North America Radiology Services Market

Market Size in USD Billion

CAGR :

%

USD

11.41 Billion

USD

21.27 Billion

2025

2033

USD

11.41 Billion

USD

21.27 Billion

2025

2033

| 2026 –2033 | |

| USD 11.41 Billion | |

| USD 21.27 Billion | |

|

|

|

|

North America Radiology Services Market Size

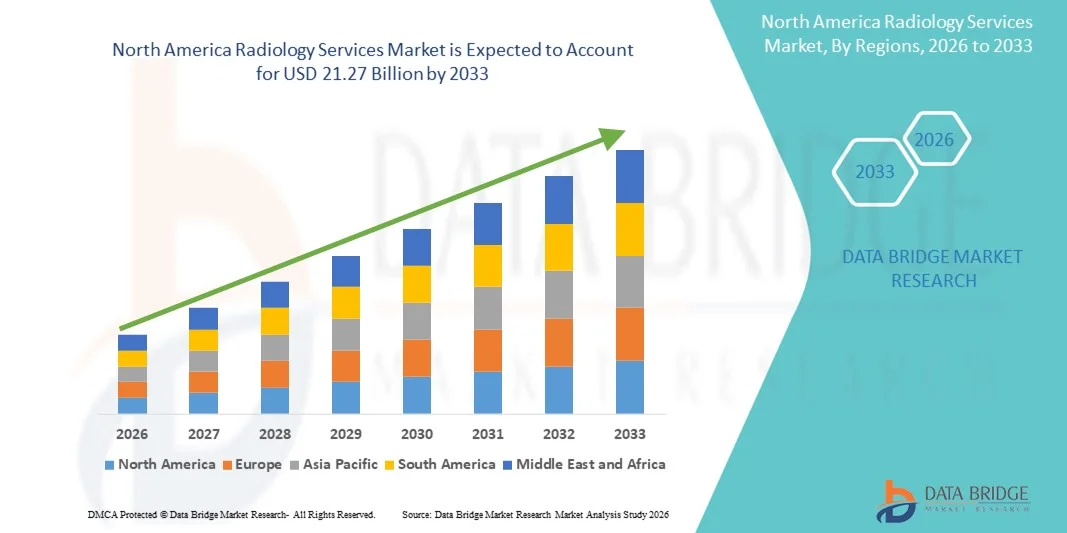

- The North America radiology services market size was valued at USD 11.41 billion in 2025 and is expected to reach USD 21.27 billion by 2033, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by the rising demand for advanced diagnostic imaging, continuous technological progress in modalities such as MRI, CT, ultrasound, and digital X-ray systems, and the increasing digitalization of healthcare facilities across both developed and emerging region

- Furthermore, growing patient preference for accurate, non-invasive diagnostic procedures, along with the expanding adoption of AI-integrated imaging solutions for faster and more precise interpretations, is accelerating the uptake of Radiology Services, thereby significantly boosting the industry’s growth

North America Radiology Services Market Analysis

- Radiology services, encompassing diagnostic imaging modalities such as X-ray, MRI, CT, ultrasound, and nuclear imaging, are increasingly vital components of modern healthcare systems in both hospital and outpatient settings due to their critical role in early disease detection, treatment planning, and real-time monitoring of patient conditions

- The escalating demand for radiology services is primarily fueled by the rising prevalence of chronic diseases, growing focus on preventive healthcare, rapid advancements in imaging technologies (including AI-assisted interpretation), and the global shift toward minimally invasive diagnostic procedures

- The U.S. dominated the Radiology Services market with the largest revenue share of 40.8% in 2025, supported by advanced healthcare infrastructure, higher diagnostic imaging utilization rates, and strong presence of leading radiology equipment manufacturers and service providers. The U.S. experienced substantial growth due to increased adoption of AI-driven imaging platforms, early disease detection programs, and rising demand for outpatient diagnostic centers

