North America Stable Isotope Labeled Compound Market

Market Size in USD Billion

CAGR :

%

USD

321.53 Billion

USD

394.86 Billion

2024

2032

USD

321.53 Billion

USD

394.86 Billion

2024

2032

| 2025 –2032 | |

| USD 321.53 Billion | |

| USD 394.86 Billion | |

|

|

|

|

Stable isotope labeled compound Market Size

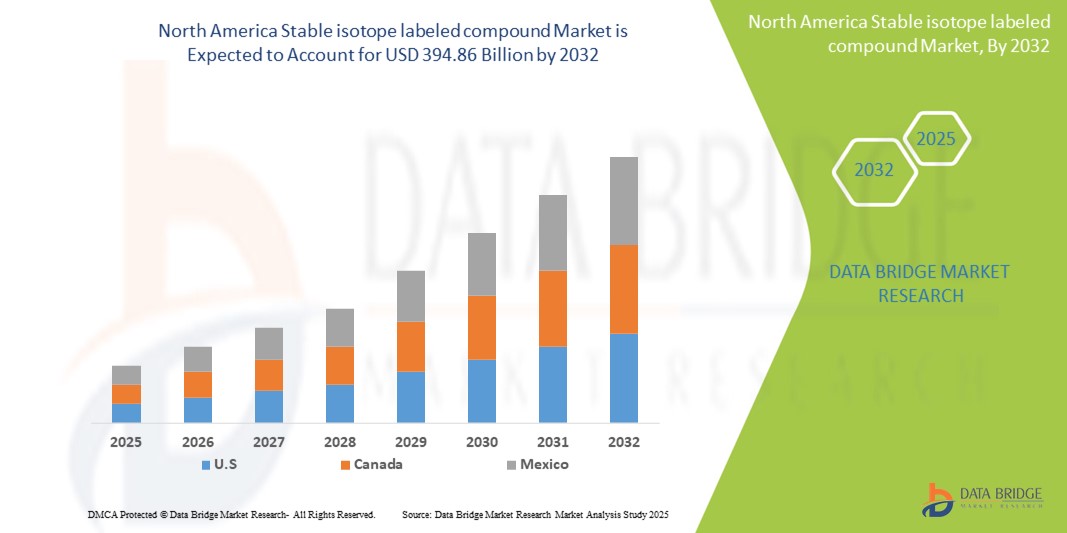

- The North America Stable isotope labeled compound market size was valued at USD 321.53 billion in 2024 and is expected to reach USD 394.86 billion by 2032, at a CAGR of 3.4% during the forecast period

- The market growth is largely fueled by rising consumer demand for plant-based protein, increasing health consciousness, environmental sustainability concerns, and the expanding vegan and flexitarian population. Additionally, advancements in food processing technologies and the growing adoption of meat alternatives by food manufacturers further accelerate the textured soy protein market expansion.

- Furthermore, supportive government initiatives promoting sustainable agriculture and plant-based diets, along with increased investment in research and development, are driving innovation in textured soy protein products. Strategic partnerships, expanding distribution channels, and consumer awareness about the environmental impact of animal farming are also contributing significantly to the market’s robust growth trajectory.

Stable isotope labeled compound Market Analysis

- The stable isotope labeled compound market is driven by rising demand in pharmaceutical research, clinical diagnostics, and metabolic studies, supported by advancements in mass spectrometry and government funding for life sciences and drug development.

- Key trends include increased adoption of 13C and 15N labeled compounds, growing use in proteomics and genomics, and strategic collaborations between manufacturers and research institutions to expand product portfolios and meet complex analytical demands.

- U.S. dominates the stable isotope labeled compound market with a 30% revenue share in 2025, driven by rapid pharmaceutical and biotech industry growth, strong government R&D investment, expanding clinical research, and increasing adoption of advanced diagnostic and analytical technologies.

- Additionally, U.S. benefits from a robust manufacturing infrastructure, cost-effective production capabilities, and rising collaborations between research institutions and global companies. These factors enhance its competitiveness and support continued leadership in the North America stable isotope labeled compound market.

- The Deuterium segment is expected to dominate the Stable isotope labeled compound market with a significant share of around 31.2% in 2025, driven by its widespread use in pharmaceutical research for enhancing drug stability, reducing toxicity, and improving efficacy. Its critical role in NMR spectroscopy and analytical applications further supports its growth.

