North America Soft Magnetic Materials Market

Market Size in USD Billion

CAGR :

%

USD

5.14 Billion

USD

8.56 Billion

2024

2032

USD

5.14 Billion

USD

8.56 Billion

2024

2032

| 2025 –2032 | |

| USD 5.14 Billion | |

| USD 8.56 Billion | |

|

|

|

|

North America Soft Magnetic Materials Market Size

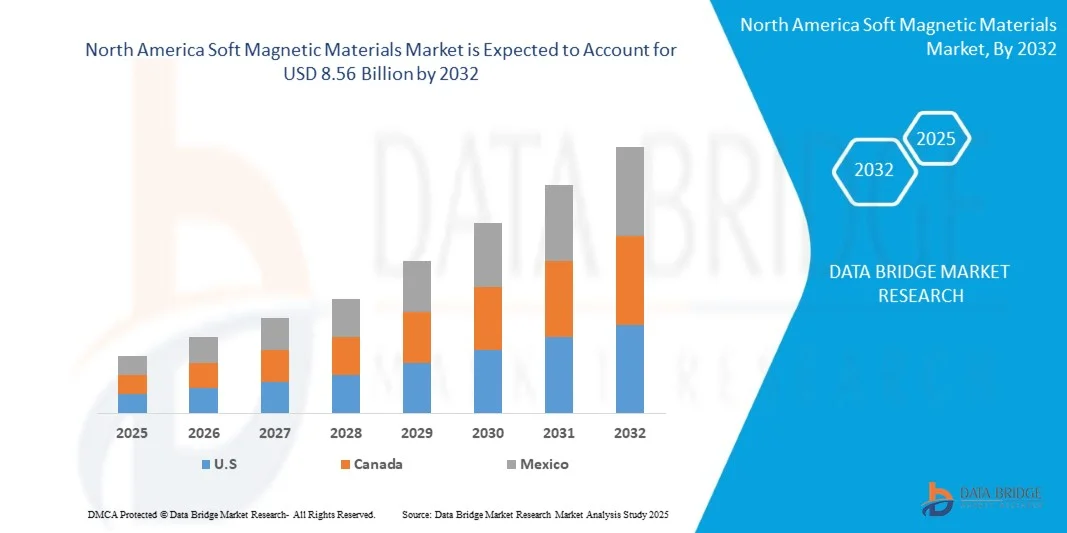

- The North America Soft Magnetic Materials Market is expected to reach 8.56 Billion by 2032 from USD 5.14 Billion in 2024, growing with a substantial CAGR of 6.7% in the forecast period of 2025 to 2032

- The North America Soft Magnetic Materials Market growth is significantly driven by the rapid expansion of the electronics, automotive, and renewable energy sectors, where these materials are essential for manufacturing transformers, electric motors, inductors, and generators. The rising adoption of electric vehicles (EVs) and renewable energy technologies further boosts the demand for high-performance soft magnetic materials.

- Market expansion is further supported by increasing industrialization, government initiatives promoting energy-efficient technologies, and ongoing investments in research and development to enhance magnetic properties and material performance. Additionally, the growing presence of local manufacturers and cost-effective production capabilities in countries such as U.S, Canada contribute to the region’s market growth and competitiveness.

North America Soft Magnetic Materials Market Analysis

- The escalating demand for high-efficiency electric motors, transformers, and inductors, driven by industrial automation, renewable energy adoption, and the growing electric vehicle (EV) market, is a major trend fueling the demand for soft magnetic materials in the North America region.

- Soft magnetic materials serve as a critical component in energy-efficient electrical systems, supporting power generation, transmission, and industrial applications across the region, making them indispensable for technological and industrial growth.

- U.S. is the dominant country in the North America Soft Magnetic Materials Market, accounting for over 73.73% market share in 2025, driven by its large manufacturing base, rapid industrial growth, and heavy investments in renewable energy and electric vehicles.

- U.S. is the fastest-growing country in the region, with a CAGR of 6.9%, reflecting increased industrial modernization, technology adoption, and demand for high-performance soft magnetic materials.

- The Sheets & Strips segment is the dominant Product Type in the North America Soft Magnetic Materials Market with a market share of 32.74% in 2025. reflecting the robust growth in automated systems necessitates the continued and strategic deployment of Precision Gearboxes for accurate motion control, positioning these systems as a vital component in the North America's industrial future.

Report Scope and North America Soft Magnetic Materials Market Segmentation

|

Attributes |

North America Soft Magnetic Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Soft Magnetic Materials Market Trends

“Expansion of renewable energy infrastructure”

- The expansion of renewable energy infrastructure, including wind turbines, solar inverters, and smart grids, is a significant trend driving the demand for soft magnetic materials in the North America region. As countries in the region aim to increase renewable energy capacity to meet sustainability targets, the need for high-performance magnetic cores in generators and transformers is rising.

