. This awareness makes industries well aware of using pulse as one of the raw materials. Not only the end-user consumers but also some industries such as the feed industry, bioplastic industry, and industries associated with functional foods also have a high demand for pulse due to its cost-effectiveness over the alternatives, increasing demand, and nutritional benefits. In addition, ongoing research trends based on the modern approaches to making new products using pulse are also shifting upwards. This research and the wide application of pulse in different industries also create an opportunity for the pulse market in North America to grow in the forecast period.

Opportunities

- HEALTH BENEFITS OF PULSE CONSUMPTION

As health factors and concerns are growing among the consumer and manufacturers of the food industry, the market has seen a shift toward sales growth. This awareness has led many consumers to make lifestyle changes like a healthy, protein-rich diet and increased natural and organic food consumption. Moreover, this awareness has opened up many new opportunities for the pulse market, as some pulse types, such as beans, lentils, and chickpeas, have health benefits when consumed. Pulse is a food component with good fiber and other nutritional benefits, such as proteins. In addition, the pulse has many kinds of classifications and categories. More or less, each category has been proven to be healthy and beneficial to consume. Recent research, health articles, and medical content promote the benefits of pulse among consumers and boost the market in the forecast period. Pulse is food with high fiber, which helps control a nutritional stock house for consumers as it contains a lot of bioactive compounds. These various health benefits of pulse grains are expected to boost the market in the forecast period.

Restraints/Challenges

- IMPACT DUE TO CLIMATE CHANGE

Climate change affects food system sustainability by influencing farmer livelihoods, consumer choices, and food security through changes in agroecosystems' natural and human components. Variations in temperature and precipitation directly impact the quantity and quality of pulse crop production and indirectly impact the scheduling of important farm operations and the economic effects of pests, weeds, and diseases. Adverse weather conditions also hamper the supply chain and transportation of pulses in the North American region.

For instance,

- In March 2023, according to Encyclopedia.com, being a major contributor to climate change, North America will also experience its effects: Over time, more greenhouse gas emissions have come from North America than any other region. This is primarily attributable to the United States, which historically ranks first among all countries in greenhouse gas emissions. Only behind China, the United States is currently the second-largest emitter of greenhouse gases worldwide. Changes in rainfall patterns and a sharp warming of the Arctic are only two examples of climate change already being seen in North America

- In March 2023, according to NewsHour Productions LLC, the extreme rainfall events brought on by climate change occurred in central and eastern North America between 2018 and 2021

- In February 2023, according to NBC UNIVERSAL, In the United States, 3.4 million people were estimated to be relocated by natural catastrophes in 2022. Hurricanes, floods, fires, and tornadoes uprooted the vast majority of these people. About 40% of people returned to their houses within a week. Around 16% of people have not (and may never) returned home, while 12% were displaced for over six months. Regional climate change has increased the frequency of these catastrophic disasters

Temperature and precipitation are the main climatic factors that can adversely affect pulse production in North America. Pulse is a specific-season crop depending on the area and conditions. This requires proper temperatures for growth and development. In the United States, the pulse is typically grown in areas with average temperatures ranging from 20°-25°C and 40-50 cm rainfall during the growing season. If temperatures are too low or too high, the growth of the pulses plant can be stunted, and yield can be reduced. Climate change is expected to impact pulse production worldwide, including North America. Rising temperatures and changes in precipitation patterns could reduce yields and affect the quality of pulses produced.

Post COVID-19 Impact on Pulses

The uncertainty brought on by the global coronavirus pandemic (COVID-19) has hampered the development of North American economies and altered the entire dynamics of the North American industries that contributed to the pandemic. Effects include behavioral adjustments (avoiding purchasing and consuming), changes in spending habits, efforts to contain disruptions in the supply of the market, volatile commodity prices, and rising debt loads. The effects of dramatic market tightening are also visible. All the nations have experienced a multi-layered crisis as a result of (COVID-19), including domestic economic disruptions, declining external demand, price collapses, and collapses in supply and demand of the products.

