North America Radiotherapy Market

Market Size in USD Billion

CAGR :

%

USD

3.76 Billion

USD

8.06 Billion

2024

2032

USD

3.76 Billion

USD

8.06 Billion

2024

2032

| 2025 –2032 | |

| USD 3.76 Billion | |

| USD 8.06 Billion | |

|

|

|

|

North America Radiotherapy Market Size

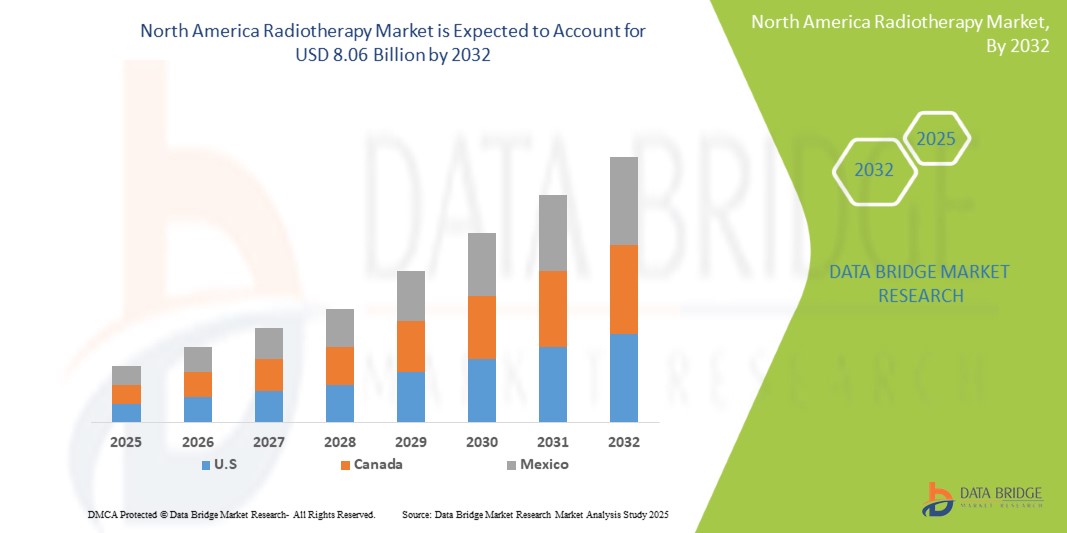

- The North America radiotherapy market size was valued at USD 3.76 billion in 2024 and is expected to reach USD 8.06 billion by 2032, at a CAGR of 10.4% during the forecast period

- The market growth is growing prevalence of cancer disease, novel technology in radiotherapy for cancer treatment and increasing adoption of radiotherapy devices and procedures

- Furthermore, the market is expected to increasing healthcare expenditure for cancer treatment, growing government initiatives toward cancer treatment and rising patients’ awareness towards cancer treatment

North America Radiotherapy Market Analysis

- The North America rise in cancer prevalence, increasing adoption of advanced radiotherapy techniques such as intensity-modulated radiotherapy (IMRT), stereotactic body radiotherapy (SBRT), and proton therapy, along with technological advancements in imaging and treatment planning systems, are key driving factors expected to propel the growth of the North America radiotherapy market

- Key factors such as rising demand for non-invasive and targeted cancer treatment solutions, growing investments in oncology-focused R&D, continuous innovation in radiotherapy equipment, and supportive government policies and funding for cancer care infrastructure are driving the growth of the North America radiotherapy market

- U.S dominated North America radiotherapy market with the market share of 80.41% in 2024 and is expected to grow with the fastest CAGR of 10.7% in the forecast period of 2025 to 2032 due to growing prevalence of cancer disease, novel technology in radiotherapy for cancer treatment and increasing adoption of radiotherapy devices and procedures

- The external beam radiotherapy segment dominated the market with a 60.93% in 2024 market share, growing with the CAGR of 10.7% in the forecast period of 2025 to 2032. driven growing prevalence of cancer disease, novel technology in radiotherapy for cancer treatment and increasing adoption of radiotherapy devices and procedures.

