North America Sanitary Ware Market

Market Size in USD Billion

CAGR :

%

USD

32.47 Billion

USD

56.63 Billion

2025

2033

USD

32.47 Billion

USD

56.63 Billion

2025

2033

| 2026 –2033 | |

| USD 32.47 Billion | |

| USD 56.63 Billion | |

|

|

|

|

North America Sanitary Ware Market Size

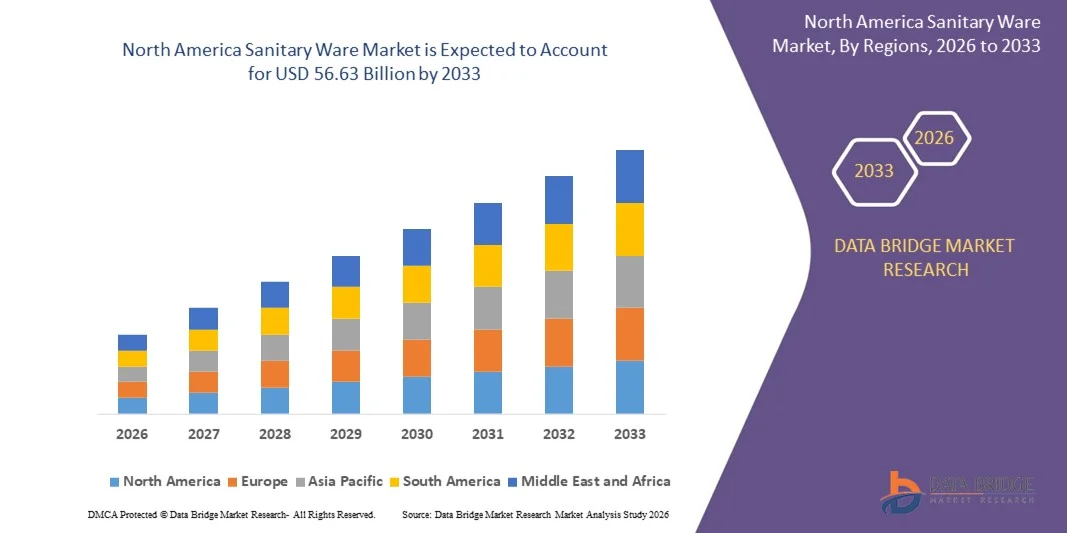

- The North America Sanitary Ware Market size was valued at USD 32.47 billion in 2025 and is projected to reach USD 56.63 billion by 2033, growing at a CAGR of 7.20% during the forecast period.

- The market growth is primarily driven by increasing urbanization, rising disposable incomes, and a shift toward modern, aesthetically appealing, and water-efficient bathroom solutions in residential and commercial spaces.

- Additionally, growing awareness of hygiene, sustainability, and innovative designs is encouraging the adoption of advanced sanitary ware products, such as touchless faucets, water-saving toilets, and designer sanitary fixtures, further propelling market expansion in the region.

North America Sanitary Ware Market Analysis

- Sanitary ware products, including toilets, faucets, sinks, and bathtubs, are essential components of modern residential and commercial bathrooms, driven by increasing demand for hygiene, functionality, and aesthetic appeal.

- The growing preference for water-efficient, durable, and stylish bathroom fixtures is primarily fueled by rising urbanization, higher disposable incomes, and increased awareness of sustainable and eco-friendly solutions.

- U.S. dominated the North America Sanitary Ware Market with the largest revenue share of 34.1% in 2025, supported by early adoption of modern bathroom designs, high consumer spending, and a strong presence of leading market players, with the U.S. witnessing significant growth in demand for smart and designer sanitary products in new residential and commercial constructions, driven by innovations in water-saving technology and contemporary designs.

- Canada is expected to be the fastest-growing region in the North America Sanitary Ware Market during the forecast period, fueled by rapid urbanization, rising disposable incomes, and increasing investments in modern infrastructure.

- The faucets segment dominated the market with the largest revenue share of 42.8% in 2025, driven by high demand for water-efficient, durable, and aesthetically appealing faucets suitable for both residential and commercial settings.

Report Scope and North America Sanitary Ware Market Segmentation

|

Attributes |

Sanitary Ware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

North America Sanitary Ware Market Trends

Enhanced Convenience Through Smart and Connected Bathroom Solutions

- A significant and accelerating trend in the North America Sanitary Ware Market is the growing integration of smart technologies and connected home systems, allowing bathroom fixtures to offer enhanced convenience, automation, and energy efficiency.

