North America Swabs Collection Kits Market

Market Size in USD Billion

CAGR :

%

USD

3.83 Billion

USD

7.52 Billion

2025

2033

USD

3.83 Billion

USD

7.52 Billion

2025

2033

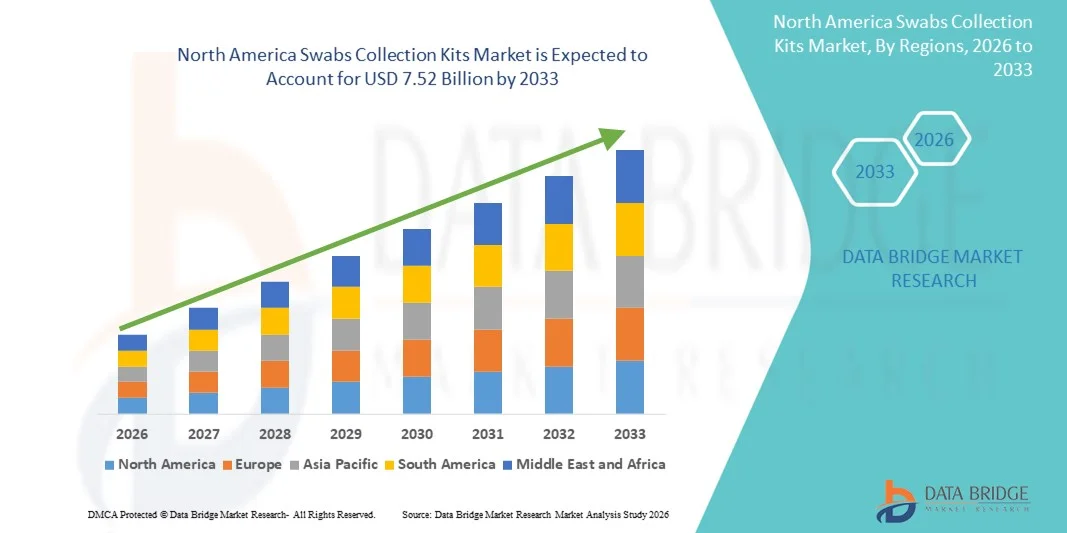

| 2026 –2033 | |

| USD 3.83 Billion | |

| USD 7.52 Billion | |

|

|

|

|

North America Swabs Collection Kits Market Size

- The North America swabs collection kits market size was valued at USD 3.83 billion in 2025 and is expected to reach USD 7.52 billion by 2033, at a CAGR of 8.80% during the forecast period

- The market growth is primarily driven by the rising demand for diagnostic testing across clinical, homecare, and laboratory settings, supported by increasing awareness of infectious diseases and the expansion of preventive healthcare practices

- Furthermore, growing adoption of self-collection kits, technological advancements in sample integrity and transport media, and strong healthcare infrastructure across the U.S. and Canada are positioning swabs collection kits as a critical component of modern diagnostic workflows. These combined factors are accelerating market adoption and significantly contributing to regional market growth

North America Swabs Collection Kits Market Analysis

- Swabs collection kits, used for the accurate and hygienic collection of biological specimens for diagnostic and screening purposes, are critical components of the healthcare and diagnostics landscape in North America due to their extensive use in hospitals, diagnostic laboratories, and home-based testing environments

- The increasing demand for swabs collection kits is mainly driven by the high volume of diagnostic testing, growing focus on early disease detection, and expanding adoption of self-collection and point-of-care diagnostic solutions

- The United States dominated the North America swabs collection kits market with the largest revenue share of 88.0% in 2025, supported by advanced healthcare infrastructure, high testing rates, strong reimbursement frameworks, and the presence of major diagnostic and medical device manufacturers, with widespread utilization across clinical diagnostics, public health programs, and home-testing kits

- Canada is expected to be fastest growing country during the forecast period, driven by rising healthcare expenditure, expanding diagnostic laboratory capacity, and increasing adoption of preventive and infectious disease screening initiatives

- Nasopharyngeal segment dominated the North America swabs collection kits market with a share of 46.5% in 2025, driven by their strong clinical acceptance, high diagnostic accuracy, and continued demand for respiratory and infectious disease diagnostics

Report Scope and North America Swabs Collection Kits Market Segmentation

|

Attributes |

North America Swabs Collection Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Swabs Collection Kits Market Trends