Report Scope and North America Radiotherapy Market Segmentation

|

Attributes |

North America Radiotherapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Radiotherapy Market Trends

“Rising Demand for Advanced, Non-Invasive, and Precision-Based Cancer Treatment Solutions Across Healthcare Systems”

- Demand for advanced, non-invasive, and precision-based cancer treatment solutions is growing rapidly—driven by increasing cancer prevalence, rising patient awareness, and a shift toward personalized medicine across healthcare systems. Radiotherapy technologies address these demands by offering targeted, effective treatment options that minimize side effects and improve patient outcomes

- As healthcare providers aim to reduce treatment-related complications and enhance quality of care, there is a growing shift toward integrating advanced radiotherapy techniques such as image-guided radiotherapy (IGRT), intensity-modulated radiotherapy (IMRT), and proton therapy. This transition is crucial for meeting stringent regulatory standards, improving treatment efficacy, and supporting the North America move toward value-based care

- Major industry players such as Siemens Healthineers, Elekta, Varian (a Siemens company), and Accuray are significantly increasing their R&D efforts to develop cutting-edge radiotherapy equipment and software that offer higher precision, automation, and integration with artificial intelligence, further driving innovation and market growth

- Advancements in imaging, treatment planning, and delivery technologies—such as adaptive radiotherapy, stereotactic radiosurgery (SRS), and proton beam therapy—are enhancing treatment accuracy, patient safety, and operational efficiency. These innovations are enabling broader adoption across hospitals and specialty centers and supporting the expansion of the North America radiotherapy market

North America Radiotherapy Market Dynamics

“Growing Prevalence of Cancer Disease”

- The rising North America demand for advanced, precise, and patient-friendly cancer treatment solutions—driven by increasing cancer prevalence, growing patient awareness, and the shift toward personalized, less invasive therapies—is putting pressure on healthcare providers and manufacturers to innovate and upgrade radiotherapy technologies across hospitals, specialty clinics, and cancer centers. To meet this demand, companies are accelerating investments in next-generation radiotherapy equipment, software, and treatment planning systems to deliver higher accuracy, improved patient outcomes, and streamlined workflows at scale. These advancements are building smarter, more efficient oncology care ecosystems, much like how precision medicine is reshaping healthcare delivery

- For instance, in early 2025, researchers from leading oncology institutes highlighted the growing prominence of proton therapy and adaptive radiotherapy as transformative approaches in cancer treatment. Their studies emphasize the benefits of these cutting-edge technologies in minimizing radiation exposure to healthy tissues while enhancing tumor targeting, significantly improving patient quality of life. The report highlights the increasing importance of integrating advanced imaging and AI-driven treatment planning as vital components in the evolving landscape of cancer care, playing a critical role in enhancing radiotherapy efficacy as a personalized and integrative approach

- These investments are not only transforming radiotherapy capabilities but also enabling broader adoption of sophisticated treatment modalities across emerging markets and high-growth segments such as pediatric oncology and rare cancers. Leading players such as Siemens, Elekta, Varian (Siemens), and Accuracy are investing heavily in innovative radiotherapy systems, AI-powered software, and patient-centric solutions to maintain competitive advantage and improve treatment performance across applications

- In addition, the ongoing commitment from governments, research institutions, and private industry toward improving cancer care infrastructure and advancing radiotherapy innovation is playing a pivotal role in shaping a more effective North America oncology market. These initiatives are establishing advanced radiotherapy as a cornerstone of modern cancer treatment and a major growth driver in the transition toward safer, more precise, and patient-aligned therapies

Restraint/Challenge

“Lack of Skilled and Certified Professionals”

- The shortage of skilled and certified radiotherapy professionals remains one of the most significant restraints limiting the growth and broader adoption of advanced radiotherapy technologies worldwide. Radiotherapy treatment requires highly trained oncologists, medical physicists, dosimetrists, and radiation therapists to ensure precise treatment planning, safe delivery, and effective patient management—skills that are in short supply, especially in developing regions

