North America Telecom Managed Services Market

Market Size in USD Billion

CAGR :

%

USD

5.23 Billion

USD

15.13 Billion

2024

2032

USD

5.23 Billion

USD

15.13 Billion

2024

2032

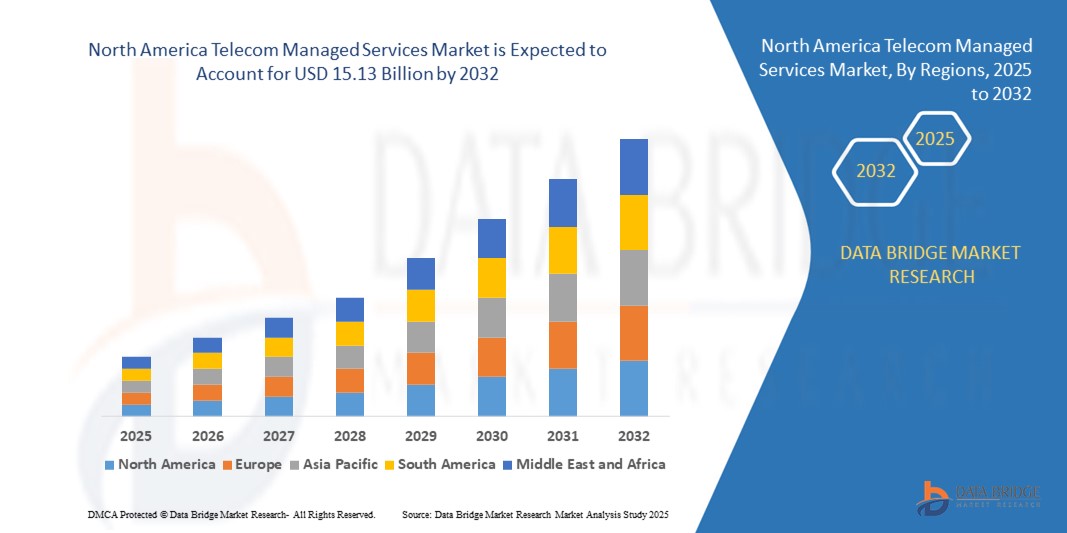

| 2025 –2032 | |

| USD 5.23 Billion | |

| USD 15.13 Billion | |

|

|

|

|

North America Telecom Managed Services Market Size

- The North America telecom managed services market size was valued at USD 5.23 billion in 2024 and is expected to reach USD 15.13 billion by 2032, at a CAGR of 14.20% during the forecast period

- The market growth is primarily driven by the increasing demand for cost-effective IT infrastructure management, enhanced cybersecurity, and the growing adoption of cloud-based solutions across enterprises

- Rising awareness of operational efficiency, scalability, and the need for advanced communication systems is further propelling the demand for telecom managed services across various industry verticals.

North America Telecom Managed Services Market Analysis

- The telecom managed services market in North America is experiencing robust growth as enterprises prioritize digital transformation, network optimization, and cybersecurity enhancements

- Growing demand from large enterprises and SMEs for managed services to reduce operational costs and improve business agility is encouraging service providers to innovate with advanced cloud, AI, and automation-driven solutions

- The U.S. dominates the North America telecom managed services market with the largest revenue share of 65.2% in 2024, driven by a mature telecom industry, widespread adoption of 5G technology, and increasing demand for managed security and cloud services

- Canada is expected to be the fastest-growing country in the North America telecom managed services market during the forecast period, fueled by rapid digitalization, government initiatives for smart city development, and rising adoption of cloud-based managed services

- The Managed Data Center Services segment dominated the largest market revenue share of 36% in 2024, driven by the increasing reliance on data centers to support expanding digital services and network infrastructure for telecom operators

Report Scope and North America Telecom Managed Services Market Segmentation

|

Attributes |

North America Telecom Managed Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Telecom Managed Services Market Trends

Increasing Integration of AI and Automation Technologies

- The North America telecom managed services market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and automation technologies

- These technologies facilitate advanced network management, predictive maintenance, and enhanced cybersecurity by processing large volumes of data to deliver actionable insights

- AI-driven managed services enable proactive issue resolution, such as identifying potential network outages or security threats before they impact operations

- For instances, companies are deploying AI-powered platforms to optimize network performance, automate customer support through chatbots, and enhance threat detection for managed security services

- This trend is strengthening the appeal of telecom managed services, offering greater efficiency and reliability for both large enterprises and small and medium enterprises (SMEs)

