North America Screen Printing Machine Market

Market Size in USD Million

CAGR :

%

USD

254.53 Million

USD

366.72 Million

2024

2032

USD

254.53 Million

USD

366.72 Million

2024

2032

| 2025 –2032 | |

| USD 254.53 Million | |

| USD 366.72 Million | |

|

|

|

|

North America Screen Printing Machine Market Size

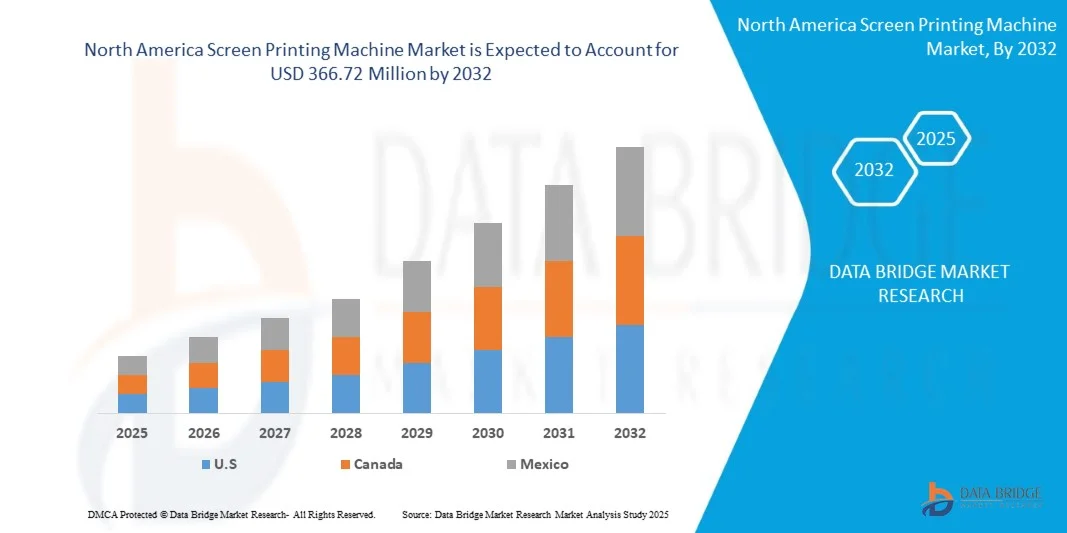

- The North America screen printing machine market size was valued at USD 254.53 million in 2024 and is expected to reach USD 366.72 million by 2032, at a CAGR of 4.80% during the forecast period

- The North America screen printing machine market is experiencing steady growth, driven by its versatility across diverse industries such as textiles, electronics, glass, ceramics, and packaging. Screen printing remains a preferred method for applications requiring vibrant colors, high durability, and compatibility with varied substrates ranging from fabrics and plastics to metals and composites.

North America Screen Printing Machine Market Analysis

- The North America screen printing machine market refers to the industry focused on the production, distribution, and adoption of equipment used for transferring images, patterns, or designs onto surfaces such as textiles, glass, ceramics, metals, and electronics through mesh-based stencil printing. This market encompasses manual, semi-automatic, and fully automated machines with varying capacities, serving industries like apparel, advertising, packaging, and industrial manufacturing.

- Technological advancements are reshaping the market, with semi-automatic and fully automatic machines increasingly replacing manual presses to enhance productivity, precision, and consistency. Integration of robotics, computer-aided design, and energy-efficient drying systems is improving throughput and lowering operating costs.

- The U.S. is projected to dominate the screen printing machine market share 78.66% during the forecast period and it is anticipated to show the fastest growth, Screen printing remains a preferred method for applications requiring vibrant colors, high durability, and compatibility with varied substrates ranging from fabrics and plastics to metals and composites. Within the textile industry, which holds the largest share, demand is supported by rising consumption of printed apparel, fashion customization, and promotional products.

