North America Saturated Kraft Paper Market

Market Size in USD Million

CAGR :

%

USD

485.25 Million

USD

711.13 Million

2024

2032

USD

485.25 Million

USD

711.13 Million

2024

2032

| 2025 –2032 | |

| USD 485.25 Million | |

| USD 711.13 Million | |

|

|

|

|

Saturated Kraft Paper Market Size

- The North America saturated kraft paper market was valued at USD 485.25 million in 2024 and is expected to reach USD 711.13 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.0%, primarily driven by rapid industrialization and urbanization.

- This growth is driven by factors such as the expansion of e-commerce, eco-friendly alternatives, cost-effectiveness and rising demand for sustainable packaging.

Saturated Kraft Paper Market Analysis

- The global saturated kraft paper market is experiencing steady growth driven by rising demand in construction, furniture, and interior design industries, where the material is valued for its strength, flexibility, and resistance to moisture and chemicals

- Increasing focus on sustainable and recyclable materials is also fueling market expansion, as saturated kraft paper is often produced from renewable wood pulp and certified under eco-labels such as FSC and PEFC

- Manufacturers are innovating with resin formulations and processing technologies to enhance product performance and meet diverse end-use requirements

- Key regions contributing to market growth include North America, Europe, and Asia-Pacific, with emerging economies showing significant potential due to rapid urbanization and infrastructure development

For instance,

- In December 2023, Mondi announced the expansion of its saturating kraft paper range and increased capacity to better serve manufacturers of building panels, worktops, furniture, and technical films. With a new paper machine at its Štĕtí plant (Czech Republic) and optimized mill production at Frantschach (Austria) and Dynäs (Sweden), Mondi ensures short lead times, reliable supply, and enhanced production of Advantage MF Boost for laminated applications across Europe

- In December 2021, Nordic Paper Holding AB completed the acquisition of Glassine Canada Inc. for a preliminary price of USD 46.3 million. The acquired company specializes in greaseproof paper for food applications and serves mainly North American markets. This acquisition strengthened Nordic Paper Holding AB’s footprint in North America and expanded its product range and proximity to customers

- It supported growth in the saturated kraft paper market by enhancing production capabilities and addressing rising demand for specialty and food-grade papers

Report Scope and Saturated Kraft Paper Market Segmentation

|

Attributes |

Saturated Kraft Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Saturated Kraft Paper Market Trends

“E-Commerce Packaging Expansion”

- The saturated kraft paper market is seeing a strong rise, particularly due to the growing e-commerce sector. As more people shop online, the demand for sustainable packaging solutions increases, making kraft paper a popular choice

- This type of paper is eco-friendly, durable, and perfect for packaging goods that need extra protection during shipping

- With e-commerce's rapid expansion, companies are turning to kraft paper for its ability to handle various product sizes and offer secure delivery. The trend toward reducing plastic use also boosts the market, as kraft paper offers an eco-conscious alternative

For instance,

- In October 2023, the e-commerce industry is experiencing rapid growth, fueled by new technologies and innovations aimed at sustainability. Manufacturers are streamlining processes to create more eco-friendly packaging solutions. With the increasing availability of smartphones and internet access globally, more people are engaging in online shopping than ever before. This has led to a significant shift in the way products are packaged and delivered, emphasizing sustainability. The future of e-commerce and packaging looks bright, driven by these advancements and a growing demand for eco-conscious practices.

- On March, 2024 According to Mondi Group As eCommerce packaging evolves, understanding how consumers handle packaging after receiving their orders is crucial. A survey reveals that sustainability is a major concern for consumers, with many eager to reduce packaging waste. Interestingly, 47% of Boomers are likely to recycle packaging, while only 32% of Gen Z do the same. The younger generation, who often purchase clothing in plastic packaging, tend to dispose of it in general waste instead. This highlights the need for more sustainable packaging options, especially for products popular with younger shoppers

- Overall, e-commerce growth is driving the adoption of saturated kraft paper in packaging across industries