- Canada is expected to be the fastest-growing region in the Radiology Services market during the forecast period, with an anticipated CAGR from 2026 to 2033, driven by improving healthcare access, rising medical tourism, expanding government investments in diagnostic imaging, and increasing awareness of early disease screening

- The Adults segment dominated the largest market revenue share of 78.2% in 2025, driven by the higher incidence of chronic diseases such as cancer, cardiovascular disorders, arthritis, and neurological conditions requiring frequent imaging

Report Scope and Radiology Services Market Segmentation

|

Attributes |

Radiology Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

• Siemens Healthineers (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Radiology Services Market Trends

Enhanced Convenience Through AI-Driven Workflow Optimization

- A significant and accelerating trend in the Radiology Services market is the deepening integration of artificial intelligence (AI) and automation into diagnostic workflows, enabling faster image interpretation, reduced clinical workload, and higher operational efficiency across healthcare settings. AI-powered imaging platforms support radiologists by prioritizing critical cases, detecting abnormalities in real time, and improving reporting accuracy

- For instance, leading radiology solution providers in the U.S. have integrated AI-driven triage systems that automatically flag urgent findings such as suspected stroke, pulmonary embolism, or fractures. These solutions enable radiology departments to deliver faster patient care, especially in overburdened emergency and trauma centers. AI-based workflow engines also automate repetitive administrative tasks such as scheduling, image sorting, and reporting templates, contributing to overall productivity

- AI integration in radiology further enables advanced capabilities such as disease early-detection algorithms, automated segmentation, and predictive analytics. For example, several FDA-cleared AI tools now assist radiologists in detecting lung nodules, breast cancer lesions, and cardiovascular complications with improved sensitivity. These tools continue to learn from large datasets, enhancing accuracy over time and helping reduce diagnostic errors

- The seamless integration of radiology AI systems with hospital picture archiving and communication systems (PACS) and electronic health records (EHR) allows clinicians to access imaging, reports, and clinical data from a single interface. This unified and automated approach optimizes clinical decision-making, reduces delays, and ensures a smoother diagnostic experience for both patients and providers

- This trend toward more intelligent, automated, and interconnected radiology systems is fundamentally transforming diagnostic standards across hospitals, imaging centers, and outpatient facilities. Consequently, companies are expanding AI-enabled radiology platforms with features such as automated quality checks, enhanced image reconstruction, and standardized reporting

- The demand for radiology services enhanced with AI-driven workflow optimization is rising rapidly across North America as healthcare providers prioritize efficiency, diagnostic accuracy, and high patient throughput

North America Radiology Services Market Dynamics

Driver

Growing Demand for Early Diagnosis and Expansion of Imaging Modalities

- The increasing burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is driving a heightened demand for radiology services across North America. Early detection through advanced imaging modalities has become a clinical priority, accelerating the consumption of CT, MRI, ultrasound, X-ray, and nuclear imaging services

- For instance, in April 2025, several major health systems in the U.S. announced expansions of their radiology departments to accommodate rising patient volumes and incorporate advanced imaging technologies. Such investments are expected to strengthen the Radiology Services industry growth in the forecast period

- Advancements in imaging technologies—including high-resolution MRI scanners, low-dose CT systems, and digital X-ray platforms—are improving diagnostic accuracy while minimizing patient exposure. These improvements encourage healthcare providers to upgrade their radiology infrastructure

- Furthermore, the growing preference for minimally invasive diagnostic procedures supports the expanding use of image-guided interventions. The increased adoption of outpatient imaging centers and tele-radiology services also contributes significantly to market expansion across the region

- The availability of AI-enabled imaging tools, enhanced reporting systems, and improved clinical workflows has further accelerated radiology adoption in both specialized and general healthcare settings

Restraint/Challenge

Concerns Regarding High Equipment Costs and Workflow Inefficiencies

- The high cost associated with advanced imaging equipment—such as MRI, CT, and PET-CT scanners—poses a significant challenge to broader market expansion. Many healthcare facilities, especially smaller centers and independent clinics, find it difficult to afford installation, maintenance, and periodic upgrades of these technologies

