North America Thermoplastic Polyurethane Market

Market Size in USD Billion

CAGR :

%

USD

753.88 Billion

USD

1,238.34 Billion

2024

2032

USD

753.88 Billion

USD

1,238.34 Billion

2024

2032

| 2025 –2032 | |

| USD 753.88 Billion | |

| USD 1,238.34 Billion | |

|

|

|

|

North America Thermoplastic Polyurethane Market Size

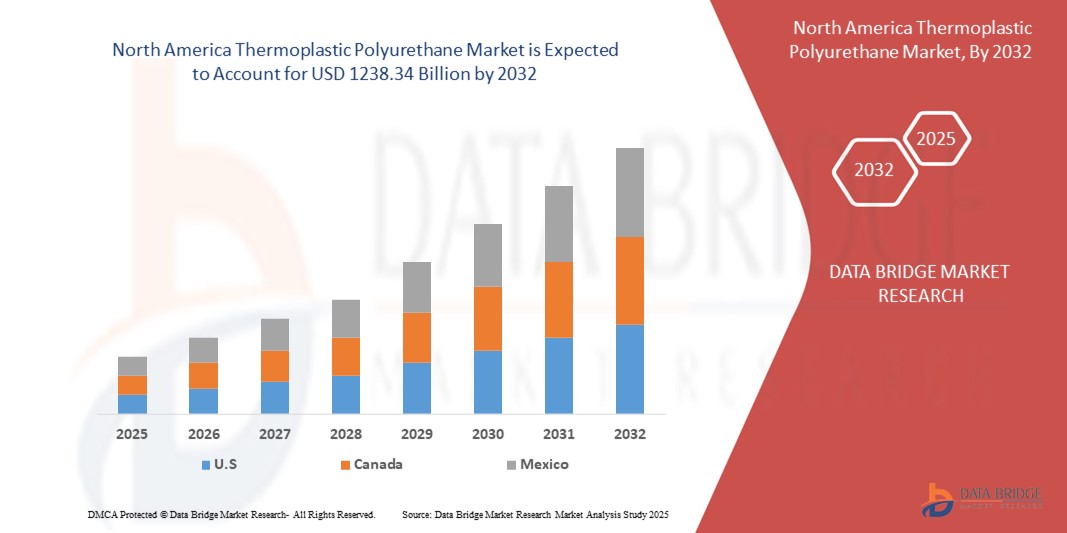

- The North America thermoplastic polyurethane market size was valued at USD 753.88 million in 2024 and is expected to reach USD 1238.34 billion by 2032, at a CAGR of 6.40% during the forecast period

- This growth is driven by factors such as the increasing demand from automotive, construction, and footwear industries; rising adoption of lightweight and durable materials; advancements in manufacturing technologies; and growing applications in medical and electronics sectors

North America Thermoplastic Polyurethane Market Analysis

- The North America thermoplastic polyurethane market is witnessing steady growth due to its rising usage in applications that demand high flexibility and abrasion resistance

- This material is increasingly preferred in industries such as automotive and electronics for products such as cable insulation and protective films due to its durable and versatile nature

- North America is expected to dominate the North America thermoplastic polyurethanes market with 83.65% shares, due to its advanced manufacturing base and diverse industrial applications

- Mexico is expected to be the fastest growing region in the North America thermoplastic polyurethane market during the forecast period due to its expanding role in automotive production and export

- The polyester segment is expected to dominate the North America thermoplastic polyurethane market with the largest share of 45.05% in 2025 due to its excellent mechanical strength, abrasion resistance, and cost-effectiveness, making it highly suitable for applications in footwear, industrial equipment, and automotive components

Report Scope and North America Thermoplastic Polyurethane Market Segmentation

|

Attributes |

North America Thermoplastic Polyurethane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Thermoplastic Polyurethane Market Trends

“Rise of Sustainable Bio-Based Thermoplastic Polyurethane”