Saturated Kraft Paper Market Dynamics

Driver

“Growing Demand for Decorative Laminates in Construction Sector”

- Saturated kraft paper serves as a foundational material in producing High-Pressure Laminates (HPLs), which are extensively used for enhancing surfaces such as flooring, countertops, and wall panels

- As urbanization accelerates and consumer preferences shift towards aesthetically pleasing and durable interiors, the need for such laminates rises

- This trend directly boosts the consumption of saturated kraft paper, given its essential role in laminate production. In addition, the construction industry's emphasis on sustainable and cost-effective materials further amplifies this demand, as saturated kraft paper offers recyclability and environmental benefits

- Consequently, the symbiotic relationship between the growth of decorative laminates in construction and the saturated kraft paper market underscores the latter's expansion in response to evolving architectural and design preferences

For instance,

- In December 2024, NBM Media Pvt. Ltd. highlighted that, CenturyPly reaffirmed its leadership in India’s plywood and decorative veneer market, with a valuation of USD 1640.97 million. The company is expanding aggressively with greenfield and brownfield investments in Andhra Pradesh to boost MDF and laminate capacity. Innovations like anti-fingerprint laminates, designer veneers, and Century Cubicles highlight its design-forward approach. CenturyPly is also widening its dealer network in tier 2–4 towns and aims to double laminate exports to USD 34.62 million in three years, reflecting robust domestic and global demand

- In December 2021, according to Techbullion, the paper market is projected to grow due to rising demand for decorative laminates in flooring, furniture, and interior applications. The surge in ready-to-assemble furniture and laminated surfaces in the construction industry, coupled with continuous design innovations, is fueling market expansion. In addition, the growth of eCommerce is opening new income streams. Saturated kraft paper’s durability, recyclability, and moisture resistance make it ideal for various construction and interior applications

- Saturated kraft paper, essential in producing high-pressure laminates for surfaces such as flooring and countertops, benefits directly from this trend. This symbiotic relationship underscores the importance of saturated kraft paper in meeting modern construction and design demands

Opportunity

“Online Retailers Prefer Kraft-Based Mailer Solutions”

- The saturated kraft paper offers notable opportunities, particularly with the increasing adoption of kraft-based mailer solutions by online retailers. As e-commerce continues to expand, there's a heightened demand for packaging that is both sustainable and durable

- Kraft paper mailers, being biodegradable and lightweight, meet these criteria, making them a preferred choice for shipping various products. In addition, advancements in kraft paper mailer designs, such as enhanced water and tear resistance, further broaden their applicability across different sectors

- Manufacturers focusing on these innovations can effectively cater to the evolving needs of the e-commerce industry and capitalize on the market's potential

For instance,

- In January 2021, according to the article published by NewsPackaging, Mondi launched a USD 72.2 million kraft paper machine at its Štětí factory in the Czech Republic, becoming the first in Europe dedicated to producing specialty kraft paper from fresh and recycled fibers for retail and online shopping bags. The machine produced up to 130,000 tons annually of 100% recyclable EcoVantage paper, offering high strength, printability, and a natural look. This development created an opportunity in the saturated kraft paper market by supporting the shift among online retailers toward kraft-based mailer solutions that are both sustainable and suitable for branding and e-commerce packaging needs

- In June 2023, as per the GIE Media, Inc., Walmart announced it would shift to kraft paper mailers for home delivery and offer an opt-out option for bags in online pickup orders, targeting wider implementation by year-end. With 27% growth in its eCommerce operations, the company aimed to support order fulfillment using paper-based alternatives across its network. This move was expected to boost kraft paper demand by over 2,000 tons annually. The decision presented a clear opportunity in the saturated kraft paper market, pointing to increasing adoption of kraft-based mailer solutions by major online retailers.

