North America Semirigid PET Multilayers Film for Food Package Market Analysis and Insights

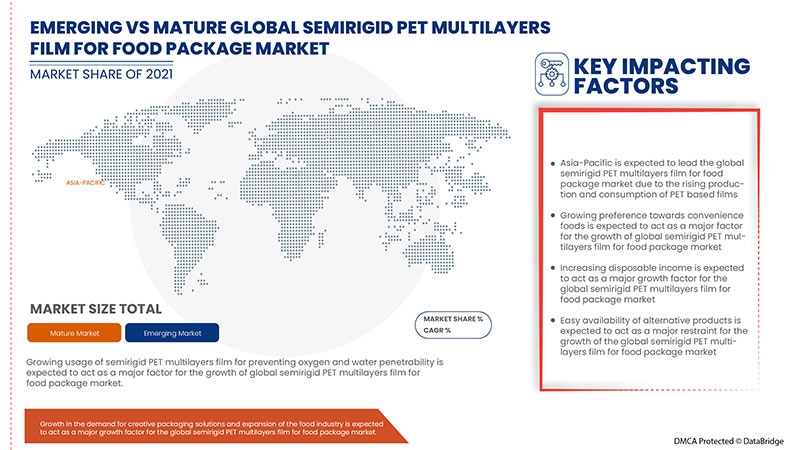

Growth in usage of semirigid pet multilayer packaging film for preventing oxygen and water penetrability and increase in demand and awareness for semirigid multilayer films for shelf-life are expected to drive the demand for the North America semirigid PET multilayers film for food package market. However, volatility in the prices of raw materials and the availability of alternative products may further restrict the market's growth.

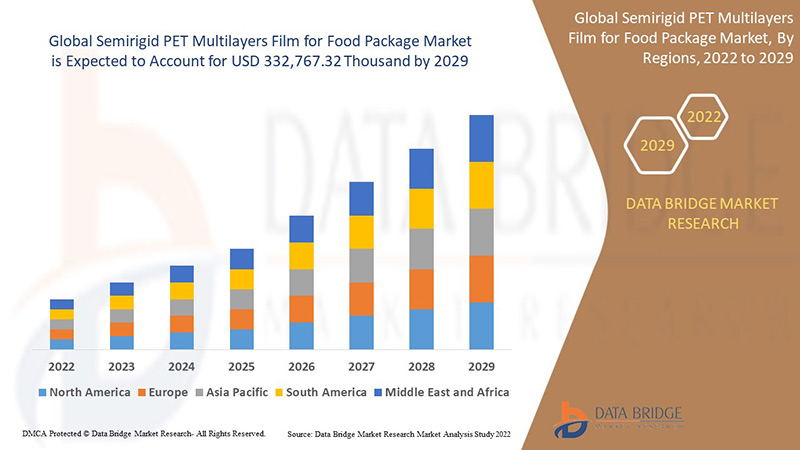

Data Bridge Market Research analyses that the North America semirigid PET multilayers film for food package market is expected to reach the value of USD 93,296.20 thousand by 2029, at a CAGR of 3.6% during the forecast period. Transparent/clear accounts for the largest type segment in the North America semirigid PET multilayers film for food package market. The North America semirigid PET multilayers film for food package market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