- For instance, high-capital investment requirements for next-generation radiology systems have discouraged some healthcare providers from timely upgrades, limiting access to advanced imaging services in certain regions

- Operational challenges such as radiologist shortages, high patient volumes, and workflow inefficiencies further hinder optimal service delivery. Delays in reporting, administrative bottlenecks, and limited interoperability between radiology platforms contribute to productivity concerns

- Addressing these challenges through better reimbursement models, adoption of cloud-based imaging solutions, and optimized workflow technologies will be vital for sustaining market growth. In addition, ongoing workforce development and training in advanced imaging interpretation are essential for enhancing service quality

- While the adoption of digital radiology continues to increase, the financial and operational barriers associated with implementing high-end systems remain key obstacles for widespread market penetration across

North America Radiology Services Market Scope

The market is segmented on the basis of type, procedure, patient age, radiation type, application, and end users.

- By Type

On the basis of type, the Radiology Services market is segmented into Stationary Digital Radiology Systems and Portable Digital Radiology Systems. The Stationary Digital Radiology Systems segment dominated the largest market revenue share of 64.3% in 2025, driven by their extensive use in hospitals and diagnostic centers for high-volume imaging procedures requiring advanced clarity and precision. These systems offer greater stability, large detector panels, and superior processing capabilities suitable for complex diagnostic needs. Their integration with PACS and RIS platforms enhances workflow efficiency and reporting accuracy. Government investments in radiology departments further strengthen adoption. Hospitals prefer stationary systems due to long-term durability, scalability, and support for multi-modality imaging. High reimbursement coverage for in-facility imaging boosts utilization. Continuous technological advancements improve image resolution and reduce radiation dose. Growing prevalence of chronic conditions increases demand for frequent imaging. Training and skill development in radiology departments prioritize stationary platforms. Large healthcare networks standardize operations using stationary systems. Their advanced automation features elevate productivity. Reliable maintenance and service networks reinforce market dominance.

The Portable Digital Radiology Systems segment is expected to witness the fastest CAGR of 12.4% from 2026 to 2033, driven by rising demand for bedside imaging and point-of-care diagnostics. Portable systems enable rapid imaging for critical care, emergency departments, and operating rooms. Their mobility supports imaging in remote locations and home-care settings. Healthcare providers increasingly adopt portable systems to reduce patient movement risks. COVID-19 accelerated adoption due to need for isolation-area imaging. Lightweight designs and wireless connectivity improve operational flexibility. Battery-powered models ensure uninterrupted functionality during emergencies. Rural healthcare initiatives encourage use in underdeveloped regions. Integration with cloud platforms allows instant image transfer. Reduced installation costs improve affordability. Growing use in mobile diagnostic vans enhances reach. Technological improvements elevate image quality to near stationary system levels. Portable radiology supports faster triaging and clinical decision-making.

- By Procedure

On the basis of procedure, the Radiology Services market is segmented into Conventional and Digital. The Digital segment dominated the largest market revenue share of 71.5% in 2025, driven by superior image quality, lower radiation dose, and faster processing compared to conventional radiology. Digital platforms enable instant image review and remote consultation through PACS systems. Hospitals and diagnostic centers increasingly shift to digital due to high efficiency and workflow automation. Digital procedures reduce operational errors and improve diagnostic accuracy. Cloud-based archiving enhances data security and accessibility. Reimbursement policies favor digital imaging, supporting wider adoption. The demand for AI-assisted digital imaging is rapidly increasing. Digital radiology minimizes repeat scans, boosting patient safety. Government modernization programs promote digital infrastructure in radiology. Clinics prefer digital platforms for seamless integration with electronic health records. Digital upgrades extend equipment life cycles. Routine imaging examinations in chronic disease monitoring rely heavily on digital systems. Advancements in detector technology continue to drive segment dominance.