Rising Adoption of Self-Collection and Home-Based Diagnostic Kits

- A significant and rapidly accelerating trend in the North America swabs collection kits market is the growing adoption of self-collection and home-based diagnostic kits, driven by increasing consumer preference for convenient, non-invasive, and accessible testing solutions across infectious disease, genetic, and routine health screening applications

- For instance, several U.S.-based diagnostic companies have expanded their at-home testing portfolios by introducing FDA-authorized swab collection kits for respiratory infections and chronic condition monitoring, enabling patients to collect samples safely without visiting healthcare facilities

- Advancements in swab material design, transport media stability, and contamination prevention technologies are enhancing sample accuracy and integrity. For instance, flocked swabs and integrated transport tubes are increasingly used to improve specimen yield and preserve nucleic acids during transit to laboratories

- The integration of swabs collection kits with digital health platforms and telehealth services is enabling seamless test ordering, sample tracking, and result delivery. Through a single digital interface, users can register kits, receive instructions, and consult healthcare professionals, creating a streamlined diagnostic experience

- This trend toward more patient-centric, convenient, and technology-enabled diagnostic solutions is reshaping expectations around sample collection. Consequently, companies such as Copan Diagnostics are developing advanced self-collection swab kits designed for both clinical-grade accuracy and ease of home use

- The demand for self-collection swabs kits is rising steadily across hospitals, diagnostic laboratories, and homecare settings, as healthcare systems and consumers increasingly prioritize accessibility, efficiency, and decentralized testing models

- Growing adoption of multiplex and molecular diagnostic tests is also supporting demand for high-quality swabs capable of maintaining sample integrity for advanced laboratory analysis

North America Swabs Collection Kits Market Dynamics

Driver

Growing Demand Due to Rising Diagnostic Testing Volumes and Preventive Healthcare Focus

- The increasing volume of diagnostic testing across North America, coupled with a growing emphasis on early disease detection and preventive healthcare, is a key driver fueling demand for swabs collection kits

- For instance, in March 2025, several U.S. public health programs expanded routine respiratory and infectious disease screening initiatives, significantly increasing procurement of swabs collection kits for hospitals and community testing centers

- As healthcare providers prioritize rapid and accurate diagnosis, swabs collection kits offer reliable, standardized, and cost-effective solutions for specimen collection across a wide range of clinical applications

- Furthermore, the expansion of point-of-care testing and decentralized diagnostic models is making swabs collection kits an essential component of modern healthcare delivery, supporting faster turnaround times and improved patient outcomes

- The increasing adoption of self-testing kits for home use, along with growing awareness of infectious disease monitoring and chronic condition management, is further accelerating market demand across both institutional and consumer segments

- Rising healthcare expenditure in the U.S. and Canada is enabling greater investment in diagnostic infrastructure, directly supporting higher consumption of swabs collection kits

- The expansion of clinical trials, research laboratories, and biobanking activities is also contributing to sustained demand for standardized and high-quality specimen collection products

Restraint/Challenge

Quality Compliance Requirements and Supply Chain Sensitivity

- Stringent regulatory requirements and quality compliance standards governing medical devices and diagnostic consumables present a significant challenge for the swabs collection kits market in North America

- For instance, manufacturers must comply with FDA regulations, ISO standards, and clinical validation requirements, which can increase development timelines and operational costs, particularly for new entrants

- Ensuring consistent product quality, sterility, and sample integrity is critical, as any deviation can compromise diagnostic accuracy and lead to regulatory scrutiny or product recalls

- In addition, the market remains sensitive to supply chain disruptions related to raw materials such as medical-grade plastics and transport media, which can impact production scalability and timely distribution

- Addressing these challenges through robust quality management systems, diversified supply chains, and continuous regulatory alignment will be essential for manufacturers to maintain competitiveness and support long-term market growth

- Price pressure from bulk procurement by public health agencies and large diagnostic networks can limit profit margins for manufacturers

- Environmental concerns related to single-use plastic waste from swabs collection kits are emerging as an additional challenge, prompting the need for sustainable material innovation

North America Swabs Collection Kits Market Scope

The market is segmented on the basis of type, configuration, tip material, shaft, specimen, application, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into nasopharyngeal, oropharyngeal, and nares swabs. The nasopharyngeal segment dominated the market in 2025 with a market share of 45.6%, driven by its high diagnostic accuracy and strong clinical preference for respiratory and infectious disease testing. These swabs are widely regarded as the gold standard for pathogen detection, particularly in molecular diagnostics. Their extensive use in hospitals and diagnostic laboratories, along with standardized testing guidelines, supports their leading position. High adoption in public health surveillance programs further reinforces dominance. Nasopharyngeal swabs are also compatible with automated laboratory systems, ensuring reproducible results. Established reliability and consistent supply chains contribute to their continued market leadership.