- Soft magnetic materials play a critical role in ensuring efficiency, reducing energy losses, and supporting reliable power conversion in renewable energy systems, making them essential components of the evolving energy landscape.

- The growing adoption of large-scale renewable projects, combined with grid modernization initiatives, leads to increased demand for advanced soft magnetic materials capable of handling high voltages, currents, and operational stresses.

- For instance, China, India, and Japan are investing heavily in wind and solar capacity, requiring high-quality magnetic components to optimize energy generation and transmission efficiency.

- The continued deployment of renewable energy technologies positions soft magnetic materials as a key enabler of the North America ’s transition to a sustainable and resilient energy ecosystem.

North America Soft Magnetic Materials Market Dynamics

Driver

“Growing Demand in Promotional Products and Advertising Materials”

- The growing demand for promotional products and advertising materials, such as magnetic business cards, branded fridge magnets, and flexible magnetic signage, is emerging as a novel driver for the North America Soft Magnetic Materials Market in the Asia‑Pacific region.

- As brands and marketers increasingly adopt magnetic media for experiential marketing and point‑of‑sale displays, raw flexible magnetic strips and sheets made from soft magnetic materials are required in greater volumes.

- These materials support lightweight, cost‑effective and reusable magnetic promotional items that cater to markets in India, China, Southeast Asia and Australia, where marketing spend and brand activation activities are rising.

- Suppliers of soft magnetic materials are positioning thinner, more form‑flexible magnetic alloys and sheets to meet requirements of promotional and advertising product producers, enabling increased usage beyond traditional industrial motors and transformers.

For Instances

- As reported by Antalis UK in June 2021, the company expanded its range of magnetic display and printable sheet materials to cater to retail brands using magnetic graphics for seasonal promotions and point-of-sale advertising. The new materials enable quick installation and replacement of visuals, reflecting growing use of flexible soft magnetic materials in marketing application

- In February 2022 Visual Magnetics, the U.S.-based manufacturer introduced its ActiveWall magnetic graphic system, designed for brand environments and retail signage. The solution allows marketers to easily update wall graphics using magnetic receptive films, promoting sustainability and flexibility in promotional display materials.

- In December 2023 Arnold Magnetic Technologies Corporation, the company highlighted its ENTICE printable pre-magnetized paper designed for marketing applications including indoor signs, calendars, coupons and business cards

- The growing demand for promotional products and advertising materials across the North America region is emerging as a key driver for the North America Soft Magnetic Materials Market. Rising brand marketing initiatives and experiential campaigns are pushing manufacturers to produce flexible magnetic sheets, strips, and custom magnetic items for business cards, fridge magnets, and point-of-sale displays. These soft magnetic materials enable lightweight, reusable, and cost-effective promotional products, making them essential for advertising applications. As marketing and brand activation activities expand in countries like China, India, and Australia, the demand for soft magnetic materials in promotional products continues to strengthen, supporting overall market growth.

Restraint/Challenge

“Volatility in Raw Material Prices”

- The manufacturing relies heavily on metals like iron, nickel, and cobalt. Sudden price swings in these raw materials increase production costs, making it difficult for manufacturers to maintain stable pricing, particularly in cost-sensitive applications such as consumer electronics and automotive components.

- Volatility in raw material prices can disrupt supply chains, leading to delays in procurement and manufacturing. This unpredictability hinders the timely delivery of soft magnetic materials to end-use industries, slowing down project timelines and limiting market expansion in the North America region.

- Smaller players and new entrants are disproportionately affected by raw material price fluctuations, as they often lack long-term supplier contracts or financial buffers. This creates barriers to entry, reduces market competitiveness, and slows overall growth in the soft magnetic materials sector.

For Instances,

- In March 2022, nickel prices on the London Metal Exchange surged over 250% within two days briefly topping USD 100,000 per ton following supply concerns related to the Russia-Ukraine conflict. The unprecedented spike disrupted global alloy supply chains and directly increased costs for manufacturers of nickel-based soft magnetic materials.

- In October 2024, cobalt prices experienced heightened volatility due to supply fluctuations in the Democratic Republic of Congo and weak downstream EV demand in China. The unstable pricing environment hindered procurement planning for magnetic alloy producers relying on cobalt-based soft magnetic materials

North America Soft Magnetic Materials Market Scope

The North America Soft Magnetic Materials Market is segmented into product type, material type, manufacturing process, application, end user, distribution channel.