- Furthermore, the complexity of modern radiotherapy techniques—such as intensity-modulated radiotherapy (IMRT), stereotactic radiosurgery (SRS), and proton therapy—demands continuous professional training and certification to keep pace with technological advancements. The lack of standardized training programs and accreditation frameworks across many countries exacerbates the issue, often leading to suboptimal treatment outcomes and limiting the ability to fully leverage sophisticated radiotherapy equipment

- For instance, in March 2025, a study by the International Atomic Energy Agency (IAEA) highlighted that many low- and middle-income countries face critical shortages of trained radiotherapy staff, which significantly delays the implementation of new treatment technologies and restricts patient access to quality care. The report emphasized the urgent need for international collaboration to develop scalable training programs and certification pathways tailored to resource-limited settings

- Similarly, a 2024 survey conducted by the American Society for Radiation Oncology (ASTRO) revealed that despite growing investments in advanced radiotherapy systems across the United States, many centers struggle to recruit and retain qualified medical physicists and dosimetrists, directly impacting treatment efficiency and patient throughput

- The shortage of skilled professionals coupled with the increasing complexity of radiotherapy techniques continues to act as a barrier to the widespread adoption and optimal utilization of radiotherapy services. While ongoing efforts in education, certification, and remote training are underway, addressing these workforce challenges remains critical to unlocking the full potential of the North America radiotherapy market

North America Radiotherapy Market Scope

The market is segmented on the basis of product, application type, procedure type, usability, end user, and distribution channel.

• By Product and Services

On the basis of product and services, the North America radiotherapy market is segmented into services, products and software. In 2025, the services segment is expected to dominate the market with a market share of 54.36% growing with the highest CAGR of 10.7% in the forecast period of 2025 to 2032, driven by growing prevalence of cancer disease, novel technology in radiotherapy for cancer treatment and increasing adoption of radiotherapy devices and procedures.

- By Type

On the basis Type, the North America radiotherapy market is segmented into external-beam radiation therapy, internal radiation therapy, systemic radiotherapy/radiopharmaceuticals and others. In 2025, the External-Beam Radiation Therapy segment is expected to dominate the market with a market share of 63.70% growing with the highest CAGR of 10.6% in the forecast period of 2025 to 2032 driven by expected to increasing healthcare expenditure for cancer treatment, growing government initiatives toward cancer treatment and rising patients awareness towards cancer treatment.

- By Application

On the basis of Application, the North America radiotherapy market is segmented into breast cancer, lung cancer, prostate cancer, colorectal cancer, lymphoma, liver cancer, thyroid cancer, brain cancer, cervical cancer, spine cancer and others. In 2025, the breast cancer segment is expected to dominate the market with a market share of 19.37% growing with the highest CAGR of 11.6% in the forecast period of 2025 to 2032 driven by growing prevalence of cancer disease, novel technology in radiotherapy for cancer treatment and increasing adoption of radiotherapy devices and procedures.

- By End User

On the basis of End User, the North America radiotherapy market is segmented into hospitals, radiation therapy centers, specialty clinics, academic & research institutes and others. In 2024, the Hospitals segment is expected to dominate the market with a 63.00% market share and growing with the CAGR of 11.8% in the forecast period of 2025 to 2032 driven expected to increasing healthcare expenditure for cancer treatment, growing government initiatives toward cancer treatment and rising patients awareness towards cancer treatment

- By Distribution Channel

On the basis of distribution channel, the North America radiotherapy market is segmented into direct tenders, third-party distributors and others. In 2024, the direct tenders segment is expected to dominate the market with a 80.91% market share and growing with the CAGR of 10.6% in the forecast period of 2025 to 2032 driven by growing prevalence of cancer disease, novel technology in radiotherapy for cancer treatment and increasing adoption of radiotherapy devices and procedures.

North America Radiotherapy Market Regional Analysis

- U.S in North America radiotherapy market is expected to reach 6.63 million USD by 2032, from 3.02 million USD.in 2024, growing at the CAGR of 10.7% in the forecast period of 2025 to 2032

- U.S allocates a significant portion of its GDP to healthcare, ensuring substantial funding for cutting-edge cancer treatment technologies, including advanced radiotherapy procedures. In contrast, emerging markets are increasing their healthcare spending due to growing cancer prevalence and rising awareness of modern treatment options. The availability of funding from both public and private sectors plays a crucial role in expanding access to radiotherapy services North Americaly.

