Global Dehydrated Food Market

Market Size in USD Billion

CAGR :

%

USD

78.80 Billion

USD

107.50 Billion

2024

2032

USD

78.80 Billion

USD

107.50 Billion

2024

2032

| 2025 –2032 | |

| USD 78.80 Billion | |

| USD 107.50 Billion | |

|

|

|

|

Dehydrated Food Market Size

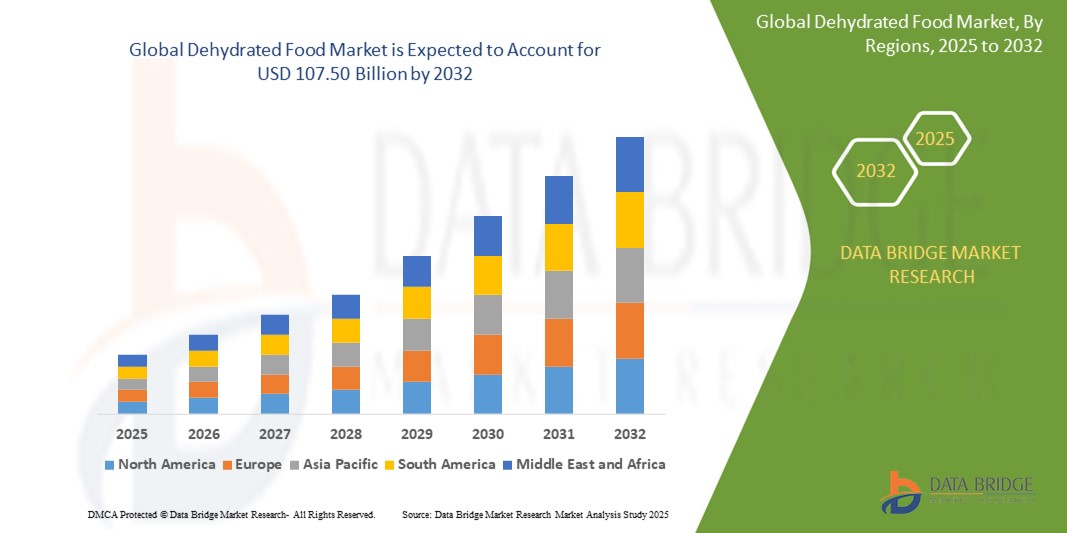

- The global dehydrated food market was valued at USD 78.80 billion in 2024 and is expected to reach USD 107.50 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.5%, primarily driven by the growing need for on-the-go and canned food products

- This growth is driven by factors such as the rise in the need for food products, particularly in seasonal products across the year with longer duration

Dehydrated Food Market Analysis

- Dehydrated food is referred to the dried kind of food by the procedure of dehydration. Dehydration allows the product to be preserved for a longer period

- The demand for dehydrated food is significantly driven by the rise in the need for enhanced year around accessibility of processed and canned meat products amongst the manufacturers

- The North America region stands out as one of the dominant region for dehydrated foods, driven by the rise in the consumption of meat products

- For instance, the U.S. military uses dehydrated meats (such as freeze-dried beef and chicken) in Meal, Ready-to-Eat (MREs) for soldiers.

Report Scope and Dehydrated Food Market Segmentation

|

Attributes |

Dehydrated Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dehydrated Food Market Trends

“Rising Demand for Clean-Label and Natural Ingredients”

- Consumers are increasingly seeking dehydrated foods with minimal additives, no artificial preservatives, and natural processing methods

- Dehydrated food brands are responding by using natural drying techniques like freeze-drying, air-drying, and sun-drying, which preserve nutrients without the need for artificial preservatives

- For instance, Freeze-dried fruits retain their flavor and nutrients but can still harbor bacteria if contaminated before drying. Rehydrating improperly stored freeze-dried meat may allow harmful microorganisms to grow, posing food safety risks

- Governments and food safety authorities (such as FDA in the U.S., EFSA in Europe) are pushing for stricter food labeling regulations, requiring brands to clearly list ingredients and remove harmful additives.

- This has led to an increase in organic and non-GMO dehydrated foods, with companies marketing their products as “free from artificial preservatives”.

Dehydrated Food Market Dynamics

Driver

“Increasing Demand for Convenience and Long-Shelf-Life Foods”

- Modern lifestyles, characterized by busy schedules and reduced time for meal preparation, have increased the demand for foods that are easy to store, require minimal preparation, and remain fresh for extended periods.

- Dehydrated foods require minimal cooking time, making them ideal for working professionals and students

- Dehydrated foods like freeze-dried meats, fruits, and vegetables are widely used in camping, hiking, and military rations due to their lightweight and extended shelf life.

- The availability of dehydrated foods through online retailers like Amazon, Walmart, and specialty food stores has made these products more accessible.

