North America Stroke Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

2.88 Billion

2025

2033

USD

1.73 Billion

USD

2.88 Billion

2025

2033

| 2026 –2033 | |

| USD 1.73 Billion | |

| USD 2.88 Billion | |

|

|

|

|

North America Stroke Diagnostics Market Size

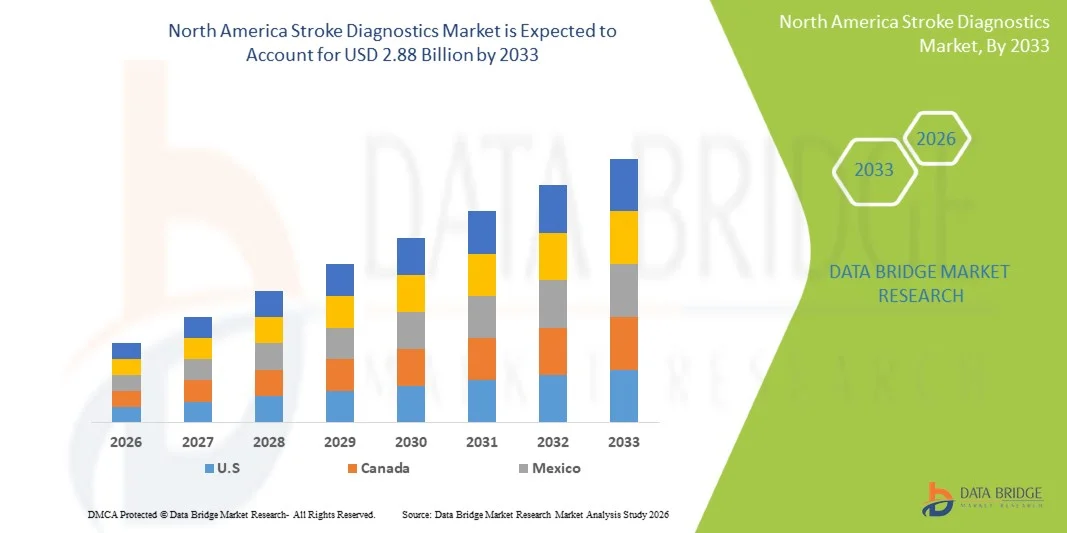

- The North America stroke diagnostics market size was valued at USD 1.73 billion in 2025 and is expected to reach USD 2.88 billion by 2033, at a CAGR of 6.6% during the forecast period

- The market growth is largely fueled by the rising prevalence of stroke, widespread adoption of advanced imaging and diagnostic technologies and increasing healthcare expenditure across both the U.S. and Canada, which together strengthen early detection and management of stroke cases

- Furthermore, heightened awareness of stroke symptoms, growing geriatric populations, favorable reimbursement policies, and strong healthcare infrastructure are driving demand for accurate, rapid, and non‑invasive diagnostic solutions—positioning stroke diagnostics as a critical component of emergency care pathways and long‑term patient monitoring in the region

North America Stroke Diagnostics Market Analysis

- Stroke diagnostics, encompassing imaging and laboratory tests such as CT, MRI, transcranial Doppler, and blood biomarkers, are increasingly critical components of emergency care and long-term patient management in both hospitals and outpatient settings due to their ability to enable rapid detection, accurate assessment, and improved treatment outcomes

- The escalating demand for stroke diagnostics is primarily fueled by the rising prevalence of stroke, growing geriatric populations, increasing healthcare expenditure, and the adoption of advanced diagnostic technologies that allow faster, non-invasive, and precise evaluation of stroke incidents

- The United States dominated the North America stroke diagnostics market with the largest revenue share of 80.9% in 2025, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading diagnostic technology providers, with substantial growth in AI-assisted imaging, portable CT scanners, and rapid biomarker testing driving adoption in hospitals and emergency care centers

- Canada is expected to witness significant growth during the forecast period due to increasing government investment in healthcare infrastructure, rising awareness of stroke prevention and early diagnosis, and expansion of hospital networks equipped with modern imaging and diagnostic technologies

- Computed Tomography (CT Scan) segment dominated the stroke diagnostics market with a market share of 45.9% in 2025, driven by its critical role in rapid stroke identification, treatment planning, and integration with AI-assisted imaging solutions that enable faster, accurate, and life-saving decisions in acute stroke care

Report Scope and North America Stroke Diagnostics Market Segmentation

|

Attributes |

North America Stroke Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Stroke Diagnostics Market Trends