- In U.S, radiotherapy is widely available and integrated into standard oncology care. In contrast, emerging markets with developing healthcare infrastructure are experiencing rapid growth in access to radiotherapy services, driven by expanding hospital networks and increasing healthcare budgets. As healthcare systems become more centralized or privatized, increased investments in advanced radiotherapy equipment and software promote market growth and improve treatment accessibility.

Canada North America Radiotherapy Market Insight

The Canada radiotherapy market is expected to register the CAGR of 9.3% from 2025 to 2032, driven by expected to increasing healthcare expenditure for cancer treatment, growing government initiatives toward cancer treatment and rising patients’ awareness towards cancer treatment.

North America Radiotherapy Market Share

The North America radiotherapy market is primarily led by well-established companies, including:

- Siemens Healthcare GmbH (Germany)

- Hitachi, Ltd. (Japan)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Elekta (Sweden)

- ZEISS International (Germany)

- IBA Worldwide (Belgium)

- Canon Medical Systems Corporation (Japan)

- Accuray Incorporated (U.S.)

- Mevion Medical Systems (U.S.)

- Brainlab (Germany)

- BEBIG Medical (Germany)

- LinaTech, Inc. (China)

- United Imaging Healthcare Co., Ltd. (China)

- Eckert & Ziegler BEBIG (Germany)

- ViewRay Systems, Inc. (U.S.)

- Nordion (Canada) Inc. (Canada)

- P-Cure (Israel)

Latest Developments in North America Radiotherapy Market

- In May 2024, Siemens Healthineers and Varian unveiled new advancements in radiation oncology at ESTRO 2024, including HyperSight imaging, ARIA CORE oncology management, and more accessible MRI for radiotherapy

- In September 2024, Ballad Health has entered a 10-year, USD 260 million collaboration with Varian, a Siemens Healthineers company, to transform cancer care in the Appalachian Highlands. This partnership will bring advanced oncology technology, including linear accelerators and digital management solutions, to six cancer centers, enhancing treatment precision and accessibility for rural communitie

- In 2023, Hitachi expanded its Digital Systems & Services (DSS) segment through cloud, AI, and IoT solutions. This included further development of its Lumada platform and integration of North AmericaLogic, an IT service company

- In May 2025, GE HealthCare is significantly expanding its radiation oncology portfolio at ESTRO 2025 with new AI-enabled solutions, including the MR Contour DL for efficient organ segmentation. They are also enhancing their Intelligent Radiation Therapy (iRT) software to integrate MR and AI-driven workflows, aiming for more precise and timely cancer treatment

- In April 2024, GE HealthCare has finalized its acquisition of MIM Software, a North America provider of medical imaging analysis and AI solutions. This strategic move bolsters GE HealthCare's portfolio, particularly in radiation oncology, by integrating MIM Software's advanced tools for image analysis, workflow automation, and AI-powered segmentation and contouring into its precision care strategy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA RADIOTHERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT & SERVICES SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 PRICING ANALYSIS

5 REGULATORY GUIDELINES FOR RADIOTHERAPY

5.1 U.S REGULATORY GUIDELINES FOR RADIOTHERAPY

5.2 EUROPE REGULATORY GUIDELINE FOR RADIOTHERAPY

5.3 INDIA REGULATORY GUIDELINE FOR RADIOTHERAPY

5.4 CLEARANCE OF THE UNIT BY AERB (TYPE APPROVED OR NOC-ISSUED EQUIPMENT)

5.5 CHINA REGULATORY GUIDELINE FOR RADIOTHERAPY

5.6 ELEMENTS OF RADIATION PROTECTION PROGRAM -

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING PREVALENCE OF CANCER DISEASE

