North America Samarium Cobalt Magnets Market

Market Size in USD Million

CAGR :

%

USD

102.11 Million

USD

157.85 Million

2025

2033

USD

102.11 Million

USD

157.85 Million

2025

2033

| 2026 –2033 | |

| USD 102.11 Million | |

| USD 157.85 Million | |

|

|

|

|

North America Samarium Cobalt Magnets Market Size

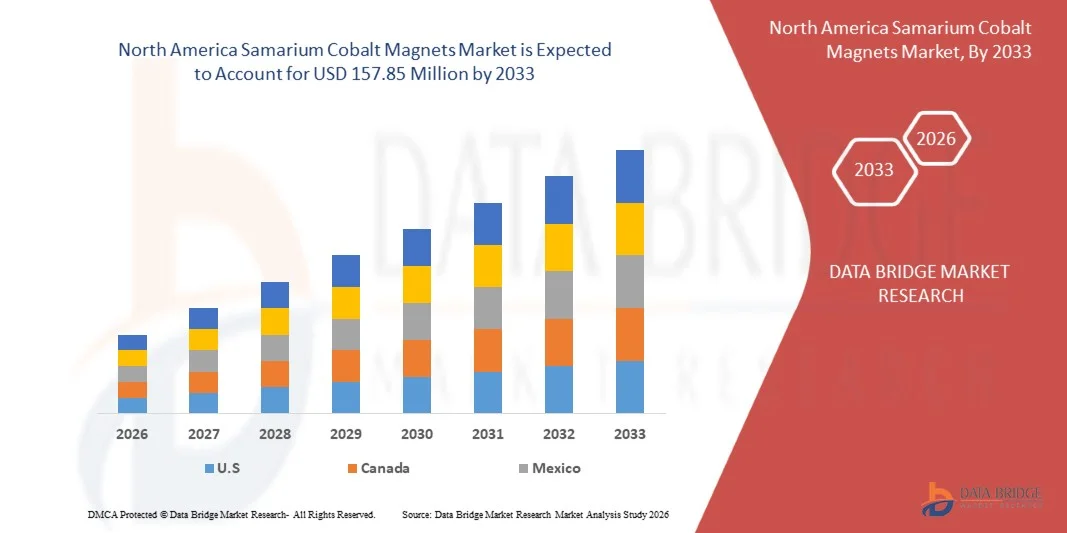

- The North America samarium cobalt magnets market size was valued at USD 102.11 million in 2025 and is expected to reach USD 157.85 million by 2033, at a CAGR of 5.7% during the forecast period.

- The North America samarium cobalt magnets market experiences steady growth driven by surging demand in defense and aerospace sectors, where these magnets excel in high-temperature environments and deliver superior magnetic strength for sensors, motors, and actuators. Rapid advancements in electric vehicles, renewable energy like wind turbines, and medical devices further propel adoption, as their corrosion resistance and thermal stability outperform alternatives in harsh conditions.

North America Samarium Cobalt Magnets Market Analysis

- Samarium cobalt (SmCo) magnets constitute a vital high-performance category within the permanent magnet sector, engineered from rare-earth alloys of samarium and cobalt in primary grades SmCo5 and Sm2Co17. These brittle, anisotropic magnets are fabricated via powder metallurgy, arc-melting alloys, jet-milling to submicron particles, aligning in magnetic fields during compaction, high-temperature sintering, heat treatment, and precision machining into discs, rings, arcs, blocks, or custom geometries for optimal flux density.

- Key drivers include the EV boom necessitating compact, high-temperature motors. Renewable energy expansion for durable generators, defense modernization and space missions, and miniaturization in consumer electronics and medical tech, amplified by policy incentives, promoting domestic supply chains.

- In 2026, U.S. is expected to dominate the North America samarium cobalt magnets market with 82.30% driven by strong investments in aerospace & defense programs, industrial manufacturing, energy infrastructure, and high-performance electrical systems. Increasing demand for high-temperature-resistant and corrosion-stable permanent magnets in mission-critical applications such as precision motors, sensors, actuators, and power systems is supporting market leadership, alongside ongoing modernization of industrial and defense capabilities.

- In 2026, the Sm2Co17 (2:17 Group) segment is expected to dominate the North America samarium cobalt magnets market with 69.48% due to its superior magnetic properties, including higher maximum energy products, greater intrinsic coercivity for enhanced demagnetization resistance, and improved thermal stability.

Report Scope and North America Samarium Cobalt Magnets Market Segmentation

|

Attributes |

North America Samarium Cobalt Magnets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Samarium Cobalt Magnets Market Trends

“Rising demand in defense and aerospace sectors”

- Rising demand in the defense and aerospace sectors is a key trend driving the samarium cobalt magnets market, as these industries increasingly require materials that deliver reliable performance under extreme conditions.

- Samarium cobalt magnets are widely used in aircraft systems, missile guidance, radar equipment, satellites, and defense-grade motors due to their exceptional thermal stability, strong magnetic strength, and resistance to corrosion and demagnetization.

- As global defense spending continues to increase and aerospace programs expand, including the development of advanced fighter jets, unmanned aerial vehicles, and space exploration missions, the need for high-performance magnetic components is growing.

- Unlike conventional magnets, samarium cobalt magnets maintain stable performance in high-temperature and high-vibration environments, making them ideal for mission-critical applications.

- This sustained reliance on durability, precision, and long operational lifespans is reinforcing long-term demand across defense and aerospace sectors.

North America Samarium Cobalt Magnets Market Dynamics

Driver

“Exceptional High-Temperature Performance of SmCo magnets”

- SmCo magnets deliver stable and reliable magnetic properties at temperatures reaching ~300–350°C, outperforming many other magnet types in extreme thermal conditions. This makes them essential for high-temperature motors, advanced aerospace systems, defense technologies, and heavy industrial machinery that operate under intense heat.

- Their consistent efficiency and durability in such demanding environments significantly enhance their appeal across multiple end-use industries, acting as a strong driver for the North America samarium cobalt magnets market.

- For instance, in April 2024, according to the blog published by Standford magnets, Samarium Cobalt magnets outperform high-temperature neodymium grades above 150°C and maintain magnetic strength up to nearly 350°C, supported by a low temperature coefficient and excellent thermal stability. Their reliability in extreme heat makes them ideal for motors, generators, and aerospace systems, while also functioning below absolute zero. This outstanding temperature resilience strengthens their demand, acting as a key driver for the North America samarium cobalt magnets market.

- The exceptional high-temperature performance of samarium cobalt magnets continues to strengthen their position as a critical material across multiple high-demand industries.