- Manufacturers are investing in research and development to create bio-based thermoplastic polyurethane that maintains performance while reducing environmental impact

- The footwear industry is increasingly utilizing bio-based thermoplastic polyurethane for its flexibility and durability, aligning with consumer demand for sustainable products

- In the automotive sector, bio-based thermoplastic polyurethane is being used for interior components, contributing to overall vehicle sustainability goals

- In conclusion, the medical industry is adopting bio-based thermoplastic polyurethane for applications such as tubing and catheters, benefiting from its biocompatibility and environmental advantages

North America Thermoplastic Polyurethane Market Dynamics

Driver

“Rising Demand for High-Performance Materials in Automotive Applications”

- Thermoplastic polyurethane is in high demand in the automotive sector for lightweight and durable components, such as seat covers in Ford vehicles

- Electric vehicle manufacturers such as Tesla are adopting TPU for cable sheathing and wiring harnesses due to its flexibility and insulation properties

- TPU is used in vibration dampening pads and protective films in automotive interiors, such as in BMW and Audi models

- The automotive industry's push for electric vehicles is driving TPU adoption in parts requiring weight reduction, such as battery insulation in Rivian vehicles

- TPU’s recyclability and performance make it a sustainable alternative, as seen in Toyota's eco-friendly materials in new vehicle designs

- This consistent demand from automakers continues to fuel TPU's growth across both conventional and electric vehicles.

Opportunity

“Expanding Use of Thermoplastic Polyurethane in Wearable Electronics”

- The rapid growth of wearable technology is creating a strong opportunity for thermoplastic polyurethane as it is increasingly used in wristbands, casings, and flexible circuits for devices such as smartwatches and fitness trackers

- TPU’s elasticity, transparency, and skin-friendly nature make it ideal for wearable electronics that need to be both durable and comfortable for long-term wear

- The demand for moisture and temperature-resistant materials in wearable technology is pushing the use of TPU in products such as health monitoring bands and biosensors

- TPU is gaining popularity in the wearable market due to its ability to combine functionality with aesthetics, offering customizable colors and designs for consumer preference

- The rise of medical-grade wearables and IoT devices is further expanding TPU’s role in monitoring real-time vital signs and supporting the growth of smart healthcare solutions

- This convergence of fashion, technology, and functionality offers a substantial opportunity for TPU growth as consumer demand for advanced, comfortable, and sustainable wearable devices increases.

Restraint/Challenge

“Fluctuating Raw Material Prices Impacting Production Costs”

- One of the major challenges for the thermoplastic polyurethane market is the volatility in raw material prices, particularly the cost of diisocyanates and polyols derived from crude oil

- Fluctuating crude oil prices due to geopolitical events or supply disruptions lead to unpredictable production costs, which can destabilize pricing strategies for manufacturers

- Small and medium-sized enterprises are particularly vulnerable to these cost fluctuations, as they often lack the financial capacity to handle sudden price increases or stockpile materials during price drops

- The growing regulatory pressure around environmental compliance, particularly related to petrochemical-based inputs, adds further cost burdens to TPU manufacturers, affecting profitability

- Increased consolidation among raw material suppliers has led to higher pricing power, further squeezing the margins of TPU producers and limiting their ability to remain competitive

- These factors collectively hinder capacity expansion and technological advancements in the TPU industry, posing a significant challenge for market players looking to invest in innovation and growth.

North America Thermoplastic Polyurethane Market Scope

The market is segmented on the basis of raw material, type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Ram Material |

|

|

By Type |

|

|

By End User |

|

In 2025, the polyester segment is projected to dominate the market with a largest share in type segment

The polyester segment is expected to dominate the North America thermoplastic polyurethane market with the largest share of 45.05% in 2025 due to its excellent mechanical strength, abrasion resistance, and cost-effectiveness, making it highly suitable for applications in footwear, industrial equipment, and automotive components.