- The rapid expansion of e-commerce has led to a heightened demand for reliable and adaptable packaging materials. Kraft paper, known for its strength and versatility, is well-suited to meet these requirements

- This shift allows kraft paper manufacturers to innovate and diversify their product offerings, such as developing enhanced kraft paper variants to cater to the specific needs of online retailers

Restraint/Challenge

“Availability of Substitute Materials with Lower Production Costs”

- The market faces a significant restraint due to the increasing availability of substitute materials that offer similar or enhanced performance at lower production costs

- Alternatives such as biogenic composites (e.g., PaperShell), synthetic laminates, and low-cost plastic-based sheets are gaining traction across industries such as furniture, packaging, and construction

- These substitutes often provide better durability, moisture resistance, or aesthetic flexibility while also being cost-effective. As industries prioritize sustainability and cost-efficiency, demand for traditional saturated kraft paper may decline, impacting market growth

For instance,

- In February 2025, according to the article published by Wood Central, a growing shift toward innovative biogenic materials such as PaperShell is emerging as a potential restraint for the market. Developed from virgin or recycled kraft paper, PaperShell offers a lightweight, moldable, and highly durable alternative for use in architecture, automotive, and consumer goods. Its ability to replace traditional materials with lower environmental impact and increasing interest from industries seeking cost-effective, sustainable solutions highlights the rising availability of substitute materials, challenging the dominance of conventional saturated kraft paper products

- In June 2022, Stora Enso launched AvantForte WhiteTop, a 100% virgin fiber-based, OBA-free kraftliner designed for premium packaging applications such as fresh food and e-commerce. Engineered with Tri-Ply technology, it offers superior strength and print quality, enabling material efficiency. Produced at the upgraded Oulu site in Finland, the product reflects a market shift toward renewable, plastic-free, and high-performing alternatives. This innovation adds pressure on conventional saturating kraft paper producers, as newer, high-strength liners may serve as efficient replacements in select end-use cases

- The rising adoption of low-cost, high-performance substitute materials poses a considerable restraint to the saturated kraft paper market. As industries increasingly shift toward more economical and sustainable alternatives, the demand for conventional kraft paper may decline

- This growing competition from substitutes could restrain market expansion, prompting manufacturers to innovate and enhance the value proposition of saturated kraft paper

Saturated Kraft Paper Market Scope

The market is segmented on the basis of basic weigh, paper grade, application, utility, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Basic Weight |

|

|

By Paper Grade |

|

|

By Application |

|

|

By Utility |

|

|

By End Use |

|

Saturated Kraft Paper Market Regional Analysis

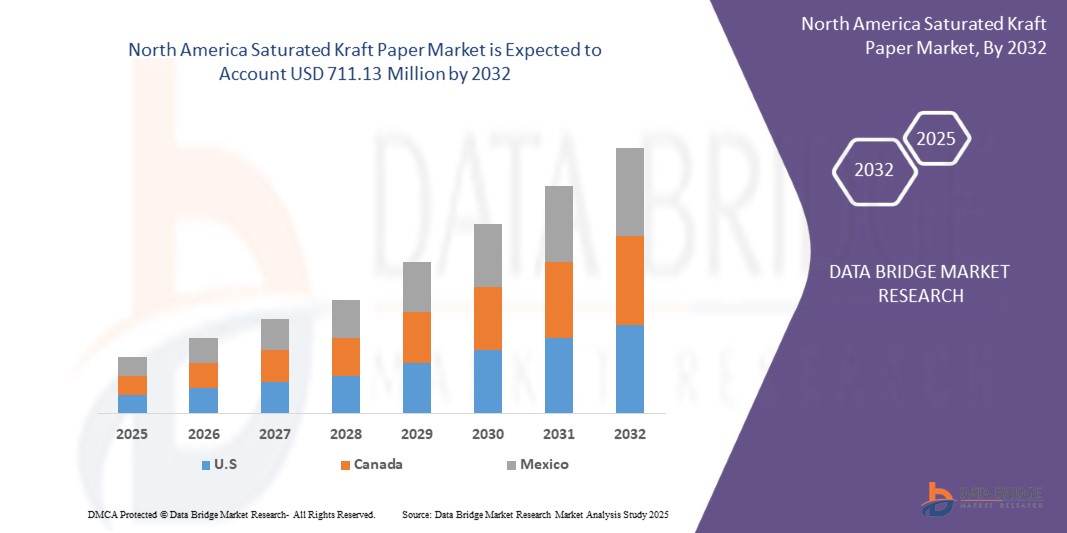

“U.S. is dominating country in North America Saturated Kraft Paper Market”