- Their ability to retain magnetic strength in extreme thermal environments, combined with advancements that enhance mechanical resilience and durability, reinforces their suitability for aerospace, defense, medical, automotive, and industrial applications.

- Supported by ongoing technological improvements and increasing adoption in temperature-intensive systems, this capability remains a key factor propelling the growth of the North America samarium cobalt magnets market.

Restraint/Challenges

“Raw-material price volatility”

- The prices of cobalt and certain rare-earth elements, which are key components in SmCo magnets, experience significant fluctuations due to supply-demand imbalances, geopolitical factors, and market speculation.

- These sharp variations increase production costs, reduce profit margins for manufacturers, and create financial uncertainty. This instability limits large-scale investments and production planning, acting as a major restraint on the growth of the North America samarium cobalt magnets market.

- For instance, In November 2025, according to the article published by International Energy Agency (IEA), The rapid growth in demand for key energy minerals, including cobalt and rare-earth elements, driven by electric vehicle batteries, energy storage, and renewable energy applications, exerts significant pressure on supply chains. This rising demand contributes to sharp price fluctuations of SmCo raw materials, increasing production costs and reducing profit margins, thereby acting as a critical restraint on the growth of the North America samarium cobalt magnets market

- The volatility of key raw materials such as cobalt and rare-earth elements poses a significant challenge for the SmCo magnet industry. Factors including rising demand from electric vehicles and renewable energy, concentrated mining regions, geopolitical risks, and supply chain dependencies drive sharp price fluctuations.

- This instability elevates production costs, compresses profit margins, and restricts large-scale investments, collectively acting as a major restraint on the growth of the North America samarium cobalt magnets market.

North America Samarium Cobalt Magnets Market Scope

The North America samarium cobalt magnets market is segmented into ten notable segments based on the type, grade, shape, remanence (BR), operating temperature, magnetization, coating, time horizon, application, and sales channel.

- By Type

On the basis of type, the North America samarium cobalt magnets market is segmented into Sm₂Co₁₇ (2:17 Group) and Sm₁Co₅ (1:5 Group). In 2026, the Sm₂Co₁₇ (2:17 Group) segment is expected to dominate the market with a 69.48% market share due to its higher maximum energy product, superior magnetic strength, better thermal stability, and enhanced resistance to demagnetization compared to SmCo₅, making it the preferred choice for high-performance applications.

The Sm₂Co₁₇ (2:17 Group) segment is expected to grow at the highest CAGR of 5.8% during the forecast period 2026 to 2033 due to increasing demand from electric vehicles, aerospace, defense, and industrial automation sectors that require high-temperature, high-reliability magnetic materials.

- By Grade

On the basis of grade, the North America samarium cobalt magnets market is segmented into standard, high-temperature grade, high-energy grade, high-coercivity grade, low-temperature grade, and others. In 2026, the standard segment is expected to dominate the market with a 39.21% market share due to its cost-effectiveness, stable magnetic performance, and wide suitability across automotive, industrial, electronics, and energy applications.

The high-energy grade segment is expected to grow at a CAGR of 6.5% during the forecast period 2026 to 2033 due to rising adoption in compact and high-power-density applications such as EV motors, aerospace actuators, and advanced industrial systems, where higher energy output per unit volume is critical.

- By Shape

On the basis of shape, the North America samarium cobalt magnets market is segmented into arcs/segments, rings, blocks, discs, cylinders/rods, custom, powders, and others. In 2026, the arcs/segments segment is expected to dominate the market with a 25.39% market share due to its extensive use in motors and generators where curved designs enable efficient magnetic flux distribution and compact assembly.

The rings segment is expected to grow at a CAGR of 6.7% during the forecast period 2026 to 2033 due to increasing demand from high-efficiency rotary applications such as brushless DC motors, EV traction motors, wind turbines, and aerospace actuators, where uniform magnetic fields and compact designs are essential.

- By Remanence (BR)

On the basis of remanence (Br), the North America samarium cobalt magnets market is segmented into 10–11 kg, 9–10 kg, up to 9 kg, and above 11 kg. In 2026, the 10–11 kg segment is expected to dominate the market with a 41.25% market share due to its optimal balance between magnetic strength, size, and cost, making it suitable for a wide range of industrial and automotive applications.

The above 11 kg segment is expected to grow at a CAGR of 6.1% during the forecast period 2026 to 2033 due to rising demand for high-flux-density magnets in EV traction motors, industrial generators, and aerospace systems requiring enhanced performance in compact designs.

- By Operating Temperature

On the basis of operating temperature, the North America samarium cobalt magnets market is segmented into up to 100 °C, 100–250 °C, 250–350 °C, and above 350 °C. In 2026, the 100–250 °C segment is expected to dominate the market with a 43.58% market share due to its alignment with mainstream industrial, automotive, and energy applications where moderate to high temperature resistance is required.

The above 350 °C segment is expected to grow at a CAGR of 6.1% during the forecast period 2026 to 2033 due to increasing deployment in extreme-environment applications such as aerospace engines, defense systems, and high-performance industrial equipment where magnetic stability at very high temperatures is critical.

- By Magnetization

On the basis of magnetization, the North America samarium cobalt magnets market is segmented into axially magnetized, diametrically magnetized, multi-pole, and radially magnetized. In 2026, the axially magnetized segment is expected to dominate the market with a 55.65% market share due to its simple design, ease of manufacturing, and widespread use in motors, sensors, and actuators.

The multi-pole segment is expected to grow at a CAGR of 6.6% during the forecast period 2026 to 2033 due to growing demand for high-efficiency rotary machines such as brushless DC motors, generators, and precision actuators used in EVs, wind energy, and aerospace applications.

- By Coating

On the basis of coating, the North America samarium cobalt magnets market is segmented into nickel plating, epoxy coating, polymer overmoulding, electroless plating, passivation/chemical treatments, and others. In 2026, the nickel plating segment is expected to dominate the market with a 44.03% market share due to its excellent corrosion resistance, durability, and suitability for high-volume industrial applications.

The epoxy coating segment is expected to grow at a CAGR of 6.4% during the forecast period 2026 to 2033 due to its superior chemical resistance, electrical insulation properties, cost-effectiveness, and suitability for harsh operating environments in EVs, aerospace, and renewable energy systems.

- By Time Horizon

On the basis of time horizon, the North America samarium cobalt magnets market is segmented into 1–3 years, 4–7 years, 8–15 years, and above 15 years. In 2026, the 8–15 years segment is expected to dominate the market with a 39.08% market share due to its alignment with typical replacement and maintenance cycles in industrial motors, EV drivetrains, and power generation equipment.

The above 15 years segment is expected to grow at a CAGR of 6.3% during the forecast period 2026 to 2033 due to increasing adoption in long-life, high-reliability applications such as aerospace systems, defense equipment, and renewable energy infrastructure.