6.1.2 NOVEL TECHNOLOGY IN RADIOTHERAPY FOR CANCER TREATMENT

6.1.3 INCREASING ADOPTION OF RADIOTHERAPY DEVICES AND PROCEDURES

6.1.4 RISING PREFERENCE FOR NON-SURGICAL PROCEDURES

6.2 RESTRAINTS

6.2.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

6.2.2 HIGH COST OF TREATMENT AND RADIOTHERAPY PROCEDURE

6.3 OPPORTUNITIES

6.3.1 INCREASING HEALTHCARE EXPENDITURE FOR CANCER TREATMENT

6.3.2 GROWING GOVERNMENT INITIATIVES TOWARD CANCER TREATMENT

6.3.3 RISING PATIENTS AWARENESS TOWARDS CANCER TREATMENT

6.4 CHALLENGES

6.4.1 STRICT REGULATIONS AND STANDARDS FOR APPROVAL AND COMMERCIALIZATION OF RADIOTHERAPY PRODUCTS

6.4.2 RISK OF RADIATION EXPOSURE

7 NORTH AMERICA RADIOTHERAPY MARKET, BY PRODUCT & SERVICES

7.1 OVERVIEW

7.2 SERVICES

7.3 PRODUCT

7.4 SOFTWARE

8 NORTH AMERICA RADIOTHERAPY MARKET, BY TYPE

8.1 OVERVIEW

8.2 EXTERNAL-BEAM RADIATION THERAPY

8.3 INTERNAL RADIATION THERAPY

8.4 SYSTEMIC RADIOTHERAPY/ RADIOPHARMACEUTICALS

8.5 OTHERS

9 NORTH AMERICA RADIOTHERAPY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BREAST CANCER

9.3 LUNG CANCER

9.4 PROSTATE CANCER

9.5 COLORECTAL CANCER

9.6 LYMPHOMA

9.7 LIVER CANCER

9.8 THYROID CANCER

9.9 BRAIN CANCER

9.1 CERVICAL CANCER

9.11 SPINE CANCER

9.12 OTHERS

10 NORTH AMERICA RADIOTHERAPY MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 RADIATION THERAPY CENTERS

10.4 SPECIALTY CLINICS

10.5 OTHERS

11 NORTH AMERICA RADIOTHERAPY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDERS

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 NORTH AMERICA RADIOTHERAPY MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA RADIOTHERAPY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 NORTH AMERICA RADIOTHERAPY MARKET, COMPANY PROFILE

15.1 SIEMENS HEALTHCARE GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 HITACHI, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 GENERAL ELECTRIC COMPANY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 KONINKLIJKE PHILIPS N.V.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ELEKTA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ACCURACY INCORPORATED

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 BEBIG MEDICAL.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BRAINLAB

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CANON MEDICAL SYSTEMS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ECKERT & ZIEGLER BEBIG

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 IBA WORLDWIDE

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 LINATECH INC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MEVION MEDICAL SYSTEMS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 NORDION (CANADA) INC. (A SUBSIDIARY OF SOTERA HEALTH)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 P-CURE

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 UNITED IMAGING HEALTHCARE CO., LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 VIEWRAY SYSTEMS, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ZEISS INTERNATIONAL

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 COMPANY SHARE ANALYSIS

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA RADIOTHERAPY MARKET: AVERAGE SELLING PRICE OF EQUIPMENT, SOFTWARE AND SERVICES