- The U.S. is the leading player in the North America Saturated Kraft Paper Market, driven by their strong packaging, construction, and furniture industries

- The U.S., in particular, holds the largest share due to high demand for decorative laminates and industrial packaging, along with a well-established manufacturing base

- U.S’s benefit from advanced recycling systems and environmental regulations that encourage kraft paper usage over plastic. Its dominance is further reinforced by key market players and technological advancements in paper processing

“Canada is Projected to Register the Highest Growth Rate”

- Canada is fastest growing country in the North America saturated kraft paper market due to increasing demand for sustainable packaging and e-commerce growth

Saturated Kraft Paper Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- International Paper (U.S.)

- WestRock Company. (U.S.)

- Ahlstrom

- Mondi (Austria)

- Mayr-Melnhof Karton AG (Austria)

- Gordon Paper Company, Inc. (U.S.)

- Potsdam Specialty Paper Inc. (U.S.)

- Mayr-Melnhof Karton AG

- Nordic Paper (Sweden)

- SCG International Corporation (Thailand)

- Fleenor Paper Company

- Northern Technologies International Corporation (NTIC). (U.S.)

- Stora Enso (Finland)

- HAL Industries Inc. (U.S.)

- WARAQ, (Saudi Arabia)

- Onyx Papers. (U.S.)

- Ranheim

- Pudumjee Paper Products (India)

- Fortune Paper Mills LLP (India)

- Venkraft Paper Mills Pvt.Ltd. (India)

Latest Developments in North America Saturated Kraft Paper Market

- In December 2021, MM Group announced plans to enter the sack kraft paper market, leveraging its Kwidzyn mill in Poland to meet growing demand for sustainable fiber-based packaging. The company will focus on bleached sack kraft paper while also expanding ABSORBEX saturating kraft paper capacity. CEO Peter Oswald highlighted strong IPACK sales growth and plans for further kraft paper innovations

- In March 2025, Mondi announced its collaboration with Hans Schmid KG, supplying Ad/Vantage Boost, a saturated kraft paper for furniture and flooring laminates. Known for its strength and absorbency, Ad/Vantage Boost acts as a resin carrier, ensuring high-performance laminate applications. Produced from 100% responsibly sourced long fibres in Sweden and Austria, it is available with FSC or PEFC certification. This partnership strengthens Europe’s supply of premium impregnated paper for worktops, furniture, and industrial uses

- In September 2024, Ahlstrom has launched a feasibility study to add saturation and release coating capability for tape base papers, addressing growing demand, especially in the Americas. The investment would enhance its product range, including creped base papers, for industries like automotive, aerospace, construction, and packaging. It aligns with Ahlstrom’s sustainability goals by improving recyclability and using more renewable materials. A decision is expected soon after the study’s completion

- In October 2024, MM Kotkamills introduced ALASKA KRAFT, a new fully coated virgin fiber cartonboard produced at its MM Količevo mill in Slovenia. The board featured a white top layer with 10% recycled fibers and a brown kraft reverse side, offering both strength and visual appeal. It was designed for packaging applications such as fruit trays, sleeves, and take-away containers. The product combined high stiffness, durability, and sustainability by using responsibly sourced virgin and recycled fibers. Through this launch, the company strengthened its eco-friendly portfolio and enhanced service flexibility across European markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SATURATED KRAFT PAPER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 BASIC WEIGHT TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 RAW MATERIAL COVERAGE

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 IMPORT EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 TARIFFS & IMPACT ON THE MARKET

4.6.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.6.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.6.3 VENDOR SELECTION CRITERIA DYNAMICS