- By Application

On the basis of application, the North America samarium cobalt magnets market is segmented into aerospace & defense, industrial manufacturing, energy & power generation, oil & gas/mining, automotive, marine, healthcare & medical devices, consumer electronics, research institutions, and others. In 2026, the aerospace & defense segment is expected to dominate the market with a 27.64% market share due to the exceptional thermal stability, corrosion resistance, and reliability of SmCo magnets in mission-critical environments.

The automotive segment is expected to grow at a CAGR of 6.4% during the forecast period 2026 to 2033 due to rising adoption of electric vehicles, increasing use of high-temperature-resistant magnets in traction motors and power electronics, and growing focus on performance and efficiency.

- By Sales Channel

On the basis of sales channel, the North America samarium cobalt magnets market is segmented into Direct (OEM) and aftermarket. In 2026, the Direct (OEM) segment is expected to dominate the market with a 77.90% market share due to direct integration of SmCo magnets into original equipment manufacturing processes across EVs, aerospace, and industrial machinery.

The Direct (OEM) segment is expected to grow at a CAGR of 5.8% during the forecast period 2026 to 2033 due to increasing OEM preference for customized SmCo specifications, long-term supply agreements, and rising production volumes of EVs, renewable energy systems, and aerospace equipment.

North America Samarium Cobalt Magnets Market Country Analysis

- North America holds a significant 21.00% market share in 2026 and is projected to grow at a CAGR of 5.7% in the forecast period from 2026 to 2033. The region benefits from advanced aerospace and defense industries, high adoption of electric vehicles, and strong investments in R&D. The presence of key magnet manufacturers and increasing focus on domestic rare-earth supply chains support sustained market growth.

U.S. Samarium Cobalt Magnets Market Insight

The United States is expected to dominate the North America samarium cobalt magnets market, accounting for the largest market share of 82.30% in 2026. This dominance is supported by the country’s strong concentration of end-use industries and advanced manufacturing capabilities, including a well-established base of aerospace, defense, automotive, and high-technology electronics manufacturers. These industries rely heavily on high-performance, temperature-resistant samarium cobalt magnets, driving substantial and sustained demand across the region.

Canada Samarium Cobalt Magnets Market Insights

Canada is expected to account for 9.24% of the North America samarium cobalt magnets market in 2026, driven by the country’s expanding aerospace manufacturing sector and growing defense contracts. The increasing demand for high-performance, heat-resistant samarium cobalt magnets in aircraft systems, propulsion components, and defense applications is supporting steady market growth, positioning Canada as an important contributor to the regional market landscape.

The North America samarium cobalt magnets market is primarily led by well-established companies, including:

- Adams Magnetic Products (United States)

- Arnold Magnetic Technologies (United States)

- Bunting Magnetics (United States)

- Electron Energy Corporation (United States)

- Integrated Magnetics (United States)

- Hangzhou Permanent Magnets Group (China)

- Ningbo Mag Spring Magnetics Ltd (China)

- MASTER MAGNETICS, Inc. (United States)

- Magnetic Component Engineering LLC (United States)

- Applied Magnets Superstore (United States)

- TyTek Industries (United States)

- Viona Magnetics (United States)

- Stanford Magnets (United States)

- Permag (United States)

- VAC (Germany)

Latest Developments in North America Samarium Cobalt Magnets Market

- In December 2025, Aclara Resources and VAC strengthened their partnership by expanding their collaboration from mining to magnet production. Through this agreement, Aclara will supply sustainably produced rare-earth materials, while VAC will use them to manufacture high-performance magnets. This collaboration helps both companies secure a stable supply chain, reduce dependence on imports, and support growing demand from industries such as electric vehicles, wind energy, and advanced electronics.

- In August 2025, VACUUMSCHMELZE (VAC) and Torngat Metals signed a non-binding Memorandum of Understanding (MOU) to formalize a strategic partnership aimed at strengthening the rare-earth supply chain for permanent magnets. Under this collaboration, Torngat Metals will supply VAC with responsibly produced, fully traceable separated rare earth oxides — including key heavy elements like terbium and dysprosium, to help secure long-term material availability for high-performance magnet production.

- In December 2025, Arnold Magnetic Technologies announced a landmark strategic supply agreement with Less Common Metals (LCM) and Solvay — a move explicitly designed to secure a stable, western-origin supply of rare-earth materials (notably samarium oxide) for use in high-performance permanent magnets. Under this new partnership, Arnold aims to shield its production chain from supply-chain volatility and export-control risks, ensuring long-term material availability for sectors such as aerospace, defense, automotive and energy.

- In September 2025, Arnold Magnetic Technologies revealed a major strategic investment initiative aimed at securing long-term supply of rare-earth materials and significantly expanding its production capacity for high-performance magnets. Over the past five years, the company has invested over US 50 million in facility upgrades, manufacturing-technology improvements, and capacity expansion — part of a broader plan to reinforce supply-chain resilience and meet rising demand.

- In April 2023, Arnold entered into a strategic partnership with Cyclic Materials to establish a circular supply chain for rare-earth elements used in permanent magnets. Under this agreement, Cyclic Materials will recycle end-of-life magnets and magnet scrap — reclaiming rare-earth elements such as samarium, neodymium, and dysprosium, along with cobalt — to supply Arnold with recycled raw material feedstock for future magnet production.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OPERATING TEMPERATURE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCE ANALYSIS

