North America Rice Based Infant Formula Market

Market Size in USD Billion

CAGR :

%

USD

3.11 Billion

USD

4.44 Billion

2024

2032

USD

3.11 Billion

USD

4.44 Billion

2024

2032

| 2025 –2032 | |

| USD 3.11 Billion | |

| USD 4.44 Billion | |

|

|

|

|

Rice Based Infant Formula Market Size

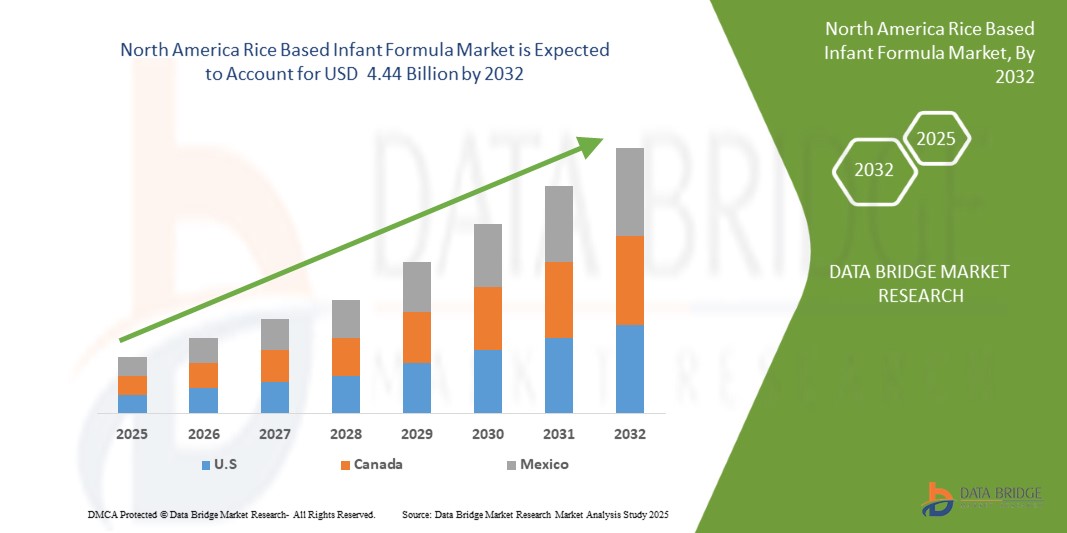

- The North America Rice Based Infant Formula market size was valued at USD 3.11 billion in 2024 and is expected to reach USD 4.44 billion by 2032, at a CAGR of 4.54% during the forecast period

- The market growth is primarily driven by increasing awareness of food allergies and lactose intolerance among infants, prompting a shift toward hypoallergenic and plant-based alternatives like rice-based formulas.

- Additionally, rising consumer preference for organic, non-GMO, and easily digestible infant nutrition options is enhancing the appeal of rice-based formulas. These converging factors are accelerating product innovation and adoption across the region, thereby significantly contributing to the industry's growth.

Rice Based Infant Formula Market Analysis

- Rice-Based Infant Formulas, developed as dairy-free alternatives, are becoming increasingly vital in infant nutrition, especially for babies with lactose intolerance, milk allergies, or digestive sensitivities. These formulas offer gentle, hypoallergenic nutrition and are gaining traction in both developed and developing markets due to rising health awareness and demand for plant-based options.

- The escalating demand for Rice-Based Infant Formulas is primarily fueled by growing parental concern for infant health, increasing prevalence of cow milk protein allergy (CMPA), and a rising trend toward clean-label and vegan-friendly nutritional products.

- U.S. dominates the Rice-Based Infant Formula market with the largest revenue share of 40.01% in 2025, driven by a large infant population, rising disposable incomes, increasing consumer preference for premium infant nutrition products, and strong distribution networks.

- Canada is expected to be the fastest-growing region in the Rice-Based Infant Formula market during the forecast period due to increasing urbanization, growing middle-class population, and expanding awareness about food allergies and digestive health in infants.

- The Standard Rice-Based Formula segment is expected to dominate the market with a market share of 43.2% in 2025, owing to its widespread availability, cost-effectiveness, and suitability for general dietary needs among infants who cannot consume traditional milk-based formulas.

Report Scope and Rice Based Infant Formula Market Segmentation

|

Attributes |

Rice Based Infant Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rice Based Infant Formula Market Trends

“Growing Innovation in Plant-Based and Hypoallergenic Infant Nutrition”

- A significant and accelerating trend in the North America Rice-Based Infant Formula market is the increased focus on plant-based and allergen-free nutrition, driven by rising incidences of cow milk protein allergy (CMPA) and lactose intolerance among infants. This shift is transforming consumer preferences toward rice-based formulations that offer a gentle, digestible, and hypoallergenic alternative to traditional dairy-based formulas.

- For instance, leading brands are launching organic rice-based infant formulas enriched with essential nutrients like DHA, iron, and vitamins to closely mimic the nutritional profile of breast milk while eliminating common allergens. These formulas are increasingly endorsed by pediatricians and allergists, further boosting consumer trust.