Post the pandemic, the demand for the pulse and pulse-based products has increased as there won't be any more restrictions on movement, so the supply of products would be easy. In addition, companies developed their processing units to manufacture pulse products, and the demand in the food processing industry, household, flour industries has also increased, which may propel the market's growth.

Moreover, the increasing demand for pulses will drive the market's growth. Furthermore, the demand for pulses in the household and retail industry after the COVID-19 pandemic has increased. Additionally, consumers' interest in pulses for their health benefit and research development is expected to fuel the growth of the North America pulses market

Recent Developments

- In March 2023, A manufacturing and distribution alliance for specialty plant-based ingredients was announced by The Scoular Company and Nepra Foods Inc. Nepra, a producer of wholesome plant-based and allergen-free food, and global agribusiness company The Scoular Company has entered into a partnership that will allow for co-development and collaboration on sales and marketing. Nepra's innovative research and development team will be used in the co-branded partnership's new product creation and specialized ingredients from both businesses. Both companies gain from the partnership, making Nepra products available through Scoular's extensive worldwide supply chain network

- In February 2020, to increase its sales and marketing efforts, WOODLAND FOODS, a leading importer and supplier of more than 1,600 specialty products, announced to enter the Mexican market. With the expansion, Woodland Foods has offered its whole product line to customers in Mexico and the Caribbean, including services for the industrial, food service, and retail industries