4.2 BRAND OUTLOOK

4.2.1 BRAND COMPARATIVE ANALYSIS

4.2.2 COMPANY VS BRAND OVERVIEW

4.3 PROCESS INTEGRATION ANALYSIS

4.3.1 SUPPLY CHAIN ROLE CLASSIFICATION

4.3.1.1 TRADER / DISTRIBUTOR

4.3.1.2 MAGNET-ONLY PRODUCER

4.3.1.3 ALLOY & POWDER PRODUCER (GRINDING & MIXING)

4.3.1.4 RARE EARTH EXTRACTOR / MINER

4.3.1.5 VERTICALLY INTEGRATED PLAYERS

4.3.2 DEGREE OF VERTICAL INTEGRATION

4.3.2.1 NUMBER OF VALUE CHAIN STAGES

4.3.2.2 STRATEGIC ADVANTAGES / RISKS

4.4 SUPPLIER LANDSCAPE

4.4.1 SUPPLY CHAIN ANALYSIS

4.4.1.1 ROLE OF LOGISTIC PROVIDERS

4.4.1.2 COST SCENARIO ACROSS STAKEHOLDERS

4.4.2 SUPPLIER RISK & OPPORTUNITY ASSESSMENT

4.4.2.1 SUPPLY RELIABILITY & CAPACITY

4.4.2.1.1 PRODUCTION CAPACITY

4.4.2.1.2 LEAD TIMES

4.4.2.1.3 SCALABILITY

4.4.2.2 GEOPOLITICAL & ORIGIN RISKS

4.4.2.2.1 DEPENDENCY ON CHINA

4.4.2.2.2 DIVERSIFICATION OPTIONS

4.4.2.3 PREFERRED SUPPLIER SHORTLIST

4.4.2.3.1 RECOMMENDED PARTNERS

4.4.2.3.2 RISK MITIGATION STRATEGIES

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL SOURCING

4.5.2 PROCESSING AND SEPARATION

4.5.3 MANUFACTURING STAGES

4.5.4 DISTRIBUTION & LOGISTIC

4.5.5 END-USER INTEGRATION

4.5.6 RISKS AND MITIGATION

4.6 TECHNICAL ADVANCEMENT

4.7 CONSUMER BUYING BEHAVIOUR

4.7.1 GROUP 1 AEROSPACE & DEFENSE GRADE BUYERS

4.7.2 GROUP 2 ADVANCED INDUSTRIAL MACHINERY MANUFACTURERS

4.7.3 GROUP 3 ELECTRIC MOBILITY AND EV MOTOR MANUFACTURERS

4.7.4 GROUP 4 SPECIALIZED RESEARCH, MILITARY R&D, AND SPACE APPLICATION USERS

4.7.5 GROUP 5 INDUSTRIAL TOOLING AND GENERAL MANUFACTURING

4.7.6 SMALL WORKSHOPS, DISTRIBUTORS, AND TRADING BUYERS

4.8 COST ANALYSIS BREAKDOWN

4.8.1 RAW MATERIAL COSTS (SAMARIUM, COBALT, ALLOYS)

4.8.2 ALLOYING, MELTING & POWDER PRODUCTION

4.8.3 SINTERING & MAGNETIC MICROSTRUCTURE FORMATION

4.8.4 MACHINING, GRINDING, COATING & FINISHING

4.8.5 MAGNETIZING, STABILIZATION & FINAL TESTING

4.8.6 YIELD LOSSES, SCRAP & REWORK

4.8.7 LABOR, UTILITIES & FACTORY OVERHEAD

4.8.8 EQUIPMENT DEPRECIATION & CAPITAL RECOVERY

4.8.9 PACKAGING, TRANSPORT, DUTIES & COMPLIANCE

4.8.10 R&D, CERTIFICATION & ADMINISTRATIVE COSTS

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.9.1.1 JOINT VENTURES

4.9.1.2 MERGERS AND ACQUISITIONS

4.9.1.3 LICENSING AND PARTNERSHIP AGREEMENTS

4.9.1.4 TECHNOLOGY COLLABORATIONS

4.9.1.5 STRATEGIC DIVESTMENTS

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 PRICING ANALYSIS

4.11 PROFIT MARGINS SCENARIO

4.11.1 RAW MATERIAL–DRIVEN MARGIN PRESSURE

4.11.2 HIGHER PROFIT MARGINS IN SPECIALTY GRADES

4.11.3 STABLE MARGINS DUE TO LIMITED NORTH AMERICA COMPETITION

4.11.4 STRONG MARGINS IN DEFENSE & AEROSPACE APPLICATIONS

4.11.5 LOWER MARGINS IN STANDARD INDUSTRIAL APPLICATIONS

4.11.6 IMPROVED MARGINS THROUGH VALUE-ADDED PROCESSING

4.11.7 PROFITABILITY IMPACTED BY ENERGY AND PROCESSING COSTS

4.11.8 RECYCLING AND SCRAP RECOVERY IMPROVE MARGINS

4.11.9 LONG-TERM SUPPLY CONTRACTS SUPPORT MARGIN STABILITY

4.12 RAW MATERIAL COVERAGE

4.12.1 SAMARIUM

4.12.2 COBALT

4.12.3 IRON

4.12.4 COPPER

4.12.5 ZIRCONIUM

4.13 RAW MATERIAL ORIGIN MAPPING

4.13.1 SOURCE OF RARE EARTH ELEMENTS

4.13.1.1 CHINA-BASED SOURCING

4.13.1.2 NON-CHINA SOURCING

4.13.1.3 MIXED ORIGIN

4.13.2 VERIFICATION OF ORIGIN

4.13.2.1 SUPPLIER DECLARATIONS & CERTIFICATES

4.13.2.2 CUSTOMS/TRADE DATA

4.13.2.3 THIRD-PARTY AUDITS

4.13.2.4 EVIDENCE LEVEL (A–D SCALE)

4.14 VALUE CHAIN ANALYSIS

4.14.1 RAW MATERIAL EXTRACTION

4.14.2 PROCESSING AND SEPARATION

4.14.3 ALLOYING AND MAGNET MANUFACTURING

4.14.4 DOWNSTREAM APPLICATIONS AND RECYCLING

4.15 VENDOR SELECTION CRITERIA

4.15.1 QUALITY ASSURANCE

4.15.2 MANUFACTURING CAPABILITIES

4.15.3 SUPPLY CHAIN RELIABILITY

4.15.4 COST AND INNOVATION

4.15.5 TECHNICAL SUPPORT

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.3.1 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIP BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS (FTAS)

