North America Thermal Paper Market

Market Size in USD Million

CAGR :

%

USD

665.12 Million

USD

1,117.42 Million

2024

2032

USD

665.12 Million

USD

1,117.42 Million

2024

2032

| 2025 –2032 | |

| USD 665.12 Million | |

| USD 1,117.42 Million | |

|

|

|

|

Thermal Paper Market Size

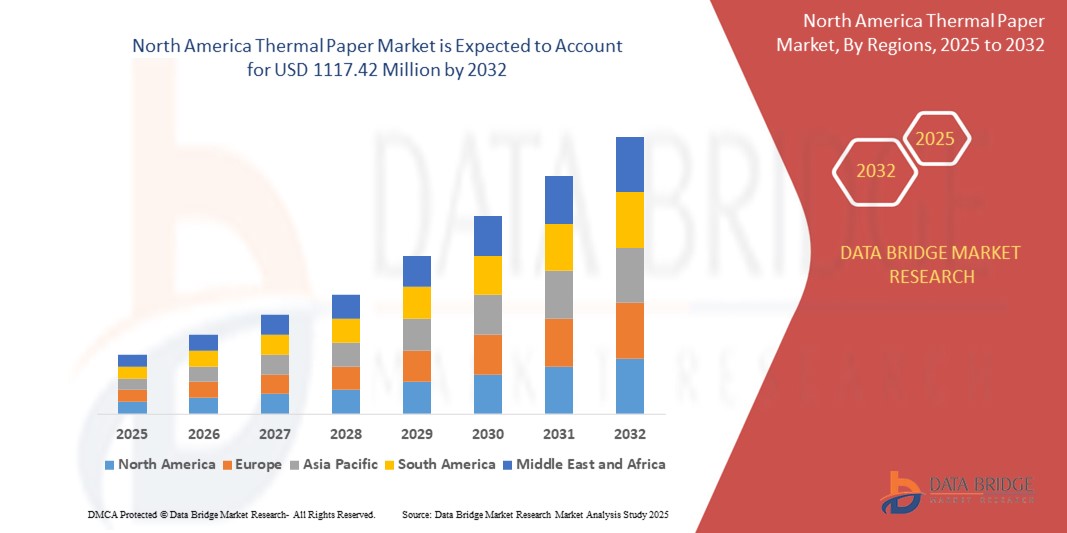

- The North America thermal paper market size was valued at USD 665.12 million in 2024 and is expected to reach USD 1117.42 million by 2032, at a CAGR of 6.7% during the forecast period

- The market growth is largely fueled by the rising demand for efficient, high-speed, and cost-effective printing solutions across industries such as retail, logistics, banking, and transportation. Thermal paper’s ability to produce sharp, smudge-free prints without ink or toner has made it the preferred choice for point-of-sale systems, ticketing, and labeling applications worldwide

- Furthermore, growing e-commerce activity and increasing automation in supply chains are driving the need for reliable thermal labels for product tracking and inventory management. These factors, combined with regulatory labeling requirements in healthcare and food sectors, are accelerating the adoption of thermal paper across various end-use segments, thereby significantly boosting market growth

Thermal Paper Market Analysis

- Thermal paper is a specialty paper coated with chemicals that react to heat, allowing for fast, high-resolution printing used in receipts, tickets, labels, and tags. Its widespread application in POS systems, ATMs, barcode labeling, and transportation tickets makes it integral to both consumer-facing and backend operations

- The market’s expansion is primarily driven by the growth of organized retail, increasing digital transactions, and the global rise in logistics and parcel delivery services. Demand is further supported by the shift toward BPA-free and environmentally compliant thermal paper grades, addressing both regulatory standards and consumer health concerns

- U.S. dominated the thermal paper market with a share of 88.3% in 2024, due to the high penetration of POS systems across retail, banking, and hospitality sectors. The country’s advanced commercial infrastructure and widespread use of transaction-based systems, including ATMs, self-service kiosks, and cash registers, continue to sustain strong demand for thermal paper

- Canada is expected to be the fastest growing region in the thermal paper market during the forecast period due to the increasing adoption of digital payment systems, expanding retail chains, and greater focus on high-quality, durable thermal printing for logistics and healthcare applications

- Direct transfer segment dominated the market with a market share of 55.8% in 2024, due to its cost-effectiveness, simplicity, and suitability for high-volume printing in retail and banking environments. It eliminates the need for ribbons or ink cartridges, reducing maintenance and operational costs for businesses. Its fast print speed and clear image quality have made it the preferred technology for POS receipts, tickets, and labels

Report Scope and Thermal Paper Market Segmentation

|

Attributes |

Thermal Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermal Paper Market Trends

“Growth in E-commerce and Retail”

- The North America thermal paper market is experiencing robust expansion, driven by the rapid growth of e-commerce and retail sectors that require efficient, high-volume receipt and label printing solutions