- Innovations in formulation science, such as the inclusion of prebiotics and probiotics in rice-based formulas to support gut health and immunity, are gaining traction. Companies are also exploring clean-label and non-GMO ingredients to align with the broader health and wellness trend.

- The demand for vegan-certified, organic, and easily digestible infant formulas is growing rapidly in both developed and emerging markets, particularly among health-conscious parents seeking safe and sustainable feeding solutions

- This trend towards specialized, functional, and plant-based nutrition is reshaping product development and brand positioning in the infant formula sector. Companies like Danone and Nestlé are increasingly investing in R&D to expand their portfolios of allergen-free and sustainable infant nutrition solutions.

- The growing awareness and demand for environmentally friendly and animal-free alternatives in early-life nutrition are driving the rice-based segment forward, establishing it as a fast-emerging category within the broader infant formula market.

Rice Based Infant Formula Market Dynamics

Driver

“Rising Incidence of Dairy Allergies and Preference for Plant-Based Nutrition”

- The increasing prevalence of milk allergies, lactose intolerance, and digestive disorders in infants is a major driver for the demand for rice-based infant formulas. These formulas serve as a safe and effective alternative, offering complete nutrition without animal-derived ingredients.

- For example, studies have shown a steady rise in cases of CMPA among infants globally, prompting healthcare professionals to recommend hypoallergenic, plant-based solutions like rice-based formulas.

- Furthermore, the shift toward plant-based diets among parents is also influencing infant feeding choices. Health-conscious consumers are more inclined to choose dairy-free, organic, and sustainable products for their children, boosting market demand.

- Growing pediatric endorsement and regulatory approvals for rice-based formulations, further enhance credibility and consumer adoption.

Restraint/Challenge

“Nutritional Limitations and Regulatory Hurdles”

- key challenge facing the rice-based infant formula market is the perceived nutritional gap compared to traditional cow milk-based formulas. Rice, while hypoallergenic, is naturally lower in protein and certain essential nutrients, requiring extensive fortification to meet infant dietary needs.

- For instance, rice-based formulas must be carefully enriched with amino acids, fats, and micronutrients to ensure comprehensive growth and brain development a process that can increase production costs and regulatory complexity.

- Additionally, regulatory approvals for new rice-based formulas can be stringent, where infant nutrition standards are highly regulated. Delays in approval or stringent testing requirements can slow down market entry for new players.

- Skepticism among some pediatricians and parents about the efficacy of rice-based alternatives compared to breast milk or cow’s milk-based formulas can also act as a psychological barrier to widespread adoption.

- Overcoming these hurdles through robust clinical trials, transparent labeling, and clear communication about nutritional adequacy is essential for building trust and expanding market reach.

Rice Based Infant Formula Market Scope

The market is segmented on the basis type, product type, form, infant age.

- By Type

On the basis of type, the Rice Based Infant Formula market is segmented into Formulated and Unformulated. The Formulated segment dominates the largest market revenue share of 43.2% in 2025, driven by its standardized composition enriched with essential nutrients such as proteins, vitamins, and minerals to support optimal infant growth. Parents and healthcare providers increasingly prefer formulated options for their consistency, safety, and clinical backing. The Unformulated segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by growing demand for customized and minimally processed nutrition. This category appeals to a niche market segment seeking more natural and less processed infant nutrition options, particularly in markets emphasizing organic or DIY feeding solutions.

- By Product Type

On the basis of Product Type, the Rice Based Infant Formula market is segmented into Standard Formula, Toddler Formula, Follow-On Formula and Special Formula. The Standard Formula held the largest market revenue share in 2025, driven by its broad applicability for healthy infants from birth and its affordability. These formulas often serve as a reliable alternative to cow milk-based products and are widely available through retail and pharmacy channels. The Special Formula segment is expected to witness the fastest CAGR from 2025 to 2032, due to rising incidences of dietary sensitivities and specific medical conditions like CMPA, gastrointestinal disorders, or metabolic syndromes. Special formulas are often prescribed by pediatricians, further driving their demand.

- By Form

On the basis of form, the Rice Based Infant Formula market is segmented into Non-GMO and GMO.

The Non-GMO segment held the largest market revenue share in 2025, driven by rising consumer preference for clean-label, natural, and ethically sourced ingredients. Parents are increasingly aware of the potential long-term impacts of genetically modified ingredients and often seek out non-GMO certified products for infants. The GMO segment, although currently smaller, is gaining traction due to its lower cost of production and increased availability in price-sensitive markets. It is expected to witness steady growth, especially in emerging economies where cost remains a key purchasing factor.