TABLE 2 NORTH AMERICA RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA SERVICES IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA PRODUCT IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA PRODUCT IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA EXTERNAL BEAM RADIOTHERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA PROTON THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SYSTEMIC RADIOTHERAPY/RADIOPHARMACEUTICALS IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SOFTWARE IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SOFTWARE IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA EXTERNAL-BEAM RADIATION THERAPY IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA EXTERNAL-BEAM RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SYSTEMIC RADIOTHERAPY/ RADIOPHARMACEUTICALS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHERS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA RADIOTHERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA BREAST CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LUNG CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA PROSTATE CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA COLORECTAL CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA LYMPHOMA IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA LIVER CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA THYROID CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BRAIN CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA CERVICAL CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA SPINE CANCER IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA OTHERS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA RADIOTHERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA HOSPITALS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA RADIATION THERAPY CENTERS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SPECIALTY CLINICS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA RADIOTHERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA DIRECT TENDERS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA OTHERS IN RADIOTHERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA RADIOTHERAPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA PRODUCT IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA EXTERNAL BEAM RADIOTHERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA PROTON THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SYSTEMIC RADIOTHERAPY/RADIOPHARMACEUTICALS IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA SOFTWARE IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA EXTERNAL-BEAM RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA RADIOTHERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA RADIOTHERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA RADIOTHERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. PRODUCT IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. EXTERNAL BEAM RADIOTHERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. PROTON THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. SYSTEMIC RADIOTHERAPY/RADIOPHARMACEUTICALS IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. SOFTWARE IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. EXTERNAL-BEAM RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. RADIOTHERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. RADIOTHERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. RADIOTHERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA PRODUCT IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA EXTERNAL BEAM RADIOTHERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA PROTON THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA SYSTEMIC RADIOTHERAPY/RADIOPHARMACEUTICALS IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA SOFTWARE IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CANADA EXTERNAL-BEAM RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA RADIOTHERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA RADIOTHERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA RADIOTHERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 81 MEXICO PRODUCT IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 82 MEXICO EXTERNAL BEAM RADIOTHERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO PROTON THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 84 MEXICO INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO SYSTEMIC RADIOTHERAPY/RADIOPHARMACEUTICALS IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO SOFTWARE IN RADIOTHERAPY MARKET, BY PRODUCT & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO EXTERNAL-BEAM RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO INTERNAL RADIATION THERAPY IN RADIOTHERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO RADIOTHERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO RADIOTHERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO RADIOTHERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA RADIOTHERAPY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RADIOTHERAPY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RADIOTHERAPY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RADIOTHERAPY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RADIOTHERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RADIOTHERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RADIOTHERAPY MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA RADIOTHERAPY MARKET: PRODUCT & SERVICES LIFELINE CURVE

FIGURE 9 NORTH AMERICA RADIOTHERAPY MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA RADIOTHERAPY MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA RADIOTHERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA RADIOTHERAPY MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA RADIOTHERAPY MARKET: EXECUTIVE SUMMARY

FIGURE 14 NORTH AMERICA RADIOTHERAPY MARKET: STRATEGIC DECISIONS

FIGURE 15 NOVEL TECHNOLOGY IN RADIOTHERAPY FOR CANCER TREATMENT IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA RADIOTHERAPY MARKET FROM 2025 TO 2032

FIGURE 16 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RADIOTHERAPY MARKET IN 2025 & 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA RADIOTHERAPY MARKET

FIGURE 18 NORTH AMERICA RADIOTHERAPY MARKET: BY PRODUCT & SERVICES, 2024

FIGURE 19 NORTH AMERICA RADIOTHERAPY MARKET: BY PRODUCT & SERVICES, 2025-2032 (USD THOUSAND)

FIGURE 20 NORTH AMERICA RADIOTHERAPY MARKET: BY PRODUCT & SERVICES, CAGR (2025-2032)

FIGURE 21 NORTH AMERICA RADIOTHERAPY MARKET: BY PRODUCT & SERVICES, LIFELINE CURVE

FIGURE 22 NORTH AMERICA RADIOTHERAPY MARKET: BY TYPE, 2024

FIGURE 23 NORTH AMERICA RADIOTHERAPY MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 24 NORTH AMERICA RADIOTHERAPY MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 25 NORTH AMERICA RADIOTHERAPY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA RADIOTHERAPY MARKET: BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA RADIOTHERAPY MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 28 NORTH AMERICA RADIOTHERAPY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 29 NORTH AMERICA RADIOTHERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA RADIOTHERAPY MARKET: BY END USER, 2024

FIGURE 31 NORTH AMERICA RADIOTHERAPY MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 32 NORTH AMERICA RADIOTHERAPY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 33 NORTH AMERICA RADIOTHERAPY MARKET: BY END USER LIFELINE CURVE

FIGURE 34 NORTH AMERICA RADIOTHERAPY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 35 NORTH AMERICA RADIOTHERAPY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 36 NORTH AMERICA RADIOTHERAPY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 37 NORTH AMERICA RADIOTHERAPY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA RADIOTHERAPY MARKET: SNAPSHOT (2024)

FIGURE 39 NORTH AMERICA RADIOTHERAPY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.