North America Sensor Cleaning System Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

3.92 Billion

2024

2032

USD

1.60 Billion

USD

3.92 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 3.92 Billion | |

|

|

|

Sensor Cleaning System Market Analysis

The North America sensor cleaning system market is experiencing steady growth, driven by the increasing reliance on sensors in various industries such as automotive, aerospace, manufacturing, and healthcare. With the rising demand for autonomous vehicles, industrial automation, and advanced monitoring systems, maintaining sensor accuracy and performance through regular cleaning is becoming critical. Environmental factors like dust, moisture, and pollutants further contribute to the need for efficient sensor cleaning solutions. Technological advancements in cleaning systems, including automated, contactless, and self-cleaning sensors, are driving market innovation. The growing emphasis on safety, operational efficiency, and reducing maintenance costs in critical applications also fuels demand. As industries continue to integrate sensors into everyday operations, the market for sensor cleaning systems is expected to expand.

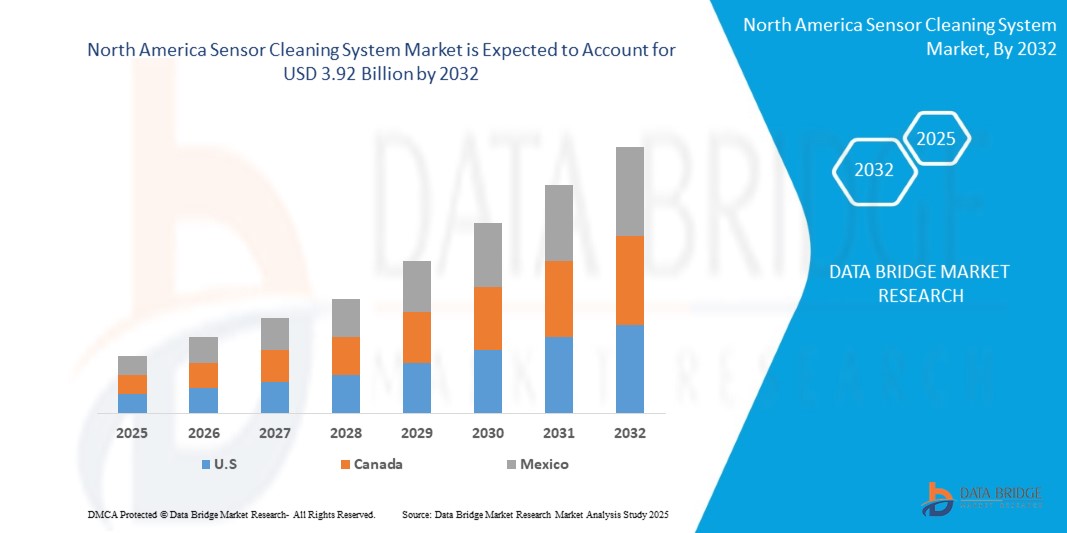

Sensor Cleaning System Market Size

North America sensor cleaning system market size was valued at USD 1.60 billion in 2024 and is projected to reach USD 3.92 billion by 2032, with a CAGR of 12.0% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Sensor Cleaning System Market Trends

“The Expansion of Smart Factories and Industry 4.0”

The growth in industrial automation is significantly impacting the sensor cleaning system market as smart factories and Industry 4.0 initiatives become more prevalent. The increasing reliance on high-precision sensors for automation, robotics, and real-time data collection has led to a surge in demand for sensor cleaning solutions. These systems ensure sensors maintain accuracy and reliability, even in challenging environments. As industries automate further, the need for continuous sensor performance and minimal downtime drives innovation in cleaning technologies. The trend also encourages the development of automated, self-cleaning sensor systems. Additionally, the push for increased efficiency and reduced maintenance costs in manufacturing operations boosts the adoption of sensor cleaning systems. These trends are expected to continue as industrial sectors move toward more advanced automation processes.