The nares swabs segment is anticipated to witness the fastest growth during the forecast period, fueled by increasing demand for self-collection and home-based diagnostic kits. Nares swabs offer improved patient comfort and ease of use compared to deeper sampling methods. Their suitability for mass screening and routine testing supports growing adoption. Rising telehealth usage and consumer-friendly testing solutions are accelerating growth. Regulatory acceptance of less invasive testing methods further contributes to expansion. Public awareness campaigns highlighting their convenience are also driving adoption.

- By Configuration

On the basis of configuration, the market is segmented into regular swabs, flocked swabs, and others. The flocked swabs segment dominated the market in 2025 due to its superior specimen collection and release efficiency. These swabs improve diagnostic sensitivity by maximizing sample yield. Strong preference from molecular and microbiology laboratories supports dominance. Compatibility with advanced diagnostic assays further strengthens adoption. They are increasingly used in high-throughput testing and automated laboratory workflows. Flocked swabs’ reliability across multiple specimen types also maintains their market leadership.

The regular swabs segment is expected to witness the fastest growth over the forecast period, driven by their cost-effectiveness and widespread availability. Regular swabs are extensively used in routine diagnostics and large-scale screening programs. Their affordability makes them suitable for high-volume testing. Continuous improvements in material quality are enhancing acceptance. Expansion in developing regions and emerging healthcare facilities supports growth. Regular swabs are also preferred for less critical applications, further contributing to demand.

- By Tip Material

On the basis of tip material, the market is segmented into rayon, polyester, nylon, foam, cotton, calcium alginate, and others. The nylon segment dominated the market in 2025, largely due to its extensive use in flocked swabs. Nylon tips provide excellent absorption and release characteristics. They are highly compatible with molecular diagnostic techniques. Strong clinical validation supports continued dominance. Nylon swabs are preferred for high-sensitivity tests and large-scale screening programs. Their durability and consistency ensure reproducible results across laboratories. High adoption in public health programs further reinforces market leadership.

The foam segment is anticipated to grow at the fastest rate during the forecast period, driven by its gentle sampling nature and improved patient comfort. Foam swabs are increasingly adopted in sensitive specimen and surface sampling. Low fiber shedding enhances diagnostic accuracy. Growth in homecare and point-of-care testing supports expansion. Foam swabs are also used in specialized assays requiring high integrity. Technological improvements in foam manufacturing further accelerate adoption. Rising demand for patient-friendly kits also contributes to growth.

- By Shaft

On the basis of shaft type, the market is segmented into plastic shafts, aluminum, wooden shafts, resins, and others. The plastic shaft segment dominated the market in 2025 due to its flexibility, durability, and compatibility with transport systems. Plastic shafts reduce breakage risk and enhance safety during sample collection. They are widely used in both clinical and home-testing kits. Cost efficiency further supports dominance. Plastic shafts are compatible with automation equipment, improving laboratory throughput. Their universal availability ensures strong adoption across healthcare facilities. Hospitals and diagnostic centers prefer plastic shafts for consistent performance.

The resin shaft segment is expected to witness the fastest growth during the forecast period, driven by advancements in lightweight and sustainable materials. Resin shafts offer improved strength and environmental benefits. Growing focus on eco-friendly medical consumables supports adoption. Innovation in material technology is accelerating demand. They are increasingly incorporated in premium swabs for specialized diagnostics. Rising awareness about medical waste management also favors growth. Consumer preference for sustainable medical products further supports adoption.

- By Specimen

On the basis of specimen, the market is segmented into throat swab, vaginal swab, penile meatal swab, rectal swab, and others. The throat swab specimen segment dominated the market in 2025 due to its widespread use in respiratory and infectious disease diagnostics. Throat swabs are commonly utilized in clinical and laboratory testing. High testing volumes support revenue leadership. Established diagnostic protocols further strengthen dominance. They are preferred for standard screening and routine laboratory assays. Reliable sample collection ensures consistent results and regulatory compliance. Public health initiatives maintain steady demand for throat swabs.