4.6.4 IMPACT ON SUPPLY CHAIN

4.6.4.1 RAW MATERIAL PROCUREMENT

4.6.4.2 MANUFACTURING AND PRODUCTION

4.6.4.3 LOGISTICS AND DISTRIBUTION

4.6.4.4 PRICE PITCHING AND POSITION OF MARKET

4.6.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.6.5.1 SUPPLY CHAIN OPTIMIZATION

4.6.5.2 JOINT VENTURE ESTABLISHMENTS

4.6.6 IMPACT ON PRICES

4.6.7 REGULATORY INCLINATION

4.6.7.1 GEOPOLITICAL SITUATION

4.6.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.6.7.2.1 FREE TRADE AGREEMENTS

4.6.7.3 DOMESTIC COURSE OF CORRECTION

4.6.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.7 VENDOR SELECTION CRITERIA

4.8 PESTEL ANALYSIS

4.8.1 POLITICAL FACTORS

4.8.2 ECONOMIC FACTORS

4.8.3 SOCIAL FACTORS

4.8.4 TECHNOLOGICAL FACTORS

4.8.5 ENVIRONMENTAL FACTORS

4.8.6 LEGAL FACTORS

4.9 REGULATION COVERAGE

4.1 POTENTIAL BUYER LIST

4.11 SUPPLY VS DEMAND ANALYSIS

4.12 LAMINATE PRODUCERS

4.13 SKB PRODUCERS

4.14 PRODUCTION CAPACITY OVERVIEW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR DECORATIVE LAMINATES IN CONSTRUCTION SECTOR

5.1.2 RISING USE IN FURNITURE AND INTERIOR DESIGN APPLICATIONS

5.1.3 INCREASING ADOPTION IN ELECTRICAL INSULATION AND TRANSFORMER COMPONENTS

5.1.4 INDUSTRIALIZATION DRIVING DEMAND FOR TECHNICAL AND SPECIALTY PAPERS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTE MATERIALS WITH LOWER PRODUCTION COSTS

5.2.2 ENVIRONMENTAL REGULATIONS ON CHEMICAL USAGE IN PAPER TREATMENT

5.3 OPPORTUNITIES

5.3.1 ONLINE RETAILERS PREFER KRAFT-BASED MAILER SOLUTIONS

5.3.2 FLEXIBLE PACKAGING INNOVATIONS USING KRAFT LAYERS

5.3.3 RISING INTEREST IN RENEWABLE PACKAGING SOLUTIONS

5.4 CHALLENGES

5.4.1 FLUCTUATING WOOD PULP PRICES IMPACT PRODUCTION COST

5.4.2 HIGH COMPETITION FROM LOW-COST ASIAN SUPPLIERS

6 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT

6.1 OVERVIEW

6.2 100 TO 200 GSM

6.3 50 TO 100 GSM

6.4 LESS THAN 50 GSM

6.5 MORE THAN 200 GSM

7 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE

7.1 OVERVIEW

7.2 UNBLEACHED

7.2.1 UNBLEACHED, BY TYPE

7.3 BLEACHED

7.3.1 BLEACHED, BY TYPE

8 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COUNTERTOP

8.3 WORKTOPS

8.4 SHELVING

8.5 PARTITION

8.6 FLOORING

8.7 OTHERS

9 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY

9.1 OVERVIEW

9.2 INTERNAL

9.3 EXTERNAL

10 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 HOUSEHOLD

10.4 COMMERCIAL

11 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA SATURATED KRAFT PAPER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTERNATIONAL PAPERS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 WESTROCK COMPANY

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 REVENUE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MAYR-MELNHOF KARTON AG

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 RECENT DEVELOPMENT

14.4 MONDI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 AHLSTROM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 FLEENOR PAPER COMPANY

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 FORTUNE PAPER MILLS LLP

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GORDON PAPER COMPANY, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HAL INDUSTRIES INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 MM KOTKAMILLS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS/NEWS