• By Product Type

On the basis of product type, the soft magnetic material market is segmented into Sheets & Strips, Cores & Core Types, Ribbons & Foils, Powders & Granules, Assembled Components, Ingots, and Others. The Cores & Core Types segment is further categorized into E-Cores, Toroidal Cores, and C-Cores, while the Ribbons & Foils segment is further divided into Amorphous Ribbons and Nanocrystalline Ribbons. The Sheets & Strips segment is expected to dominate the market due to their extensive use in transformers, electric motors, and generators, which are key components across automotive, power, and industrial applications. Their excellent magnetic permeability, low core losses, and ease of fabrication make them ideal for high-efficiency energy conversion and transmission systems.

Sheet and Strip is projected to be the fastest-growing segment due to the increasing demand for energy-efficient electrical devices and transformers across the North America region. These materials offer superior magnetic performance, reduced core losses, and enhanced thermal stability, making them ideal for high-performance applications in motors, generators, and power distribution systems. The growth is further driven by technological advancements in manufacturing processes such as grain-oriented and non-oriented electrical steel, which improve magnetic properties and operational efficiency. Additionally, the rising adoption of electric vehicles, renewable energy systems, and industrial automation is fueling the demand for high-quality sheet and strip soft magnetic materials, positioning this segment for rapid expansion.

• By Material Type

On the basis of Material Type, the soft magnetic material market is segmented into Electrical Steels (Fe-Si), Amorphous & Nanocrystalline Alloys, Soft Ferrites, Powdered Iron & Metal Powders, Soft Magnetic Alloys, Thin Films & Magnetic Coatings, and Others. The Electrical Steels (Fe-Si) segment is further divided into Grain-Oriented (GO) and Non-Oriented (NO) types, while the Soft Ferrites segment is further categorized into MnZn Ferrites and NiZn Ferrites. The Electrical Steels (Fe-Si) segment is expected to dominate the market due to their widespread application in transformers, motors, and generators, which are essential for power generation, transmission, and electric mobility. Their high magnetic permeability, low hysteresis loss, and superior energy efficiency make them a preferred choice in industrial and utility-scale applications.

Electrical Steels (Fe-Si) are projected to be the fastest-growing segment in the North America Soft Magnetic Materials Market, driven by increasing demand for energy-efficient electrical devices, transformers, and motors across the North America region. Technological advancements in grain-oriented and non-oriented electrical steel improve magnetic performance, reduce energy losses, and enhance thermal stability, making them critical for modern power generation and distribution systems. The rising adoption of electric vehicles, renewable energy infrastructure, and industrial automation is further accelerating the need for high-quality Fe-Si steels. Continued innovations in manufacturing processes and performance optimization are expected to sustain rapid growth in this segment over the forecast period.

• By Manufacturing Process

On the basis of Manufacturing Process, the soft magnetic material market is segmented into Cold Rolling & Annealing, Melt Spinning, Powder Metallurgy, and Others. The Cold Rolling & Annealing segment is expected to dominate the market due to its ability to enhance magnetic permeability, reduce core losses, and improve surface finish and dimensional accuracy of materials. This process allows precise control over microstructure and texture, leading to superior magnetic performance.

The Cold Rolling & Annealing segment is projected to be the fastest-growing in the North America Soft Magnetic Materials Market, driven by increasing demand for high-performance electrical steels used in transformers, motors, and renewable energy applications. Advanced cold rolling and annealing processes enhance grain orientation, reduce core losses, and improve magnetic permeability, making the materials highly efficient for energy-saving applications. The growth of electric vehicles, smart grids, and industrial automation in the North America region is fueling adoption, while continuous innovations in process optimization and quality control further strengthen the segment’s market expansion prospects over the forecast period.

• By Application

On the basis of Application, the soft magnetic material market is segmented into Electromagnetic Induction, Electromagnetic Energy Conversion, Magnetic Shielding, Electromagnetic Sensing and Detection, Power Conditioning and Conversion, Signal Processing and Noise Suppression, Energy Storage and Transfer, Magnetic Recording and Data Storage, Magnetization & Demagnetization Systems, and Others. The Electromagnetic Induction segment is further categorized into Transformer Cores, Inductors and Chokes, Reactor Cores, Magnetic Amplifiers, and Ballast Cores, while the Power Conditioning and Conversion segment is further divided into SMPS Transformers, DC-DC Converter Cores, Inverter Inductors, and Power Filters and Line Reactors. The Electromagnetic Induction segment is expected to dominate the market due to its extensive use in transformers, inductors, reactors, and other power conversion devices that form the backbone of modern electrical infrastructure. The segment benefits from the rising demand for efficient energy transfer and power distribution systems, especially in renewable energy and smart grid applications.