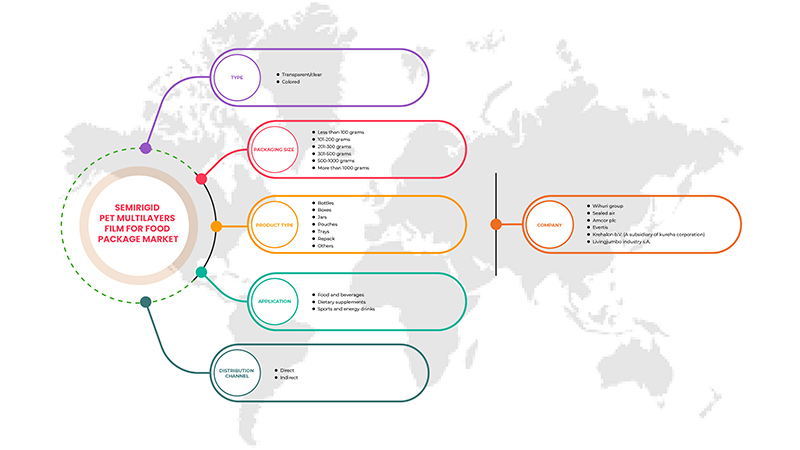

Type (Transparent/Clear and Colored), Product Type (Bottles, Boxes, Jars, Pouches, Trays, Repack, and Others), Packaging Size (Less Than 100 Grams, 101-200 Grams, 201-300 Grams, 301-500 Grams, 500-1000 Grams, and More Than 1000 Grams), Application (Food and Beverages, Dietary Supplements, Sports and Energy Drinks), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Wihuri Group, Evertis, Sealed Air, Amcor plc, and Krehalon B.V. (A subsidiary of KUREHA CORPORATION), among others |

Market Definition

Polyethylene Terephthalate is a clear, strong, lightweight plastic belonging to the polyester family. It is widely used as a food packaging material because it is hygienic, strong, lightweight, shatterproof, and retains freshness. The semirigid PET multilayers film has a combination of several layers. This significantly increases the shelf life by controlling oxygen, carbon dioxide, and moisture transmission rate.

Manufacturers and packaging designers prefer the semirigid PET multilayers film as they are safe, strong, transparent, and versatile. Their properties allow for superior innovation in terms of both package design and performance. It helps in protecting the integrity, freshness, and taste of the food items. Consumers highly recognize them due to their light weight, resealability, shatter resistance, and innovative style. They have good barrier properties that protect and preserve the contents of the package. They can be recycled easily, and the PET material can be used again for a wide range of applications.

North America Semirigid PET Multilayers Film For Food Package Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing usage of semirigid pet multilayer packaging film for preventing oxygen and water penetrability

In the current scenario, there is a huge demand for multilayer-based packaging films owing to shifting consumers' preference toward the adoption of packed food. Such films are co-extruded because they are created through a multilayer coextrusion process. The semirigid PET multilayer packaging film is made up of several layers of PETs as well as other materials that enhance the mechanical and physical properties of the film, such as puncture, tear, and heat resistance, as well as helping to prevent interaction with oxygen, moisture, and other gases such as carbon dioxide, as well as limiting the effect of mineral oil and UV light. Therefore, the increasing use of semirigid PET multilayer films for food packaging to protect packaged products from gases and moisture is expected to boost demand for these multilayer films, resulting in the growth of the North America semirigid PET multilayers film for food package market.

- Increasing demand and awareness for semirigid multilayer films for shelf-life

The increasing consumers' busy modern lifestyles and the resulting demand for convenient food packaging is constantly driving demand for semirigid PET multilayer films. This is because semirigid PET multilayer films help extend the product life of the package. The mixture of several polymer layers greatly increases shelf-life by controlling the rate of oxygen, carbon dioxide, and moisture transmission, as well as the concentration of oxygen inside the package, conserving the freshness of fresh produce for a prolonged period. People are becoming more aware of the semirigid PET multilayer film food packaging for longer shelf-life as their environmental concerns grow. Moreover, the spread of COVID-19 across most countries in the world has the demand for packaged food to rise by three folds than normal as consumers look to long shelf-life food products.

- Shifting consumer preferences towards the consumption of packaged foods

The immense global popularity of ready-to-eat food products is increasing, influencing consumer shifts toward packaged goods. Working professionals with a hectic work-life balance and an increasing workload are driving up demand for packaged food. Thus, rising demand for packaged foods is expected to aid in developing the North America semirigid PET multilayers film market for food packaging. Food spoilage during handling and storage is also expected to drive uptake of packaging PET multilayer films in the coming years, as their impermeable nature makes them ideal for storing packaged food items. As a result of busier consumer lifestyles and the resulting demand for convenience food products through packaging, the market's growth may accelerate.