- For instance, smart toilets from TOTO and Kohler feature automated flushing, heated seats, and built-in bidet functions that can be controlled via mobile apps or voice assistants. Similarly, Moen and Delta Faucets offer app-enabled faucets that allow users to control water temperature and flow remotely, improving both comfort and water efficiency.

- Integration with AI and connected systems enables features such as learning user preferences for water usage, lighting, and temperature to optimize energy consumption and enhance hygiene. For example, some Grohe smart showers can memorize individual shower settings, while smart mirrors with AI capabilities provide personalized lighting and health monitoring insights.

- The seamless integration of smart sanitary ware with digital assistants and broader smart home platforms facilitates centralized control over the bathroom environment. Through a single interface, users can manage toilets, faucets, showers, lighting, and ventilation, creating a fully automated and convenient living experience.

- This trend toward more intelligent, intuitive, and interconnected bathroom solutions is fundamentally reshaping consumer expectations for modern bathrooms. Consequently, companies such as Kohler and Moen are developing AI-enabled, app-controlled, and voice-compatible products that enhance both convenience and functionality.

- The demand for smart, connected, and user-friendly sanitary ware solutions is growing rapidly across residential and commercial sectors, driven by consumers’ increasing focus on hygiene, comfort, energy efficiency, and integrated smart home experiences.

North America Sanitary Ware Market Dynamics

Driver

Growing Need Due to Rising Hygiene Awareness and Smart Bathroom Adoption

- The increasing focus on hygiene, water efficiency, and modern bathroom aesthetics, coupled with the accelerating adoption of smart home ecosystems, is a significant driver for the heightened demand for advanced sanitary ware.

- For instance, in 2025, Kohler introduced a new line of AI-enabled smart toilets and touchless faucets designed for residential and commercial applications, incorporating features such as automated flushing, water usage monitoring, and app-controlled operation. Such innovations by leading companies are expected to drive North America sanitary ware market growth during the forecast period.

- As consumers become more aware of hygiene standards, water conservation, and convenience, smart sanitary ware offers advanced features such as touchless operation, self-cleaning functions, and personalized settings, providing a compelling upgrade over traditional bathroom fixtures.

- Furthermore, the growing popularity of connected home devices and the desire for integrated living spaces are making smart sanitary ware an essential component of modern bathrooms, offering seamless interaction with other smart home systems such as lighting, climate control, and voice assistants.

- The convenience of automated operation, water and energy efficiency, and the ability to customize bathroom settings through smartphone applications are key factors propelling the adoption of smart sanitary ware in both residential and commercial sectors. The trend toward DIY smart bathroom upgrades and the increasing availability of user-friendly smart bathroom solutions further contribute to market growth.

Restraint/Challenge

Concerns Regarding High Initial Costs and Maintenance Complexity

- The relatively high initial cost of advanced sanitary ware products, including smart toilets, touchless faucets, and AI-enabled showers, poses a significant challenge to broader market adoption. Premium features such as app-controlled operation, water-saving technology, and integrated hygiene functions often come at a higher price compared to conventional bathroom fixtures, limiting adoption among price-sensitive consumers.

- For instance, while basic water-efficient faucets and toilets have become more affordable, fully integrated smart bathroom systems from brands such as Kohler, TOTO, and Moen remain a significant investment, making some consumers hesitant to upgrade their bathrooms.

- Additionally, the complexity of installing and maintaining connected sanitary ware devices can discourage potential buyers. Concerns about proper installation, software updates for smart features, and potential malfunctions increase perceived risks associated with adoption.

- While prices of smart and connected bathroom solutions are gradually decreasing, the perceived premium for advanced features can still hinder widespread adoption, particularly among homeowners who do not immediately prioritize automation, water efficiency, or integrated hygiene technologies.

- Overcoming these challenges through the development of more affordable models, simplified installation processes, comprehensive after-sales support, and consumer education on long-term benefits such as water savings, hygiene, and convenience will be vital for sustained market growth in North America.

North America Sanitary Ware Market Scope

The sanitary ware market is segmented on the basis of the type, material, operating mode, shape, colour and end-user.

- By Type

On the basis of type, the North America Sanitary Ware Market is segmented into toilet seats, wash basins, urinals, faucets, cisterns, showers, bathtubs, bathroom accessories, and others. The faucets segment dominated the market with the largest revenue share of 42.8% in 2025, driven by high demand for water-efficient, durable, and aesthetically appealing faucets suitable for both residential and commercial settings. Faucets are often prioritized due to their daily utility, compatibility with modern bathroom designs, and availability of smart and sensor-based models enhancing convenience and hygiene.