The Electromagnetic Induction segment is projected to be the fastest-growing in the North America Soft Magnetic Materials Market, driven by rising demand for energy-efficient transformers, electric motors, and inductors across industrial and consumer applications. Advances in induction technology improve magnetic flux control, reduce energy losses, and enable miniaturization of electrical devices, making these materials increasingly essential in modern electronics and renewable energy systems. The growth of electric vehicles, smart grids, and high-performance industrial equipment in the North America region is accelerating adoption. Continuous research in material composition and processing techniques further supports the segment’s rapid expansion over the forecast period.

• By End user

On the basis of End User, the soft magnetic material market is segmented into Automotive Industry, Electrical & Power Utilities, Consumer Electronics, IT & Telecommunications, Industrial Manufacturing, Aerospace & Defense, Healthcare & Medical, Renewable Energy, and Construction Industry. The Automotive Industry segment is expected to dominate the market due to the rapid electrification of vehicles and growing adoption of electric and hybrid electric vehicles (EVs/HEVs). These materials play a crucial role in motors, sensors, actuators, transformers, and inductors, enhancing energy efficiency and magnetic performance. The automotive sector’s shift toward lightweight and energy-efficient components has further increased the demand for soft magnetic materials such as electrical steels and amorphous alloys.

The Automotive Industry segment is projected to be the fastest-growing in the North America Soft Magnetic Materials Market, driven by the rapid adoption of electric vehicles (EVs), hybrid vehicles, and advanced driver-assistance systems (ADAS). Increasing demand for lightweight, high-efficiency electric motors and powertrain components is boosting the use of soft magnetic materials to reduce energy losses and improve performance. Additionally, government initiatives promoting sustainable mobility and stricter emission regulations are accelerating the transition to EVs, fueling market growth. Continuous innovations in material engineering and magnetic design for automotive applications further enhance the segment’s expansion across the North America and global markets.

• By Distribution Channel

Distribution Channel, the market is segmented into Direct Sales and Indirect Sales. The Direct Sales segment is expected to dominate the market its ability to provide stronger customer relationships, personalized service, and tailored technical support.

Manufacturers can work closely with key industrial clients, including automotive, electronics, and power generation companies, to ensure material specifications, quality standards, and delivery schedules are met precisely. Direct sales also allow for better integration of after-sales services, faster response to market demands, and direct feedback for product improvements. Additionally, high-value and customized soft magnetic materials often require direct negotiation, making this channel the preferred and dominant mode of distribution.

North America Soft Magnetic Materials Market Regional Analysis

- U.S. is recognized as a significant market for Soft magnetic materials, driven by rapid industrialization, growing electric vehicle production, expansion of renewable energy projects, and large-scale investments in digital infrastructure. These developments make Soft magnetic materials essential for supporting the country’s industrial and technological growth strategies.

- The escalating adoption of smart grids, energy-efficient transformers, and high-capacity data centers across Canada & Canada, coupled with rising internet penetration and increasing industrial automation, is a major catalyst for the growing demand for Soft magnetic materials in the region.

- The steady expansion and modernization of manufacturing, automotive, and telecommunications infrastructure, especially in emerging Southeast Asian economies like Thailand, Malaysia, and Indonesia, and the need for reliable power distribution and electronic applications, are further accelerating the adoption of high-performance Soft magnetic materials across the North America

U.S. North America Soft Magnetic Materials Market Insight

The U.S. North America Soft Magnetic Materials Market is primarily driven by the country’s rapid industrialization, growing electric vehicle production, and large-scale adoption of renewable energy infrastructure, which collectively require high-performance Soft magnetic materials for efficient energy conversion and electronic applications. The surging demand for advanced transformers, inductors, and electric motors in automotive, industrial, and consumer electronics sectors is further fueling market growth. Additionally, increasing investments in domestic research and development are enhancing product innovation, enabling Chinese manufacturers to reduce reliance on imports while meeting the country’s expanding energy-efficient and digital infrastructure needs.

Canada North America Soft Magnetic Materials Market Insight

The Canada North America Soft Magnetic Materials Market is primarily driven by the country’s accelerating industrialization, expanding renewable energy projects, and the rapid growth of the automotive and electronics sectors, which require efficient and high-performance soft magnetic materials for transformers, motors, and inductors. The increasing adoption of electric vehicles, smart grids, and energy-efficient appliances is further boosting demand across the nation. Moreover, government initiatives supporting “Make in India” and domestic manufacturing are encouraging local production and innovation, reducing dependency on imports while addressing the rising need for reliable, high-capacity, and technologically advanced soft magnetic materials in India’s expanding industrial and digital infrastructure.