Report Scope and Sensor Cleaning System Market Segmentation

|

Attributes |

Sensor Cleaning System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

SOLERO TECHNOLOGIES, LLC.( U.S.), Continental AG(Germany), Ficosa International SA (Spain), Valeo Service (Valeo SA) (France), Actasys Inc. (U.S.), Araymond (France), Röchling SE & Co. KG (Germany), Kautex (Textron GmbH & Co. KG) (Germany ), Process Instruments UK Ltd (U.K.), Mettler Toledo (Germany), Vitesco Technologies (Schaeffler AG) (U.S), Endress+Hauser Group Services AG (Switzerland), Jet Clean gmbh (Australia), Rapa (Germany ), and entegris inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Sensor Cleaning System Market Definition

The North America sensor cleaning system market is concerned with technologies and solutions for cleaning and maintaining sensors used in a wide range of applications, including manufacturing, automotive, aerospace, and healthcare. These systems are necessary for guaranteeing the best performance and longevity of sensors, which are essential components in contemporary equipment and machinery. Increased use of automation and smart devices, as well as rising demand for precise data in industries such as automotive and industrial manufacturing, are driving market expansion. Furthermore, advances in sensor technologies, such as those used in self-driving cars and robotics, are driving the industry. The market comprises both standalone cleaning systems and integrated solutions for sensor maintenance. Key market trends include efficiency, cost-effectiveness, and the drive for sustainability.

Sensor Cleaning System Market Dynamics

Drivers

- Increasing Demand of Sensor Accuracy in Automotive Industries

As automation continues to shape the future of the automotive industry, sensors play an increasingly important role in assuring the precision, efficiency, and safety of production processes and robotic operations. Sensors are utilized in a variety of automobile manufacturing applications, including assembly lines, robotic arms, and car safety systems. As these technologies grow and become more complex, sensors must remain clean and functional in order to preserve operating efficiency and reduce the possibility of costly errors or malfunctions.

For Instance:

As per the Newelectronics, as the number of sensors in automotive like Ultrasonic Sensors, Infrared Sensors, Capacitive Sensors continues to rise, driven by advancements in safety, efficiency, and autonomous driving technologies, the demand for automotive sensor cleaning solutions will also increase. Sensors, such as LiDAR, infrared, and radar, require regular maintenance to ensure optimal performance. This will create a growing market for specialized cleaning products and services tailored to these high-tech automotive sensors. Consequently, sensor cleaning will become a crucial aspect of vehicle maintenance, supporting the broader automotive sensor market's expansion.

- Rising Regulatory Standards for Cleanliness and Sensor Accuracy

Environmental concerns are increasingly influencing North America industrial plans and operations. As sustainability becomes a top issue, firms face increasing pressure to reduce their environmental impact while maintaining efficient and productive manufacturing processes. In sectors that rely on sensor technologies, preserving sensor operation while adhering to environmental requirements has become a top priority. This has resulted in the use of modern sensor cleaning systems that are intended not just to ensure performance but also to reduce environmental effect.

For instance,

According to the Springer Nature, World Health Organization Baseline Country Survey on Medical Devices (World Health Organization,2014), only 65 percent of the 145 responding countries have a national authority responsible for implementing and enforcing medical device regulations. This shows the need for proper maintenance for the use of the medical equipment. Because of this, the need for the sensor cleaning increases.

Opportunities

- Collaborating With IoT and Smart Sensor Manufacturers

Strategic alliances in the sensor cleaning systems market are proven to be effective growth drivers, particularly with makers of IoT devices, smart sensors, and original equipment manufacturers (OEMs). As the need for linked devices and advanced sensor technology grows, firms offering sensor cleaning solutions are increasingly seeing the value of creating alliances to provide integrated, bespoke solutions. These collaborations enable the development of more efficient, compatible, and customized cleaning methods, hence boosting the overall expansion of sensor technology across industries.

For instance,

As per the fraunhofer article, IoT-enabled sensor cleaning systems offer up to 75% energy savings and a 50% reduction in cleaning time. These systems enhance equipment capacity, reduce cleaning agent use, and lower wastewater disposal costs. Customizable cleaning processes meet specific requirements with minimal investment. The adaptability of IoT-enabled sensor cleaning systems across multiple industries opens new revenue streams and increases market penetration potential. Collaborative partnerships with smart sensor manufacturers can drive innovation, creating a broader customer base and accelerating market growth.