North America Pulses Market Scope

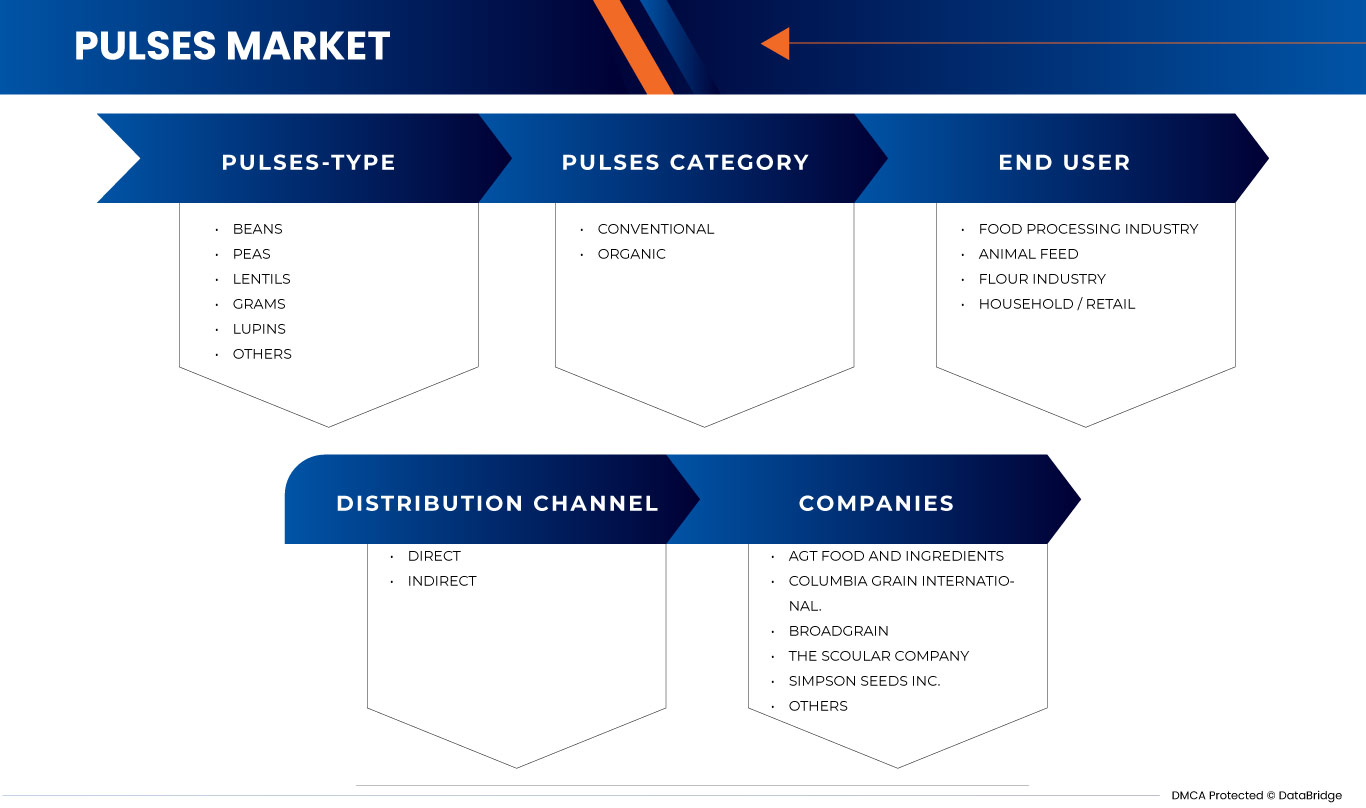

North America pulses market is segmented into four notable segments based on pulse type, nature, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY PULSE-TYPE

- Lentils

- Peas

- Beans

- Grams

- Lupins

- Others

On the basis of pulse type, the North America pulses market is segmented into lentils, peas, beans, grams, lupins, and others.

BY NATURE

- Organic

- Conventional

On the basis of nature, the North America pulses market is segmented into organic and conventional.

BY END USER

- Household/Retail

- Food Processing Industry

- Flour Industry

- Animal Feed

On the basis of end user, the North America pulses market is segmented into household/retail, food processing industry, flour industry, and animal feed.

BY DISTRIBUTION CHANNEL

- Direct

- Indirect

On the basis of distribution channel, the North America pulses market is segmented into direct and indirect.

North America Pulses Market Regional Analysis/Insights

North America pulses market are analyzed, and market size insights and trends are provided based on as referenced above.

The countries in the North America pulses market are the U.S., Canada, and Mexico. The U.S is dominating the North America pulses market with a CAGR of around 5.1%. The U.S. dominates the pulses market in the North America due to large production, easy availability of products and an increase in consumers.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Pulses Market Share Analysis

North America pulses market, competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America pulses market.

Some of the prominent participants operating in the North America pulses market are armada FOODS, Broadgrain, Simpson Seeds Inc., Woodland Foods., Nuragro, The Scoular Company, AGT Food and Ingredients, Columbia Grain International., BRR International Inc., Prime Seeds International Inc., AdasCan Grain Corporation., and MEHSOM Corp among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PULSES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA PULSES MARKET

4.2 FACTORS AFFECTING PURCHASE DECISION

4.2.1 PRODUCT PRICING

4.2.2 PULSE TYPE AND NUTRITIONAL CONTENT

4.2.3 AUTHENTICITY OF PRODUCT

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.4.1 IMPACT OF COVID-19 AND WAR

4.4.2 IMPACT ON PRICE

4.4.3 IMPACT ON SUPPLY CHAIN

4.5 IMPORT-EXPORT ANALYSIS

4.5.1 IMPORTERS

4.5.2 EXPORTERS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6.1 RISING RESEARCH AND DEVELOPMENT AND TECHNOLOGY IN THE PULSE INDUSTRY

4.6.2 PLANT-BASED PRODUCT LAUNCHES BY MANUFACTURERS

4.6.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.7 OVERVIEW OF VITERRA, ETG, AND ADM

4.7.1 ETC GROUP (ETG)

4.7.2 VITERRA

4.8 PRICING INDEX

4.8.1 PRICING ANALYSIS

4.9 PRODUCTION AND CONSUMPTION ANALYSIS

4.9.1 NORTH AMERICA PRODUCTION AND CONSUMPTION TREND

4.9.2 PRODUCTION ANALYSIS

4.9.3 CONSUMPTION ANALYSIS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 PRODUCTION AND PROCESSING

4.10.2 DISTRIBUTION

4.10.3 END USERS

4.11 TECHNOLOGICAL INNOVATION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING EXPORT OF PULSES FROM NORTH AMERICA