North America Soft Magnetic Materials Market Share

The Soft magnetic materials industry is primarily led by well-established companies, including:

- MMG India Pvt Ltd (India)

- AMES Group Sintering, SA (Spain)

- MATE CO., LTD (South Korea)

- Arnold Magnetic Technologies (USA)

- VOESTALPINE AG (Austria)

- FERROXCUBE INTERNATIONAL HOLDING B.V. (Netherlands)

- Miba AG (Austria)

- Advanced Technology & Materials Co., Ltd. (China)

- GKN POWDER METALLURGY (UK)

- Nippon Steel Corporation (Japan)

- POSCO HOLDINGS (South Korea)

- PROTERIAL, Ltd. (Japan)

- VACUUMSCHMELZE GmbH & Co. KG (Germany)

- DMEGC MAGNETICS CO., LTD. (China)

- Daido Steel Co., Ltd. (Japan)

- Kede Magnetics (China)

- THYSSENKRUPP AG (Germany)

- TDK CORPORATION (Japan)

- TATA STEEL LTD. (India)

- JFE STEEL CORPORATION (Japan)

- ARCELORMITTAL S.A. (Luxembourg)

Latest Developments in North America Soft Magnetic Materials Market

- In January 2023, Hitachi Metals announced a strategic expansion of its production facilities in Canada to target growing demand for soft magnetic materials in EVs and renewable energy applications. This move strengthens its local manufacturing footprint in APAC, improving supply‑chain responsiveness and catering to the regional EV/renewables growth. The expansion is indicative of global players recognising APAC as a key growth market for soft magnetic materials.

- In June 2023, Arnold Magnetic Technologies completed the acquisition of a niche manufacturing company specialising in high‑performance soft magnetic materials for automotive applications. The acquisition bolsters Arnold’s automotive segment offering globally, which in turn has impact in APAC markets given the region’s strong EV and automotive growth. It signals that consolidation and capability expansion are happening and will affect the APAC soft magnetic materials supply chain.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 BRAND COMPARATIVE ANALYSIS OF NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET

4.1.2 PRODUCT VS BRAND OVERVIEW

4.1.3 PRODUCT OVERVIEW

4.1.4 BRAND OVERVIEW

4.2 CLIMATE CHANGE SCENARIO – SOFT MAGNETIC MATERIAL MARKET

4.2.1 ENVIRONMENTAL CONCERNS

4.2.2 INDUSTRY RESPONSE

4.2.3 GOVERNMENT’S ROLE

4.2.4 ANALYST RECOMMENDATIONS

4.2.5 CONCLUSION

4.3 CONSUMER BUYING BEHAVIOUR – NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET

4.3.1 WHAT IS CONSUMER BEHAVIOUR?

4.3.2 PROBLEM RECOGNITION AND AWARENESS

4.3.3 INFORMATION SEARCH

4.3.4 EVALUATION OF ALTERNATIVES

4.3.5 PURCHASE DECISION

4.3.6 POST-PURCHASE BEHAVIOUR

4.3.7 DEMOGRAPHIC INSIGHTS

4.3.8 CONCLUSION

4.4 INDUSTRY ECOSYSTEM ANALYSIS

4.4.1 PROMINENT COMPANIES

4.4.2 SMALL & MEDIUM SIZE COMPANIES

4.4.3 END USERS

4.4.4 CONCLUSION

4.5 PRICING SURVEY

4.5.1 MAXWELL COMPANY OVERVIEW

4.5.2 PRODUCTS AND TECHNOLOGIES

4.5.3 STRATEGIC DEVELOPMENTS

4.6 IWATANI CORPORATION

4.6.1 COMPANY OVERVIEW

4.6.2 PRODUCTS AND TECHNOLOGIES

4.6.3 STRATEGIC DEVELOPMENTS

4.7 MATERIAL

4.7.1 HIGH-SILICON ELECTROMAGNETIC STEEL (FE-6.5 SI)

4.7.2 Ε-IRON OXIDE (Ε-FE₂O₃)

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 INTRODUCTION

4.8.2 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.8.3 JOINT VENTURES

4.8.4 MERGERS AND ACQUISITIONS

4.8.5 LICENSING AND PARTNERSHIPS

4.8.6 TECHNOLOGY COLLABORATIONS

4.8.7 STRATEGIC DIVESTMENTS

4.8.8 NUMBER OF PRODUCTS IN DEVELOPMENT

4.8.9 STAGE OF DEVELOPMENT

4.8.10 TIMELINES AND MILESTONES

4.8.11 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.12 RISK ASSESSMENT AND MITIGATION