“Advancements in AI-Enabled Imaging and Telemedicine Integration”

- A significant and accelerating trend in the North America stroke diagnostics market is the integration of artificial intelligence (AI) with imaging modalities such as CT, MRI, and transcranial Doppler, as well as telemedicine platforms, enhancing diagnostic accuracy and speed

- For instance, AI-powered CT imaging solutions can automatically detect ischemic regions and potential hemorrhages, providing real-time alerts to clinicians, while cloud-based platforms enable remote consultation and faster triage in stroke centers

- AI integration enables predictive analytics, allowing systems to assess patient risk factors, prioritize critical cases, and suggest optimal diagnostic pathways, while continuous learning improves detection accuracy over time

- The combination of AI and telemedicine facilitates centralized monitoring of stroke patients, enabling neurologists to remotely review scans, track progression, and coordinate care across hospitals and emergency units

- This trend toward intelligent, interconnected, and remote-capable stroke diagnostics is reshaping hospital workflows and patient management protocols. Consequently, companies such as Viz.ai and RapidAI are developing AI-enabled stroke imaging solutions with automated alerts, CT perfusion analysis, and teleconsultation capabilities

- The demand for stroke diagnostics systems that integrate AI and telemedicine is growing rapidly across both hospitals and outpatient care centers, as healthcare providers prioritize speed, accuracy, and coordinated patient care

- Portable and point-of-care imaging solutions, such as mobile CT scanners, are gaining traction, enabling rapid on-site diagnostics in ambulances and smaller clinics, particularly in rural or underserved areas

North America Stroke Diagnostics Market Dynamics

Driver

“Rising Stroke Incidence and Need for Rapid Diagnosis”

- The increasing prevalence of stroke, particularly among aging populations and individuals with lifestyle risk factors, is a significant driver for the growing demand for advanced stroke diagnostics

- For instance, in March 2025, GE Healthcare launched an AI-assisted stroke imaging platform aimed at improving detection time in emergency rooms, reflecting industry efforts to enhance rapid stroke diagnosis

- As awareness of stroke symptoms and the importance of early intervention rises, hospitals are adopting imaging-based diagnostics and biomarker tests that allow clinicians to initiate timely treatment and reduce long-term disability

- Furthermore, the growing investment in hospital infrastructure, expansion of stroke centers, and the rising adoption of telemedicine solutions are making advanced stroke diagnostics increasingly accessible across the U.S. and Canada

- The urgency for rapid, accurate diagnosis, combined with AI-assisted imaging, remote consultation, and integration with electronic health records, is propelling the adoption of stroke diagnostics across healthcare facilities

- Increasing government initiatives and reimbursement programs for stroke care are encouraging hospitals and clinics to adopt state-of-the-art diagnostic solutions

- Rising collaborations between diagnostic technology companies and healthcare providers to develop AI-enabled stroke detection tools are further accelerating market adoption

Restraint/Challenge

“High Cost and Regulatory Hurdles”

- The relatively high cost of advanced imaging modalities such as CT and MRI scanners, combined with AI-enabled diagnostic software, poses a challenge to widespread adoption, particularly in smaller clinics or rural hospitals

- For instance, some healthcare providers may delay upgrading to AI-assisted stroke diagnostics due to budget constraints, despite clinical benefits in accuracy and speed

- Additionally, stringent regulatory requirements, including FDA approvals for AI-enabled diagnostic tools, can slow the introduction of new solutions to the market, limiting availability in certain regions

- While prices are gradually decreasing and AI platforms are becoming more scalable, the upfront investment for integrated imaging systems, software licenses, and training remains a barrier for many healthcare providers

- Overcoming these challenges through cost-effective solutions, streamlined regulatory approvals, and clinician education on AI-assisted stroke diagnostics will be crucial for sustaining market growth and improving patient outcomes

- Concerns around data privacy and cybersecurity for patient imaging and health records may slow adoption, as hospitals need to ensure secure handling of sensitive medical data

- Limited skilled personnel to operate advanced AI-enabled stroke diagnostics systems and interpret results accurately can also restrict adoption, particularly in smaller hospitals or rural healthcare centers

North America Stroke Diagnostics Market Scope

The market is segmented on the basis of severity, type, application, end user, distribution channel, and stage.