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 INTRODUCTION

6.2 PRODUCT CODES

6.3 CERTIFIED STANDARDS

6.4 SAFETY STANDARDS

6.4.1 MATERIAL HANDLING & STORAGE

6.4.2 TRANSPORT & PRECAUTIONS

6.4.3 HAZARD IDENTIFICATION

6.4.3.1 CHEMICAL/HEALTH HAZARDS (GHS)

6.4.3.2 PHYSICAL/TRANSPORT HAZARDS (NON-GHS)

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXCEPTIONAL HIGH-TEMPERATURE PERFORMANCE OF SMCO MAGNETS

7.1.2 SUPERIOR CORROSION AND DEMAGNETIZATION RESISTANCE OF SMCO MAGNETS

7.1.3 MINIATURIZATION AND HIGH ENERGY DENSITY REQUIREMENTS

7.1.4 INCREASED ADOPTION IN TURBO MACHINERY, HIGH-SPEED MOTORS, AND ELECTRIC VEHICLES

7.2 RESTRAINTS

7.2.1 RAW-MATERIAL PRICE VOLATILITY

7.2.2 COMPETITION FROM LOWER-COST NDFEB AND FERRITE MAGNETS

7.3 OPPORTUNITIES

7.3.1 ADVANCES IN RECYCLING AND SECONDARY SOURCING

7.3.2 MATERIALS AND PROCESS RESEARCH & DEVELOPMENT FOR SAMARIUM COBALT MAGNETS

7.3.3 STRATEGIC STOCKPILING OF CRITICAL MINERALS BY GOVERNMENTS

7.4 CHALLENGES

7.4.1 GEOPOLITICAL EXPORT CONTROLS AND POLICY SHIFTS

7.4.2 TECHNICAL HANDLING AND YIELD CONSTRAINTS RELATED TO SMCO.

8 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE

8.1 OVERVIEW

8.1.1 SM2CO17 (2:17 GROUP)

8.1.2 SM1CO5 (1:5 GROUP)

8.2 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

8.2.1 SM2CO17 (2:17 GROUP)

8.2.2 SM1CO5 (1:5 GROUP)

8.3 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1 SMCO28M

8.3.2 SMCO30M

8.3.3 SMCO26M

8.3.4 SMCO30

8.3.5 SMCO28

8.3.6 SMCO26

8.3.7 SMCO32M

8.3.8 SMCO32

8.3.9 SMCO26H

8.3.10 SMCO28H

8.3.11 SMCO30H

8.3.12 SMCO24H

8.3.13 SMCO26L

8.3.14 SMCO28L

8.3.15 SMCO24L

8.3.16 SMCO30L

8.3.17 SMCO32L

8.4 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

8.4.1 SMCO28M

8.4.2 SMCO30M

8.4.3 SMCO26M

8.4.4 SMCO30

8.4.5 SMCO28

8.4.6 SMCO26

8.4.7 SMCO32M

8.4.8 SMCO32

8.4.9 SMCO26H

8.4.10 SMCO28H

8.4.11 SMCO30H

8.4.12 SMCO24H

8.4.13 SMCO26L

8.4.14 SMCO28L

8.4.15 SMCO24L

8.4.16 SMCO30L

8.4.17 SMCO32L

8.5 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (KG)

8.6.1 ASIA-PACIFIC

8.6.2 NORTH AMERICA

8.6.3 EUROPE

8.6.4 SOUTH AMERICA

8.6.5 MIDDLE EAST & AFRICA

8.7 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 SMCO16

8.7.2 SMCO18

8.7.3 SMCO20

8.7.4 SMCO22

8.7.5 SMCO24

8.7.6 SMCO18S

8.7.7 SMCO20S

8.7.8 SMCO22S

8.8 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

8.8.1 SMCO16

8.8.2 SMCO18

8.8.3 SMCO20

8.8.4 SMCO22

8.8.5 SMCO24

8.8.6 SMCO18S

8.8.7 SMCO20S

8.8.8 SMCO22S

8.9 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.9.1 ASIA-PACIFIC

8.9.2 NORTH AMERICA

8.9.3 EUROPE

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (KG)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

9 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY GRADE

9.1 OVERVIEW

9.2 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

9.2.1 STANDARD

9.2.2 HIGH-TEMPERATURE GRADE

9.2.3 HIGH-ENERGY GRADE

9.2.4 HIGH-COERCIVITY GRADE

9.2.5 LOW-TEMPERATURE GRADE

9.2.6 OTHERS

9.3 NORTH AMERICA STANDARD IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 NORTH AMERICA

9.3.3 EUROPE

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST & AFRICA

9.4 NORTH AMERICA HIGH-TEMPERATURE GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 NORTH AMERICA

9.4.3 EUROPE

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST & AFRICA

9.5 NORTH AMERICA HIGH-ENERGY GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 NORTH AMERICA HIGH-COERCIVITY GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 NORTH AMERICA

9.6.3 EUROPE

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 NORTH AMERICA LOW-TEMPERATURE GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 NORTH AMERICA

9.7.3 EUROPE

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST & AFRICA

10 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY SHAPE

10.1 OVERVIEW

10.1.1 ARCS / SEGMENTS

10.1.2 RINGS

10.1.3 BLOCKS

10.1.4 DISCS

10.1.5 CYLINDERS / RODS

10.1.6 CUSTOM

10.1.7 POWDERS

10.1.8 OTHERS

10.2 NORTH AMERICA ARCS / SEGMENTS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.2.1 ASIA-PACIFIC

10.2.2 NORTH AMERICA

10.2.3 EUROPE

10.2.4 SOUTH AMERICA

10.2.5 MIDDLE EAST & AFRICA

10.3 NORTH AMERICA RINGS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 NORTH AMERICA

10.3.3 EUROPE

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 NORTH AMERICA BLOCKS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 NORTH AMERICA

10.4.3 EUROPE

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 NORTH AMERICA DISCS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 NORTH AMERICA CYLINDERS / RODS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 NORTH AMERICA

10.6.3 EUROPE

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

10.7 NORTH AMERICA CUSTOM IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 NORTH AMERICA POWDERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

11 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY REMANENCE

11.1 OVERVIEW

11.1.1 10–11 KG

11.1.2 9–10 KG

11.1.3 UP TO 9 KG

11.1.4 ABOVE 11 KG

11.2 NORTH AMERICA 10–11 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.2.1 ASIA-PACIFIC

11.2.2 NORTH AMERICA

11.2.3 EUROPE

11.2.4 SOUTH AMERICA

11.2.5 MIDDLE EAST & AFRICA

11.3 NORTH AMERICA 9–10 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 NORTH AMERICA

11.3.3 EUROPE

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST & AFRICA

11.4 NORTH AMERICA UP TO 9 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 NORTH AMERICA

11.4.3 EUROPE

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST & AFRICA

11.5 NORTH AMERICA ABOVE 11 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

12 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY OPERATING TEMPERATURE

12.1 OVERVIEW

12.1.1 100–250 °C

12.1.2 250–350 °C

12.1.3 UP TO 100 °C

12.1.4 ABOVE 350 °C

12.2 NORTH AMERICA 100–250 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.2.1 ASIA-PACIFIC

12.2.2 NORTH AMERICA

12.2.3 EUROPE

12.2.4 SOUTH AMERICA

12.2.5 MIDDLE EAST & AFRICA

12.3 NORTH AMERICA 250–350 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.3.1 NORTH AMERICA 250–350 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.3.2 ASIA-PACIFIC

12.3.3 NORTH AMERICA

12.3.4 EUROPE

12.3.5 SOUTH AMERICA

12.3.6 MIDDLE EAST & AFRICA

12.4 NORTH AMERICA UP TO 100 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 NORTH AMERICA

12.4.3 EUROPE

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 NORTH AMERICA ABOVE 350 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 NORTH AMERICA

