North America Respiratory Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

3,486.69 Million

USD

6,264.86 Million

2022

2030

USD

3,486.69 Million

USD

6,264.86 Million

2022

2030

| 2023 –2030 | |

| USD 3,486.69 Million | |

| USD 6,264.86 Million | |

|

|

|

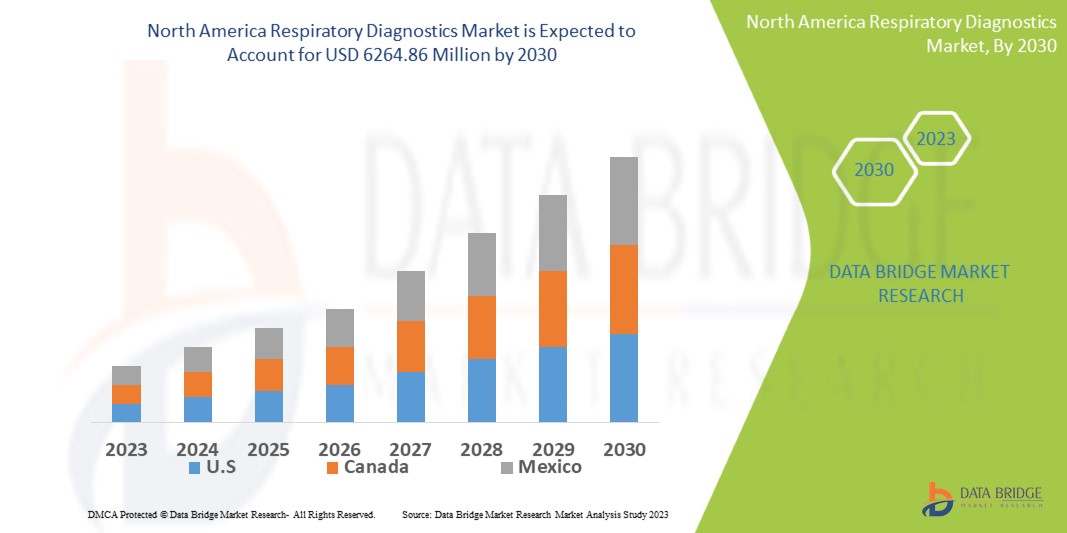

North America Respiratory Diagnostics Market Analysis and Size

The North America region is largely affected because of the burden of chronic diseases especially after the pandemic which increases the adoption of respiratory diagnostics. Chronic diseases are one of the world's major healthcare concerns, resulting in around 40 million lives every year, 8.5 million of whom are from Asia. The technological advances, growing portability, and ease of operation of devices are expected to increase the growth. The increasing incidence of respiratory diseases has set a huge concern for accurate disease diagnosis and hence increased the growth of the respiratory diagnostics market.

Data Bridge Market Research analyses a growth rate in the respiratory diagnostics market in the forecast period 2023-2030. The expected CAGR of respiratory diagnostics market is tend to be around 7.60% in the mentioned forecast period. The market was valued at USD 3486.69 million in 2022, and it would grow upto USD 6264.86 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Respiratory Diagnostics Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product and Services (Instruments and Devices, Assays and Reagents and Services and Software), Test Type (Traditional Diagnostic Tests, Mechanical Tests, Imaging Tests and Molecular Diagnostic Tests), Diseases (Chronic Obstructive Pulmonary Disease (COPD), Lung Cancer, Asthma, Tuberculosis, Bronchitis, Pulmonary Fibrosis and Other Diseases), End User (Hospital/Clinical Laboratories, Physician Offices, Reference Laboratories and Other End Users), Distribution Channel (Direct Tender, Retail Sales and Other) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

BD (U.S.), COSMED srl (Italy), Abbott (U.S.), NIHON KOHDEN CORPORATION (Japan), Drägerwerk AG & Co. KGaA (Germany), Bio-Rad Laboratories, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), General Electric (U.S.), Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), F. Hoffmann-La Roche Ltd (Switzerland), MGC DIAGNOSTICS CORPORATION (U.S.), Masimo (U.S.), BIOMÉRIEUX (France), Carestream Health (U.S.), VYAIRE (U.S.), Seegene Inc. (South Korea) and ResMed (U.S.) |

|

Market Opportunities |

|

Market Definition

Respiratory diagnostics are the type of medical products and technologies that are widely used to diagnose the respiratory diseases and disorders in the patients. Respiratory diagnostics are effective since it can diagnose the diseases at an early stage. It involve procedures such as computed tomography, spirometry, oximetry, chest X-ray, transcutaneous carbon dioxide monitoring, sniff nasal inspiratory pressure (SNIP) among several other types.