- By Severity

On the basis of severity, the North America stroke diagnostics market is segmented into mild, moderate, and severe stroke. The moderate stroke segment dominated the market with the largest revenue share in 2025, driven by the high prevalence of patients presenting with moderate stroke symptoms requiring immediate imaging and intervention. Moderate stroke cases often demand comprehensive diagnostics to prevent progression, creating steady demand for CT, MRI, and biomarker-based testing. Hospitals and clinics prioritize accurate assessment in these patients to guide thrombolytic or endovascular therapy, fueling sustained market adoption. Additionally, moderate stroke diagnosis contributes significantly to reducing long-term disability, increasing the need for rapid and reliable diagnostic tools. Advanced AI-assisted imaging systems are frequently utilized for moderate stroke cases to ensure timely decision-making. The segment also benefits from reimbursement coverage for diagnostic procedures, further supporting its dominance.

The mild stroke segment is expected to witness the fastest growth during 2026–2033, fueled by early detection initiatives and growing awareness among patients and clinicians about transient ischemic attacks (TIAs) and minor strokes. Mild stroke diagnostics increasingly rely on non-invasive imaging, portable CT scanners, and telemedicine-based assessments, enabling rapid intervention and follow-up care. Early diagnosis in mild cases helps prevent progression to severe stroke, driving hospital adoption of portable and AI-enabled solutions. Additionally, wearable and home monitoring devices for early symptom detection are gaining popularity, contributing to segment growth. The increasing focus on outpatient stroke clinics and home healthcare monitoring is further accelerating adoption in mild stroke cases.

- By Type

On the basis of type, the North America stroke diagnostics market is segmented into Computed Tomography (CT Scan), Computed Tomography Angiography (CTA), Magnetic Resonance Imaging (MRI), Magnetic Resonance Angiography (MRA), Transcranial Doppler Ultrasound, Video Head Impulse Test (VHIT), and Others. The Computed Tomography (CT Scan) segment dominated the market with the largest revenue share of 45.9% in 2025, driven by its widespread availability, rapid imaging capability, and crucial role in early ischemic and hemorrhagic stroke detection. CT scans are considered the first-line imaging modality in emergency departments, allowing for immediate treatment planning. AI-assisted CT solutions enhance detection accuracy and speed, making CT scans highly preferred by hospitals and stroke centers. Integration with telemedicine platforms ensures remote expert interpretation and timely intervention. The segment also benefits from strong reimbursement policies and a well-established presence across urban and rural healthcare facilities.

The MRI segment is expected to witness the fastest growth during 2026–2033, fueled by its superior soft tissue contrast, high sensitivity for detecting ischemic lesions, and growing adoption in specialized stroke centers. Advanced MRI techniques, including diffusion-weighted imaging (DWI) and perfusion imaging, enable precise evaluation of stroke severity and tissue viability. AI-assisted MRI interpretation is gaining traction, reducing diagnostic errors and improving clinical decision-making. Increasing investment in MRI infrastructure and growing awareness of MRI’s role in long-term stroke management are further driving adoption. MRI is also preferred for recurrent stroke evaluation and research applications, adding to its growth potential.

- By Application

On the basis of application, the North America stroke diagnostics market is segmented into ischemic stroke, hemorrhagic stroke, and transient ischemic attacks (TIAs). The ischemic stroke segment dominated the market with the largest revenue share in 2025, as ischemic strokes represent the majority of cases in the U.S. and Canada. Rapid identification of ischemic strokes is critical for timely thrombolytic therapy, driving demand for CT, MRI, and biomarker-based diagnostics. Hospitals and specialized stroke centers prioritize advanced imaging and AI-assisted diagnostics for accurate clot localization and treatment planning. Integration with telemedicine ensures faster remote consultations for ischemic stroke cases, particularly in underserved areas. The segment benefits from strong government initiatives and insurance coverage for early detection and treatment. Continuous innovation in imaging and AI-based prediction tools further reinforces the dominance of ischemic stroke diagnostics.

The hemorrhagic stroke segment is expected to witness the fastest growth during 2026–2033, fueled by rising awareness of intracerebral hemorrhage risks and the critical need for precise and rapid diagnosis to prevent fatal outcomes. Advanced CT angiography, MRI, and transcranial Doppler technologies are increasingly utilized to detect bleeding sites and monitor disease progression. AI-assisted systems help clinicians differentiate between ischemic and hemorrhagic stroke efficiently. Expanding stroke centers and emergency care infrastructure in urban and semi-urban areas support segment growth. Early detection and monitoring of hemorrhagic stroke patients through telemedicine and portable imaging are also driving adoption.