The rectal swab specimen segment is anticipated to witness the fastest growth during the forecast period, driven by increasing screening for gastrointestinal and antimicrobial resistance infections. Growing awareness of hospital-acquired and sexually transmitted infections supports demand. Expansion of specialized diagnostic testing is accelerating growth. Rectal swabs are increasingly adopted in research and surveillance studies. Improved clinical guidelines for infectious disease testing support adoption. Rising prevalence of gastrointestinal pathogens fuels market expansion. Healthcare providers emphasize rectal swabs for accurate detection of specific infections.

- By Application

On the basis of application, the market is segmented into pharmaceutical, microbiological, laboratory, and disinfection applications. The laboratory segment dominated the market in 2025 due to high diagnostic testing volumes and centralized laboratory infrastructure. Laboratories require standardized and reliable swabs for accurate diagnostics. Strong investment in diagnostic capacity supports dominance. They are critical for molecular, microbiological, and immunological assays. High adoption in hospital laboratories further strengthens market position. Continuous quality validation and regulatory approvals maintain leadership. Increased government funding for laboratory testing also sustains demand.

The pharmaceutical segment is expected to grow at the fastest rate during the forecast period, driven by increasing clinical trials and drug development activities. Swabs are widely used for sample collection in research studies. Expansion of biopharmaceutical R&D is fueling demand. Growing outsourcing to contract research organizations further supports growth. Advanced testing requirements in pharmacology increase adoption. Pharmaceutical companies are investing in high-quality swabs to ensure study reliability. The trend toward personalized medicine further drives swab usage.

- By End User

On the basis of end user, the market is segmented into diagnostic laboratories, hospitals & clinics, research & academic institutes, home healthcare, and others. The diagnostic laboratories segment dominated the market in 2025 due to high testing throughput and centralized diagnostic services. Laboratories are the primary consumers of swabs collection kits. Expansion of molecular diagnostics further supports dominance. Regulatory compliance and quality assurance requirements reinforce adoption. Laboratories rely on standardized swabs for consistent results. High-volume procurement maintains leadership in the market. Continuous training of laboratory staff ensures proper usage and preference.

The home healthcare segment is anticipated to witness the fastest growth during the forecast period, driven by rising adoption of self-testing and home-based diagnostic kits. Consumer preference for convenience and remote testing is increasing. Growth of telemedicine platforms supports adoption. Regulatory approvals for home-use kits further accelerate growth. Home-based testing for infectious diseases and chronic conditions is expanding. Digital health integration improves user experience and accessibility. Increasing awareness and comfort with self-collection drive rapid adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market in 2025, driven by bulk procurement by hospitals, diagnostic laboratories, and public health agencies. Long-term supply contracts ensure stable demand. Government-funded testing programs significantly contribute to market share. Large-scale tenders reduce per-unit costs and improve supply chain efficiency. Hospitals and public health institutions prefer direct sourcing for reliability. Direct tender ensures timely delivery for high-volume testing needs. Strong partnerships with manufacturers maintain consistent supply.

The retail sales segment is expected to witness the fastest growth during the forecast period, supported by increasing availability of swabs collection kits through pharmacies and online channels. Rising consumer awareness and accessibility are driving demand. Expansion of e-commerce healthcare platforms further accelerates growth. Convenience and rapid product availability are key growth drivers. Growing popularity of at-home testing kits fuels retail sales. Marketing and subscription-based sales models enhance consumer adoption. Increasing home healthcare trends continue to boost retail segment growth.

North America Swabs Collection Kits Market Regional Analysis

- The United States dominated the North America swabs collection kits market with the largest revenue share of 88.0% in 2025, supported by advanced healthcare infrastructure, high testing rates, strong reimbursement frameworks, and the presence of major diagnostic and medical device manufacturers, with widespread utilization across clinical diagnostics, public health programs, and home-testing kits

- Consumers and healthcare providers in the region prioritize accuracy, reliability, and convenience in sample collection, which has led to a strong preference for standardized swabs collection kits across hospitals, diagnostic laboratories, and home healthcare settings

- This widespread adoption is further supported by high healthcare expenditure, strong regulatory frameworks, and the presence of major diagnostic and medical device manufacturers, establishing swabs collection kits as an essential component of routine diagnostics, disease surveillance, and preventive healthcare programs