12.5.3 EUROPE

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

13 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY MAGNETIZATION

13.1 OVERVIEW

13.1.1 AXIALLY MAGNETIZED

13.1.2 DIAMETRICALLY MAGNETIZED

13.1.3 MULTI-POLE

13.1.4 RADIALLY MAGNETIZED

13.2 NORTH AMERICA AXIALLY MAGNETIZED IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.2.1 ASIA-PACIFIC

13.2.2 NORTH AMERICA

13.2.3 EUROPE

13.2.4 SOUTH AMERICA

13.2.5 MIDDLE EAST & AFRICA

13.3 NORTH AMERICA DIAMETRICALLY MAGNETIZED IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.3.1 ASIA-PACIFIC

13.3.2 NORTH AMERICA

13.3.3 EUROPE

13.3.4 SOUTH AMERICA

13.3.5 MIDDLE EAST & AFRICA

13.4 NORTH AMERICA MULTI-POLE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 NORTH AMERICA RADIALLY MAGNETIZED IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY COATING

14.1 OVERVIEW

14.1.1 NICKEL PLATING

14.1.2 EPOXY COATING

14.1.3 POLYMER OVERMOULDING

14.1.4 ELECTROLESS PLATING

14.1.5 PASSIVATION / CHEMICAL TREATMENTS

14.1.6 OTHERS

14.2 NORTH AMERICA NICKEL PLATING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.2.1 ASIA-PACIFIC

14.2.2 NORTH AMERICA

14.2.3 EUROPE

14.2.4 SOUTH AMERICA

14.2.5 MIDDLE EAST & AFRICA

14.3 NORTH AMERICA EPOXY COATING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.3.1 ASIA-PACIFIC

14.3.2 NORTH AMERICA

14.3.3 EUROPE

14.3.4 SOUTH AMERICA

14.3.5 MIDDLE EAST & AFRICA

14.4 NORTH AMERICA POLYMER OVERMOULDING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.4.1 ASIA-PACIFIC

14.4.2 NORTH AMERICA

14.4.3 EUROPE

14.4.4 SOUTH AMERICA

14.4.5 MIDDLE EAST & AFRICA

14.5 NORTH AMERICA ELECTROLESS PLATING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.5.1 ASIA-PACIFIC

14.5.2 NORTH AMERICA

14.5.3 EUROPE

14.5.4 SOUTH AMERICA

14.5.5 MIDDLE EAST & AFRICA

14.6 NORTH AMERICA PASSIVATION / CHEMICAL TREATMENTS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.6.1 ASIA-PACIFIC

14.6.2 NORTH AMERICA

14.6.3 EUROPE

14.6.4 SOUTH AMERICA

14.6.5 1.50.6 MIDDLE EAST & AFRICA

14.7 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.7.1 ASIA-PACIFIC

14.7.2 NORTH AMERICA

14.7.3 EUROPE

14.7.4 SOUTH AMERICA

14.7.5 MIDDLE EAST & AFRICA

15 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON

15.1 OVERVIEW

15.2 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON, 2018-2033 (USD THOUSAND)