Report Scope and Stable isotope labeled compound Market Segmentation

|

Attributes |

Stable isotope labeled compound Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stable isotope labeled compound Market Trends

“Increasing use in drug development and diagnostic research applications”

- Stable isotope labeled compounds are increasingly used in drug development and diagnostics due to their role in enhancing drug metabolism studies, improving diagnostic accuracy, and supporting personalized medicine. Rising pharmaceutical R&D investment and favorable regulatory support further drive their adoption in clinical trials, metabolic research, and advanced analytical technologies.

- Stable isotope labeled compounds play a crucial role in tracing metabolic pathways, allowing researchers to understand disease mechanisms and drug interactions more precisely. This aids in identifying biomarkers and developing targeted therapies, boosting their demand across pharmaceutical and biomedical research sectors globally.

- These compounds are increasingly used in environmental studies to track pollutant sources, study ecosystem dynamics, and monitor chemical transformations. Their precision and reliability help in advancing sustainable practices, making them essential tools in environmental research and regulatory compliance.

- In food science, stable isotope labeling helps authenticate food origins, detect adulteration, and study nutrient metabolism. The growing focus on food safety and quality assurance fuels the demand for these compounds in agricultural research and food industry applications worldwide.

- Advancements in mass spectrometry, NMR spectroscopy, and labeling techniques are expanding the applications of stable isotope labeled compounds. Improved synthesis methods and reduced costs make these compounds more accessible, driving their adoption in diverse research fields and industrial processes.

Stable isotope labeled compound Market Dynamics

Driver

“Increasing pharmaceutical R&D investments”

- Increasing pharmaceutical R&D investments enable more comprehensive drug discovery and development processes. Stable isotope labeled compounds are critical in tracing drug metabolism, allowing researchers to better understand pharmacokinetics and optimize therapeutic efficacy.

- Stable isotopes improve the precision of pharmacokinetic and metabolic studies by serving as reliable tracers, helping pharmaceutical companies reduce errors in drug absorption, distribution, metabolism, and excretion analysis.

- The surge in R&D spending supports the exploration of innovative treatments like biologics and personalized medicines, which require stable isotope labeled compounds for detailed study and validation during clinical trials.

- Increased R&D efforts facilitate the discovery of biomarkers using isotope-labeled compounds, enabling personalized medicine approaches and targeted therapies that improve patient outcomes and reduce adverse effects.

- Greater investment allows companies to meet stringent regulatory requirements by using stable isotope techniques for thorough drug safety and efficacy testing, ensuring faster approvals and market access for new pharmaceuticals.

Restraint/Challenge

“High production costs increase final product prices, limiting affordability”

- Stable isotope labeled compounds require costly enriched isotopes as raw materials, significantly raising production expenses. This inflates the final product price, making it less affordable for smaller research labs and companies with limited budgets.

- The synthesis of stable isotope labeled compounds involves intricate, time-consuming procedures and advanced technologies. These complexities increase operational costs, which are reflected in higher product prices, restricting wider market accessibility.

- Producing these compounds demands high-precision instruments and skilled personnel. The investment in specialized equipment and training adds to production costs, resulting in elevated prices that may limit customer adoption, especially in emerging markets.

- Due to niche demand and technical challenges, manufacturers often operate at smaller scales, missing out on economies of scale. This lack of mass production keeps unit costs high, impacting product affordability and market expansion.

- High production costs create financial barriers for new entrants, limiting competition and innovation. This concentration among a few large players may slow price reductions, keeping stable isotope labeled compounds expensive and less accessible for broader applications.

Stable isotope labeled compound Market Scope

- By Type

On the basis of type, the Stable isotope labeled compound market is segmented into Deuterium, Carbon 12 & 13, Nitrogen 15, Oxygen 16 & 18, Lithium 6 & 7, Sulphur 34, Chlorine 35 & 37. The Deuterium segment dominates the largest market revenue share of approximately 30% in 2025, driven by rising demand in nuclear fusion research, pharmaceutical development, and advanced spectroscopy applications, supported by increased investments in clean energy and scientific innovation.

The Deuterium segment is anticipated to witness the fastest growth rate of around 6.5% CAGR from 2025 to 2032, fueled by expanding applications in drug discovery, nuclear fusion, and environmental tracing..

- By Application

On the basis of application, the Stable isotope labeled compound market is segmented in to Research, Clinical Diagnostics, Industrial, . The Research segment drives the stable isotope labeled compound market due to increasing investments in life sciences, rising demand for advanced drug development, expanding use in metabolic studies, and growing academic and pharmaceutical research focused on disease mechanisms and biomarker discovery.