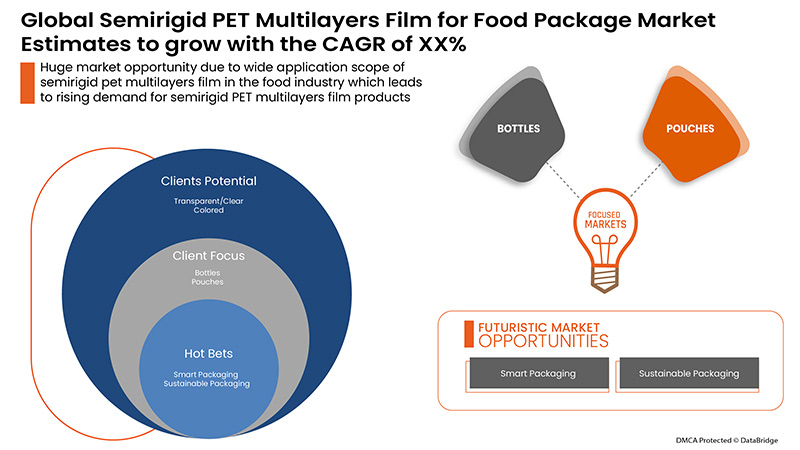

- Wide application scope of semirigid pet multilayers film in the food industry

PET film is used in many applications due to its unique optical, physical, mechanical, thermal, and chemical properties. It is primarily used in a wide range of semirigid PET multilayer film packaging applications, from food and drugs to industrial and consumer goods. For the barrier, metal adhesion is laminating adhesion, extrusion coating adhesion, printing, or sealing, as plain or metalized, formable, heat-shrinkable, and coated. PET multilayer film has exceptional properties for the packaging market. A semirigid PET multilayer film has a wide range of applications in the food industry, including meat, poultry, fish, dairy, snacks, beverages, dehydrated food and cereals, bakery products, confectionery, pet food, and many others. A semirigid PET multilayer film has a wide range of applications in food packaging, including bread bags, pasta bags, snack & nutrition bars, high temperature/microwave/boil-in bag packaging, pet food packaging, and pouches/stand-up pouches/re-closable pouches or trays, and many others.

Opportunities

-

Growing creative packaging solutions with new design ideas

Packaging is constantly changing with new materials, technologies, and processes. These changes are due to the need for improved product quality, productivity, logistics, environmental performance, and ever-changing consumer preferences. In the food industry, most packaging operations are automatic or semi-automatic. Adopting new and advanced printing technologies is on the rise to offer consumers personalized packaging solutions. This has helped businesses to increase their brand value in the market and enhance customer engagement with the product packaging. Therefore, the growth in the packaging solutions with new designs and innovations for creating and sustaining competitive advantage, meeting changes in consumer behavior, and availability of new materials and technologies may provide various growth opportunities for the North America semirigid PET multilayers film for food package market.

-

Upsurge in the demand for customer-friendly packaging

A major factor critical for innovation in food packaging is the increasing consumer demand for convenience. Modern packaging solutions offer many convenience attributes. These include ease of access and opening, disposal and handling, product visibility, reseal ability, microwave ability, and prolonged shelf life. There has also been an inclination towards the consumption of convenience foods. The fast-paced lifestyle changes have increased the demand for ready-to-eat foods. This increases the need for semirigid PET multilayer films for packaging, delivering, and preserving food items. Thus, the ever-changing consumer preferences, trends in the e-commerce industry, and demand for customer-friendly packaging products have opened up ample opportunities for semirigid PET multilayers film packaging solution providers to adopt innovative technologies and designs to increase their market share.

-

Expansion of food industry influences packaging films

The evolution of food service packaging is a major cause of the expansion of the food industry. Foodservice has grown to be a significant part of consumer spending. The food service industry includes restaurants, hotels, cafes, and catering services. As this trend increases, its influence on food packaging also increases. Packaging plays a key role in ensuring food safety and providing convenience to consumers. Furthermore, factors including globalization, changing standard of living, health and wellbeing, and higher disposable incomes are creating demand in the food industry. The food industry has undergone drastic developments in recent times. Therefore the growth and development of the industry may provide new opportunities for the growth of the North America semirigid PET multilayers film for food package market.

