North America Timing Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.72 Billion

USD

7.57 Billion

2025

2033

USD

3.72 Billion

USD

7.57 Billion

2025

2033

| 2026 –2033 | |

| USD 3.72 Billion | |

| USD 7.57 Billion | |

|

|

|

|

What is the North America Timing Devices Market Size and Growth Rate?

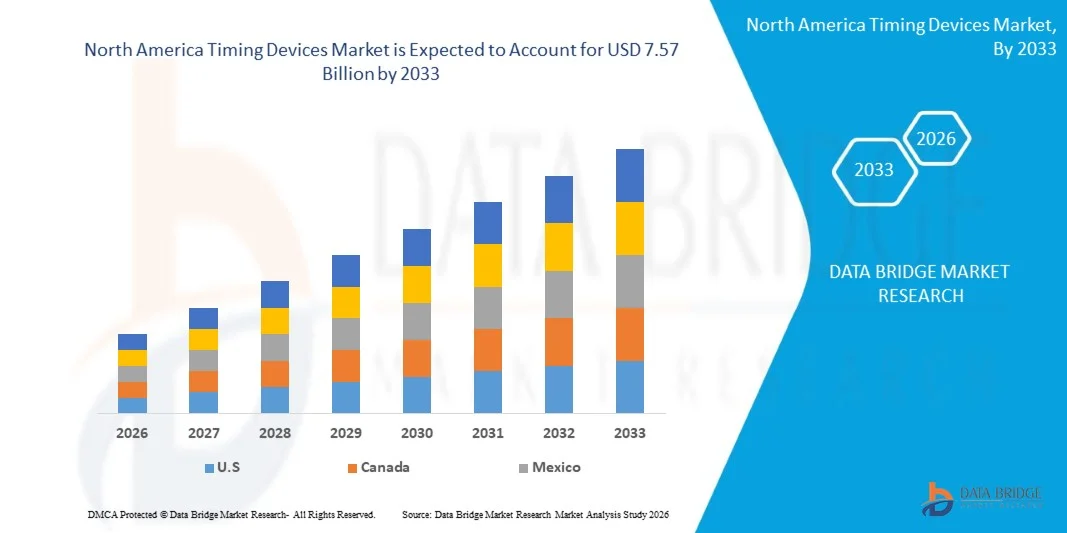

- The North America timing devices market size was valued at USD 3.72 billion in 2025 and is expected to reach USD 7.57 billion by 2033, at a CAGR of 9.30% during the forecast period

- In the timing devices market, the integration of cutting-edge technology such as Quantum Clocks enhances precision and reliability

- Quantum Clocks utilize atomic properties to achieve unparalleled accuracy, revolutionizing applications in telecommunications, navigation systems, and scientific research. This innovation elevates timing device capabilities, meeting the increasingly stringent demands of modern industries

What are the Major Takeaways of Timing Devices Market?

- The rising popularity of smartphones, tablets, wearables, and other consumer electronics fuels demand for integrated timing devices. Essential for communication, data processing, and multimedia functions, these devices rely on precise timing for seamless operation. As consumer expectations for performance and connectivity grow, and the need for accurate timing solutions in electronics

- The U.S. dominated the North America timing devices market with the largest revenue share of 46.8% in 2024, driven by a highly developed food processing industry, strong demand for packaged and ready-to-eat foods, and large-scale investments in automated processing, packaging, and material handling systems across meat, dairy, and beverage segments

- Canada is witnessing the fastest growth rate of 8.34%, supported by rising processed food exports, increasing automation in meat and dairy processing, and strong compliance with food safety standards

- The Oscillator segment dominated the timing devices market with the largest revenue share of 35.8% in 2024, driven by its critical role in generating stable clock signals required for timing precision across various electronic devices

Report Scope and Timing Devices Market Segmentation

|

Attributes |

Timing Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Timing Devices Market?

“Enhanced Convenience Through AI and Voice Integration”

- A prominent trend shaping the timing devices market is the seamless integration with artificial intelligence (AI) and voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit, offering enhanced control and automation

- Devices such as SiTime’s Elite Platform MEMS oscillators are using AI to self-adjust in dynamic environments, maintaining precision timing for complex systems. In consumer electronics, AI-assisted timing helps optimize power usage and device responsiveness

- AI integration also enables predictive failure analysis and real-time adaptive timing control in automotive and industrial applications, boosting reliability. Voice interfaces, though more prominent in smart homes, are also making headway in consumer tech where timing synchronization is essential

- These innovations improve user experience, power efficiency, and system uptime, especially in smart wearables, telecom, and automotive electronics. Timing devices are now central to enabling smooth interaction in AI-powered environments

- Key players such as SiTime, Analog Devices, and Texas Instruments are developing advanced timing solutions with intelligent software control and voice integration-ready microchips, setting a new standard in performance and automation

- The ongoing convergence of timing precision, AI-driven adaptability, and intuitive control is expected to elevate demand across industries, positioning smart timing components as critical enablers in next-generation electronic systems

What are the Key Drivers of Timing Devices Market?