6.1.2 GROWING APPLICATION OF PULSES IN DIFFERENT INDUSTRIES

6.1.3 RISING DEMAND FOR PULSES IN PLANT-BASED PRODUCTS

6.1.4 RESEARCH AND DEVELOPMENT ON INNOVATIVE PRODUCT LAUNCHES BY MANUFACTURER

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN PRICES OF PULSES IN THE NORTH AMERICAN MARKET

6.2.2 LACK OF CONSUMER AWARENESS

6.3 OPPORTUNITIES

6.3.1 HEALTH BENEFITS OF PULSE CONSUMPTION

6.3.2 ACTIVE ENGAGEMENT OF THE KEY MARKET PLAYERS IN THE MARKET

6.3.3 INCREASING NUMBER OF VEGAN POPULATIONS

6.4 CHALLENGES

6.4.1 IMPACT DUE TO CLIMATE CHANGE

6.4.2 AVAILABLE ALTERNATIVES OF PROTEIN SOURCES OTHER THAN PULSES

7 NORTH AMERICA PULSES MARKET, BY PULSE-TYPE

7.1 OVERVIEW

7.2 BEANS

7.2.1 BEANS, BY TYPE

7.2.1.1 CHICKPEAS

7.2.1.2 KIDNEY BEANS

7.2.1.3 GREEN BEANS

7.2.1.4 BLACK BEANS

7.2.1.5 WHITE BEANS

7.2.1.6 RED BEANS

7.2.1.7 OTHERS

7.2.2 BEANS, BY PULSES CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.3 PEAS

7.3.1 PEAS, BY TYPE

7.3.1.1 GREEN PEA

7.3.1.2 YELLOW PEA

7.3.2 PEAS, BY PULSES CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.4 LENTILS

7.4.1 LENTILS, BY TYPE

7.4.1.1 GREEN LENTILS

7.4.1.2 RED LENTILS

7.4.1.3 BLACK LENTILS

7.4.1.4 BROWN LENTILS

7.4.2 LENTILS, BY PULSES CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.5 GRAMS

7.5.1 GRAMS, BY TYPE

7.5.1.1 BLACK GRAMS

7.5.1.2 GREEN GRAMS

7.5.2 GRAMS, BY PULSES CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.6 LUPINS

7.6.1 LUPINS, BY PULSES CATEGORY

7.6.1.1 CONVENTIONAL

7.6.1.2 ORGANIC

7.7 OTHERS

7.7.1 OTHERS, BY PULSES CATEGORY

7.7.1.1 CONVENTIONAL

7.7.1.2 ORGANIC

8 NORTH AMERICA PULSES MARKET, BY NATURE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 NORTH AMERICA PULSES MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD PROCESSING INDUSTRY