The Conventional segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, sustained by its cost-effectiveness in low-resource settings. Small clinics and rural healthcare centers still rely on conventional imaging due to lower equipment investment. Conventional radiology remains suitable for basic skeletal and chest evaluations. Training requirements are minimal, supporting adoption in developing regions. Government health outreach programs use conventional radiology for large-scale screenings. Portable conventional units support temporary medical camps. Maintenance and spare parts availability keeps adoption steady. Some countries retain conventional systems for redundancy. Hospitals in emerging markets utilize conventional radiology during digital system downtime. The affordability of film-based imaging attracts smaller diagnostic setups. Conventional systems are still widely used in veterinary imaging. Incremental upgrades keep systems serviceable for extended years. Despite digital growth, conventional radiology remains essential in low-cost healthcare delivery environments.

- By Patient Age

On the basis of patient age, the Radiology Services market is segmented into Adults and Pediatric. The Adults segment dominated the largest market revenue share of 78.2% in 2025, driven by the higher incidence of chronic diseases such as cancer, cardiovascular disorders, arthritis, and neurological conditions requiring frequent imaging. Growing geriatric population significantly boosts demand. Adults undergo more diagnostic tests for trauma, orthopedic issues, and lifestyle-related diseases. Hospitals prioritize advanced imaging systems for adult patients due to high throughput. Screening programs for early cancer detection contribute to imaging volume. Adult patients benefit from specialized imaging protocols offering superior accuracy. Increased health insurance penetration supports higher radiology service utilization. Rising surgical interventions for adults increase pre- and post-operative imaging demand. Fitness and wellness trends drive preventive imaging. AI-assisted adult radiology solutions accelerate workflow efficiency. Corporate health checks contribute additional imaging demand. Expansion of outpatient imaging centers strengthens access for adults. Advancements in imaging technology enhance diagnostic precision for complex adult cases.

The Pediatric segment is expected to witness the fastest CAGR of 11.6% from 2026 to 2033, driven by rising awareness of early disease detection in children. Pediatric radiology requires low-dose, child-safe imaging techniques, increasing adoption of advanced systems. Hospitals invest in pediatric-specific radiology suites to reduce radiation exposure risks. Congenital disorders and developmental abnormalities contribute to imaging requirements. AI-enabled pediatric imaging enhances accuracy in difficult-to-interpret cases. Pediatric trauma cases increase demand for emergency radiology. Tele-radiology expands pediatric imaging access in underserved regions. Growing prevalence of respiratory infections drives chest imaging volumes. Government programs promote neonatal and pediatric screening. Portable systems support bedside imaging for critical pediatric patients. Specialized training in pediatric radiology enhances service quality. Parents increasingly seek preventive imaging for early diagnosis. Expanding pediatric hospitals and children’s specialty centers further fuel market growth.

- By Radiation Type

On the basis of radiation type, the Radiology Services market is segmented into Diagnostics and Interventional Radiology. The Diagnostics segment dominated the largest market revenue share of 69.8% in 2025, driven by rising demand for X-rays, CT scans, and MRI for early disease detection and clinical evaluation. Diagnostic imaging supports routine examinations for chronic diseases. Hospitals rely on diagnostic radiology for high-volume, fast-turnaround imaging. AI-powered diagnostic tools enhance interpretation accuracy and reduce errors. Screening programs for heart disease and cancer expand diagnostic imaging volumes. Diagnostic imaging is crucial in emergency departments for trauma and acute illnesses. Insurance policies typically cover diagnostic scans, increasing accessibility. Technological advances improve image clarity and reduce radiation dose. Outpatient centers rely heavily on diagnostic radiology to attract patients. Remote diagnostics through tele-radiology increases reach. Digital archiving improves clinical workflow efficiency. Chronic population growth drives continuous demand. Diagnostic radiology remains the backbone of overall healthcare imaging services.

