North America Recycled Plastic Market

Market Size in USD Billion

CAGR :

%

USD

54.30 Billion

USD

83.33 Billion

2024

2032

USD

54.30 Billion

USD

83.33 Billion

2024

2032

| 2025 –2032 | |

| USD 54.30 Billion | |

| USD 83.33 Billion | |

|

|

|

|

North America Recycled Plastic Market Size

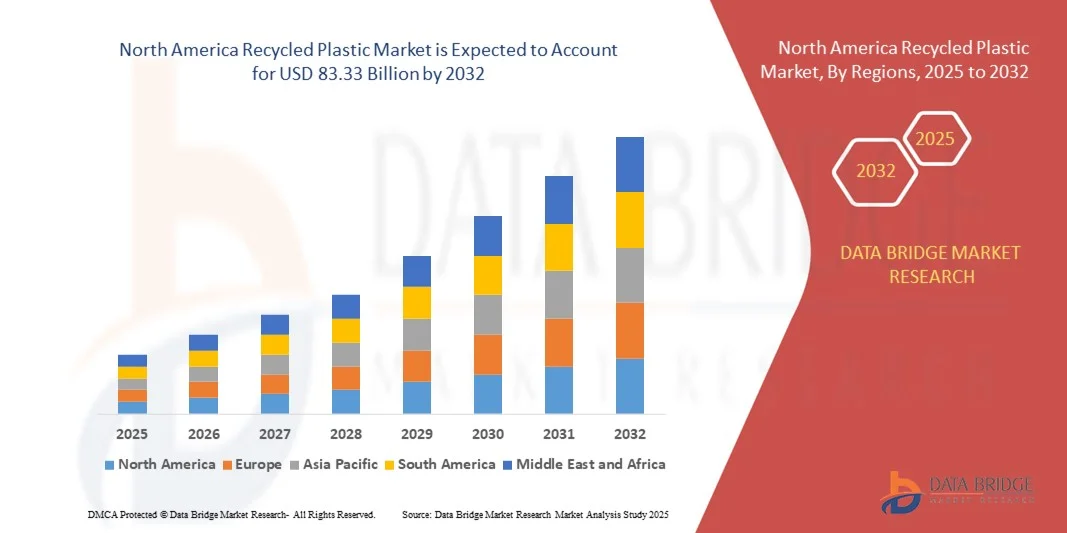

- The North America Recycled Plastic Market size was valued at USD 54.30 billion in 2024 and is projected to reach USD 83.33 billion by 2032, growing at a CAGR of 5.50% during the forecast period

- The market expansion is primarily driven by increasing environmental concerns, regulatory pressure on plastic waste management, and growing demand for sustainable packaging solutions across industries

- Additionally, advancements in recycling technologies and the shift toward circular economy practices are encouraging manufacturers to adopt recycled plastics, significantly propelling the market’s growth across North America

North America Recycled Plastic Market Analysis

- Recycled plastics, derived from post-consumer or post-industrial plastic waste, are becoming essential components in sustainable manufacturing across sectors such as packaging, automotive, construction, and consumer goods, due to their cost-effectiveness and reduced environmental footprint

- The rising demand for recycled plastic is primarily driven by stringent environmental regulations, corporate sustainability initiatives, and increasing consumer preference for eco-friendly products

- U.S. dominated the North America Recycled Plastic Market with the largest revenue share of 36% in 2024, supported by robust recycling infrastructure, strong governmental support for sustainability policies, and widespread corporate adoption of circular economy models, with the U.S. leading in recycled plastic consumption across packaging and automotive industries

- Canada is expected to be the fastest-growing region in the North America Recycled Plastic Market during the forecast period due to expanding industrialization, growing environmental awareness, and supportive government initiatives promoting recycling

- The Polyethylene Terephthalate (PET) segment dominated the market with the largest revenue share of 34.5% in 2024, primarily due to its widespread use in packaging applications, especially for bottles and food containers

Report Scope and North America Recycled Plastic Market Segmentation

|

Attributes |

Recycled Plastic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Recycled Plastic Market Trends

Enhanced Sustainability and Circular Economy Integration

- A significant and accelerating trend in the North America Recycled Plastic Market is the growing focus on sustainability through enhanced circular economy initiatives. Companies are increasingly adopting advanced recycling technologies and processes that improve the quality and usability of recycled plastics, reducing reliance on virgin materials and minimizing environmental impact.

