North America Surgical Sealants Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

11.75 Billion

USD

23.59 Billion

2024

2032

USD

11.75 Billion

USD

23.59 Billion

2024

2032

| 2025 –2032 | |

| USD 11.75 Billion | |

| USD 23.59 Billion | |

|

|

|

|

Surgical Sealants and Adhesives Market Size

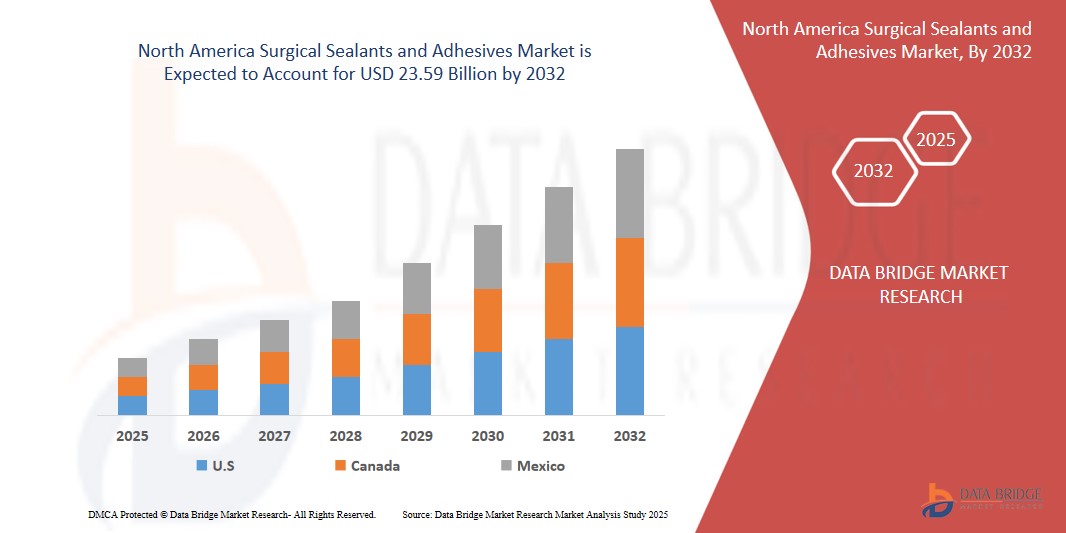

- The North America Surgical Sealants and Adhesives market was valued at USD 11.75 billion in 2024 and is expected to reach USD 23.59 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.1%, primarily driven by advancements in healthcare, increasing surgical procedures, and rising demand for minimally invasive treatments

- This growth is driven by factors such as technological advancements, increasing healthcare investments, rising surgical procedures, and growing demand for minimally invasive treatments

Surgical Sealants and Adhesives Market Analysis

- Surgical sealants and adhesives are increasingly used to replace traditional suturing techniques, heal tissues during surgeries, and prevent complications such as arterial issues and aortic root replacements. These adhesives enhance surgical efficiency and offer an alternative to conventional methods, contributing to the growing demand in the medical field

- The rising prevalence of cardiovascular diseases, increasing demand for minimally invasive procedures, and the growing geriatric population significantly drive the growth of the surgical sealants and adhesives market. Additionally, the surge in industrialization, along with a higher number of accidents and sports-related injuries, further boosts market expansion

- The market growth is further supported by technological advancements in surgical products, as well as rising awareness of the benefits of surgical sealants. The adoption of these materials is expected to rise with advancements in medical technology, improving patient outcomes and surgical efficiency

- Additionally, the growth and expansion of healthcare industries, especially in emerging economies, and the increasing focus on adhesive dentistry are creating numerous growth opportunities for the surgical sealants and adhesives market

Report Scope and Surgical Sealants and Adhesives Market Segmentation

|

Attributes |

Surgical Sealants and Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical Sealants and Adhesives Market Trends

“Rising Surgical Volumes”

- One prominent trend in the advancement of Surgical Sealants and Adhesives is the growing demand driven by the increasing number of surgical procedures, especially among the aging population

- The rise in surgeries, including general, cardiac, orthopedic, and cosmetic procedures, is contributing to a heightened need for efficient and reliable surgical sealants and adhesives

- For instance, surgical sealants and adhesives are becoming increasingly essential in various medical procedures, helping to ensure wound closure, prevent leakage, and promote faster healing.

- These materials offer enhanced sealing properties, making them critical for improving patient recovery and minimizing complications during and after surgery.