- Integrating Sensor Cleaning Systems with Predictive Maintenance Frameworks

As organizations embrace predictive maintenance to improve operational efficiency and reduce downtime, incorporating sensor cleaning systems into these frameworks presents enormous opportunities. Predictive maintenance uses real-time sensor data to predict equipment breakdowns before they occur, and introducing sensor cleaning methods into these systems can improve sensor performance and durability. This integration not only keeps sensors in top condition, but it also improves the whole value proposition of predictive maintenance programs, especially in businesses that rely on complex machinery and automated systems.For instance,

As per the MDPI article, by using vibration signals from cleaning robots, predictive maintenance frameworks can identify performance degradation and potential safety issues early. This allows for proactive intervention, preventing operational failures in autonomous mobile cleaning systems. The integration of predictive maintenance into sensor cleaning technologies offers a significant opportunity for growth, as it enhances system reliability and reduces downtime. As the demand for autonomous driving increases, sensor cleaning solutions with advanced monitoring capabilities will be essential to maintaining optimal sensor performance. This opens a new avenue for innovation and growth in the sensor cleaning market.

Restraints/Challenges

- Integrating Sensor Cleaning Systems with Existing Infrastructure

As companies rely more on advanced sensor technology, integrating sensor cleaning systems into existing infrastructure has become a key task. While the demand for effective cleaning solutions grows, integrating new systems with older facilities or legacy gear can be challenging. This is especially true in businesses where outdated technology are still in use, posing further challenges to the adoption of sophisticated sensor cleaning solutions.

As companies rely on more advanced sensor technology, integrating sensor cleaning systems into existing infrastructure has become a key task. While the demand for effective cleaning solutions grows, integrating new systems with older facilities or legacy gear can be challenging. This is especially true in businesses where outdated technology are still in use, posing further challenges to the adoption of sophisticated sensor cleaning solutions.

For instance,

As per the SEA international, designing cleaning mechanisms compatible with various sensor shapes and placements often requires significant reconfiguration by manufacturers, such as adjusting liquid-jet sprays or adapting ultrasonic systems. These adjustments complicate integration efforts. Older facilities and equipment often require significant modifications to accommodate new sensor cleaning technologies, which can be costly and time-consuming. Because of this, the sensor cleaning systems cause restraint.

- The Rise of Self-Cleaning Sensors and Alternative Maintenance Technologies

As sensor technologies continue to evolve, the rise of alternative solutions such as self-cleaning sensors and innovative maintenance methods poses a potential challenge to traditional sensor cleaning systems. These advancements aim to reduce or eliminate the need for external cleaning systems, offering a more streamlined approach to maintaining sensor performance. While traditional sensor cleaning systems have proven effective, the development of these alternatives presents competition in the market, prompting companies to reassess their strategies and innovations.

Self-cleaning sensors, for example, use sophisticated materials or built-in systems to automatically remove pollutants without requiring external intervention. This approach can greatly minimize the maintenance load by providing continuous sensor performance in tough or distant situations where manual cleaning is unfeasible. Similarly, alternative maintenance approaches, like as cleaning with UV light or nanotechnology, may enable more sustainable and effective ways to keep sensors operating in the absence of standard cleaning systems. As these technologies evolve, they may gain acceptance, particularly in industries where lowering operational costs and maintenance time is critical. While traditional sensor cleaning systems remain functional, these developing alternatives may provide a more cost-effective and low-maintenance solution for certain applications, introducing competition into the market.