- By End User

On the basis of end user, the North America stroke diagnostics market is segmented into hospitals, clinics, ambulatory surgical centers, and home healthcare. The hospitals segment dominated the market with the largest revenue share in 2025, driven by the concentration of advanced imaging equipment, trained specialists, and stroke units in hospital settings. Hospitals are the primary sites for acute stroke management, requiring rapid CT, MRI, and CTA diagnostics. AI-enabled imaging and telemedicine integration in hospitals enhance accuracy and speed of diagnosis. High patient volumes and the need for comprehensive stroke care contribute to sustained demand. Hospitals also lead in implementing government-mandated stroke protocols and performance metrics. Ongoing investments in hospital infrastructure further support market dominance.

The home healthcare segment is expected to witness the fastest growth during 2026–2033, fueled by the rising adoption of remote monitoring devices, telemedicine consultations, and wearable sensors for early detection of stroke symptoms. Portable CT scanners, AI-assisted risk prediction tools, and home-based biomarker testing enable early intervention. The segment benefits from growing awareness among patients and caregivers about stroke prevention and post-stroke monitoring. Insurance reimbursement policies for home healthcare and telehealth solutions are improving adoption. Integration with mobile health apps allows continuous patient monitoring and real-time alerts for urgent care, driving segment growth.

- By Distribution Channel

On the basis of distribution channel, the North America stroke diagnostics market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated the market with the largest revenue share in 2025, driven by hospitals and clinics procuring imaging and diagnostic equipment directly from manufacturers for assured quality, post-sale service, and customization. Direct procurement ensures compliance with regulatory standards and faster deployment of AI-assisted solutions. High-value equipment such as CT and MRI scanners is often purchased through direct tenders. Hospitals prefer direct relationships with vendors for training, maintenance, and software updates. Strategic partnerships with manufacturers for technology upgrades further reinforce this segment’s dominance.

The third-party distributors segment is expected to witness the fastest growth during 2026–2033, fueled by the expansion of multi-vendor supply networks and the need to provide diagnostic solutions to smaller clinics, home healthcare providers, and rural hospitals. Third-party distributors enable cost-effective procurement, flexible financing, and rapid delivery of portable and mid-range diagnostic tools. Increasing collaborations between distributors and manufacturers to offer AI-enabled stroke diagnostics drive segment adoption. This channel also supports telemedicine integration and remote monitoring solutions, enhancing accessibility in underserved regions.

- By Stage

On the basis of stage, the North America stroke diagnostics market is segmented into pre-operative, peri-operative, and post-operative. The pre-operative segment dominated the market with the largest revenue share in 2025, driven by the critical need for accurate imaging and diagnostics before interventions such as thrombectomy or neurosurgery. Pre-operative stroke diagnostics allow clinicians to assess lesion location, clot composition, and potential risks, facilitating optimal treatment planning. Hospitals rely heavily on CT, CTA, and MRI imaging in the pre-operative stage. AI-assisted tools enhance precision and speed, reducing procedure-related complications. The segment benefits from well-established clinical protocols and strong reimbursement coverage. Pre-operative diagnostics also play a key role in risk stratification and patient triage, reinforcing market dominance.

The post-operative segment is expected to witness the fastest growth during 2026–2033, fueled by the increasing emphasis on follow-up imaging, monitoring for recurrence, and long-term patient management. Portable imaging, telemedicine consultations, and AI-assisted analysis enable clinicians to track recovery and detect complications early. Home-based monitoring tools are gaining traction for post-operative patients. Growing awareness of the importance of rehabilitation and monitoring after stroke procedures drives adoption. Hospitals and clinics are integrating post-operative diagnostics with EHR and patient management platforms, further supporting market growth.

North America Stroke Diagnostics Market Regional Analysis

- The United States dominated the North America stroke diagnostics market with the largest revenue share of 80.9% in 2025, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading diagnostic technology providers

- Patients and healthcare providers in the region highly value rapid, accurate, and AI-assisted stroke diagnostics that enable timely treatment decisions, reduce long-term disability, and improve patient outcomes across emergency rooms, specialized stroke units, and outpatient clinics

- This widespread adoption is further supported by government initiatives, insurance reimbursement policies, high hospital investment in diagnostic tools, and the presence of leading imaging technology providers, establishing stroke diagnostics as a critical component of emergency care and long-term patient management in the United States

U.S. Stroke Diagnostics Market Insight

The U.S. stroke diagnostics market captured the largest revenue share of 80.9% in 2025 within North America, fueled by widespread adoption of advanced imaging technologies and AI-assisted diagnostic tools. Healthcare providers are increasingly prioritizing rapid and accurate detection of ischemic and hemorrhagic strokes to improve patient outcomes and reduce long-term disability. The growing availability of specialized stroke centers, robust hospital infrastructure, and high healthcare expenditure are key factors driving market growth. Furthermore, integration with telemedicine platforms and electronic health records enhances timely diagnosis and coordinated care. Early detection initiatives, combined with government programs and reimbursement support, are accelerating adoption in both urban and rural healthcare facilities. The strong presence of leading imaging technology providers and ongoing innovations in AI-assisted CT and MRI diagnostics continue to propel market expansion.