- For Instance, companies such as MBA Polymers and GreenMantra Technologies are pioneering chemical recycling methods that break down plastics into their original monomers, allowing recycled materials to be reused in high-value applications such as packaging, automotive parts, and consumer goods.

- Innovations in recycling processes, including advanced sorting technologies powered by AI and machine learning, enable more efficient separation of plastic types, improving purity and yield of recycled resin. This reduces contamination and boosts the economic viability of recycled plastics for manufacturers.

- The integration of recycled plastics into large-scale manufacturing supply chains is becoming more seamless, supported by growing consumer demand for eco-friendly products and increasing regulatory pressure to reduce plastic waste. Brands across sectors—from packaging to construction—are incorporating higher percentages of recycled content in their products to meet sustainability goals.

- This shift towards circularity is reshaping industry standards and driving partnerships across the value chain, from waste collection and sorting to end-product manufacturing. Companies such as Plastic Energy and Indorama Ventures are expanding their recycling capacities and developing closed-loop systems that support continuous reuse of plastic materials.

- The demand for recycled plastics with verified environmental benefits is rapidly growing across consumer, industrial, and governmental sectors, as stakeholders prioritize reducing carbon footprints and fostering a more sustainable materials economy in North America.

North America Recycled Plastic Market Dynamics

Driver

Growing Need Due to Sustainability Mandates and Corporate Responsibility

- The increasing pressure from governments, regulators, and consumers to reduce plastic waste and carbon emissions is a significant driver of growth in the North America Recycled Plastic Market. Sustainability commitments and environmental, social, and governance (ESG) goals are pushing companies to adopt recycled plastic materials across industries such as packaging, automotive, construction, and consumer goods.

- For instance, in early 2024, several major corporations—including Coca-Cola and Unilever—announced plans to increase the use of post-consumer recycled (PCR) plastics in their packaging lines across North America, aiming to meet their 2030 sustainability targets. These moves reflect a broader industry shift toward circular material usage.

- Recycled plastics offer a lower-carbon alternative to virgin materials, and growing awareness about the environmental impact of single-use plastics is prompting both governments and corporations to act. Public policies such as extended producer responsibility (EPR), recycled content mandates, and plastic taxes in states like California and New York are accelerating demand.

- Moreover, the expansion of advanced recycling technologies, including chemical recycling and AI-powered material recovery systems, is enabling higher-quality recycled plastic production, making them suitable for high-performance applications.

- The rise of green procurement standards and sustainable product labeling is also influencing purchasing behavior in both B2B and consumer markets. As a result, companies across sectors are integrating recycled plastic not just as an environmental measure but also as a competitive differentiator.

Restraint/Challenge

Inconsistent Supply and Quality of Recycled Plastics

- One of the key challenges in the North America Recycled Plastic Market is the inconsistent supply and quality of recycled plastic feedstock. Variability in material types, contamination levels, and collection infrastructure can limit the availability of high-quality recycled plastics suitable for use in demanding applications such as food-grade packaging or automotive components.

- For Instance, despite growing recycling awareness, the actual recycling rates for plastics in North America remain relatively low—hovering around 9–10% in the U.S.—due to fragmented waste collection systems and limited consumer participation in recycling programs.

- The absence of standardized processes for sorting, cleaning, and processing plastic waste often results in recycled resins with fluctuating properties, which makes it difficult for manufacturers to ensure consistent product performance. This reliability issue can deter companies from switching to recycled alternatives, especially in industries with strict regulatory or safety requirements.

- Additionally, the cost of recycled plastic can, at times, exceed that of virgin plastic due to supply chain inefficiencies and limited scale, particularly when oil prices are low, making virgin plastic more economically attractive.