For instance,

As per the Royal Society of Chemistry research paper publication, materials like titanium dioxide (TiO2) are used in photocatalytic self-cleaning systems that break down pollutants under UV light, which can be applied to sensor surfaces for self-maintenance in harsh environments. The continuous evolution of self-cleaning technologies, along with the development of alternative maintenance methods such as nanocoatings and automated cleaning solutions, poses a significant challenge to traditional sensor cleaning systems. As these technologies become more efficient and cost-effective, they could reduce the demand for conventional cleaning methods, forcing the market to adapt to a new landscape where manual or sensor-based cleaning processes may become obsolete. This shift could disrupt existing business models and require companies to invest in new, advanced solutions to stay competitive.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Sensor Cleaning System Market Scope

The market is segmented on the basis of sensor type, cleaning system, end user and sales channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Sensor Type

- Camera cleaning systems

- Lidar cleaning systems

- Radar cleaning system

- Others

Cleaning System

- Automated Sensor Cleaning Systems

- Manual Sensor Cleaning Systems

- Semi-Automated Sensor Cleaning Systems

End-User

- Automotive

- Commercial vehicle

- Passenger cars

- Compact Cars

- Luxury Cars

- Mid Sized Cars

- Suvs

- Aerospace & Defence

- Industrial

- Healthcare & Medical Devices

- Consumer Electronics

- Oil & Gas

- Others

Sales Channel

- Aftermarket

- Original Equipment Manufacturer

Sensor Cleaning System Market Regional Analysis

The market is analyzed and market size insights and trends are provided by sensor type, cleaning system, end user and sales channel as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

In North America, the U.S. dominates the sensor cleaning system market due to its robust automotive and electronics manufacturing sectors, coupled with high adoption of advanced technologies. The region benefits from significant R&D investments and stringent regulations driving demand for efficient sensor maintenance solutions. The U.S. also leads in consumer electronics innovation, boosting market growth. Furthermore, the presence of key manufacturers and a mature aftermarket ecosystem solidify its dominance.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Sensor Cleaning System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Sensor Cleaning System Market Leaders Operating in the Market Are:

- SOLERO TECHNOLOGIES, LLC.( U.S.)

- Continental AG(Germany)

- Ficosa International SA (Spain)

- Valeo Service (Valeo SA) (France)

- Actasys Inc. (U.S.)

- Araymond (France)

- Röchling SE & Co. KG (Germany)

- Kautex (Textron GmbH & Co. KG) (Germany )

- Process Instruments UK Ltd (U.K.)

- Mettler Toledo (Germany)

- Vitesco Technologies (Schaeffler AG) (U.S)

- Endress+Hauser Group Services AG (Switzerland)

- Jet Clean gmbh (Australia)

- Rapa (Germany )

- entegris inc. (U.S.)

Latest Developments in North America Sensor Cleaning System Market

- In September 2024, Entegris, a leading electronics materials company, is investing $600 million in a new facility in Colorado Springs to manufacture FOUPS and advanced liquid filters, supporting the reshoring of semiconductor supply chain components. This expansion strengthens Entegris' expertise in sensor cleaning systems by improving defect control in wafer handling. The facility will utilize advanced processes to produce highly precise FOUPS, boosting production yields for semiconductor manufacturers

- In August 2024, SICK and Endress+Hauser have formed a strategic partnership, with Endress+Hauser assuming North America sales and service responsibilities for SICK's process analyzers and gas flowmeters, alongside a joint venture for their production and development. This partnership enhances Endress+Hauser's portfolio by incorporating advanced analyzers and flowmeter technologies, bolstering its sensor cleaning systems to improve contamination control and support more efficient industrial processes

- In May 2021, The Fluid Control Unit (FCU), developed by dlhBOWLES and RAPA Automotive, is now commercially available, enhancing sensor and camera cleaning technology for advanced driving systems and autonomous vehicles. This development allows RAPA Group to leverage its valve design expertise, improving the performance and reliability of sensor cleaning systems, thereby supporting the functionality of advanced driving and autonomous vehicle technologies

- In April 2024, Solero Technologies, backed by Atar Capital, has announced the acquisition of Kendrion’s automotive business. This strategic move enhances Solero's capabilities in electrification and sustainability, expanding its North America presence with additional plants in Europe and the U.S., doubling its annual revenue

- In January 2024, Ficosa and indie Semiconductor have partnered to develop AI-based automotive camera solutions aimed at enhancing safety. This collaboration will combine Ficosa’s vision expertise with indie’s AI processing technology to provide advanced object detection and imaging for improved external element protection. The first smart camera solutions are set to be tested in 2024, with full-scale production expected by 2025. The partnership aligns with increasing automotive safety regulations focused on protecting vulnerable road users, like pedestrians and cyclists, through intelligent sensing in ADAS systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SENSOR CLEANING SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND OF SENSOR ACCURACY IN AUTOMOTIVE INDUSTRIES