The footwear segment is expected to account for the largest share during the forecast period in end user segment

In 2025, the footwear segment is expected to dominate the market with the largest market share of 34.11% due to the rising demand for lightweight, durable, and flexible materials in sports and casual footwear, with thermoplastic polyurethane offering superior comfort, wear resistance, and design versatility preferred by major global footwear brands.

North America Thermoplastic Polyurethane Market Regional Analysis

“U.S. Holds the Largest Share in the North America Thermoplastic Polyurethane Market”

- The U.S. holds a leading position in the thermoplastic polyurethane market with 83.65% shares, due to its advanced manufacturing base and diverse industrial applications

- The country has a high concentration of automotive, electronics, and healthcare companies that heavily rely on thermoplastic polyurethane for its performance and versatility

- Strong demand for sustainable and high-quality materials across consumer and industrial products continues to drive adoption

- Widespread integration of thermoplastic polyurethane in areas such as electric vehicle parts, sports gear, and medical devices supports consistent market dominance

- Innovation in processing technologies and the presence of key producers ensure product availability and customization for various end uses

- Government support for environmentally friendly manufacturing further accelerates material transitions toward thermoplastic polyurethane

- The U.S. market benefits from a combination of established infrastructure, strong R&D focus, and high consumer expectations for product durability and functionality

“Mexico is Projected to Register the Highest CAGR in the North America Thermoplastic Polyurethane Market”

- Mexico is emerging as a fast-growing market for thermoplastic polyurethane driven by its expanding role in automotive production and export

- Global brands are increasingly sourcing from Mexican facilities that are integrating thermoplastic polyurethane into interior trims, cable insulation, and under-the-hood components

- The country’s footwear and electronics industries are adopting thermoplastic polyurethane for its lightweight, flexible, and wear-resistant properties

- Local industries are investing in manufacturing capabilities that support the processing of advanced polymers, including thermoplastic polyurethane

- Growing construction and packaging sectors are also exploring thermoplastic polyurethane for applications such as flexible films and insulation layers

- Mexico’s industrial growth is supported by trade connectivity, low operational costs, and increasing adoption of value-added materials

- These factors combined make Mexico a key high-potential growth market in the regional thermoplastic polyurethane landscape

North America Thermoplastic Polyurethane Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- HEXPOL AB (Sweden)

- AVERY DENNISON CORPORATION (U.S.)

- Huntsman International LLC (U.S.)

- Avient Corporation (U.S.)

- Tosoh Corporation (Japan)

- AMERICAN POLYFILM, INC. (U.S.)

- BASF SE (Germany)

- Coim Group (Italy)

- Covestro AG (Germany)

- KURARAY CO., LTD. (Japan)

- Mitsui Chemicals, Inc. (Japan)

- Novotex Italiana S.p.A. (Italy)

- Sanyo Corporation of America (U.S.),

- SONGWON (South Korea)

- The Lubrizol Corporation (U.S.)

- Wanhua Chemical Group Co., Ltd. (China)

Latest Developments in North America Thermoplastic Polyurethane Market

- In February 2023, Covestro AG announced the construction of the largest TPU facility in Zhuhai, South China. This expansion, occurring in three phases and slated for completion by 2033, aims to reach an annual capacity of 120 thousand tons of TPU polyurethane, bolstering production capabilities

- In May 2020, BASF SE commenced the development of electronics plastics compounding and TPU plants in Zhanjiang, China, as part of its advanced chemical manufacturing facility ('Verbund'). These facilities, the first on-site, will enhance support for Southern China's market and global clientele, promoting proximity and productivity

- In August 2022, RODIM, a BASF SE brand, introduced its new invisible TPU paint protection film (PPF) in the Asia Pacific region. Engineered to deliver comprehensive and enduring protection for automotive coatings, the innovation underscores BASF's commitment to TPU advancements in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Thermoplastic Polyurethane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Thermoplastic Polyurethane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Thermoplastic Polyurethane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.