The Research segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising government and private funding in R&D, growing focus on personalized medicine, and increasing adoption of stable isotope-labeled compounds in biomedical and pharmaceutical research.

- By End-User

On the basis of end-user, the Stable isotope labeled compound market is segmented in Academic & Research, Institution, Hospital & Diagnostic Centers, Pharmaceutical & Biopharmaceutical Companies. The Academic & Research segment drives the stable isotope labeled compound market due to increasing use in biomedical research, rising demand for metabolic and proteomic studies, growing academic collaborations, and enhanced funding for scientific innovation in universities and research institutions globally.

The Academic & Research segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing government and institutional funding, growing emphasis on advanced research in life sciences and chemistry, expanding applications in proteomics and metabolomics, and rising collaborations between academic institutions and industry for scientific innovation.

Stable isotope labeled compound Market Regional Analysis

- U.S. dominates the stable isotope labeled compound market with a 30% revenue share in 2025, driven by rapid pharmaceutical and biotech industry growth, strong government R&D investment, expanding clinical research, and increasing adoption of advanced diagnostic and analytical technologies.

- The market's growth in U.S. is further driven by the increasing adoption of advanced diagnostic and analytical technologies, along with a surge in clinical research activities aimed at drug discovery, personalized medicine, and disease pathway analysis across academic and commercial institutions.

- U.S.’s dominance is also attributed to its growing infrastructure for isotope production, rising collaborations with global research organizations, and supportive regulatory frameworks that encourage innovation and commercialization of stable isotope labeled compounds across pharmaceutical, environmental, and biomedical research applications.

Canada Stable isotope labeled compound Market Insight

The Canada stable isotope labeled compound market captured the largest revenue share of approximately 22% within North America (APAC) in 2025, driven by strong pharmaceutical R&D, advanced healthcare infrastructure, high adoption of precision medicine, and continuous innovation in analytical and diagnostic technologies.

Mexico Stable isotope labeled compound Market Insight

The Mexico market is projected to expand at a substantial CAGR due to rapid growth in pharmaceutical manufacturing, increasing clinical research activities, government initiatives supporting biotech innovation, rising demand for cost-effective labeled compounds, and expanding adoption in drug development and diagnostics.

Stable isotope labeled compound Market Share

The Stable isotope labeled compound industry is primarily led by well-established companies, including:

- Cambridge Isotope Laboratories, Inc. (United States)

- Merck KGaA (Germany)

- PerkinElmer Inc. (United States)

- JSC Isotope (Russia)

- Medical Isotopes, Inc. (United States)

- Omicron Biochemicals, Inc. (United States)

- Trace Sciences International (Canada)

- Alsachim (France)

- Taiyo Nippon Sanso Corporation (Japan)

- IsoSciences, LLC (United States)

- LGC Standards / C/D/N Isotopes Inc. (Canada)

- Rotem Industries Ltd. (Israel)

- Huayi Isotopes Co. (U.S.)

- CortecNet (France)

- BOC Sciences (United States)

Latest Developments in North America Stable isotope labeled compound Market

- In January 2024, Merck KGaA entered into a five-year agreement with India's Heavy Water Board (HWB) to locally manufacture deuterated compounds. This collaboration aims to enhance the availability of stable isotope-labeled compounds in India, supporting the growing pharmaceutical and diagnostic sectors.

- In March 2024, Cambridge Isotope Laboratories (CIL) announced the relocation and expansion of its headquarters to Tewksbury, Massachusetts, . This move is designed to enhance the company's operational capabilities and support its growth in the stable isotope-labeled compounds market.

- In January 2022, Merck KGaA announced the expansion of its Stable Isotope Center of Excellence in Miamisburg, Ohio. The new infrastructure increases production capacity of GMP-grade urea-13C Active Pharmaceutical Ingredients, supporting the demand for stable isotope-labeled compounds in clinical diagnostics

- In September 2022, Cambridge Isotope Laboratories (CIL) announced a partnership with ISO topic Solutions to release stable isotope-labeled and unlabeled Crude Lipid Yeast Extracts. These products are designed for use in mass spectrometry lipidomics research and development

- In May 2024, Shimadzu Corporation introduced a new line of stable isotope-labeled compounds designed for enhanced accuracy in mass spectrometry and pharmaceutical research. This launch strengthens Shimadzu’s position in North America, supporting growing demand for precise analytical tools in life sciences and clinical diagnostics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Stable Isotope Labeled Compound Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Stable Isotope Labeled Compound Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Stable Isotope Labeled Compound Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.