4.9 PATENT ANALYSIS

4.9.1 PATENT QUALITY AND STRENGTH

4.9.2 REGION PATENT LANDSCAPE

4.9.3 IP STRATEGY AND MANAGEMENT

4.9.4 PATENT FAMILIES

4.9.5 LICENSING & COLLABORATION

4.1 RAW MATERIAL COVERAGE

4.10.1 IRON AND LOW-CARBON STEEL

4.10.2 SILICON ALLOYS (ELECTRICAL STEEL)

4.10.3 NICKEL-IRON ALLOYS

4.10.4 IRON-COBALT ALLOYS

4.10.5 AMORPHOUS AND NANOCRYSTALLINE ALLOYS

4.10.6 FERRITES AND SOFT MAGNETIC COMPOSITES

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11.4 CONCLUSION

4.12 TECHNOLOGICAL ADVANCEMENTS

4.12.1 ADVANCEMENTS IN MATERIAL COMPOSITION AND ALLOY DESIGN

4.12.2 IMPROVEMENTS IN MANUFACTURING AND PROCESSING TECHNOLOGIES

4.12.3 DEVELOPMENT OF HIGH-FREQUENCY AND ENERGY-EFFICIENT MATERIALS

4.12.4 SURFACE ENGINEERING AND COATING INNOVATIONS

4.12.5 INTEGRATION OF DIGITAL AND SIMULATION TECHNOLOGIES

4.12.6 CONCLUSION

4.13 VALUE CHAIN ANALYSIS

4.13.1 OVERVIEW

4.13.2 RAW MATERIAL SUPPLY

4.13.3 COMPONENT MANUFACTURING AND PROCESSING

4.13.4 EQUIPMENT AND TECHNOLOGY PROVIDERS

4.13.5 DISTRIBUTION AND LOGISTICS

4.13.6 END-USERS (BRANDS AND INDUSTRY SECTORS)

4.13.7 CONCLUSION

4.14 COMPANY EVALUATION QUADRANT

4.15 NUMBER OF DEALS BY COMPANIES

4.16 NUMBER OF DEALS, BY TYPE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND IN PROMOTIONAL PRODUCTS AND ADVERTISING MATERIALS

