North America Smart Lighting Market

Market Size in USD Billion

CAGR :

%

USD

6.80 Billion

USD

19.10 Billion

2024

2032

USD

6.80 Billion

USD

19.10 Billion

2024

2032

| 2025 –2032 | |

| USD 6.80 Billion | |

| USD 19.10 Billion | |

|

|

|

|

North America Smart Lighting Market Size

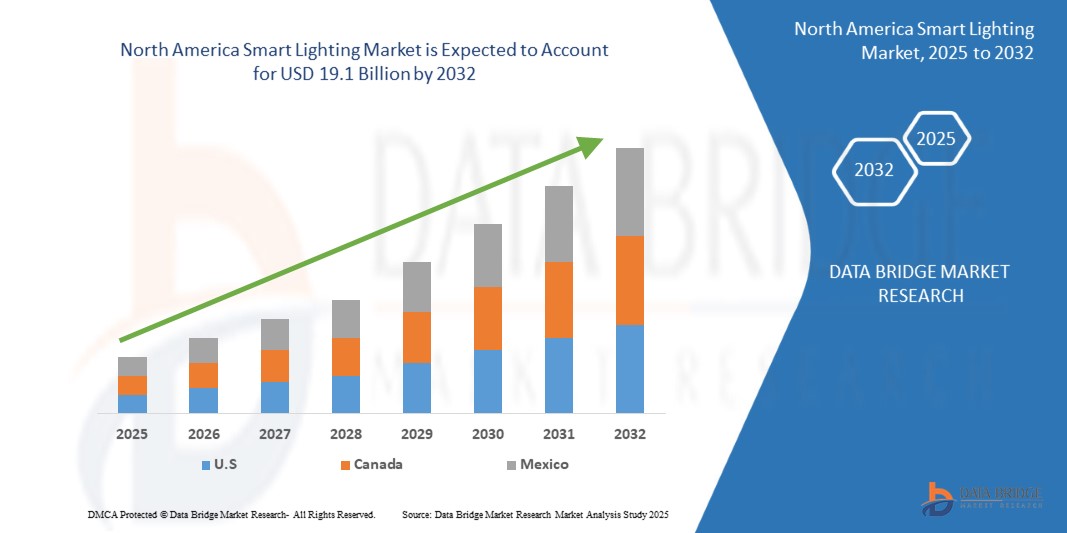

- The North America Smart Lighting Market size was valued at USD 6.8 billion in 2024 and is expected to reach USD 19.1 billion by 2032, at a CAGR of 15.9% during the forecast period.

- This growth is driven by Increased awareness of sustainability and cost-saving on energy bills is pushing residential and commercial adoption.

North America Smart Lighting Market Analysis

- Smart lighting is integral to smart cities for adaptive illumination, energy savings, and safety. Cities like Los Angeles and New York are rapidly deploying connected street lighting systems.

- Federal and state-level policies in the U.S. and Canada offer tax rebates and subsidies for energy-efficient retrofits.

- U.S. holds a significant market share due to Technological Advancements.

- U.S. is expected to register the fastest growth, fuelled by IoT and Wireless Control Integration.

- The Software segment is projected to account for a significant market share of approximately 31.1% in 2025, driven by Government Incentives for Energy Efficiency.

Report Scope and North America Smart Lighting Market Segmentation

|

Attributes |

North America Smart Lighting Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Smart Lighting Market Trends

“Cloud computing”

- Cloud computing adoption in IoT for public safety enhances scalability, flexibility, and cost-efficiency. Cloud platforms facilitate real-time data analysis and remote access, improving emergency coordination.

- IoT technologies are increasingly being integrated into smart city infrastructures, supporting enhanced surveillance, traffic management, and emergency response. This fosters better resource management during critical events.

In 2024, GE Current launched a smart lighting solution in New York that integrates emergency alert systems and video capture for enhanced public safety.

- Cloud-based platforms offer scalability and real-time data processing capabilities, enhancing coordination between agencies during emergencies.

North America Smart Lighting Market Dynamics

Driver

“Simplified Data Management”

- Modern IoT platforms allow non-technical personnel to analyze and manage data independently, speeding up decision-making.

- Growing regulatory demands push for IoT solutions that meet data protection and public safety standards, fostering trust and operational efficiency.

For instance, In January 2025, (NextGen 911 Systems) The modernization of emergency dispatch systems using IoT for geolocation and multimedia data feeds is accelerating across the U.S., led by companies like Rapid SOS.