Restraints/Challenges

- Volatility in prices of raw materials

PET is a synthetic fiber that has been manufactured. However, its raw materials are still derived from nature, a non-renewable natural resource. It is a type of plastic that is commonly derived from petroleum. There are alternatives to petroleum-derived PET, such as those made from recycled plastic, crops, or even waste. Rising crude oil prices are causing concern in industries that rely on natural oil derivatives, such as semirigid PET multilayer films. The selling prices of semirigid PET multilayer films fluctuate due to changes in the prices of purified terephthalic acid (PTA) and mono ethylene glycol (MEG), the basic raw materials used to make PET from crude oil. PTA and MEG prices are heavily influenced by crude oil prices and currency exchange rates. Some consumers of semirigid PET multilayer films appear to accept the fluctuating price trend, while most consumers do not. As a result, the growth of the North America semirigid PET multilayers film for food packaging market is severely hampered.

- Availability of alternative products

People have been witnessing a never-before-seen global campaign against the production and use of plastic in recent years. Plastic waste has influenced public opinion, and due to this new consumer susceptibility, international legislators are passing restrictive laws on the use of disposable plastics—creating new processes and polymers capable of replacing the current oil-based PET film production. So, the PET alternatives already on the market and those being developed are BIO-PET, other non-biodegradable polymers, and natural and biodegradable polymers. Polyethylene furoate (PEF) and polytrimethylene furan dicarboxylate are two alternative polymers currently available (PTF). They are furan polymers that could be obtained from 100 percent renewable sources. There is a tremendous amount of activity around the world related to developing biodegradable polymers for all types of applications traditionally associated with plastic.

- Concerns about the recycling of multilayer films

Manufacturers can choose different materials and layer combinations while developing multilayer packaging solutions. This has led to prevention in a clear separation of individual material groups. The major challenge in recycling post-consumed plastic waste is sorting the multilayer packaging. The multilayer packaging is difficult to identify and hard to recycle. Identification technologies need to be deployed to identify the different surface properties. Multilayer packaging is a complex mixture of other materials that are also contaminated after use. Therefore, a lack of large-scale industrial sorting and recycling processes for multilayer packaging solutions may challenge the growth of the North America semirigid PET multilayers film for food package market.

- Environmental concerns and strict government regulation

PET is one of the most commonly used plastics. There are growing concerns regarding the serious issues of plastic pollution and its negative environmental impact. It disturbs the environment in many ways by affecting the air, soil, and water quality. Burning PET material releases harmful gases such as nitric oxide, sulfur dioxide, and chlorofluorocarbon. The production process of PET is an energy-intensive process. The emissions from the process severely contaminate water sources with many pollutants. Moreover, improper management and stringent government regulations further decrease the demand for these products in developing countries. This, in turn, may challenge the growth of the North America semirigid PET multilayers film for food package market.

Post-COVID-19 Impact on North America Semirigid PET Multilayers Film For Food Package Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the North America semirigid PET multilayers film for food package market has experienced a significant downfall in sales due to the restaurants and food service outlets being shut down over the past few years.

However, the growth of the North America semirigid PET multilayers film for food package market post-pandemic period is attributed to the opening up of food joints, grocery purchases, and consumer spending. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve their offerings through hygienic and sustainable food packaging solutions.