- For instance, companies such as Appvion Operations, Inc., Domtar Corporation, and Thermal Solutions International, Inc. are investing in advanced thermal paper products to meet the rising demand from major retailers, logistics providers, and online marketplaces

- The adoption of point-of-sale (POS) systems and self-service kiosks is accelerating, with POS receipts representing the largest application segment in 2024, accounting for over 60% of market revenue

- Sustainability initiatives are influencing product development, with leading manufacturers introducing BPA-free and recyclable thermal papers to comply with evolving regulations and consumer preferences

- Technological advancements in printing—such as mobile POS integration, RFID-enabled labels, and high-speed digital presses—are enhancing efficiency and expanding the range of thermal paper applications across retail, logistics, and healthcare

- The convergence of e-commerce growth, retail innovation, and sustainability initiatives is positioning thermal paper as an essential component in North America's packaging and transaction ecosystem, with continued investments expected in product innovation and market expansion

Thermal Paper Market Dynamics

Driver

“Expansion of Online Food Delivery Services Globally”

- The surge in online food delivery services is a major driver, as restaurants and delivery platforms require reliable thermal paper for order receipts, packing slips, and transaction confirmations

- For instance, companies such as Appvion Operations, Inc. and Ricoh Company, Ltd. are expanding production to supply thermal paper rolls and labels to food delivery giants and POS system providers across North America

- The convenience and speed of thermal printing support the high transaction volumes in food delivery, ensuring accurate order processing and efficient customer service

- Integration with mobile POS and contactless payment systems is fueling demand for compact, high-quality thermal paper solutions tailored to the needs of foodservice and quick commerce operators

- As online food delivery continues to grow, especially in urban centers, the requirement for durable, legible, and environmentally friendly thermal paper products is expected to rise

Restraint/Challenge

“Price Volatility of Raw Materials”

- Price volatility for key raw materials—such as pulp, specialty chemicals, and thermal coatings—remains a significant challenge for thermal paper manufacturers in North America

- For instance, fluctuations in the cost of wood pulp and chemicals such as bisphenol A (BPA) and its alternatives can impact production expenses and profit margins, as seen with companies such as Domtar Corporation and Appvion Operations, Inc.

- The shift toward BPA-free and phenol-free formulations, driven by regulatory and environmental pressures, adds further complexity and cost to the manufacturing process

- Supply chain disruptions, energy price swings, and global competition for raw materials can lead to unpredictable pricing and supply constraints, affecting both large and regional producers

- Addressing these challenges requires ongoing investment in supply chain resilience, alternative material sourcing, and process optimization to ensure stable, cost-effective production in a competitive market

Thermal Paper Market Scope

The market is segmented on the basis of width, technology, application, and end-use.

- By Width

On the basis of width, the thermal paper market is segmented into 57mm, 80mm, and others. The 80mm segment dominated the largest market revenue share in 2024, owing to its widespread usage in point-of-sale (POS) terminals across retail, hospitality, and transportation sectors. Its broader print area supports detailed transaction information, logos, and barcodes, making it highly preferred for customer-facing applications. Retail chains and supermarkets especially rely on 80mm rolls for their compatibility with high-speed printers and enhanced customer interaction through clearer receipts.

The 57mm segment is projected to witness the fastest CAGR from 2025 to 2032, primarily due to growing demand in compact POS machines, handheld payment terminals, and mobile receipt printers. The smaller width reduces paper usage and supports eco-conscious operations, while also meeting the space-saving requirements of portable and mobile devices used in logistics, small-scale retail, and mobile banking.

- By Technology

On the basis of technology, the thermal paper market is segmented into direct transfer, thermal transfer, and others. The direct transfer segment held the largest market revenue share of 55.8% in 2024 due to its cost-effectiveness, simplicity, and suitability for high-volume printing in retail and banking environments. It eliminates the need for ribbons or ink cartridges, reducing maintenance and operational costs for businesses. Its fast print speed and clear image quality have made it the preferred technology for POS receipts, tickets, and labels.

The thermal transfer segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by its superior durability, resistance to heat, light, and moisture, and suitability for applications that demand long-lasting prints. Industries such as logistics, pharmaceuticals, and manufacturing are increasingly adopting thermal transfer labels for tracking and compliance labeling, where print longevity is critical.

- By Application

On the basis of application, the thermal paper market is segmented into thermal label, thermal ticket and tags, thermal POS, and others. The thermal POS segment accounted for the largest market share in 2024, underpinned by the continued expansion of organized retail, fast food chains, and service-based establishments globally. The POS application benefits from the fast, reliable, and low-cost printing capabilities of thermal paper, which supports daily transactional efficiency.

The thermal label segment is projected to register the fastest growth rate between 2025 and 2032, propelled by rising use in barcode and product labeling across supply chains. The e-commerce boom, along with the need for precise tracking and inventory control in industries such as healthcare and warehousing, has significantly increased the demand for high-quality thermal labels that ensure clear readability and resistance to smudging.