- AI algorithms analyze network traffic patterns, user behaviors, and system performance metrics to improve service delivery and reduce operational costs

North America Telecom Managed Services Market Dynamics

Driver

Rising Demand for Cloud-Based Solutions and Enhanced Cybersecurity

- The growing adoption of cloud computing and the need for robust cybersecurity are key drivers for the North America telecom managed services market

- Managed services, such as managed data center services and managed security services, support businesses in transitioning to cloud environments while ensuring data protection and compliance

- Government regulations, particularly in the U.S., such as those related to data privacy and cybersecurity, are accelerating the adoption of managed services to meet compliance requirements

- The rollout of 5G technology and the expansion of IoT applications are enabling faster and more reliable data transmission, driving demand for managed network and mobility services

- Service providers are increasingly offering tailored solutions, such as managed communication and collaboration services, to meet the evolving needs of enterprises and enhance operational efficiency

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- The high upfront costs associated with deploying managed services, including hardware, software, and integration, pose a significant barrier, particularly for SMEs in cost-sensitive markets

- Integrating managed services into legacy systems can be complex and expensive, requiring specialized expertise and resources

- Data privacy and security concerns are a major challenge, as managed services involve the collection and transmission of sensitive business and customer data, raising risks of breaches or non-compliance with regulations such as GDPR and CCPA

- The varying regulatory frameworks across the U.S., Canada, and Mexico regarding data handling and storage create operational complexities for service providers

- These challenges can hinder market growth, especially in regions with heightened data privacy awareness or limited budgets for technology investments

North America Telecom Managed Services market Scope

The market is segmented on the basis of Type, Managed Information Service (MIS), Deployment Model, and Organization Size.

- By Type

On the basis of type, the North America Telecom Managed Services Market is segmented into Managed Data Center Services, Managed Network Services, Managed Communication and Collaboration Services, Managed Security Services, Managed Mobility Services, and Others. The Managed Data Center Services segment dominated the largest market revenue share of 36% in 2024, driven by the increasing reliance on data centers to support expanding digital services and network infrastructure for telecom operators. These services offer specialized expertise in data center operations, including maintenance, security, and scalability, enabling telecom companies to reduce operational complexities.

The Managed Security Services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by escalating cybersecurity threats and stringent regulatory compliance requirements. The need for comprehensive solutions such as threat intelligence, incident response, and endpoint detection is accelerating adoption across enterprises to ensure data security and regulatory adherence.

- By Managed Information Service (MIS)

On the basis of managed information service (MIS), the North America Telecom Managed Services Market is segmented into Business Process Management, Managed Operational Support Systems/Business Support Systems, Project & Portfolio Management, and Others. The Business Process Management segment held the largest market revenue share of 37.4% in 2024, driven by its role in streamlining business operations, including supply chain management, accounting, and customer service, allowing telecom companies to enhance operational efficiency.

The Managed Operational Support Systems/Business Support Systems segment is anticipated to experience robust growth from 2025 to 2032. The increasing adoption of advanced technologies such as 5G, IoT, and cloud computing necessitates robust support systems to manage complex telecom operations, driving demand for these services to optimize network performance and customer experience.

- By Deployment Model

On the basis of deployment model, the North America Telecom Managed Services Market is segmented into On-Premise and Cloud. The Cloud segment dominated the market with a revenue share of 55% in 2024, attributed to the increasing demand for flexible and scalable communication solutions. The transition of telecom operations to cloud-based platforms supports cost efficiency, ease of integration, and enhanced service delivery, driving its widespread adoption.

The On-Premise segment is expected to witness significant growth from 2025 to 2032, particularly in industries with stringent data control and regulatory requirements. On-premise solutions offer greater control over sensitive data and compliance with regional regulations, making them a preferred choice for certain telecom operators.

- By Organization Size

On the basis of organization size, the North America Telecom Managed Services Market is segmented into Large Enterprises and Small and Medium Enterprises (SMEs). The Large Enterprises segment held the largest market revenue share of 60% in 2024, driven by their need to offload routine IT tasks and focus on strategic objectives. Large enterprises require comprehensive managed services, including network management, cybersecurity, and cloud computing, to enhance operational effectiveness and maintain a competitive edge.

The Small and Medium Enterprises (SMEs) segment is anticipated to witness the fastest growth rate of 15.2% from 2025 to 2032. SMEs are increasingly adopting managed services due to limited internal IT capabilities and the rising demand for cost-effective, scalable solutions to support digital transformation and operational efficiency.