- Addressing these challenges will require significant investment in recycling infrastructure, public-private collaboration, and the development of material certification standards. Companies like KW Plastics and Veolia are actively investing in improving recycling capacity and feedstock consistency, but wider industry participation and supportive government policy will be key to unlocking the full potential of the recycled plastic economy in North America.

North America Recycled Plastic Market Scope

The recycled plastic market is segmented on the basis of type, source and industry.

- By Type

On the basis of type, the North America Recycled Plastic Market is segmented into Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and Others. The Polyethylene Terephthalate (PET) segment dominated the market with the largest revenue share of 34.5% in 2024, primarily due to its widespread use in packaging applications, especially for bottles and food containers. Its excellent recyclability, strength, and clarity make it the preferred choice for consumer product companies seeking sustainable alternatives.

The Polypropylene (PP) segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its growing application in automotive components, packaging, and household goods. PP is lightweight, durable, and resistant to chemicals and moisture, making it increasingly popular among manufacturers shifting to more sustainable materials. Ongoing innovations in recycling techniques, including advanced sorting and cleaning technologies, are also boosting the recyclability and adoption of PP in high-performance applications.

- By Source

On the basis of source, the North America Recycled Plastic Market is segmented into Bottles, Bags, Films, Fibers, Foams, and Others. The Bottles segment held the largest market share of 38.7% in 2024, supported by high collection rates, well-established recycling infrastructure, and the significant use of PET bottles in the beverage and food industry. This segment benefits from regulatory initiatives encouraging bottle deposit systems and commitments by major brands to incorporate post-consumer recycled (PCR) content in packaging.

The Films segment is expected to record the fastest CAGR from 2025 to 2032, driven by increasing recovery and recycling of polyethylene films used in packaging, agriculture, and retail. Technological advancements in film recycling, such as improved washing and extrusion systems, are enabling higher quality outputs, making recycled films suitable for reuse in flexible packaging and industrial applications. The rising demand for sustainable flexible packaging solutions across sectors is a major growth driver for this segment.

- By Industry

On the basis of industry, the North America Recycled Plastic Market is segmented into Packaging, Building and Construction, Textile, Automotive, Electrical and Electronics, Household Goods, Agriculture, Healthcare, and Others. The Packaging industry dominated the market with the largest revenue share of 41.2% in 2024, owing to its extensive use of recycled plastics—especially PET, PE, and PP—for making bottles, containers, and films. Growing consumer awareness, corporate sustainability commitments, and regulatory mandates for minimum recycled content in packaging are key factors fueling this segment's dominance.

The Automotive industry is anticipated to register the fastest CAGR from 2025 to 2032, driven by the push for lightweight and sustainable materials to reduce vehicle emissions. Recycled plastics are increasingly used in automotive interiors, bumpers, and under-the-hood components. The rising adoption of electric vehicles and growing OEM commitments to environmental targets are further accelerating demand for recycled materials in automotive manufacturing across North America.

North America Recycled Plastic Market Regional Analysis

- U.S. dominated the North America Recycled Plastic Market with the largest revenue share of 36% in 2024, driven by strong regulatory support, rising environmental awareness, and increasing demand from end-use industries such as packaging, automotive, and construction.

- Consumers and businesses in the region are prioritizing sustainability and actively seeking products that incorporate recycled materials, particularly in response to corporate ESG targets and government initiatives aimed at reducing plastic waste.

- This widespread adoption is further supported by an established recycling infrastructure, rising investment in advanced recycling technologies, and the presence of key players like KW Plastics, GreenMantra Technologies, and MBA Polymers. These factors are positioning North America as a leader in both the production and consumption of recycled plastic, reinforcing its dominance in the regional market and contributing to the ongoing shift toward a circular economy.

U.S. Recycled Plastic Market Insight

The U.S. recycled plastic market captured the largest revenue share of 81% in 2024 within North America, driven by rising environmental awareness, favorable government policies, and corporate sustainability initiatives. The U.S. is seeing significant growth in the use of recycled plastics across industries such as packaging, automotive, and construction, fueled by the demand for eco-friendly and cost-effective alternatives to virgin plastics. Companies like KW Plastics and MBA Polymers are leading efforts to scale recycling operations and improve the quality of post-consumer resins. Additionally, increasing adoption of Extended Producer Responsibility (EPR) policies at the state level, coupled with innovation in advanced recycling technologies such as chemical recycling, continues to strengthen the market outlook.