- By End-Use

On the basis of end-use, the thermal paper market is segmented into food, industrial, logistic, pharmaceutical, retail, bank, entrance, lottery and gaming, parking, transportation tickets, self-service kiosks, ATM, cash register, coupon, guarantee receipts, and others. The retail segment led the market with the highest revenue share in 2024, driven by the rapid digitization of retail transactions, proliferation of POS terminals, and rising consumer footfall in organized retail outlets. Retailers favor thermal paper for its efficiency, clarity, and ability to print at high speeds with minimal downtime.

The logistics segment is expected to experience the fastest CAGR from 2025 to 2032, owing to the exponential growth of e-commerce, global trade, and warehouse automation. Thermal paper is extensively used in printing shipping labels, barcodes, and tracking information. Its reliability, cost efficiency, and print durability make it an essential material for real-time logistics and inventory operations.

Thermal Paper Market Regional Analysis

- U.S. dominated the thermal paper market with the largest revenue share of 88.3% in 2024, driven by the high penetration of POS systems across retail, banking, and hospitality sectors. The country’s advanced commercial infrastructure and widespread use of transaction-based systems, including ATMs, self-service kiosks, and cash registers, continue to sustain strong demand for thermal paper

- The presence of leading thermal paper manufacturers, along with robust distribution networks and growing adoption of digital receipts paired with physical backups, is fueling market growth. Regulatory compliance in healthcare and banking sectors further supports the use of thermal labels and receipts

- The U.S. market also benefits from continuous technological advancements in thermal printing and paper coatings, such as BPA-free formulations and longer image retention, enhancing its dominance in North America’s transaction and labeling ecosystem

Canada Thermal Paper Market Insight

Canada is projected to record the fastest CAGR in the North America thermal paper market from 2025 to 2032, driven by the increasing adoption of digital payment systems, expanding retail chains, and greater focus on high-quality, durable thermal printing for logistics and healthcare applications. Government regulations on labeling and traceability in pharmaceuticals and food sectors are also contributing to the growing demand.

Mexico Thermal Paper Market Insight

The Mexico thermal paper market is expected to witness steady growth between 2025 and 2032, supported by the expanding e-commerce sector, rising retail activity, and increased deployment of POS and ticketing systems. Domestic investment in thermal paper production and rising demand for thermal labels in logistics and transportation are enhancing market prospects across the country.

Thermal Paper Market Share

The thermal paper industry is primarily led by well-established companies, including:

- Mitsubishi HiTec Paper Europe GmbH (Germany)

- Nippon Paper Industries Co., Ltd. (Japan)

- Appvion Operations, Inc. (U.S.)

- Kanzaki Specialty Papers Inc. (Japan)

- Domtar Corporation (U.S.)

- Ricoh Industrie France SAS (France)

- Lecta Group Companies (Spain)

- Papierfabrik August Koehler SE (Germany)

- Hankuk Paper Mfg. Co. Ltd. (South Korea)

- Thermal Solutions International, Inc. (U.S.)

- Siam Nippon Industrial Paper Co., Ltd. (Thailand)

- Nakagawa Manufacturing (USA), Inc. (U.S.)

- Deli Group Co., Ltd. (China)

Latest Developments in North America Thermal Paper Market

- In September 2024, Lecta announced the launch of its new Termax range of high-substance thermal papers, specifically engineered for ticketing applications. This strategic product expansion is expected to strengthen Lecta’s position in the thermal paper market by addressing rising demand for high-quality, durable solutions across diverse use cases such as event ticketing, transportation passes, boarding cards, parking tickets, supply chain tracking, and shelf labeling. By catering to evolving performance requirements in sectors such as logistics, retail, and access control, the Termax range enhances market competitiveness and supports the broader shift toward reliable, high-performance thermal printing media

- In November 2022, Koehler Paper, a German thermal paper manufacturer, raised prices by 8% effective from February 1, 2023, citing escalating development costs of chemicals, pulps, logistics, and personnel. This price hike reflects the impact of rising operational expenses on the thermal paper market, potentially influencing industry dynamics and customer purchasing behavior

- In March 2022, Oji Imaging Media Co. Ltd. disclosed plans to enhance thermal paper production at KANZAN Spezialpapiere GmbH, Germany. The expansion aims to boost output capacity, reinforcing their market presence and competitiveness in meeting growing demands within the thermal paper market

- In December 2021, Wynnchurch Capital, L.P. finalized an acquisition of a majority of assets belonging to Appvion Holding Corp. and its subsidiaries. This agreement is poised to inject new resources into the thermal paper market, fostering opportunities for expansion and innovation within the industry, potentially shaping its competitive landscape

- In October 2020, Mitsubishi HiTec Paper Europe GmbH received recognition from the Chamber of Industry and Commerce for exceptional training in paper machine technology. This accolade enhances the company's reputation, fostering customer trust and loyalty, ultimately contributing to increased revenue in the competitive thermal paper market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Thermal Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Thermal Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Thermal Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.