Recent Developments

- In June 2022, Winpak Ltd. received ISCC (International Sustainability and Carbon Certification) PLUS Certificate for the use of Recycled Content. This certification provides traceability along the supply chain and verifies that companies meet environmental and social standards. ISCC PLUS certification proves that the process to be used by the company for the use of recycled content follows defined and transparent rules. This certification will enhance the company's image in the market and help it gain a competitive advantage

- In May 2022, Sealed Air launched a new portfolio of digital printing, design, and smart packaging solutions. These products have been found under a new brand - prismiq. The brand is aimed at creating value for customers through digital packaging solutions. This new product launch will help the company tap into future digital packaging and graphics, thereby enhancing its product offerings in the market

North America Semirigid PET Multilayers Film For Food Package Market Scope

The North America semirigid PET multilayers film for food package market is segmented based on type, product type, packaging size, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Transparent/Clear

- Colored

On the basis of type, the North America semirigid PET multilayers film for food package market is segmented into transparent/clear and colored.

Product Type

- Bottles

- Boxes

- Jars

- Pouches

- Trays

- Repack

- Others

On the basis of product type, the North America semirigid PET multilayers film for food package market is segmented into bottles, boxes, jars, pouches, trays, repack, and others.

Packaging Size

- Less Than 100 Grams

- 101-200 Grams

- 201-300 Grams

- 301-500 Grams

- 500-1000 Grams

- More Than 1000 Grams

On the basis of packaging size, the North America semirigid PET multilayers film for food package market is segmented into less than 100 grams, 101-200 grams, 201-300 grams, 301-500 grams, 500-1000 grams, and more than 1000 grams.

Application

- Food and Beverages

- Dietary Supplements

- Sports and Energy Drinks

On the basis of application, the North America semirigid PET multilayers film for food package market is segmented into food and beverages, dietary supplements, and sports and energy drinks.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the North America semirigid PET multilayers film for food package market is segmented into direct and indirect.

North America Semirigid PET Multilayers Film For Food Package Market

The North America semirigid PET multilayers film for food package market is analyzed, and market size insights and trends are provided by country, type, product type, packaging size, application, and distribution channel as referenced above.

The North America semirigid PET multilayers film for food package market covers countries such as U.S., Canada, and Mexico. The U.S. is expected to dominate the North America semirigid PET multilayers film for food package market as the packaging market is being driven by reducing the weight of packing materials by reducing material usage without compromising the performance. Also, food waste and food safety are becoming more important challenges for regulatory bodies, particularly in the U.S., Canada, and Mexico.

The country section of the North America semirigid PET multilayers film for food package market report also provides individual market impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Semirigid PET Multilayers Film For Food Package Market Share Analysis

The North America semirigid PET multilayers film for food package market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the North America semirigid PET multilayers film for food package market.

Some of the major players operating in the North America semirigid PET multilayers film for food package market are Wihuri Group, Evertis, Sealed Air, Amcor plc, and Krehalon B.V. (A subsidiary of KUREHA CORPORATION), among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THE THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.3 BRAND OUTLOOK

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 RAW MATERIAL PRODUCTION COVERAGE

4.11 REGULATORY FRAMEWORK AND GUIDELINES

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN USAGE OF SEMIRIGID PET MULTILAYER PACKAGING FILM FOR PREVENTING OXYGEN AND WATER PENETRABILITY

6.1.2 INCREASE IN DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE

6.1.3 SHIFT IN CONSUMER PREFERENCES TOWARDS THE CONSUMPTION OF PACKAGED FOODS

6.1.4 WIDE APPLICATION SCOPE OF SEMIRIGID PET MULTILAYERS FILM IN THE FOOD INDUSTRY

6.2 RESTRAINTS

6.2.1 VOLATILITY IN PRICES OF RAW MATERIALS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWTH OF CREATIVE PACKAGING SOLUTIONS WITH NEW DESIGN IDEAS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.3.3 EXPANSION OF THE FOOD INDUSTRY INFLUENCES PACKAGING FILMS