- Dehydrated foods have a much longer shelf life compared to fresh produce, reducing food spoilage and waste

- Food manufacturers and consumers are adopting dehydration techniques to extend the usability of food products

For instance,

- In January 2021, according to an article published by Barbara Willenberg, dehydrated foods like raisins, apple chips, and fruit leathers serve as nutritious snacks. Dried vegetables, such as tomatoes and mushrooms, enhance soups. Hikers prefer dried meals for their portability and long shelf life

- According to the article published by Raw Blend, dehydrated fruits like apples and bananas last longer without refrigeration, retaining fiber and vitamins. Jerky preserves protein without spoilage. Dried herbs maintain flavor for months, making them ideal for cooking and seasoning

- This demand for convenience, extended shelf life, and minimal food waste continues to drive innovation and market expansion for dehydrated foods

Opportunity

“Expansion of Plant-Based Dehydrated Foods”

- Increasing consumer preference for vegan and plant-based diets is driving demand for dehydrated plant-based proteins, dairy alternatives, and snacks

- Growth opportunities exist in dehydrated lentils, chickpeas, soy protein, almond/oat milk powders, and plant-based jerky as alternatives to traditional meat and dairy

- Supermarkets and online platforms are expanding their plant-based dehydrated product offerings, making it more accessible to consumers and driving market expansion

- Consumers are seeking nutrient-dense, high-fiber, and protein-rich dehydrated foods, such as superfood powders, dehydrated greens, and plant-based protein snacks, for better health and wellness

For instance,

- In October 2024, according to an article published by MDPI, many fast-food chains now offer plant-based burgers, dairy-free milk alternatives are mainstream, and companies like Beyond Meat and Oatly are expanding globally to meet rising consumer demand for sustainable, plant-based options

- The expansion of dehydrated plant-based products aligns with global trends in health-conscious eating, sustainability, and long shelf-life convenience, making it a key growth opportunity in the dehydrated food market

Restraint/Challenge

“High Energy Consumption in Dehydration Process”

- Dehydration techniques like freeze-drying, spray-drying, and air-drying require high electricity and fuel consumption, leading to higher operational costs

- The cost of running industrial dehydrators is significant, especially with rising energy prices. This affects profit margins and increases retail prices for consumers

- Carbon footprint concerns arise due to high energy consumption in the dehydration process. Many companies face pressure to adopt sustainable production practices

- While solar drying and heat recovery systems can reduce energy use, high upfront costs and limited infrastructure prevent widespread adoption

- Governments and organizations are pushing for lower energy consumption and eco-friendly processing. Compliance with environmental regulations adds complexity to production

For instance,

- In November 2023, according to an article published by MDPI, hot-air drying of apricot slices consumes approximately 5.19 kWh/kg, leading to significant energy use and potential nutrient loss. Innovative techniques like electrohydrodynamic drying offer more energy-efficient alternatives, reducing energy consumption and preserving product quality.

- This challenge highlights the need for energy-efficient innovations and sustainable practices in the dehydrated food industry

Dehydrated Food Market Scope

The market is segmented on the basis of type, type by technology, distribution channel, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technology |

|

|

By Distribution Channel |

|

|

By Application

|

|

Dehydrated Food Market Regional Analysis

“North America is the Dominant Region in the Dehydrated Food Market”

- North America dominates the dehydrated food market, driven by a high demand for convenient, ready-to-eat food products, boosting the popularity of dehydrated foods

- The U.S. holds a significant share due to its well-established food processing sector and cutting-edge dehydration technologies support large-scale production and innovation in dehydrated food products

- An increasing focus on healthy eating has driven consumers toward nutritious, shelf-stable options like dehydrated fruits and vegetables further strengthen the market.

- In addition, the popularity of outdoor activities and preparedness for emergencies have further increased the demand for portable, long-lasting dehydrated food products., is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the dehydrated food market, driven by rapid urbanization and changing lifestyles

- Countries like China, India, and Southeast Asian nations are experiencing swift urbanization. This shift has led to busier lifestyles, increasing the demand for convenient and ready-to-eat food options, including dehydrated products

- The economic growth in the Asia-Pacific region has resulted in higher disposable incomes. As consumers have more spending power, there's a growing preference for processed and packaged foods that offer convenience without compromising on nutrition

- Innovations in food dehydration technologies have enhanced product quality and shelf life. These advancements have made dehydrated foods more appealing to consumers further contribute to market growth

Dehydrated Food Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Nestlé (Switzerland)

- Unilever (Netherlands)

- Mercer Milling Company, Inc. (U.S.)

- Kerry. (Ireland)

- Mondelez International, Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- Chaucer Foods Ltd (U.K.)

- Novartis (Switzerland)

- DSM (Netherlands)

- General Mills Inc. (U.S.)

- Ting Hsin International Group (Taiwan)

- AJINOMOTO CO., INC. (Japan)

- House Foods Group Inc (Japan)

- Nissin Food Holdings Co. Ltd. (Japan)

- The Kraft Foods Group (U.S.)

- Van Drunen Farms. (U.S.)

- Harmony House Foods Inc. (U.S.)

- Mother Earth Products (U.S.)

Latest Developments in Global Dehydrated Food Market

- In January 2024, NRGene launched Supree, a food-tech company focused on self-drying fruits and vegetables. Their innovative offerings include semi-dried tomatoes with enhanced taste, nutrition, and a one-year frozen shelf-life. Supree aims to establish a new dried tomato category in the market, targeting premium B2B sectors in Israel, Europe, and the Middle East.

- In September 2023, Agri-Neo partnered with BCFoods to improve food safety in the dehydrated vegetable and spice sector in China. BCFoods plans to integrate Agri-Neo’s Neo-Pure Organic Pasteurization system at its Shandong processing facility, introducing a validated kill step in the cleaning and dehydration process. The initiative will begin with dehydrated onions, ensuring higher quality and safety of ingredients.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dehydrated Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dehydrated Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dehydrated Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.