The Interventional Radiology segment is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, driven by growing preference for minimally invasive procedures. Interventional radiology reduces hospital stays and recovery times. Rising cases of cardiovascular and cancer patients increase demand for image-guided treatments. Technological advancements improve device precision and imaging guidance. Hospitals establish specialized interventional radiology suites to expand capacity. AI and robotics enhance accuracy in interventional procedures. Reimbursement support fuels adoption of minimally invasive therapies. Increasing patient preference for less painful procedures boosts usage. Interventional radiology plays a critical role in emergency clot retrieval and vascular interventions. Growing oncological interventions such as tumor ablation drive segment growth. Specialist training programs expand skilled workforce availability. Integration with hybrid operating rooms enhances treatment flexibility. Research and innovations continue to improve clinical outcomes.

- By Application

On the basis of application, the Radiology Services market is segmented into Cardiovascular, Oncology, Gynecology, Neurology, Urology, Dental, Pelvic and Abdominal, Musculoskeletal, and Others. The Cardiovascular segment dominated the largest market revenue share of 28.7% in 2025, driven by increasing prevalence of heart diseases, hypertension, and stroke. Cardiovascular imaging supports diagnosis of heart failure, structural abnormalities, and vascular diseases. Hospitals rely heavily on CT angiography and cardiac MRI for precision assessment. Screening initiatives for early cardiac detection boost imaging demand. Cardiologists depend on real-time radiology data for treatment planning. Advanced imaging techniques reduce the need for invasive diagnostic procedures. AI tools improve detection of subtle cardiac abnormalities. Growing elderly population increases cardiovascular imaging volumes. Emergency departments frequently use radiology for acute cardiac evaluations. Insurance reimbursement supports widespread usage. Cardiac imaging technologies continue improving accuracy and speed. Hybrid imaging expands clinical applications. Rising global burden of cardiac diseases sustains steady demand.

The Oncology segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, driven by increasing cancer incidence and expanding applications of imaging in detection, staging, and treatment monitoring. Advanced modalities like PET-CT and MRI guide precise tumor assessment. Imaging is critical for radiotherapy planning. Early cancer screening programs significantly increase imaging volumes. Oncology patients require repeated imaging throughout treatment cycles. AI and machine learning improve tumor detection sensitivity. Hospitals invest heavily in oncology imaging infrastructure. Personalized medicine drives demand for accurate imaging biomarkers. Growth in oncology centers fuels specialized imaging services. Rising awareness encourages early cancer diagnosis. Government programs support affordable cancer screening. Technological innovations continue enhancing oncology imaging. Increasing survivorship rates maintain long-term imaging needs.

- By End Users

On the basis of end users, the Radiology Services market is segmented into Hospitals, Ambulatory Centers, Diagnostic Centers, and Clinics. The Hospitals segment dominated the largest market revenue share of 58.4% in 2025, supported by advanced imaging infrastructure and availability of multidisciplinary care. Hospitals handle complex cases requiring high-end imaging such as MRI, CT, PET-CT, and interventional radiology. Emergency departments drive significant imaging volumes. Surgeons rely on high-resolution imaging for pre-operative and post-operative evaluations. Hospitals integrate AI-powered diagnostic systems for accuracy and efficiency. Government funding strengthens hospital radiology upgrades. Hospitals benefit from established reimbursement networks. Staff expertise ensures accurate imaging interpretation. Advanced PACS systems enhance workflow productivity. Hospitals serve as referral centers for complex imaging needs. Continuous training programs improve clinical radiology skills. Large patient footfall ensures steady imaging volume. Hospital-based radiology remains the cornerstone of diagnostic healthcare.

The Ambulatory Centers segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, driven by rising demand for cost-effective, fast-turnaround outpatient imaging. Ambulatory centers provide convenient radiology access with shorter wait times. Their flexible scheduling attracts non-emergency patients. Lower operating costs make imaging more affordable. Advanced digital imaging devices enhance diagnostic accuracy in ambulatory settings. Expansion of urban ambulatory networks increases patient reach. Corporate health programs frequently partner with ambulatory centers for routine screening. Insurance reimbursement encourages outpatient imaging utilization. Ambulatory centers adopt AI tools for efficient workflow management. Tele-radiology partnerships allow expert interpretation. Increasing shift toward outpatient surgeries boosts imaging demand. Rapid expansion in developing regions increases availability. Growing patient preference for convenience fuels sustained growth.