6.4 CHALLENGES

6.4.1 CONCERNS ABOUT THE RECYCLING OF MULTILAYER FILMS

6.4.2 ENVIRONMENTAL CONCERNS AND STRICT GOVERNMENT REGULATION

7 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TRANSPARENT/CLEAR

7.3 COLORED

8 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BOTTLES

8.3 BOXES

8.4 JARS

8.5 POUCHES

8.6 TRAYS

8.7 REPACK

8.8 OTHERS

9 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE

9.1 OVERVIEW

9.2 LESS THAN 100 GRAMS

9.3 101-200 GRAMS

9.4 201-300 GRAMS

9.5 301-500 GRAMS

9.6 500-1000 GRAMS

9.7 MORE THAN 1000 GRAMS

10 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD AND BEVERAGES

10.2.1 FOOD

10.2.1.1 DAIRY

10.2.1.1.1 CHEESE

10.2.1.1.2 ICE CREAM

10.2.1.1.3 MILK POWDER

10.2.1.1.4 DAIRY SPREAD

10.2.1.1.5 YOGURT

10.2.1.1.6 OTHERS

10.2.1.1.7 DAIRY, BY TYPE

10.2.1.1.7.1 TRANSPARENT/CLEAR

10.2.1.1.7.2 COLORED

10.2.1.1.8 DAIRY, BY PRODUCT TYPE

10.2.1.1.8.1 BOTTLES

10.2.1.1.8.2 BOXES

10.2.1.1.8.3 JARS

10.2.1.1.8.4 POUCHES

10.2.1.1.8.5 TRAYS

10.2.1.1.8.6 REPACK

10.2.1.1.8.7 OTHERS

10.2.1.2 BAKERY

10.2.1.2.1 BREADS & ROLLS

10.2.1.2.2 CAKES & PASTRIES

10.2.1.2.3 BISCUITS

10.2.1.2.4 MUFFINS

10.2.1.2.5 COOKIES

10.2.1.2.6 DOUGHNUTS

10.2.1.2.7 OTHERS

10.2.1.2.8 BAKERY, BY TYPE

10.2.1.2.8.1 TRANSPARENT/CLEAR

10.2.1.2.8.2 COLORED

10.2.1.2.9 BAKERY, BY PRODUCT TYPE

10.2.1.2.9.1 BOTTLES

10.2.1.2.9.2 BOXES

10.2.1.2.9.3 JARS

10.2.1.2.9.4 POUCHES

10.2.1.2.9.5 TRAYS

10.2.1.2.9.6 REPACK

10.2.1.2.9.7 OTHERS

10.2.1.3 PROCESSED FOOD

10.2.1.3.1 READY MEALS

10.2.1.3.2 SAUCES, DRESSINGS AND CONDIMENTS

10.2.1.3.3 SOUPS

10.2.1.3.4 JAMS, PRESERVES AND MARMALADES

10.2.1.3.5 OTHERS

10.2.1.3.6 PROCESSED FOOD, BY TYPE

10.2.1.3.6.1.1 TRANSPARENT/CLEAR

10.2.1.3.6.1.2 COLORED

10.2.1.3.7 PROCESSED FOOD, BY PRODUCT TYPE

10.2.1.3.7.1.1 BOTTLES

10.2.1.3.7.1.2 BOXES

10.2.1.3.7.1.3 JARS

10.2.1.3.7.1.4 POUCHES

10.2.1.3.7.1.5 TRAYS

10.2.1.3.7.1.6 REPACK

10.2.1.3.7.1.7 OTHERS

10.2.1.4 CONFECTIONARY

10.2.1.4.1 HARD-BOILED SWEETS

10.2.1.4.2 MINTS

10.2.1.4.3 GUMS & JELLIES

10.2.1.4.4 CHOCOLATE

10.2.1.4.5 CHOCOLATE SYRUPS

10.2.1.4.6 CARAMELS & TOFFEES

10.2.1.4.7 OTHERS

10.2.1.5 CONFECTIONARY, BY TYPE

10.2.1.5.1 TRANSPARENT/CLEAR

10.2.1.5.2 COLORED

10.2.1.6 CONFECTIONARY, BY PRODUCT TYPE

10.2.1.6.1 BOTTLES

10.2.1.6.2 BOXES

10.2.1.6.3 JARS

10.2.1.6.4 POUCHES

10.2.1.6.5 TRAYS

10.2.1.6.6 REPACK

10.2.1.6.7 OTHERS

10.2.1.7 FROZEN DESSERTS

10.2.1.7.1 GELATO

10.2.1.7.2 CUSTARD

10.2.1.7.3 SORBET

10.2.1.7.4 OTHERS

10.2.1.8 FROZEN DESSERTS,BY TYPE

10.2.1.8.1 TRANSPARENT/CLEAR

10.2.1.8.2 COLORED

10.2.1.9 FROZEN DESSERTS, BY PRODUCT TYPE

10.2.1.9.1 BOTTLES

10.2.1.9.2 BOXES

10.2.1.9.3 JARS

10.2.1.9.4 POUCHES

10.2.1.9.5 TRAYS

10.2.1.9.6 REPACK

10.2.1.9.7 OTHERS

10.2.1.10 FUNCTIONAL FOODS

10.2.1.10.1 TRANSPARENT/CLEAR

10.2.1.10.2 COLORED

10.2.1.10.3 BOTTLES

10.2.1.10.4 BOXES

10.2.1.10.5 JARS

10.2.1.10.6 POUCHES

10.2.1.10.7 TRAYS

10.2.1.10.8 REPACK

10.2.1.10.9 OTHERS

10.2.1.11 CONVENIENCE FOOD

10.2.1.11.1 INSTANT NOODLES

10.2.1.11.2 PASTA

10.2.1.11.3 SNACKS AND EXTRUDED SNACKS

10.2.1.11.4 OTHERS

10.2.1.12 CONVENIENCE FOOD, BY TYPE

10.2.1.12.1 TRANSPARENT/CLEAR

10.2.1.12.2 COLORED

10.2.1.13 CONVENIENCE FOOD, BY PRODUCT TYPE

10.2.1.13.1 BOTTLES

10.2.1.13.2 BOXES

10.2.1.13.3 JARS

10.2.1.13.4 POUCHES

10.2.1.13.5 TRAYS

10.2.1.13.6 REPACK

10.2.1.13.7 OTHERS

10.2.1.14 MEAT PRODUCTS

10.2.1.14.1 BEEF MEAT

10.2.1.14.2 PORK MEAT

10.2.1.14.3 POULTRY MEAT

10.2.1.14.4 OTHERS

10.2.1.15 MEAT PRODUCTS, BY TYPE

10.2.1.15.1 TRANSPARENT/CLEAR

10.2.1.15.2 COLORED

10.2.1.16 MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.16.1 BOTTLES

10.2.1.16.2 BOXES

10.2.1.16.3 JARS

10.2.1.16.4 POUCHES

10.2.1.16.5 TRAYS

10.2.1.16.6 REPACK

10.2.1.16.7 OTHERS

10.2.1.17 PROCESSED MEAT PRODUCTS

10.2.1.17.1 BACON

10.2.1.17.2 MEAT SNACKS

10.2.1.17.3 SAUSAGE

10.2.1.17.4 HOT DOGS