- The semi-automatic segment is expected to lead the screen printing machine market by 2025, accounting for the largest share 42.55% and it is anticipated to show the fastest growth during the forecast period. Growing use among Small and Medium Enterprises (SMEs) in apparel and advertising industries fuels the semi-automatic segment. These machines offer an ideal balance of affordability, flexibility, and control. Easy operation, lower maintenance costs, and suitability for short-run printing applications encourage widespread adoption across emerging manufacturing economies.

Report Scope and North America Screen Printing Machine Market Segmentation

|

Attributes |

North America Screen Printing Machine Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Screen Printing Machine Market Trends

“Integration of Automation and Digital Hybrid Printing Technologies”

- The North America screen printing machine market is witnessing a major shift as manufacturers increasingly integrate automation, digital hybrid technologies, and smart control systems to enhance precision, speed, and productivity.

- This transition is driven by the need for cost-efficient, high-quality printing solutions across industries such as textiles, electronics, packaging, and automotive.

- Manufacturers are focusing on automated screen alignment, servo-driven print heads, and IoT-enabled monitoring systems that reduce setup time and improve print consistency.

- For instance, hybrid screen printing machines that combine traditional screen techniques with digital inkjet capabilities are gaining traction for their flexibility in short-run and customized printing applications.

- The growing adoption of Industry 4.0 technologies is also enabling predictive maintenance and real-time production tracking, improving operational efficiency.

- This trend reflects a broader industry shift toward smart manufacturing, customization, and sustainability, positioning automated and hybrid screen printing systems as the next evolution in industrial printing.

North America Screen Printing Machines Market Dynamics

Driver

“Rise in Ceramic and Glass Printing”

- The adoption of screen printing in ceramic and glass applications is rising across commercial, industrial, and decorative sectors, driven by the demand for intricate, durable, and high-quality designs.

- Advances in machinery, heat-resistant inks, and multi-layered printing processes have enhanced precision, speed, and versatility for printing on hard or curved surfaces.

- Manufacturers are investing in automated, high-speed machines to maintain consistent print quality and improve production efficiency.

- According to GranitiFiandre news in February 2025, an Italian ceramic tile manufacturer adopted automated screen printing machinery to produce decorative ceramic tiles with intricate designs, improving production efficiency and enabling limited-edition collections for premium interior decor projects.

- As reported by SAATI News in April 2025, SAATI Glass launched advanced screen printing machines for architectural and automotive glass, capable of printing multi-layered, heat-resistant patterns, addressing the growing demand for customized glass solutions in building and automotive applications.

Opportunity

“Expansion of Screen Printing in Electronics & Packaging”

- Screen printing is witnessing rapid growth in the electronics and packaging industries due to its precision, scalability, and cost-effectiveness.

- In electronics, it is used for producing flexible circuits, sensors, and touchscreens, while in packaging, it delivers vibrant, durable prints that enhance product appeal.

- Technological advancements and sustainable practices are further driving adoption across both sectors.

- In June 2025, Packaging Today reported that a major European packaging company in Rotterdam upgraded to hybrid screen and digital printing systems for custom food and beverage labels, achieving faster turnaround and greater design flexibility.

- Overall, the rising adoption of screen printing in electronics and packaging presents a major growth opportunity, fueled by technology integration, sustainability, and the demand for high-precision, versatile, and eco-friendly printing solutions.

Restraint/Challenge

High Initial Investment and Maintenance Costs for Automated Systems

- While automation and hybrid technologies improve quality and efficiency, the high capital investment required for advanced screen printing machines poses a challenge, especially for Small and Mid-Sized Enterprises (SMEs).

- Costs include servo motors, PLC control systems, UV curing units, and precision screen tensioning mechanisms, which increase the total equipment expenditure.

- Small print shops often struggle with limited financing options and long payback periods, restricting adoption of advanced systems.

- Maintenance complexity—such as regular calibration, replacement of fine-mesh screens, and ink system cleaning—further adds to operational costs.

- Moreover, the need for skilled operators capable of handling automated setups and software-controlled machines increases training and labor expenses.