- Philips Hue partnered with Nobilia to introduce integrated smart lighting solutions for kitchen furniture, featuring custom Hue lights designed exclusively for Nobilia.

Opportunity

“Predictive Analytics & Data Mining”

- These tools help agencies anticipate incidents, allocate resources more efficiently, and take proactive measures.

- Increasing digitalization in North American cities opens doors for IoT vendors to provide advanced public safety solutions.

For instance, as of 2025, there's growing adoption of SaaS platforms tailored for government use, including those offered by Amazon Web Services (AWS)

- Hexagon Safety & Infrastructure deployed integrated IoT dashboards across several U.S. states to unify operations among police, fire, and EMS units.

Restraint/Challenge

“Capital Intensive Deployments”

- Initial costs for hardware, software, and system integration pose barriers, especially for small and mid-sized municipalities.

- High upfront costs of deploying IoT systems, including hardware, software, and services, are significant barriers for smaller municipalities.

For instance, In May 2025, Brilliant introduced its second-generation smart home control panels, featuring higher-resolution screens and improved responsiveness, following its acquisition by Almeida Strategic Investments and Cullinan Holdings in 2024.

- Full-scale IoT deployments involving sensors, analytics, and infrastructure remain financially challenging for smaller jurisdictions.

North America Smart Lighting Market Scope

The market is segmented based on Offering, Installation Type, and Communication Technology, Application Type.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Installation Type |

|

|

By Communication Technology |

|

|

By Application Type |

|

In 2025, Software segment is projected to dominate the End User segment

The Software segment is expected to hold a market share of approximately 31.1% in 2025, driven by Advanced 5G and Edge Connectivity.

The Surveillance and Security segment is expected to account for the largest share during the forecast period in the Road Type market

In 2025, the Cities segment is projected to account for a market share of 29.8%, driven by Growing regulatory demands push for IoT solutions that meet data protection and public safety standards, fostering trust and operational efficiency.

“U.S. Holds the Largest Share in the North America Smart Lighting Market”

- U.S. dominates the market due to Growing regulatory demands push for IoT solutions that meet data protection and public safety standards, fostering trust and operational efficiency.

- The U.S. holds a significant share, driven by Modern IoT platforms allow non-technical personnel to analyze and manage data independently, speeding up decision-making.

- Increasing digitalization in North American cities opens doors for IoT vendors to provide advanced public safety solutions.

“U.S. is Projected to Register the Highest CAGR in the North America Smart Lighting Market”

- U.S. growth is driven by Predictive Analytics & Data Mining.

- U.S. is projected to exhibit the highest CAGR due to there's growing adoption of SaaS platforms tailored for government use, including those offered by Amazon Web Services (AWS).

- Analytics tools like predictive analytics and data mining allow agencies to extract actionable insights from IoT data, aiding proactive responses and efficient resource deployment.

North America Smart Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Philips Lighting Holding B.V.

- Acuity Brands Lighting, Inc.

- Hafele,

- Honeywell International Inc.,

- Cree, Inc.

- Digital Lumens, Inc.

- OSRAM GmbH.,

- Lutron Electronics Co., Inc,

- Legrand SA,

- Seiko Epson Corporation,

- Encelium technologies,

- Virtual Extension,

- Zumtobel Group AG,

- Wipro Consumer Care & Lighting,

- Schneider Electric SE,

- Eaton,

- Leviton Manufacturing Co., Inc.,

- Syska LED

- Beam Labs B.V.

Latest Developments in North America Smart Lighting Market

- In January 2024, GE Lighting launched the Cync Reveal HD+ Full Color Undercabinet Fixtures and Pucks, marking the first full-color, edge-lit smart undercabinet lights available in North America.

- In September 2024, Philips Hue partnered with Nobilia to introduce integrated smart lighting solutions for kitchen furniture, featuring custom Hue lights designed exclusively for Nobilia.

- In September 2024, At IFA 2024, Govee unveiled a range of Matter-enabled decorative lighting products, including smart string lights, curtain lights, and strip lights, enhancing compatibility across smart home ecosystems.

- As of May 2025, Brilliant introduced its second-generation smart home control panels, featuring higher-resolution screens and improved responsiveness, following its acquisition by Almeida Strategic Investments and Cullinan Holdings in 2024.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.