North America Textile Films Market

Market Size in USD Million

CAGR :

%

USD

3,361.98 Million

USD

5,545.68 Million

2022

2030

USD

3,361.98 Million

USD

5,545.68 Million

2022

2030

| 2023 –2030 | |

| USD 3,361.98 Million | |

| USD 5,545.68 Million | |

|

|

|

North America Textile Films Market Analysis and Size

Textile films are used in the most common cold films and lamination techniques. Textile films are classified into two types: breathable and non-breathable. Breathable textile films have greatly aided the field of hygiene. Because of its high strength and flexibility, as well as its surface characteristics and other mechanical qualities, the market for textile film has grown significantly. Because of the inclusion of polymers and other sophisticated composites, textile films can achieve these mechanical properties. Growing consumer awareness of textile film's use in the industry of hygiene products is one of the factors driving market expansion.

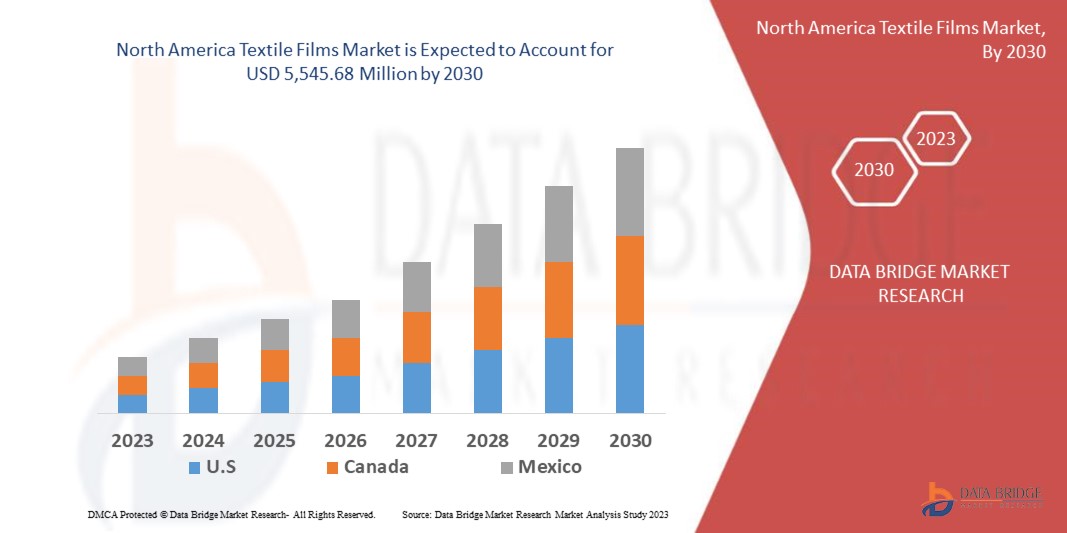

Data Bridge Market Research analyses that the North America textile films market, which was USD 3,361.98 million in 2022, would rocket up to USD 5,545.68 million by 2030 and is expected to undergo a CAGR of 6.2% during the forecast period of 2023 to 2030. “Breathable textile films” dominates the type segment of the North America textile films market, increasing the demand for hygienic products. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, pipeline analysis, pricing analysis, and regulatory framework.

North America Textile Films Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Tons, Pricing in USD |

|

Segments Covered |

By Material (Polyester, Polyurethane, and Others), Type (Breathable and Non-Breathable), Application (Agriculture, Industrial, Infrastructure, Medical, Sports, Transportation, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

AMERICAN POLYFILM, INC.(U.S.), Arkema (France), Berry North America (U.S.), Covestro (Germany), Daika Kogyo Co.,Ltd. ( Thailand), Fatra, as (Europe), Mitsui Hygiene Materials (Thailand) Co., Ltd. (Thailand, Polyzen (U.S.), RKW Group (Germany), Schweitzer-Mauduit International, Inc. (U.S.), Sunplac Corporation (Tokyo), AND Toray Industries (Japan) |

|

Market Opportunities |

|

Market Definition

The term "textile films" refers to a class of cold films with various mechanical advantages, including flexibility, waterproofing, and tremendous strength. Various industries, including agriculture, industry, infrastructure, medicine, sports, transportation, and others, use textile films. The use of textile films is growing among consumers daily as a result of rising hygiene awareness.