- These barriers can slow modernization in developing markets, where manual and semi-automatic machines remain dominant due to their affordability and simpler operation.

North America Screen Printing Machine Market Scope

The North America screen printing machine market is segmented into seven notable segments based on the machine type, machine configuration, capacity, ink type, material type/ substrate, end-user, distribution channel.

• By Machine Type

On the basis of machine type, the North America screen printing machine market is segmented into fully automatic, semi-automatic, manual. In 2025, the semi-automatic segment is expected to dominate the North America screen printing machine market with 42.55% share due to the semi-automatic machines balance affordability and productivity, enabling small-to-medium print shops to increase output without full automation costs.

Semi-automatic segment is estimated to grow with the highest CAGR of 5.96% due to rising demand from SMEs seeking cost-effective yet reliable solutions drives adoption, particularly in regions where labor costs are moderate and customization requirements are high, supporting steady market growth.

• By Machine Configuration

On the basis of machine configuration, the North America screen printing machine market is segmented into flatbed (sheet-type), rotary (cylindrical/fast packaging), cylinder (roll-to-roll), hybrid (screen + digital). In 2025, flatbed (sheet-type) segment is expected to dominate the North America screen printing machine market with 36.43% share as flatbed machines are preferred for rigid substrates like glass, wood, and metal due to precision and consistent print quality.

Flatbed (sheet-type) segment is estimated to grow with the highest CAGR of 5.37% due to growing industrial decoration, signage, and electronics applications boost demand, as manufacturers seek versatile presses capable of handling various sheet sizes efficiently while maintaining high resolution and durability.

• By Capacity

On the basis of capacity, the North America screen printing machine market is segmented into medium-capacity machines (500-2000 prints/hour), low-capacity machines (less than 200 prints/ hour), high-capacity machines (2000-5000 prints/ hour), ultra high (above 2000 prints/ hour). In 2025, the low-capacity machines (less than 200 prints/ hour) segment is anticipated to dominate the North America screen printing machine market 27.12% share as low-capacity machines (less than 200 prints/ hour) presses meet the needs of mid-sized apparel, textile, and promotional goods businesses, offering optimal throughput without excessive capital investment.

High-capacity machines (2000-5000 prints/ hour) segment is estimated to grow with the highest CAGR of 5.12% in the forecast period due to rising demand for mass production efficiency in textiles, packaging, and electronics industries. Manufacturers seek faster turnaround and consistent quality, pushing adoption of automated, servo-driven, and multi-color systems. These machines enable large-scale, high-precision printing, reducing labor costs and enhancing productivity for industrial and commercial applications globally.

• By Ink Type

On the basis of ink type, the North America screen printing machine market is segmented into UV curable, specialty inks , conductive inks, solvent. In 2025, the UV curable segment is expected to dominate the North America screen printing machine market 38.86% share due to UV-curable inks provide fast drying, high adhesion, and environmental compliance, appealing to industrial and textile printers.

UV curable segment is estimated to grow with the highest CAGR of 5.17% in the forecast period as its adoption is driven by regulations limiting solvent-based inks and the demand for vibrant, durable prints on multiple substrates, accelerating growth in both commercial and industrial screen printing applications globally.

• By Material Type/ Substrate

On the basis of material type/ substrate, the North America screen printing machine market is segmented into textile, plastic sheets, paper/cardboard (packaging), metal panels, and glass. In 2025, the textile segment is expected to dominate the North America screen printing machine market 28.60% share due to textile applications dominate screen printing demand due to vibrant, long-lasting prints on fabrics.

Textile segment is estimated to grow with the highest CAGR of 5.82% in the forecast period as its growth is fueled by fashion trends, fast-fashion cycles, and promotional merchandise expansion. Increasing customization, small-batch production, and durability requirements encourage manufacturers to adopt specialized textile screen printing machines.