10.2.1.17.5 DELI MEAT

10.2.1.17.6 OTHERS

10.2.1.18 PROCESSED MEAT PRODUCTS, BY TYPE

10.2.1.18.1 TRANSPARENT/CLEAR

10.2.1.18.2 COLORED

10.2.1.19 PROCESSED MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.19.1 BOTTLES

10.2.1.19.2 BOXES

10.2.1.19.3 JARS

10.2.1.19.4 POUCHES

10.2.1.19.5 TRAYS

10.2.1.19.6 REPACK

10.2.1.19.7 OTHERS

10.2.2 BEVERAGES

10.2.2.1 BEVERAGES, BY APPLICATION

10.2.2.1.1 SMOOTHIES

10.2.2.1.2 JUICES

10.2.2.1.3 SPORTS DRINKS

10.2.2.1.4 ENERGY DRINKS

10.2.2.1.5 DAIRY BASED DRINKS

10.2.2.1.5.1 DAIRY BASED DRINKS, BY APPLICATION

10.2.2.1.5.1.1 REGULAR PROCESSED MILK

10.2.2.1.5.1.2 FLAVORED MILK

10.2.2.1.5.1.3 MILK SHAKES

10.2.2.1.5.1.4 FUNCTIONAL BEVERAGES

10.2.2.2 BEVERAGES, BY TYPE

10.2.2.2.1 TRANSPARENT/CLEAR

10.2.2.2.2 COLORED

10.2.2.3 BEVERAGES, BY PRODUCT TYPE

10.2.2.3.1 BOTTLES

10.2.2.3.2 BOXES

10.2.2.3.3 JARS

10.2.2.3.4 POUCHES

10.2.2.3.5 TRAYS

10.2.2.3.6 REPACK

10.2.2.3.7 OTHERS

10.3 DIETARY SUPPLEMENTS

10.3.1 DIETARY SUPPLEMENTS, BY TYPE

10.3.1.1 TRANSPARENT/CLEAR

10.3.1.2 COLORED

10.3.2 DIETARY SUPPLEMENTS, BY PRODUCT TYPE

10.3.2.1 BOTTLES

10.3.2.2 BOXES

10.3.2.3 JARS

10.3.2.4 POUCHES

10.3.2.5 TRAYS

10.3.2.6 REPACK

10.3.2.7 OTHERS

10.4 SPORTS AND ENERGY DRINKS

10.4.1 SPORTS AND ENERGY DRINKS, BY TYPE

10.4.1.1 TRANSPARENT/CLEAR

10.4.1.2 COLORED

10.4.2 SPORTS AND ENERGY DRINKS, BY PRODUCT TYPE

10.4.2.1 BOTTLES

10.4.2.2 BOXES

10.4.2.3 JARS

10.4.2.4 POUCHES

10.4.2.5 TRAYS

10.4.2.6 REPACK

10.4.2.7 OTHERS

11 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 COLLABORATION

13.3 CERTIFICATION

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 WIHURI GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SEALED AIR

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 EVERTIS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 KREHALON B.V. (A SUBSIDIARY OF KUREHA CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 LIVINGJUMBO INDUSTRY S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF POLYETHYLENE TEREPHTHALATE IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYETHYLENE TEREPHTHALATE, IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 3 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRANSPARENT/CLEAR IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA COLORED IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA BOTTLES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA BOXES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA JARS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA POUCHES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA TRAYS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA REPACK IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA LESS THAN 100 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA 101-200 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA 201-300 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA 301-500 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA 500-1000 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA MORE THAN 1000 GRAMS SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA DIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA INDIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 92 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 NORTH AMERICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 106 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 U.S. FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 U.S. FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 U.S. DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 U.S. DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 U.S. DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 U.S. FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 U.S. FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 U.S. DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 U.S. DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 U.S. DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 U.S. SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 U.S. SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 147 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 150 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 CANADA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 CANADA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 CANADA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 CANADA DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 CANADA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 160 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 CANADA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 CANADA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 174 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 CANADA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 182 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 CANADA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 CANADA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 CANADA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 CANADA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 188 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 190 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 191 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 192 MEXICO FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 MEXICO FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 MEXICO DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 MEXICO DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 MEXICO DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 198 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 200 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 201 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 202 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 204 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 207 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 MEXICO FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 MEXICO FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 211 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 212 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 214 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 216 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 218 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 219 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 220 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 221 MEXICO DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 222 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 223 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 224 MEXICO DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 MEXICO DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 226 MEXICO SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 MEXICO SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 228 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE IS EXPECTED TO DRIVE THE NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE TRANSPARENT/CLEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS – NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 17 VALUE CHAIN OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 19 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY PACKAGING SIZE, 2021

FIGURE 22 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY TYPE (2022-2029)

FIGURE 29 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: COMPANY SHARE 2021 (%)

North America Semirigid Pet Multilayers Film For Food Package Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Semirigid Pet Multilayers Film For Food Package Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Semirigid Pet Multilayers Film For Food Package Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.