Canada Recycled Plastic Market Insight

The Canada recycled plastic market is projected to expand at a robust CAGR during the forecast period, supported by strong federal and provincial efforts to reduce single-use plastic waste. The Canadian government’s zero plastic waste agenda and mandatory recycled content regulations are accelerating demand for recycled materials across packaging and industrial applications. Canadian companies such as GreenMantra Technologies are innovating in the chemical recycling space, producing high-value outputs from post-consumer plastics. Additionally, public-private partnerships and investments in circular economy infrastructure are boosting recycling rates and supporting sustainable manufacturing practices across the country.

Mexico Recycled Plastic Market Insight

The Mexico recycled plastic market is expected to grow at a steady pace, fueled by the country’s increasing industrial output and evolving waste management infrastructure. Rising consumer awareness of plastic pollution and corporate commitments to sustainability are encouraging greater adoption of recycled plastics in packaging, automotive, and consumer goods. Mexico's role as a manufacturing hub for North America further strengthens demand for cost-efficient recycled materials. However, challenges such as inconsistent collection systems and limited processing capacity persist, though ongoing investments in modernizing recycling facilities and government support for circular economy initiatives are expected to drive long-term market growth.

North America Recycled Plastic Market Share

The Recycled Plastic Recycled Plastic industry is primarily led by well-established companies, including:

• BlueAlp (Netherlands)

• Mura Technology (U.K.)

• ReCircle (India)

• Plastics For Change (India)

• Oceanworks (U.S.)

• Banyan Nation (India)

• GreenMantra Technologies (Canada)

• Plastic Energy (U.K.)

• Recykal (India)

• PureCycle Technologies (U.S.)

• Carbios (France)

• MBA Polymers (U.S.)

• KW Plastics (U.S.)

• Suez Recycling (France)

• TerraCycle (U.S.)

• Indorama Ventures (Thailand)

• ALPLA Recycling (Austria)

• Veolia (France)

• Avangard Innovative (U.S.)

• Jayplas (U.K.)

What are the Recent Developments in North America Recycled Plastic Market?

- In April 2023, MBA Polymers, a global leader in plastics recycling, announced the expansion of its recycling facility in California, aimed at increasing the processing capacity of post-consumer plastics used in automotive and electronics sectors. This expansion reflects the company’s commitment to supporting the circular economy by converting more plastic waste into high-quality recycled resins, addressing growing regional demand and reinforcing its leadership in the North America recycled plastic market.

- In March 2023, GreenMantra Technologies, headquartered in Canada, launched a new line of specialty recycled polymer additives designed to enhance the performance of recycled plastics in packaging and construction applications. This innovation showcases GreenMantra’s dedication to improving the functionality and market appeal of recycled plastics, promoting wider adoption across industries seeking sustainable material solutions.

- In March 2023, KW Plastics, one of the largest plastic recyclers in the U.S., successfully secured a multi-year contract with a major North American beverage company to supply recycled polyethylene terephthalate (rPET) pellets. This partnership underlines the growing demand for recycled content in consumer packaging and highlights KW Plastics’ pivotal role in meeting sustainability goals across the region.

- In February 2023, Recycling Technologies Inc. announced a collaboration with several North American municipalities to deploy advanced chemical recycling systems for polyethylene waste. This initiative aims to improve the quality and scalability of recycled plastic feedstock, addressing challenges related to plastic waste contamination and diversifying recycling options in the North American market.

- In January 2023, PureCycle Technologies unveiled a state-of-the-art recycling facility in Ohio focused on producing ultra-pure recycled polypropylene (PP) from post-consumer waste. The facility leverages proprietary purification technology to create recycled resins that closely match virgin polypropylene in quality, driving higher recycled content use in automotive, packaging, and consumer goods industries across North America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Recycled Plastic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Recycled Plastic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Recycled Plastic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.