15.2.1 8–15 YEARS

15.2.2 ABOVE 15 YEARS

15.2.3 4–7 YEARS

15.2.4 1–3 YEARS

15.3 NORTH AMERICA 8–15 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

15.3.1 ASIA-PACIFIC

15.3.2 NORTH AMERICA

15.3.3 EUROPE

15.3.4 SOUTH AMERICA

15.3.5 MIDDLE EAST & AFRICA

15.4 NORTH AMERICA ABOVE 15 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

15.4.1 ASIA-PACIFIC

15.4.2 NORTH AMERICA

15.4.3 EUROPE

15.4.4 SOUTH AMERICA

15.4.5 MIDDLE EAST & AFRICA

15.5 NORTH AMERICA 4–7 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

15.5.1 ASIA-PACIFIC

15.5.2 NORTH AMERICA

15.5.3 EUROPE

15.5.4 SOUTH AMERICA

15.5.5 MIDDLE EAST & AFRICA

15.6 NORTH AMERICA 1–3 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

15.6.1 ASIA-PACIFIC

15.6.2 NORTH AMERICA

15.6.3 EUROPE

15.6.4 SOUTH AMERICA

15.6.5 MIDDLE EAST & AFRICA

16 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY APPLICATION

16.1 OVERVIEW

16.1.1 AEROSPACE & DEFENSE

16.1.2 INDUSTRIAL MANUFACTURING

16.1.3 ENERGY & POWER GENERATION

16.1.4 OIL & GAS / MINING

16.1.5 AUTOMOTIVE

16.1.6 MARINE

16.1.7 HEALTHCARE & MEDICAL DEVICES

16.1.8 CONSUMER ELECTRONICS

16.1.9 RESEARCH INSTITUTIONS

16.1.10 OTHERS

16.2 NORTH AMERICA AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.2.1 ACTUATORS & SERVOS

16.2.2 AVIONICS SYSTEMS

16.2.3 MISSILE GUIDANCE

16.2.4 SATELLITE COMPONENTS

16.2.5 OTHERS

16.3 NORTH AMERICA AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.3.1 ASIA-PACIFIC

16.3.2 NORTH AMERICA

16.3.3 EUROPE

16.3.4 SOUTH AMERICA

16.3.5 MIDDLE EAST & AFRICA

16.4 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.4.1 SERVO MOTORS

16.4.2 ROBOTICS ACTUATORS

16.4.3 COUPLINGS & CLUTCHES

16.4.4 INDUSTRIAL GENERATORS

16.4.5 OTHERS

16.5 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.5.1 ASIA-PACIFIC

16.5.2 NORTH AMERICA

16.5.3 EUROPE

16.5.4 SOUTH AMERICA

16.5.5 MIDDLE EAST & AFRICA

16.6 NORTH AMERICA ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.6.1 TURBINE GENERATORS

16.6.2 SPECIALTY MOTORS

16.6.3 WIND TURBINES

16.6.4 HYDROELECTRIC DRIVES

16.6.5 OTHERS

16.7 NORTH AMERICA ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.7.1 ASIA-PACIFIC

16.7.2 NORTH AMERICA

16.7.3 EUROPE

16.7.4 SOUTH AMERICA

16.7.5 MIDDLE EAST & AFRICA

16.8 NORTH AMERICA OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.8.1 DOWNHOLE TOOLS

16.8.2 LOGGING INSTRUMENTS

16.8.3 MUD MOTORS

16.8.4 SUBSEA SENSORS

16.8.5 OTHERS

16.9 NORTH AMERICA OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.9.1 ASIA-PACIFIC

16.9.2 NORTH AMERICA

16.9.3 EUROPE

16.9.4 SOUTH AMERICA

16.9.5 MIDDLE EAST & AFRICA

16.1 NORTH AMERICA AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.10.1 SENSORS & ACTUATORS

16.10.2 TRACTION MOTORS

16.10.3 ELECTRIC DRIVES

16.10.4 HYBRID SYSTEMS

16.10.5 OTHERS

16.11 NORTH AMERICA AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.11.1 ASIA-PACIFIC

16.11.2 NORTH AMERICA

16.11.3 EUROPE

16.11.4 SOUTH AMERICA

16.11.5 MIDDLE EAST & AFRICA

16.12 NORTH AMERICA MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.12.1 THRUSTER MOTORS

16.12.2 SUBSEA SENSORS

16.12.3 SONAR SYSTEMS

16.12.4 MARINE GENERATORS

16.12.5 UNDERWATER ACTUATORS

16.12.6 NAVIGATION EQUIPMENT

16.12.7 CORROSION‑RESISTANT DRIVES

16.12.8 OTHERS

16.13 NORTH AMERICA MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.13.1 ASIA-PACIFIC

16.13.2 NORTH AMERICA

16.13.3 EUROPE

16.13.4 SOUTH AMERICA

16.13.5 MIDDLE EAST & AFRICA

16.14 NORTH AMERICA HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.14.1 LAB EQUIPMENT

16.14.2 SURGICAL TOOLS

16.14.3 DIAGNOSTIC DEVICES

16.14.4 MRI COMPONENTS

16.14.5 OTHERS

16.15 NORTH AMERICA HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.15.1 ASIA-PACIFIC

16.15.2 NORTH AMERICA

16.15.3 EUROPE

16.15.4 SOUTH AMERICA

16.15.5 MIDDLE EAST & AFRICA

16.16 NORTH AMERICA CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.16.1 MINI MOTORS

16.16.2 HAPTICS

16.16.3 SENSORS

16.16.4 AUDIO DEVICES

16.16.5 OTHERS

16.17 NORTH AMERICA CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.17.1 ASIA-PACIFIC

16.17.2 NORTH AMERICA

16.17.3 EUROPE

16.17.4 SOUTH AMERICA

16.17.5 MIDDLE EAST & AFRICA

16.18 NORTH AMERICA RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

16.18.1 CRYOGENIC MAGNETS

16.18.2 TEST EQUIPMENT

16.18.3 EXPERIMENTAL MOTORS

16.18.4 MAGNETIC ASSEMBLIES

16.18.5 OTHERS

16.19 NORTH AMERICA RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.19.1 ASIA-PACIFIC

16.19.2 NORTH AMERICA

16.19.3 EUROPE

16.19.4 SOUTH AMERICA

16.19.5 MIDDLE EAST & AFRICA

16.2 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

16.20.1 ASIA-PACIFIC

16.20.2 NORTH AMERICA

16.20.3 EUROPE

16.20.4 SOUTH AMERICA

16.20.5 MIDDLE EAST & AFRICA

17 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY SALES CHANNEL

17.1 OVERVIEW

17.1.1 DIRECT (OEM)

17.1.2 AFTERMARKET

17.2 NORTH AMERICA DIRECT (OEM) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

17.2.1 ASIA-PACIFIC

17.2.2 NORTH AMERICA

17.2.3 EUROPE

17.2.4 SOUTH AMERICA

17.2.5 MIDDLE EAST & AFRICA

17.3 NORTH AMERICA AFTERMARKET IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

17.3.1 ASIA-PACIFIC

17.3.2 NORTH AMERICA

17.3.3 EUROPE

17.3.4 SOUTH AMERICA

17.3.5 MIDDLE EAST & AFRICA

18 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY REGION

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 SWOT ANALYSIS

20 COMPANY PROFILES MANUFACTURER

20.1 HANGZHOU PERMANENT MAGNET GROUP CO., LTD

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 RECENT DEVELOPMENT

20.2 VACUUMSCHMELZE GMBH & CO. KG

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 RECENT DEVELOPMENT

20.3 ARNOLD MAGNETIC TECHNOLOGIES

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 RECENT DEVELOPMENT

20.4 NINGBO MAG SPRING MAGNETICS LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 RECENT DEVELOPMENT

20.5 ELECTRON ENERGY CORPORATION

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 A TO Z MAGNET MFG.CO.

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 ADAMS MAGNETIC PRODUCTS, LLC

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 ANHUI ASTROMAGNET CO., LTD

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 BUNTING MAGNETICS

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 DURA MAGNETICS

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 ECLIPSE MAGNETICS

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 EXOTIC SOURCING SOLUTIONS

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 INTEGRATED MAGNETICS

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 J R STRONG MAGNET.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 JAI-MAG INDUSTRIES.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 MAGNA CO., LTD.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 MASTER MAGNETICS, INC.

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 MIANYANG HENGXIN MAGNETIC MATERIAL CO., LTD.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 NINGBO NINGGANG PERMANENT MAGNETIC MATERIALS CO., LTD.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 RARE EARTH MAGNETICS

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 SONAL MAGNETICS.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

20.22 THE SAMARIUM MAGNET CO.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 TOKIN CORPORATION

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 TYTEK GROUP

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

20.25 XIAMEN LINKUP MAGNET CO., LTD.

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

21 COMPANY PROFILES DISTRIBUTORS

21.1 APPLIED MAGNETS SUPERSTORE

21.1.1 COMPANY SNAPSHOT

21.1.2 PRODUCT PORTFOLIO

21.1.3 RECENT DEVELOPMENT

21.2 MAGNET EXPERT

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 RECENT DEVELOPMENT

21.3 STORCH MAGNETICS

21.3.1 COMPANY SNAPSHOT

21.3.2 PRODUCT PORTFOLIO

21.3.3 RECENT DEVELOPMENT

21.4 SUPERMAGNETICSHOP

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENT

21.5 THE QUAINT MAGNET SHOP OF SUPREME MAGNETS

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 RECENT DEVELOPMENT

22 QUESTIONNAIRE

23 RELATED REPORTS

List of Table

TABLE 1 COUNTRY-WISE TARIFF COMPARISON TABLE FOR SAMARIUM COBALT MAGNETS

TABLE 2 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 4 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 6 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (KG)

TABLE 8 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 10 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (KG)