The shower segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, fueled by growing adoption of smart showers with automated temperature control, water conservation features, and integration with connected home systems. The increasing preference for luxurious and spa-like bathroom experiences in urban households and hospitality establishments is further accelerating demand for advanced shower solutions.

- By Material

On the basis of material, the North America Sanitary Ware Market is segmented into ceramic, metal, glass, and others. The ceramic segment held the largest market revenue share of 51.3% in 2025, owing to its durability, ease of maintenance, cost-effectiveness, and aesthetic versatility for a wide range of bathroom fixtures including toilets, basins, and urinals. Ceramic products are widely preferred in residential and commercial projects due to their long service life and resistance to stains and corrosion.

The metal segment is expected to register the fastest CAGR of 17.8% during 2026–2033, driven by rising demand for premium faucets, shower fittings, and bathroom accessories offering modern designs and enhanced durability. Increasing adoption of stainless steel, brass, and other corrosion-resistant metals in commercial and luxury residential projects is supporting this growth, alongside consumer preference for contemporary, high-quality finishes in bathroom interiors.

- By Operating Mode

On the basis of operating mode, the North America Sanitary Ware Market is segmented into manual and automated. The manual segment dominated the market with a 58.6% share in 2025, primarily due to its affordability, widespread availability, and compatibility with conventional bathroom setups in both residential and commercial properties. Manual fixtures, including faucets, showers, and toilets, remain the preferred choice for cost-sensitive markets and regions with limited access to smart home technologies.

The automated segment is expected to witness the fastest CAGR of 20.2% from 2026 to 2033, driven by the growing adoption of touchless and sensor-based faucets, smart toilets, and showers with automated water flow and temperature control. Rising consumer awareness regarding hygiene, water conservation, and convenience in modern smart homes is fueling the shift toward automated sanitary ware solutions, particularly in urban and high-income areas.

- By Shape

On the basis of shape, the North America Sanitary Ware Market is segmented into curved, rectangle, circle, domed top, square, and others. The rectangle segment accounted for the largest market revenue share of 39.4% in 2025, driven by its modern aesthetic appeal and suitability for space-efficient designs in urban residential and commercial bathrooms. Rectangular basins, bathtubs, and showers are increasingly preferred in new constructions and renovations for their versatility and clean lines that complement contemporary interiors.

The curved segment is expected to register the fastest CAGR of 18.7% from 2026 to 2033, fueled by rising demand for ergonomic and visually appealing designs that offer comfort, elegance, and a premium look in both luxury homes and hospitality spaces. Consumers are increasingly adopting curved shapes for bathtubs, basins, and shower trays to achieve a balance of aesthetics and functional usability.

- By Colour

On the basis of colour, the North America Sanitary Ware Market is segmented into white, black, and others. The white segment dominated the market with a 61.2% share in 2025, owing to its timeless appeal, versatility, and ability to complement a wide range of bathroom designs. White sanitary ware products are widely adopted across residential, commercial, and institutional projects due to their clean look, ease of maintenance, and ability to create an illusion of space in smaller bathrooms.

The black segment is expected to witness the fastest CAGR of 19.0% during 2026–2033, driven by the growing popularity of modern and luxury bathroom designs. Increasing demand for matte black faucets, shower fittings, basins, and accessories as premium and statement pieces is contributing to this growth trend, especially in urban developments and high-end hospitality establishments.

- By End-User

On the basis of end-user, the North America Sanitary Ware Market is segmented into residential, commercial, institutional, and others. The residential segment accounted for the largest market revenue share of 54.7% in 2025, driven by rising urbanization, increasing disposable incomes, and the growing adoption of modern and smart bathroom solutions in new housing and renovation projects. Rising awareness of hygiene, water efficiency, and convenience further fuels adoption in the residential sector.

The commercial segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, supported by rapid development in hotels, restaurants, offices, and retail spaces. Demand for durable, aesthetically appealing, and technologically advanced sanitary ware products that enhance guest experiences and operational efficiency is accelerating growth in the commercial segment, along with a shift toward automated and touchless solutions.

North America Sanitary Ware Market Regional Analysis

- U.S. dominated the North America Sanitary Ware Market with the largest revenue share of 34.1% in 2025, driven by rising demand for modern, water-efficient, and smart bathroom solutions, as well as increasing awareness of connected home technologies.