• By End-User

On the basis of end-user, the North America screen printing machine market is segmented into textile & apparel industry, packaging industry, advertising & commercial, electronics industry, glass & ceramics industry, automotive industry, medical & healthcare industry, consumer goods & craft, industrial, others In 2025, the textile & apparel industry segment is expected to dominate the North America screen printing machine market 39.04% share and it is anticipated to show the fastest growth during the forecast period. due to The textile and apparel sector drives machine adoption as brands and converters invest in efficient presses for mass and custom production.

Textile & apparel industry segment is estimated to grow with the highest CAGR of 5.67% in the forecast period due to rising apparel exports, brand differentiation through printed garments, and growing e-commerce fashion demand boost mid- and high-capacity machine sales globally.

• By Distribution Channel

On the basis of distribution channel, the North America screen printing machine market is segmented into indirect sales, direct sales. In 2025, the indirect sales segment is expected to dominate the North America screen printing machine market 64.44% share due to Indirect demand comes from suppliers, distributors, and OEM partners purchasing equipment for resale or integration into industrial processes. This channel expands market reach in regions with fragmented manufacturing sectors and supports adoption where end-user direct purchases are limited.

Indirect sales segment is estimated to grow with the highest CAGR of 5.00% in the forecast period due to increasing partnerships between manufacturers and distribution networks, enhanced after-sales support, and the rising preference of small and medium-scale enterprises to procure machines through trusted intermediaries.

North America Screen Printing Machine Market Regional Analysis

- U.S. dominates the North America screen printing machine market with the largest revenue share 78.66% in 2025, due to robust manufacturing bases, rising textile exports, and growing electronics production. Rapid industrialization, expanding automotive sectors, and increasing demand for printed packaging drive equipment adoption. Continuous investments in automation and low-cost labor availability further enhance regional market competitiveness.

Canada Screen Printing Machine Market Insight

The Canada screen printing machine market captured the market share of over 12.90% within North America in 2025, Canada leads in screen printing machine production and consumption, supported by large-scale electronics and textile manufacturing. Government initiatives promoting advanced manufacturing and automation drive local machine upgrades. The booming packaging and promotional product industries, along with cost-effective production capabilities, make Canada a North America supply hub for screen printing equipment.

Mexico Screen Printing Machine Market Insight

Mexico screen printing market is driven by high-quality standards, technological innovation, and sustainability initiatives. Demand for eco-friendly inks and energy-efficient machines is rising, especially in fashion, automotive, and industrial printing. Strong R&D investments, digital integration, and export-oriented manufacturing continue to strengthen Mexico presence in advanced printing technologies.

North America Screen Printing Machine Market Share

The screen printing machine market is primarily led by well-established companies, including:

- MICRO-TEC CO., LTD. (Japan)

- Panasonic Holdings Corporation (Japan)

- Heidelberger Druckmaschinen AG (Germany)

- SPG PRINTS (Netherlands)

- The M&R Companies (U.S.)

- MINO GROUP CO., LTD. (Japan)

- Dongguan Yaodong Machinery Manufacturing Co., Ltd. (China)

- NEWLONG SEIMITSU KOGYO CO. LTD. (Japan)

- MHM Direct GB (U.K.)

- Sakurai Graphic Systems Corporation (Japan)

- ATMA (DONGYUAN MACHINERY INDUSTRY) (China),

- innovativemachines.com (U.S.)

- THIEME (Germany)

- ROQ.US (U.S.)

- SEISHIN TRADING CO., LTD. (Japan)

- TAS Screen Printing Machines (Australia)

- Lawson Screen & Digital Products (U.S.)

- SYSTEMATIC AUTOMATION (U.S.)

- P3 MACHINES (India)

- PRINTEX UE S.C. (Poland)

- GPE Ardenghi S.r.l. (Italy)

- Workhorse Products (U.S.)

- Printride Industries Pvt Ltd (India)

- VASTEX INTERNATIONAL INC. (U.S.)

- ZIMMER MASCHINENBAU GmBh (Austria)

- UMRAO AUTOMATION PVT. LTD. (India)

- Lingtie (Xiamen ) Machinery Co. Ltd. (China)

- ANATOL EQUIPMENT MANUFACTURING CO. (U.S.)