U.S. Swabs Collection Kits Market Insight

The U.S. swabs collection kits market captured the largest revenue share of 88.0% in 2025 within North America, driven by the high volume of diagnostic testing and the widespread adoption of home-based and self-collection kits. Healthcare providers and consumers are increasingly prioritizing accuracy, convenience, and safety in sample collection for infectious disease testing, chronic condition monitoring, and preventive health screening. The growing integration of telehealth services, mobile app–based test management, and home healthcare solutions is further propelling market growth. Moreover, strong regulatory approvals from the FDA and well-established healthcare infrastructure ensure reliability and accessibility of swabs collection kits, driving sustained demand across residential, clinical, and laboratory settings.

Canada Swabs Collection Kits Market Insight

The Canada swabs collection kits market is expected to grow at a substantial CAGR during the forecast period, supported by rising healthcare expenditure and government-led public health initiatives. Increasing awareness about early disease detection and preventive healthcare is encouraging the adoption of both clinical and at-home swab collection solutions. The country’s well-developed healthcare infrastructure, coupled with high adoption of telemedicine services, further promotes the use of standardized and easy-to-use swabs. Demand is also driven by research institutions and diagnostic laboratories seeking reliable sample collection methods for large-scale testing.

Mexico Swabs Collection Kits Market Insight

The Mexico swabs collection kits market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in healthcare infrastructure and expanding diagnostic services. Growing awareness of infectious disease monitoring and preventive healthcare is encouraging hospitals, clinics, and home healthcare providers to adopt swabs collection kits. The increasing availability of cost-effective, FDA or local regulatory-approved kits is further boosting market adoption. Rising urbanization and government initiatives aimed at improving public health outcomes are also contributing to market growth.

North America Swabs Collection Kits Market Share

The North America Swabs Collection Kits industry is primarily led by well-established companies, including:

- Copan Diagnostics Inc. (U.S.)

- HiMedia Laboratories (India)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Puritan Medical Products Company LLC (U.S.)

- QIAGEN N.V. (Germany)

- DiaSorin S.p.A. (Italy)

- VIRCELL S.L. (Spain)

- BTNX, Inc. (Canada)

- QuidelOrtho Corporation (U.S.)

- Labcorp (U.S.)

- Hologic, Inc. (U.S.)

- Abbott (U.S.)

- Medline Industries, Inc. (U.S.)

- Medical Wire & Equipment Co. Ltd (U.K.)

- BIOMÉRIEUX (France)

- Sarstedt AG & Co. KG (Germany)

- Greiner Bio-One International GmbH (Austria)

- Norgen Biotek Corp. (Canada)

- Hardy Diagnostics (U.S.)

What are the Recent Developments in North America Swabs Collection Kits Market?

- In December 2025, Amazon launched its direct‑to‑consumer COVID‑19 test collection kit with a nasal swab that customers can order online and use at home, including pre‑paid delivery to a lab expanding access to self‑swab based diagnostic collection beyond traditional clinical settings

- In September 2025, Tia Health and Molecular Testing Labs announced the launch of the first FDA‑cleared home‑collected 4‑plex STI test, enabling patients to collect samples including vaginal swabs at home and mail them for comprehensive detection of four common sexually transmitted infections. This partnership expands access to self‑collection diagnostics by integrating telehealth support and laboratory testing for broader sexual health screening

- In May 2025, the FDA approved the first at‑home cervical cancer self‑collection kit (Teal Wand) that allows women to collect vaginal samples using a swab‑based device for HPV testing and mail them to a lab, representing a significant expansion of self‑collection diagnostics beyond infectious diseases

- In May 2025, the FDA approved the Teal Wand at‑home self‑collection device for cervical cancer screening, allowing individuals to collect vaginal swab samples at home and mail them to a lab for HPV testing. This approval represented a major advancement in expanding self‑collection beyond infectious disease testing to routine cancer screening, improving access and convenience for preventive care

- In April 2024, Labcorp announced that the U.S. Food and Drug Administration (FDA) granted Emergency Use Authorization (EUA) for its Mpox PCR Test Home Collection Kit, enabling individuals to self‑collect lesion swab specimens at home and send them to a laboratory for mpox diagnosis marking the first at‑home mpox sample collection kit authorized by the FDA

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.