5.1.2 RISING IMPORTANCE OF SENSOR CLEANING SYSTEMS FOR MAINTAINING ACCURACY AND PERFORMANCE

5.1.3 THE GROWTH OF AUTOMATION IN MANUFACTURING AND ROBOTICS INDUSTRIES

5.1.4 RISING REGULATORY STANDARDS FOR CLEANLINESS AND SENSOR ACCURACY

5.1.5 GROWING DEMAND FOR CLEAN ENVIRONMENTS IN THE SEMICONDUCTOR AND ELECTRONICS INDUSTRIES

5.2 RESTRAINTS

5.2.1 INTEGRATING SENSOR CLEANING SYSTEMS WITH EXISTING INFRASTRUCTURE

5.2.2 HIGH UPFRONT COST FOR IMPLEMENTING SENSOR CLEANING SYSTEMS

5.3 OPPORTUNITIES

5.3.1 COLLABORATING WITH IOT AND SMART SENSOR MANUFACTURERS

5.3.2 INTEGRATING SENSOR CLEANING SYSTEMS WITH PREDICTIVE MAINTENANCE FRAMEWORKS

5.3.3 IMPLEMENTING AI AND ML INTO SENSOR CLEANING SYSTEMS TO IMPROVE EFFICIENCY

5.4 CHALLENGES

5.4.1 THE RISE OF SELF-CLEANING SENSORS AND ALTERNATIVE MAINTENANCE TECHNOLOGIES

5.4.2 DIFFICULTIES IN THE ADOPTION OF SENSORS CLEANING SYSTEMS IN MINING AND HEAVY MANUFACTURING INDUSTRIES

6 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE

6.1 OVERVIEW

6.2 CAMERA CLEANING SYSTEMS

6.3 LIDAR CLEANING SYSTEMS

6.4 RADAR CLEANING SYSTEMS

6.5 OTHERS

7 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY CLEANING SYSTEMS

7.1 OVERVIEW

7.2 AUTOMATED SENSOR CLEANING SYSTEMS

7.3 SEMI AUTOMATED SENSOR CLEANING SYSTEMS

7.4 MANUAL SENSOR CLEANING SYSTEMS

8 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY END USER

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.2.1 AUTOMOTIVE, BY TYPE

8.2.1.1 PASSENGER CARS

8.2.1.1.1 PASSENGER CARS, BY TYPES

8.2.1.1.1.1 SUVS

8.2.1.1.1.2 MID SIZED CARS

8.2.1.1.1.3 COMPACT CARS

8.2.1.1.1.4 LUXURY CARS

8.2.1.2 COMMERCIAL VEHICLE

8.3 INDUSTRIAL

8.4 HEALTHCARE & MEDICAL DEVICES

8.5 AEROSPACE & DEFENCE

8.6 CONSUMER ELECTRONICS

8.7 OTHERS

9 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 ORIGINAL EQUIPMENT

9.3 AFTERMARKET

10 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 VALEO SERVICE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CONTINENTAL AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 ARAYMOND ET CIE

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 ROCHLING SE AND CO. KG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 METTLER TOLEDO

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ACTASYS INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENDRESS+HAUSER GROUP SERVICES AG

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 ENTEGRIS

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FICOSA INTERNATIONAL SA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 JETCLEAN GMBH

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KAUTEX

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 PROCESS INSTRUMENTS UK LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 RAPA GRUPPE

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 SOLERO TECHNOLOGIES, LLC

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 VITESCO TECHNOLOGIES GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 PRICING RANGE FOR DIFFERENT SENSOR CLEANING SYSTEMS