North America Respiratory Diagnostics Market Dynamics

Drivers

- Increasing Adoption of Self Testing Products

Growing adoption of self-testing products and point-of-care products may boost the growth. For instance, Abbott received EUA for introducing the BinaxNOW COVID-19 Ag Card rapid test in 2020, which delivers results at home in 15 minutes. As of August 2021, about 59 at-home testing products have been authorized by the U.S. FDA for COVID-19 diagnosis that uses home-collected specimens. In addition to this, 6 antigens Over the Counter (OTC) at-home tests, 3 antigen prescription at-home tests, 2 molecular OTC at-home tests, and 1 molecular prescription at-home test were also authorized by the U.S. FDA for self-testing of COVID-19. Thus, this increasing prevalence demands increased diagnostics which boost the market growth.

- Increased Rate of Saliva Sample

The saliva sample type is expected to witness a huge growth rate during the forecast period. This growth is due to the growing use of samples in testing along with an urgent need for non-invasive tests. In a study published in May 2020, several researchers established the sensitivity and specificity of the saliva sample test, which were found to be about 84.2% and 98.9%, respectively. Consequently, market players started developing and commercializing no-swabs saliva-based tests. Thus, this factor boosts the market growth.

Opportunities

- Increased Rate of Tuberculosis

The increasing rate of tuberculosis in the North America region is boosting the growth of the market. In 2021, the U.S. reported 7,882 TB cases and an incidence rate of 2.4 cases per 100,000 persons. TB data from 2021 show a rebound in the number of reported cases of TB disease in the U.S. Thus, all these factors boost the market growth.

- Growing Product Launches and Collaborations

Numerous product launches, partnership and agreement are initiated by many companies globally, which are also increasing the respiratory diagnostics market. For instance, Cipla Limited launched Spirofy, India's first pneumotach-based portable, wireless Spirometer, on World COPD Day in November 2021. Thus, these kinds of launches associated with the respiratory diagnostics boost the market growth.

Restraints/Challenges

- High Cost of Diagnostic Instruments

The increased expenditure required for the installation of these instruments hamper the market growth. Many of the diagnostic equipment are very high in cost, becoming unaffordable for many underdeveloped countries. Numerous market players make huge investments in installing new and advanced machines to increase the process and in return the cost is increased. Thus, this factor hamper the market growth.

This North America respiratory diagnostics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the North America respiratory diagnostics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, F. Hoffmann-La Roche Ltd received emergency use approval from the U.S. FDA for testing cobas SARS-CoV-2 and influenza A/B used in the F600 / 80,000 system. As a result of the company’s approval of this emergency use, SARC has increased demand for its diagnostic products for Covid, which has increased sales and revenue.

- In 2020, F. Hoffmann-La Roche Ltd received Emergency Use Authorization (EUA) approval from the American Food and Drug Administration (FDA) for a product, Alexis Anti-SARS-CoV-2 Antibody Test. The FDA approval obtained by the company during the emergence of COVID-19 will surge its revenue and sales in the market.

North America Respiratory Diagnostics Market Scope

The North America respiratory diagnostics market is segmented on the basis of product and services, test type, diseases, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product and Services

- Instruments and Devices

- Assays and Reagents

- Services and Software

Test Type

- Traditional Diagnostic Tests

- Mechanical Tests

- Imaging Tests

- Molecular Diagnostic Tests

Diseases

- Chronic Obstructive Pulmonary Disease (COPD)

- Lung Cancer

- Asthma

- Tuberculosis

- Bronchitis

- Pulmonary Fibrosis

- Other Diseases

End User

- Hospital/Clinical Laboratories

- Physician Offices

- Reference Laboratories

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Other

North America Respiratory Diagnostics Market Regional Analysis/Insights

The North America respiratory diagnostics market is analyzed and market size insights and trends are provided by product and services, test type, diseases, end-user and distribution channel as referenced above.

The major countries covered in the respiratory diagnostics market report are U.S., Canada and Mexico.

U.S. is leading the market growth because of the high testing rates, proactive government measures, major improvements in healthcare infrastructure, technological advancements, and the increasing presence of major market players. Also, the favourable government initiatives and reimbursement policies are likely to drive the region’s growth in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The respiratory diagnostics also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for respiratory diagnostics market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the respiratory diagnostics market. The data is available for historic period 2011-2021.

Competitive Landscape and North America Respiratory Diagnostics Market Share Analysis

The North America respiratory diagnostics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America respiratory diagnostics market.

Key players operating in the North America respiratory diagnostics market include:

- BD (U.S.)

- COSMED srl (Italy)

- Abbott (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Drägerwerk AG & Co. KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- General Electric (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- MGC DIAGNOSTICS CORPORATION (U.S.)

- Masimo (U.S.)

- BIOMÉRIEUX (France)

- Carestream Health (U.S.)

- VYAIRE (U.S.)

- Seegene Inc. (South Korea)

- ResMed (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.