- By Infant Age

On the basis of Infant Age, the Rice Based Infant Formula market is segmented into 6-12 Months, 0-6 Months and 1-3 Years. The 0–6 Months segment accounted for the largest market revenue share in 2025, as this is the critical period when many infants require a reliable alternative to breast milk, especially in cases of milk allergy or intolerance. The demand for rice-based infant formulas is particularly high in this age group due to their gentle digestion and hypoallergenic profile. The 1–3 Years segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increased parental awareness of nutritional needs during toddlerhood and a growing demand for toddler transition formulas that support immunity, bone development, and cognitive growth.

Rice Based Infant Formula Market Regional Analysis

- North America dominates the Rice Based Infant Formula market with the largest revenue share of 40.01% in 2024, driven by increasing birth rates, rising incidences of cow milk allergies, and a growing demand for hypoallergenic and plant-based alternatives to traditional infant formulas. The region’s expanding middle-class population and increasing awareness about infant nutrition further fuel the demand for rice-based formulas.

- Consumers in the region highly value rice-based infant formulas for their digestive ease, hypoallergenic nature, and suitability for lactose-intolerant infants. These formulas are increasingly preferred by health-conscious parents seeking clean-label and non-GMO options.

- This widespread adoption is further supported by strong government focus on child health, increasing disposable incomes, and the availability of regionally sourced rice ingredients, which make the formulas more affordable and trusted by local consumers. North America’s large infant population base also plays a key role in market dominance.

U.S. Rice Based Infant Formula Market Insight

The U.S. Rice Based Infant Formula market is gaining momentum due to the country's well-established healthcare infrastructure, tech-savvy population, and emphasis on innovation in infant nutrition. Japanese parents are increasingly seeking safe, allergen-free, and organic feeding options, particularly rice-based formulas, due to their gentle impact on infant digestion. The country’s aging demographic structure also indirectly contributes to the demand, as grandparents often influence or directly manage childcare, preferring well-established and health-conscious feeding options. Additionally, the integration of e-commerce and health retail chains makes specialized infant formulas more accessible across urban and rural areas.

Canada Rice Based Infant Formula Market Insight

Canada accounted for the largest market revenue share in the North America region in 2025, fueled by rapid urbanization, increasing birth rates in some regions, and growing health awareness among young parents. With a high prevalence of cow milk protein allergies in infants, rice-based formulas are viewed as a safer and more digestible alternative. The government’s focus on food safety and domestic production, along with stringent regulations, has created a competitive landscape dominated by trusted brands. smart retail evolution and demand for premium, organic, and hypoallergenic infant nutrition further drive the rice-based infant formula market. Moreover, local manufacturers are innovating with fortified and nutritionally enhanced rice-based options, making Canada hotbed for product development and consumer testing within the infant formula space.

Rice Based Infant Formula Market Share

The Rice Based Infant Formula industry is primarily led by well-established companies, including:

- SCIENTIFIC BRAIN NUTRACEUTICAL PVT. LTD. (India)

- Bellamy's Organic (Australia)

- Abbott (U.S.)

- Nestlé (Switzerland)

- Bayer AG (Germany)

- BIMBOSAN AG (Switzerland)

- Danone (France)

- Meredith Corporation (U.S.)

- Mead Johnson & Company, LLC (U.S.)

- Savencia SA (France)

Latest Developments in North America Rice Based Infant Formula Market

- In April 2024, Nestlé launched a new line of rice-based infant formulas under its NAN brand, designed specifically for infants with cow milk protein allergies and lactose intolerance. This product line emphasizes clean-label ingredients, non-GMO rice protein, and added micronutrients tailored for digestive sensitivity. The initiative underscores Nestlé’s continued focus on innovation in hypoallergenic and plant-based infant nutrition, particularly in emerging Asian markets with rising infant allergy concerns.

- In March 2024, SCIENTIFIC BRAIN NUTRACEUTICAL PVT. LTD., an infant nutrition company, announced its expansion, introducing its rice-based infant formula products in Malaysia and Thailand. This move aligns with the company’s vision to offer affordable, easily digestible, and culturally relevant nutritional solutions in countries with high rice consumption and increasing awareness of alternative infant feeding options.

- In February 2024, Danone partnered with regional pediatric associations to promote clinical research on rice-based infant formulas for infants with atopic dermatitis and food allergies. The collaboration aims to increase scientific validation and physician adoption of rice-based formulas as safe alternatives to cow milk-based options, particularly in sensitive populations. The partnership also supports Danone’s R&D leadership in growing medical nutrition sector.

- In January 2024, Bellamy’s Organic introduced a certified organic rice-based follow-on formula for infants aged 6–12 months, targeting health-conscious parents. The product features organic brown rice protein, DHA from algae, and iron fortification, positioning it as a premium, natural alternative for infants with digestive sensitivities.

- In December 2023, Abbott enhanced its Similac product line by launching a plant-based, rice-derived hypoallergenic infant formula through its e-commerce platforms. This marks Abbott’s first foray into rice protein-based formulas, reflecting growing consumer demand for vegan, lactose-free, and clean-label alternatives in infant nutrition.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Rice Based Infant Formula Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Rice Based Infant Formula Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Rice Based Infant Formula Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.