- Ruian Koten Machinery Co.Ltd (China)

- TORCH BEIJING TORCH CO., LTD. (China)

- HANGZHOU TAOXING PRINTING MACHINERY CO., LTD. (China)

- Western Japan Trading Co., Ltd. (Japan)

- Atlas Screen Supply Company (U.S.)

- TOSHIN KOGYO CO., LTD. (Japan)

- BSM India (India)

- TODO IMPRESION SYSTEMS SL (Spain)

Latest Developments in North America Screen Printing Machine Market

- In November 2023, Nazdar Ink Technologies expanded its long-standing partnership with the M&R Companies by entering an exclusive development and OEM supplier agreement, strengthening their collaboration in the screen printing and digital textile printing space. This partnership specifically focuses on M&R’s new QUATRO direct-to-film (DTF) printer, a cutting-edge digital printing system designed to complement traditional screen-printing machines in hybrid production workflows. As part of the agreement, Nazdar will develop a specialized ink set tailored to the QUATRO, ensuring optimal print performance, color vibrancy, and durability. This strategic move reflects M&R’s continued innovation in digital and screen-printing integration, offering printers a versatile solution that bridges analog screen presses with modern DTF technology.

- In March 2024, Thieme launched the THIEME 3000 Vision AL, a fully automatic high-precision screen printing machine designed for industrial applications such as automotive foil/FIM printing, decorative panels, membrane switches, and printed electronics. It features maximum flexibility, outstanding print quality, automated material feeding options, camera alignment systems, and intelligent controls for best process reliability.

- In February 2025, Lawson Screen & Digital Products and Workhorse Products officially merged, uniting two leading names in the screen printing industry. This strategic merger aims to offer customers expanded product lines, including manual and automatic presses, conveyor dryers, exposure units, and advanced digital printing technologies. The merger enhances customer support with a larger team, faster response times, and deeper expertise. Both companies continue to operate independently with the same staff and contact information, ensuring business continuity while leveraging combined resources for innovation and improved services. This partnership reflects their shared vision to provide better products and solutions for screen printers of all sizes, fostering industry growth and customer success.

- In March 2024 Kongsberg Discovery has introduced the Seapath 385, an innovative navigation system aimed at improving accuracy and reliability in hydrographic surveying. This launch bolsters Kongsberg Discovery's presence in the hydrographic survey equipment market by delivering a state-of-the-art, reliable solution tailored to meet high-precision surveying requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SCREEN PRINTING MACHINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MACHINE TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 BARGAINING POWER OF SUPPLIERS:

4.1.3 BARGAINING POWER OF BUYERS:

4.1.4 THREAT OF SUBSTITUTES:

4.1.5 INDUSTRY RIVALRY:

4.2 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE IN THE SCREEN PRINTING MACHINE MARKET

4.3 CONSUMER BEHAVIOR IN THE SCREEN PRINTING MACHINE MARKET

4.4 IN-HOUSE IMPLEMENTATION VS OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.6 PENETRATION AND GROWTH PROSPECT MAPPING FOR THE SCREEN PRINTING MACHINE MARKET

4.7 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE IN THE SCREEN PRINTING MACHINE MARKET