- This demand is shaping the future of surgical technologies, driving innovation in medical adhesives and contributing to better surgical outcomes, patient safety, and overall healthcare efficiency

Surgical Sealants and Adhesives Market Dynamics

Driver

“Advancements in Surgical Techniques:”

- The rise in minimally invasive and robotic-assisted surgeries is significantly driving the growth of the Surgical Sealants and Adhesives market

- As surgical techniques evolve, medical professionals are increasingly relying on advanced sealants and adhesives to improve the precision and effectiveness of these procedures

- Surgical Sealants and Adhesives play a critical role in tissue sealing and hemostasis, offering enhanced wound closure and reduced bleeding, leading to better patient recovery and fewer complications

- These products improve surgical outcomes, reduce recovery times, and enhance patient safety, particularly in delicate and complex procedures performed with minimal incisions

- As the demand for minimally invasive surgeries continues to increase, the need for innovative Surgical Sealants and Adhesives is expected to rise, supporting the future of advanced surgical technologies and improving overall patient care

- For instance, In April 2025, the application of a fibrin sealant patch successfully controlled a major vascular injury during a robotic-assisted laparoscopic procedure. The patient experienced minimal blood loss and no thrombotic events, demonstrating the safety and efficacy of the sealant in complex surgeries, contributing to improved surgical outcomes and driving demand for innovative materials in medical procedures

- In April 2025, Tisseel® fibrin sealant was utilized in a series of eleven patients undergoing robotic-assisted laparoscopic repair of vesicovaginal fistulas. The sealant was effective in achieving hemostasis and facilitating tissue sealing, highlighting its efficacy as an alternative to tissue interposition and contributing to improved surgical outcomes in complex procedures

Opportunity

“Technological Advancements and Product Innovation”

- The growing demand for biodegradable and biocompatible materials in surgical sealants and adhesives is driven by their eco-friendly nature and ability to naturally degrade within the body, reducing the need for surgical removal and minimizing long-term complications

- These materials contribute to improved patient safety and comfort by reducing the risk of adverse reactions and supporting more sustainable medical practices

- Additionally, the shift towards biodegradable sealants aligns with the healthcare industry's sustainability efforts, promoting the development of safer, environmentally friendly solutions for medical procedures

- For instance, In April 2025, a study published in PubMed demonstrated the development of liquid copolymers as biodegradable surgical sealants. These sealants exhibited longer persistence times compared to fibrin glue, minimal cytotoxicity in vitro, and excellent biocompatibility in vivo, showcasing their potential to reduce the need for surgical removal and minimize long-term complications, contributing to the advancement of safer, more effective surgical materials

- In April 2025, research published in ScienceDirect focused on the preparation of a biocompatible and biodegradable tissue adhesive made from polyethylene glycol dimethacrylate (PEGDMA) and mercapto chitosan (CSS). This adhesive demonstrated rapid setting times and strong adhesion properties, highlighting its suitability for cosmetic and minimally invasive surgeries and contributing to the development of advanced, efficient surgical adhesives

Restraint/Challenge

“High Product Costs”

- While advanced surgical sealants and adhesives offer superior performance, their elevated price points pose a significant challenge to their adoption in cost-sensitive healthcare settings

- These high-cost materials, while providing enhanced efficacy, can strain hospital and clinic budgets, making it difficult to justify their use in financially constrained environments

- The financial pressures on healthcare providers to manage budgets effectively limit the broader acceptance and adoption of these advanced materials, hindering the overall growth of the surgical sealants and adhesives market in cost-conscious regions

Surgical Sealants and Adhesives Market Scope

The market is segmented on the basis of product, indication, application, end-user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Indication |

|

|

By Application |

|

|

By End-User

|

|

|

By Distribution Channel |

|

Surgical Sealants and Adhesives Market Regional Analysis

“U.S. is the Dominant Country in the Surgical Sealants and Adhesives Market”

- The U.S. holds a significant share of the market, benefiting from the rapid adoption of advanced technologies like precision farming solutions, AI, and IoT. These innovations enhance efficiency, sustainability, and yield, boosting market growth

“Canada is Projected to Register the Highest Growth Rate”

- Canada, with its increasing focus on healthcare innovation and improved regulatory approvals, is emerging as the fastest-growing market. The country’s expansion is further supported by a growing healthcare infrastructure and rising awareness of modern surgical solutions

Surgical Sealants and Adhesives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson Services, Inc. (U.S.)

- CryoLife, Inc. (U.S.)

- Baxter (U.S.)

- BD (U.S.)

- B. Braun Melsungen AG (Germany)

- Vivostat A/S (Denmark)

- Ocular Therapeutix, Inc. (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Advanced Medical Solutions Israel (Sealantis) Ltd (Israel)

- Tricol Biomedical (U.S.)

- Gem Srl (Italy)

- Tissuemed (U.K)

- Cardinal Health (U.S.)

- Medline Industries, Inc. (U.S.)

- Adhezion Biomedical (U.S.)

- CSL Limited (Australia)

- Stryker (U.S.)

Latest Developments in North America Surgical Sealants and Adhesives Market

- In August 2024, Resivant Medical received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its first products: the Cutiva Topical Skin Adhesive and the Cutiva PLUS Skin Closure System. The latter uniquely combines an adhesive mesh patch with the high-viscosity Cutiva liquid adhesive.

- In March 2024, TELA Bio, Inc. introduced its LIQUIFIX FIX8 Laparoscopic and LIQUIFIX Precision Open Hernia Mesh Fixation Devices in the United States. Remarkably, LIQUIFIX is the first adhesive-based product approved for securing mesh without penetrating patient tissue, providing a strong and secure application.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Surgical Sealants Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Surgical Sealants Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Surgical Sealants Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.