- The rising demand for high-performance electronics across industries such as telecom, automotive, aerospace, and consumer electronics is a major driver of the Timing Devices market

- For instance, in February 2024, Murata Manufacturing launched a new surface mount crystal unit tailored for 5G base stations, meeting the need for ultra-low jitter and high-frequency stability

- The proliferation of IoT devices, autonomous vehicles, and AI-powered systems increases the need for ultra-precise synchronization, making timing components essential for maintaining system integrity and performance

- Furthermore, the shift to 5G networks and increased data center activity require advanced timing solutions such as OCXOs, TCXOs, and MEMS oscillators that offer superior stability and frequency accuracy

- Consumer expectations for faster and more efficient devices, along with growing embedded systems in health tech and wearables, are also boosting demand for compact, energy-efficient timing devices

- Overall, the market is driven by a growing reliance on real-time communication, system precision, and high-frequency performance in mission-critical applications

Which Factor is Challenging the Growth of the Timing Devices Market?

- Thermal sensitivity and environmental instability remain significant challenges for timing devices, particularly in harsh or mobile environments where consistent precision is critical

- For instance, traditional quartz-based oscillators struggle with temperature-induced drift, making them less ideal for aerospace or industrial automation, where extreme conditions are common

- While MEMS-based timing solutions offer better resistance, the initial cost and performance calibration for ultra-stable output can limit adoption in cost-sensitive markets or mass consumer products

- In addition, supply chain disruptions for specialized raw materials and chip components impact timely production and delivery. Events such as the 2023 silicon wafer shortage continue to cause backlogs for precision component suppliers

- As applications demand smaller, more power-efficient, and thermally stable timing devices, manufacturers must invest in material innovation, thermal compensation technologies, and predictive calibration algorithms to maintain accuracy

- Addressing these challenges through advanced MEMS designs, robust testing, and strategic component sourcing will be key to sustaining market expansion across diversified verticals

How is the Timing Devices Market Segmented?

The market is segmented on the basis of type, mounting type, material, application, and end use.

• By Type

On the basis of type, the timing devices market is segmented into Semiconductor Clocks, Oscillators, Clock Buffers, Clock Generators, Jitter Attenuators, and Resonators. The Oscillator segment dominated the timing devices market with the largest revenue share of 35.8% in 2024, driven by its critical role in generating stable clock signals required for timing precision across various electronic devices. Oscillators are extensively used in smartphones, wearables, and computing systems, ensuring consistent performance and synchronization across components. Their reliability, cost-efficiency, and broad application range contribute to their dominant market position.

The Semiconductor Clocks segment is expected to witness the fastest CAGR of 9.4% from 2025 to 2032, owing to their compact design, scalability in integration with SoCs, and ability to meet the rising demand for power-efficient solutions in advanced microprocessors and data communication systems.

• By Mounting Type

On the basis of mounting type, the market is segmented into Surface Mount and Through Hole. The Surface Mount segment held the largest market share in 2024, driven by its suitability for automated manufacturing, compact size, and widespread adoption in consumer electronics and high-density PCBs. Surface-mount technology (SMT) offers improved performance in high-frequency applications and helps reduce assembly costs, making it a preferred choice across industries.

The Through Hole segment is projected to register the fastest growth rate during the forecast period, attributed to its durability and reliability in harsh operating environments, particularly in aerospace, military, and industrial applications where mechanical strength and thermal resistance are crucial.

• By Material

On the basis of material, the timing devices market is segmented into Silicon, Crystal, and Ceramic. The Crystal segment dominated the market in 2024 with the highest revenue share of 48.6%, owing to the long-established use of quartz crystal oscillators in ensuring high-precision frequency control. Crystal-based timing devices offer excellent stability, temperature tolerance, and low phase noise, which make them ideal for applications in telecommunications, consumer electronics, and instrumentation.

The Silicon segment is anticipated to witness the fastest CAGR from 2025 to 2032, as silicon-based MEMS timing solutions gain traction for their robustness, miniaturization capabilities, and cost-effectiveness. Their integration with CMOS processes and suitability for automotive and IoT devices drives adoption.