5.1.2 GROWING FOCUS ON RENEWABLE ENERGY INTEGRATION

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN MATERIAL SCIENCE

5.1.4 RAPID EXPANSION OF CONSUMER ELECTRONICS AND INDUSTRIAL AUTOMATION

5.2 RESTRAINTS

5.2.1 VOLATILITY IN RAW MATERIAL PRICES

5.2.2 COMPLEX MANUFACTURING AND PROCESSING REQUIREMENTS

5.3 OPPORTUNITIES

5.3.1 SURGING DEMAND FOR HIGH-EFFICIENCY ELECTRIC MOTORS

5.3.2 EXPANSION OF SMART GRIDS AND ENERGY STORAGE SYSTEMS

5.3.3 DEVELOPMENT OF NEXT-GENERATION MAGNETIC ALLOYS

5.4 CHALLENGES

5.4.1 COMPETITION FROM SUBSTITUTE MATERIALS

5.4.2 SUPPLY CHAIN VULNERABILITIES AND RAW MATERIAL VOLATILITY

6 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SHEETS & STRIPS

6.3 CORES & CORE TYPES

6.4 POWDERS & GRANULES

6.5 RIBBONS & FOILS

6.6 ASSEMBLED COMPONENTS

6.7 INGOTS

6.8 OTHERS

7 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 SOFT FERRITES

7.3 ELECTRICAL STEELS (FE-SI)

7.4 POWDERED IRON & METAL POWDERS

7.5 AMORPHOUS & NANOCRYSTALLINE ALLOYS

7.6 SOFT MAGNETIC ALLOYS

7.7 PERMALLOY

7.8 PERMENDUR

7.9 CIP — CARBONYL IRON POWDER (CIP)

7.1 HIGH-PURITY IRON POWDER

7.11 SOLENOID-QUALITY STAINLESS STEEL POWDER

7.12 SENDUST POWDER (FE-SI-AL)

7.13 IRON-SILICON POWDER

7.14 THIN FILMS & MAGNETIC COATINGS

7.15 OTHERS

8 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MANUFACTURING PROCESS

8.1 OVERVIEW

8.2 COLD ROLLING & ANNEALING

8.3 MELT SPINNING

8.4 POWDER METALLURGY

8.5 OTHERS

9 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ELECTROMAGNETIC INDUCTION

9.3 ELECTROMAGNETIC ENERGY CONVERSION

9.4 POWER CONDITIONING AND CONVERSION

9.5 ELECTROMAGNETIC SENSING & DETECTION

9.6 MAGNETIC SHIELDING

9.7 MAGNETIZATION & DEMAGNETIZATION SYSTEMS

9.8 ENERGY STORAGE & TRANSFER

9.9 MAGNETIC RECORDING & DATA STORAGE

9.1 SIGNAL PROCESSING & NOISE SUPPRESSION

9.11 OTHERS

10 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY END USER

10.1 OVERVIEW

10.2 AUTOMOTIVE INDUSTRY

10.3 CORES & CORE TYPES

10.4 RIBBONS & FOILS

10.5 ELECTRICAL & POWER UTILITIES

10.6 CORES & CORE TYPES

10.7 RIBBONS & FOILS

10.8 CONSUMER ELECTRONICS

10.9 CORES & CORE TYPES

10.1 RIBBONS & FOILS

10.11 IT AND TELECOMMUNICATION

10.12 CORES & CORE TYPES

10.13 RIBBONS & FOILS

10.14 INDUSTRIAL MANUFACTURING

10.15 CORES & CORE TYPES

10.16 RIBBONS & FOILS

10.17 AEROSPACE & DEFENCE

10.18 CORES & CORE TYPES

10.19 RIBBONS & FOILS

10.2 CORES & CORE TYPES

10.21 RIBBONS & FOILS

10.22 RENEWABLE ENERGY

10.23 CORES & CORE TYPES

10.24 RIBBONS & FOILS

10.25 CONSTRUCTION INDUSTRY

10.26 CORES & CORE TYPES

10.27 RIBBONS & FOILS

10.28 OTHERS

10.29 CORES & CORE TYPES

10.3 RIBBONS & FOILS

11 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 IN-DIRECT

12 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ARCELORMITTAL

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JFE STEEL CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 TATA STEEL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 TDK CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 THYSSENKRUPP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AMES

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ARNOLD MAGNETIC TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DAIDO STEEL CO., LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 DMEGC MAGNETICS CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 FERROXCUBE.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 GKN POWDER METALLURGY

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 KEDE MAGNETICS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MATE CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MIBA AG

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 MMG INDIA PVT. LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 NIPPON STEEL CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 POSCO HOLDINGS (SUBSIDIARY OF POSCO MOBILITY SOLUTION)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 PROTERIAL, LTD

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 VACUUMSCHMELZE GMBH & CO. KG

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 VOESTALPINE AG

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 3 NORTH AMERICA SHEETS & STRIPS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA POWDERS & GRANULES IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA ASSEMBLED COMPONENTS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA INGOTS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 14 NORTH AMERICA SOFT FERRITES IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA SOFT FERRITES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTRICAL STEELS (FE-SI) IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRICAL STEELS (FE-SI) IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA POWDERED IRON & METAL POWDERS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA AMORPHOUS & NANOCRYSTALLINE ALLOYS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA SOFT MAGNETIC ALLOYS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA PERMALLOY IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA PERMENDUR IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA CIP — CARBONYL IRON POWDER (CIP) IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA CIP — CARBONYL IRON POWDER (CIP) IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA HIGH-PURITY IRON POWDER IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA SOLENOID-QUALITY STAINLESS STEEL POWDER IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA SENDUST POWDER (FE-SI-AL) IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA IRON-SILICON POWDER IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA THIN FILMS & MAGNETIC COATINGS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA COLD ROLLING & ANNEALING IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA MELT SPINNING IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA POWDER METALLURGY IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA ELECTROMAGNETIC INDUCTION IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA ELECTROMAGNETIC INDUCTION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA ELECTROMAGNETIC ENERGY CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA POWER CONDITIONING AND CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA POWER CONDITIONING AND CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA ELECTROMAGNETIC SENSING & DETECTION IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA MAGNETIC SHIELDING IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA MAGNETIZATION & DEMAGNETIZATION SYSTEMS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA ENERGY STORAGE & TRANSFER IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA MAGNETIC RECORDING & DATA STORAGE IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA SIGNAL PROCESSING & NOISE SUPPRESSION IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 HEALTHCARE & MEDICAL

TABLE 81 NORTH AMERICA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA DIRECT IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA INDIRECT IN SOFT MAGNETIC MATERIAL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 105 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 106 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 107 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 111 NORTH AMERICA SOFT FERRITES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA ELECTRICAL STEELS (FE-SI) IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA ELECTROMAGNETIC INDUCTION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA POWER CONDITIONING AND CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 148 NORTH AMERICA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 150 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 152 NORTH AMERICA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 153 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 156 NORTH AMERICA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 157 NORTH AMERICA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 NORTH AMERICA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 160 U.S. SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 161 U.S. SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 162 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 U.S. SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION)