9.2.1 FOOD PROCESSING INDUSTRY, BY TYPE

9.2.1.1 SNACKS

9.2.1.1.1 TORTILLAS

9.2.1.1.2 CRIPS/CHIPS

9.2.1.1.3 PASTA

9.2.1.1.4 NACHOS

9.2.1.1.5 PRETZELS

9.2.1.1.6 OTHERS

9.2.1.2 NUTRITION BARS

9.2.1.3 BAKERY

9.2.1.3.1 BISCUITS & COOKIES

9.2.1.3.2 BREAD

9.2.1.3.3 WAFFLES

9.2.1.3.4 PANCAKES

9.2.1.3.5 CAKES

9.2.1.3.6 MUFFIN

9.2.1.3.7 OTHERS

9.2.1.4 PLANT-BASED DAIRY PRODUCTS

9.2.1.4.1 PLANT-BASED MILK

9.2.1.4.2 PLANT-BASED YOUGURT

9.2.1.4.3 PLANT-BASED CHEESE

9.2.1.4.4 OTHERS

9.2.1.5 PLANT-BASED MEAT

9.2.1.5.1 MEAT CHUNKS

9.2.1.5.2 SAUSAGES

9.2.1.5.3 NUGGETS

9.2.1.5.4 STRIPS

9.2.1.5.5 BACON

9.2.1.5.6 FILLETS

9.2.1.5.7 OTHERS

9.2.1.6 SPORTS NUTRITION

9.2.1.7 BABY FOOD

9.2.1.8 OTHERS

9.2.2 FOOD PROCESSING INDUSTRY, BY PULSES- TYPE

9.2.2.1 BEANS

9.2.2.2 PEAS

9.2.2.3 LENTILS

9.2.2.4 GRAMS

9.2.2.5 LUPINS

9.2.2.6 OTHERS

9.3 ANIMAL FEED

9.3.1 ANIMAL FEED, BY PULSE-TYPE

9.3.1.1 BEANS

9.3.1.2 PEAS

9.3.1.3 LENTILS

9.3.1.4 GRAMS

9.3.1.5 LUPINS

9.3.1.6 OTHERS

9.4 FLOUR INDUSTRY

9.4.1 FLOUR INDUSTRY, BY PULSE-TYPE

9.4.1.1 BEANS

9.4.1.2 PEAS

9.4.1.3 LENTILS

9.4.1.4 GRAMS

9.4.1.5 LUPINS

9.4.1.6 OTHERS

9.5 HOUSEHOLD/RETAIL

9.5.1 HOUSEHOLD/RETAIL, BY PULSE-TYPE

9.5.1.1 BEANS

9.5.1.2 PEAS

9.5.1.3 LENTILS

9.5.1.4 GRAMS

9.5.1.5 LUPINS

9.5.1.6 OTHERS

10 NORTH AMERICA PULSES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 NORTH AMERICA PULSES MARKET, BY COUNTRIES

11.1 OVERVIEW

11.1.1 U.S.

11.1.2 MEXICO

11.1.3 CANADA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY SHARE ANALYSIS

14.1 AGT FOOD AND INGREDIENTS

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 COLUMBIA GRAIN INTERNATIONAL.

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 BROADGRAIN

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 THE SCOULAR COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 SIMPSON SEEDS INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 ADASCAN GRAIN CORPORATION.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 ARMADA FOODS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BRR INTERNATIONAL INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 MEHSOM CORP

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 NURAGRO

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 PRIME SEEDS INTERNATIONAL INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 WOODLAND FOODS.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 THERE HAS BEEN AN UPSURGE IN THE PRICES OF PULSES IN THE US DUE TO DROUGHT CONDITIONS FROM 2019-20 TO 2020-21. CWT-HUNDREDWEIGHT

TABLE 2 LIST OF IMPORTERS FOR DRIED LEGUMINOUS VEGETABLES, SHELLED, WHETHER OR NOT SKINNED OR SPLIT, HS CODE- 0713, UNIT (TONS)

TABLE 3 LIST OF EXPORTERS FOR DRIED LEGUMINOUS VEGETABLES, SHELLED, WHETHER OR NOT SKINNED OR SPLIT, HS CODE- 0713, UNIT (TONS)

TABLE 4 NORTH AMERICA PULSE PRICES (USD/TON)

TABLE 5 PULSE PRODUCTION (KILO TONS)

TABLE 6 PULSE CONSUMPTION (KILO TONS)