- Consumers in the region highly value the convenience, hygiene, and energy-saving benefits offered by smart and touchless sanitary ware, along with seamless integration with other smart home devices such as lighting, climate control, and voice assistants.

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for personalized, automated, and aesthetically appealing bathroom experiences, establishing advanced sanitary ware as a preferred choice for both residential and commercial properties.

U.S. Sanitary Ware Market Insight

The U.S. sanitary ware market captured the largest revenue share of 81% in 2025 within North America, driven by rising demand for modern, water-efficient, and smart bathroom solutions. Consumers are increasingly prioritizing hygiene, convenience, and energy-saving features in residential and commercial bathrooms. The growing adoption of smart home technologies, including app-controlled toilets, touchless faucets, and AI-enabled showers, further propels the market. Moreover, high disposable incomes, urbanization, and the trend toward luxury and customizable bathroom designs are significantly contributing to market expansion.

Canada Sanitary Ware Market Insight

The Canada sanitary ware market is projected to grow at a substantial CAGR during the forecast period, fueled by increasing awareness of water conservation, eco-friendly bathroom solutions, and smart home integration. The adoption of advanced sanitary ware in residential, commercial, and hospitality sectors is rising, driven by consumer demand for convenience, hygiene, and sustainability. Government initiatives promoting energy and water efficiency, coupled with a technologically inclined population, are supporting market growth across urban and suburban areas.

Mexico Sanitary Ware Market Insight

The Mexico sanitary ware market is expected to expand at a notable CAGR during the forecast period, supported by rapid urbanization, rising disposable incomes, and growing investments in residential and commercial infrastructure. Consumers are increasingly adopting modern and smart bathroom fixtures, such as touchless faucets, water-saving toilets, and designer sanitary ware. The market is further boosted by government programs encouraging water efficiency and hygiene, along with the increasing availability of affordable and innovative products from both domestic and international manufacturers.

North America Sanitary Ware Market Share

The Sanitary Ware industry is primarily led by well-established companies, including:

• TOTO (Japan)

• Kohler (U.S.)

• American Standard (U.S.)

• Jaquar Group (India)

• Hindware (India)

• Cera Sanitaryware (India)

• Roca (Spain)

• Grohe (Germany)

• Duravit (Germany)

• Parryware (India)

• Vitra (Turkey)

• Ideal Standard (Belgium)

• MOEN (U.S.)

• Armitage Shanks (U.K.)

• Novellini (Italy)

• Geberit (Switzerland)

• RAK Ceramics (U.A.E.)

• Ferroli (Italy)

• Mirage Bathrooms (Italy)

• Karbonn (India)

What are the Recent Developments in North America Sanitary Ware Market?

- In April 2024, Kohler Co., a global leader in kitchen and bathroom solutions, launched a strategic initiative in North America aimed at promoting water-efficient and smart bathroom technologies for residential and commercial properties. This initiative highlights the company’s dedication to delivering innovative, high-quality sanitary ware products tailored to evolving consumer preferences. By leveraging its global expertise and advanced product portfolio, Kohler is addressing regional demands while reinforcing its position in the rapidly growing North America Sanitary Ware Market.

- In March 2024, Moen Inc., a U.S.-based premium faucet and bathroom fixtures manufacturer, introduced its Smart Faucet Series featuring app-controlled operation, voice assistant integration, and advanced water-saving technologies. Designed for both residential and commercial applications, this product line underscores Moen’s commitment to enhancing convenience, sustainability, and user experience in modern bathroom spaces.

- In March 2024, American Standard successfully launched its EcoSmart Smart Toilet Initiative, aimed at reducing water consumption and improving hygiene standards in urban households. This initiative leverages advanced flushing technology, touchless controls, and IoT-enabled monitoring, demonstrating American Standard’s dedication to sustainable innovation and modern bathroom solutions.

- In February 2024, TOTO U.S. announced a strategic partnership with leading smart home integrators to expand the adoption of its AI-enabled toilets and touchless fixtures in luxury residential and commercial projects. The collaboration focuses on enhancing hygiene, energy efficiency, and seamless connectivity with home automation systems, reflecting TOTO’s commitment to smart and sustainable bathroom experiences.

- In January 2024, Delta Faucet Company unveiled its Voice-Activated Smart Faucet at the Kitchen & Bath Industry Show (KBIS) 2024. Equipped with AI-enabled voice control and app connectivity, this innovative product allows users to manage water flow and temperature hands-free, exemplifying Delta’s focus on integrating advanced technology to enhance convenience, hygiene, and water efficiency in modern bathrooms.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.