4.8 TECHNOLOGICAL TRENDS IN THE SCREEN PRINTING MACHINE MARKET

4.9 FUNDING DETAILS-INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

5 TARIFFS & IMPACT ON THE NORTH AMERICA SCREEN PRINTING MACHINE MARKET

5.1 OVERVIEW

5.2 TARIFF STRUCTURES

5.2.1 IMPORT TARIFFS

5.2.2 EXPORT TARIFFS

5.3 U.S. VS. REGIONAL TARIFF STRUCTURES

5.4 UNITED STATES: TARIFF POLICIES

5.5 EMERGING MARKETSCHALLENGES IN TARIFF IMPLEMENTATION

5.6 INCREASED COSTS

5.7 SUPPLY CHAIN DISRUPTIONS

5.8 UNCERTAINTY AND INVESTMENT

5.9 IMPACT ON INNOVATION

5.1 COMPETITION AND MARKET DYNAMICS

5.11 DEPLOYMENT OF INFRASTRUCTURE

5.12 STRATEGIC RESPONSES AND INDUSTRY OUTLOOK

5.13 DIVERSIFICATION OF SUPPLY CHAINS

5.14 LEVERAGING ADVANCED LOGISTICS

5.15 ADVOCACY FOR POLICY ADJUSTMENTS

5.16 CONCLUSION

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND IN PROMOTIONAL PRODUCTS AND ADVERTISING MATERIALS

7.1.2 POPULARITY OF CUSTOMIZED FASHION AND LIFESTYLE PRODUCTS

7.1.3 RISE IN CERAMIC AND GLASS PRINTING

7.1.4 SUPPORT FROM GOVERNMENT INITIATIVES FOR SMES

7.2 RESTRAINTS

7.2.1 LIMITED SCALABILITY FOR HIGH-VOLUME PRODUCTION

7.2.2 SKILLED WORKFORCE REQUIREMENT

7.3 3.1. OPPORTUNITY

7.3.1 AUTOMATION & HYBRID PRINTING INTEGRATION

7.3.2 EXPANSION OF SCREEN PRINTING IN ELECTRONICS & PACKAGING

7.3.3 RISING DEMAND FOR ECO-FRIENDLY & SUSTAINABLE PRINTING

7.4 CHALLENGES

7.4.1 REGULATORY & ENVIRONMENTAL PRESSURES

7.4.2 HIGH INITIAL INVESTMENT & MAINTENANCE COSTS

8 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE

8.1 OVERVIEW

8.2 FULLY AUTOMATIC

8.3 SEMI-AUTOMATIC

8.4 MANUAL

9 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION

9.1 OVERVIEW

9.2 FLATBED (SHEET-TYPE)

9.4 CYLINDER (ROLL-TO-ROLL)

9.5 HYBRID (SCREEN + DIGITAL)

10 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 MEDIUM-CAPACITY MACHINES (500-2000 PRINTS/HOUR)

10.3 LOW-CAPACITY MACHINES (LESS THAN 200 PRINTS/ HOUR)

10.4 HIGH-CAPACITY MACHINES (2000-5000 PRINTS/ HOUR)

10.5 ULTRA HIGH (ABOVE 2000 PRINTS/ HOUR)

11 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY INK TYPE

11.1 OVERVIEW

11.2 UV CURABLE

11.4 CONDUCTIVE INKS

11.5 SOLVENT

12 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MATERIAL TYPE/ SUBSTRATE

12.1 OVERVIEW

12.2 TEXTILE

12.3 PLASTIC SHEETS

12.4 PAPER/CARDBOARD (PACKAGING)

12.5 METAL PANELS

12.6 GLASS

13 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY END USER

13.1 OVERVIEW

13.2 TEXTILE & APPAREL INDUSTRY

13.3 PACKAGING INDUSTRY

13.4 ADVERTISING & COMMERCIAL

13.5 ELECTRONICS INDUSTRY

13.6 GLASS & CERAMICS INDUSTRY

13.7 AUTOMOTIVE INDUSTRY

13.8 MEDICAL & HEALTHCARE INDUSTRY

13.9 CONSUMER GOODS & CRAFT

13.1 INDUSTRIAL

13.11 OTHERS

14 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT SALES

14.3 DIRECT SALES

15 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY REGION

15.1 OVERVIEW

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

16 NORTH AMERICA SCREEN PRINTING MACHINE MARKETCOMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMAPANY PROFILES

18.1 PANASONIC HOLDINGS CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 MICRO-TEC CO., LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 HEIDELBERGER DRUCKMASCHINEN AG

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 SPGPRINTS.