North America Radiology Services Market Regional Analysis

- North America dominated the radiology services market with the largest revenue share in 2025, driven by advanced healthcare infrastructure, high diagnostic imaging utilization rates, and increasing adoption of digital radiology systems across hospitals and outpatient centers

- Consumers in the region highly value the accuracy, speed, and enhanced diagnostic capabilities enabled by modern radiology services, including AI-assisted imaging, early disease detection programs, and seamless integration with electronic health record (EHR) systems

- This widespread adoption is further supported by rising healthcare expenditure, a technologically advanced population, and the growing preference for fast, reliable, and minimally invasive diagnostic procedures, establishing radiology services as a critical component of modern healthcare delivery

U.S. Radiology Services Market Insight

The U.S. radiology services market captured the largest revenue share of 40.8% in 2025 within North America, supported by strong investments in advanced imaging technologies, adoption of AI-driven diagnostic platforms, and early implementation of nationwide disease-screening programs. The U.S. market continues to expand due to, High utilization of MRI, CT, and digital X-ray systems, Rising demand for outpatient diagnostic centers, Growing emphasis on early detection of chronic diseases and Strong presence of leading radiology equipment manufacturers and service providers

Canada Radiology Services Market Insight

Canada radiology services market is expected to be the fastest-growing market in North America from 2026 to 2033, driven by improving access to diagnostic imaging, rising medical tourism, and expanding government investment in radiology infrastructure. Growing awareness of early disease screening, adoption of portable imaging systems, and rapid expansion of diagnostic centers are further contributing to market acceleration in Canada.

North America Radiology Services Market Share

The Radiology Services industry is primarily led by well-established companies, including:

• Siemens Healthineers (Germany)

• GE HealthCare (U.S.)

• Philips Healthcare (Netherlands)

• Canon Medical Systems Corporation (Japan)

• Fujifilm Holdings Corporation (Japan)

• Hologic, Inc. (U.S.)

• Agfa-Gevaert Group (Belgium)

• Carestream Health (U.S.)

• Varian Medical Systems (U.S.)

• Hitachi Healthcare (Japan)

• Esaote SpA (Italy)

• Mindray Medical International (China)

• Shimadzu Corporation (Japan)

• Konica Minolta Healthcare (Japan)

• Samsung Medison (South Korea)

• Toshiba Medical Systems (Japan)

• United Imaging Healthcare (China)

• Bracco Imaging (Italy)

• Guerbet Group (France)

• Medtronic (Ireland)

Latest Developments in North America Radiology Services Market

- In May 2024, the U.S. Food and Drug Administration (FDA) added more than 120 new AI-enabled medical devices focused on radiology to its list of approved devices — significantly expanding the availability of AI tools for imaging, diagnostics, workflow automation and image reconstruction

- In December 2024, Bayer announced at the Radiological Society of North America Annual Meeting (RSNA 2024) that it will roll out its new CT-injection system MEDRAD Centargo CT Injection System along with a connected digital-workflow platform (Cortenic) — signalling a push toward more integrated, efficient radiology suites combining hardware, software, and workflow tools

- In July 2025, a report confirmed that more than 1,000 clinical AI applications have now been cleared for medical use by the FDA — with radiology applications accounting for over 70% of those clearances, underscoring radiology’s leadership in AI-enabled clinical imaging tools

- In May 2025, the radiology software company Blackford Analysis announced a commercial partnership to integrate its AI-powered bone-health algorithm (detecting bone mineral density reductions via standard X-rays) into its imaging platform — allowing early detection of osteoporosis or osteopenia without dedicated bone-density scans

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.