TABLE 2 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE, 2020-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA CAMERA CLEANING SYSTEMS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA LIDAR CLEANING SYSTEMS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA RADAR CLEANING SYSTEMS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA OTHERS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY CLEANING SYSTEMS, 2020-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA AUTOMATED SENSOR CLEANING SYSTEMS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SEMI AUTOMATED SENSOR CLEANING SYSTEMS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA MANUAL SENSOR CLEANING SYSTEMS IN NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY END USER, 2020-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA AUTOMOTIVE IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA AUTOMOTIVE IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PASSENGER CARS IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA INDUSTRIAL IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA HEALTHCARE & MEDICAL DEVICES IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA AEROSPACE & DEFENCE DEVICES IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA CONSUMER ELECTRONICS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SALES CHANNEL, 2020-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA ORIGINAL EQUIPMENT IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA AFTERMARKET IN SENSOR CLEANING SYSTEM MARKET, BY REGION, 2020-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY COUNTRY, 2020-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE, 2020-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY CLEANING SYSTEMS, 2020-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY END USER, 2020-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA AUTOMOTIVE IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA PASSENGER CARS IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SALES CHANNEL, 2020-2032 (USD THOUSAND)

TABLE 30 U.S. SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE, 2020-2032 (USD THOUSAND)

TABLE 31 U.S. SENSOR CLEANING SYSTEM MARKET, BY CLEANING SYSTEMS, 2020-2032 (USD THOUSAND)

TABLE 32 U.S. SENSOR CLEANING SYSTEM MARKET, BY END USER, 2020-2032 (USD THOUSAND)

TABLE 33 U.S. AUTOMOTIVE IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 34 U.S. PASSENGER CARS IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 35 U.S. SENSOR CLEANING SYSTEM MARKET, BY SALES CHANNEL, 2020-2032 (USD THOUSAND)

TABLE 36 CANADA SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE, 2020-2032 (USD THOUSAND)

TABLE 37 CANADA SENSOR CLEANING SYSTEM MARKET, BY CLEANING SYSTEMS, 2020-2032 (USD THOUSAND)

TABLE 38 CANADA SENSOR CLEANING SYSTEM MARKET, BY END USER, 2020-2032 (USD THOUSAND)

TABLE 39 CANADA AUTOMOTIVE IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 40 CANADA PASSENGER CARS IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 41 CANADA SENSOR CLEANING SYSTEM MARKET, BY SALES CHANNEL, 2020-2032 (USD THOUSAND)

TABLE 42 MEXICO SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE, 2020-2032 (USD THOUSAND)

TABLE 43 MEXICO SENSOR CLEANING SYSTEM MARKET, BY CLEANING SYSTEMS, 2020-2032 (USD THOUSAND)

TABLE 44 MEXICO SENSOR CLEANING SYSTEM MARKET, BY END USER, 2020-2032 (USD THOUSAND)

TABLE 45 MEXICO AUTOMOTIVE IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 46 MEXICO PASSENGER CARS IN SENSOR CLEANING SYSTEM MARKET, BY TYPE, 2020-2032 (USD THOUSAND)

TABLE 47 MEXICO SENSOR CLEANING SYSTEM MARKET, BY SALES CHANNEL, 2020-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: SENSOR TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: MARKET END USER COVERAGE GRID

FIGURE 12 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: SEGMENTATION

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 FOUR SEGMENTS COMPRISE THE NORTH AMERICA SENSOR CLEANING SYSTEM MARKET, BY SENSOR TYPE (2024)

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 INCREASING DEMAND OF SENSOR ACCURACY IN AUTOMOTIVE INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA SENSOR CLEANING SYSTEM MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 CAMERA CLEANING SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SENSOR CLEANING SYSTEM MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SENSOR CLEANING SYSTEM MARKET

FIGURE 19 SIZE OF COMMERCIAL ROBOTIC MARKET

FIGURE 20 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: BY SENSOR TYPE, 2024

FIGURE 21 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: BY CLEANING SYSTEMS, 2024

FIGURE 22 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: BY END USER 2024

FIGURE 23 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: BY SALES CHANNEL, 2024

FIGURE 24 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: SNAPSHOT (2024)

FIGURE 25 NORTH AMERICA SENSOR CLEANING SYSTEM MARKET: COMPANY SHARE 2024 (%)

North America Sensor Cleaning System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Sensor Cleaning System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Sensor Cleaning System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.