14.11 NORDIC PAPER HOLDING AB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NORTHERN TECHNOLOGIES INTERNATIONAL CORPORATION (NTIC) (A PART OF ZERUST)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ONYX PAPERS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 POTSDAM SPECIALTY PAPER INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PUDUMJEE PAPER PRODUCTS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 RANHEIM PAPER & BOARD

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SCG INTERNATIONAL CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 STORA ENSO

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 VENKRAFT PAPER MILLS PVT. LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 WARAQ

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 SATURATED KRAFT PAPER TOP EXPORTS IN 12 MONTHS

TABLE 2 REGULATORY STANDARDS RELATED TO NORTH AMERICA SATURATED KRAFT PAPER MARKET

TABLE 3 POTENTIAL BUYER LIST IN THE NORTH AMERICA SATURATED KRAFT PAPER MARKET

TABLE 4 KEY SUPPLY ACROSS THE REGIONS

TABLE 5 SUPPLY VS DEMAND GAPS: KEY OBSERVATIONS

TABLE 6 LAMINATE PRODUCERS

TABLE 7 SKB PRODUCERS

TABLE 8 CHINA LOW PRICE SATURATED KRAFT PAPER

TABLE 9 ASIAN LOW-COST SATURATED KRAFT PAPER SUPPLIERS

TABLE 10 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 12 NORTH AMERICA 100 TO 200 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA 50 TO 100 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LESS THAN 50 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA MORE THAN 200 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA COUNTERTOP IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA WORKTOPS IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SHELVING IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA PARTITION IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA FLOORING IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHERS IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA INTERNAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA EXTERNAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 42 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 54 U.S. SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)..

TABLE 60 U.S. INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 66 CANADA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 75 CANADA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 78 MEXICO SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MEXICO SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 82 MEXICO SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 84 MEXICO INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA SATURATED KRAFT PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SATURATED KRAFT PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SATURATED KRAFT PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SATURATED KRAFT PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SATURATED KRAFT PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SATURATED KRAFT PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SATURATED KRAFT PAPER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SATURATED KRAFT PAPER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SATURATED KRAFT PAPER MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA SATURATED KRAFT PAPER MARKET: BASIC WEIGHT TIMELINE CURVE

FIGURE 11 NORTH AMERICA SATURATED KRAFT PAPER MARKET: END-USE COVERAGE GRID

FIGURE 12 NORTH AMERICA SATURATED KRAFT PAPER MARKET: SEGMENTATION

FIGURE 13 FOUR SEGMENTS COMPRISE THE NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT (2024)

FIGURE 14 NORTH AMERICA SATURATED KRAFT PAPER MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING DEMAND FOR DECORATIVE LAMINATES IN CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA SATURATED KRAFT PAPER MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 100 TO 200 GSM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SATURATED KRAFT PAPER MARKET IN 2025 & 2032

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 NUMBER OF IMPORTS AND EXPORTS – YEARLY

FIGURE 20 FACTORS AFFECTING PESTEL FRAMEWORK

FIGURE 21 PRODUCTION CAPACITY OVERVIEW

FIGURE 22 DROC ANALYSIS

FIGURE 23 KRAFT PULP PIRCE IN (USD UNITS)

FIGURE 24 PRICE INDEX PULP, PAPER, AND ALLIED PRODUCTS: WOOD PULP IN AVERAGE

FIGURE 25 NORTH AMERICA SATURATED KRAFT PAPER MARKET: BY BASIC WEIGHT, 2024

FIGURE 26 NORTH AMERICA SATURATED KRAFT PAPER MARKET: BY PAPER GRADE, 2024

FIGURE 27 NORTH AMERICA SATURATED KRAFT PAPER MARKET: BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA SATURATED KRAFT PAPER MARKET: BY UTILITY, 2024

FIGURE 29 NORTH AMERICA SATURATED KRAFT PAPER MARKET: BY END-USE, 2024

FIGURE 30 NORTH AMERICA SATURATED KRAFT PAPER MARKET: SNAPSHOT (2024)

FIGURE 31 NORTH AMERICA SATURATED KRAFT PAPER MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.