North America Textile Films Market Dynamics

Drivers

- Growing demand for technical textiles

The demand for textile films is driven by the expanding use of technical textiles in numerous industries, including construction, healthcare, and automotive. The functional qualities of textiles, such as waterproofing, UV resistance, and flame retardancy, are improved by these films.

- Rising disposable income and changing lifestyle

Consumer spending on clothing and home furnishings rises in lockstep with disposable income. Textile films are used in various products, including decorative laminates, upholstery, and clothing, due to changing lifestyles and fashion trends.

Opportunities

- New developments in textile films

Technological advancements in the processes used to manufacture textile films, such as developing recyclable and environmentally friendly films, provide significant growth opportunities. Furthermore, advances in nanotechnology have enabled the development of films with enhanced properties such as antimicrobial and self-cleaning properties.

- Demand for eco-friendly alternatives

The demand for sustainable textile products is rising as environmental concerns grow. By providing solutions that are recyclable, biodegradable, and energy-efficient, textile films can aid in sustainability. This provides a chance for producers to meet the demand for eco-friendly substitutes.

Restraints/Challenges

- Volatile raw material prices

The production of textile films requires various raw materials, including polyester, polyethylene, and polypropylene. The profitability of manufacturers may be impacted by changes in the price of these raw materials. Managing price volatility and ensuring a stable supply of raw materials pose a significant challenge for the industry.

- High Competition in the Market

Many manufacturers are operating in the highly competitive North America market for textile films. Price wars and decreased profit margins may result from this fierce competition. Companies must differentiate themselves through product innovation, quality, and customer service to remain competitive.

Recent Development

-

On April 1, 2023, Berry North America Group, Inc. started expanding one of its flagship stretch film manufacturing sites in Lewisburg, Tennessee. The extension is scheduled to be finished by the beginning of 2024. Three new cast lines will be installed as part of the 25,000-square-foot expansion, which will also boost the capacity of the facility's post-industrial resin (PIR) reprocessing system and extend its rail spur for resin material handling. This will assist Berry in meeting increased demand for its stretch films, which are Berry's highest performing, most sustainable stretch films.

-

On March 2023, Covestro boosted Thailand's film production capacity. The Makrofol film range is most commonly used in identity documents, automotive displays, and electrical and electronic applications. The investment is expected to be completed in the higher double-digit million euro range by 2025.

North America Textile Films Market Scope

The market is segmented on the basis of type, availability, material, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

TYPE

- BREATHABLE

- NON-BREATHABLE

AVAILABILITY

- WHITE TEXTILE FILM

- TEXTILE GOLD

- TEXTILE SILVER

MATERIAL

- POLYESTER

- POLYURETHANE

- OTHERS

APPLICATION

- HYGIENE

- MEDICAL

- SPORTSWEAR

- PROTECTIVE APPAREL

- OTHERS

North America Textile Films Market Regional Analysis/Insights

The North America textile films market is analyzed, and market size insights and trends are provided by country, type, availablity, material, and application as referenced above.

The countries covered in the North America textile films market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate due to its large population and rising disposable incomes have created a substantial consumer market for textiles and related products.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Textile Films Industry Growth and New Technology Penetration

The North America textile films market also provides you with detailed market analysis for every country growth in nucleating and clarifying agents industry, installed new production plant, impact of technology using life line curves and changes in North America textile films regulatory scenarios and their impact on the North America textile films market. The data is available for historic period 2015-2020.

Competitive Landscape and North America Textile Films Market Share Analysis

The North America textile films market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to nucleating and clarifying agents market.

Some of the major players operating in the North America textile films market are:

- AMERICAN POLYFILM, INC.(U.S.)

- Arkema (France)

- Berry North America (U.S.)

- Covestro (Germany)

- Daika Kogyo Co.,Ltd. ( Thailand)

- Fatra, as (Europe)

- Mitsui Hygiene Materials (Thailand) Co., Ltd. (Thailand)

- Polyzen (U.S.)

- RKW Group (Germany)

- Schweitzer-Mauduit International, Inc. (U.S.)

- Sunplac Corporation (Tokyo)

- Toray Industries (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Textile Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Textile Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Textile Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.