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 THE M&R COMPANIES

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ANATOL EQUIPMENT MANUFACTURING CO.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BEIJING TORCH CO., LTD.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ATLAS SCREEN SUPPLY COMPANY

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 ATMA CHAMP ENT. CORP.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 BENGAL SHOE MACHINERY PVT LTD.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 DONGGUAN YAODONG MACHINERY MANUFACTURING CO., LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GPE ARDENGHI SRL

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 HANGZHOU TAOXING PRINTING MACHINERY CO., LTD.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 INNOVATIVEMACHINES

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 J. ZIMMER MASCHINENBAU GMBH

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 KOTEN MACHINERY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 LAWSON SCREEN & DIGITAL PRODUCTS

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 LINGTIE (XIAMEN) MACHINERY CO. LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 MHM DIRECT GB

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 MINO GROUP CO.,LTD.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 NEWLONG SEIMITSU KOGYO CO., LTD.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 P3 MACHINERY.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 PRINTEX

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 PRINTRIDE

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 ROQ US

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 SAKURAI GRAPHIC SYSTEMS CORPORATION.

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 SEISHIN TRADING CO., LTD.

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 SYSTEMATIC AUTOMATION

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

18.29 TAS SCREEN PRINTING MACHINES

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 THIEME

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 TODO IMPRESIÓN

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENT

18.32 TOSHIN KOGYO CO.,LTD.

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENT

18.33 UMRAO AUTOMATION PVT. LTD.

18.33.1 COMPANY SNAPSHOT

18.33.2 PRODUCT PORTFOLIO

18.33.3 RECENT DEVELOPMENT

18.34 VASTEX INTERNATIONAL, INC.

18.34.1 COMPANY SNAPSHOT

18.34.2 PRODUCT PORTFOLIO

18.34.3 RECENT DEVELOPMENT

18.35 WESTERN JAPAN TRADING CO.,LTD.

18.35.1 COMPANY SNAPSHOT

18.35.2 PRODUCT PORTFOLIO

18.35.3 RECENT DEVELOPMENT

18.36 WORKHORSE PRODUCTS

18.36.1 COMPANY SNAPSHOT

18.36.2 PRODUCT PORTFOLIO

18.36.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SCREEN PRINTING MACHINE MARKET

TABLE 3 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (UNIT)

TABLE 5 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 7 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 10 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 12 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 15 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 17 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 20 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND

TABLE 21 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 22 NORTH AMERICA FLATBED (SHEET-TYPE) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA FLATBED (SHEET-TYPE) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 24 NORTH AMERICA ROTARY (CYLINDRICAL/FAST PACKAGING) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA ROTARY (CYLINDRICAL/FAST PACKAGING) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 26 NORTH AMERICA CYLINDER (ROLL-TO-ROLL) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA CYLINDER (ROLL-TO-ROLL) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 28 NORTH AMERICA HYBRID (SCREEN + DIGITAL) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA HYBRID (SCREEN + DIGITAL) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNITS)

TABLE 30 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA MEDIUM-CAPACITY MACHINES (500-2000 PRINTS/HOUR) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA LOW-CAPACITY MACHINES (LESS THAN 200 PRINTS/ HOUR) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA HIGH-CAPACITY MACHINES (2000-5000 PRINTS/ HOUR) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GULTRA HIGH (ABOVE 5000 PRINTS/ HOUR) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY INK TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA UV CURABLE IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA SPECIALTY INKS IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CONDUCTIVE INKS IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA SOLVENT IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MATERIAL TYPE/ SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TEXTILE IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA PLASTIC SHEETS IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA PAPER/CARDBOARD (PACKAGING) IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA METAL PANELS IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA GLASS IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 54 NORTH AMERICA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA OTHERS IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA OTHERS IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA INDIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA INDIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA DIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA DIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY REGION, 2018-2032 (UNIT)

TABLE 83 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY COUNTRY, 2018-2032 (UNIT)

TABLE 85 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (UNIT)

TABLE 87 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 90 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 93 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 UNIT)

TABLE 96 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 98 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY INK TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY MATERIAL TYPE/ SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA OTHERS IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA SCREEN PRINTING MACHINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA INDIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA DIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.S.