TABLE 7 NORTH AMERICA PULSES MARKET: BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA BEANS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BEANS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA BUILDING & CONSTRUCTION IN PULSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PEAS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA LENTILS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA LENTILS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA GRAMS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA GRAMS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LUPINS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PULSES MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PULSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HOUSEHOLD/RETAIL IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA SNACKS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA BAKERY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA PLANT-BASED DAIRY PRODUCTS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PLANT-BASED MEAT IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD PROCESSIN INDUSTRY IN PULSES MARKET, BY PULSES- TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ANIMAL FEEED IN PULSES MARKET, BY PULSES- TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FLOUR INDUSTRY IN PULSES MARKET, BY PULSES- TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA HOUSEHOLD/RETAIL IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA PULSES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA PULSES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 31 U.S. PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. LENTILS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. LENTILS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 34 U.S. PEAS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 U.S. PEAS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 U.S. BEANS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BEANS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 U.S. GRAMS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 U.S. GRAMS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 40 U.S. LUPINS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 U.S. OTHERS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 42 U.S. PULSES MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 43 U.S. PULSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 44 U.S. HOUSEHOLD / RETAIL IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. FOOD PROCESSING INDUSTRY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. SNACKS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. BAKERY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. PLANT-BASED MEAT IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.S. PLANT-BASED DAIRY PRODUCTS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. FOOD PROCESSING INDUSTRY IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. FLOUR INDUSTRY IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. ANIMAL FEED IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. PULSES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 54 MEXICO PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 55 MEXICO LENTILS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 MEXICO LENTILS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 57 MEXICO PEAS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO PEAS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 59 MEXICO BEANS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO BEANS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 61 MEXICO GRAMS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO GRAMS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 63 MEXICO LUPINS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 64 MEXICO OTHERS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 65 MEXICO PULSES MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO PULSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HOUSEHOLD / RETAIL IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO FOOD PROCESSING INDUSTRY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO SNACKS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO BAKERY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MEXICO PLANT-BASED MEAT IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 MEXICO PLANT-BASED DAIRY PRODUCTS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO FOOD PROCESSING INDUSTRY IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 74 MEXICO FLOUR INDUSTRY IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 75 MEXICO ANIMAL FEED IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 76 MEXICO PULSES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 77 CANADA PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA LENTILS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA LENTILS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 80 CANADA PEAS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA PEAS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 82 CANADA BEANS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA BEANS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 84 CANADA GRAMS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA GRAMS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 86 CANADA LUPINS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 CANADA OTHERS IN PULSES MARKET, BY PULSES CATEGORY, 2021-2030 (USD MILLION)

TABLE 88 CANADA PULSES MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 89 CANADA PULSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 90 CANADA HOUSEHOLD / RETAIL IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA FOOD PROCESSING INDUSTRY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 CANADA SNACKS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 CANADA BAKERY IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA PLANT-BASED MEAT IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 CANADA PLANT-BASED DAIRY PRODUCTS IN PULSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA FOOD PROCESSING INDUSTRY IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 97 CANADA FLOUR INDUSTRY IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 98 CANADA ANIMAL FEED IN PULSES MARKET, BY PULSE-TYPE, 2021-2030 (USD MILLION)

TABLE 99 CANADA PULSES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PULSES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PULSES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PULSES MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA PULSES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PULSES MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PULSES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PULSES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PULSES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA PULSES MARKET: SEGMENTATION

FIGURE 10 RISING EXPORT OF PULSE FROM NORTH AMERICA IS DRIVING THE GROWTH OF THE NORTH AMERICA PULSES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE BEANS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PULSES MARKET IN 2023 & 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA PULSES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PULSES MARKET

FIGURE 14 NORTH AMERICA PULSES MARKET: BY PULSE-TYPE, 2022

FIGURE 15 NORTH AMERICA PULSES MARKET: BY NATURE, 2022

FIGURE 16 NORTH AMERICA PULSES MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA PULSES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 18 NORTH AMERICA PULSES MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA PULSES MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA PULSES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA PULSES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA PULSES MARKET: BY PULSE-TYPE (2023-2030)

FIGURE 23 NORTH AMERICA PULSES MARKET: COMPANY SHARE 2022 (%)

North America Pulses Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Pulses Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Pulses Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.