Canada Stroke Diagnostics Market Insight

The Canadian stroke diagnostics market is witnessing steady growth, driven by increased government investment in healthcare infrastructure, rising awareness of stroke prevention, and adoption of advanced imaging modalities such as CT, CTA, and MRI. Hospitals and clinics in Canada are increasingly utilizing AI-assisted imaging solutions to enhance diagnostic accuracy and enable timely intervention. The country’s focus on emergency care, telemedicine integration, and remote monitoring for stroke patients is contributing to improved accessibility and efficiency. Growing prevalence of stroke among aging populations, combined with public health initiatives to support early diagnosis, is further driving market growth. Canada’s centralized healthcare system allows for effective rollout of advanced diagnostic technologies, strengthening adoption across both urban and semi-urban areas. Collaborations between diagnostic technology providers and healthcare institutions also support continued innovation and market expansion.

Mexico Stroke Diagnostics Market Insight

The Mexican stroke diagnostics market is gradually expanding due to increased awareness of stroke risks, rising prevalence of cardiovascular diseases, and growing adoption of modern imaging and laboratory diagnostics in hospitals and clinics. Investment in healthcare infrastructure and expansion of specialized stroke units in major cities are supporting the uptake of CT, MRI, and transcranial Doppler imaging. Telemedicine solutions and AI-assisted diagnostic platforms are slowly being integrated to enhance early detection and treatment planning. Public health campaigns focused on stroke education and prevention are raising demand for timely diagnostics. Furthermore, partnerships between international diagnostic technology companies and local healthcare providers are facilitating access to advanced imaging solutions, driving market growth. Mexico’s expanding middle class and urbanization trends are also contributing to the increasing demand for stroke diagnostics across residential and commercial healthcare facilities.

North America Stroke Diagnostics Market Share

The North America Stroke Diagnostics industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

- FUJIFILM Holdings Corporation (Japan)

- Analogic Corporation (U.S.)

- Aspect Imaging Ltd (Israel)

- Carestream Health (U.S.)

- Esaote S.p.A (Italy)

- Hologic, Inc. (U.S.)

- IMRIS Inc. (Canada)

- Fonar Corporation (U.S.)

- Medfield Diagnostics AB (Sweden)

- MEDTRON AG (Germany)

- SAMSUNG Medison (South Korea)

- Shenzhen Anke High Tech Co., Ltd. (China)

- Shimadzu Corporation (Japan)

- ALPINION MEDICAL SYSTEMS Co., Ltd. (South Korea)

- BPL Medical Technologies (India)

What are the Recent Developments in North America Stroke Diagnostics Market?

- In November 2025, AI‑Stroke, a company developing an AI “neurologist” for pre‑CT stroke triage, raised USD 4.6 million in seed funding to support FDA regulatory efforts and multisite clinical studies across leading U.S. stroke centers, aiming to speed up early triage using smartphone‑based video analysis of stroke signs

- In July 2025, AiimSense, a Canadian health‑tech startup, developed and showcased BrainScreen, a portable AI and electromagnetic imaging‑based stroke detection system that enables rapid, field‑deployable diagnosis of both ischemic and hemorrhagic strokes, potentially improving early treatment decisions before hospital arrival

- In April 2025, Brainomix received an expanded FDA clearance for its Brainomix 360 stroke imaging software that enables physicians to assess ischemic core volume from widely available non‑contrast CT scans, improving triage and treatment decisions up to 24 hours after stroke onset

- In November 2023, Brainomix launched its full Brainomix 360 AI stroke imaging platform in the United States, integrating multiple FDA‑cleared modules (including e‑ASPECTS, e‑CTP, and e‑MRI) to support clinicians in comprehensive stroke imaging and decision support across the patient pathway

- In March 2023, Brainomix’s Brainomix 360 e‑ASPECTS tool received FDA clearance to automatically assess ASPECTS scores from non‑contrast CT scans, aiding clinicians in faster and more consistent ischemic stroke evaluation in U.S. stroke centers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.