TABLE 125 U.S. SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (UNIT)

TABLE 127 U.S. FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 130 U.S. SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 133 U.S. MANUAL IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 UNIT)

TABLE 136 U.S. SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 138 U.S. SCREEN PRINTING MACHINE MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. SCREEN PRINTING MACHINE MARKET, BY INK TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. SCREEN PRINTING MACHINE MARKET, BY MATERIAL TYPE/ SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. SCREEN PRINTING MACHINE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 U.S. PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 U.S. ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.S. ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. OTHERS IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. SCREEN PRINTING MACHINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. INDIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. DIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA

TABLE 165 CANADA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (UNIT)

TABLE 167 CANADA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 170 CANADA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 173 CANADA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 UNIT)

TABLE 176 CANADA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 178 CANADA SCREEN PRINTING MACHINE MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA SCREEN PRINTING MACHINE MARKET, BY INK TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA SCREEN PRINTING MACHINE MARKET, BY MATERIAL TYPE/ SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA SCREEN PRINTING MACHINE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 CANADA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 CANADA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 CANADA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 189 CANADA ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 191 CANADA GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 CANADA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 CANADA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 CANADA MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 197 CANADA CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 CANADA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA OTHERS IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA SCREEN PRINTING MACHINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA INDIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA DIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO

TABLE 205 MEXICO SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (UNIT)

TABLE 207 MEXICO FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO FULLY AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 210 MEXICO SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO SEMI-AUTOMATIC IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 213 MEXICO MANUAL IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO MANUAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 UNIT)

TABLE 216 MEXICO SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO SCREEN PRINTING MACHINE MARKET, BY MACHINE CONFIGURATION, 2018-2032 (UNIT)

TABLE 218 MEXICO SCREEN PRINTING MACHINE MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO SCREEN PRINTING MACHINE MARKET, BY INK TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO SCREEN PRINTING MACHINE MARKET, BY MATERIAL TYPE/ SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO SCREEN PRINTING MACHINE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO TEXTILE & APPAREL INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO PACKAGING INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO ADVERTISING & COMMERCIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO ELECTRONICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 MEXICO GLASS & CERAMICS INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 233 MEXICO AUTOMOTIVE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MEXICO MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 MEXICO MEDICAL & HEALTHCARE INDUSTRY IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 MEXICO CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 237 MEXICO CONSUMER GOODS & CRAFT IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 MEXICO INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 239 MEXICO INDUSTRIAL IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MEXICO OTHERS IN SCREEN PRINTING MACHINE MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 MEXICO SCREEN PRINTING MACHINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 242 MEXICO INDIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 MEXICO DIRECT SALES IN SCREEN PRINTING MACHINE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: MULTIVARIVATE MODELING

FIGURE 10 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: MACHINE TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: SEGMENTATION

FIGURE 13 THREE SEGMENTS COMPRISE THE NORTH AMERICA SCRENN PRINTING MACHINE MARKET, BY MACHINE TYPE (2024)

FIGURE 14 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING DEMAND IN PROMOTIONAL PRODUCTS AND ADVERTISING MATERIALS IS EXPECTED TO DRIVE THE NORTH AMERICA SCREEN PRINTING MACHINE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 MACHINE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SCREEN PRINTING MACHINE MARKET IN 2025 & 2032

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY MACHINE TYPE, 2024

FIGURE 20 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY MACHINE CONFIGURATION, 2024

FIGURE 21 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY CAPACITY, 2024

FIGURE 22 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY INK TYPE, 2024

FIGURE 23 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY MATERIAL TYPE/ SUBSTRATE, 2024

FIGURE 24 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY END USER, 2024

FIGURE 25 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 26 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: SNAPSHOT (2024)

FIGURE 27 NORTH AMERICA SCREEN PRINTING MACHINE MARKET: COMPANY SHARE 2024 (%)

North America Screen Printing Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Screen Printing Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Screen Printing Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.