North America Telecom Managed Services Market Regional Analysis

- The U.S. dominates the North America telecom managed services market with the largest revenue share of 65.2% in 2024, driven by a mature telecom industry, widespread adoption of 5G technology, and increasing demand for managed security and cloud services

- The trend toward digitalization and increasing regulatory requirements for data security further boost market expansion

- Major service providers’ presence and robust IT infrastructure complement the growing need for managed data center and network services, creating a dynamic market ecosystem

Canada Telecom Managed Services Market Insight

Canada is expected to witness the fastest growth rate in the North America telecom managed services market, supported by rapid digital development and increasing adoption of cloud computing and IT security solutions. Enterprises seek services that enhance network reliability and support remote work environments. The growth is prominent in both large enterprises and SMEs, with significant uptake in urban centers such as Toronto due to rising technological infrastructure and regulatory compliance needs.

North America Telecom Managed Services Market Share

The telecom managed services industry is primarily led by well-established companies, including:

- FUJITSU (Japan)

- Wipro Limited (India)

- Capgemini (France)

- Accenture (Ireland)

- Tata Consultancy Services Limited (India)

- HCL Technologies Limited (India)

- NTT DATA Corporation (Japan)

- ZTE Corporation (China)

- Huawei Technologies Co., Ltd. (China)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia Corporation (Finland)

- Comarch SA (Poland)

- Tech Mahindra Limited (India)

- Infosys Limited (India)

- BT (U.K.)

What are the Recent Developments in North America Telecom Managed Services Market?

- In November 2025, Charter Communications announced that its shareholders had overwhelmingly approved the planned $35.4 billion acquisition of Cox Communications. With over 99% of votes in favor, the deal moves closer to completion, pending regulatory approval expected by mid-2026. The merger will create one of the largest broadband and cable operators in the U.S., combining Cox’s fiber infrastructure with Charter’s Spectrum network. The combined entity aims to deliver enhanced connectivity and better compete in the evolving broadband and mobile landscape

- In August 2025, Arista Networks announced its acquisition of VeloCloud, Broadcom’s SD-WAN business unit, in a strategic move to enhance its AI-driven networking capabilities. VeloCloud, known for its cloud-delivered SD-WAN solutions with integrated security, complements Arista’s existing data center and campus networking portfolio. The acquisition aims to revamp Arista’s SD-WAN strategy, enabling seamless, application-aware connectivity across distributed enterprise environments. While the financial terms were not disclosed, the deal reflects Arista’s commitment to building robust, AI-optimized WAN infrastructure to support evolving enterprise needs and data flows in the age of generative and agentic AI

- In July 2025, Hilliary Communications announced its acquisition of TDS Telecom’s network operations in Oklahoma, expanding its service footprint by nearly 35,000 new locations. The deal includes communities across rural Oklahoma, from Elgin and Jones to Adair, and marks a major step in Hilliary’s mission to deliver reliable, high-speed internet statewide. The company plans to immediately deploy fiber-to-the-home networks, modernize infrastructure, and enhance broadband access. This acquisition reflects Hilliary’s commitment to bridging the digital divide and supporting economic growth through future-ready connectivity

- In May 2025, Thrive, a global Managed Service Provider (MSP) and Managed Security Service Provider (MSSP), announced its acquisition of Abacode, a Tampa-based Managed Cybersecurity & Compliance Provider (MCCP). This marks Thrive’s second acquisition of the year, reinforcing its commitment to expanding governance, risk, and compliance (GRC) services. Abacode’s integrated approach to cybersecurity and compliance aligns with Thrive’s mission to deliver streamlined, outcome-driven solutions for mid-market businesses. The acquisition strengthens Thrive’s presence in the Southeastern U.S. and supports clients navigating increasingly complex regulatory landscapes, including CMMC, HIPAA, and emerging AI legislation

- In February 2025, a report revealed that Ericsson’s cloud-native suite enabled T-Mobile to reduce its network operations costs by 30% and accelerate service-launch cycles from weeks to hours. This transformation was driven by Ericsson’s Cloud Native Infrastructure Solution (CNIS), which supports scalable, high-performance telecom environments optimized for cloud-native applications. The success of this deployment highlights the growing importance of modern, cloud-based managed services in the telecom sector, especially as operators seek to improve efficiency, reduce costs, and support advanced technologies such as AI and 5G

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.