• By Application

On the basis of application, the timing devices market is segmented into Computing Tools, Consumer Electronics, Automotive Sector, Telecommunications, and the Industrial Sector. The Consumer Electronics segment accounted for the largest revenue share in 2024, due to the increasing demand for smartphones, tablets, wearables, and smart appliances requiring accurate timing synchronization for enhanced functionality. With higher device penetration and evolving features, consumer electronics continue to drive significant demand for timing components.

The Automotive Sector is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rapid adoption of advanced driver assistance systems (ADAS), infotainment, autonomous driving technologies, and EV powertrains, all of which require high-reliability timing devices for safety-critical functions.

• By End Use

On the basis of end use, the timing devices market is segmented into Consumer Electronics, Industrial, Medical and Healthcare, Automotive, Telecommunications and Datacenter, Military and Defense, and Others. The Telecommunications and Datacenter segment dominated the market with the largest share in 2024, propelled by the rising deployment of 5G infrastructure, optical networks, and cloud computing services. These applications demand ultra-low jitter and high-stability timing devices for signal synchronization and data integrity.

The Medical and Healthcare segment is projected to register the fastest CAGR during the forecast period, as wearable health monitors, implantable devices, and remote diagnostics increasingly rely on miniaturized and accurate timing components to ensure functionality, power efficiency, and real-time data processing

Which Region Holds the Largest Share of the Timing Devices Market?

- The U.S. dominated the North America timing devices market with the largest revenue share of 46.8% in 2024, driven by a highly developed food processing industry, strong demand for packaged and ready-to-eat foods, and large-scale investments in automated processing, packaging, and material handling systems across meat, dairy, and beverage segments

- Widespread adoption of automation, robotics, conveyor systems, cold-chain handling equipment, and smart packaging technologies across large food manufacturing facilities is strengthening regional market leadership

- Strong regulatory emphasis on food safety, continuous modernization of processing infrastructure, and integration of AI-, IoT-, and sensor-enabled equipment position the U.S. as the most technology-driven regional market

Canada Timing Devices Market Insight

Canada is witnessing the fastest growth rate of 8.34%, supported by rising processed food exports, increasing automation in meat and dairy processing, and strong compliance with food safety standards. Adoption of advanced material handling systems, robotic palletizing, and cold storage solutions is enhancing production efficiency. Government support for agri-food innovation and investments in sustainable processing technologies are reinforcing Canada’s role as a stable growth market in the North America landscape.

Mexico Timing Devices Market Insight

Mexico is expanding at a healthy pace, driven by growth in food and beverage manufacturing, increasing foreign direct investment, and the country’s role as a key export hub for North America. Rising deployment of automated packaging lines, conveyor systems, and warehouse material handling equipment is improving operational scalability. Favorable trade agreements, cost-efficient manufacturing, and expanding food processing infrastructure position Mexico as an emerging high-growth market within North America.

Which are the Top Companies in Timing Devices Market?

The timing devices industry is primarily led by well-established companies, including:

- Texas Instruments Incorporated (U.S.)

- LIHOM XTALS (South Korea)

- Masterclock Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- Infineon Technologies AG (Germany)

- TXC (Taiwan)

- KYOCERA Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Abracon (U.S.)

- Seiko Epson Corporation (Japan)

- Microchip Technology Inc. (U.S.)

- Rakon Limited (New Zealand)

- NIHON DEMPA KOGYO CO., LTD. (Japan)

- Silicon Laboratories (U.S.)

- SiTime Corp. (U.S.)

- Analog Devices, Inc. (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

What are the Recent Developments in Global Timing Devices Market?

- In January 2022, ID Quantique launched the ID1000 timing device, expanding its photonic quantum sensing portfolio. Positioned to unify single-photon experiments and applications, the ID1000 contributes to the evolving landscape of timing devices, addressing demands in quantum technologies and precision timing within the market

- In March 2021, saw Renesas Electronics Corporation launch three ICs, including the 8V19N850, its first fully-integrated 5G synchronization solution. With a dual DPLL front-end architecture, this addition to Renesas' communication timing portfolio aims to address timing constraints in the emerging 5G market, bolstering the company's timing products for this dynamic industry

- In February 2021, SiTime Corporation launched the SiT5008 temperature-compensated silicon MEMS oscillator (TCXO). As a MEMS timing provider, SiTime's innovation contributes to the timing devices market, offering a solution with temperature compensation for enhanced precision in various applications

- In December 2020, Texas Instruments Incorporated strategically expanded its reach in the timing devices market by making its high-reliability (HiRel) semiconductor products available for online purchase on TI.com. This move aimed to facilitate quick access for aerospace and defense companies to authentic TI products, boosting online sales and reinforcing TI's presence in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Timing Devices Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Timing Devices Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Timing Devices Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.