TABLE 165 U.S. SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 166 U.S. SOFT FERRITES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 167 U.S. ELECTRICAL STEELS (FE-SI) IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 168 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 169 U.S. SOFT MAGNETIC MATERIAL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 170 U.S. SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 171 U.S. ELECTROMAGNETIC INDUCTION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 172 U.S. POWER CONDITIONING AND CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 U.S. SOFT MAGNETIC MATERIAL MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 174 U.S. AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 175 U.S. AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 176 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 U.S. ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 179 U.S. ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 180 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 182 U.S. CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 183 U.S. CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 184 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 U.S. IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 187 U.S. IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 188 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 U.S. INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 191 U.S. INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 192 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 U.S. AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 195 U.S. AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 196 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 197 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 U.S. HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 U.S. HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 200 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 U.S. RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 203 U.S. RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 204 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 205 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 U.S. CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 207 U.S. CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 208 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 209 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 210 U.S. OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 211 U.S. OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 212 U.S. CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 213 U.S. RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 214 U.S. SOFT MAGNETIC MATERIAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 215 CANADA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 216 CANADA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 217 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 219 CANADA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION)

TABLE 220 CANADA SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 221 CANADA SOFT FERRITES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 222 CANADA ELECTRICAL STEELS (FE-SI) IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 223 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 CANADA SOFT MAGNETIC MATERIAL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 225 CANADA SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 226 CANADA ELECTROMAGNETIC INDUCTION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 227 CANADA POWER CONDITIONING AND CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 CANADA SOFT MAGNETIC MATERIAL MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 229 CANADA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 230 CANADA AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 231 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 CANADA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 234 CANADA ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 235 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 236 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 CANADA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 238 CANADA CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 239 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 CANADA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 242 CANADA IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 243 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 CANADA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 246 CANADA INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 247 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 248 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 249 CANADA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 250 CANADA AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 251 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 CANADA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 254 CANADA HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 255 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 CANADA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 258 CANADA RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 259 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 260 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 CANADA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 CANADA CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 263 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 264 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 265 CANADA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 266 CANADA OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 267 CANADA CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 CANADA RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 CANADA SOFT MAGNETIC MATERIAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 270 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 271 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 272 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION)

TABLE 275 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 276 MEXICO SOFT FERRITES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 MEXICO ELECTRICAL STEELS (FE-SI) IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 280 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 281 MEXICO ELECTROMAGNETIC INDUCTION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 MEXICO POWER CONDITIONING AND CONVERSION IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 284 MEXICO AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 285 MEXICO AUTOMOTIVE INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 286 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 287 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 288 MEXICO ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 289 MEXICO ELECTRICAL & POWER UTILITIES IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 290 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 291 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 292 MEXICO CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 MEXICO CONSUMER ELECTRONICS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 294 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 295 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 296 MEXICO IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 297 MEXICO IT AND TELECOMMUNICATION IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 298 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 300 MEXICO INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 301 MEXICO INDUSTRIAL MANUFACTURING IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 302 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 303 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 MEXICO AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 305 MEXICO AEROSPACE & DEFENCE IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 306 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 307 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 308 MEXICO HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 309 MEXICO HEALTHCARE & MEDICAL IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 310 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 MEXICO RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 313 MEXICO RENEWABLE ENERGY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 314 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 MEXICO CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 317 MEXICO CONSTRUCTION INDUSTRY IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 318 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 320 MEXICO OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 MEXICO OTHERS IN SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 322 MEXICO CORES & CORE TYPES IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 MEXICO RIBBONS & FOILS IN SOFT MAGNETIC MATERIAL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 MEXICO SOFT MAGNETIC MATERIAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET

FIGURE 2 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 SEVEN SEGMENTS COMPRISE THE NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET, BY PRODUCT (2024)

FIGURE 14 INCREASED USE IN NEUTRON DETECTION SYSTEMS IS EXPECTED TO DRIVE THE NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE SHEETS & STRIPS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET IN 2025 AND 2032

FIGURE 16 PATENT ANALYSIS BY IPC CODE

FIGURE 17 PATENT ANALYSIS BY COUNTRIES

FIGURE 18 PATENT ANALYSIS BY YEAR

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET

FIGURE 20 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: BY PRODUCT TYPE, 2024

FIGURE 21 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: BY MATERIAL TYPE, 2024

FIGURE 22 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: BY MANUFACTURING PROCESS, 2024

FIGURE 23 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: BY APPLICATION, 2024

FIGURE 24 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: BY END USER, 2024

FIGURE 25 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 26 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET

FIGURE 27 NORTH AMERICA SOFT MAGNETIC MATERIAL MARKET: COMPANY SHARE 2024 (%)

North America Soft Magnetic Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Soft Magnetic Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Soft Magnetic Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.