TABLE 12 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA STANDARD IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA HIGH-TEMPERATURE GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA HIGH-ENERGY GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA HIGH-COERCIVITY GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA LOW-TEMPERATURE GRADE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY SHAPE, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA ARCS / SEGMENTS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA RINGS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA BLOCKS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA DISCS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA CYLINDERS / RODS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA CUSTOM IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA POWDERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY REMANENCE (BR), 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA 10–11 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA 9–10 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA UP TO 9 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA ABOVE 11 KG IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY OPERATING TEMPERATURE, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA 100–250 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA UP TO 100 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA ABOVE 350 °C IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY MAGNETIZATION, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA AXIALLY MAGNETIZED IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIAMETRICALLY MAGNETIZED IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA MULTI-POLE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA RADIALLY MAGNETIZED IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA NICKEL PLATING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA EPOXY COATING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA POLYMER OVERMOULDING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTROLESS PLATING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA PASSIVATION / CHEMICAL TREATMENTS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA 8–15 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA ABOVE 15 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA 4–7 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA 1–3 YEARS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 NORTH AMERICA CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA OTHERS IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA DIRECT (OEM) IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA AFTERMARKET IN SAMARIUM COBALT MAGNETS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, 2018-2033 (USD THOUSAND & KG)

TABLE 78 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY COUNTRY, 2018-2033 (KG)

TABLE 80 USD THOUSAND

TABLE 81 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 83 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 85 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 87 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY SHAPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY REMANENCE (BR), 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY OPERATING TEMPERATURE, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY MAGNETIZATION, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 93 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 95 NORTH AMERICA AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 NORTH AMERICA ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 NORTH AMERICA AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 NORTH AMERICA HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 NORTH AMERICA RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 105 U.S. SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 U.S. SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 107 U.S. SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 U.S. SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 109 U.S. SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 U.S. SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 111 U.S. SAMARIUM COBALT MAGNETS MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 112 U.S. SAMARIUM COBALT MAGNETS MARKET, BY SHAPE, 2018-2033 (USD THOUSAND)

TABLE 113 U.S. SAMARIUM COBALT MAGNETS MARKET, BY REMANENCE (BR), 2018-2033 (USD THOUSAND)

TABLE 114 U.S. SAMARIUM COBALT MAGNETS MARKET, BY OPERATING TEMPERATURE, 2018-2033 (USD THOUSAND)

TABLE 115 U.S. SAMARIUM COBALT MAGNETS MARKET, BY MAGNETIZATION, 2018-2033 (USD THOUSAND)

TABLE 116 U.S. SAMARIUM COBALT MAGNETS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 117 U.S. SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON, 2018-2033 (USD THOUSAND)

TABLE 118 U.S. SAMARIUM COBALT MAGNETS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 119 U.S. AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 U.S. INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 U.S. ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 U.S. OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 U.S. AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 U.S. MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 U.S. HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 U.S. CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 U.S. RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 U.S. SAMARIUM COBALT MAGNETS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 129 CANADA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 CANADA SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 131 CANADA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 CANADA SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 133 CANADA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 CANADA SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 135 CANADA SAMARIUM COBALT MAGNETS MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 136 CANADA SAMARIUM COBALT MAGNETS MARKET, BY SHAPE, 2018-2033 (USD THOUSAND)

TABLE 137 CANADA SAMARIUM COBALT MAGNETS MARKET, BY REMANENCE (BR), 2018-2033 (USD THOUSAND)

TABLE 138 CANADA SAMARIUM COBALT MAGNETS MARKET, BY OPERATING TEMPERATURE, 2018-2033 (USD THOUSAND)

TABLE 139 CANADA SAMARIUM COBALT MAGNETS MARKET, BY MAGNETIZATION, 2018-2033 (USD THOUSAND)

TABLE 140 CANADA SAMARIUM COBALT MAGNETS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 141 CANADA SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON, 2018-2033 (USD THOUSAND)

TABLE 142 CANADA SAMARIUM COBALT MAGNETS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 143 CANADA AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 CANADA INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 CANADA ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 CANADA OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 CANADA AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 CANADA MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 CANADA HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 CANADA CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 CANADA RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 CANADA SAMARIUM COBALT MAGNETS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 153 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 155 MEXICO SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 MEXICO SM2CO17 (2:17 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 157 MEXICO SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 MEXICO SM1CO5 (1:5 GROUP) IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (KG)

TABLE 159 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 160 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY SHAPE, 2018-2033 (USD THOUSAND)

TABLE 161 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY REMANENCE (BR), 2018-2033 (USD THOUSAND)

TABLE 162 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY OPERATING TEMPERATURE, 2018-2033 (USD THOUSAND)

TABLE 163 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY MAGNETIZATION, 2018-2033 (USD THOUSAND)

TABLE 164 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 165 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY TIME HORIZON, 2018-2033 (USD THOUSAND)

TABLE 166 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 167 MEXICO AEROSPACE & DEFENSE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 MEXICO INDUSTRIAL MANUFACTURING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 MEXICO ENERGY & POWER GENERATION IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 MEXICO OIL & GAS / MINING IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 MEXICO AUTOMOTIVE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 MEXICO MARINE IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 MEXICO HEALTHCARE & MEDICAL DEVICES IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 MEXICO CONSUMER ELECTRONICS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 MEXICO RESEARCH INSTITUTIONS IN SAMARIUM COBALT MAGNETS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 MEXICO SAMARIUM COBALT MAGNETS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: OPERATING TEMPERATURE TIMELINE CURVE

FIGURE 11 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, BY TYPE (2025)

FIGURE 14 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 SUPERIOR CORRSION AND DEMAGNETIZATION RESISTANCE OF SMCO MAGNET IS EXPECTED TO DRIVE THE NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET IN 2026 & 2033

FIGURE 18 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GROWING REGION IN THE NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 19 ASIA PACIFIC IS THE FASTEST-GROWING REGION FOR THE NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 20 NUMBER OF DEALS, BY TYPE

FIGURE 21 YEARLY NUMBER OF DEALS BY COMPANIES

FIGURE 22 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, 2018-2033, AVERAGE PRICE (USD/KG)

FIGURE 23 VENDOR SELECTION CRITERIA

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET

FIGURE 25 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY TYPE, 2025

FIGURE 26 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY GRADE, 2025

FIGURE 27 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY SHAPE, 2025

FIGURE 28 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY REMANENCE, 2025

FIGURE 29 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY OPERATING TEMPERATURE, 2025

FIGURE 30 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY MAGNETIZATION, 2025

FIGURE 31 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY COATING, 2025

FIGURE 32 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY TIME HORIZON, 2025

FIGURE 33 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY APPLICATION, 2025

FIGURE 34 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET: BY SALES CHANNEL, 2025

FIGURE 35 NORTH AMERICA SAMARIUM COBALT MAGNETS MARKET, SNAPSHOT (2025)

North America Samarium Cobalt Magnets Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Samarium Cobalt Magnets Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Samarium Cobalt Magnets Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.